Filed pursuant to Rule 424(b)(3)

Registration No. 333-239185

PROSPECTUS SUPPLEMENT NO. 10

(to Prospectus dated July 17, 2020)

Nikola Corporation

Up to 53,390,000 Shares of Common Stock

Up to 23,890,000 Shares of Common Stock

Issuable Upon Exercise of

Warrants

This

prospectus supplement supplements the prospectus dated July 17, 2020 (the “Prospectus”), which forms a part of our

registration statement on Form S-1 (No. 333-239185). This prospectus supplement is being filed to update and

supplement the information in the Prospectus with the information contained in our current report on Form 8-K, filed with

the Securities and Exchange Commission on November 30, 2020 (the “Current Report”). Accordingly, we have attached the

Current Report to this prospectus supplement.

The Prospectus and this prospectus supplement

relates to the issuance by us of up to an aggregate of up to 23,890,000 shares of our common stock, $0.0001 par value per share

(“Common Stock”), which consists of (i) up to 890,000 shares of Common Stock that are issuable upon the exercise of

890,000 warrants (the “Private Warrants”) originally issued in a private placement in connection with the initial public

offering of VectoIQ and (ii) up to 23,000,000 shares of Common Stock that are issuable upon the exercise of 23,000,000

warrants (the “Public Warrants” and, together with the Private Warrants, the “Warrants”) originally issued

in the initial public offering of VectoIQ.

The Prospectus and this prospectus supplement

also relates to the offer and sale from time to time by the selling securityholders named in the Prospectus (the “Selling

Securityholders”) of (i) up to 53,390,000 shares of Common Stock (including up to 890,000 shares of Common Stock that may

be issued upon exercise of the Private Warrants) and (ii) up to 890,000 Private Warrants.

Our Common Stock is listed on the Nasdaq

Global Select Market under the symbol “NKLA”. On November 27, 2020, the closing price of our Common Stock was $27.93.

Our warrants were traded on the Nasdaq Global Select Market under the symbol “NKLAW”; however, the warrants ceased

trading on the Nasdaq Global Select Market and were delisted following their redemption.

This prospectus supplement updates and supplements

the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with,

the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with

the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you

should rely on the information in this prospectus supplement.

See the section entitled “Risk

Factors” beginning on page 7 of the Prospectus to read about factors you should consider before buying our securities.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement

or the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement

is November 30, 2020.

united

states

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 29, 2020

Nikola

Corporation

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

001-38495

|

|

82-4151153

|

(State or Other Jurisdiction of

Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

4141 E Broadway Road

|

|

|

|

Phoenix, AZ

|

|

85040

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(480) 666-1038

(Registrant’s telephone number,

including area code)

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240-13e-4(c))

|

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each class

|

|

Trading

symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value per share

|

|

NKLA

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b–2

of the Securities Exchange Act of 1934 (§240.12b–2 of this chapter).

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

Item 1.02

|

Termination of a Material Definitive Agreement.

|

On

September 8, 2020, Nikola Corporation (the “Company”) filed a Current Report on Form 8-K to report it had entered into

agreements with respect to certain transactions with General Motors Holdings LLC (“GM Holdings”) and its affiliates

(collectively with GM Holdings, “GM”). Concurrently with entering into the Memorandum of Understanding with GM Holdings

on November 29, 2020, as described in Item 8.01 of this Current Report on Form 8-K, the Company and GM terminated the following

agreements, each dated September 3, 2020: (a) Subscription Agreement with GM Holdings, (b) Master Electric Truck Development Agreement

with GM Holdings and GM Global Technology Operations LLC, including the Master Vehicle Supply Agreement Term Sheet and (c) Fuel

Cell Supply Agreement Term Sheet with GM Holdings (collectively, the “Prior Agreements”). The Prior Agreements were

terminated without any further obligation or liability of the parties with respect to the subject matter of the agreements. Under

the Prior Agreements, the parties agreed, among other things, that, in exchange for the issuance of 47,698,545 shares of the Company’s

common stock and certain future payments, GM would (i) assist Nikola with the design and manufacture of the Nikola Badger, and

(ii) be an exclusive supplier (except for the European market) of hydrogen fuel cell propulsion systems, and assist with integration,

for the Company’s Class 7 and Class 8 trucks for a period of time.

On

November 29, 2020, the Company entered into a non-binding Memorandum of Understanding (“MOU”) with GM Holdings for

a global supply agreement related to the integration of GM’s Hydrotec fuel cell system into the Company’s commercial

semi-trucks. Under the terms of the MOU, the Company and GM will work to integrate GM’s Hydrotec fuel-cell technology into

the Company’s Class 7 and Class 8 trucks for the medium- and long-haul trucking sectors. The MOU also contemplates the parties

considering a potential supply arrangement related to GM’s Ultium batteries for use in the Company’s Class 7 and Class

8 trucks. The terms of any definitive agreement between the Company and GM are subject to the negotiation and execution of definitive

documentation.

The

MOU does not provide for the issuance of any of the Company’s common stock to GM. In addition, the Company announced that

it will refund all previously submitted order deposits for the Nikola Badger.

Forward Looking Statements

Certain statements included

herein that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under

the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such

as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” “should,” “would,” “plan,” “predict,”

“potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions

that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking

statements include, but are not limited to, the Company’s expectations regarding the terms and potential benefits

of the MOU or a definitive agreement with GM. These statements are based on various assumptions and on the current expectations

of the Company’s management and are not predictions of actual performance. Forward-looking statements are subject

to a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements,

including but not limited to: the parties’ ability to enter into definitive documentation for the supply agreement and the

terms of any such definitive documentation; the failure to realize the anticipated benefits of the MOU or any definitive agreement;

general economic, financial, legal, political and business conditions and changes in domestic and foreign markets; the potential

effects of COVID-19; the impact of judicial, regulatory or administrative proceedings to

which the Company is, or may become a party; risks related to the rollout of the Company’s business and the timing

of expected business milestones; the effects of competition on the Company’s future business; the availability of capital;

and the other risks discussed under the heading “Risk Factors” in the Company’s Quarterly Report on Form

10-Q for the quarter ended September 30, 2020 other reports and documents the Company files from time to time with the Securities

and Exchange Commission. If any of these risks materialize or the Company’s assumptions prove incorrect, actual results could

differ materially from the results implied by these forward-looking statements. These forward-looking statements speak

only as of the date hereof and the Company specifically disclaims any obligation to update these forward-looking statements.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Dated: November 29, 2020

|

|

NIKOLA CORPORATION

|

|

|

|

|

|

By:

|

/s/ Britton M. Worthen

|

|

|

Britton M. Worthen

|

|

|

Chief Legal Officer and Secretary

|

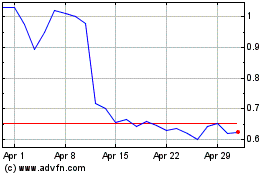

Nikola (NASDAQ:NKLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nikola (NASDAQ:NKLA)

Historical Stock Chart

From Apr 2023 to Apr 2024