UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ENERTOPIA CORPORATION

(Exact name of registrant as specified in its charter)

|

Nevada

|

20-1970188

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

18 - 1873 Spall Road Kelowna,

British Columbia

Canada

(Address of Principal Executive Offices) (Zip Code)

2014 Stock Option Plan

(Full title of the plan)

Nevada Agency and Transfer Company

50 West Liberty Street, Suite 880

Reno, Nevada 89501

Telephone: (775) 322-5623

(Name and address of agent for service)

(775) 322-5623

(Telephone number, including area code, of agent for service)

Copies of all communications to:

W.L. Macdonald Law Corporation

Attention: William L. Macdonald

409 - 221 W. Esplanade

North Vancouver, British Columbia

V7M 3J3, Canada

Telephone: (604) 973-0579

Facsimile: (604) 973-0280

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☐

|

Smaller reporting company

|

☒

|

|

(Do not check if a smaller reporting company)

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act ☐

1-22

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

Proposed

|

|

|

Proposed

|

|

|

|

|

|

|

|

|

|

maximum

|

|

|

maximum

|

|

|

|

|

|

|

Amount to be

|

|

|

offering price

|

|

|

aggregate

|

|

|

Amount of

|

|

|

Title of securities to be registered (1)

|

|

registered (2)

|

|

|

per share

|

|

|

offering price

|

|

|

registration fee(4)

|

|

|

Common shares, par value $0.001, subject to outstanding options

|

|

7,920,000 shares

|

|

|

$0.05

|

(3)

|

$

|

396,000

|

|

$

|

43.20

|

|

|

Common shares, par value $0.001 subject to unissued options

|

|

9,480,000 share

|

|

|

$0.06

|

(5)

|

$

|

568,800

|

|

$

|

62.06

|

|

|

Total

|

|

17,400,000 shares

|

|

|

|

|

$

|

964,800

|

|

$

|

105.26

|

|

(1) Common shares, par value $0.001, of Enertopia Corp. (the " Registrant ") pursuant to the Registrant's 2014 Stock Option Plan (effective July 15, 2014) (the " Plan ").

(2) Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the " Securities Act "), this registration statement also covers an indeterminate number of additional common shares that may be offered and issued to prevent dilution resulting from stock splits, stock dividends or similar transactions as provided in the Plan.

(3) Based on the weighted average exercise price of $0.0507 of options granted under the Plan outstanding as of January 21, 2021.

(4) Calculated pursuant to Rule 457(a) based on the Amount of Securities to be Registered multiplied by the Proposed Maximum Offering Price per common share.

(5) The price is estimated in accordance with Rule 457(h)(1) under the Securities Act of 1933, as amended, solely for the purpose of calculating the registration fee. Our estimate is based on the average of the high and low prices for our common stock as reported on the OTC Markets on January 21, 2021.

EXPLANATORY NOTE

We prepared this registration statement in accordance with the requirements of Form S-8 under the Securities Act of 1933, to register an aggregate of 17,400,000 shares of our common stock that are issued or issuable pursuant to stock options granted and to be granted under our 2014 stock option plan. The purpose of our 2014 stock option plan is to furnish directors, officers, consultants, and employees with an opportunity to invest in our company in a simple and cost effective manner and to better aligning the interests of our directors, officers, consultants, and employees with those of our company and our shareholders through the ownership of common shares of our company.

Under cover of this registration statement on Form S-8 is our reoffer prospectus prepared in accordance with Part I of Form S-3 under the Securities Act of 1933 (in accordance with Section C of the General Instructions to Form S-8). The reoffer prospectus may be used for reoffers and resales of up to an aggregate of 7,920,000 "restricted securities" and/or "control securities" (as such terms are defined in Form S-8) issued or issuable upon exercise of the stock options granted pursuant to our 2014 stock option plan on a continuous or delayed basis in the future.

2/22

Part I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1. Plan Information.*

Item 2. Registrant Information and Employee Plan Annual Information.*

* The document(s) containing the information specified in Part I of Form S-8 will be sent or given to participants in our 2014 stock option plan as specified by Rule 428(b)(1) under the Securities Act of 1933. Such documents are not being filed with the Securities and Exchange Commission, but constitute, along with the documents incorporated by reference into this registration statement, a prospectus that meets the requirements of Section 10(a) of the Securities Act of 1933.

Reoffer Prospectus

7,920,000 Shares

Enertopia Corporation

Common Stock

_______________________________

The selling stockholders identified in this reoffer prospectus may offer and sell up to 7,920,000 of our common stock issued or issuable upon exercise of stock options. We granted the stock options to such selling stockholders pursuant to our 2014 stock option plan.

The selling stockholders may sell all or a portion of the shares being offered pursuant to this reoffer prospectus at fixed prices, at prevailing market prices at the time of sale, at varying prices or at negotiated prices.

The selling stockholders and any brokers executing selling orders on their behalf may be deemed to be "underwriters" within the meaning of the Securities Act of 1933, in which event commissions received by such brokers may be deemed to be underwriting commissions under the Securities Act of 1933.

We will not receive any proceeds from the sale of the shares of our common stock by the selling stockholders. We may, however, receive proceeds upon exercise of the stock options by the selling stockholders. We will pay for expenses of this offering, except that the selling stockholders will pay any broker discounts or commissions or equivalent expenses and expenses of their legal counsel applicable to the sale of their shares.

Our common stock is quoted on the Financial Industry Regulatory Authority's OTC Markets under the symbol "ENRT". On January 21, 2021, the closing price of our common stock on the OTC Markets was $0.060 per share.

_______________________________

Investing in our common stock involves risks. See "Risk Factors" beginning on page 7.

_______________________________

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

_______________________________

The date of this reoffer prospectus is January 21, 2021.

