Form S-1

as filed with the Securities and Exchange Commission on December 9, 2020

Registration

No. 333-______

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

SILVER

BULL RESOURCES, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

1000

|

91-1766677

|

|

(State or other jurisdiction

of incorporation or organization)

|

(Primary Standard

Industrial Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

777

Dunsmuir Street, Suite 1610

Vancouver,

B.C.

V7Y

1K4 Canada

(604)

687-5800

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Christopher

Richards

Chief

Financial Officer

777

Dunsmuir Street, Suite 1610

Vancouver,

B.C.

V7Y

1K4 Canada

(604)

687-5800

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

with

a copy to:

Brian Boonstra

Davis Graham

& Stubbs LLP

1550 Seventeenth

Street, Suite 500

Denver,

Colorado 80202

(303) 892-9400

From

time to time after the effective date of this registration statement.

(Approximate

date of commencement of proposed sale to the public)

If any

of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933 check the following box: x

If this

Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. o

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this

Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer o

Emerging

growth

company o

|

Accelerated

filer o

|

Non-accelerated

filer o

|

Smaller

reporting company x

|

If an

emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

CALCULATION

OF REGISTRATION FEE

|

Title

of Each Class of Securities to be Registered

|

Amount

to be Registered (1)

|

Proposed

Maximum Offering Price per Share (2)

|

Proposed

Maximum Aggregate Offering Price

|

Amount

of Registration Fee (3)

|

|

Common

stock, $0.01 par value per share (4)

|

5,913,869

|

$0.52

|

$3,075,212

|

$335.51

|

|

|

(1)

|

Pursuant

to Rule 416(b) under the Securities Act of 1933, as amended (the “Securities

Act”), the shares of common stock offered hereby also include an indeterminate

number of additional shares of common stock as may from time to time become issuable

by reason of stock splits or stock dividends.

|

|

|

(2)

|

Estimated

solely for the purpose of calculating the registration fee and based upon the average

bid and ask price of the registrant’s common stock as reported on the OTCQB Venture

Marketplace on December 8, 2020, which was within five business days of the filing

date of this registration statement, in accordance with Rule 457(c) under the Securities

Act.

|

|

|

(3)

|

Pursuant

to Rule 457(o) under the Securities Act, the registration fee has been calculated

on the basis of the maximum aggregate offering price.

|

|

|

(4)

|

The

shares of common stock will be offered under the secondary offering prospectus relating

to resales by the selling stockholders of the shares of common stock issued to such selling

stockholders. The shares consist of (i) 3,623,580 shares issued to the selling stockholders

on October 27, 2020 in the initial tranche of a private placement, (ii) 1,811,789

shares issuable upon exercise of the warrants issued to the selling stockholders on October 27,

2020 in the initial tranche of the private placement, (iii) 319,000 shares issued

to a selling stockholder on November 9, 2020 in the second and final tranche of

the private placement, and (iv) 159,500 shares issuable upon exercise of the warrants

issued to a selling stockholder on November 9, 2020 in the second and final tranche

of the private placement.

|

THE REGISTRANT

HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT

SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN

ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON

SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

THE

INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THE SELLING STOCKHOLDERS MAY NOT SELL THESE SECURITIES UNTIL

THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO

SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

Subject

to Completion, dated DECEMBER 9, 2020

PROSPECTUS

5,913,869

Shares

SILVER BULL

RESOURCES, INC.

Common Stock

This

prospectus relates to the sale by the selling stockholders identified in this prospectus of up to 5,913,869 shares of common stock,

par value $0.01 per share, consisting of (i) 3,623,580 shares issued to the selling stockholders on October 27, 2020

in the initial tranche of a private placement, (ii) 1,811,789 shares issuable upon exercise of the warrants issued to the

selling stockholders on October 27, 2020 in the initial tranche of the private placement, (iii) 319,000 shares issued

to a selling stockholder on November 9, 2020 in the second and final tranche of the private placement, and (iv) 159,500

shares issuable upon exercise of the warrants issued to a selling stockholder on November 9, 2020 in the second and final

tranche of the private placement. Each of the warrants issued is exercisable until the fifth anniversary of the closing date of

the respective tranche of the private placement at an exercise price of $0.59.

All

of the shares of common stock offered by this prospectus are being sold by the selling stockholders. It is anticipated that the

selling stockholders will sell these shares of common stock from time to time in one or more transactions, in negotiated transactions

or otherwise, at prevailing market prices or at prices otherwise negotiated (see the section entitled “Plan of Distribution”

beginning on page 26 of this prospectus). We will not receive any proceeds from the sale of these shares by the selling stockholders.

All expenses of registration incurred in connection with this offering are being borne by us, but all selling and other expenses

incurred by the selling stockholders will be borne by the selling stockholders.

The

shares of common stock being offered by the selling stockholders pursuant to this prospectus are “restricted securities”

under the Securities Act of 1933, as amended (the “Securities Act”), before their sale under this prospectus. This

prospectus has been prepared for the purpose of registering these shares of common stock under the Securities Act to allow for

the sale by the selling stockholders to the public without restriction.

Our

common stock is quoted on the Toronto Stock Exchange under the symbol “SVB” and is traded on the OTCQB Venture Marketplace

under the symbol “SVBL.” On December 8, 2020, the closing price of our common stock was Cdn$0.66 per share on

the Toronto Stock Exchange and $0.52 per share on the OTCQB Venture Marketplace.

The

securities offered in this prospectus involve a high degree of risk. You should carefully consider the matters set forth in “Risk

Factors” on page 8 of this prospectus or incorporated by reference herein in determining whether to purchase our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this

prospectus is ,

2020.

TABLE

OF CONTENTS

|

PROSPECTUS

SUMMARY

|

1

|

|

The

Offering

|

4

|

|

FORWARD-LOOKING

STATEMENTS

|

5

|

|

RISK

FACTORS

|

8

|

|

USE

OF PROCEEDS

|

17

|

|

MARKET

FOR OUR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

|

17

|

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

19

|

|

SELLING

STOCKHOLDERS

|

20

|

|

DESCRIPTION

OF SECURITIES

|

23

|

|

PLAN

OF DISTRIBUTION

|

26

|

|

LEGAL

MATTERS

|

28

|

|

EXPERTS

|

29

|

|

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

|

29

|

|

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

|

30

|

You should

rely only on the information contained in this prospectus. We have not authorized any dealer, salesperson or other person to give

any information or represent anything not contained in this prospectus. You should not rely on any unauthorized information. This

prospectus does not offer to sell or buy any shares in any jurisdiction in which it is unlawful. The information in this prospectus

is current as of the date of this prospectus even though this prospectus may be delivered on a later date. Our business, financial

condition, results of operations and prospects may have changed since that date.

