Prospectus Filed Pursuant to Rule 424(b)(5) (424b5)

January 14 2021 - 5:03PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-223269

PROSPECTUS SUPPLEMENT

(To Prospectus dated March 19, 2018)

vTv Therapeutics Inc.

Up to $5,500,000

Class A Common Stock

________________________

We have entered into a Controlled Equity OfferingSM Sales Agreement, or sales agreement, with Cantor Fitzgerald & Co., or Cantor Fitzgerald, relating to shares of our Class A common stock, $0.01 par value per share, offered by this prospectus supplement and the accompanying prospectus. In accordance with the terms of the sales agreement, from time to time we may offer and sell shares of our Class A common stock having an aggregate gross sales price of up to $5.5 million through or to Cantor Fitzgerald, acting as sales agent or principal, pursuant to this prospectus supplement and the accompanying prospectus.

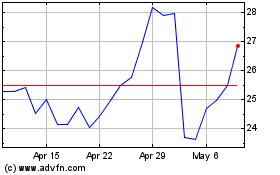

Our Class A common stock is traded on The Nasdaq Capital Market under the symbol “VTVT.” On January 13, 2021, the last reported sale price of our Class A common stock as reported on The Nasdaq Capital Market was $2.26 per share.

As of January 13, 2021, the aggregate market value of the outstanding Class A common stock held by non-affiliates, computed by reference to the price at which our Class A common stock was last sold on December 11, 2020 was $55,547,344, based on 54,550,710 shares of our outstanding Class A common stock as of January 13, 2021, of which 17,918,498 shares of Class A common stock were held by non-affiliates. During the 12 calendar months prior to and including the date of this prospectus (excluding this offering), we have sold $12,999,999 pursuant to General Instruction I.B.6 of Form S-3.

Sales of our Class A common stock, if any, under this prospectus supplement may be made in sales deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended, or the Securities Act. Subject to terms of the sales agreement, Cantor Fitzgerald is not required to sell any specific number or dollar amounts of securities but will act as our sales agent using commercially reasonable efforts consistent with its normal trading and sales practices, on mutually agreed terms between Cantor Fitzgerald and us. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

Cantor Fitzgerald will be entitled to compensation under the terms of the sales agreement at a fixed commission rate of up to 3.0% of the gross sales price per share sold. In connection with the sale of our Class A common stock on our behalf, Cantor Fitzgerald will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Cantor Fitzgerald will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contributions to Cantor Fitzgerald against certain civil liabilities, including liabilities under the Securities Act.

Investing in our Class A common stock involves risks that are referenced under the caption “Risk Factors” on page S-3 of this prospectus supplement. We are a “smaller reporting company” and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus supplement, the accompanying base prospectus and our filings with the Securities and Exchange Commission.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Cantor

The date of this prospectus supplement is January 14, 2021.

TABLE OF CONTENTS

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus relate to an offering of our Class A common stock. Before buying any of the securities that we are offering, we urge you to carefully read this prospectus supplement and the accompanying prospectus, together with the information incorporated by reference as described under “Where You Can Find More Information” and “Incorporation of Certain Information by Reference” in this prospectus supplement. These documents contain important information that you should consider when making your investment decision.

Unless the context requires otherwise, references in this prospectus supplement and the accompanying prospectus to “vTv,” “the company,” “we,” “us” and “our” refer to vTv Therapeutics Inc.

This document is in two parts. The first part is this prospectus supplement, which describes the terms of this offering and also adds to, updates and changes information contained in the accompanying prospectus and the documents incorporated by reference. The second part is the accompanying prospectus, which gives more general information. To the extent the information contained in this prospectus supplement differs from or conflicts with the information contained in the accompanying prospectus or any document incorporated by reference, the information in this prospectus supplement will control. If any statement in one of these documents is inconsistent with a statement in another document having a later date — for example, a document incorporated by reference into this prospectus supplement or the accompanying prospectus — the statement in the document having the later date modifies or supersedes the earlier statement.

Neither we nor Cantor Fitzgerald have authorized anyone to provide you with information different from that which is contained in or incorporated by reference in this prospectus supplement, the accompanying prospectus and in any free writing prospectus that we have authorized for use in connection with this offering. No one is making offers to sell or seeking offers to buy these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained in this prospectus supplement is accurate as of the date on the front cover of this prospectus supplement only and that any information we have incorporated by reference or included in the accompanying prospectus is accurate only as of the date given in the document incorporated by reference or as of the date of the prospectus, as applicable, regardless of the time of delivery of this prospectus supplement, the accompanying prospectus, any related free writing prospectus, or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference into this prospectus supplement or the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus supplement and the accompanying prospectus are part of the registration statement on Form S-3 we filed with the Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”) and do not contain all the information set forth in the registration statement. Whenever a reference is made in this prospectus supplement or the accompanying prospectus to any of our contracts, agreements or other documents, the reference may not be complete and you should refer to the exhibits that are a part of the registration statement or the exhibits to the reports or other documents incorporated by reference in this prospectus supplement and the accompanying prospectus for a copy of such contract, agreement or other document. Because we are subject to the information and reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), we file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the internet at the SEC’s website at http://www.sec.gov. Our SEC filings are also available free of charge on or through our website at www.vtvtherapeutics.com, as soon as reasonably practicable after we electronically file such material with or otherwise furnish it to the SEC. The information on, or accessible through, our website is not part of, and is not

S-ii

incorporated into, this prospectus supplement or the accompanying prospectus and should not be considered part of this prospectus supplement or the accompanying prospectus.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

In this prospectus supplement, we “incorporate by reference” certain information that we file with the SEC, which means that we can disclose important information to you by referring you to that information. The information we incorporate by reference is an important part of this prospectus supplement, and later information that we file with the SEC will automatically update and supersede this information. The following documents have been filed by us with the SEC and are incorporated by reference into this prospectus supplement:

|

|

|

|

|

|

|

•

|

|

our Annual Report on Form 10-K for the year ended December 31, 2019, filed with the SEC on February 21, 2020 (our “2019 Annual Report”);

|

|

|

•

|

|

our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, filed with the SEC on May 7, 2020; Quarterly Report on Form 10-Q for the quarter ended June 30, 2020, filed with the SEC on August 3, 2020; and Quarterly Report on Form 10-Q for the quarter ended September 30, 2020, filed with the SEC on November 5, 2020;

|

|

|

•

|

|

our Current Reports on Form 8-K filed with the SEC on January 7, 2020, January 28, 2020, February 25, 2020, April 7, 2020, April 24, 2020; May 12, 2020, June 15, 2020, June 26, 2020, September 1, 2020, October 2, 2020, October 26, 2020 (Item 8.01 only), November 17, 2020, November 24, 2020, December 10, 2020, December 15, 2020, December 17, 2020, and December 30, 2020, and

|

|

|

•

|

|

the description of our Class A common stock set forth in our registration statement filed on Form 8-A pursuant to Section 12 of the Exchange Act with the SEC on July 30, 2015, and any amendment or report filed for the purpose of updating that description.

|

All documents and reports that we file with the SEC (other than any portion of such filings that are furnished under applicable SEC rules rather than filed) under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act from the date of this prospectus supplement until the completion of the offering under this prospectus supplement shall be deemed to be incorporated in this prospectus supplement by reference. The information contained on or accessible through our website (http://www.vtvtherapeutics.com) is not incorporated into this prospectus supplement.