Table of Contents

In this reoffer prospectus, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock. As used in this reoffer prospectus, unless otherwise specified, the terms “we”, “us”, “our” mean Enertopia Corporation, a Nevada corporation and/or our wholly owned subsidiaries, where applicable.

Prospectus Summary

Our Business

Enertopia Corp. ("we", "us", "our", "Enertopia", or the "Company") is a development and exploration stage company pursuing business opportunities in the natural resource sector (with a focus on the acquisition of lithium resource properties and lithium brine extraction technology), and in the renewable energy sector. To date, we have only generated nominal revenues from our former renewable energy operations and our previously owned oil and gas assets.

Mineral Property Exploration and Acquisition

In July 2017, we acquired a land position in the Clayton Valley of Nevada by staking 8 placer mining claims (the Steve claims) and 9 lode mining claims (the Dan claims). The claims were staked by McKay Mineral Exploration of Ogden, Utah for our U. S. subsidiary, Enertopia Corporation of Reno, Nevada. The land package covers 160 acres (65 hectares). Enertopia holds the claims free and clear with the exception of two 1% NSR royalties held by third parties.

Soon after the claim staking and initial sampling on our claims in 2017, we began bench testing commercially available extraction methods using surface samples from our Clayton Valley property. On November 5, 2018, we received an Area of Disturbance permit from the Bureau of Land Management, Nevada, allowing access for a series of five diamond drill holes totaling approximately 2,000 feet. Drilling commenced on December 8, 2018 and was completed on December 18, 2018. Four of the holes were for exploration and the fifth one was used for metallurgical testing.

On February 14, 2019 we announced the drill result from the diamond drill program. On April 2, 2020 the Company announced its maiden resource report prepared pursuant to Canadian National Instrument 43-101 (Standards of Disclosure for Mineral Projects) which can be found at the Company's website www.enertopia.com.

We have not determined whether our property contains any mineral reserve. A mineral reserve is defined by the Securities and Exchange Commission in its Industry Guide 7 (which can be viewed over the Internet at h ttp://www.sec.gov/about/forms/industryguides.pdf) as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination.

We have not begun significant operations and are considered an exploration stage company, as that term is defined in Industry Guide 7.

Renewable Energy

On December 14, 2021 we entered into an Asset Purchase Agreement and a Patent Assignment Agreement with Albert Clark Rich pursuant to which we acquired all rights, title and associated intellectual property in and to USPTO patent #6,024,086 - Solar energy collector having oval absorption tubes, which is a method for harnessing waste heat with potential applications in mining and other industrial settings. The total purchase price payable by the Company to the seller is 2,000,000 of our common shares. 1,000,000 common shares were issued upon the transfer and delivery of the IP Assets to the Company and the remaining 1,000,000 common shares will be issued and held in escrow until the updated patents are approved by the US Patent Office as fully set out in the Asset Purchase Agreement.

Our principal offices are located at #22 1873 Spall Road, Kelowna, British Columbia V1Y 4R2. Our telephone number is (250) 870-2219.

The Offering

The selling stockholders identified in this reoffer prospectus may offer and sell up to 7,920,000 shares of our common stock issued or issuable upon exercise of stock options. We granted the stock options to such selling stockholders pursuant to our 2014 stock option plan.

The selling stockholders may sell all or a portion of the shares being offered pursuant to this reoffer prospectus at fixed prices, at prevailing market prices at the time of sale, at varying prices or at negotiated prices.

Number of Shares Outstanding

There were 133,471,700 shares of our common stock issued and outstanding as at January 21, 2020.

Use of Proceeds

We will not receive any proceeds from the sale of any shares of our common stock by the selling stockholders. We may however receive proceeds upon exercise of the stock options by the selling stockholders. If we receive proceeds upon exercise of these stock options, we intend to use these proceeds for working capital and general corporate purposes.

Risk Factors

An investment in our common stock involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in this prospectus in evaluating our company and our business. Our business, operating results and financial condition could be seriously harmed by the occurrence of any of the following risks. You could lose all or part of your investment due to any of these risks. You should invest in our common stock only if you can afford to lose your entire investment.

Risks Associated With Mining

Our property is in the exploration stage. There is no assurance that we can establish the existence of any mineral reserve on our property. Unless and until we can do so, we cannot earn any revenues from operations and if we do not do so we may lose all of the funds that we have spent on exploration. If we do not discover any mineral reserve, our business may fail.

Although we have commenced exploration work on our mineral property, we have not established that it contains any mineral reserve, and there is no assurance that any such reserve will be established. If we are unable to establish a mineral reserve on our property, our business may fail.

A mineral reserve is defined by the Securities and Exchange Commission in its Industry Guide 7 (which can be viewed over the Internet at h ttp://www.sec.gov/about/forms/industryguides.pdf ) as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. The probability of an individual prospect ever having a "reserve" that meets the requirements of the Securities and Exchange Commission's Industry Guide 7 is extremely remote; in all probability none of our mineral resource properties contains any 'reserve' and any funds that we spend on exploration will probably be lost.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the resource to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral resource unprofitable.

Mineral operations are subject to applicable law and government regulation. Even if we discover a mineral resource in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of that mineral resource. If we cannot exploit any mineral resource that we discover on our property, our business may fail.

Both mineral exploration and extraction require permits from various foreign, federal, state, provincial and local governmental authorities, and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration of our mineral property or for the construction and operation of a mine on our property at an economically viable cost. If we cannot accomplish these objectives, our business could fail. Although we believe that we are compliant with all material laws and regulations that currently apply to our activities, we can give no assurance that we will continue to remain in compliance. Current laws and regulations may be amended and we might not be able to comply with them, as amended. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that we will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of our mineral property.

