UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10

Amendment No. 2

GENERAL

FORM FOR REGISTRATION OF SECURITIES

Pursuant

to Section 12(b) or (g) of the Securities Exchange Act of 1934

US

LIGHTING GROUP, INC.

(Exact

Name of Registrant as Specified in Charter)

|

Florida

|

|

46-3556776

|

|

(State

or Other Jurisdiction of

Incorporation

or Organization)

|

|

(I.R.S.

Employer

Identification

No.)

|

|

|

|

|

|

1148

East 222d St, Euclid, OH

|

|

44117

|

|

(Address of Principal

Executive Offices)

|

|

(Zip Code)

|

|

Registrant’s

telephone number, including area code:

|

(216)

896-7000

|

Securities

to be registered under Section 12(g) of the Exchange Act:

Common

Stock, par value $0.0001 per share

(Title

of class)

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer

|

|

☐

|

|

Accelerated Filer

|

☐

|

|

Non-accelerated Filer

|

|

☐

|

|

Smaller Reporting Company

|

☒

|

|

|

|

|

|

Emerging growth company

|

☐

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY

NOTE

US

Lighting Group, Inc. is filing this General Form for Registration of Securities on Form 10, which we refer to as the Registration

Statement, to register its common stock, par value $0.0001 per share, pursuant to Section 12(g) of the Securities Exchange Act

of 1934, as amended, or the Exchange Act. Unless otherwise mentioned or unless the context requires otherwise, when used in this

Registration Statement, the terms “US Lighting Group,” “Company,” “we,” “us,” and “our”

refer to US Lighting Group, Inc.

Once

this registration statement is deemed effective, we will be subject to the requirements of Section 13(a) under the Exchange Act,

which will require us to file annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, and

we will be required to comply with all other obligations of the Exchange Act applicable to issuers filing registration statements

pursuant to Section 12(g) of the Exchange Act.

FORWARD

LOOKING STATEMENTS

This

Registration Statement contains forward-looking statements that involve substantial risks and uncertainties. All statements, other

than statements of historical fact, contained in this Registration Statement, including statements regarding our strategy, future

operations, future financial position, future revenues, projected costs, prospects, plans and objectives of management, are forward-looking

statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,”

“may,” “plan,” “predict,” “project,” “target,” “potential,” “will,”

“would,” “could,” “should,” “continue,” and similar expressions are intended to identify

forward-looking statements, although not all forward-looking statements contain these identifying words.

We

may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not

place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions

and expectations disclosed in the forward-looking statements we make. We have included important cautionary statements in this

Registration Statement that we believe could cause actual results or events to differ materially from the forward-looking statements

that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions,

joint ventures or investments we may make.

You

should read this Registration Statement and the documents that we have filed as exhibits to this Registration Statement with the

understanding that our actual future results may be materially different from what we expect. The forward-looking statements contained

in this Registration Statement are made as of the date of this Registration Statement, and we do not assume any obligation to

update any forward-looking statements except as required by applicable law.

WHERE

YOU CAN FIND MORE INFORMATION ABOUT US

When

this Registration Statement becomes effective, we will begin to file reports, proxy statements, information statements and other

information with the United States Securities and Exchange Commission, or SEC. You may read and copy this information, for a copying

fee, at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for

more information on its Public Reference Room. Our SEC filings will also be available to the public from commercial document retrieval

services, and at the website maintained by the SEC at http://www.sec.gov.

Our

Internet website address is http://www.uslightinggroup.com and www.intellitronix.com. Information contained on the website

does not constitute part of this Registration Statement. We have included our website address in this Registration Statement solely

as an inactive textual reference. When this Registration Statement is effective, we will make available, through a link to the

SEC’s website, electronic copies of the materials we file with the SEC, including annual reports on Form 10-K, quarterly reports

on Form 10-Q, current reports on Form 8-K, the Section 16 reports filed by our executive officers, directors and 10% stockholders

and amendments to those reports.

US

LIGHTING GROUP, INC.

FORM

10

TABLE

OF CONTENTS

ITEM

1. BUSINESS.

Overview

The Company designs and manufactures commercial

LED lighting. Intellitronix Corporation (“Intellitronix”), our wholly owned subsidiary, is a manufacturer of automotive

aftermarket and original equipment manufacturer (OEM) electronics.

Background

The Company was incorporated in the State of

Florida on October 17, 2003, under the corporate name Luxurious Travel Corp., in order to develop,

market and distribute a hotel booking engine software that interfaces and captures various rate channels and inventory controls

for hotel reservations. The system allowed users to market, manage and sell hotel reservations, and to produce invoices, track

follow up and manage customer relationships.

The Company was a “Reporting Issuer” subject

to the reporting requirements of Section 13 or 15(d) of the Exchange Act from January 16, 2014 when it filed a Form S-1 until

it deregistered August 8, 2017 with the filing of a Form 15.

The Company acquired all of the issued and

outstanding capital stock of US Lighting Group, Inc. (founded in 2013 in accordance with the laws of the State of Wyoming) on July

13, 2016, and the corporate name was changed on August 9, 2016 to the US Lighting Group, Inc.

Intellitronix was acquired by the Company on December 1,

2016. The Company agreed to pay $4,000,000.00 to Paul Spivak, seller, sole owner and officer of Intellitronix, in exchange for

all of the shares of Intellitronix. The terms of the purchase were a deposit of $200,000.00 (5%) payable by the Company to Mr.

Spivak on or before January 2, 2017 and the remaining balance of $3,800.000.00 was payable upon closing and memorialized with

a Promissory Note on December 1, 2016. Mr. Spivak is the founder, CEO and product inventor of the Company, but he is not considered

a promoter.

Intellitronix has access to the automotive electronics market

and has an established distributor and consumer base.

As a consolidated entity, the Company has demonstrated

revenue growth; however, the Company has historically reported operating losses primarily from expenses associated with public

company costs, corporate marketing, and product development activities. We intend to raise capital to operate and expand our business

to meet the growing demand for our products. We plan to grow revenue through the increase in sale of our existing products and

our new products via our existing distribution networks, as well as, completing more OEM projects for the recreational vehicle

(RV) and marine industries.

US

Lighting Group

In

recent years, we have seen a more energy-efficient, environmentally safe, and flexible lighting for businesses and residential

homes. Light emitting diodes (LEDs) offer numerous advantages over traditional light bulbs. LEDs are more durable resembling a

hard plastic versus a thin glass. Since mercury is not required in the manufacturing process, LEDs are more environmentally friendly.

Benefits of using our LED lights include an immediate and significant reduction in lighting bills with no yearly bulb or ballast

replacements. LED lights are durable and rugged, resistant to external impacts, and emit virtually no heat and ultraviolet emissions.

Furthermore, unlike the previous fluorescent bulb, LED lights are ecologically friendly as they do not include mercury or hazardous

chemical and are recyclable.

Applications for our LED lights include commercial

spaces such as board rooms, offices, factories, stores, gymnasiums, schools, hospitals, warehouses, and greenhouses, as well as

some residential applications such as garages.