We will furnish without charge to you, upon written or oral request, a copy of any or all of the documents incorporated by reference, including exhibits to these documents. You should direct any requests for documents to:

vTv Therapeutics Inc.

Attn: Chief Financial Officer

3980 Premier Drive, Suite 310

High Point, NC 27265

Telephone: (336) 841-0300

You should rely only on the information contained or incorporated by reference in the prospectus, this prospectus supplement, any free writing prospectus that we authorize and any pricing supplement. We have not authorized any person, including any salesman or broker, to provide information other than that provided in the prospectus, this or any applicable prospectus supplement, any free writing prospectus that we authorize or any pricing supplement. We have not authorized anyone to provide you with different information. We do not take responsibility for, and can provide no assurance as to the reliability of, any information that others may give you. We are not making an offer of the securities in any jurisdiction where the offer is not permitted. You should not assume that the information in the prospectus, this or any applicable prospectus supplement, any free writing prospectus that we authorize and any pricing supplement or any document incorporated by reference is accurate as of any date other than the date of the applicable document.

Any statement contained in a document incorporated or deemed to be incorporated by reference into this prospectus supplement will be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained in the prospectus, this or any prospectus supplement, or any other subsequently

S-iii

filed document that is deemed to be incorporated by reference into this prospectus supplement modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying prospectus, including the documents that we incorporate by reference herein and therein, contain statements that are not strictly historical in nature and are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These forward-looking statements are subject to the “safe harbor” created by Section 27A of the Securities Act and Section 21E of the Exchange Act and may include, but are not limited to, statements about:

|

|

•

|

our ability to successfully develop, market, commercialize and achieve market acceptance for any of our product candidates or therapies that we may develop;

|

|

|

•

|

our estimates for future performance;

|

|

|

•

|

our estimates regarding anticipated operating losses, future revenues, capital requirements and our needs for additional financing;

|

|

|

•

|

the progress or success of our research, development and clinical programs, including the application for and receipt of regulatory clearances and approvals;

|

|

|

•

|

our ability to protect our intellectual property and operate our business without infringing upon the intellectual property rights of others;

|

|

|

•

|

scientific studies and the conclusions we draw from them; and

|

|

|

•

|

our anticipated use of proceeds from this offering.

|

In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “goal,” “intends,” “may,” “outlook,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would,” the negative of these words and words or similar expressions intended to identify forward-looking statements. These statements reflect our views as of the date on which they were made with respect to future events and are based on assumptions and subject to risks and uncertainties. The underlying information and expectations are likely to change over time. Given these risks and uncertainties, you should not place undue reliance on these forward-looking statements as actual events or results may differ materially from those projected in the forward-looking statements due to various factors, including, but not limited to, those set forth under the heading “Risk Factors” in this prospectus supplement, in the accompanying prospectus, in our 2019 Annual Report and in our other filings with the SEC. These forward-looking statements represent our estimates and assumptions only as of the date of the document containing the applicable statement.

You should understand that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in the foregoing documents by these cautionary statements. Unless required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. Before deciding to purchase our securities in this offering, you should carefully consider the risk factors discussed or incorporated by reference herein, in addition to the other information set forth in this prospectus supplement, the accompanying prospectus and in the documents incorporated by reference.

S-iv

PROSPECTUS SUPPLEMENT SUMMARY

This summary does not contain all the information that you should consider before investing in the securities offered by this prospectus supplement. Before making an investment decision, you should carefully read the entire prospectus supplement and the accompanying prospectus, including the “Risk Factors” sections, as well as the financial statements and the other information incorporated by reference herein and the information in any free writing prospectus that we may authorize for use in connection with this offering.

Overview

We are a clinical-stage pharmaceutical company focused on treating metabolic and inflammatory diseases to minimize their long-term complications and improve the lives of patients. We have an innovative pipeline of first-in-class small molecule clinical and pre-clinical drug candidates for the treatment of a wide range of diseases. Our pipeline is led by our programs for the treatment of type 1 diabetes (TTP399) and for psoriasis (HPP737). We completed the Simplici-T1 Study, an adaptive Phase 1b/2 study supported by JDRF International (“JDRF”), to explore the effects of TTP399 in patients with type 1 diabetes at the beginning of 2020. In February 2020, we reported positive results from the Phase 2 - Part 2 confirming phase of this study which achieved its primary objective by demonstrating statistically significant improvements in HbA1c (long-term blood sugar) for TTP399 compared to placebo. We are working on the design for pivotal and registration studies for TPP399, with input from the FDA. In addition to the pivotal studies of TTP399, we are conducting a mechanistic study in a small number of patients with type 1 diabetes to determine the impact of TTP399 on ketone body formation during a period of acute insulin withdrawal.

In addition, we are conducting a multiple ascending dose phase 1 study of HPP737, an orally administered phosphodiesterase type 4 (“PDE4”) inhibitor, to assess the pharmacokinetics, pharmacodynamics, safety and tolerability of HPP737 in healthy volunteers as part of our psoriasis program. The goal of this study is to confirm the maximum tolerated dose with minimal or no gastrointestinal intolerance in the form of nausea, vomiting, or diarrhea. We expect to complete this study in the second quarter of 2021.

On December 15, 2020, the Company announced that the Phase 2 Elevage study of azeliragon in people with mild Alzheimer’s disease and type 2 diabetes did not meet its primary objective of demonstrating an improvement in cognition as assessed by the 14-item Alzheimer’s Disease Assessment Scale – Cognitive Subscale (ADAS-cog14) relative to placebo.

In addition to our internal development programs, we are furthering the clinical development of four other programs, a small molecule GLP-1r agonist, a PDE4 inhibitor, a PPAR-delta agonist, and an Nrf2 activator through partnerships with pharmaceutical partners via licensing arrangements. In December 2020, we entered into a License Agreement with Anteris Bio, Inc. (“Anteris”) (the “Anteris License Agreement”), under which Anteris obtained a worldwide, exclusive and sublicensable license to develop and commercialize vTv LLC’s Nrf2 activator, HPP971.

