Current Report Filing (8-k)

January 06 2021 - 9:23AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 6, 2021

FOMO

CORP.

(Exact

name of Registrant as specified in its Charter)

|

CALIFORNIA

|

|

001-13126

|

|

83-3889101

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

No.)

|

|

(IRS

Employer

Identification

No.)

|

1

E Erie St, Ste 525 Unit #2250, Chicago, IL 60611

(Address

of principal executive offices)

(630)

286-9560

(Registrant’s

Telephone Number)

(Former

name or address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

|

|

ETFM

|

|

OTC

Pink

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2) [X]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act [X]

FOMO

CORP. is referred to herein as “we”, “us”, or “us”

ITEM

8.01 Other Events

FOMO

CORP. (“FOMO”) is hereby updating investors with regard to convertible debentures and accrued interest as of January

6, 2021. Three loans to “Jabro” and “Other” are unable to be confirmed. No documentation of such loans

was provided by prior management, previous accountants or prior auditors when FOMO’s current management was appointed on

or around March 6, 2019. In discussion with the Company’s audit firm Boyle CPA, LLC, management believes it is appropriate

to move these undocumented loans out of long-term debt and make adjustments to shareholders’ equity if/when extinguished.

Separately, though substantial common shares have been reserved for conversions of “aged loans” subject to Rule 144,

management believes reserves are conservative at an estimated 10x amounts required by lenders because, at the times of these loans,

the Company’s common stock price was substantially lower than recent levels. If and when lenders complete conversions of

their positions, remaining common stock reserves will be released back to the Company, which management believes will mitigate

the need for an increase in authorized shares or other corporate actions including a change to the Company’s share structure.

A debt scheduled is attached as Exhibit 10.1.

Item

9.01. Exhibits

(a)

Exhibits. The following exhibit is filed with this Current Report on Form 8-K:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

FOMO

CORP.

|

|

|

|

|

Date:

January 6, 2021

|

By:

|

/s/

Vikram Grover

|

|

|

|

Vikram

Grover

|

|

|

|

Chief

Executive Officer

|

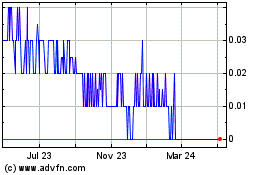

FOMO (PK) (USOTC:FOMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

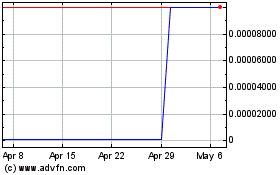

FOMO (PK) (USOTC:FOMC)

Historical Stock Chart

From Apr 2023 to Apr 2024