LEDs are acost-effective, energy-savings alternative

to incandescent lights, touting a 2000% efficiency rate over conventional light bulbs and a 500% efficiency rate over compact fluorescent

bulbs. Over a 10-year period, the lighting industry could save $1 trillion in energy costs, eliminate the need for nearly 1 billion

barrels of petroleum leading to a substantial reduction in carbon dioxide emissions. With technology advancements, the true potential

of LED lighting lies in their ability to transform lighting technology. The light spectrum could be custom-tailored for all wavelengths,

accurately matching the sun’s light qualities that could revolutionize indoor agriculture and help night-shift workers. The

use of polarized light from LEDs could also improve computer displays and lower the glare from car headlights.1

References:

|

|

1

|

February

28, 2019, “The coming revolution in LED lighting” by Optical Society of America US

Lighting Group has a competitive advantage with its proprietary “transformerless” power supply design that offers

significant energy savings.

|

Transformerless

Circuit Controls Speed of Energy

Most LED lighting companies use a transformer

to appropriately drive an LED. Transformers, however, emit heat; that heat reduces a light bulb’s energy efficiency. US Lighting

Group has created a proprietary “transformerless” circuit that controls the speed of energy powered to the LED. Eliminating

the expense of an additional circuit board and timely assembly that goes along with it allows us to put money into the part that

matters most, the actual LED. Our driverless and transformerless technologyallows our LED lights to offer maximum efficiency.

Ballast

or no-ballast fluorescent lighting retrofits

Most

businesses use fluorescent lighting for work areas, conference rooms, and hallways. These fixtures have a “ballast”

which regulates the amount of electricity going through the fluorescent tube providing enough electricity to “start up.”

Our BH4 and GFY LED lighting product lines do not require a ballast in its fixture, allowing for maximum energy efficiency. Our

FEB Ballast Compatible line of bulbs eliminates the guesswork and retrofitting associated with these fixtures. TheseLED bulbs

are “plug-and-play” so customers do not have to worry about the type of ballast, and they can literally begin saving

money on their electricity by removing the old fluorescent bulb and replacing it with our Ballast Compatible LED Bulbs.

LED

Technology

According

to the U.S. Department of Energy, commercial and residential LED usage has shown that LED lights use at least 75% less energy

and last 25 times longer than incandescent bulbs. The actual LED component determines a light’s efficiency. To ensure

our LED is the most efficient, we use one of the most powerful LEDs available, such as Samsung LM561C,that emits the most lumens

per watt. All LEDs are rated to last at least 100,000 hours. However, this lifespan is only possible should an LED not exceed

clearly defined power and temperature limits, which is the main consideration behind our “transformerless” design.

Principal

Products

US Lighting Group

designs, manufactures, and distributes 4’ LED tube lights that are superior in power usage, lifespan, warranty, and cost

savings, because of the exclusive minimalistic design and proprietary manufacturing processes. Channels to market include The

Home Depot drop ship program, and earlier in the company history, a chain of regional distributors. US Lighting Group, Inc. has

research and development, testing, and production facilities based in Euclid, Ohio, USA where all products are engineered and

manufactured from domestic and imported components

The

US Lighting Group currently produces a series of bulbs, each with their own unique specifications and applications:

|

|

●

|

BH4

Series is our flagship LED light bulb line and has remained our top seller throughout

the years. The BH4 bulb is a powerful, highly efficient top-level bulb offering the greatest

savings potential and longest life span at 21 years. This light has been engineered to

emit zero RF.

|

|

|

●

|

GFY

Series designed for those looking for something a little less powerful and lower

cost. This series combines the demand for lower-watt bulbs with the need for highly efficient,

sustainable lighting options to create two highly affordable LED bulb options. This tube

is more cost-effective on the upfront purchase, while still offering a 15-year warranty

and significant savings on energy costs.

|

|

|

●

|

FEB

Series is our plug-and-play LED lighting option with power at each end that works

with both electronic and magnetic ballasts.

|

Distribution

and Current Market

LED

lighting is a commodity product, which has become very competitive due to overseas imports with low pricing, making it a difficult

climate for US Lighting Group, Inc. to operate in. We are looking into other LED lighting product lines that would leverage our

electronics innovativeness to provide more specialty-type LED lighting. US Lighting Group has a supplier contractual relationship

with The Home Depot. Customers can order product online at HomeDepot.com and it ships to the customer directly from our warehouse,

however the sales have been minimal in the last two years.

US

Lighting Group is looking at other industries such as robotics and fiberglass, but they are still in the early development stage.

Patents

The

following patents have been issued to our majority shareholder, CEO, Paul Spivak:

Patent

No. 10308330 for the company’s new motion stabilized spotlight product for the marine industry, Issued - 06/04/2019, with

a calculated expiration date of 01/27/2037

Patent

No. 6353781 GPS Controlled Marine Speedometer Unit with Multiple Operational Modes, Issued - 03/05/2002 and expired on 07/05/2020

Currently,

there is no formal patent license agreement between the CEO and the Company. The Company intends to acquire patent No. 10308330

once the development of such product aligns with Company’s R&D goals.

Intellitronix

Corporation

In recent years, the Company’s primary

activity has been centered around Intellitronix. Intellitronix is engaged in automotive electronics manufacturing, serving a niche

market of aftermarket electronics for customer installations as well as several emerging OEM applications.

Products

|

|

●

|

Automotive - Our portfolio includes direct fit replacement gauge panels for specific vehicle models manufactured by Chevrolet, Ford, Jeep, etc., and universal gauges for numerous other makes and models of classic cars. Other products include vehicle lighting, ignition systems, RPM switches and other automotive electronics. Intellitronix is a well-established brand that is available to consumers through major aftermarket distributors. The Company offers a Limited Lifetime Factory Warranty on all its branded products.

|

|

|

●

|

Marine

- We design and manufacture products for the marine industry including GPS controlled

marine speedometer and Prometheus Ignition System to guard against ignition failures.

|

|

|

●

|

OEM

- In recent years, we have developed several custom OEM projects from design to production

for companies such as Kawasaki Motors and Coachman RV. The Energy Management Multifunctional

System (EMMS) was designed and manufactured for recreational vehicles as an OEM project,

and our first customer orders were recently received. The 4-in-1 unit that is currently

in development incorporates energy management and load shed, a breaker panel, automatic

transfer switch, automatic generator starter plus display unit, Bluetooth, WiFi and multiplexing

capabilities.

|

Our

capabilities include a broad range of design and manufacturing services, such as various microprocessor-controlled products for

the automotive, electronic, marine, and recreational vehicle markets and the Company has been leveraging its competitive advantage

as an efficient low-cost manufacturing partner to other OEM providers. We are focusing on growing the OEM and private label segments

that provide high-volume and low-overhead manufacturing opportunities.

The

vast majority of our products are manufactured at our facility in Euclid, Ohio.