PROSPECTUS

SUMMARY

The

following summary highlights information contained elsewhere in this prospectus. It may not contain all the information that may

be important to you. You should read this entire prospectus carefully, including the section entitled “Risk Factors”

and our historical financial statements and related notes included or incorporated by reference in this prospectus. As used in

this prospectus, unless otherwise specified, references to “Silver Bull,” the “Company,” “we,”

“our” and “us” refer to Silver Bull Resources, Inc. and, unless otherwise specified, its subsidiaries.

All currency amounts in this prospectus are expressed in United States (“U.S.”) dollars, unless otherwise indicated.

Overview

Silver

Bull Resources, Inc. (the “Company”) was incorporated in the State of Nevada on November 8, 1993 as the Cadgie

Company for the purpose of acquiring and developing mineral properties. The Cadgie Company was a spin-off from its predecessor,

Precious Metal Mines, Inc. On June 28, 1996, the Company’s name was changed to Metalline Mining Company. On April 21,

2011, the Company’s name was changed to Silver Bull Resources, Inc. The Company’s fiscal year-end is October 31.

The Company has not realized any revenues from its planned operations and is considered an exploration stage company. The Company

has not established any reserves with respect to its exploration projects and may never enter into the development stage with

respect to any of its projects.

The

Company engages in the business of mineral exploration. The Company currently owns a number of property concessions in Mexico

(collectively known as the “Sierra Mojada Property”). The Company conducts its operations in Mexico through its wholly-owned

subsidiary corporations, Minera Metalin S.A. de C.V. (“Minera Metalin”), Contratistas de Sierra Mojada S.A. de C.V.

(“Contratistas”) and Minas de Coahuila SBR S.A. de C.V. (“Minas”).

In

April 2010, Metalline Mining Delaware, Inc., a wholly-owned subsidiary of the Company incorporated in the State of Delaware, was

merged with and into Dome Ventures Corporation (“Dome”), a Delaware corporation. As a result, Dome became a wholly-owned

subsidiary of the Company. Dome has a wholly-owned subsidiary, Dome Asia Inc. (“Dome Asia”), which is incorporated

in the British Virgin Islands. Dome Asia has a wholly-owned subsidiary, Dome Minerals Nigeria Limited, incorporated in Nigeria.

The

Company’s efforts and expenditures have been concentrated on the exploration of properties, principally the Sierra Mojada

Property located in Coahuila, Mexico (the “Sierra Mojada Project”). The Company has not determined whether its exploration

properties contain ore reserves that are economically recoverable. The ultimate realization of the Company’s investment

in exploration properties is dependent upon the success of future property sales, the existence of economically recoverable reserves,

and the ability of the Company to obtain financing or make other arrangements for exploration, development, and future profitable

production activities. The ultimate realization of the Company’s investment in exploration properties cannot be determined

at this time.

Our

principal office is located at 777 Dunsmuir Street, Suite 1610, Vancouver, British Columbia, V7Y 1K4, Canada, and our telephone

number is (604) 687-5800. We are a Nevada corporation.

We

maintain a website at www.silverbullresources.com, which contains information about us. Our website and the information

contained in and connected to it are not a part of this prospectus.

Current

Developments

South32

Earn-In Option Agreement

On

June 1, 2018, the Company and its subsidiaries Minera Metalin and Contratistas entered into an earn-in option agreement (the

“South32 Option Agreement”) with South32 International Investment Holdings Pty Ltd (“South32”), a wholly

owned subsidiary of South32 Limited (ASX/JSE/LSE: S32), whereby South32 is able to obtain an option to purchase 70% of the shares

of Minera Metalin and Contratistas (the “South32 Option”). Upon the terms and subject to the conditions set forth

in the South32 Option Agreement, in order for South32 to earn and maintain its four-year Option, South32 must have contributed

to Minera Metalin for exploration of the Sierra Mojada Project at least $10 million by the end of Year 4 (the “Initial

Funding”). South32 may exercise the South32 Option by contributing $100 million to Minera Metalin (the “Subscription

Payment”), less the amount of Initial Funding previously contributed by South32. If the full amount of the Subscription

Payment is advanced by South32 and the South32 Option becomes exercisable and is exercised, the Company and South32 will be obligated

to contribute funding to Minera Metalin on a 30/70 pro rata basis. If South32 elects not to continue with the South32 Option during

the four-year option period, the Sierra Mojada Project will remain 100% owned by the Company. The exploration program will be

initially managed by the Company, with South32 being able to approve the exploration program funded by it.

The

Company received funding of $3,144,163 from South32 for Year 1 of the South32 Option Agreement. In April 2019, the Company

received a notice from South32 to maintain the South32 Option Agreement for Year 2 by providing cumulative funding of $6

million by the end of such period. The Company has received funding of $1,414,702 from South32 for Year 2 of the South32

Option Agreement as of July 31, 2020, which time period has been extended by an event of force majeure described in more

detail below. If the South32 Option Agreement is terminated by South32 without cause or if South32 is unable to obtain antitrust

authorization from the Mexican government, the Company is under no obligation to reimburse South32 for amounts contributed under

the South32 Option Agreement.

On

October 11, 2019, the Company and its subsidiary Minera Metalin issued a notice of force majeure to South32 pursuant to the

South32 Option Agreement. Due to a blockade by a cooperative of local miners called Sociedad Cooperativa de Exploración

Minera Mineros Norteños, S.C.L. (“Mineros Norteños”), the Company has temporarily halted all work on

the Sierra Mojada Property. The notice of force majeure was issued because of the blockade’s impact on the ability of the

Company and its subsidiary Minera Metalin to perform their obligations under the South32 Option Agreement. Pursuant to the South32

Option Agreement, any time period provided for in the South32 Option Agreement will generally be extended by a period equal to

the period of delay caused by the event of force majeure. As of December 9, 2020, the blockade by Mineros Norteños

at, on and around the Sierra Mojada Property is ongoing.

Beskauga

Option Agreement

On

August 12, 2020, the Company entered into an option agreement (the “Beskauga Option Agreement”) with Copperbelt

AG, a corporation existing under the laws of Switzerland (“CB Parent”), and Dostyk LLP, an entity existing under the

laws of Kazakhstan and a wholly-owned subsidiary of CB Parent (the “CB Sub,” and together with CB Parent, “CB”),

pursuant to which the Company will receive the exclusive right and option (the “Beskauga Option”) to acquire CB’s

right, title and 100% interest in the Beskauga property located in Kazakhstan (the “Beskauga Property”), which consists

of the Beskauga Main project (the “Beskauga Main Project”) and the Beskauga South project (the “Beskauga South

Project”). Upon the execution of the Beskauga Option Agreement, the Company paid CB Parent $30,000.

The

closing of the transactions contemplated by the Beskauga Option Agreement is subject to customary closing conditions, including

the payment by the Company to CB Parent of $40,000 within five business days after the Company’s due diligence on the Beskauga

Property is completed to the Company’s satisfaction. The Company’s 60-day due diligence period ends on January 15,

2021.

