Jiayin Group Inc. (“Jiayin” or the “Company”) (NASDAQ: JFIN), a

leading fintech platform in China, today announced its unaudited

financial results for the third quarter ended September 30, 2020.

Third Quarter 2020 Operational and Financial Highlights

:

- Loan origination volume1 was RMB3,330 million (US$490.5

million), representing a decrease of 29.4% from the same period of

2019, and an increase of 48.8% sequentially.

- Average borrowing amount per borrower was RMB6,556 (US$965.6),

representing a decrease of 12.0% from the same period of 2019.

- Repeat borrowing rate2 was 74.5%, compared with repeat

borrowing rate of 52.7% in the same period of 2019.

- Institutional funding accounted for 100% of the total loans

facilitated, compared with 8.2% in the same period of 2019.

- Net revenue was RMB401.3 million (US$59.1 million),

representing a decrease of 21.4% from the same period of 2019, and

an increase of 63.8% sequentially.

- Operating income was RMB150.0 million (US$22.1 million),

representing an increase of 79.6% from the same period of 2019, and

an increase of 212.5% sequentially.

- Net income was RMB88.4 million (US$13.0 million), representing

an increase of 8.1% from the same period of 2019, and an increase

of 115.1% sequentially.

Mr. Yan Dinggui, the Founder, Director and Chief Executive

Officer, commented: “I am excited to report another solid quarter

of strong business performance. Most notably, we completed the

business transition upon which we embarked at the start of the

year. I am proud to announce that as of November 10, 2020, the

outstanding loan balance of our legacy P2P lending business was

reduced to zero! This marks a significant milestone. Jiayin has

successfully transformed to a finance technology company fully

funded only by institutions. Considering that at this time

one year ago, our platform funding was over 90% from individuals,

this rapid transition demonstrates our agility and outstanding

execution capability.”

Yan added, “In addition to successfully completing our funding

transition, we continued to deliver encouraging business results

despite the challenging environment. The loans we facilitated

performed very well, investor confidence remained strong, we

improved operating efficiency, and we maintained attractive

profitability. In the quarter, our net income reached RMB88.4

million, up 8.1% year over year and 115.1% sequentially. This

remarkable improvement demonstrates both the effectiveness of our

growth strategy and our strong execution. Jiayin always strives to

operate conservatively but profitably. We believe that our strong

underlying business and brand recognition will enable us to achieve

robust growth for the coming years.”

Third Quarter 2020 Financial Results

Net revenue was RMB401.3 million (US$59.1

million), representing a decrease of 21.4% from the same period of

2019.

Revenue from loan facilitation services was RMB290.6 million

(US$42.8 million), representing a decrease of 26.7% from the same

period of 2019. The decrease was primarily due to the lower loan

origination volume and the shift to institutional funding

partners.

Revenue from post-origination services was RMB33.7 million

(US$5.0 million), representing a decrease of 43.2% from the same

period of 2019. The decrease was due to the lower outstanding loan

balance.

Other revenue was RMB77.0 million (US11.3 million), representing

an increase of 40.0% from the same period of 2019. The increase was

primarily due to the variable consideration related to automated

investment program recognized from loans previously facilitated

under the P2P business.

Origination and servicing expenses were RMB59.5

million (US$8.8 million), representing a decrease of 41.1% from the

same period of 2019, primarily due to the lower volume of loans

facilitated by the Company and reduced collection costs as the

company no longer provides such services under its new business

model.

Allowance for uncollectable receivables, contract assets

and loan receivables was RMB15.8 million (US$2.3 million),

representing a decrease of 76.7% from the same period of 2019,

primarily due to the the overall decrease of facilitation volume,

as well as the relatively lower credit risk of the new business

model.

Sales and marketing expenses were RMB99.5

million (US$14.7 million), representing a decrease of 34.7% from

the same period of 2019, primarily due to the lower customer

acquisition expenses and reduced advertising spending for

promotional activities.