Distribution

We

currently have three sales channels, including Intellitronix branded automotive product lines sold through business-to-consumer

(B2C) and retail channels, business-to-business (B2B) and private labeled product lines, and original equipment manufacturers

(OEM). For OEM customers, we provide design and manufacturing services to meet original equipment manufacturer’s specifications

and these products are incorporated in the new vehicles. The most recent projects have been completed in the growing RV industry,

meeting all applicable safety standards.

Our

customers include O’Reilly Auto Parts, Summit Racing Equipment, JEGS, Kawasaki Motors, Coachman RV, US Auto Parts, CJ Pony

Parts, Corvette Central, Mid America Motorworks, Eckler’s, and others. We also sell our products through eBay, Amazon, and

other e-commerce platforms.

Employees

As of September 2020, we had 37 employees,

of which 9 employees are part-time. Our engineering staff designs products from conception through prototype, testing, and production.

Our staff consists of both electrical and mechanical engineers, and we periodically utilize contractors on an as-needed basis.

Our other departments include sales, marketing, administration, production, and technical support.

Equipment

We

have a line of automated electronic assembly equipment and other machinery required to assemble and test printed circuit boards.

We are expanding our capabilities by regularly purchasing in-house equipment in order to produce more intricate or customized

products. Our current equipment line includes Stencil printers, SMT (Surface Mount Technology) pick-and-place machine, reflow

oven, wave soldering machine, wire stripping, and laser cutting.

Markets

The

global Automotive Electronics market was valued at $285 billion in 2018 and is estimated to be worth more than $645 billion by

2030 based on the compound annual growth rate (CAGR*) of 7% between 2019 and 2030. The Automotive Electronics global market includes

automotive software, electrical/electronic component, ECUs/EDUs, power electronics, sensors, software, integration, verification

and validation, and other electronic components.2

The COVID-19 pandemic has made a significant

impact on the automotive industry. The automotive industry may see a shift in its global supply chain due to the level of dependence

on Chinese production and tooling. The industry could potentially reduce its reliance on China, because of the supply chain disruptions.

In this scenario, a larger percentage of production could feasibly move back to the U.S. It is expected that the Chinese tooling

and production industries will be extremely aggressive with pricing and will have the full backing of local Chinese authorities

and governments. Our strategic business plan for Intellitronix includes plans to reduce our dependency on Chinese imports.3

|

|

*

|

Compound

annual growth rate (CAGR) is the rate of return that would be required for an investment to grow from its beginning

balance to its ending balance, assuming the profits were reinvested at the end of each year of the investment’s lifespan.

|

References:

|

|

2

|

2018,

“Global Automotive Electronics Market Report” by Global Market Insights

|

|

|

3

|

2020,

“Automotive Industry Insight” by Peakstone

|

Suppliers

– International and Domestic

US

Lighting Group and Intellitronix both source components from preferred vendors and alternative sources:

US

Lighting Group

|

|

●

|

LED

manufacturers (preferred vendor with alternative vendors)

|

|

|

●

|

Circuit

boards (per specifications)

|

|

|

●

|

Enclosures

(per specifications)

|

|

|

●

|

Induction

components (per specifications)

|

|

|

●

|

Tooling

(per specifications)

|

Intellitronix Corporation

|

|

●

|

LED

manufacturers (custom tooled)

|

|

|

●

|

Circuit

boards (per specifications)

|

|

|

●

|

Sending

units and sensors (custom made)

|

|

|

●

|

Electronics

components (USA based distributors)

|

Competition

US

Lighting Group

We

compete with numerous companies in the LED Lighting marketplace including Lithonia Lighting, Toggled, Feit Electric and countless

Chinese companies.

Intellitronix Corporation

We compete primarily with four companies in

the Automotive Aftermarkets industry for automotive electronics, including Dakota Digital, Autometer, Classic Instruments, and

Holley Ignition Boxes (MSD).

Product

Safety

We use Intertek Testing Services NA, Inc. for product safety testing. We comply with environmental regulations

regarding product safety.

Reports

to Shareholders

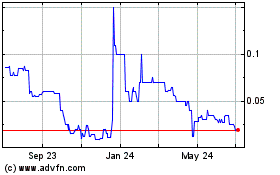

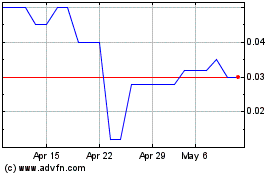

The Company is a Pink Sheet Issuer

filing current, public information with OTC Markets Group Inc. electronic quotation venue under the trading symbol “USLG.”

There is a highly illiquid nature in investing in the Company’s common stock.

When

this Registration Statement becomes effective, we will be a fully public reporting company and we will begin to file reports,

proxy statements, information statements and other information with the United States Securities and Exchange Commission, or SEC.

You may read and copy this information, for a copying fee, at the SEC’s Public Reference Room at 100 F Street, N.E., Washington,

D.C. 20549. Please call the SEC at 1-800-SEC-0330 for more information on its Public Reference Room. Our SEC filings will also

be available to the public from commercial document retrieval services, and at the website maintained by the SEC at http://www.sec.gov.

Regulatory

Mandates

Government

Regulations

We

are subject to regulations by securities laws as a public company.

Compliance

with Environmental Laws and Regulations

No

industry specific governmental approvals are required related to the operation of our business.

ITEM

1A. RISK FACTORS.

Not

required for smaller reporting companies.

ITEM

2. FINANCIAL INFORMATION.

MANAGEMENTS’

DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The

following discussion summarizes the significant factors affecting the operating results, financial condition and liquidity and

cash flows of our company for the years ended December 31, 2019 and 2018, and for the six months ended June 30, 2020. You should

read this discussion together with the consolidated financial statements, related notes and other financial information included

in this Form 10. Except for historical information, the matters discussed in this Management’s Discussion and Analysis of

Financial Condition and Results of Operations are forward looking statements that involve risks and uncertainties, and are based

upon judgments concerning various factors that are beyond our control. These risks could cause our actual results to differ materially

from any future performance suggested below.

General

Overview

We

are engaged in the business of manufacturing and distributing LED digital gauges, automotive electronics, and accessories for

commercial and industrial customers, as well as LED lighting tubes and bulbs.