The

Beskauga Option Agreement provides that subject to the terms and conditions set forth in the Beskauga Option Agreement, in order

to maintain the effectiveness of the Beskauga Option, the Company must incur $2,000,000 in cumulative exploration expenditures

on the Beskauga Property by the first anniversary following the closing of the transactions contemplated by the Beskauga Option

Agreement (the “Closing Date”), $5,000,000 in cumulative expenditures on the Beskauga Property by the second anniversary

following the Closing Date, $10,000,000 in cumulative expenditures on the Beskauga Property by the third anniversary following

the Closing Date, and $15,000,000 in cumulative expenditures on the Beskauga Property by the fourth anniversary following the

Closing Date (collectively, the “Exploration Expenditures”). The Beskauga Option Agreement also provides that subject

to the terms and conditions set forth in the Beskauga Option Agreement, after the Company has incurred the Exploration Expenditures,

it may exercise the Beskauga Option and acquire (i) the Beskauga Property by paying CB $15,000,000 in cash, (ii) the

Beskauga Main Project only by paying CB $13,500,000 in cash, or (iii) the Beskauga South Project only by paying CB $1,500,000

in cash.

In

addition, the Beskauga Option Agreement provides that subject to the terms and conditions set forth in the Beskauga Option Agreement,

the Company may be obligated to make the following bonus payments (collectively, the “Bonus Payments”) to CB Parent

if the Beskauga Main Project or the Beskauga South Project is the subject of a bankable feasibility study in compliance with Canadian

National Instrument 43-101 indicating gold equivalent resources in the amounts set forth below, with (i) (A) 20% of

the Bonus Payments payable after completion of the bankable feasibility study or after the mineral resource statement is finally

determined and (B) the remaining 80% of the Bonus Payments due within 15 business days of commencement of on-site construction

of a mine for the Beskauga Main Project or the Beskauga South Project, as applicable, and (ii) up to 50% of the Bonus Payments

payable in shares of common stock of the Company to be valued at the 20-day volume-weighted average trading price of the shares

on the Toronto Stock Exchange calculated as of the date immediately preceding the date such shares are issued:

|

Gold

equivalent resources

|

Cumulative

Bonus Payments

|

|

Beskauga

Main Project

|

|

|

3,000,000

ounces

|

$2,000,000

|

|

5,000,000

ounces

|

$6,000,000

|

|

7,000,000

ounces

|

$12,000,000

|

|

10,000,000

ounces

|

$20,000,000

|

|

Beskauga

South Project

|

|

|

2,000,000

ounces

|

$2,000,000

|

|

3,000,000

ounces

|

$5,000,000

|

|

4,000,000

ounces

|

$8,000,000

|

|

5,000,000

ounces

|

$12,000,000

|

The

Beskauga Option Agreement may be terminated under certain circumstances, including (i) upon the mutual written agreement

of the Company and CB; (ii) upon the delivery of written notice by the Company, provided that at the time of delivery of

such notice, unless there has been a material breach of a representation or warranty given by CB that has not been cured, the

Beskauga Property is in good standing; (iii) if there is a material breach by a party of its obligations under the Beskauga

Option Agreement and the other party has provided written notice of such material breach, which is incapable of being cured or

remains uncured; or (iv) if the Closing Date does not occur by August 12, 2021.

The

Offering

The

following summary describes the principal terms of the offering but is not intended to be complete. See “Selling Stockholders”

and “Plan of Distribution” in this prospectus for a more detailed description of the selling stockholders, the terms

and conditions of the distribution of the shares of common stock and the shares of common stock issuable upon the exercise of

warrants, and the offering. For a more detailed description of our common stock and warrants to purchase our common stock, see

“Description of Securities.”

|

Common

stock offered by the selling stockholders:

|

|

5,913,869

shares of common stock, par value $0.01 per share, consisting of (i) 3,623,580 shares issued to the selling stockholders

on October 27, 2020 in the initial tranche of the private placement, (ii) 1,811,789 shares issuable upon exercise

of the warrants (at an exercise price of $0.59) issued to the selling stockholders on October 27, 2020 in the initial

tranche of the private placement, (iii) 319,000 shares issued to a selling stockholder on November 9, 2020 in the

second and final tranche of the private placement, and (iv) 159,500 shares issuable upon exercise of the warrants (at

an exercise price of $0.59) issued to a selling stockholder on November 9, 2020 in the second and final tranche of the

private placement.

|

|

Common

stock outstanding on December 8, 2020:

|

|

33,484,945

shares (1)

|

|

Common

stock outstanding after this offering:

|

|

35,456,234

shares (2)

|

|

Use

of proceeds:

|

|

We

will not receive any proceeds from the sale of shares in this offering by the selling stockholders.

|

|

Ticker

symbol:

|

|

SVB

(Toronto Stock Exchange); SVBL (OTCQB Venture Marketplace)

|

|

Risk

factors:

|

|

You

should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth

in the “Risk Factors” section beginning on page 8 of this prospectus before deciding whether or not to invest

in shares of our common stock.

|

|

|

(1)

|

Excludes

(a) 1,811,789 shares issuable upon the exercise of warrants issued to the selling

stockholders on October 27, 2020 in the initial tranche of the private placement,

(b) 159,500 shares issuable upon the exercise of warrants issued to the selling

stockholders on November 9, 2020 in the second and final tranche of the private

placement, (c) 2,043,750 shares of common stock issuable upon the exercise of outstanding

options, which are not being offered by this prospectus.

|

|

|

(2)

|

Includes

(a) 1,811,789 shares issuable upon the exercise of warrants issued to the selling

stockholders on October 27, 2020 in the initial tranche of the private placement

and (b) 159,500 shares issuable upon the exercise of warrants issued to the selling

stockholders on November 9, 2020 in the second and final tranche of the private

placement, and excludes (i) 2,043,750 shares of common stock issuable upon the exercise

of outstanding options, which are not being offered by this prospectus.

|

FORWARD-LOOKING

STATEMENTS

This

registration statement on Form S-1 includes certain statements that may be deemed to be “forward-looking statements”

within the meaning of the Securities Act, the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and

the U.S. Private Securities Litigation Reform Act of 1995, and “forward-looking information” within the meaning of

applicable Canadian securities legislation. We use words such as “anticipate,” “continue,” “likely,”

“estimate,” “expect,” “may,” “will,” “projection,” “should,”

“believe,” “potential,” “could,” or similar words suggesting future outcomes (including negative

and grammatical variations) to identify forward-looking statements. These statements concern the following, among other things:

|

|

·

|

The

sufficiency of our existing cash resources to enable us to continue our operations for

the next 12 months as a going concern;

|

|

|

·

|

Future

payments that may be made by South32 under the terms of the Earn-In Option Agreement;

|

|

|

·

|

The

anticipated closing of the transactions contemplated by the Beskauga Option Agreement,

future exploration expenditures on the Beskauga Property, the potential exercise of the

