Myanmar Investments Intl Ltd Notice of AGM And Posting Of Annual Report (2751I)

December 11 2020 - 8:00AM

UK Regulatory

TIDMMIL

RNS Number : 2751I

Myanmar Investments Intl Ltd

11 December 2020

This announcement contains inside information 11 December

2020

Myanmar Investments International Limited

Publication of the Annual Report & Accounts and the Notice

of AGM

Myanmar Investments International Limited ("MIL" or the

"Company"), the AIM-quoted Myanmar focused investment company, is

pleased to announce that it has posted to its shareholders and

warrant holders its Annual Report and audited financial statements

for the financial period from 1 April 2019 to 30 September 2020

together with the Notice of its AGM and a Form of Proxy.

Due to current restrictions on the way in which we all conduct

business and in particular on public gatherings related to the

Covid-19 outbreak, the Directors have decided to facilitate holding

the AGM remotely, while still endeavouring to create a forum for

the conduct of the formal business set out in the notice of the

Annual General Meeting and providing an opportunity for

shareholders to raise questions of the Directors. As such, notice

is hereby given that the 2020 Annual General Meeting of Myanmar

Investments International Limited (the "Company") will be held as a

virtual meeting at 2.30 p.m. (Myanmar time) on 12 January 2021.

The Company will offer shareholders the option to participate in

the meeting remotely via a Zoom webinar that can be accessed from

any computer with internet access.

Copies of the Annual Report and audited financial statements for

the financial period from 1 April 2019 to 30 September 2020 and the

Notice of AGM have been published and are available in electronic

form on the Company's website at

http://myanmarinvestments.com/financial-reports/.

For further information please contact:

Nick Paris Michael Rudolf

Managing Director CFO

Myanmar Investments International Myanmar Investments International

Limited +95 (0) 1 387 947 Limited +95 (0) 1 387 947

nickparis@myanmarinvestments.com michaelrudolf@myanmarinvestments.com

Nominated Adviser Broker

Philip Secrett / Jamie Barklem William Marle / Giles Rolls

/ Seamus Fricker finnCap Ltd

Grant Thornton UK LLP +44 (0) 20 7220 0500

+44 (0) 20 7383 5100

For more information about MIL, please visit

www.myanmarinvestments.com

Notes to Editors

Myanmar Investments International Limited (AIM: MIL) was the

first Myanmar-focused investment company to be admitted to trading

on the AIM market of the London Stock Exchange. MIL was established

in 2013 with the intention of building long-term shareholder value

by proactively investing in a diversified portfolio of Myanmar

businesses that will benefit from the country's re-emergence and

ongoing economic development. The Company is led by an experienced

and entrepreneurial team who between them have considerable

industrial, corporate and financial management experience. At the

Annual General Meeting on 24 October 2019, the Company's

shareholders approved a change in the investment policy of the

Company to now seek to harvest the Company's investments over

time.

MIL's largest investment to-date at a cost of US$21 million is

in AP Towers, one of Myanmar's largest telecommunications towers

companies with approximately 3,245 towers. Apollo operates in the

high growth telecommunications sector with a strong management that

is growing the number of co-locations (i.e. multiple tenancies) on

its portfolio of towers. The re-financing Towers which is now

completed is expected to produce a more efficient and profitable

combined investment with greater prospects for an eventual

liquidity event for shareholders.

MIL's first investment in August 2014 was into Myanmar Finance

International Limited ("MFIL") which today is one of the leading

microfinance companies in Myanmar. Since MIL invested, MFIL's

business has expanded rapidly. The business is profitable with a

sustainable expansion plan for long-term growth. In November 2015,

the Norwegian Government's Norwegian Investment Fund for Developing

Countries ("Norfund"), the Norwegian development finance

institution, also became a 25 per cent shareholder in MFIL. MIL is

in the process of selling this investment. On 1 April 2020 MIL

announced that it has accepted an offer to sell its shareholding in

MFIL subject to the purchaser's AGM approving the purchase,

lender's consent, and Myanmar regulatory approval. Subsequent to

that announcement, the purchaser's AGM on 23(rd) April 2020 has

approved the transaction and the lenders have given their consent.

However, because of Covid-19 which, inter alia, has stopped all

commercial air travel between Myanmar and Thailand, little progress

has been made in obtaining regulatory approval. Assuming a level of

normalcy returns over the next few months we expect completion to

take place within the next 4 to 6 months.

On 28 November 2019, the Company announced that it had agreed to

dispose of its entire shareholding in Medicare International Health

& Beauty Pte. Ltd for US$1 million and this transaction

completed in December 2019.

Myanmar, a country of approximately 54 million people and

roughly the size of France, has been isolated for much of the last

50 years. Strategically situated in one of the world's most

economically dynamic regions amid the intersection of India, China

and South East Asia it is a key component of China's 'One Belt One

Road' strategy providing direct access to the Indian Ocean.

Whilst it was once one of the more prosperous countries in

Southeast Asia with an abundance of natural resources (oil, natural

gas, arable land, tourist attractions and a long coastline), it is

now one of the least developed countries in the world. However, it

has a number of competitive advantages: a population of 54 million

people (it is the 26th most populous country in the world); a large

workforce with a high literacy rate of 90 per cent; 68 per cent of

the population is of working age (between 15 and 65); and 28 per

cent of the population is under 24 which is expected to provide a

strengthening consumer demand. According to the IMF, Myanmar's GDP

growth rate is expected to be 6.8 per cent through to 2024.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOAUROSRRBUUAAA

(END) Dow Jones Newswires

December 11, 2020 08:00 ET (13:00 GMT)

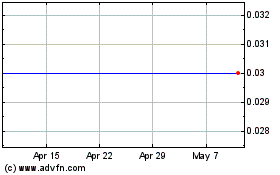

Myanmar Investments (LSE:MIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

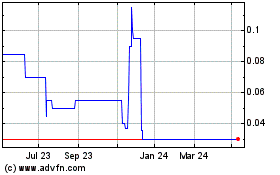

Myanmar Investments (LSE:MIL)

Historical Stock Chart

From Apr 2023 to Apr 2024