By R.T. Watson

Streaming hit Hollywood fast. In its wake, the industry is

racing to find a new way of doing business, rethinking who's in

charge, how contracts are set up and how stars get paid.

Studios are overturning their management ranks, empowering

executives with backgrounds in business development, technology and

strategy. Producers, filmmakers and actors such as Will Smith and

Tom Hanks are trying to protect their interests in new contracts

that aren't built around ticket sales in movie theaters.

With most theaters in the U.S. closed and studios sitting on

billions of dollars of unreleased movies, corporate parents see

streaming as their best opportunity for growth. Last year's

domestic box-office revenues were just $2.28 billion, down from

$11.4 billion in 2019, according to Comscore.

Now the talk of the town centers around how many subscriptions

Disney+, HBO Max and Peacock have versus Netflix. Executives are

asking how much tech companies like Apple Inc. and Amazon.com Inc.

are spending on movies and shows, and how long movies should appear

exclusively in theaters -- if at all.

In a sign of how dramatically the shift is remaking Hollywood,

Warner Bros., owned by AT&T Inc.'s WarnerMedia, for the first

time in its nearly 100-year history, doesn't have a single

executive whose sole job is to oversee the production and

distribution of movies meant for the big screen.

In December, the company announced it would debut all 17 of

Warner Bros.' 2021 movies, including "Matrix 4" and "Dune," in

America's movie theaters and on its HBO Max service at the same

time.

That left a tricky job to Toby Emmerich, head of Warner Bros.

and HBO Max's film division, who had built his career on his strong

relationships, a Hollywood staple. On the morning of Dec. 3, he

called leaders of powerful talent agencies to blow up the deals

he'd made with them for films originally destined for exclusive

theatrical release, according to people familiar with the

matter.

Big-name stars and top producers often negotiate for a

percentage of ticket sales, but Mr. Emmerich's news derailed hopes

of cash windfalls. As unwelcome as the news was, some sympathized

with his predicament. "Everyone knows...Toby is not driving this

boat at all," said one person to receive a call.

WarnerMedia has said it plans to use its hybrid approach only

through 2021 and remains committed to theatrical distribution.

Around the world, revenues generated from movie theater releases

hovered around $40 billion annually in the years leading up to the

pandemic, according to the Motion Picture Association.

That's little compared with projections of streaming's financial

prowess. By the end of 2020, subscription streaming services should

exceed $50 billion in global revenue with 880 million users,

according to Statista, a media research firm. By 2025, it expects

services including Disney+, Netflix and HBO Max to count 1.34

billion users and generate $85 billion in global revenues.

While studios generally split half of ticket revenues with

theaters, they keep the majority of money generated from streaming

services.

"The streaming platform at these big media companies is at the

center of their initiative," says Josh Grode, chief executive

officer of Legendary Entertainment, which financed and produced two

big-budget films for Warner Bros. that are slated to debut in

theaters and on HBO Max simultaneously this year -- a remake of

"Dune" and monster flick "Godzilla vs. Kong."

Warner Bros. tested the hybrid distribution strategy with

"Wonder Woman 1984" on Christmas Day. After four weeks, the film

made a meager $35.8 million domestically, with nearly two-thirds of

U.S. theaters closed. The company said close to half of the

service's retail subscribers viewed the film during its first day.

Warner declined to say how many subscribers watched the movie or

how many new subscribers the film attracted.

In October, Mr. Emmerich -- a credited producer and writer --

was put in charge of making films for both HBO Max and theaters.

His superiors have taken a more active role in overseeing

production and distribution of content, according to current and

former colleagues.

They include Jason Kilar, a former Amazon tech executive who

co-founded streaming service Hulu, recruited by AT&T's CEO John

Stankey in April to be chief executive of WarnerMedia. Below him,

Ann Sarnoff, a newcomer to Hollywood who had been president at BBC

Studios-Americas, heads WarnerMedia Studios, which is responsible

for HBO Max, several cable TV networks, and Warner Bros.' film and

television studio.

At Walt Disney Co.'s investor day on Dec. 10, CEO Bob Chapek

addressed the camera as a computer graphic appeared next to him,

showing a copy of Walt Disney's handwritten 1957 vision for the

company he founded. At the center of all the company's divisions

was theatrical films. Mr. Chapek proceeded to describe a modern

era, with direct-to-consumer Disney+ at the heart of

everything.

Disney, too, has shuffled its top ranks. After a recent

reorganization, four-decade Hollywood veteran Alan Horn, who guided

the film studio to unprecedented box-office success in the 2010s,

no longer has profit-and-loss responsibility or decides how movies

will be distributed. That job now belongs to Kareem Daniel, a

Stanford University MBA with a stint at Goldman Sachs before

joining Disney in 2007. He left his post as president of Disney's

consumer products division and now reports directly to Mr.

Chapek.