Beskauga Option and potential Bonus Payments under the Beskauga Option Agreement;

|

|

|

·

|

Prospects

of entering the development or production stage with respect to any of our projects;

|

|

|

·

|

Our

planned activities at the Sierra Mojada Project;

|

|

|

·

|

Whether

any part of the Sierra Mojada Project will ever be confirmed or converted into Securities

and Exchange Commission (“SEC”) Industry Guide 7-compliant “reserves”;

|

|

|

·

|

The

requirement of additional power supplies for the Sierra Mojada Project if a mining operation

is determined to be feasible;

|

|

|

·

|

Our

ability to obtain and hold additional concessions in the Sierra Mojada Project area;

|

|

|

·

|

The

timing, duration and overall impact of the COVID-19 pandemic on the Company’s business;

|

|

|

·

|

Whether

we will be required to obtain additional surface rights if a mining operation is determined

to be feasible;

|

|

|

·

|

The

possible impact on the Company’s operations of the blockade by a cooperative of

miners on the Sierra Mojada Property;

|

|

|

·

|

The

potential acquisition of additional mineral properties or property concessions;

|

|

|

·

|

Testing

of the impact of the fine bubble flotation test work on the recovery of minerals and

initial rough concentrate grade;

|

|

|

·

|

The

impact of recent accounting pronouncements on our financial position, results of operations

or cash flows and disclosures;

|

|

|

·

|

The

impact of changes to current state or federal laws and regulations on estimated capital

expenditures, the economics of a particular project and/or our activities;

|

|

|

·

|

Our

ability to raise additional capital and/or pursue additional strategic options, and the

potential impact on our business, financial condition and results of operations of doing

so or not;

|

|

|

·

|

The

impact of changing foreign currency exchange rates on our financial condition;

|

|

|

·

|

The

period during which unrecognized compensation expense is expected to be recognized;

|

|

|

·

|

Whether

using major financial institutions with high credit ratings mitigates credit risk;

|

|

|

·

|

The

impact of changing economic conditions on interest rates;

|

|

|

·

|

Our

expectations regarding future recovery of value-added taxes paid in Mexico; and

|

|

|

·

|

The

merits of any claims in connection with, and the expected timing of any, ongoing legal

proceedings.

|

These

statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical

trends, current conditions, expected future developments and other factors we believe are appropriate in the circumstances. Such

statements are subject to a number of assumptions, risks and uncertainties, and our actual results could differ from those expressed

or implied in these forward-looking statements as a result of the factors described under “Risk Factors” in our Annual

Report on Form 10-K for the fiscal year ended October 31, 2019 and Quarterly Reports on Form 10-Q for the quarters

ended January 31, 2020, April 30, 2020, and July 31, 2020 including without limitation, risks associated with the

following:

|

|

·

|

The

continued funding by South32 of amounts required under the Earn-In Option Agreement;

|

|

|

·

|

The

satisfaction of the closing conditions for the transactions contemplated by the Beskauga

Option Agreement, the results of future exploration at the Beskauga Property, including

a feasibility study in compliance with Canadian National Instrument 43-101, and our ability

to raise the capital for exploration expenditures on the Beskauga Property to maintain

the effectiveness of the Beskauga Option;

|

|

|

·

|

Our

ability to obtain additional financial resources on acceptable terms to (i) conduct our

exploration activities and (ii) maintain our general and administrative expenditures

at acceptable levels;

|

|

|

·

|

Our

ability to acquire additional mineral properties or property concessions;

|

|

|

·

|

Results

of future exploration at our Sierra Mojada Project;

|

|

|

·

|

Worldwide

economic and political events affecting (i) the market prices for silver, zinc,

lead, copper and other minerals that may be found on our exploration properties (ii) interest

rates and (iii) foreign currency exchange rates;

|

|

|

·

|

Outbreaks

of disease, including the COVID-19 pandemic, and related stay-at-home orders, quarantine

policies and restrictions on travel, trade and business operations;

|

|

|

·

|

The

amount and nature of future capital and exploration expenditures;

|

|

|

·

|

Volatility

in our stock price;

|

|

|

·

|

Our

inability to obtain required permits;

|

|

|

·

|

Competitive

factors, including exploration-related competition;

|

|

|

·

|

Timing

of receipt and maintenance of government approvals;

|

|

|

·

|

Unanticipated

title issues;

|

|

|

·

|

Changes

in regulatory frameworks or regulations affecting our activities;

|

|

|

·

|

Our

ability to retain key management, consultants and experts necessary to successfully operate

and grow our business; and

|

|

|

·

|

Political

and economic instability in Mexico and other countries in which we conduct our business,

and future potential actions of the governments in such countries with respect to nationalization

of natural resources or other changes in mining or taxation policies.

|

These

factors are not intended to represent a complete list of the general or specific factors that could affect us.

All

forward-looking statements speak only as of the date made. All subsequent written and oral forward-looking statements attributable

to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements. Except as required

by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on

which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. You should not place undue

reliance on these forward-looking statements.

RISK

FACTORS

A

purchase of our securities involves a high degree of risk. Our business, operating or financial condition could be harmed due

to any of the following risks. Accordingly, investors should carefully consider these risks in making a decision as to whether

to purchase, sell or hold our securities. In addition, investors should note that the risks described below are not the only risks

facing us. Additional risks not presently known to us, or risks that do not seem significant today, may impair our business operations

in the future.

Risks

Related to Our Business

If

South32 exercises its option to purchase 70% of the equity of Minera Metalin and Contratistas, we will no longer control the development

of the Sierra Mojada Project.

On

June 1, 2018, we entered into the South32 Option Agreement with South32, a wholly owned subsidiary of South32 Limited (ASX/JSE/LSE:

S32), whereby South32 is able to obtain the option to purchase 70% of the equity of Minera Metalin and Contratistas. If South32

exercises the South32 Option, then we will no longer control the development of the Sierra Mojada Project. South32 would have

the ability to control the timing and pace of future development, and its decisions may not be in the best interests of the Company

and its stockholders.

If

South32 were to exercise its option to purchase 70% of the equity of Minera Metalin and Contratistas, we will be required to contribute

30% of subsequent funding toward development of the Sierra Mojada Project, and we do not currently have sufficient funds to do

so.

If

South32 exercises its option to purchase 70% of the equity of Minera Metalin and Contratistas, under the terms of the South32

Option Agreement, we will retain a 30% ownership in Minera Metalin and Contratistas, and be obligated to contribute 30% of subsequent

funding toward the development of the Sierra Mojada Project. If we fail to satisfy our funding commitment, our interest in Minera

Metalin and Contratistas will be diluted. We do not currently have sufficient funds with which to satisfy this future funding

commitment, and there is no certainty that we will be able to obtain sufficient future funds on acceptable terms or at all.

We

may have difficulty meeting our current and future capital requirements.

