UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16

OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2020

Commission File Number: 001-31528

IAMGOLD Corporation

(Translation of registrant's name into English)

401 Bay Street Suite 3200, PO Box 153

Toronto, Ontario, Canada M5H 2Y4

Tel: (416) 360-4710

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [ x ] Form 40-F

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule

101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely

to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Note: Regulation S-T Rule

101(b)(7) only permits the submission in paper of a Form 6-K if submitted to

furnish a report or other document that the registrant foreign private issuer

must furnish and make public under the laws of the jurisdiction in which the

registrant is incorporated, domiciled or legally organized (the registrant’s

“home country”), or under the rules of the home country exchange on which the

registrant’s securities are traded, as long as the report or other document is

not a press release, is not required to be and has not been distributed to the

registrant’s security holders, and, if discussing a material event, has already

been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing the information

contained in this Form, the registrant is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

Yes [ ]

No [ x ]

If "Yes" is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): 82- ________

SUBMITTED HEREWITH

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

IAMGOLD CORPORATION |

| |

(Registrant) |

| |

|

|

| Date: December 30, 2020 |

By: |

/s/ Tim Bradburn |

| |

|

Tim Bradburn |

| |

Title: |

Senior Vice President, General Counsel and Corporate Secretary |

IAMGOLD COMPLETES SALE OF ITS INTEREST IN THE

SADIOLA GOLD MINE

All amounts are in US dollars, unless otherwise indicated.

Toronto, Ontario, December 30, 2020 - IAMGOLD Corporation ("IAMGOLD" or the "Company") announces that the Company, together with joint venture partner, AngloGold Ashanti Limited ("AGA"), have completed the previously announced sale (see news release dated December 23, 2019) of our collective interests in Société d'Exploitation des Mines d'Or de Sadiola S.A. ("SEMOS") to Allied Gold Corp ("Allied Gold") (the "Transaction"). SEMOS' principal asset is the Sadiola Gold Mine, located in the Kayes region of Western Mali.

Prior to the completion of the Transaction ("Completion"), IAMGOLD and AGA each held a 41% interest in SEMOS with the remaining 18% interest held by the Republic of Mali (the "Republic of Mali"). Pursuant to the Transaction and immediately prior to Completion, the Republic of Mali acquired a further 2% interest in SEMOS (1% each from IAMGOLD and AGA) (the "Republic Transaction"). Consequently, upon Completion, IAMGOLD and AGA each sold a 40% interest in SEMOS to Allied Gold.

Immediately prior to the Republic Transaction, a dividend of $20 million was declared and paid by SEMOS pro-rata to its shareholders. IAMGOLD and AGA each received a cash dividend of $8.2 million and the Republic of Mali received a cash dividend of $3.6 million.

Upon Completion, IAMGOLD and AGA received $50 million ($25 million each to IAMGOLD and AGA) from Allied Gold and the Republic of Mali. In addition, within three business days of Completion, IAMGOLD and AGA will receive agreed additional consideration of approximately $3.6 million (approximately $1.8 million each to IAMGOLD and AGA) based upon the amount by which the cash balance of SEMOS at April 30, 2020 was greater than the amount agreed pursuant to the Transaction agreement entered into by IAMGOLD and AGA with Allied Gold in December 2019.

Following Completion, IAMGOLD and AGA remain entitled to the following deferred consideration:

- $25 million ($12.5 million each to IAMGOLD and AGA) upon the production of the first 250,000 ounces from the Sadiola Sulphides Project ("SSP");

- $25 million ($12.5 million each to IAMGOLD and AGA) upon the production of a further 250,000 ounces from the SSP; and

- $2.5 million ($1.25 million each to IAMGOLD and AGA) in the event a favourable settlement is achieved by SEMOS in ongoing litigation pending before the Malian courts.

Gordon Stothart, President and CEO of IAMGOLD, commented, "We are pleased to complete this transaction, which underpins our commitment and focus on a prudent capital allocation strategy as we embark on a transformational path with the execution on our growth pipeline. The Sadiola mine was the founding cornerstone asset and building block of our Company, and we would like to recognize the Sadiola team, surrounding communities and all stakeholders for their valued support over more than twenty years."

Financial Advisors

TD Securities acted as exclusive financial advisor to IAMGOLD in connection with the Transaction.

About IAMGOLD

IAMGOLD is a mid-tier mining company with three gold mines on three continents, including the Essakane mine in Burkina Faso, the Rosebel mine in Suriname, and the Westwood mine in Canada. A solid base of strategic assets is complemented by the Côté Gold development project in Canada, the Boto Gold development project in Senegal, as well as greenfield and brownfield exploration projects in various countries located in West Africa and the Americas. On July 21, 2020, the Company, together with joint venture partner Sumitomo Metal Mining Co. Ltd., announced the decision to proceed with the construction of the Côté Gold Project.

IAMGOLD is committed to maintaining its culture of accountable mining through high standards of ESG practices and employs approximately 5,000 people. IAMGOLD's commitment is to Zero Harm, in every aspect of its business. IAMGOLD is one of the companies on the JSI index.

IAMGOLD is listed on the Toronto Stock Exchange (trading symbol "IMG") and the New York Stock Exchange (trading symbol "IAG").

For further information please contact:

Indi Gopinathan, VP, Investor Relations & Corporate Communications, IAMGOLD Corporation

Tel: (416) 360-4743 Mobile: (416) 388-6883

Philip Rabenok, Senior Analyst, Investor Relations, IAMGOLD Corporation

Tel: (416) 933-5783 Mobile: (647) 967-9942

Toll-free: 1-888-464-9999 info@iamgold.com

Please note:

This entire news release may be accessed via fax, e-mail, IAMGOLD's website at www.iamgold.com and through Newsfile's website at www.newsfilecorp.com. All material information on IAMGOLD can be found at www.sedar.com or at www.sec.gov.

Si vous désirez obtenir la version française de ce communiqué, veuillez consulter le www.iamgold.com/French/Home/default.aspx.

This regulatory filing also includes additional resources:

exhibit99-1.pdf

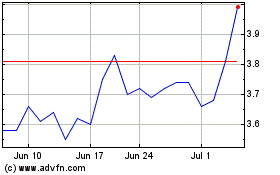

Iamgold (NYSE:IAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Iamgold (NYSE:IAG)

Historical Stock Chart

From Apr 2023 to Apr 2024