Current Report Filing (8-k)

January 04 2021 - 9:44AM

Edgar (US Regulatory)

0000813762

false

0001034563

false

8-K

2021-01-04

false

false

false

¨

false

0000813762

2021-01-04

2021-01-04

0000813762

iep:IcahnEnterprisesHoldingsMember

2021-01-04

2021-01-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): January 4, 2021

Commission

File

Number

|

Exact

Name of Registrant as Specified in Its Charter,

Address of Principal

Executive Offices and Telephone

Number

|

State of

Incorporation

|

I.R.S.

Employer

Identification

No.

|

|

1-9516

|

ICAHN ENTERPRISES L.P.

16690 Collins Ave, PH-1

Sunny Isles Beach, FL 33160

(305) 422-4100

|

Delaware

|

13-3398766

|

|

|

|

|

|

|

333-118021-01

|

ICAHN ENTERPRISES HOLDINGS L.P.

16690 Collins Ave, PH-1

Sunny Isles Beach, FL 33160

(305) 422-4100

|

Delaware

|

13-3398767

|

N/A

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Depositary Units

|

|

IEP

|

|

Nasdaq Global Select Market

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule

12b-2 of the Securities Exchange Act of 1934. Emerging growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

Co-Registrant CIK

|

0001034563

|

|

Co-Registrant Amendment Flag

|

false

|

|

Co-Registrant Form Type

|

8-K

|

|

Co-Registrant DocumentPeriodEndDate

|

2021-01-04

|

|

Co-Registrant Written Communications

|

false

|

|

Co-Registrant Solicitating Materials

|

false

|

|

Co-Registrant PreCommencement Tender Offer

|

false

|

|

Emerging Growth Company

|

¨

|

|

Co-Registrant PreCommencement Issuer Tender Offer

|

false

|

Former Address

|

|

Item 7.01.

|

Regulation FD Disclosure

|

In connection with the offering described in Item 8.01 below,

Icahn Enterprises L.P. (“Icahn Enterprises”) is making investor presentations to certain existing and potential investors.

The investor presentation is attached hereto as Exhibit 99.1

The information in this Item 7.01, including the exhibits attached

hereto, of this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and

shall not be deemed to be incorporated by reference into any of the Registrant’s filings under the Securities Act of 1933,

as amended (the “Securities Act”), or the Exchange Act, whether made before or after the date hereof and regardless

of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such a

filing.

On January 4, 2021, Icahn Enterprises issued a press release

announcing that it, together with Icahn Enterprises Finance Corp. (together with Icahn Enterprises, the “Issuers”),

intends to commence an offering of Senior Notes due 2029 (the “Notes”), for issuance in a private placement (the “Notes

Offering”) not registered under the Securities Act. The Notes will be issued under an indenture to be dated the issue date

of the Notes by and among the Issuers, Icahn Enterprises Holdings L.P., as guarantor, and Wilmington Trust, National Association,

as trustee. The net proceeds from the Notes Offering will be used to redeem a portion of the Issuers’ existing 6.250% Senior

Notes due 2022 pursuant to the Issuers’ previously announced notice of conditional redemption. There can be no assurance

that the issuance and sale of any debt securities of the Issuers will be consummated, that the conditions precedent to the redemption

will be satisfied, or that the redemption will occur.

A copy of the press release is attached hereto as Exhibit 99.2.

This Current Report on Form 8-K is neither an offer to sell

nor a solicitation of an offer to buy any securities of Icahn Enterprises.

|

|

Item 9.01.

|

Financial Statements and Exhibits

|

(d) Exhibits

99.1 – Investor Presentation.

99.2 – Press Release dated January 4, 2021 announcing the Notes Offering.

104 – Cover Page Interactive Data

File (formatted in Inline XBRL in Exhibit 101).

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, each Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ICAHN ENTERPRISES L.P.

(Registrant)

|

|

|

|

|

|

|

|

By:

|

Icahn Enterprises G.P. Inc.

its general partner

|

|

|

|

|

|

|

Date: January 4, 2021

|

|

By:

|

/s/ Ted Papapostolou

|

|

|

|

|

Ted Papapostolou

|

|

|

|

|

Chief Accounting Officer

|

|

|

ICAHN ENTERPRISES HOLDINGS L.P.

(Registrant)

|

|

|

|

|

|

|

|

By:

|

Icahn Enterprises G.P. Inc.

its general partner

|

|

|

|

|

|

|

Date January 4, 2021

|

|

By:

|

/s/ Ted Papapostolou

|

|

|

|

|

Ted Papapostolou

Chief Accounting Officer

|

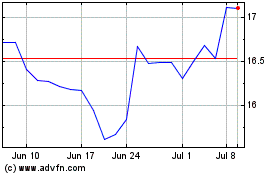

Icahn Enterprises (NASDAQ:IEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Icahn Enterprises (NASDAQ:IEP)

Historical Stock Chart

From Apr 2023 to Apr 2024