Our

management and our board of directors monitor our overall costs and expenses and, if necessary, adjust our programs and planned

expenditures in an attempt to ensure that we have sufficient operating capital. We continue to evaluate our costs and planned

expenditures for our ongoing exploration efforts at our Sierra Mojada Project. As of July 31, 2020, we had cash and cash

equivalents of $1,038,756. Even with the South32 funds, the continued exploration and possible development of the Sierra Mojada

Project will require significant amounts of additional capital. If we are unable to fund future operations by way of financings,

including public or private offerings of equity or debt securities, we will need to significantly reduce operations, which will

result in an adverse impact on our business, financial condition and exploration activities. We do not have a credit, off-take

or other commercial financing arrangement in place that would finance continued evaluation or development of the Sierra Mojada

Project, and we believe that securing credit for these projects may be difficult. Moreover, equity financing may not be available

on attractive terms and, if available, will likely result in significant dilution to existing stockholders.

We

are an exploration stage mining company with no history of operations.

We

are an exploration stage enterprise engaged in mineral exploration in Mexico. We have a very limited operating history and are

subject to all the risks inherent in a new business enterprise. As an exploration stage company, we may never enter the development

and production stages. To date, we have had no revenues and have relied upon equity financing and South32 funding to fund our

operations. The likelihood of our success must be considered in light of the problems, expenses, difficulties, complications,

and delays frequently encountered in connection with an exploration stage business, and the competitive and regulatory environment

in which we operate and will operate, such as under-capitalization, personnel limitations, and limited financing sources.

We

have no commercially mineable ore body.

No

commercially mineable ore body has been delineated on our Sierra Mojada Project, nor have our properties been shown to contain

proven or probable mineral reserves. Investors should not assume that the projections contained in the report on our Sierra Mojada

Project will ever be realized. We cannot assure you that any mineral deposits we identify on the Sierra Mojada Project or on another

property will qualify as an ore body that can be legally and economically exploited or that any particular level of recovery of

silver, zinc or other minerals from discovered mineralization will in fact be realized. Most exploration projects do not result

in the discovery of commercially mineable ore deposits. Even if the presence of reserves is established at a project, the legal

and economic viability of the project may not justify exploitation.

Mineral

resource estimates may not be reliable.

There

are numerous uncertainties inherent in estimating quantities of mineralized material such as silver, zinc, lead, and copper, including

many factors beyond our control, and no assurance can be given that the recovery of mineralized material will be realized. In

general, estimates of mineralized material are based upon a number of factors and assumptions made as of the date on which the

estimates were determined, including:

|

|

·

|

geological

and engineering estimates that have inherent uncertainties;

|

|

|

·

|

the

assumed effects of regulation by governmental agencies;

|

|

|

·

|

the

judgment of the engineers preparing the estimate;

|

|

|

·

|

estimates

of future metals prices and operating costs;

|

|

|

·

|

the

quality and quantity of available data;

|

|

|

·

|

the

interpretation of that data; and

|

|

|

·

|

the

accuracy of various mandated economic assumptions, all of which may vary considerably

from actual results.

|

All

estimates are, to some degree, uncertain. For these reasons, estimates of the recoverable mineral resources prepared by different

engineers or by the same engineers at different times may vary substantially. As such, there is significant uncertainty in any

mineralized material estimate, and actual deposits encountered and the economic viability of a deposit may differ materially from

our estimates.

Our

business plan is highly speculative, and its success largely depends on the successful exploration of our Sierra Mojada concessions.

Our

business plan is focused on exploring the Sierra Mojada concessions to identify reserves and, if appropriate, to ultimately develop

this property. Although we have reported mineralized material on our Sierra Mojada Project, we have not established any reserves

and remain in the exploration stage. We may never enter the development or production stage. Exploration of mineralization and

determination of whether the mineralization might be extracted profitably is highly speculative, and it may take a number of years

until production is possible, during which time the economic viability of the project may change. Substantial expenditures are

required to establish reserves, extract metals from ore and construct mining and processing facilities.

The

Sierra Mojada Project is subject to all of the risks inherent in mineral exploration and development. The economic feasibility

of any mineral exploration and/or development project is based upon, among other things, estimates of the size and grade of mineral

reserves, proximity to infrastructures and other resources (such as water and power), anticipated production rates, capital and

operating costs, and metals prices. To advance from an exploration project to a development project, we will need to overcome

various hurdles, including completing favorable feasibility studies, securing necessary permits, and raising significant additional

capital to fund activities. There can be no assurance that we will be successful in overcoming these hurdles. Because of our focus

on the Sierra Mojada Project, the success of our operations and our profitability may be disproportionately exposed to the impact

of adverse conditions unique to the Torreon, Mexico region, as the Sierra Mojada Project is located 250 kilometers north of this

area.

Due

to our history of operating losses, we are uncertain that we will be able to maintain sufficient cash to accomplish our business

objectives.

During

the fiscal years ended October 31, 2019 and October 31, 2018, we suffered net losses of $3,939,000 and $3,520,000 respectively.

At July 31, 2020, we had stockholders’ equity of $8,188,383 and cash and cash equivalents of $1,038,756. Significant

amounts of capital will be required to continue to explore and potentially develop the Sierra Mojada concessions. We are not engaged

in any revenue producing activities, and we do not expect to be in the near future. Currently, our potential sources of funding

consist of the sale of additional equity securities, entering into joint venture agreements or selling a portion of our interests

in our assets. There is no assurance that any additional capital that we will require will be obtainable on terms acceptable to

us, if at all. Failure to obtain such additional financing could result in delays or indefinite postponement of further exploration

of our projects. Additional financing, if available, will likely result in substantial dilution to existing stockholders.

Our

exploration activities require significant amounts of capital that may not be recovered.

Mineral

exploration activities are subject to many risks, including the risk that no commercially productive or extractable resources

will be encountered. There can be no assurance that our activities will ultimately lead to an economically feasible project or

that we will recover all or any portion of our investment. Mineral exploration often involves unprofitable efforts, including

drilling operations that ultimately do not further our exploration efforts. The cost of minerals exploration is often uncertain,

and cost overruns are common. Our drilling and exploration operations may be curtailed, delayed or canceled as a result of numerous

factors, many of which are beyond our control, including title problems, weather conditions, protests, compliance with governmental

requirements, including permitting issues, and shortages or delays in the delivery of equipment and services.

Our

financial condition could be adversely affected by changes in currency exchange rates, especially between the U.S. dollar and

the Mexican peso (“$Mxn”) and the U.S dollar and the Canadian dollar (“$Cdn”) given our focus on the Sierra

Mojada Project in Mexico and our corporate office in Vancouver, Canada.