For a description of our business, financial condition, results of operations and other important information regarding us, see our filings with the SEC incorporated by reference in this prospectus supplement. For instructions on how to find copies of the filings incorporated by reference in this prospectus supplement, see “Where You Can Find More Information.”

Corporate Information

We were incorporated in Delaware under the name vTv Therapeutics Inc. in April 2015. Our principal executive office is located at 3980 Premier Drive, Suite 310, High Point, NC 27265, Telephone (336) 841-0300. Our website address is www.vtvtherapeutics.com. The information contained in, and that can be accessed through, our website is not incorporated into and does not form a part of this prospectus supplement.

S-1

The Offering

|

Issuer

|

vTv Therapeutics Inc.

|

|

Class A common stock offered by us

|

Shares of our Class A common stock having an aggregate offering price of up to $5,500,000

|

|

Class A common stock to be outstanding following this offering

|

Up to 51,586,222 shares of Class A common stock, assuming sales of 2,433,628 shares of Class A common stock in this offering at an offering price of $2.26 per share, which was the last reported sale price of our Class A common stock on the Nasdaq Capital Market on January 13, 2021. The actual number of shares issued will vary depending on the sales price under this offering.

|

|

Manner of offering

|

“At the market offering” that may be made from time to time through or to, Cantor Fitzgerald, as sales agent or principal. See “Plan of Distribution” on page S-10 of this prospectus supplement.

|

|

Use of proceeds

|

We intend to use the net proceeds from this offering for general corporate purposes, including manufacturing expenses, clinical trial expenses, research and development expenses, general and administrative expenses, and other expenses associated with the development of our drug candidates. See “Use of Proceeds” on page S-7 of this prospectus supplement.

|

|

Risk factors

|

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page S-3 of this prospectus supplement and in the documents incorporated by reference herein.

|

|

Nasdaq Capital Market symbol

|

“VTVT.”

|

The number of shares of Class A common stock to be outstanding immediately after this offering is based on 49,152,594 shares of our Class A common stock outstanding as of September 30, 2020. Unless otherwise indicated, the number of shares of common stock presented in this prospectus supplement excludes:

|

|

•

|

23,094,221 shares of Class B common stock issued and outstanding as of September 30, 2020 which is exchangeable on a one-for-one basis for shares of Class A common stock;

|

|

|

•

|

1,875,000 shares of Class A common stock issuable under the letter agreement as of September 30, 2020 between vTv and MacAndrews & Forbes Group, LLC dated as of December 23, 2019 with a price of $1.60 per share;

|

|

|

•

|

1,823,917 shares of Class A common stock issuable upon the exercise of outstanding warrants issued pursuant to certain letter agreements between vTv and MacAndrews & Forbes Group, LLC dated, with exercise prices between $1.53 and $5.04 per share;

|

|

|

•

|

190,586 shares of Class A common stock issuable upon the exercise of outstanding warrants held by Horizon Technology Finance Corporation and Silicon Valley Bank, with exercise prices between $5.92 and $6.39 per share;

|

and

|

|

•

|

2,600,191 shares of Class A common stock issuable under our 2015 equity incentive plan.

|

S-2

RISK FACTORS

Investing in our securities involves a high degree of risk. You should carefully consider the risks described below and discussed under the section captioned “Risk Factors” contained in our 2019 Annual Report, our Quarterly Report on Form 10-Q for the quarter ended September 30, 2020, as well as any amendment or update to our risk factors reflected in subsequent filings with the SEC, which are incorporated by reference in this prospectus supplement, and all other information contained in this prospectus supplement and the accompanying prospectus and incorporated by reference in this prospectus supplement and the accompanying prospectus, and in any free writing prospectus that we have authorized for use in connection with this offering, before purchasing shares of our Class A common stock. These risks and uncertainties are not the only ones facing us. Additional risks and uncertainties that we are unaware of, or that we currently deem immaterial, also may become important factors that affect us. If any of such risks or the risks described below or in our SEC filings occur, our business, financial condition or results of operations could be materially and adversely affected. In that case, the trading price of our Class A common stock could decline, and you may lose some or all of your investment.

The widespread outbreak of an illness or any other communicable disease, or any other public health crisis, could adversely affect our business, results of operations and financial condition.

We could be negatively affected by the widespread outbreak of an illness or any other communicable disease, or any other public health crisis that results in economic and trade disruptions, including the disruption of global supply chains. In March 2020, the World Health Organization declared COVID-19 a pandemic. The COVID-19 pandemic has negatively impacted the global economy, disrupted global supply chains, and created significant volatility and disruption of financial markets. Due to the spread of COVID-19, many countries around the world and jurisdictions in the United States have imposed quarantines and restrictions on travel and mass gatherings to slow the spread of the virus. Further, “non-essential” businesses have been required to close operations or shift to a remote working environment.

Due to the various restrictions put into effect by governments around the world, including the United States and Canada, health professionals may reduce staffing and reduce or postpone meetings with clients in response to the spread of an infectious disease. Such events may result in a period of business disruption, and in reduced operations, any of which could materially affect our business, financial condition and results of operations.

Quarantines, stay-at-home orders and other limitations can disrupt our research and administrative functions, regardless of whether we are actually forced to close our own facilities. Similar disruptions may also affect other organizations and persons that we collaborate with or whose services we are dependent on. The need for our employees and business partners to work remotely also creates greater potential for risks related to cybersecurity, confidentiality and data privacy.

With respect to the COVID-19 outbreak specifically, such outbreak could also potentially affect the operations of the FDA, EMA or other health authorities, which could result in delays in meetings related to planned clinical trials. Further, it may also slow potential enrollment of our ongoing clinical trials. The COVID-19 outbreak and mitigation measures also have had, and may continue to have, an adverse impact on global economic conditions which could have an adverse effect on our business and financial condition, including impairing our ability to raise capital when needed.

Although, as of the date of this prospectus supplement, we do not expect any material impact on our long-term activity, the extent to which the COVID-19 outbreak impacts our business and operations will depend on future developments that are highly uncertain and cannot be predicted, including new information that may emerge concerning the severity of the virus and the actions to contain its impact. As a result, there can be no assurance as to the manner and extent to which the COVID-19 outbreak (or other large-scale disruption) could impact our operations, results and financial condition.

S-3

The recent outbreak of COVID-19 may materially and adversely affect our clinical trials, the operations of our licensees and our financial results.

