Current Report Filing (8-k)

January 13 2021 - 5:25PM

Edgar (US Regulatory)

United

States

Securities and Exchange Commission

Washington, D.C. 20549

FORM

8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (date of earliest event reported):

January 8, 2021

Puget Technologies, Inc.

(Exact Name

of Registrant as Specified in Charter)

|

Nevada

|

|

(State

of Incorporation)

|

|

|

|

333-179212

|

|

01-0959140

|

|

Commission

File Number

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

1200 North Federal Highway, Suite 200-A;

Boca Raton, Florida

|

|

33432

|

|

(Address of

Principal Executive Offices)

|

|

(Zip Code)

|

|

|

|

|

|

1 561 2108535

|

|

(Registrant’s

Telephone Number, Including Area Code)

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425).

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12).

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to

Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to

Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 2 - Financial

Information

Item 2.02 Results of Operations and Financial Condition.

The Registrant has fully complied with all of its obligations under

the series of 8% Convertible Notes entered into by prior management during 2015 - 2017 and in conjunction therewith is free of

related debt and litigation. Its focus now is on completing its audit and related filings with the Commission as recommended by

Qest Consulting Group, Inc. (“Qest”). Qest, which serves as the Registrant’s strategic consultant, is an Affiliate

of the Registrant as well as its current Parent, as that term is defined in Rule 405 of Commission Regulation C (“…an

affiliate controlling such person directly or indirectly through one or more intermediaries … [as well] as a person

that directly or indirectly through one or more intermediaries, controls or is controlled by, or is under common control with,

the person specified”).

Section 3 - Securities

and Trading Markets

Item 3.02 Unregistered Sales of Equity Securities.

As of the date of this report of special event, all of the 8% Convertible

Notes have been fully converted or paid. The original issuance of the 8% Convertible Notes during 2015, 2016 and 2017 relied on

the exemption from registration provided by Section 4(a)(2) of the Securities Act. Conversion of the 8% Convertible Notes into

shares of Common Stock was effected in reliance on Section 3(a)(9) of the Securities Act. The formula for conversion of the 8%

Convertible Notes was disclosed in a report of current event filed with the Commission on November 30, 2020 and is incorporated

herein by reference.

Section

5 - Corporate Governance and Management

Item 5.02 Departure of Directors or Certain Officers;

Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

At Qest’s recommendation, the Registrant’s current officers

and directors intend to initiate a nationwide search during calendar year 2021 for new officers and directors as well as to add

new members to its Board of Advisors with the goal of assembling the best corporate team possible for implementation of the Registrant’s

new operational plan (summarized below). It is hoped that new the officers will replace the current board of directors and management

during the next eighteen months allowing the members of current management to shift their focus to Qest where they also serve as

officers and directors, and thus eliminating existing conflicts of interest. The newly recruited board members would be subject

to ratification by the Registrant’s shareholders at the next annual meeting expected to be held during February of 2022.

Qest has recommended that the Registrant’s board of directors

be expanded to seven or more members, at least three of whom should be independent so that audit and compensation committees could

be implemented as envisioned by the Registrant’s articles of incorporation and bylaws. In terms of experience, Qest has recommended

that the new board of directors continue to employ persons with investment banking and accounting experience but also with experience

with mutual funds, the insurance industry, innovative technologies (e.g., alternative energy), the medical industry, intellectual

property and regulatory compliance. In order to recruit qualified personnel, the Registrant is adopting qualified and non-qualified

stock option plans and will undertake a limited offering of its securities on reliance on Rule 506(b) of Regulation D, the proceeds

of which will be used for, among other things, obtaining officers and directors liability insurance, discharging all remaining

corporate debt (approximately $100,000 involving expenses incurred in the ordinary course of business), payment of legal and auditing

expenses required to bring and maintain the Registrant current with its reporting obligations under the Exchange Act and provide

initial working capital. Significant additional funding will be required in order to implement the Registrant’s business

plan summarized below and it is expected that Qest will assist the Registrant in that regard since it is anticipated that, although

the Registrant’s current officers and directors would not continue in their current roles with the Registrant, they would

continue to be indirectly involved as Qest is expected to remain as the Registrant’s strategic consultant for at least the

next three years.