Our

financial condition is affected in part by currency exchange rates, as portions of our exploration costs in Mexico and general

and administration costs in Canada are denominated in the local currency. A weakening U.S. dollar relative to the $Mxn and $Cdn

will have the effect of increasing exploration costs and general and administration costs while a strengthening U.S. dollar will

have the effect of reducing exploration costs and general and administration costs. The exchange rates between the $Cdn and the

U.S. dollar and between the $Mxn and U.S. dollar have fluctuated widely in response to international political conditions, general

economic conditions and other factors beyond our control.

Our

success depends on developing and maintaining relationships with local communities and other stakeholders.

Our

ongoing and future success depends on developing and maintaining productive relationships with the communities surrounding our

operations and other stakeholders in our operating locations. We believe that our operations can provide valuable benefits to

surrounding communities, in terms of direct employment, training and skills development. In addition, we seek to maintain our

partnerships and relationships with local communities and stakeholders in a variety of ways, including in-kind contributions,

sponsorships and donations. Notwithstanding our ongoing efforts, local communities and stakeholders can become dissatisfied with

our activities or the level of benefits provided, which may result in legal or administrative proceedings, civil unrest, protests,

direct action or campaigns against us, such as the recent blockade by Mineros Norteños that caused us to halt all work

on the Sierra Mojada Property. Any such occurrences, including the blockade, could materially and adversely affect our financial

condition, results of operations and cash flows.

There

is substantial doubt about whether we can continue as a going concern.

To

date, we have earned no revenues and have incurred accumulated net losses of $131,326,341. In addition, we have limited financial

resources. As of July 31, 2020, we had cash and cash equivalents of $1,038,756 and working capital of $940,551. Therefore,

our continuation as a going concern is dependent upon our achieving a future financing or strategic transaction. However, there

is no assurance that we will be successful pursuing a financing or strategic transaction. Accordingly, there is substantial doubt

as to whether our existing cash resources and working capital are sufficient to enable us to continue our operations for the next

12 months as a going concern. Ultimately, in the event that we cannot obtain additional financial resources, or achieve profitable

operations, we may have to liquidate our business interests and investors may lose their investment. The accompanying consolidated

financial statements have been prepared assuming that our company will continue as a going concern. Continued operations are dependent

on our ability to obtain additional financial resources or generate profitable operations. Such additional financial resources

may not be available or may not be available on reasonable terms. Our consolidated financial statements do not include any adjustments

that may result from the outcome of this uncertainty. Such adjustments could be material.

Our

operations may be disrupted, and our financial results may be adversely affected, by global outbreaks of contagious diseases,

including the novel coronavirus (COVID-19) pandemic.

Global

outbreaks of contagious diseases, including the December 2019 outbreak of a novel strain of coronavirus (COVID-19), have the potential

to significantly and adversely impact our operations and business. On March 11, 2020, the World Health Organization recognized

COVID-19 as a global pandemic. Pandemics or disease outbreaks such as the currently ongoing COVID-19 outbreak may have a variety

of adverse effects on our business, including by depressing commodity prices and the market value of our securities and limiting

the ability of our management to meet with potential financing sources. The spread of COVID-19 has had, and continues to have,

a negative impact on the financial markets, which may impact our ability to obtain additional financing in the near term. A prolonged

downturn in the financial markets could have an adverse effect on our business, results of operations and ability to raise capital.

Risks

Related to the Mineral Exploration Industry

There

are inherent risks in the mineral exploration industry

We

are subject to all of the risks inherent in the minerals exploration industry including, without limitation, the following:

|

|

·

|

we

are subject to competition from a large number of companies, many of which are significantly

larger than we are, in the acquisition, exploration and development of mining properties;

|

|

|

·

|

we

might not be able raise enough money to pay the fees and taxes and perform the labor

necessary to maintain our concessions in good status;

|

|

|

·

|

exploration

for minerals is highly speculative, involves substantial risks and is frequently unproductive,

even when conducted on properties known to contain significant quantities of mineralization,

and our exploration projects may not result in the discovery of commercially mineable

deposits of ore;

|

|

|

·

|

the

probability of an individual prospect ever having reserves that meet the requirements

for reporting under SEC Industry Guide 7 is remote and any funds spent on exploration

may be lost;

|

|

|

·

|

our

operations are subject to a variety of existing laws and regulations relating to exploration

and development, permitting procedures, safety precautions, property reclamation, employee

health and safety, air quality standards, pollution and other environmental protection

controls, and we may not be able to comply with these regulations and controls; and

|

|

|

·

|

a

large number of factors beyond our control, including fluctuations in metal prices, inflation,

and other economic conditions, will affect the economic feasibility of mining.

|

Metals

prices are subject to extreme fluctuation.

Our

activities are influenced by the prices of commodities, including silver, zinc, lead, copper and other metals. These prices fluctuate

widely and are affected by numerous factors beyond our control, including interest rates, expectations for inflation, speculation,

currency values (in particular the strength of the U.S. dollar), global and regional demand, political and economic conditions

and production costs in major metal-producing regions of the world.

Our

ability to establish reserves through our exploration activities, our future profitability and our long-term viability, depend,

in large part, on the market prices of silver, zinc, lead, copper and other metals. The market prices for these metals are volatile

and are affected by numerous factors beyond our control, including:

|

|

·

|

global

or regional consumption patterns;

|

|

|

·

|

supply

of, and demand for, silver, zinc, lead, copper and other metals;

|

|

|

·

|

speculative

activities and producer hedging activities;

|

|

|

·

|

expectations

for inflation;

|

|

|

·

|

political

and economic conditions; and

|

|

|

·

|

supply

of, and demand for, consumables required for production.

|

Future

weakness in the global economy could increase volatility in metals prices or depress metals prices, which could in turn reduce

the value of our properties, make it more difficult to raise additional capital and make it uneconomical for us to continue our

exploration activities.

There

are inherent risks with foreign operations.

Our

business activities are primarily conducted in Mexico, and as such, our activities are exposed to various levels of foreign political,

economic and other risks and uncertainties. These risks and uncertainties include, but are not limited to, terrorism, hostage

taking, military repression, extreme fluctuations in currency exchange rates, high rates of inflation, labor unrest, the risks

of war or civil unrest, expropriation and nationalization, renegotiation or nullification of existing concessions, licenses, permits,

approvals and contracts, illegal mining, changes in taxation policies, restrictions on foreign exchange and repatriation, changing

political conditions (including with respect to North American Free Trade Agreement negotiations), currency controls and governmental

regulations that favor or require the rewarding of contracts to local contractors or require foreign contractors to employ citizens

of, or purchase supplies from, a particular jurisdiction.

Changes,

if any, in mining or investment policies or shifts in political attitude in Mexico may adversely affect our exploration and possible

future development activities. We may also be affected in varying degrees by government regulations with respect to, but not limited

to, foreign investment, maintenance of claims, environmental legislation, land use, land claims of local people, water use and

mine safety. Failure to comply strictly with applicable laws, regulations and local practices relating to mineral right applications

and tenure, could result in loss, reduction or expropriation of entitlements or the imposition of additional local or foreign

parties as joint venture partners with carried or other interests.