The extent to which COVID-19 may impact our clinical trials will depend on future developments, which are highly uncertain and cannot be predicted with confidence, such as the duration of the outbreak, the severity of COVID-19, or the effectiveness of actions to contain and treat for COVID-19. The continued spread of COVID-19 globally could adversely impact our clinical trial operations in the United States, including our ability to recruit and retain patients in our mechanistic study of TTP399 and our multiple ascending dose study of HPP737. COVID-19 may also affect the employees and operations of third-party contract research organizations located in affected geographies that we rely upon to carry out such enrollments and trials. Further, it may delay the initiation of any additional clinical trials we are planning for which we require additional approval or are seeking guidance from the FDA or other regulatory agencies. The negative impacts of COVID-19 in these instances may result in delays to our operational plans, increases in our operating expenses, and may have a material adverse effect on our financial results.

Additionally, COVID-19 may hinder the ability of our license partners to continue the development of our licensed product candidates. This may result in the delay or the inability of the partners to execute on their development plans which, in turn, may cause delays in or the inability to achieve the clinical, regulatory and sales milestones which trigger payments to us under the terms of our license agreements. This may have a material adverse effect on our financial results and operations as the related milestone payments may not be received at the expected time, if at all.

Risks Related to This Offering

Management will have broad discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

Because we have not designated the amount of net proceeds from this offering to be used for any particular purpose, our management will have broad discretion as to the application of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of the offering. Our management may use the net proceeds for corporate purposes that may not improve our financial condition or market value.

You may experience immediate and substantial dilution in the net tangible book deficit per share of the Class A common stock you purchase.

The offering price per share in this offering may exceed the net tangible book value per share of our Class A common stock outstanding prior to this offering. Assuming that an aggregate 2,433,628 shares of our Class A common stock are sold at a price of $2.26 per share pursuant to this prospectus supplement, which was the last reported sale price of our Class A common stock on The Nasdaq Capital Market on January 13, 2021, for aggregate gross proceeds of $5.5 million, after deducting commissions and estimated aggregate offering expenses payable by us, you would experience immediate dilution of $2.27 per share, representing the difference between our as adjusted net tangible book value per share as of September 30, 2020 after giving effect to this offering and the assumed offering price.

You may experience future dilution as a result of future equity offerings.

In order to raise additional capital, we may in the future offer additional shares of our Class A common stock or other securities convertible into or exchangeable for our Class A common stock at prices that may not be the same as the price per share in this offering. We may sell shares or other securities in any other offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our Class A common stock, or securities convertible or exchangeable into Class A common stock, in future transactions may be higher or lower than the price per share paid by investors in this offering.

In addition, the sale of shares in this offering and any future sales of a substantial number of shares of our Class A common stock in the public market, or the perception that such sales may occur, could adversely affect the price of our Class A common stock. We cannot predict the effect, if any, that market sales of those shares of Class A common stock, or the perception that those shares may be sold, will have on the market price of our Class A common stock.

S-4

We plan to sell shares of our Class A common stock in “at the market offerings” and investors who buy shares of our Class A common stock at different times will likely pay different prices.

Investors who purchase shares of our Class A common stock in this offering at different times will likely pay different prices and may experience different outcomes in their investment results. We will have discretion, subject to the effect of market conditions, to vary the timing, prices, and numbers of shares sold in this offering. Investors may experience a decline in the value of their shares of our Class A common stock. Many factors could have an impact on the market price of our Class A common stock, including the factors described above and in the accompanying prospectus and those disclosed under “Risk Factors” in our 2019 Annual Report as updated in subsequent reports filed with the SEC.

We do not expect to pay any dividends in the foreseeable future.

In the past, we have not paid dividends on our Class A common stock. We do not currently intend to pay dividends on our Class A common stock and we intend to retain our future earnings, if any, to fund the development and growth of our business. In addition, the terms of certain existing and any future debt agreements may preclude us from paying dividends. As a result, capital appreciation, if any, of our Class A common stock may be your sole source of gain for the foreseeable future.

Our share price may be volatile, which could subject us to securities class action litigation and result in substantial losses for our stockholders.

The market price of shares of our Class A common stock could be subject to wide fluctuations in response to many risk factors listed in this section and in the documents incorporated by reference herein, and others beyond our control, including:

|

|

•

|

results and timing of our clinical trials and receipt of data from the trials;

|

|

|

•

|

the availability of cash or financing to continue our clinical trials and other operations;

|

|

|

•

|

results of clinical trials of our competitors’ products;

|

|

|

•

|

failure or discontinuation of any of our research programs;

|

|

|

•

|

delays in the development or commercialization of our potential products;

|

|

|

•

|

regulatory actions with respect to our products or our competitors’ products;

|

|

|

•

|

actual or anticipated fluctuations in our financial condition and operating results;

|

|

|

•

|

actual or anticipated changes in our growth rate relative to our competitors;

|

|

|

•

|

actual or anticipated fluctuations in our competitors’ operating results or changes in their growth rate;

|

|

|

•

|

competition from existing products or new products that may emerge;

|

|

|

•

|

announcements by us or our competitors of significant acquisitions, strategic partnerships, joint ventures, collaborations or capital commitments;

|

|

|

•

|

issuance of new or updated research or reports by securities analysts;

|

|

|

•

|

fluctuations in the valuation of companies perceived by investors to be comparable to us;

|

|

|

•

|

share price and volume fluctuations attributable to inconsistent trading volume levels of our shares;

|

S-5

|

|

•

|

additions or departures of key management or scientific personnel;

|

|

|

•

|

disputes or other developments related to proprietary rights, including patents, litigation matters and our ability to obtain, maintain, defend or enforce proprietary rights relating to our products and technologies;

|

|

|

•

|

announcement or expectation of additional financing efforts;

|

|

|

•

|

sales of our Class A common stock by us, our insiders or our other stockholders;

|

|

|

•

|

issues in manufacturing our potential products;

|

|

|

•

|

market acceptance of our potential products;

|

|

|

•

|

market conditions for biopharmaceutical stocks in general; and

|

|

|

•

|

general economic and market conditions.

|

Furthermore, the stock markets have experienced extreme price and volume fluctuations that have affected and continue to affect the market prices of equity securities of many companies. These fluctuations often have been unrelated or disproportionate to the operating performance of those companies. These broad market and industry fluctuations, as well as general economic, political and market conditions such as recessions, interest rate changes or international currency fluctuations, may negatively impact the market price of shares of our Class A common stock. In addition, such fluctuations could subject us to securities class action litigation, which could result in substantial costs and divert our management’s attention from other business concerns, which could potentially harm our business. As a result of this volatility, our stockholders may not be able to sell their Class A common stock at or above the price at which they purchased their shares.

An active trading market for our Class A common stock may not be sustained.

Our shares of Class A common stock began trading on The NASDAQ Global Market on July 30, 2015 and its listing was transferred to The NASDAQ Capital Market on October 30, 2018. Given the limited trading history of our Class A common stock, there is a risk that an active trading market for our shares will not be sustained, which could put downward pressure on the market price of our Class A common stock and thereby affect the ability of our stockholders to sell their shares.