If we establish the existence of a mineral reserve on our property, we will require additional capital in order to develop the property into a producing mine. If we cannot raise this additional capital, we will not be able to exploit the reserve and our business could fail.

If we do discover a mineral reserve on our property, we will be required to expend substantial sums of money to establish the extent of the reserve, develop processes to extract it and develop extraction and processing facilities and infrastructure. Although we may derive substantial benefits from the discovery of a reserve, there can be no assurance that any reserve established will be large enough to justify commercial operations, nor can there be any assurance that we will be able to raise the funds required for development on a timely basis. If we cannot raise the necessary capital or complete the necessary facilities and infrastructure, our business may fail.

Mineral exploration and development is subject to extraordinary operating risks. We do not currently insure against these risks. In the event of a cave-in or similar occurrence, our liability may exceed our resources, which would have an adverse impact on our company.

Mineral exploration, development and production involves many risks that may not be mitigated, even by a combination of experience, knowledge and careful evaluation. Our operations will be subject to all of the hazards and risks inherent in mineral exploration and, if we discover a mineral reserve, our operations will be subject to all of the hazards and risks inherent in the development and production of a mineral reserve, including liability for pollution, cave-ins or similar hazards against which we cannot insure, or against which we may elect not to insure. Any such event could result in work stoppages and damage to property, including damage to the environment. We do not currently maintain any insurance coverage against these operating hazards. The payment of any liabilities that may arise from any such occurrence would likely have a material adverse impact on our company.

Mineral prices are subject to dramatic and unpredictable fluctuations and the economic viability of our exploration property cannot be accurately predicted.

We expect to derive revenues, if any, either from the sale of our mineral property or from the extraction and sale of base metals such copper. The price of this commodity has fluctuated widely in recent years and is affected by numerous factors beyond our control, including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities and increased production due to new extraction developments and improved extraction and production methods. The effect of these factors are based on the price of base metals and therefore the economic viability of our exploration property cannot accurately be predicted.

Title to properties in we retain an ownership interest may be challenged, impugned or revoked or be subject to undetected defects, which may result in the loss of all or a portion of our rights or interests.

Although we have exercised customary due diligence with respect to determining title to our properties, there can be no assurance that our rights or interests will not be challenged, impugned or revoked. Our properties may be subject to prior unregistered agreements or transfers or indigenous land claims and title may be affected by undetected defects. If a title defect exists, it is possible that we may lose all or a portion of our interest in the applicable property(ies). Until any competing rights or interest in our properties have been determined, there is no assurance as to the validity of our rights or interest to any properties. In addition, we may be unable to operate our properties as permitted, or to enforce our rights with respect to our properties, and the title to our mineral properties may also be impacted by state action.

The mining industry is highly competitive and there is no assurance that we will continue to be successful in acquiring mineral claims. If we cannot continue to acquire properties to explore for mineral resources, we may be required to reduce or cease operations.

The mineral exploration, development, and production industry is largely unintegrated. We may compete with other exploration companies looking for mineral resource properties. Some of these other companies possess greater financial resources and technical facilities. This competition could adversely affect our ability to acquire suitable prospects for exploration in the future. Accordingly, there can be no assurance that we will acquire any interest in additional mineral resource properties that might yield reserves or result in commercial mining operations. While we may compete with other exploration companies in the effort to locate and acquire mineral resource properties, we do not believe that we will compete with them for the removal or sales of mineral products from our properties if we should eventually discover the presence of them in quantities sufficient to make production economically feasible. Readily available markets exist worldwide for the sale of mineral products. Therefore, we will likely be able to sell any mineral products that we identify and produce.

Newer battery and/or fuel cell technologies could decrease demand for lithium over time, which could significantly affect our prospects and future revenues.

Many materials and technologies are being researched and developed with the goal of making batteries lighter, more efficient, faster charging and less expensive. Some of these technologies could be successful and could impact demand for lithium batteries in personal electronics, electric and hybrid vehicles and other applications. Advances in nanotechnology, in particular, offer the prospect of significantly better batteries in the future. For example, researchers at Stanford University have recently demonstrated ultra-lightweight, bendable batteries and super capacitors made from paper coated with ink made of carbon nanotubes and silver nanowires; the material charges and discharges very quickly, making it potentially useful in hybrid and electric vehicles, which need rapid power for acceleration and would benefit from quicker charging than is available with current technologies. We cannot predict which new technologies may ultimately prove to be commercially viable and on what time horizon. While lithium battery technology is currently among the best available for electronics, vehicles and other applications, commercialized battery technologies that offer superior weight, capacity, charging time and/or cost could significantly adversely affect the demand for lithium in the future and thus could significantly adversely impact our prospects and future revenues.

Lithium prices are subject to unpredictable fluctuations, making it difficult to predict the economic viability of our exploration property.

We may derive revenues, if any, from the extraction and sale of lithium from our Clayton Valley resource property, as well as other potentially economic salts produced from the lithium brines. The price of these commodities may fluctuate widely, and is affected by numerous factors beyond our control, including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities, increased production due to new extraction developments and improved extraction and production methods and technological changes in the markets for the end products. The effect of these factors on the price of these minerals, and therefore the economic viability of our exploration properties, cannot accurately be predicted.

Risks Associated with Our Company

We have a limited operating history with losses and we expect the losses to continue, which raises concerns about our ability to continue as a going concern.

We have generated minimal revenues since our inception and will, in all likelihood, continue to incur operating expenses with minimal revenues until we are able to successfully develop our business. Our business plan will require us to incur further expenses. We may not be able to ever become profitable. These circumstances raise concerns about our ability to continue as a going concern. We have a limited operating history and must be considered in the start-up stage.