General and administrative expenses were

RMB37.3 million (US$5.5 million), representing a decrease of 21.5%

from the same period of 2019, primarily due to the decrease in

share-based compensation expense and the decrease in salaries and

personnel related costs, as well as other business-related

expenses.

Research and development expenses were RMB39.2

million (US$5.8 million), representing a decrease of 33.1% from the

same period of 2019, primarily due to the decrease in share-based

compensation expense and a more streamlined team in the technology

and development department resulting from the business

transition.

Income from operations was RMB150.0 million

(US$22.1 million), representing an increase of 79.6% from the same

period of 2019, and an increase of 212.5% sequentially.

Other income (expense), net was a net loss of

RMB32.8 million (US$4.8 million), compared with a net gain of

RMB7.3 million for the corresponding period in 2019. The loss

in this quarter was primarily due to the estimated loss of

short-term investments.

Net income was RMB88.4 million (US$13.0

million), representing an increase of 8.1% from the same period of

2019, and an increase of 115.1% sequentially.

Cash and cash equivalents were RMB94.8 million

(US$14.0 million) as of September 30, 2020, compared with RMB69.9

million as of June 30, 2020.

Conference Call

The Company will host a conference call to discuss its financial

results on Monday, November 30, 2020 at 8:00 a.m. US. Eastern Time

(9:00 PM Beijing/Hong Kong Time).

Please register in advance to join the conference using the link

provided below and dial in 10 minutes before the call is scheduled

to begin. Conference access information will be provided upon

registration.

Participant Online Registration:

http://apac.directeventreg.com/registration/event/5890747

A replay of the conference call may be accessed by phone at the

following numbers until December 8, 2020. To access the replay,

please reference the conference ID

5890747.

|

|

Phone Number |

Toll-Free Number |

| United States |

+1 (646) 254-3697 |

+1 (855) 452-5696 |

| Hong Kong |

+852 30512780 |

+852 800963117 |

| Mainland China |

|

+86 4006322162+86 8008700205 |

A live and archived webcast of the conference call will be

available on the company’s investors relations website

at http://ir.jiayin-fintech.com/.

About Jiayin Group Inc.

Jiayin Group Inc. is a leading fintech platform in China

committed to facilitating effective, transparent, secure and fast

connections between investors and borrowers, whose needs are

underserved by traditional financial institutions. The origin of

the business of the Company can be traced back to 2011. The Company

operates a highly secure and open platform with a comprehensive

risk management system and a proprietary and effective risk

assessment model which employs advanced big data analytics and

sophisticated algorithms to accurately assess the risk profiles of

potential borrowers.

Exchange Rate Information

This announcement contains translations of certain RMB amounts

into U.S. dollars (“US$”) at a specified rates solely for the

convenience of the reader. Unless otherwise noted, all translations

from RMB to U.S. dollars are made at a rate of RMB6.7896 to

US$1.00, the exchange rate set forth in the H.10 statistical

release of the Board of Governors of the Federal Reserve System as

of September 30, 2020. The Company makes no representation that the

RMB or US$ amounts referred could be converted into US$ or RMB, as

the case may be, at any particular rate or at all.

Safe Harbor / Forward-Looking Statements

This announcement contains forward-looking statements. These

statements are made under the “safe harbor” provisions of the

United States Private Securities Litigation Reform Act of 1995.

These forward-looking statements can be identified by terminology

such as “will,” “expects,” “anticipates,” “future,” “intends,”