Our stock price may decline and we may not be able to maintain compliance with NASDAQ listing requirements.

Our Class A common stock is listed on The NASDAQ Capital Market, which imposes certain minimum continued listing requirements. If compliance with these requirements is not maintained, NASDAQ may make a determination to delist our Class A common stock, which could, among other things, reduce the price of our Class A common stock and the levels of liquidity available to our stockholders.

S-6

USE OF PROCEEDS

We may issue and sell shares of our Class A common stock having aggregate sales proceeds of up to $5.5 million from time to time. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. There can be no assurance that we will sell any shares under or fully utilize the sales agreement with Cantor Fitzgerald as a source of financing.

We intend to use the net proceeds from this offering for general corporate purposes, including manufacturing expenses, clinical trial expenses, research and development expenses, general and administrative expenses, and other expenses associated with the development of our Late Stage Drug Candidates and our other product candidates.

Specifically, we intend to use the net proceeds from this offering, together with our existing cash and cash equivalents as follows:

|

|

•

|

to fund the multiple ascending dose study of HPP737;

|

|

|

•

|

to fund activities related to conducting a pivotal trial of TTP399 in patients with type 1 diabetes, including the conduct of the mechanistic study; and

|

|

|

•

|

for working capital and general corporate purposes.

|

We have not determined the amounts we plan to spend on any of the areas listed above or the timing of these expenditures. As a result, our management will have broad discretion to allocate the net proceeds from this offering.

S-7

DILUTION

The net tangible book deficit of our common stock as of September 30, 2020 was approximately $(5.8) million, or approximately $(0.08) per share of common stock based upon a total of 72,246,815 shares outstanding as of September 30, 2020, reflective of the combined outstanding 49,152,594 shares of Class A common stock and 23,094,221 shares of Class B common stock. Net tangible book deficit per share is equal to our total tangible assets, less our total liabilities, exclusive of the redeemable noncontrolling interest, divided by the total number of shares outstanding.

After giving effect to the sale by us of our Class A common stock in the aggregate amount of $5.5 million in this offering at an assumed offering price of $2.26 per share, which was the last reported sale price of our Class A common stock on The Nasdaq Capital Market on January 13, 2021, and after deducting commissions and estimated offering expenses payable by us, our adjusted net tangible book deficit as of September 30, 2020 would have been approximately $(0.6) million, or $(0.01) per share of common stock. This amount represents an immediate increase in net tangible book deficit of $0.07 per share to existing stockholders and an immediate dilution of $2.27 per share to purchasers in this offering. The following table illustrates the dilution:

|

Public offering price per share

|

|

|

|

|

$

|

2.26

|

|

|

Net tangible book value per share as of September 30, 2020

|

|

(0.08

|

)

|

|

|

|

|

|

Increase per share attributable to new investors

|

|

0.07

|

|

|

|

|

|

|

As adjusted net tangible book value per share as of September 30, 2020, after giving effect to this offering

|

|

|

|

|

$

|

(0.01

|

)

|

|

Dilution per share to new investors purchasing shares in this offering

|

|

|

|

|

$

|

2.27

|

|

The table above assumes, for illustrative purposes, that an aggregate of 2,433,628 shares of our Class A common stock are sold at a price of $2.26 per share, the last reported sale price of our Class A common stock on the Nasdaq Capital Market on January 13, 2021, for aggregate gross proceeds of $5.5 million. The shares sold in this offering, if any, will be sold from time to time at various prices. An increase of $0.25 per share in the price at which the shares are sold from the assumed offering price of $2.26 per share shown in the table above, assuming all of our Class A common stock in the aggregate amount of $5.5 million during the term of the sales agreement with Cantor Fitzgerald is sold at that price, would increase our as adjusted net tangible book deficit per share after the offering to $(0.01) per share and would increase the dilution in net tangible book value per share to new investors to $2.52 per share, after deducting commissions and estimated aggregate offering expenses payable by us. A decrease of $0.25 per share in the price at which the shares are sold from the assumed offering price of $2.26 per share shown in the table above, assuming all of our Class A common stock in the aggregate amount of $5.5 million during the term of the sales agreement with Cantor Fitzgerald is sold at that price, would increase our as adjusted net tangible book deficit per share after the offering to $(0.01) per share and would decrease the dilution in net tangible book value per share to new investors to $2.02 per share, after deducting commissions and estimated aggregate offering expenses payable by us. This information is supplied for illustrative purposes only and may differ based on the actual offering price and the actual number of shares offered.

The number of shares of common stock expected to be outstanding after this offering included in the table above are based on 72,246,815 shares of common stock outstanding, reflective of the combined outstanding shares of Class A common stock and Class B common stock as of September 30, 2020 and excludes:

|

|

|

|

|

|

|

•

|

|

1,875,000 shares of Class A common stock issuable under the letter agreement between vTv and MacAndrews & Forbes Group, LLC dated as of December 23, 2019 with a price of $1.60 per share;

|

|

|

•

|

|

1,823,917 shares of Class A common stock issuable upon the exercise of outstanding warrants issued pursuant to certain letter agreements between vTv and MacAndrews & Forbes Group, LLC dated December 5, 2017, July 30, 2018, December 11, 2018, September 26, 2019 and December 23, 2019, with exercise prices between $1.53 and $5.04 per share;

|

|

|

•

|

|

190,586 shares of Class A common stock issuable upon the exercise of outstanding warrants held by Horizon Technology Finance Corporation and Silicon Valley Bank, with exercise prices between $5.92 and $6.39 per share;

|

S-8

|

|

|

|

|

|

|

•

|

|

2,600,191 shares of Class A common stock issuable under our 2015 equity incentive plan.

|

To the extent that other shares are issued, investors purchasing shares in this offering could experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations, even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of those securities could result in further dilution to our stockholders.

S-9

PLAN OF DISTRIBUTION

We have entered into a sales agreement with Cantor Fitzgerald, under which we may issue and sell shares of our Class A common stock having an aggregate gross sales price of up to $5,500,000 from time to time through or to Cantor Fitzgerald acting as sales agent or principal. The sales agreement has been filed as an exhibit to a report filed under the Exchange Act and incorporated by reference in this prospectus supplement.

Following delivery of a placement notice and subject to the terms and conditions of the sales agreement, Cantor Fitzgerald may offer and sell our Class A common stock by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act. We may instruct Cantor Fitzgerald not to Class A sell common stock if the sales cannot be effected at or above the price designated by us from time to time. We or Cantor Fitzgerald may suspend the offering of Class A common stock upon notice and subject to other conditions.