Principal

Products

US

Lighting Group designs, manufactures, and distributes 4’ LED tube lights that are superior in power usage, lifespan, warranty,

and cost savings, because of the exclusive minimalistic design and proprietary manufacturing processes. Channels to market include

The Home Depot drop ship program, and earlier in the company history, a chain of reginal distributors. US Lighting Group, Inc.

has research and development, testing, and production facilities based in Euclid, Ohio, USA where all products are engineered

and manufactured from domestic and imported components

The

US Lighting Group currently produces a series of bulbs, each with their own unique specifications and applications:

|

|

●

|

BH4

Series is our flagship LED light bulb line and has remained our top seller throughout

the years. The BH4 bulb is a powerful, highly efficient top-level bulb offering the greatest

savings potential and longest life span at 21 years. This light has been engineered to

emit zero RF.

|

|

|

●

|

GFY

Series designed for those looking for something a little less powerful and lower

cost. This series combines the demand for lower-watt bulbs with the need for highly efficient,

sustainable lighting options to create two highly affordable LED bulb options. This tube

is more cost-effective on the upfront purchase, while still offering a 15-year warranty

and significant savings on energy costs.

|

|

|

●

|

FEB

Series is our plug-and-play LED lighting option with power at each end that works

with both electronic and magnetic ballasts.

|

Distribution

and Current Market

LED

lighting is a commodity product, which has become very competitive due to overseas imports with low pricing, making it a difficult

climate for US Lighting Group, Inc. to operate in. We are looking into other LED lighting product lines that would leverage our

electronics innovativeness to provide more specialty-type LED lighting. US Lighting Group has a supplier contractual relationship

with The Home Depot. Customers can order product online at HomeDepot.com and it ships to the customer directly from our warehouse,

however the sales have been minimal in the last two years.

US

Lighting Group is looking at other industries such as robotics and fiberglass, but they are still in the early development stage.

Intellitronix

Corporation

In

recent years, the Company’s primary activity has been centered around Intellitronix. Intellitronix is engaged in automotive

electronics manufacturing, serving a niche market of aftermarket electronics for customer installations as well as several emerging

OEM applications.

Products

|

|

●

|

Automotive

- Our portfolio includes direct fit replacement gauge panels for specific vehicle models manufactured by Chevrolet, Ford,

Jeep, etc. and universal gauges for numerous other makes and models of classic cars. Other products include vehicle lighting,

ignition systems, RPM switches and other automotive electronics. Intellitronix Corporation is a well-established brand that is

available to consumers through major aftermarket distributors. The Company offers a Limited Lifetime Factory Warranty on all its

branded products.

|

|

|

●

|

Marine

- We design and manufacture products for the marine industry including GPS controlled marine speedometer and Prometheus Ignition

System to guard against ignition failures.

|

|

|

●

|

OEM

- In recent years, we have developed several custom OEM projects from design to production

for companies such as Kawasaki Motors and Coachman RV. The Energy Management Multifunctional

System (EMMS) was designed and manufactured for recreational vehicles as an OEM project,

and our first customer orders were recently received. The 4-in-1 unit that is currently

in development incorporates energy management and load shed, a breaker panel, automatic

transfer switch, automatic generator starter plus display unit, Bluetooth, WiFi and multiplexing

capabilities.

|

Our

capabilities include a broad range of design and manufacturing services, such as various microprocessor-controlled products for

the automotive, electronic, marine, and recreational vehicle markets and the Company has been leveraging its competitive advantage

as an efficient low-cost manufacturing partner to other OEM providers. We are focusing on growing the OEM and private label segments

that provide high-volume and low-overhead manufacturing opportunities.

The

vast majority of our products are manufactured at our facility in Euclid, Ohio.

Distribution

We

currently have three sales channels, including Intellitronix branded automotive product lines sold through business-to-consumer

(B2C) and retail channels, business-to-business (B2B) and private labeled product lines, and original equipment manufacturers

(OEM). For OEM customers, we provide design and manufacturing services to meet original equipment manufacturer’s specifications

and these products are incorporated in the new vehicles. The most recent projects have been completed in the growing RV industry,

meeting all applicable safety standards. Our customers include O’Reilly Auto Parts, Summit Racing Equipment, JEGS, Kawasaki

Motors, Coachman RV, US Auto Parts, CJ Pony Parts, Corvette Central, Mid America Motorworks, Eckler’s and others. We also

sell our products through eBay, Amazon, and other e-commerce platforms.

COVID-19

Considerations

Through

the date these financial statements were issued, the COVID-19 pandemic did not have a net material impact on our operating results.

In the future, the pandemic may cause reduced demand for our products if, for example, the pandemic results in a recessionary

economic environment, which negatively effects the consumers who purchase our products.

Our

ability to operate without significant negative operational impact from the COVID-19 pandemic will in part depend on our ability

to protect our employees and our supply chain. The Company has endeavored to follow the recommended actions of government and

health authorities to protect our employees. Through the date that these financial statements were issued, we maintained the consistency

of our operations during the onset of the COVID-19 pandemic. However, the uncertainty resulting from the pandemic could result

in an unforeseen disruption to our workforce and supply chain (for example an inability of a key supplier or transportation supplier

to source and transport materials) that could negatively impact our operations.

Through

the date that these financial statements were issued, the COVID-19 pandemic has not negatively impacted the Company’s liquidity

position as of such date, and the Company continues to generate cash flows to meet its short-term liquidity needs, and it expects

to maintain access to the capital markets. The Company has not observed any material impairments of its assets or a significant

change in the fair value of its assets due to the COVID-19 pandemic.

Critical

Accounting Policies

This

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” section is based upon

our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in

the United States of America (“U.S. GAAP”). The preparation of consolidated financial statements requires that we

make estimates and judgments that affect the reported amounts of assets, liabilities, net sales and expenses and related disclosures.

On an ongoing basis, we evaluate our estimates, including, but not limited to, those related to inventories, income taxes, accounts

receivable allowance, fair value derivatives, and reserve for warranty claims. We base our estimates on historical experience,

performance metrics and on various other assumptions that we believe to be reasonable under the circumstances, the results of

which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from

other sources. Actual results will differ from these estimates under different assumptions or conditions. We apply the following

critical accounting policies in the preparation of our consolidated financial statements:

Use

of Estimates

Financial

statements prepared in accordance with accounting principles generally accepted in the United States require management to make

estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and

the reported amounts of revenues and expenses during the reporting period. Among other things, management estimates include the

estimated collectability of its accounts receivable, the valuation of long lived assets, warranty reserves, the assumptions used

to calculate derivative liabilities, assumptions used to value equity instruments issued for financing and compensation, and the

valuation of deferred tax assets. Actual results could differ from those estimates.

Revenue

recognition

We

recognize revenue in accordance with Accounting Standard Update (“ASU”) No. 2014-09. This standard provides authoritative

guidance clarifying the principles for recognizing revenue and developing a common revenue standard for U.S. generally accepted

accounting principles. The core principle of the guidance is that an entity should recognize revenue to depict the transfer of

promised goods and services to customers in an amount that reflects the consideration to which the entity expects to be entitled

in the exchange for those goods or services.

Under

this guidance, revenue is recognized when control of promised goods or services is transferred to the Company’s customers,

in an amount that reflects the consideration the Company expects to be entitled to in exchange for those goods or services. The

Company reviews its sales transactions to identify contractual rights, performance obligations, and transaction prices, including

the allocation of prices to separate performance obligations, if applicable. Revenue and costs of sales are recognized once products

are delivered to the customer’s control and performance obligations are satisfied.

Products

sold by the Company are distinct individual products. The products are offered for sale as finished goods only, and there are

no performance obligations required post-shipment for customers to derive the expected value from them. Most of the Company’s

sales are received through several eBay web-commerce websites, which requires customer payment at time of order placement.