We will require additional financing to develop our business plan.

Because we have generated only minimal revenue from our business and cannot anticipate when we will be able to generate meaningful revenue from our business, we will need to raise additional funds to conduct and grow our business. We do not currently have sufficient financial resources to completely fund the development of our business plan. We anticipate that we will need to raise further financing. We do not currently have any arrangements for financing and we can provide no assurance to investors that we will be able to find such financing if required. The most likely source of future funds presently available to us is through the sale of equity capital. Any sale of share capital will result in dilution to existing security-holders.

Because the majority of our officers and directors are located outside of the United States, you may have no effective recourse against them for misconduct and you may not be able to enforce judgment and civil liabilities against them.

A majority of our directors and officers are nationals and/or residents of countries other than the United States and all or a substantial portion of their assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof.

Conflicts of interest between our company and our directors and officers may result in a loss of business opportunity.

Our directors and officers are not obligated to commit their full time and attention to our business and, accordingly, they may encounter a conflict of interest in allocating their time between our future operations and those of other businesses. In the course of their other business activities, they may become aware of investment and business opportunities which may be appropriate for presentation to us as well as other entities to which they owe a fiduciary duty. As a result, they may have conflicts of interest in determining to which entity a particular business opportunity should be presented. They may also in the future become affiliated with entities, engaged in business activities similar to those we intend to conduct.

In general, officers and directors of a corporation are required to present business opportunities to a corporation if:

-

the corporation could financially undertake the opportunity;

-

the opportunity is within the corporation's line of business; and

-

it would be unfair to the corporation and its stockholders not to bring the opportunity to the attention of the corporation.

We plan to adopt a code of ethics that obligates our directors, officers and employees to disclose potential conflicts of interest and prohibits those persons from engaging in such transactions without our consent. Despite our intentions, conflicts of interest may nevertheless arise which may deprive our company of a business opportunity, which may impede the successful development of our business and negatively impact the value of an investment in our company.

Risks Associated with Our Common Stock

Our stock is a penny stock. Trading of our stock may be restricted by the SEC's penny stock regulations and the FINRA's sales practice requirements, which may limit a stockholder's ability to buy and sell our stock.

Our stock is a penny stock. The Securities and Exchange Commission has adopted Rule 15g-9 which generally defines "penny stock" to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and "accredited investors". The term "accredited investor" refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in, and limit the marketability of, our common stock.

The Financial Industry Regulatory Authority, or FINRA, has adopted sales practice requirements which may also limit a stockholder's ability to buy and sell our stock.

In addition to the "penny stock" rules promulgated by the Securities and Exchange Commission, the Financial Industry Regulatory Authority has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, the Financial Industry Regulatory Authority believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The Financial Industry Regulatory Authority requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock.

Because we can issue additional shares, purchasers of our shares may incur immediate dilution and may experience further dilution.

We are authorized to issue up to 200,000,000 shares. The board of directors of our company has the authority to cause us to issue additional shares, and to determine the rights, preferences and privileges of such shares, without consent of any of our stockholders. Consequently, our stockholders may experience more dilution in their ownership of our company in the future.

Our by-laws contain provisions indemnifying our officers and directors against all costs, charges and expenses incurred by them.

Our by-laws contain provisions with respect to the indemnification of our officers and directors against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, actually and reasonably incurred by him, including an amount paid to settle an action or satisfy a judgment in a civil, criminal or administrative action or proceeding to which he is made a party by reason of his being or having been one of our directors or officers.

Investors' interests in our company will be diluted and investors may suffer dilution in their net book value per share if we issue additional shares or raise funds through the sale of equity securities.

Our constating documents authorize the issuance of 200,000,000 shares of common stock with a par value of $0.001. In the event that we are required to issue any additional shares or enter into private placements to raise financing through the sale of equity securities, investors" interests in our company will be diluted and investors may suffer dilution in their net book value per share depending on the price at which such securities are sold. If we issue any such additional shares, such issuances also will cause a reduction in the proportionate ownership and voting power of all other shareholders. Further, any such issuance may result in a change in our control.

Our by-laws do not contain anti-takeover provisions, which could result in a change of our management and directors if there is a take-over of our company.

We do not currently have a shareholder rights plan or any anti-takeover provisions in our By-laws. Without any anti-takeover provisions, there is no deterrent for a take-over of our company, which may result in a change in our management and directors.

Forward-Looking Statements

This reoffer prospectus contains forward-looking statements. Forward-looking statements are projections of events, revenues, income, future economic performance or management's plans and objectives for future operations. In some cases, you can identify forward- looking statements by the use of terminology such as "may", "should", "expect", "plan", "anticipate", "believe", "estimate", "predict", "potential" or "continue" or the negative of these terms or other comparable terminology. Examples of forward-looking statements made in this prospectus include statements about:

• Our future exploration programs and results,

• Our future capital expenditures, and

• Our future investments in and acquisitions of mineral resource properties.

These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including:

• General economic and business conditions;

• Exposure to market risks in our financial instruments;

• Fluctuations in worldwide prices and demand for minerals,

• Fluctuations in the levels of our exploration and development activities;

• Risks associated with mineral resource exploration and development activities;

• Competition for resource properties and infrastructure in the mineral exploration industry;

• Technological changes and developments in the mineral exploration and mining industry; Technological changes and developments in the lithium battery industry and related industries,

• Regulatory uncertainties and potential environmental liabilities; and The risks in the section of this prospectus entitled "Risk Factors";

any of which may cause our company's or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements and any assumptions upon which they are based are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States and Canada, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

The Offering

The selling stockholders identified in this reoffer prospectus may offer and sell up to 7,920,000 shares of our common stock issued or issuable upon exercise of stock options. We granted the stock options to such selling stockholders pursuant to our 2014 stock option plan.

