E-Commerce Strength Boosted November Retail Sales

December 03 2020 - 7:31AM

Dow Jones News

By Matt Grossman

U.S. retail spending edged higher last month despite the

continuing coronavirus pandemic as a surge in online shopping

boosted sales, according to data from Mastercard Inc.

The data, which cover cash and check payments as well as credit

cards, show that consumer spending rose 3.1% year over year in

November, excluding car sales. Excluding gasoline as well, spending

rose 5.1%, according to Mastercard.

Shoppers spent more on furniture, groceries and hardware in the

month, with each of those categories rising by double-digit

percentages. Apparel spending fell by 21%, and department-store

sales declined by 15%.

As shopping continues to shift online during the public-health

crisis, e-commerce spending rose by 53% compared with last November

to make up 18% of the month's total retail sales, excluding cars.

Big retailers with robust online sales platforms such as Walmart

Inc., Target Corp. and Home Depot Inc. have experienced booms in

digital shopping this year as people hoping to avoid crowds during

the pandemic place orders from home.

Holiday shopping -- more of which took place before Black Friday

this year -- drove a portion of the November spending growth,

according to Mastercard. Because of the pandemic, many retailers

launched seasonal promotions well before the holiday shopping

season's traditional start on the Friday after Thanksgiving, to

avoid attracting large crowds.

Customers also reacted last month to rising virus cases and the

prospect of more government restrictions by stocking up on

groceries and continuing to spend more on home goods, Mastercard

said. Grocery sales rose 10% year over year in November, while

spending on furniture and furnishings climbed 16%.

The same mind-set also drove more spending on electronics and

appliances, for which sales rose 8.2% year over year in November.

More cooking at home and more new residential construction this

year have left buyers clamoring for products such as refrigerators

and dishwashers, stretching appliance showrooms thin, said Chad

Lyon, a Wells Fargo & Co. banker whose group finances appliance

retailers' inventories.

"You've really seen retail demand spike," Mr. Lyon said. "The

manufacturers have been playing some level of catch-up."

Soaring online sales also extended to fashion. Despite falling

apparel sales overall, e-commerce spending on apparel rose 13% year

over year in November.

Online jewelry sales jumped 46%.

In a sign that fashion companies are more focused on their

internet presence during the pandemic, Swiss luxury-goods giant

Compagnie Financière Richemont, which owns the Cartier jewelry

brand, said last month it planned to invest $550 million in

Farfetch, a French fashion website.

The deal will help Richemont improve its reach outside of

traditional stores, Richemont Chairman Johann Rupert said.

(END) Dow Jones Newswires

December 03, 2020 07:16 ET (12:16 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

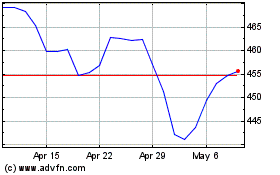

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

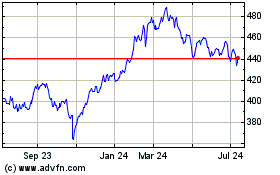

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024