The

Company does offer a 30-day return policy from the date of shipment. The Company also provides a limited lifetime warranty on

its products. Due to a limited history of returns, the Company does not maintain a warranty reserve.

Recent

Accounting Pronouncements

See

Note 1 of Notes to Consolidated Financial Statements contained in this Form 10 for management’s discussion of recent accounting

pronouncements.

Results

of Operations for the Year Ended December 31, 2019 Compared to the Year Ended December 31, 2018

Our

revenue, operating expenses, and net loss from operations for the year ended December 31, 2019 as compared to the year ended December

31, 2018, were as follows:

|

|

|

For the year ended

|

|

|

|

|

|

Percentage

|

|

|

|

|

December 31,

|

|

|

|

|

|

Change

|

|

|

|

|

2019

|

|

|

2018

|

|

|

Change

|

|

|

Inc. (Dec.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Sales, net

|

|

|

2,647,000

|

|

|

|

2,422,000

|

|

|

|

225,000

|

|

|

|

9

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Cost of goods sold

|

|

|

1,041,000

|

|

|

|

1,602,000

|

|

|

|

(561,000

|

)

|

|

|

(35

|

)%

|

|

Gross profit

|

|

|

1,606,000

|

|

|

|

820,000

|

|

|

|

786,000

|

|

|

|

96

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

|

|

1,902,000

|

|

|

|

3,257,000

|

|

|

|

(1,355,000

|

)

|

|

|

(42

|

)%

|

|

Product development costs

|

|

|

230,000

|

|

|

|

465,000

|

|

|

|

(235,000

|

)

|

|

|

(51

|

)%

|

|

Stock-based compensation

|

|

|

7,976,000

|

|

|

|

812,000

|

|

|

|

7,164,000

|

|

|

|

882

|

%

|

|

Loss on disposal of property and equipment

|

|

|

-

|

|

|

|

149,000

|

|

|

|

(149,000

|

)

|

|

|

(100

|

)%

|

|

|

|

|

10,108,000

|

|

|

|

4,683,000

|

|

|

|

5,425,000

|

|

|

|

116

|

%

|

|

Loss from operations

|

|

|

(8,502,000

|

)

|

|

|

(3,863,000

|

)

|

|

|

(4,639,000

|

)

|

|

|

120

|

%

|

|

Interest

|

|

|

(200,000

|

)

|

|

|

(222,000

|

)

|

|

|

(22,000

|

)

|

|

|

(10

|

)%

|

|

Net loss

|

|

$

|

(8,702,000

|

)

|

|

$

|

(4,085,000

|

)

|

|

$

|

(4,617,000

|

)

|

|

|

113

|

%

|

Sales

Sales

increased by $225,000 (9%) to $2.6 million for the year ended December 31, 2019, compared to $2.4 million for the year ended December

31, 2018. The increase in revenue is attributed to the utilization of the eBay e-commerce website, which has provided us access

to a larger customer base.

Cost

of Goods Sold

Cost

of goods sold decreased by $561,000 (35%) to $1.0 million for the year ended December 31, 2019, compared to $1.6 million for the

year ended December 31, 2018. The decrease in costs of goods sold was primarily attributable to increased automation leading to

reduced labor costs, and improved supply chain management. Gross profit as a percentage of sales increased by 80% to 60.7% for

the year ended December 31, 2019, compared to 33.8% for the year ended December 31, 2018.

Operating

Expenses

Operating expenses include selling, general

and administrative expenses, product development costs, and non-cash stock-based compensation expense, and loss on disposal of

property and equipment.

Selling, general and administrative expenses

decreased approximately $1.4 million to $1.9 million during the year ended December 31, 2019, compared to $3.3 million during the

year ended December 31, 2018. The decrease in selling, and general and administrative expenses was due to planned personnel and

expense reductions leading to decreased compensation and benefit expense, and decreased professional fees, as compare to the prior

year period.

Product

development costs decreased approximately $235,000 to $230,000 during the year ended December 31, 2019, compared to $465,000 during

the year ended December 31, 2018. The decrease in product development costs was due primarily to the completion of major engineering

milestones for the RV industry in early 2019.

Non-cash stock-based compensation expense increased

approximately $7.2 million to $8.0 million during the year ended December 31, 2019 compared to $812,000 during the year ended December

31, 2018. We issued stock in lieu of cash payment for services received from employees and contractors. During the year ended December

31, 2019, we issued 27,091,000 shares of the Company’s common to our CEO valued at $6.8 million.

Loss

from Operations

Loss

from operations increased to approximately $8.5 million during the year ended December 31, 2019, compared to $3.9 million during

the year ended December 31, 2018. The increase in operating loss was due primarily to the increase in non-cash stock based compensation

expense discussed above, offset by increased sales and gross profit, decreased selling, general and administrative expenses, and

decreased product development costs.

Other

Expense

Other

expenses include interest. Interest decreased approximately $22,000 to $200,000 during the year ended December 31, 2019, compared

to $222,000 during the year ended December 31, 2018. The decrease in interest was primarily attributable to the decrease in notes

payable to related parties as compared to the prior year period.

Net

Loss

Net

loss increased $4.6 million to $8.7 million during the year ended December 31, 2019, compared to a net loss of $4.1 million for

the year ended December 31, 2018. The increase in net loss was due to the increase in non-cash stock based compensation expense

discussed above, offset by increased gross profit, decreased selling, general and administrative expenses, and decreased product

development costs. Net loss per common share increased to $0.15 per share for the year ended December 31, 2019, compared to $0.09

net loss per common share for the year ended December 31, 2018, due to the increase in net loss for the year ended December 31,

2019, offset by the increase in weighted-average shares outstanding during the year ended December 31, 2019.

Results

of Operations for the Six Months Ended June 30, 2020 Compared to the Six Months Ended June 30, 2019

Our

revenue, operating expenses, and net loss from operations for the six months ended June 30, 2020 as compared to the six months

ended June 30, 2019 were as follows:

|

|

|

For the six months ended

|

|

|

|

|

|

Percentage

|

|

|

|

|

June 30,

|

|

|

|

|

|

Change

|

|

|

|

|

2020

|

|

|

2019

|

|

|

Change

|

|

|

Inc. (Dec.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Sales, net

|

|

|

1,562,000

|

|

|

|

1,286,000

|

|

|

|

276,000

|

|

|

|

21

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Cost of goods sold

|

|

|

604,000

|

|

|

|

373,000

|

|

|

|

231,000

|

|

|

|

62

|

%

|

|

Gross profit

|

|

|

958,000

|

|

|

|

913,000

|

|

|

|

45,000

|

|

|

|

5

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

|

|

891,000

|

|

|

|

1,055,000

|

|

|

|

(164,000

|

)

|

|

|

(16

|

)%

|

|

Product development costs

|

|

|

220,000

|

|

|

|

111,000

|

|

|

|

109,000

|

|

|

|

98

|

%

|

|

Stock-based compensation

|

|

|

31,000

|

|

|

|

225,000

|

|

|

|

(194,000

|

)