We will pay Cantor Fitzgerald commissions, in cash, for its services in acting as agent in the sale of our Class A common stock. Cantor Fitzgerald will be entitled to compensation at a commission rate of up to 3.0% of the gross sales price per share sold. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. We have also agreed to reimburse Cantor Fitzgerald for certain specified fees and documented expenses, including the fees and documented expenses of its legal counsel in an amount not to exceed $65,000. We estimate that the total expenses for the offering, excluding compensation and reimbursements payable to Cantor Fitzgerald under the terms of the sales agreement, will be approximately $123,000.

Settlement for sales of Class A common stock will occur on the second trading day following the date on which any sales are made, or on some other date that is agreed upon by us and Cantor Fitzgerald in connection with a particular transaction, in return for payment of the net proceeds to us. Sales of our Class A common stock as contemplated in this prospectus supplement will be settled through the facilities of The Depository Trust Company or by such other means as we and Cantor Fitzgerald may agree upon. There is no arrangement for funds to be received in an escrow, trust or similar arrangement. Cantor Fitzgerald will use its commercially reasonable efforts consistent with its normal trading and sales practices, to solicit offers to purchase the shares of Class A common stock under the terms and subject to the conditions set forth in the sales agreement. In connection with the sale of the Class A common stock on our behalf, Cantor Fitzgerald will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Cantor Fitzgerald will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification and contribution to Cantor Fitzgerald against certain civil liabilities, including liabilities under the Securities Act.

The offering of our Class A common stock pursuant to the sales agreement will terminate as permitted therein. We and Cantor Fitzgerald may each terminate the sales agreement at any time upon ten days’ prior notice.

Cantor Fitzgerald and its affiliates may in the future provide various investment banking, commercial banking and other financial services for us and our affiliates, for which services they may in the future receive customary fees. To the extent required by Regulation M, Cantor Fitzgerald will not engage in any market making activities involving our Class A common stock while the offering is ongoing under this prospectus supplement.

This prospectus supplement in electronic format may be made available on a website maintained by Cantor Fitzgerald, and Cantor Fitzgerald may distribute this prospectus supplement electronically.

S-10

LEGAL MATTERS

Certain legal matters in connection with the offered securities will be passed upon for us by Paul, Weiss, Rifkind, Wharton & Garrison LLP, New York, New York. Certain legal matters will be passed upon for Cantor Fitzgerald by Duane Morris LLP, New York, New York.

EXPERTS

The consolidated financial statements of vTv Therapeutics Inc. appearing in vTv Therapeutics Inc.’s 2019 Annual Report have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their report thereon (which contains an explanatory paragraph describing conditions that raise substantial doubt about the Company’s ability to continue as a going concern as described in Note 1 to the consolidated financial statements), included therein, and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

S-11

PROSPECTUS

Class A Common Stock

________________________

This prospectus contains a general description of the Class A common stock that we may offer for sale with an aggregate initial offering price of up to $250,000,000 from time to time in one or more offerings. Each time we offer and sell Class A common stock, we will provide a supplement to this prospectus that contains specific information about the offering and the amounts, prices and terms of the Class A common stock. Read this prospectus and any supplement carefully before you invest.

Our Class A common stock is listed on The NASDAQ Global Market under the symbol “VTVT”. On February 23, 2018, the closing price of our Class A common stock on The NASDAQ Global Market was $6.85 per share.

We are an “emerging growth company” under applicable Securities and Exchange Commission rules and are subject to reduced public company reporting requirements.

As of February 23, 2018, our public float, which is equal to the aggregate market value of our outstanding voting and non-voting common stock held by non-affiliates, was approximately $48.5 million, based on 9,693,254 shares of outstanding Class A common stock, of which approximately 7,077,588 shares were held by non-affiliates, and a closing sale price of our Class A common stock of $6.85 on that date. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75.0 million.

________________________

Investing in our Class A common stock involves risks that are referenced under the caption “Risk Factors” on page 5 of this prospectus. You should carefully review the risks and uncertainties described under the heading “Risk Factors” contained in the applicable prospectus supplement and any related free writing prospectus, and under similar headings in the other documents that are incorporated by reference in this prospectus.

The Class A Common Stock HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION NOR HAS THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

________________________

The date of this prospectus is March 19, 2018.

________________________

1

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

To understand the terms of the Class A common stock offered by this prospectus, you should carefully read this prospectus and any applicable prospectus supplement. You should also read the documents referred to under the heading “Where You Can Find More Information” for information on vTv Therapeutics Inc. and its financial statements. Certain capitalized terms used in this prospectus are defined elsewhere in this prospectus.

This prospectus is part of a registration statement on Form S-3 that vTv Therapeutics Inc., a Delaware corporation, which is also referred to as “vTv Therapeutics,” “the Company,” “our company,” “we,” “us” and “our,” has filed with the U.S. Securities and Exchange Commission, or the SEC, using a “shelf” registration procedure. Under this procedure, vTv Therapeutics Inc. may offer and sell from time to time shares of its Class A common stock, par value $0.01 per share, with an aggregate initial offering price of up to $250,000,000, which we refer to in this prospectus as the “Class A common stock.” Furthermore, in no event will we sell Class A common stock with a value exceeding more than one-third of our “public float” (the market value of our Class A common stock and any other equity securities that we may issue in the future that are held by non-affiliates) in any 12-calendar month period so long as our public float remains below $75.0 million.

This prospectus provides you with a general description of the Class A common stock we may offer. Each time we offer shares of Class A common stock, we will provide you with a prospectus supplement that will describe the specific amounts, prices and terms of the Class A common stock being offered. The prospectus supplement may also add, update or change information contained or incorporated by reference in this prospectus. If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the information in the prospectus supplement.

The prospectus supplement may also contain information about any material U.S. Federal income tax considerations relating to the Class A common stock covered by the prospectus supplement.

We may sell Class A common stock to underwriters who will sell the Class A common stock to the public on terms fixed at the time of sale. In addition, the Class A common stock may be sold by us directly or through dealers or agents designated from time to time, which agents may be affiliates of ours. If we, directly or through agents, solicit offers to purchase the Class A common stock, we and our agents reserve the sole right to accept and to reject, in whole or in part, any offer.

The prospectus supplement will also contain, with respect to the Class A common stock being sold, the names of any underwriters, dealers or agents, together with the terms of the offering, the compensation of any underwriters, dealers or agents and the net proceeds to us, as applicable.

Any underwriters, dealers or agents participating in the offering may be deemed “underwriters” within the meaning of the Securities Act of 1933, as amended, which we refer to in this prospectus as the “Securities Act.”