Puget Technologies, Inc., current report on Commission Form 8-K, Page 2

With reference to anticipated future operations under the new officers

and directors, the Registrant, at the suggestion of Qest, has adopted a new business model as a holding company operating through

subsidiaries in four different albeit related areas. These would primarily involve assisting promising operating companies to attain

independent public company status. The four diverse areas in which it intends to concentrate through subsidiaries are, in the order

in which it is anticipated projects will be undertaken:

|

|

1.

|

Through traditional acquisition of development stage operating companies that the Registrant’s

Board of Directors determines provide positive business opportunities. In that regard, the Registrant is considering the acquisition

of a consolidated company currently engaged in the operation of behavioral health clinics in the State of Florida and is considering

a joint venture in the solar energy industry involving proprietary nanotechnologies with current members of its Board of Advisors;

|

|

|

2.

|

Through acquisition of promising privately held operating companies that eventually want to attain

publicly traded status after a two-and-a-half to four and a half year period as subsidiaries of the Registrant during which time

they would control most of their own operations but learn the intricacies of being regulated under state and federal securities

regulation. The Registrant would control all legal and accounting operations and seek to generate savings and synergy by coordinating

activities (e.g., purchases, marketing, warehousing, etc., among its subsidiaries;

|

|

|

3.

|

Through organization and operation of a Business Development Company under the limited exemptive

provisions of Sections 54(a) through 65 of the Investment Company Act; and

|

|

|

4.

|

By formation of specialty acquisition vehicles for operating companies that desire to become

public.

|

In addition to the foregoing, given the experience that the Registrant’s

current president has with tax related benefits of doing business in the Commonwealth of Puerto Rico, Qest has also recommended

that the Registrant explore opportunities for potential subsidiaries there.

Section 8 - Other Events

Item 8.01 Other Events.

The Registrant has upgraded its website at https://pugettechnologies.com/

and expects to have it activated by Friday, January 15, 2021. It will include a restricted subsite for accredited investors available

on a password protected basis. Such limitation is required in order to avoid “general solicitation” in conjunction

with the proposed limited offering of the Registrant’s securities. All other aspects of the website including posting of

its reports filed with the Commission, principal corporate documents (e.g., articles of incorporation, bylaws, documents

defining the rights of securities holders, securities based compensation plans and its agreement with Qest), press releases, articles

of interest to shareholders, disclosure concerning the Registrant and contact information will be freely accessible.

Puget Technologies, Inc., current report on Commission Form 8-K, Page 3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of

1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Puget

Technologies, Inc.

|

|

|

|

|

|

By:

|

/s/Hermann

Burckhardt

|

|

Date:

January 13, 2021

|

|

Hermann Burckhardt,

President and Chief Executive Officer

|

|

|

|

|

|

By:

|

/s/Thomas

Jaspers

|

|

|

|

Thomas Jaspers,

Treasurer, Secretary and Chief Financial Officer

|

Puget Technologies, Inc., current report on Commission Form 8-K, Page 4

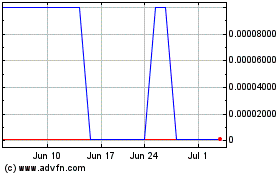

Puget Technologies (CE) (USOTC:PUGE)

Historical Stock Chart

From Mar 2024 to Apr 2024

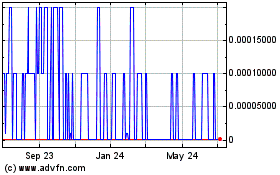

Puget Technologies (CE) (USOTC:PUGE)

Historical Stock Chart

From Apr 2023 to Apr 2024