|

|

|

(86

|

)%

|

|

Total operating expenses

|

|

|

1,142,000

|

|

|

|

1,391,000

|

|

|

|

(249,000

|

)

|

|

|

(18

|

)%

|

|

Loss from operations

|

|

|

(184,000

|

)

|

|

|

(478,000

|

)

|

|

|

294,000

|

|

|

|

62

|

%

|

|

Interest

|

|

|

(98,000

|

)

|

|

|

(88,000

|

)

|

|

|

10,000

|

|

|

|

11

|

%

|

|

Net loss

|

|

$

|

(282,000

|

)

|

|

$

|

(566,000

|

)

|

|

$

|

284,000

|

|

|

|

50

|

%

|

Sales

Sales

increased by $276,000 (21%) to $1.6 million for the six months ended June 30, 2020, compared to $1.3 million for the six months

ended June 30, 2019. The increase in revenue is attributed to the utilization of the eBay e-commerce website, which has provided

us access to a larger customer base.

Cost

of Goods Sold

Cost of goods sold increased by $231,000 (62%)

to $604,000 for the six months ended June 30, 2020, compared to $373,000 for the six months ended June 30, 2019. The increase in

costs of goods sold was primarily attributable to our increase in sales, offset by increased material, freight, and tariffs costs,

as compared to the prior year period. Gross profit as a percentage of sales decreased by 14% to 61.3% for the six months ended

June 30, 2020, compared to 71.0% for the six months ended June 30, 2019. The decrease in gross margin as a percentage of sales

was due to increased material, freight, and tariffs costs, as compared to the prior year period.

Operating

Expenses

Operating

expenses include selling, general and administrative expenses, product development costs, and non-cash stock-based compensation

expense.

Selling, general and administrative expenses

decreased approximately $164,000 to $891,000 during the six months ended June 30, 2020, compared to $1.1 million during the six

months ended June 30, 2019. The decrease in selling, and general and administrative expenses was due to planned personnel and expense

reductions leading to decreased compensation and benefit expense, and decreased professional fees, as compare to the prior year

period.

Product

development costs increased approximately $109,000 to $220,000 during the six months ended June 30, 2020, compared to $111,000

during the six months ended June 30, 2019. The increase in product development costs was due primarily to new product engineering

initiatives and various OEM projects.

Non-cash

stock-based compensation expense decreased approximately $194,000 to $31,000 during the six months ended June 30, 2020, compared

to $225,000 during the six months ended June 30, 2019. During the six months ended June 30, 2020, the reduced the amount of stock

we issued to our employees and contractors, as compared to the prior year period.

Loss

from Operations

Loss from operations decreased to approximately

$184,000 during the six months ended June 30, 2020, compared to $478,000 during the six months ended June 30, 2019. The decrease

in operating loss was due primarily to the increase in gross profit, and decreased operating expenses discussed above.

Other

Expense

Other

expenses include interest. Interest increased approximately $10,000 to $98,000 during the six months ended June 30, 2020, compared

to $88,000 during the six months ended June 30, 2019. The increase in interest was primarily attributable to the increase in notes

payable and convertible notes payables balances as compared to the prior year period.

Net

Loss

Net

loss decreased $284,000 to $282,000 during the six months ended June 30, 2020, compared to $566,000 for the six months ended June

30, 2019. The decrease in operating loss was due to the increase in gross profit, and decreased operating expense discussed above.

Net loss per common share decreased to $0.00 per share for the six months ended June 30, 2020, compared to $0.01 net loss per

common share for the six months ended June 30, 2019, due to an increase in weighted-average shares outstanding during the six

months ended June 30, 2020, and the decrease in net loss for the six months ended June 30, 2020.

Liquidity

and Capital Resources

Our

working capital deficiency as of June 30, 2020 and December 31, 2019 was as follows:

|

|

|

As of

|

|

|

As of

|

|

|

|

|

June 30,

2020

|

|

|

December 31,

2019

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

Current Assets

|

|

$

|

360,000

|

|

|

$

|

314,000

|

|

|

Current Liabilities

|

|

|

3,902,000

|

|

|

|

2,484,000

|

|

|

Net Working Capital Deficiency

|

|

$

|

(3,542,000

|

)

|

|

$

|

(2,170,000

|

)

|

The

following summarizes our cash flow activity for the six months ended June 30, 2020, and the fiscal year ended December 31, 2019:

|

Cash Flows

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six months

|

|

|

Year

|

|

|

|

|

Ended

|

|

|

Ended

|

|

|

|

|

June 30,

2020

|

|

|

December 31,

2019

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

Net cash provided by (used in) Operating Activities

|

|

$

|

14,000

|

|

|

$

|

(315,000

|

)

|

|

Net cash used in Investing Activities

|

|

|

(769,000

|

)

|

|

|

(101,000

|

)

|

|

Net cash provided by Financing Activities

|

|

|

711,000

|

|

|

|

299,000

|

|

|

Decrease in Cash during the period

|

|

|

(44,000

|

)

|

|

|

(117,000

|

)

|

|

Cash, Beginning of Period

|

|

|

107,000

|

|

|

|

224,000

|

|

|

Cash, End of Period

|

|

$

|

63,000

|

|

|

$

|

107,000

|

|

Since

inception, our principal sources of liquidity have been cash provided by financing, including through the private placement of

convertible notes and equity securities, loans, and gross profit from the sales of our products. Our principal uses of cash have

been primarily for labor and outside services, expansion of our operations, development of new products and improvement of existing

products, expansion of marketing efforts to promote our products and brand, and capital expenditures. We anticipate that additional

expenditures will be necessary to develop and expand our assets before sufficient and consistent positive operating cash flows

will be achieved, including sufficient cash flows to service existing liabilities and related interest. Additional funds may be

needed in order to continue production and operations, maintain profitability and to achieve our objectives. As such, our cash

resources may not be sufficient to meet our current operating expense and production requirements, and planned business objectives

beyond the date of this Form 10 filing without additional financing.

As further presented in our consolidated financial

statements and related notes included in this Form 10, during the six months ended June 30, 2020 we incurred a net loss of $282,000,

and at June 30, 2020, had a stockholders’ deficit of $3.5 million. In addition, during the fiscal year ended December 31,

2019, we incurred a net loss of $8.7 million, and used cash in operations of $315,000, and at December 31, 2019, we had a stockholders’

deficit of $3.3 million, and a working capital deficit of $2.2 million. These factors raise substantial doubt about our ability

to continue as a going concern, as noted by our independent registered public accounting firm in its report on our December 31,

2019 financial statements.