Use of Proceeds

We will not receive any proceeds from the sale of the shares of our common stock by the selling stockholders. We may, however, receive proceeds upon exercise of the stock options granted to the selling stockholders. If we receive proceeds upon exercise of stock options, we intend to use these proceeds for working capital and general corporate purposes.

Determination of Offering Price

The selling stockholders may sell all or a portion of the shares being offered pursuant to this reoffer prospectus at fixed prices, at prevailing market prices at the time of sale, at varying prices or at negotiated prices.

Selling Stockholders

The selling stockholders may offer and sell, from time to time, any or all of shares of our common stock issued or issuable upon exercise of the stock options granted pursuant to our 2014 stock option plan.

The following table sets forth certain information regarding the beneficial ownership of shares of common stock by the selling stockholders as of January 18, 2021 and the number of shares of our common stock being offered pursuant to this reoffer prospectus. We believe that the selling stockholders have sole voting and investment powers over their shares.

Because the selling stockholders may offer and sell all or only some portion of the 7,920,000 shares of our common stock being offered pursuant to this reoffer prospectus, the numbers in the table below representing the amount and percentage of these shares of our common stock that will be held by the selling stockholders upon termination of the offering are only estimates based on the assumption that each selling stockholder will sell all of his shares of our common stock being offered in the offering.

None of the selling stockholders is a broker-dealer or an affiliate of a broker-dealer. We may require the selling stockholders to suspend the sales of the shares of our common stock being offered pursuant to this reoffer prospectus upon the occurrence of any event that makes any statement in this reoffer prospectus or the related registration statement untrue in any material respect or that requires the changing of statements in those documents in order to make statements in those documents not misleading.

|

Name of

Selling Stockholder

|

Shares Owned

by the Selling

Stockholder

before the

Offering(1)

|

Total Shares

Offered

in the Offering

|

Number of Shares to Be Owned

by Selling Stockholder

and Percent of Total Issued

and Outstanding Shares

After the Offering (1)

|

|

# of Shares(2)

|

% of

Class(2),(3)

|

|

|

|

|

|

|

|

Robert McAllister(4)

|

8,105,000 (5)

|

1,000,000

|

7,105,000

|

5.32%

|

|

Bal Bhullar(6)

|

501,000 (7)

|

500,000

|

1,000

|

*

|

|

Kevin Brown(8)

|

1.055,000(9)

|

750,000

|

Nil

|

*

|

|

Kristin Hamilton**

|

70,000(10)

|

70,000

|

Nil

|

*

|

|

JAT Metconsult Ltd **

|

700,000(11)

|

500,000

|

Nil

|

*

|

|

Kristian Ross(12)

|

762,500(13)

|

750,000

|

12,500

|

*

|

|

John Thomas(14)

|

251,204(15)

|

250,000

|

1,024

|

*

|

|

Mark Snyder**

|

3,429,462(16)

|

3,000,000

|

429,462

|

*

|

|

Steve Haas**

|

500,000(17)

|

500,000

|

Nil

|

*

|

|

Albert Charles Rich**

|

500,000(18)

|

500,000

|

Nil

|

*

|

|

Rodney B. Blake**

|

100,000(19)

|

100,000

|

Nil

|

*

|

Notes

* Less than 1%.

** Non-Affiliate Advisor or Consultant

(1) Beneficial ownership is determined in accordance with Securities and Exchange Commission rules and generally includes voting or investment power with respect to shares of common stock. Shares of common stock subject to options, warrants and convertible preferred stock currently exercisable or convertible, or exercisable or convertible within 60 days, are counted as outstanding for computing the percentage of the person holding such options, warrants or convertible preferred stock but are not counted as outstanding for computing the percentage of any other person.

(2) We have assumed that the selling stockholders will sell all of the shares being offered in this offering.

(3) Based on 133,471,700 shares of our common stock issued and outstanding as of January 21, 2021. Shares of our common stock being offered pursuant to this reoffer prospectus by a selling stockholder are counted as outstanding for computing the percentage of that particular selling stockholder but are not counted as outstanding for computing the percentage of any other person.

(4) Mr. McAllister is the President, Chief Executive Officer, Chief Financial Officer and sole director of our company.

(5) Represents 6,505,000 issued common shares, 500,000 unissued common shares underlying stock options exercisable until 20-01-2022 at 0.07 per share, 500,000 unissued common shares underlying stock options exercisable until 24-12-2025 at 0.05 per share, 400,000 unissued common shares underlying stock warrants exercisable until 31-08-2021 at 0.05 per share, and 200,000 unissued common shares underlying stock warrants exercisable until 21-09-2021 at 0.05 per share .

(6) Ms. Bhullar is our former Chief Financial Officer.

(7) Represents 1,000 issued common shares and 500,000 unissued common shares underlying stock options exercisable until 20-01-2022 at 0.07 per share.

(8) Mr. Brown is a former Director of the Company.

(9) Represent 305,000 issued common shares, 500,000 unissued common shares underlying stock options exercisable until 20-1-2022 at $0.07 per share, and 250,000 unissued common shares underlying stock options exercisable until 11-5-2023 at $0.05 per share

(10) Represents 35,000 unissued common shares underlying stock options exercisable until 20-01-2022 at 0.07 per share, and 35,000 unissued common shares underlying stock options exercisable until 11-5-2023 at $0.06 per share.

(11) Represents 200,000 issued common shares and 500,000 unissued common shares underlying stock options exercisable until 5-2-2022 at $0.10 per share.

(12) Mr. Ross is a former Director of the Company.

(13) Represent 12,500 issued common shares, 500,000 unissued common shares underlying stock options exercisable until 27-10-2022 at $0.05 per share, and 250,000 unissued common shares underlying stock options exercisable until 11-5-2023 at $0.06 per share.

