Transocean's $1.5 Billion Restructuring Survives Hedge-Fund Lawsuit

December 17 2020 - 1:02PM

Dow Jones News

By Andrew Scurria

A federal judge upheld a $1.5 billion debt restructuring by

offshore-drilling contractor Transocean Ltd., ruling against a

hedge-fund bondholder that claimed it was treated unfairly as the

company took steps to survive a turbulent oil market.

Judge George B. Daniels of the U.S. District Court in New York

rejected efforts by Whitebox Advisors LLC to call a debt default

against Transocean during a painful period for deep-water drilling

that has sent several peer companies to bankruptcy.

Transocean has stayed afloat in part through a September bond

exchange covering roughly $1.5 billion in debt that shaved some

$826 million from the company's balance sheet. Whitebox and Pacific

Investment Management Co. held out, objecting to the exchange and

saying their claims against some Transocean assets had been

weakened in violation of debt contracts.

In September, they told Transocean they believed the

restructuring amounted to a default and sued the company. The

default notice gave the company 90 days, until Dec. 1, to resolve

the allegation or else risk accelerated bond repayments, the loss

of bank credit and a forced bankruptcy filing.

The company denied it was in default and called the allegations

baseless. Still, with the Dec. 1 deadline looming, Transocean

unwound some asset-shifting maneuvers that Whitebox had complained

about. The company said that resolved the alleged default before

the cure period lapsed and investors could take action.

On Thursday, the judge said no default had occurred. Whitebox

didn't immediately respond to a request for comment.

Transocean isn't alone among offshore drilling contractors in

facing severe financial strains. Several of the Switzerland-based

company's competitors have restructured their balance sheets in

recent months, slammed by volatile crude prices and the coronavirus

pandemic's impact on global oil demand.

The world's largest deep-water rig owner, Transocean is on more

solid footing than U.S. offshore contractor Diamond Offshore

Drilling Inc., the U.K.'s Noble Corp. and Valaris PLC and

Luxembourg-based Pacific Drilling SA, all of which have filed for

bankruptcy since April.

Transocean had accused Whitebox in court papers of waging a

campaign to force an unnecessary bankruptcy in which bondholders

like itself could take equity control.

Even before the pandemic, a sluggish oil market had idled many

offshore fleets as advanced techniques for tapping deep oil

deposits on land led to record oil production in the U.S.,

diverting investment interest from more-complex drilling

offshore.

Write to Andrew Scurria at andrew.scurria@wsj.com

(END) Dow Jones Newswires

December 17, 2020 12:47 ET (17:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

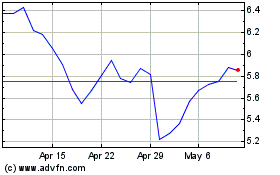

Transocean (NYSE:RIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

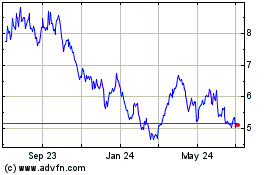

Transocean (NYSE:RIG)

Historical Stock Chart

From Apr 2023 to Apr 2024