Our ability to continue as a going concern

is dependent upon our ability to raise additional capital and to maintain revenues and generate profit from operations. Subsequent

to June 30, 2020, we received aggregate proceeds of $274,000 through proceeds received from a private placement transaction. During

the six months ended June 30, 2020, we were able to raise $58,000 through proceeds received from a private placement transaction

and $227,000 from the issuance of convertible notes. During the fiscal year ended December 31, 2019, we were able to raise $622,000

through proceeds received from a private placement transaction and $113,000 from the issuance of convertible notes. At June 30,

2020, we had cash on hand of approximately $63,000, and may not be able to generate sufficient funds from our future operations

to meet our cash flow requirements. We may need additional funds to meet our cash flow requirements to operate our business through

December 31, 2020.

At

June 30, 2020, we had a working capital deficit of approximately $3.5 million compared to a working capital deficit of $2.2 million

at December 31, 2019. The increase in working capital deficit was primarily related to the increase in short-term debt. At December

31, 2019, we had a working capital deficit of approximately $2.2 million compared to a working capital deficit of $1.6 million

at December 31, 2018. The increase in working capital deficit was primarily related to the increase in short-term debt and the

increase in accrued and unpaid payroll to our President and CEO during the year ended December 31, 2019.

Net

cash provided by operating activities for the six months ended June 30, 2020 totaled $14,000, compared to net cash used in operating

activities for the six months ended June 30, 2019 of $260,000. The decrease in net cash used in operations for the six months

ended June 30, 2020 was primarily due to a decrease in net loss during the six months ended June 30, 2020 of $282,000 compared

to a net loss of $566,000 incurred during the six months ended June 30, 2019. Net cash used in operating activities for the fiscal

year ended December 31, 2019 totaled $315,000. This compares to net cash used in operating activities of $2.7 million for the

year ended December 31, 2018.

Net

cash used in investing activities was approximately $769,000 for the six months ended June 30, 2020, compared to $3,000 for the

six months ended June 30, 2019. During the six months ended June 30, 2020, the Company purchased land, building, and improvements

for $736,000, and moved its operations to Euclid, Ohio. Net cash used in investing activities was approximately $101,000 for year

ended December 31, 2019, compared to $70,000 for the year ended December 31, 2018, and relates to the purchase of automobiles,

machinery and equipment.

Net cash provided by financing activities

for the six months ended June 30, 2020 was $711,000, and included proceeds of $58,000 received in the private placement of common

stock, $227,000 from the issuance of secured convertible promissory notes, $345,000 from proceeds from the issuance of notes payable,

and $408,000 in proceeds from the issuance of a note payable to a related party. These proceeds were offset by the payment of

$2,000 on a finance lease, repayment of $131,000 of notes payable, and repayment of $194,000 of notes payable to a related party.

Net cash provided by financing activities for the six months ended June 30, 2019 was $123,000, which included $493,000 of proceeds

from private placement of common stock, offset by payment of $4,000 on a finance lease, and repayment of $66,000 of notes payable,

and repayment of $300,000 on notes payable to a related party. Net cash provided by financing activities for the year ended December

31, 2019 was $299,000, and included $622,000 of proceeds from the private placement of common stock, $113,000 from the issuance

of secured convertible promissory notes, and $280,000 in proceeds from loans payable. These proceeds were offset by the payment

of $8,000 on a finance lease, repayment of $174,000 of notes payable, and repayment of $534,000 of notes payable to a related

party. Net cash provided by financing activities for the year ended December 31, 2018 was $3.0 million, and included $3.9 million

of proceeds from the private placement of common stock, $60,000 on the conversion of warrants into common stock, offset by the

repayment of $182,000 of notes payable, and repayment of $743,000 of a note payable to a related party.

Off-Balance

Sheet Arrangements

We

have not entered any off-balance sheet arrangements.

Commitments

Lease

Obligations

We

currently have no lease obligations.

ITEM

3. PROPERTIES

Our

principal corporate office and production facility, which we purchased on April 27, 2020, is located at 1148 East 222nd

Street, Euclid, Ohio 44117. The commercial building has 26,000 sq. ft. of manufacturing,

warehouse and office space and sits on 2.0 acres of land. Previously, the Company rented space at 34099 Melinz Parkway,

Unit E, Eastlake, Ohio. We believe our facilities are adequate to meet our current and near-term needs.

ITEM

4. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT.

The

following table sets forth information with respect to the beneficial ownership of our outstanding common stock by:

|

|

●

|

each

person who is known by us to be the beneficial owner of five percent (5%) or more of our common stock;

|

|

|

●

|

our

executive officers, and each director as identified in the “Management — Executive Compensation” section; and

|

|

|

●

|

all

of our directors and executive officers as a group.

|

Beneficial

ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or

investment power with respect to securities. Shares of common stock and options, warrants and convertible securities that are

currently exercisable or convertible within 60 days of the date of this document into shares of our common stock are deemed to

be outstanding and to be beneficially owned by the person holding the options, warrants or convertible securities for the purpose

of computing the percentage ownership of the person, but are not treated as outstanding for the purpose of computing the percentage

ownership of any other person.

The

information below is based on the number of shares of our common stock that we believe was beneficially owned by each person or

entity as of September 25, 2020.

(a)

Security Ownership of Certain Beneficial Owners

|

Title

of Class

|

|

Name

and Address of

Beneficial Owner

|

|

Amount

and Nature of

Beneficial

Owner

|

|

Percent

of Class

Outstanding

|

|

Common

Stock

|

|

None

|

|

|

|

|

(b)

Security Ownership of Management

|

Title

of Class

|

|

Name

and Address of

Beneficial Owner

|

|

Amount

and Nature of

Beneficial

Owner

|

|

Percent

of Class

Outstanding

|

|

Common

Stock

|

|

Paul

Spivak

309

Lake Breeze Cv,

Eastlake,

OH 44095

|

|

50,000,479

shares

CEO

|

|

55.153%

|

(b)

Changes in Control

None.

ITEM 5. DIRECTORS AND EXECUTIVE OFFICERS.

The

following table sets forth the names, positions and ages of our current executive officers and directors. All directors serve

until the next annual meeting of stockholders or until their successors are elected and qualified. Officers are appointed by our

board of directors and their terms of office are, except to the extent governed by an employment contract, at the discretion of

our board of directors.

|

Name

|

|

Age

|

|

Title

|

|

Paul

Spivak (a)

|

|

61

|

|

President

and Chief Executive Officer

|

|

(a)

|

Appointed

effective July 13, 2016.

|

Paul

Spivak, President and Chief Executive Officer

Mr.

Spivak is an innovative entrepreneur, design engineer, inventor, and patent holder with over 30 years of experience in

creating new high technology products and successfully developing four profitable startup companies. Initially designing electronic

surveillance equipment for IBM, Motorola, and Westinghouse, he ultimately left his day job to pursue his own business ventures,

inventions, and patents. Mr. Spivak has an extensive list of patents and patents pending and has several patents in the areas

of GPS speedometer, LED Tanning, Spray Tanning, LED Technologies and Automotive Aftermarket Technologies. His engineering and

design specialties include microprocessor-controlled product development, printed circuit board design, analog and digital circuitry,

and LED technology. His innovations and entrepreneurial spirit have led him to successfully develop 4 start-up companies in the

electronics industry, including Cyberdyne, Magic Tan (currently known as Sunless Inc.) and Intellitronix Corporation. Mr. Spivak’s

education includes a Bachelor of Science in Electrical Engineering from Penn State University, Penn College of Technology. Mr.

