Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

November 30 2020 - 7:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of November 2020

Commission File Number: 001-34602

DAQO NEW ENERGY CORP.

Unit 29D, Huadu Mansion, 838 Zhangyang

Road,

Shanghai, 200122

The People’s Republic of China

(+86-21) 5075-2918

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b) (1): ¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b) (7): ¨

In September 2020, Daqo New Energy Corp.

announced that the application documents regarding a potential initial public offering and listing

of the shares of Xinjiang Daqo New Energy Co., Ltd. (“Xinjiang Daqo”), a principal operating subsidiary of Daqo New

Energy, on the Shanghai Stock Exchange's Sci-Tech innovation board (the "STAR Market") had been submitted to and received

by the Shanghai Stock Exchange.

The

board of directors of Xinjiang Daqo approved to amend Xinjiang Daqo’s issuance and listing plan on

the STAR Market as follows:

|

|

1.

|

Number of Shares Issued

|

Before the amendment:

In the

absence of an over-allotment option, the number of shares to be issued and listed in this initial public offering of Xinjiang Daqo

shall not be less than 286,764,706 shares, and the proportion of publicly offered shares shall not be less than 15% of the total

share capital of the company after this offering. The company and the lead underwriter may negotiate an over-allotment option,

and the number of shares issuable under the over-allotment option shall not exceed 15% of the number of shares of this offering;

and the board of directors is authorized to negotiate with the sponsor (lead underwriter) to determine the final offering size,

based on the requirements of relevant regulatory authorities, the securities market conditions and the fundraising needs.

After

the amendment:

In the

absence of an over-allotment option, the number of shares to be issued and listed this initial public offering of Xinjiang Daqo

shall not exceed 300,000,000 shares, and the proportion of publicly offered shares shall not be less than 10% of the company's

total equity after this offering. The company and the lead underwriter may negotiate an over-allotment option, and the number of

shares issuable under the over-allotment option shall not exceed 15% of the number of shares of this offering; and the board of

directors is authorized to negotiate with the sponsor (lead underwriter) to determine the final offering size, based on the requirements

of relevant regulatory agencies, the securities market conditions and the fundraising needs.

Before

the amendment:

If this

issuance and listing adopt strategic allotment, the total amount of shares allocated to the strategic investors shall not exceed

20% of the shares issued and listed (excluding the number of shares issued under over-allotment options). The placees of the strategic

allotment include, but are not limited to, securities investment funds legally established in line with specific investment purposes,

subsidiaries established by the issuer’s sponsor, other subsidiaries legally established by the securities company controlling

the sponsor and the specialized asset management plan legally established by the senior management and the core employees of the

issuer.

After

the amendment:

If this issuance and listing

adopt strategic allotment, it shall be implemented in accordance with relevant regulations of the Shanghai Stock Exchange. The

placees of the strategic allotment include, but are not limited to, securities investment funds legally established in line with

specific investment purposes, subsidiaries established by the issuer’s sponsor, other subsidiaries legally established by

the securities company controlling the sponsor and the specialized asset management plan legally established by the senior management

and the core employees of the issuer. The sponsor and the issuer will further formulate a specific plan for participating in the

strategic placement of the offering and listing and submit relevant documents to the Shanghai Stock Exchange.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

DAQO NEW ENERGY CORP.

|

|

|

By:

|

/s/ Longgen Zhang

|

|

|

Name:

|

Longgen Zhang

|

|

|

Title:

|

Director and Chief Executive Officer

|

|

Date: November 30, 2020

|

|

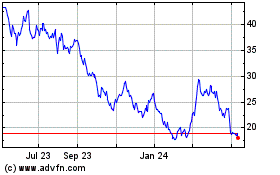

Daqo New Energy (NYSE:DQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Daqo New Energy (NYSE:DQ)

Historical Stock Chart

From Apr 2023 to Apr 2024