The

occurrence of these various factors and uncertainties cannot be accurately predicted and could have an adverse effect on our operations.

In addition, legislation in the United States, Canada or Mexico regulating foreign trade, investment and taxation could have a

material adverse effect on our financial condition.

Our

Sierra Mojada Project is located in Mexico and is subject to various levels of political, economic, legal and other risks.

The

Sierra Mojada Project, our primary focus, is in Mexico. In the past, Mexico has been subject to political instability, changes

and uncertainties, which have resulted in changes to existing governmental regulations affecting mineral exploration and mining

activities. Mexico’s status as a developing country may make it more difficult for us to obtain any required financing for

the Sierra Mojada Project or other projects in Mexico in the future. Our Sierra Mojada Project is also subject to a variety of

governmental regulations governing health and worker safety, employment standards, waste disposal, protection of historic and

archaeological sites, mine development, protection of endangered and protected species and other matters. Mexican regulators have

broad authority to shut down and/or levy fines against facilities that do not comply with regulations or standards.

Our

exploration activities in Mexico may be adversely affected in varying degrees by changing government regulations relating to the

mining industry or shifts in political conditions that increase the costs related to the Sierra Mojada Project. Changes, if any,

in mining or investment policies or shifts in political attitude may adversely affect our financial condition. Expansion of our

activities will be subject to the need to obtain sufficient access to adequate supplies of water, assure the availability of sufficient

power, as well as sufficient surface rights which could be affected by government policy and competing operations in the area.

We

also have litigation risk with respect to our operations. In particular, on May 20, 2014, Mineros Norteños filed an

action in the Local First Civil Court in the District of Morelos, State of Chihuahua, Mexico, against our subsidiary, Minera Metalin,

claiming that Minera Metalin breached an agreement regarding the development of the Sierra Mojada Project. Mineros Norteños

sought payment of the Royalty (as defined below), including interest at a rate of 6% per annum since August 30, 2004, even

though no revenue has been produced from the applicable mining concessions. It also sought payment of wages to the cooperative’s

members since August 30, 2004, even though none of the individuals were ever hired or performed work for Minera Metalin under

this agreement and Minera Metalin never committed to hiring them. On January 19, 2015, the case was moved to the Third District

Court (of federal jurisdiction). In October 2017, the court ruled that Mineros Norteños was time barred from bringing the

case. Subsequently, in October 2017, Mineros Norteños appealed this ruling. On July 31, 2019, the Federal Appeal Court

upheld the original ruling. This ruling was subsequently challenged by Mineros Norteños and on January 24, 2020, the

Federal Circuit Court ruled that the Federal Appeal Court must consider additional factors in its ruling. In March 2020, the Federal

Appeals Court upheld the original ruling after considering these additional factors. In August 2020, Mineros Norteños appealed

this ruling. The Company and the Company’s Mexican legal counsel believe that it is unlikely that the court’s ruling

will be overturned. The Company has not accrued any amounts in its interim condensed consolidated financial statements with respect

to this claim.

The

occurrence of these various factors and uncertainties cannot be accurately predicted and could have an adverse effect on our financial

condition. Future changes in applicable laws and regulations or changes in their enforcement or regulatory interpretation could

negatively impact current or planned exploration activities with the Sierra Mojada Project or in respect to any other projects

in which we become involved in Mexico. Any failure to comply with applicable laws and regulations, even if inadvertent, could

result in the interruption of exploration operations or material fines, penalties or other liabilities.

Title

to our properties may be challenged or defective.

Our

future operations, including our activities at the Sierra Mojada Project and other exploration activities, will require additional

permits from various governmental authorities. Our operations are and will continue to be governed by laws and regulations governing

prospecting, mineral exploration, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land

use, environmental protection, mine safety, mining royalties and other matters. There can be no assurance that we will be able

to acquire all required licenses, permits or property rights on reasonable terms or in a timely manner, or at all, that such terms

will not be adversely changed, that required extensions will be granted or that the issuance of such licenses, permits or property

rights will not be challenged by third parties.

We

attempt to confirm the validity of our rights of title to, or contract rights with respect to, each mineral property in which

we have a material interest. However, we cannot guarantee that title to our properties will not be challenged. The Sierra Mojada

Property may be subject to prior unregistered agreements, interests or native land claims, and title may be affected by undetected

defects. There may be valid challenges to the title of any of the claims comprising the Sierra Mojada Property that, if successful,

could impair possible development and/or operations with respect to such properties in the future. Challenges to permits or property

rights, whether successful or unsuccessful, changes to the terms of permits or property rights or a failure to comply with the

terms of any permits or property rights that have been obtained, could have a material adverse effect on our business by delaying

or preventing or making continued operations economically unfeasible.

A

title defect could result in Silver Bull losing all or a portion of its right, title and interest to and in the properties to

which the title defect relates. Title insurance generally is not available, and our ability to ensure that we have obtained secure

title to individual mineral properties or mining concessions may be severely constrained. In addition, we may be unable to operate

our properties as permitted or to enforce our rights with respect to our properties. We annually monitor the official mining records

in Mexico City to determine if there are annotations indicating the existence of a legal challenge against the validity of any

of our concessions. As of December 2020, and to the best of our knowledge, there are no such annotations, nor are we aware of

any challenges from the government or from third parties, except for the Mineros Norteños legal proceeding described in

the aforementioned risk factor entitled “Our Sierra Mojada Project is located in Mexico and is subject to various levels

of political, economic, legal and other risks.”

In

addition, in connection with the purchase of certain mining concessions, Silver Bull agreed to pay a net royalty interest on revenue

from future mineral sales on certain concessions at the Sierra Mojada Project, including concessions on which a significant portion

of our mineralized material is located. The aggregate amount payable under this royalty is capped at $6.875 million (the “Royalty”),

an amount that will only be reached if there is significant future production from the concessions. In addition, records from

prior management indicate that additional royalty interests may have been created, although the continued applicability and scope

of these interests are uncertain. The existence of these royalty interests may have a material effect on the economic feasibility

of potential future development of the Sierra Mojada Project.

We

are subject to complex environmental and other regulatory risks, which could expose us to significant liability and delay and,

potentially, the suspension or termination of our exploration efforts.

Our

mineral exploration activities are subject to federal, state and local environmental regulations in the jurisdictions where our

mineral properties are located. These regulations mandate, among other things, the maintenance of air and water quality standards

and land reclamation. They also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous

waste. No assurance can be given that environmental standards imposed by these governments will not be changed, thereby possibly

materially adversely affecting our proposed activities. Compliance with these environmental requirements may also necessitate

significant capital outlays or may materially affect our earning power.

Environmental

legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance,

more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their

officers, directors and employees. For example, as a result of recent changes in environmental laws in Mexico, more legal actions

supported or sponsored by non-governmental groups interested in halting projects may be filed against companies operating in all

industrial sectors, including the mining sector. Mexican projects are also subject to the environmental agreements entered into

by Mexico, the United States and Canada in connection with the North American Free Trade Agreement.