“plans,” “believes,” “estimates” and similar statements. The

Company may also make written or oral forward-looking statements in

its periodic reports to the SEC, in its annual report to

shareholders, in press releases and other written materials and in

oral statements made by its officers, directors or employees to

third parties. Statements that are not historical facts, including

statements about the Company’s beliefs and expectations, are

forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties and are based on current

expectations, assumptions, estimates and projections about the

Company and the industry. Potential risks and uncertainties

include, but are not limited to, those relating to the Company’s

ability to retain existing investors and borrowers and attract new

investors and borrowers in an effective and cost-efficient way, the

Company’s ability to increase the investment volume and loan

origination of loans volume facilitated through its marketplace,

effectiveness of the Company’s credit assessment model and risk

management system, PRC laws and regulations relating to the online

individual finance industry in China, general economic conditions

in China, and the Company’s ability to meet the standards necessary

to maintain listing of its ADSs on the Nasdaq Stock Market or other

stock exchange, including its ability to cure any non-compliance

with the continued listing criteria of the Nasdaq Stock Market. All

information provided in this press release is as of the date

hereof, and the Company undertakes no obligation to update any

forward-looking statements to reflect subsequent occurring events

or circumstances, or changes in its expectations, except as may be

required by law. Although the Company believes that the

expectations expressed in these forward-looking statements are

reasonable, it cannot assure you that its expectations will turn

out to be correct, and investors are cautioned that actual results

may differ materially from the anticipated results. Further

information regarding risks and uncertainties faced by the Company

is included in the Company’s filings with the U.S. Securities and

Exchange Commission, including its annual report on Form 20-F.

For more information, please contact:

In China:

Jiayin GroupMs. Shelley BaiEmail:

ir@jiayinfintech.cn

or

The Blueshirt GroupMs. Susie WangEmail:

susie@blueshirtgroup.com

In the U.S.:

Ms. Julia QianEmail: julia@blueshirtgroup.com

|

|

|

JIAYIN GROUP INC. UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except for share and per share data) |

|

|

|

|

|

As ofDecember 31, |

|

|

As of September 30, |

|

|

|

|

2019 |

|

|

2020 |

|

|

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

122,149 |

|

|

|

94,826 |

|

|

|

13,966 |

|

|

Restricted cash |

|

|

— |

|

|

|

2,000 |

|

|

|

295 |

|

|

Amounts due from related parties3 |

|

|

130,722 |

|

|

|

5,604 |

|

|

|

825 |

|

|

Accounts receivable, net3 |

|

|

139,164 |

|

|

|

116,227 |

|

|

|

17,118 |

|

|

Loan receivables, net3 |

|

|

— |

|

|

|

17,965 |

|

|

|

2,646 |

|

|

Short-term investment3 |

|

|

69,618 |

|

|

|

33,698 |

|

|

|

4,963 |

|

|

Prepaid expenses and other current assets |

|

|

91,002 |

|

|

|

56,546 |

|

|

|

8,328 |

|

|

Deferred tax assets |

|

|

68,292 |

|

|

|

68,292 |

|

|

|

10,058 |

|

|

Property and equipment |

|

|

39,084 |

|

|

|

24,488 |

|

|

|

3,607 |

|

|

Right-of-use assets |

|

|

37,215 |

|

|

|

13,152 |

|

|

|

1,937 |

|

|

Long-term investment |

|

|

3,826 |

|

|

|

99,640 |

|

|

|

14,675 |

|

| TOTAL

ASSETS |

|

|

701,072 |

|

|

|

532,438 |

|

|

|

78,418 |

|

| LIABILITIES AND

EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

Payroll and welfare payable |

|

|

48,524 |

|

|

|

39,948 |

|

|

|

5,884 |

|

|

Amounts due to related parties |

|

|

872 |

|

|

|

12,753 |

|

|

|

1,878 |

|

|

Refund liabilities |

|

|

180,104 |

|

|

|

13,071 |

|

|

|

1,925 |

|

|

Tax payables |

|

|

179,421 |

|

|

|

248,070 |

|

|

|

36,537 |

|

|

Accrued expenses and other current liabilities |

|

|

158,705 |

|

|

|

81,681 |

|

|

|

12,030 |

|

|

Other payable related to the disposal of Shanghai Caiyin |

|

|

839,830 |

|

|

|

680,683 |

|

|

|

100,254 |

|

|

Lease liabilities |

|

|

35,215 |

|

|

|

11,101 |

|

|

|

1,635 |

|

| TOTAL

LIABILITIES |

|

|

1,442,671 |

|

|

|

1,087,307 |

|

|

|

160,143 |

|

| SHAREHOLDERS'