WHERE YOU CAN FIND MORE INFORMATION

vTv Therapeutics files annual, quarterly and current reports, proxy statements and other information with the SEC. You may obtain such SEC filings from the SEC’s website at http://www.sec.gov. You can also read and copy these materials at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. You can obtain further information about the operation of the SEC’s public reference room by calling the SEC at 1-800-SEC-0330.

As permitted by SEC rules, this prospectus does not contain all of the information we have included in the registration statement and the accompanying exhibits and schedules we file with the SEC. You may refer to the registration statement, exhibits and schedules for more information about us and the Class A common stock. The registration statement, exhibits and schedules are available through the SEC’s website or at its public reference room.

1

INCORPORATION BY REFERENCE

In this prospectus, we “incorporate by reference” certain information that we file with the SEC, which means that we can disclose important information to you by referring you to that information. The information we incorporate by reference is an important part of this prospectus, and later information that we file with the SEC will automatically update and supersede this information. The following documents have been filed by us with the SEC and are incorporated by reference into this prospectus:

All documents and reports that we file with the SEC (other than any portion of such filings that are furnished under applicable SEC rules rather than filed) under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) from the date of this prospectus until the completion of the offering under this prospectus shall be deemed to be incorporated in this prospectus by reference. The information contained on or accessible through our website (http://www.vtvtherapeutics.com) is not incorporated into this prospectus.

You may request a copy of these filings, other than an exhibit to these filings unless we have specifically included or incorporated that exhibit by reference into the filing, from the SEC as described under “Where You Can Find More Information” or, at no cost, by writing or telephoning vTv Therapeutics at the following address:

vTv Therapeutics Inc.

Attn: Chief Financial Officer

4170 Mendenhall Oaks Pkwy

High Point, NC 27265

Telephone: (336) 841-0300

You should rely only on the information contained or incorporated by reference in this prospectus, the prospectus supplement, any free writing prospectus that we authorize and any pricing supplement. We have not authorized any person, including any salesman or broker, to provide information other than that provided in this prospectus, any applicable prospectus supplement, any free writing prospectus that we authorize or any pricing supplement. We have not authorized anyone to provide you with different information. We do not take responsibility for, and can provide no assurance as to the reliability of, any information that others may give you. We are not making an offer of the securities in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus, any applicable prospectus supplement, any free writing prospectus that we authorize and any pricing supplement or any document incorporated by reference is accurate as of any date other than the date of the applicable document.

Any statement contained in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus, any prospectus supplement, or any other subsequently filed document that is deemed to be incorporated by reference into this prospectus modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

Certain information included in this prospectus or in other materials we have filed or will file with the SEC (as well as information included in oral statements or other written statements made or to be made by us) includes forward-looking statements that reflect our plans, estimates, assumptions and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to these

2

differences include those discussed below and in our Annual Report on Form 10-K for the year ended December 31, 2017 under “Part I—Item 1A, Risk Factors.” Forward-looking statements include information concerning our possible or assumed future results of operations, business strategies and operations, financing plans, potential growth opportunities, potential market opportunities, potential results of our drug development efforts or trials, and the effects of competition. Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “anticipates,” “believes,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those terms. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our management’s plans, estimates, assumptions and beliefs only as of the date made. Except as required by law, we assume no obligation to update these forward-looking statements publicly or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

3

THE COMPANY

We are a clinical-stage biopharmaceutical company engaged in the discovery and development of orally administered small molecule drug candidates to fill significant unmet medical needs. We have a powerful pipeline of clinical drug candidates, led by our programs for the treatment of mild Alzheimer’s disease (“AD”) and diabetes. Our drug candidate for the treatment of AD, azeliragon (TTP488), is an orally administered, small molecule antagonist targeting the receptor for advanced glycation endproducts (“RAGE”), for which we have successfully completed the enrollment of both sub-studies in a Phase 3 clinical trial (the “STEADFAST Study”) under a Food and Drug Administration (“FDA”) agreed Special Protocol Assessment (“SPA”). Our diabetes drug candidates include TTP399, an orally administered, liver-selective glucokinase activator (“GKA”), for which we have completed a Phase 2b clinical trial in type 2 diabetes (the “AGATA Study”) in August 2016, and TTP273, an orally administered, non-peptide agonist that targets the glucagon-like peptide-1 receptor (“GLP-1r”), for which we have completed a Phase 2 clinical trial in type 2 diabetes (the “LOGRA Study”) in December 2016. We have also initiated an adaptive Phase 1b/2 study to explore the effects of TTP399 in type 1 diabetics in partnership with JDRF International (“JDRF”). We have two additional programs in various stages of preclinical and clinical development for the treatment of inflammatory disorders.

For a description of our business, financial condition, results of operations and other important information regarding us, see our filings with the SEC incorporated by reference in this prospectus. For instructions on how to find copies of the filings incorporated by reference in this prospectus, see “Where You Can Find More Information.”

Our principal executive office is located at 4170 Mendenhall Oaks Pkwy, High Point, NC 27265, Telephone (336) 841-0300.

4

RISK FACTORS

Investing in our securities involves risk. You should carefully consider the specific risks discussed or incorporated by reference in the applicable prospectus supplement, together with all the other information contained in any applicable prospectus supplement or incorporated by reference in this prospectus and the applicable prospectus supplement. You should also consider the risks, uncertainties and assumptions discussed under the caption “Part I—Item 1A, Risk Factors” included in our Annual Report on Form 10-K for the year ended December 31, 2017, which are incorporated by reference in this prospectus, and which may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future.

5

USE OF PROCEEDS

We will use the net proceeds we receive from the sale of the Class A common stock offered by us for general corporate purposes, unless we specify otherwise in the applicable prospectus supplement. General corporate purposes may include additions to working capital, capital expenditures, repayment of debt, the financing of possible acquisitions and investments or stock repurchases.

6

DESCRIPTION OF THE CAPITAL STOCK

Capital Stock

Our authorized capital stock consists of 100,000,000 shares of Class A common stock, par value $0.01 per share, 100,000,000 shares of Class B common stock, par value $0.01 per share, and 50,000,000 shares of preferred stock, par value $0.01 per share. As of February 23, 2018, we have approximately 9,693,254 shares of our Class A common stock outstanding, 23,119,246 shares of our Class B common stock outstanding and no shares of preferred stock outstanding.

Common Stock

Voting. Holders of our Class A common stock and Class B common stock are entitled to one vote for each share held on all matters submitted to stockholders for their vote or approval. The holders of our Class A common stock and Class B common stock vote together as a single class on all matters submitted to stockholders for their vote or approval, except with respect to the amendment of certain provisions of our amended and restated certificate of incorporation that would alter or change the powers, preferences or special rights of the Class B common stock so as to affect them adversely, which amendments must be approved by a majority of the votes entitled to be cast by the holders of the shares affected by the amendment, voting as a separate class, or as otherwise required by applicable law.