(14) Mr. Thomas is a former Director of the Company.

(15) Represents 1,204 issued common shares and 250,000 unissued common shares underlying stock options exercisable until 22-5-2022 at $0.07 per share.

(16) Represent 429,462 issued common shares, 2,000,000 unissued common shares underlying stock options exercisable until 25-2-2022 at $0.02 per share, and 1,000,000 unissued common shares underlying stock options exercisable until 14-12-2025 until $0.05 per share.

(17) Represent 500,000 unissued common shares underlying stock options exercisable until 14-12-2025 at $0.05 per share.

(18) Represent 500,000 unissued common shares underlying stock options exercisable until 14-12-2025 at $0.05 per share.

(19) Represent 100,000 unissued common shares underlying stock options exercisable until 14-12-2025 at $0.05 per share.

Plan of Distribution

The selling stockholders may, from time to time, sell all or a portion of the shares of our common stock on any market upon which our common stock may be listed or quoted (currently Financial Industry Regulatory Authority's OTC Bulletin Board and the Canadian National Stock Exchange), in privately negotiated transactions or otherwise. Such sales may be at fixed prices prevailing at the time of sale, at prices related to the market prices or at negotiated prices. The shares of our common stock being offered for resale pursuant to this reoffer prospectus may be sold by the selling stockholders by one or more of the following methods, without limitation:

1. block trades in which the broker or dealer so engaged will attempt to sell the shares of our common stock as agent but may position and resell a portion of the block as principal to facilitate the transaction;

2. purchases by broker or dealer as principal and resale by the broker or dealer for its account pursuant to this reoffer prospectus;

3. an exchange distribution in accordance with the rules of the exchange or quotation system;

4. ordinary brokerage transactions and transactions in which the broker solicits purchasers;

5. privately negotiated transactions;

6. market sales (both long and short to the extent permitted under the federal securities laws);

7. at the market to or through market makers or into an existing market for the shares;

8. through transactions in options, swaps or other derivatives (whether exchange listed or otherwise); and

9. a combination of any aforementioned methods of sale.

In the event of the transfer by any of the selling stockholders of his shares of our common stock or stock options to any pledgee, donee or other transferee, we will amend this reoffer prospectus and the registration statement of which this reoffer prospectus forms a part by the filing of a post-effective amendment in order to have the pledgee, donee or other transferee in place of the selling stockholder who has transferred his shares.

In effecting sales, brokers and dealers engaged by the selling stockholders may arrange for other brokers or dealers to participate. Brokers or dealers may receive commissions or discounts from a selling stockholder or, if any of the broker-dealers act as an agent for the purchaser of such shares, from a purchaser in amounts to be negotiated which are not expected to exceed those customary in the types of transactions involved. Broker-dealers may agree with a selling stockholder to sell a specified number of the shares of our common stock at a stipulated price per share. Such an agreement may also require the broker-dealer to purchase as principal any unsold shares of our common stock at the price required to fulfill the broker-dealer commitment to the selling stockholder if such broker- dealer is unable to sell the shares on behalf of the selling stockholder. Broker-dealers who acquire shares of our common stock as principal may thereafter resell the shares of our common stock from time to time in transactions which may involve block transactions and sales to and through other broker-dealers, including transactions of the nature described above. Such sales by a broker-dealer could be at prices and on terms then prevailing at the time of sale, at prices related to the then-current market price or in negotiated transactions. In connection with such resale, the broker-dealer may pay to or receive from the purchasers of the shares commissions as described above.

The selling stockholders and any broker-dealers or agents that participate with the selling stockholders in the sale of the shares of our common stock may be deemed to be "underwriters" within the meaning of the Securities Act of 1933 in connection with these sales. In that event, any commissions received by the broker-dealers or agents and any profit on the resale of the shares of common stock purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act of 1933.

From time to time, any of the selling stockholders may pledge shares of our common stock pursuant to the margin provisions of customer agreements with brokers. Upon a default by a selling stockholder, his broker may offer and sell the pledged shares of our common stock from time to time. Upon a sale of the shares of our common stock, we believe that the selling stockholders will satisfy the prospectus delivery requirements under the Securities Act of 1933. We will file any amendments or other necessary documents in compliance with the Securities Act of 1933 which may be required in the event any of the selling stockholders defaults under any customer agreement with brokers.

To the extent required under the Securities Act of 1933, a post-effective amendment to the registration statement of which this reoffer prospectus forms a part will be filed disclosing the name of any broker-dealers, the number of shares of our common stock involved, the price at which our common stock is to be sold, the commissions paid or discounts or concessions allowed to such broker-dealers, where applicable, that such broker-dealers did not conduct any investigation to verify the information set out or incorporated by reference in this reoffer prospectus and other facts material to the transaction.

We and the selling stockholders will be subject to applicable provisions of the Securities Exchange Act of 1934 and the rules and regulations under it, including, without limitation, Rule 10b-5 and, insofar as a selling stockholder is a distribution participant and we, under certain circumstances, may be a distribution participant, under Regulation M. All of the foregoing may affect the marketability of our common stock.

All expenses for this reoffer prospectus and related registration statement including legal, accounting, printing and mailing fees are and will be borne by us. Any commissions, discounts or other fees payable to brokers or dealers in connection with any sale of the shares of common stock will be borne by the selling stockholders, the purchasers participating in such transaction, or both.

Any shares of our common stock being offered pursuant to this reoffer prospectus which qualify for sale pursuant to Rule 144 under the Securities Act of 1933, may be sold under Rule 144 rather than pursuant to this reoffer prospectus.