DEFICIT |

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A ordinary shares (US$ 0.000000005 par value;

100,100,000 shares issued and outstanding as of

December 31, 2019 and September 30, 2020)4 |

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

Class B ordinary shares (US$ 0.000000005 par value;

116,000,000 shares issued and outstanding as of

December 31, 2019 and September 30, 2020)4 |

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

Additional paid-in capital |

|

|

777,408 |

|

|

|

799,602 |

|

|

|

117,769 |

|

|

Accumulated deficit |

|

|

(1,519,731 |

) |

|

|

(1,352,471 |

) |

|

|

(199,197 |

) |

|

Other comprehensive income |

|

|

469 |

|

|

|

(4,385 |

) |

|

|

(647 |

) |

|

Total Jiayin Group shareholder's deficit |

|

|

(741,854 |

) |

|

|

(557,254 |

) |

|

|

(82,075 |

) |

|

Non-controlling interests |

|

|

255 |

|

|

|

2,385 |

|

|

|

350 |

|

| TOTAL SHAREHOLDERS'

DEFICIT |

|

|

(741,599 |

) |

|

|

(554,869 |

) |

|

|

(81,725 |

) |

| TOTAL LIABILITIES AND

DEFICIT |

|

|

701,072 |

|

|

|

532,438 |

|

|

|

78,418 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

JIAYIN GROUP INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME(Amounts in thousands, except for share and per