Future

changes in environmental regulations in the jurisdictions where our projects are located may adversely affect our exploration

activities, make them prohibitively expensive or prohibit them altogether. Environmental hazards may exist on the properties in

which we currently hold interests, such as the Sierra Mojada Project, or may hold interests in the future, which are unknown to

us at present and may have been caused by us or previous owners or operators, or may have occurred naturally. We may be liable

for remediating any damage that we may have caused. The liability could include costs for removing or remediating the release

and damage to natural resources, including ground water, as well as paying fines and penalties.

Our

industry is highly competitive, attractive mineral properties and property concessions are scarce, and we may not be able to obtain

quality properties or concessions.

We

compete with other mining and exploration companies in the acquisition of mineral properties and property concessions. There is

competition for a limited number of attractive mineral property acquisition opportunities, some of which is with other companies

having substantially greater financial resources, staff and facilities than we do. As a result, we may have difficulty acquiring

quality mineral properties or property concessions.

We

may face a shortage of water.

Water

is essential in all phases of the exploration and development of mineral properties. It is used in such processes as exploration,

drilling, leaching, placer mining, dredging, testing, and hydraulic mining. Both the lack of available water and the cost of acquisition

may make an otherwise viable project economically impossible to complete. In November 2013, Silver Bull was granted the right

to exploit up to 3.5 million cubic meters of water per year from six different well sites by the water regulatory body in Mexico,

La Comisión Nacional del Agua, but it has yet to be determined if the six well sites can produce this much water over a

sustained period of time.

Our

non-operating properties are subject to various hazards.

We

are subject to risks and hazards, including environmental hazards, the encountering of unusual or unexpected geological formations,

cave-ins, flooding, earthquakes and periodic interruptions due to inclement or hazardous weather conditions. These occurrences

could result in damage to, or destruction of, mineral properties or future production facilities, personal injury or death, environmental

damage, delays in our exploration activities, asset write-downs, monetary losses and possible legal liability. We may not be insured

against all losses or liabilities, either because such insurance is unavailable or because we have elected not to purchase such

insurance due to high premium costs or other reasons. Although we maintain insurance in an amount that we consider to be adequate,

liabilities might exceed policy limits, in which event we could incur significant costs that could adversely affect our activities.

The realization of any significant liabilities in connection with our activities as described above could negatively affect our

activities and the price of our common stock.

We

need and rely upon key personnel.

Presently,

we employ a limited number of full-time employees, utilize outside consultants and, in large part, rely on the personal efforts

of our officers and directors. Our success will depend, in part, upon the ability to attract and retain qualified employees. In

particular, we have only three executive officers, Brian Edgar, Timothy Barry and Christopher Richards, and the loss of the services

of any of these three would adversely affect our business.

Risks

Relating to Our Common Stock

Further

equity financings may lead to the dilution of our common stock.

In

order to finance future operations, we may raise funds through the issuance of common stock or the issuance of debt instruments

or other securities convertible into common stock. We cannot predict the size of future issuances of common stock or the size

and terms of future issuances of debt instruments or other securities convertible into common stock or the effect, if any, that

future issuances and sales of our securities will have on the market price of our common stock. Any transaction involving the

issuance of previously authorized but unissued shares, or securities convertible into common stock, would result in dilution,

possibly substantial, to present and prospective security holders. Demand for equity securities in the mining industry has been

weak; therefore, equity financing may not be available on attractive terms and if available, will likely result in significant

dilution to existing stockholders.

No

dividends are anticipated.

At

the present time, we do not anticipate paying dividends, cash or otherwise, on our common stock in the foreseeable future. Future

dividends will depend on our earnings, if any, our financial requirements and other factors. There can be no assurance that we

will pay dividends.

Our

stock price can be very volatile.

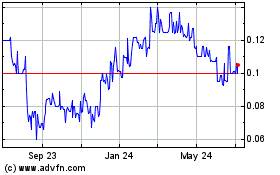

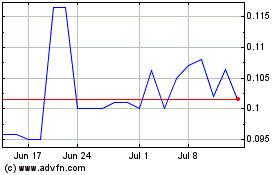

Our

common stock is listed on the Toronto Stock Exchange (“TSX”) and trades on the OTCQB. The trading price of our common

stock has been, and could continue to be, subject to wide fluctuations in response to announcements of our business developments,

results and progress of our exploration activities at the Sierra Mojada Project, progress reports on our exploration activities

and other events or factors. In addition, stock markets have experienced significant price volatility in recent months and years.

This volatility has had a substantial effect on the share prices of companies, at times for reasons unrelated to their operating

performance. These fluctuations could be in response to:

|

|

·

|

volatility

in metal prices;

|

|

|

·

|

political

developments in the foreign countries in which our properties are located; and

|

|

|

·

|

news

reports relating to trends in our industry or general economic conditions.

|

These

broad market and industry fluctuations may adversely affect the price of our common stock, regardless of our operating performance.

We

cannot make any predictions or projections as to what the prevailing market price for our common stock will be at any time, including

as to whether our common stock will achieve or remain at levels at or near its offering price, or as to what effect the sale of

shares or the availability of common stock for sale at any time will have on the prevailing market price.

USE

OF PROCEEDS

The

proceeds from the sale or issuance of the shares of common stock that may be offered pursuant to this prospectus will be received

directly by the selling stockholders, and we will not receive any proceeds from the sale of these shares.

MARKET

FOR OUR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

On

September 18, 2020, the Company completed a one-for-eight reverse stock split of the shares of Silver Bull common stock.

All share and per share information in this prospectus has been adjusted to reflect the impact of the reverse stock split.

Market

Information

From

May 2, 2011 to June 28, 2015, our common stock traded on the NYSE American or its predecessor stock exchange under the

symbol “SVBL.” On June 5, 2015, we announced our decision to voluntarily delist our shares of common stock from

the NYSE American due to costs associated with the continued listing and NYSE American exchange rules regarding maintenance of

a minimum share price. On June 29, 2015, our shares began trading on the OTCQB marketplace operated by OTC Markets Group.

Since August 26, 2010, our common stock has been trading on the TSX under the symbol “SVB.”

The

following table sets forth the high and low sales prices of our common stock for each quarter during the fiscal years ending October 31,

2020 and October 31, 2019 and the subsequent interim period, as reported by the OTCQB and the TSX. The sales prices on the

OTCQB reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

|

|

|

|

|

Toronto

Stock Exchange

(SVB)

|

|

|

|

High

|

|

Low

|

|

High

|

|

Low

|

|

|

|

($)

|

|

(Cdn$)

|

|

|

2021:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First

Quarter ended January 31, 2021 (through December 8, 2020)

|

|

|

$

|

0.61

|

|

|

$

|

0.46

|

|

|

$

|

0.85

|