Experts and Counsel

Our financial statements for the years ended August 31, 2020 and 2019 incorporated in this reoffer prospectus by reference from our annual report on Form 10-K for the year ended August 31, 2020 filed with the Securities and Exchange Commission on November 04, 2020 have been audited by Davidson & Company LLP Chartered Professional Accountants which are incorporated herein by reference, and have been so incorporated in reliance upon such report given upon the authority of said firm as experts in auditing and accounting.

W.L. Macdonald Law Corporation, of 409 - 221 W. Esplanade, North Vancouver, British Columbia, Canada, V7M 3J3has provided an opinion on the validity of the shares of our common stock being offered pursuant to this reoffer prospectus.

Interest of Named Experts and Counsel

No expert named in the registration statement of which this reoffer prospectus forms a part as having prepared or certified any part thereof (or is named as having prepared or certified a report or valuation for use in connection with such registration statement) or counsel named in this reoffer prospectus as having given an opinion upon the validity of the securities being offered pursuant to this reoffer prospectus or upon other legal matters in connection with the registration or offering such securities was employed for such purpose on a contingency basis. Also at the time of such preparation, certification or opinion or at any time thereafter, through the date of effectiveness of such registration statement or that part of such registration statement to which such preparation, certification or opinion relates, no such person had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in our company or any of its parents or subsidiaries. Nor was any such person connected with our company or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer or employee.

Material Changes

There have been no material changes to the affairs of our company since August 31, 2020 which have not previously been described in a report on Form 10-Q or Form 8-K filed with the Securities and Exchange Commission.

Incorporation of Certain Information by Reference

The following documents filed by our company with the Securities and Exchange Commission are incorporated into this reoffer prospectus by reference:

1. Our annual report on Form 10-K for the year ended August 31, 2020 filed on November 04, 2020;

2. Our quarterly report on Form 10-Q filed on January 13, 2011;

3. Our current reports on Form 8-K filed on December 17, 2020, and January 13, 2021;

4. The description of our common stock contained in our registration statement on Form SB-2/A filed on March 21, 2006, as amended by our current reports on Form 8-K filed on September 25, 2009 and March 4, 2010, including any amendments or reports filed for the purpose of updating such description.

In addition to the foregoing, all documents that we subsequently file pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, prior to the filing of a post-effective amendment indicating that all of the securities offered pursuant to the registration statement of which this reoffer prospectus forms a part have been sold or deregistering all securities then remaining unsold, will be deemed to be incorporated by reference into this reoffer prospectus and to be part hereof from the date of filing of such documents. Any statement contained in a document incorporated by reference in this reoffer prospectus will be deemed to be modified or superseded for purposes of this reoffer prospectus to the extent that a statement contained in this reoffer prospectus or in any subsequently filed document that is also incorporated by reference in this reoffer prospectus modifies or supersedes such statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this reoffer prospectus.

Where You Can Find More Information

We will provide to each person, including any beneficial owner, to whom this reoffer prospectus is delivered, a copy of any or all of the information that has been incorporated by reference into this reoffer prospectus but not delivered with this reoffer prospectus, upon written or oral request of such person at no cost to such person. Please send us such request by writing to Enertopia Corporation at #22 1873 Spall Rd., Kelowna, British Columbia, Canada V1Y 4R2, or by calling the Company at (250) 870-2219.

We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission. Such filings are available to the public over the internet at the Securities and Exchange Commission's website at http://www.sec.gov. The public may also read and copy any materials we file with the Securities and Exchange Commission at its public reference room at 100 F Street, N.E. Washington, D.C. 20549. The public may obtain information on the operation of the public reference room by calling the Securities and Exchange Commission at 1-800-SEC-0330.

We have filed with the Securities and Exchange Commission a registration statement on Form S-8 under the Securities Act of 1933 with respect to the securities offered under this reoffer prospectus. This reoffer prospectus, which forms a part of that registration statement, does not contain all information included in the registration statement. Certain information is omitted and you should refer to the registration statement and its exhibits.

You should only rely on the information incorporated by reference or provided in this reoffer prospectus or any supplement. We have not authorized anyone else to provide you with different information. This reoffer prospectus does not constitute an offer to sell or a solicitation of an offer to buy any of the securities offered hereby by anyone in any jurisdiction in which such offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such offer or solicitation. You should not assume that the information in this reoffer prospectus or any supplement is accurate as of any date other than the date of this reoffer prospectus.

17,400,000

Enertopia Corporation

Common Stock

_________________________________

Prospectus

_________________________________

January 21, 2021

Part II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed by our company with the Securities and Exchange Commission are incorporated into this registration statement by reference:

1. Our annual report on Form 10-K for the year ended August 31, 2020 filed on November 04, 2020;

2. Our quarterly report on Form 10-Q filed on January 13, 2011;

3. Our current reports on Form 8-K filed on December 17, 2020, and January 13, 2021;

4. The description of our common stock contained in our registration statement on Form SB-2/A filed on March 21, 2006, as amended by our current reports on Form 8-K filed on September 25, 2009 and March 4, 2010, including any amendments or reports filed for the purpose of updating such description.

In addition to the foregoing, all documents that we subsequently file pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, prior to the filing of a post-effective amendment indicating that all of the securities offered pursuant to this registration statement have been sold or deregistering all securities then remaining unsold, will be deemed to be incorporated by reference into this registration statement and to be part hereof from the date of filing of such documents. Any statement contained in a document incorporated by reference in this registration statement will be deemed to be modified or superseded for purposes of this registration statement to the extent that a statement contained in this registration statement or in any subsequently filed document that is also incorporated by reference in this registration statement modifies or supersedes such statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this registration statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

No expert named in this registration statement as having prepared or certified any part thereof (or is named as having prepared or certified a report or valuation for use in connection with this registration statement) or counsel named in this registration statement as having given an opinion upon the validity of the securities being offered pursuant to this registration statement or upon other legal matters in connection with the registration or offering such securities was employed for such purpose on a contingency basis. Also at the time of such preparation, certification or opinion or at any time thereafter, through the date of effectiveness of such registration statement or that part of such registration statement to which such preparation, certification or opinion relates, no such person had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in our company or any of its parents or subsidiaries. Nor was any such person connected with our company or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer or employee.