Not every studio is moving on from theatrical premieres. One

risk: putting films on streaming services makes them vulnerable to

digital piracy, which is likely to hurt international box-office

revenues.

Comcast Corp.'s Universal Pictures decision last year to skip

theaters and release "Trolls World Tour" online set off a public

spat with theater chain AMC Entertainment Holdings Inc. The

companies worked out an agreement last summer in which Universal

can release new films to home video in as little as 2 1/2 weeks

after they hit theaters.

Netflix and Apple both inquired if Paramount Pictures would be

willing to sell the highly anticipated sequel "Top Gun: Maverick,"

starring Tom Cruise, which had been due to open in theaters last

summer. Based on the strength of the film's perceived box-office

prospects, the studio refused to consider offers, according to

people familiar with the matter. So far, "Top Gun: Maverick" is set

to debut in theaters this July.

Stars, filmmakers and directors are pushing studios for extra

fees or other remuneration to make up for what might have been made

at the box office. According to several talent agents, talks are

ongoing with streaming services to formulate a new

performance-based compensation model that would include a bonus

when a movie is a hit on the platform.

Actor Will Smith was in the midst of filming "King Richard" in

Los Angeles -- a biopic about the father of tennis stars Serena and

Venus Williams -- when he got a call from his talent agency,

according to a person familiar with the matter. The distribution

deal he had in place with Warner Bros. for the film had fallen

apart after the HBO Max plan.

Mr. Smith had agreed to a $60 million deal with Warner Bros. on

the condition that the film would be available online only after a

traditional theatrical release, the person said, after turning down

a lucrative offer from Netflix. His production company participated

in a deal to pay $1 million for the rights to the story the film is

based on. Mr. Smith and his agents are working to renegotiate, the

person said.

After spending years as a top Warner Bros. director, Christopher

Nolan, who wrote and directed last year's "Tenet," is unlikely to

return to the studio with his next project, in part because he was

disappointed with the studio's hybrid distribution strategy for

2021, according to people familiar with the matter.

In the case of "Wonder Woman 1984," Warner Bros. hashed out a

deal with star Gal Gadot and director Patty Jenkins ahead of

announcing in November that the film would premiere in theaters and

HBO Max on Christmas Day. It agreed to pay Ms. Gadot and Ms.

Jenkins $15 million and $13 million, respectively, on top of their

regular fee, according to a person familiar with the matter.

Disney has yet to renegotiate new terms with actor Tom Hanks

after it shifted distribution plans for "Pinocchio," according to a

person familiar with the matter. Mr. Hanks had signed up to play

Gepetto in the remake, originally intended for a traditional

theatrical release. The movie hasn't yet begun filming. On Dec. 10,

Disney said that "Pinocchio" would debut on its streaming

service.

The same is true for actor Jude Law, who agreed to play Captain

Hook in "Peter Pan & Wendy," the person said, now also set to

premiere on Disney+ rather than theaters.

"Every company that ignores the artist and the artistry of

entertainment ultimately ends up failing," said talent agent ICM

President Chris Silbermann. "You have to build these companies

around artistic endeavors and artistic relationships."

Other filmmakers and actors are embracing projects for streaming

companies.

Fresh off directing the highest-grossing film of all time,

Disney's "Avengers: Endgame," filmmakers Anthony and Joe Russo

struggled to find a traditional studio seriously interested in

distributing their next movie, a passion project about an Iraq war

veteran, according to a person familiar with the film. The Russo

brothers gave up waiting and instead sold the project, titled

"Cherry," to Apple for about $40 million, according to the person,

in part because they felt it would be the quickest way to reach a

large audience.

"It's not our job to sell subscriptions or popcorn," said Chris

Slager, an executive at the content-production arm of Endeavor

Group Holdings Inc., which was involved in the deal for "Cherry."

"It's our job to empower artists by finding the best distribution

to bring their stories to audiences."

Director Sofia Coppola also recently signed on with Apple to do

her first-ever episodic series, according to a person familiar with

the matter. To do the project -- an adaptation of the Edith Wharton

novel "The Custom of the Country" -- Ms. Coppola garnered one of

the most lucrative paydays of her career, that person said.

Vine Alternative Investment CEO Jim Moore, who runs a fund that

has invested more than $1 billion in film and television since

2007, says he won't miss the days where catering to actors and

filmmakers sometimes came above investors' interests. "At the end

of the day, Hollywood is a business," he says.

(END) Dow Jones Newswires

January 21, 2021 12:00 ET (17:00 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

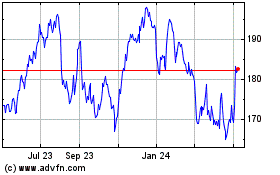

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

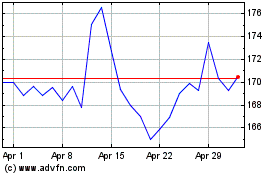

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Apr 2023 to Apr 2024