share data) |

|

|

|

|

|

For the Three Months EndedSeptember

30, |

|

|

For the Nine Months EndedSeptember

30, |

|

|

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

Net revenue (including revenue from related parties

of RMB 654 and RMB 993 for 2019Q3 and

2020Q3, respectively) |

|

|

510,773 |

|

|

|

401,310 |

|

|

|

59,107 |

|

|

|

1,887,556 |

|

|

|

959,825 |

|

|

|

141,367 |

|

| Operating cost and

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Origination and servicing |

|

|

(101,128 |

) |

|

|

(59,478 |

) |

|

|

(8,760 |

) |

|

|

(354,929 |

) |

|

|

(174,341 |

) |

|

|

(25,678 |

) |

| Allowance for uncollectible

accounts receivable, contract assets and loan

receivables |

|

|

(67,780 |

) |

|

|

(15,845 |

) |

|

|

(2,334 |

) |

|

|

(182,325 |

) |

|

|

(56,971 |

) |

|

|

(8,391 |

) |

| Sales and marketing |

|

|

(152,364 |

) |

|

|

(99,500 |

) |

|

|

(14,655 |

) |

|

|

(492,336 |

) |

|

|

(257,584 |

) |

|

|

(37,938 |

) |

| General and

administrative |

|

|

(47,465 |

) |

|

|

(37,273 |

) |

|

|

(5,490 |

) |

|

|

(154,405 |

) |

|

|

(112,099 |

) |

|

|

(16,510 |

) |

| Research and development |

|

|

(58,566 |

) |

|

|

(39,200 |

) |

|

|

(5,774 |

) |

|

|

(162,785 |

) |

|

|

(109,674 |

) |

|

|

(16,153 |

) |

| Total operating cost

and expenses |

|

|

(427,303 |

) |

|

|

(251,296 |

) |

|

|

(37,013 |

) |

|

|

(1,346,780 |

) |

|

|

(710,669 |

) |

|

|

(104,670 |

) |

| Income from

operation |

|

|

83,470 |

|

|

|

150,014 |

|

|

|

22,094 |

|

|

|

540,776 |

|

|

|

249,156 |

|

|

|

36,697 |

|

| Interest income (expense) |

|

|

88 |

|

|

|

2,488 |

|

|

|

366 |

|

|

|

(88 |

) |

|

|

7,727 |

|

|

|

1,138 |

|

| Other income (expense),

net |

|

|

7,308 |

|

|

|

(32,763 |

) |

|

|

(4,825 |

) |

|

|

20,876 |

|

|

|

(28,611 |

) |

|

|

(4,214 |

) |

| Income before income

taxes and income from investment in affiliates |

|

|

90,866 |

|

|

|

119,739 |

|

|

|

17,635 |

|

|

|

561,564 |

|

|

|

228,272 |

|

|

|

33,621 |

|

| Income tax expense |

|

|

(9,099 |

) |

|

|

(32,128 |

) |

|

|

(4,732 |

) |

|

|

(79,623 |

) |

|

|

(60,070 |

) |

|

|

(8,847 |

) |

| Income from investment in

affiliates |

|

|

— |

|

|

|

740 |

|

|

|

109 |

|

|

|

— |

|

|

|

713 |

|

|

|

105 |

|

| Net

income |

|

|

81,767 |

|

|

|

88,351 |

|

|

|

13,012 |

|

|

|

481,941 |

|

|

|

168,915 |

|

|

|

24,879 |

|

| Less: net income (loss)

attributable to non-controlling interest shareholders |

|

|

152 |

|

|

|

2,209 |

|

|

|

324 |

|

|

|

(76 |

) |

|

|

1,655 |

|

|

|

244 |

|

| Net income

attributable to Jiayin Group Inc. |

|

|

81,615 |

|

|

|

86,142 |

|

|

|

12,688 |

|

|

|

482,017 |

|

|

|

167,260 |

|

|

|

24,635 |

|

| Weighted average

shares used in calculating net income

per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| - Basic and diluted |

|

|

216,100,000 |

|

|

|

216,100,000 |

|

|

|

216,100,000 |

|

|

|

206,307,671 |

|

|

|

216,100,000 |

|

|

|

216,100,000 |

|

| Net income per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| - Basic and diluted |

|

|

0.38 |

|

|

|

0.40 |

|

|

|

0.06 |

|

|

|

2.34 |

|

|

|

0.77 |

|

|

|

0.11 |

|

| Other comprehensive

income, net of tax of nil: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation

adjustments |

|

|

10,769 |

|

|

|

(8,449 |

) |

|

|

(1,243 |

) |

|

|

10,777 |

|

|

|

(4,878 |

) |

|

|

(719 |

) |

| Comprehensive

income |

|

|

92,536 |

|

|

|

79,902 |

|

|

|

11,769 |

|

|

|

492,718 |

|

|

|

164,037 |

|

|

|

24,160 |

|

| Comprehensive income (loss)

attributable to non-controlling interest |

|

|

151 |

|

|

|

2,151 |

|

|

|

317 |

|

|

|

(76 |

) |

|

|

1,631 |

|

|

|

240 |

|

| Total comprehensive

income attributable to Jiayin Group

Inc. |

|

|

92,385 |

|

|

|

77,751 |

|

|

|

11,452 |

|

|

|

492,794 |

|

|

|

162,406 |

|

|

|

23,920 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_____________________

1 “Loan origination volume” refers to the total amount of loans

facilitated in Mainland China during the period presented.2 “Repeat

borrowing rate” refers to the repeat borrowers as a percentage of

all of our borrowers in Mainland China.3 The Company has adopted

“ASC 326, Financial Instruments — Credit Losses”

beginning January 1, 2020 . As of now, the adoption of the new

guidance did not have material impacts on the Company’s results of

operations, financial condition or liquidity.4 The total shares

authorized for both Class A and Class B are 10,000,000,000,000.

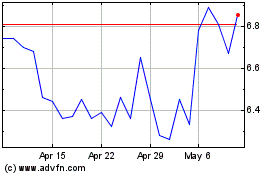

Jiayin (NASDAQ:JFIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

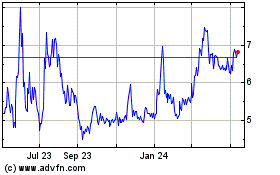

Jiayin (NASDAQ:JFIN)

Historical Stock Chart

From Apr 2023 to Apr 2024