Bed, Bath & Beyond, Micron Technology, Moderna: What to Watch When the Market Opens

January 07 2021 - 7:35AM

Dow Jones News

By Paul J. Davies

Here's what we're watching ahead of the opening bell on

Thursday.

-- U.S. stock futures rose as investors looked past Wednesday

night's storming of Congress by a pro-Trump mob that disrupted the

Senate's confirmation of Joe Biden's election victory. Futures tied

to the Dow Jones Industrial Average gained 0.2%, suggesting the

index of blue-chip stocks will extend a rally that pushed it to a

record closing high Wednesday. S&P 500 futures also rose

0.4%.

Futures on the Nasdaq-100 Index gained 0.6%, suggesting that

giant technology stocks may recoup some of their losses. Tech

shares took a beating Wednesday when investors pushed into other

stocks that are more dependent on economic growth.

What's Coming Up

-- Weekly jobless claims, due at 8:30 a.m. ET, are expected to

be up 815,000 in the week ended Jan. 2, compared with 787,000 the

week before. U.S. trade data are expected to show a deficit in

November of $67.3 billion, up from $63.1 billion in October as

imports grew by more than exports.

Later in the morning, figures on business services sentiment are

expected to have worsened slightly in December, though still to

have remained in expansion territory.

-- Corporate earnings season also gets underway with several

companies due to give updates, including Walgreens Boots Alliance,

Bed Bath & Beyond and Conagra Brands, all reporting before

stock markets open.

Market Movers to Watch

-- Bed Bath & Beyond stock rose nearly 6.5% on Wednesday and

was up another 0.8% in premarket trading Thursday. Analysts will be

looking to see how the firm's sales performed during the key

holiday season, including Black Friday.

-- Micron Technology is up 1% in premarket trading ahead of its

earnings due Thursday afternoon, adding to the 2.6% rise its stock

has enjoyed since the start of the year. Citigroup's analyst this

week had a dramatic pivot on the stock, moving it from sell

straight to buy and nearly trebling the price target to $100 from

$35.

-- Moderna is up more than 3.2% in premarket, building on a 6.5%

jump Wednesday after the European Union gave a green light to its

Covid-19 vaccine for use in Europe.

-- Fox Corp. B shares were down 1.4% having leapt 8.4% on

Wednesday.

-- Twitter shares slipped 1.5% premarket following a 1.2% drop

the day before. The social media site blocked President Trump's

account and deleted some of his posts late on Wednesday after he

continued to claim he'd won the election in a "sacred landslide."

Facebook also blocked Mr. Trump from posting, but its shares were

0.5% better after falling nearly 3% Wednesday.

Market Fact

Shares of Wall Street giant Goldman Sachs closed at a record for

the first time in nearly three years, a sign of how much the bank

has profited from the financial chaos of the past year. Its stock

has risen about 19% over the past month, far more than any of its

five big-bank peers.

Chart of the Day

The politics of reflation matters most for investors, but the

long-term impact of elections is often quite different than it

appears the day after the vote, writes columnist James

Mackintosh.

Must Reads Since You Went to Bed

Robinhood Wants More Female Investors. So Does Everyone

Else.

U.S. Weighs Adding Alibaba, Tencent to China Stock Ban

Roblox Plans to Go Public Through Direct Listing

The SPAC Bubble May Burst -- and Not a Day Too Soon

Dutch Lawsuit Seeks Quicker Resolution in Google Privacy

Case

(END) Dow Jones Newswires

January 07, 2021 07:20 ET (12:20 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

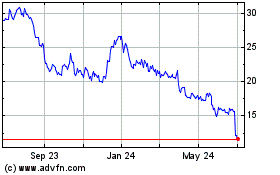

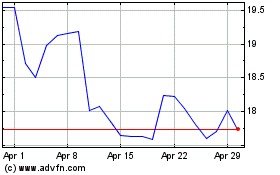

Walgreens Boots Alliance (NASDAQ:WBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Walgreens Boots Alliance (NASDAQ:WBA)

Historical Stock Chart

From Apr 2023 to Apr 2024