Item 6. Indemnification of Directors and Officers.

Nevada Revised Statutes provide that:

• a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, except an action by or in the right of the corporation, by reason of the fact that he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses, including attorneys' fees, judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with the action, suit or proceeding if he or she acted in good faith and in a manner which he or she reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful;

• a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that he or she is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against expenses, including amounts paid in settlement and attorneys' fees actually and reasonably incurred by him or her in connection with the defense or settlement of the action or suit if he or she acted in good faith and in a manner which he or she reasonably believed to be in or not opposed to the best interests of the corporation. Indemnification may not be made for any claim, issue or matter as to which such a person has been adjudged by a court of competent jurisdiction, after exhaustion of all appeals therefrom, to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only to the extent that the court in which the action or suit was brought or other court of competent jurisdiction determines upon application that in view of all the circumstances of the case, the person is fairly and reasonably entitled to indemnity for such expenses as the court deems proper; and

• to the extent that a director, officer, employee or agent of a corporation has been successful on the merits or otherwise in defense of any action, suit or proceeding, or in defense of any claim, issue or matter therein, the corporation must indemnify him or her against expenses, including attorneys' fees, actually and reasonably incurred by him or her in connection with the defense.

Nevada Revised Statutes provide that we may make any discretionary indemnification only as authorized in the specific case upon a determination that indemnification of the director, officer, employee or agent is proper in the circumstances. The determination must be made:

• by our stockholders;

• by our board of directors by majority vote of a quorum consisting of directors who were not parties to the action, suit or proceeding;

• if a majority vote of a quorum consisting of directors who were not parties to the action, suit or proceeding so orders, by independent legal counsel in a written opinion;

• if a quorum consisting of directors who were not parties to the action, suit or proceeding cannot be obtained, by independent legal counsel in a written opinion; or

• by court order.

Nevada Revised Statutes provide that a corporation may purchase and maintain insurance or make other financial arrangements on behalf of any person who is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise for any liability asserted against him and liability and expenses incurred by him in his capacity as a director, officer, employee or agent, or arising out of his status as such, whether or not the corporation has the authority to indemnify him against such liability and expenses.

Our bylaws provide that:

• our directors must cause our company to indemnify a director or former director of our company and our directors may cause our company to indemnify a director or former director of a corporation of which our company is or was a shareholder and the heirs and personal representatives of any such person against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, actually and reasonably incurred by him or them including an amount paid to settle an action or satisfy a judgment inactive criminal or administrative action or proceeding to which he is or they are made a party by reason of his or her being or having been a director of our company or a director of such corporation, including an action brought by us or another corporation. Each director of our company on being elected or appointed is deemed to have contracted with our company on the terms of the foregoing indemnity;

• our directors may cause our company to indemnify an officer, employee or agent of our company or of a corporation of which our company is or was a shareholder (notwithstanding that he is also a director of our company), and his or her heirs and personal representatives against all costs, charges and expenses incurred by him or them and resulting from his or her acting as an officer, employee or agent of our company or another corporation. In addition we must indemnify the Secretary or an Assistance Secretary of our company (if he is not a full time employee of our company and notwithstanding that he is also a director of our company), and his or her respective heirs and legal representatives against all costs, charges and expenses incurred by him or them and arising out of the functions assigned to the Secretary by the Nevada corporate law, or our articles of incorporation and each such Secretary and Assistant Secretary, on being appointed is deemed to have contracted with our company on the terms of the foregoing indemnity; and

Our directors may cause our company to purchase and maintain insurance for the benefit of a person who is or was serving as a director, officer, employee or agent of our company or as a director, officer, employee or agent of a corporation of which our company is or was a shareholder and his or her heirs or personal representatives against a liability incurred by him as a director, officer, employee or agent.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

*Filed herewith.

Item 9. Undertakings.

The undersigned registrant hereby undertakes:

1. To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

i. To include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

ii. To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the "Calculation of Registration Fee" table in the effective registration statement; and

iii. To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

Provided however, that paragraphs (1)(i) and (1)(ii) do not apply if the information required to be included in a post- effective amendment by those paragraphs is contained in reports filed with or furnished to the Securities and Exchange Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement

2. That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; and

3. To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant's annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan's annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Kelowna, Province of British Columbia, Canada, on January 22, 2021.

Enertopia Corporation

By:

/s/ Robert McAllister

Robert McAllister

President and Director

(Principal Executive Officer)

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the date indicated.

/s/ Robert McAllister

Robert McAllister

President and Director

(Principal Executive Officer)

Date: January 22, 2021

/s/ Robert McAllister

Robert McAllister

Chief Financial Officer

(Principal Financial Officer)

Date: January 22, 2021

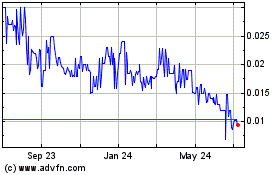

Enertopia (QB) (USOTC:ENRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

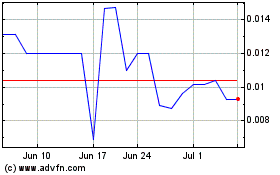

Enertopia (QB) (USOTC:ENRT)

Historical Stock Chart

From Apr 2023 to Apr 2024