As of February 23, 2018, subsidiaries and affiliates of MacAndrews & Forbes Incorporated (collectively “MacAndrews”) hold 23,084,267 shares of our Class B common stock and 2,615,666 shares of our Class A common stock and therefore control approximately 78.3% of the combined voting power of our outstanding common stock. As a result, MacAndrews is able to control our business policies and affairs and any action requiring the general approval of our stockholders, including the adoption of amendments to our certificate of incorporation and bylaws, the approval of mergers or sales of substantially all of our assets and the removal of members of our Board of Directors with or without cause. MacAndrews also has the power to nominate a majority of the members to our Board of Directors under our investor rights agreement. The concentration of ownership and voting power of MacAndrews may also delay, defer or even prevent an acquisition by a third party or other change of control of our company and may make some transactions more difficult or impossible without the support of MacAndrews, even if such events are in the best interests of minority stockholders.

Dividends. The holders of Class A common stock are entitled to receive dividends when, as, and if declared by our Board of Directors out of legally available funds. The holders of our Class B common stock do not have any right to receive dividends other than dividends consisting of shares of our Class B common stock paid proportionally with respect to each outstanding share of our Class B common stock.

Liquidation or Dissolution. Upon our liquidation or dissolution, the holders of our Class A common stock are entitled to share ratably in those of our assets that are legally available for distribution to stockholders after payment of liabilities and subject to the prior rights of any holders of preferred stock then outstanding. Other than their par value, the holders of our Class B common stock do not have any right to receive a distribution upon a liquidation or dissolution of our company.

Transferability and Exchange. Subject to the terms of an exchange agreement and the operating agreement of vTv Therapeutics LLC (“vTv LLC”), our principal operating subsidiary, units of vTv LLC (along with a corresponding number of shares of our Class B common stock) are exchangeable for (i) shares of our Class A common stock or (ii) cash (based on the market price of the shares of Class A common stock), at our option (as the managing member of vTv LLC). Any decision to require an exchange for cash rather than shares of Class A common stock will ultimately be determined by our entire Board of Directors. Each such exchange will be on a one-for-one equivalent basis, subject to customary conversion rate adjustments for stock splits, stock dividends and reclassifications. Shares of Class B common stock may not be transferred except in connection with an exchange or transfer of units of vTv LLC.

Upon exchange, each share of our Class B common stock will be cancelled.

7

Preferred Stock

We have been authorized to issue up to 50,000,000 shares of preferred stock. Our board of directors has authorized, subject to limitations prescribed by Delaware law and our amended and restated certificate of incorporation, to determine the terms and conditions of the preferred stock, including whether the shares of preferred stock will be issued in one or more series, the number of shares to be included in each series and the powers, designations, preferences and rights of the shares. Our Board of Directors has also been authorized to designate any qualifications, limitations or restrictions on the shares without any further vote or action by the stockholders. The issuance of preferred stock may have the effect of delaying, deferring or preventing a change in control of our company and may adversely affect the voting and other rights of the holders of our Class A common stock and Class B common stock, which could have an adverse impact on the market price of our Class A common stock. We have no current plan to issue any shares of preferred stock.

Corporate Opportunities

Our amended and restated certificate of incorporation provides that, to the fullest extent permitted by law, the doctrine of “corporate opportunity” will not apply to MacAndrews, any of our non-employee directors who are employees, affiliates or consultants of MacAndrews or its affiliates (other than us or our subsidiaries) or any of their respective affiliates in a manner that would prohibit them from investing in competing businesses or doing business with our clients or customers. See “Risk Factors—Risks Relating to this Offering and Ownership of Our Class A Common Stock—MacAndrews has substantial influence over our business, and their interests may differ from our interests or those of our other stockholders” in our Annual Report on Form 10-K for the year ended December 31, 2017, which is incorporated herein by reference.

Anti-Takeover Effects of our Certificate of Incorporation and Bylaws

Our amended and restated certificate of incorporation and bylaws contain certain provisions that are intended to enhance the likelihood of continuity and stability in the composition of the Board of Directors and which may have the effect of delaying, deferring or preventing a future takeover or change in control of us unless such takeover or change in control is approved by our Board of Directors.

These provisions include:

Action by Written Consent; Special Meetings of Stockholders. Our amended and restated certificate of incorporation provides that, following the date on which MacAndrews ceases to beneficially own more than 50% of our common stock (the “Triggering Event”), stockholder action can be taken only at an annual or special meeting of stockholders and cannot be taken by written consent in lieu of a meeting. Our amended and restated certificate of incorporation and bylaws also provide that, except as otherwise required by law, special meetings of the stockholders can only be called by the chairman or vice-chairman of the board, the chief executive officer, or pursuant to a resolution adopted by a majority of the Board of Directors or, until the Triggering Event, at the request of holders of 50% or more of our outstanding shares of common stock. Except as described above, stockholders will not be permitted to call a special meeting or to require the Board of Directors to call a special meeting.

Advance Notice Procedures. Our bylaws establish an advance notice procedure for stockholder proposals to be brought before an annual meeting of our stockholders, including proposed nominations of persons for election to the Board of Directors. Stockholders at an annual meeting will only be able to consider proposals or nominations specified in the notice of meeting or brought before the meeting by or at the direction of the Board of Directors or by a stockholder who was a stockholder of record on the record date for the meeting, who is entitled to vote at the meeting and who has given our Secretary timely written notice, in proper form, of the stockholder’s intention to bring that business before the meeting. Although the bylaws do not give the Board of Directors the power to approve or disapprove stockholder nominations of candidates or proposals regarding other business to be conducted at a special or annual meeting, the bylaws may have the effect of precluding the conduct of certain business at a meeting if the proper procedures are not followed or may discourage or deter a potential acquirer from conducting a solicitation of proxies to elect its own slate of directors or otherwise attempting to obtain control of us.

8

Vacancies and Newly-Created Directorships on the Board of Directors. Our bylaws provide that the Board of Directors can fill vacancies on the Board of Directors. In addition, the Board of Directors will be permitted to increase the number of directors and fill the vacant positions. These provisions could make it more difficult for shareholders to affect the composition of our Board of Directors.

Authorized but Unissued Shares. Our authorized but unissued shares of common stock and preferred stock will be available for future issuance without stockholder approval. These additional shares may be utilized for a variety of corporate purposes, including future public offerings to raise additional capital, corporate acquisitions and employee benefit plans. The existence of authorized but unissued shares of common stock and preferred stock could render more difficult or discourage an attempt to obtain control of a majority of our common stock by means of a proxy contest, tender offer, merger or otherwise.