Spivak resides in Cleveland, Ohio. He is an avid world traveler and enjoys boating and reading history.

Mr. Spivak has been performing duties

of the CEO of Intellitronix Corp. and US Lighting Group Inc. since their inception and for the last consecutive 5 years. Mr. Spivak

works fulltime for the Company.

He is also currently performing functions

of Chief Financial Officer for the Company.

ITEM

6. EXECUTIVE COMPENSATION.

The

following table and related footnotes show the compensation paid to our Chief Executive Officer during the last fiscal year ended

December 31, 2019, and information concerning all compensation paid for services rendered to us in all capacities for our last

two fiscal years.

|

Name and Principal Position

|

|

Year

|

|

Salary($)

|

|

|

Stock

Awards($) (2)

|

|

|

All Other

Compensation($)

|

|

|

Total($)

|

|

|

Paul Spivak, CEO

|

|

2019

|

|

|

150,000

|

(1)

|

|

|

6,772,750

|

|

|

|

-

|

|

|

|

6,922,750

|

|

|

|

|

2018

|

|

|

150,000

|

(1)

|

|

|

-

|

|

|

|

-

|

|

|

|

350,000

|

|

|

|

(1)

|

This

amount was accrued and unpaid as of December 31, 2019.

|

|

(2)

|

On December 23, 2019, Mr. Spivak was granted 27,091,000 shares of US Lighting Group, Inc. common stock valued at $0.25 per share.

|

Employment

Contracts and Termination of Employment and Change-in-Control Arrangements

There

are employment contracts with employees but no compensatory plans or arrangements, including payments to be received from us,

with respect to any of our directors or executive officers which would in any way result in payments to any such person because

of his or her resignation, retirement or other termination of employment with us. These agreements do not provide for payments

to be made as a result of any change in control of us, or a change in the person’s responsibilities following such a change in

control.

The

January 2, 2017, the Company entered into an Employment Agreement with Paul Spivak, that outlines Mr. Spivak’s retention

as President and CEO of the Company in exchange for an annual salary of $150,000, with allowances for bonuses and the issuance

of the Company’s common stock. On July 1, 2020, the Company amended the Employment Agreement to increase Mr Spivak’s

annual salary to $156,000.

The Employment Agreement does not require

Mr. Spivak to work for the Company fulltime; however it is estimated that he devotes at least 40 hours a week to the Company.

Compensation

Committee Interlocks and Insider Participation

Our

board of directors in our entirety acts as the compensation committee for the Company.

Compensation

of Directors

At

this time, our Directors do not receive cash compensation for serving as members of our Board of Directors. The term of office

for each Director is one (1) year, or until his/her successor is elected at our annual meeting and qualified. The term of office

for each of our Officers is at the pleasure of the Board of Directors. The Board of Directors has no nominating, auditing committee

or a compensation committee. Therefore, the selection of person or election to the Board of Directors was neither independently

made nor negotiated at arm’s length.

During

the years ended 2017, 2018, and 2019, the Company’s sole director, and President and CEO, Paul Spivak, received no compensation

for services provided as a director.

Limitation

on Liability and Indemnification

To

the fullest extent permitted by the laws of the State of Florida, and our Bylaws, we may indemnify an officer or director who

is made a party to any proceeding, including a lawsuit, because of his/her position, if he/she acted in good faith and in a manner

he/she reasonably believed to be in our best interest. We may advance expenses incurred in defending a proceeding. To the extent

that the officer or director is successful on the merits in a proceeding as to which he/she is to be indemnified, we must indemnify

him/her against all expenses incurred, including attorney’s fees. With respect to a derivative action, indemnity may be

made only for expenses actually and reasonably incurred in defending the proceeding, and if the officer or director is judged

liable, only by a court order.

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling

us pursuant to the foregoing provisions, we have been informed that in the opinion of the Securities and Exchange Commission such

indemnification is against public policy as expressed in the Securities Act and is theretofore unenforceable.

Equity

Compensation Plan Information

US

Lighting Group Corporation issues stock bonuses to Company employees from time-to-time based on the CEO’s recommendations.

The Company does not currently offer a Stock Option or Award Plan for its employees.

ITEM

7. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE.

Other

than the stock transactions discussed below, we have not entered into any transaction nor are there any proposed transactions

in which any of our founders, directors, executive officers, stockholders or any members of the immediate family of any of the

foregoing had or are to have a direct or indirect material interest.

Paul

Spivak

Beginning

in January 2018, the Company’s President voluntarily elected to defer a portion of his employment compensation. The balance

of the compensation owed to the Company’s President was $364,000 and $312,000 as of June 30, 2020 and December 31, 2019,

respectively. There is no maturity date, and the balances bear no interest. The Company has not entered into any agreements

in regard to the deferred compensation repayment.

On

December 23, 2019, the Company issued Paul Spivak, the Company’s President and a shareholder, 27,091,000 shares of Company

common stock, with a fair value of $6,772,000, or $0.25 per shares, which was recognized as compensation cost.

Loans

payable to Paul Spivak, or affiliated with Paul Spivak, consist of the following:

|

|

|

June 30,

2020

|

|

|

December 31,

2019

|

|

|

|

|

|

|

|

|

|

|

Loan payable to officers/shareholders (a)

|

|

$

|

2,620,000

|

|

|

$

|

2,738,000

|

|

|

Loan payable to related party (b)

|

|

|

125,000

|

|

|

|

125,000

|

|

|

Loan payable to related party – past due (c)

|

|

|

30,000

|

|

|

|

32,000

|

|

|

Loan payable to related party – (d)

|

|

|

413,000

|

|

|

|

-

|

|

|

Total loans payable to related parties

|

|

|

3,188,000

|

|

|

|

2,895,000

|

|

|

Loans payable to related parties, current portion

|

|

|

(2,745,000

|

)

|

|

|

(1,662,000

|

)

|

|

Loans payable to related parties, net of current portion

|

|

$

|

443,000

|

|

|

$

|

1,233,000

|

|

|

a.

|

Intellitronix was acquired by the Company on December 1,

2016. The Company agreed to pay $4,000,000.00 to Paul Spivak, seller, sole owner and officer of Intellitronix, in exchange for

all of the shares of Intellitronix. The terms of the purchase were a deposit of $200,000.00 (5%) payable by the Company to Mr.

Spivak on or before January 2, 2017 and the remaining balance of $3,800.000.00 was payable upon closing and memorialized with

a Promissory Note on December 1, 2016. Mr. Spivak is the founder, CEO and product inventor of the Company, but he is not considered

a promoter.

The sixty-month loan matures in December 2021, requires monthly payments of $74,000, carries an interest rate of 6.25%,