By Joe Wallace and Julie Steinberg

An abrupt reversal in many of this year's most-persistent market

trends has hurt a cluster of computer-driven funds.

Caution gave way to euphoria in financial markets when Pfizer

Inc. and BioNTech SE said their coronavirus vaccine was more than

90% effective on Nov. 9. Shares of companies that have suffered in

the pandemic leapt, as did government-bond yields and energy prices

-- a pattern that repeated with the arrival of promising results

for Moderna Inc.'s vaccine Monday.

That was bad news for investors who aim to ride winning assets

higher and losing markets lower, a popular quantitative strategy

known as momentum investing. A gauge of performance by members of

the S&P 500 classified as momentum stocks slumped almost 14% on

Nov. 9, according to JPMorgan Chase & Co. That was the biggest

one-day loss for the grouping since at least the mid-1980s.

Among those caught out: A momentum fund run by AQR Capital

Management LLC that manages $3.4 billion in stock, bond, commodity

and currency futures. Class I shares in the mutual fund dropped

2.9% on the day of the Pfizer news, according to FactSet, one of

their worst days since inception in 2010. A spokesman declined to

comment.

AlphaSimplex Group LLC was another to feel the pain. Stung by

bets against oil and bond yields, as well as wagers on haven

currencies like Japan's yen, the firm's managed futures fund lost

2.6%, its second-biggest fall of 2020. Profitable bets on

agricultural commodities and stocks cushioned the blow, and the

fund is up over 7% for the year.

"We definitely got hit by that massive move in yields," said

portfolio manager Kathryn Kaminski. "Anything that had been your

friend throughout Covid was now coming back" to earth, she

added.

Though small, the losses demonstrate how funds that aim to

capitalize on existing trends are exposed when markets turn.

Momentum funds suffered in the spring of 2009, when the U.S. stock

market rebounded from the financial crisis.

"The problem with momentum investors is by definition they're

always going to crash at market turning points," said Yin Luo, vice

chairman for quantitative research at Wolfe Research LLC.

Sovereign-wealth funds and yield-starved European pension funds are

among the biggest momentum investors, gaining exposure through

asset managers and instruments sold by investment banks, he

added.

The blow also highlights the risks involved in piling into

crowded trades that investors exit en masse when prices turn

against them. This dynamic was one of the main reasons why

quantitative hedge funds that focus on stocks notched their worst

two-day performance since March last week, down 2.9%, according to

estimates from Goldman Sachs Group Inc.

Momentum funds weren't the only ones to be burned. Funds betting

on tech stocks that had benefited from the stay-at-home craze also

lost out last week. ARK Innovation ETF, with $10 billion in assets

under management, invests in companies benefiting from "disruptive

innovation" such as Spotify Technology SA, Slack Technologies Inc.

and Zoom Video Communications Inc. The fund was down 4.6% on Nov.

9. It fell 2.7% the following day before recovering more than 4% on

Nov. 11.

Investors in the recent rotation moved into stocks in industries

that "we believe are particularly at risk" of being upended long

term, said Ren Leggi, ARK's client portfolio manager, including

pharmaceuticals, banks, energy and automotive. He believes the

current rotation will be short lived as industry incumbents are

displaced, and that investors in value stocks might face more risk

than they have historically.

"Longer-term we expect the rotation to reverse and shift in

favor of innovation and growth," he added.

Proponents of momentum investing, such as AQR's billionaire

co-founder, Clifford Asness, point to evidence that the strategy

has paid off for over two centuries in the U.S. stock market.

Still, the past few years have been tough, in part because of a

series of shifts in stock-market leadership.

These reversals, involving rallies in value stocks such as banks

and energy producers that trade at low multiples of their net

worth, typically proved fleeting. They have tended to coincide with

sudden moves in bond yields, as in September 2019. Such is the

potential for vaccines to revive industries that languished during

the pandemic that many investors think the current rotation has

room to run.

Others don't think the rotation portends a significant shift,

and believe that value stocks in sectors such as retail were cheap

due to secular trends that Covid merely exacerbated. Either way,

some traders think investor positioning means more swings are in

store for stocks.

"There are still a lot of short positions in the market," said

Pierino Ursone, an options trader at Dutch firm Webb Traders.

Losses can be self-fueling. Trend-following algorithmic funds

rushed to close out losing wagers against crude oil, the FTSE 100

and other markets when prices jumped on Nov. 9, according to

analysis by Bridgeton Research Group LLC. Funds bought back futures

they had sold short when prices passed certain levels, giving them

a further boost.

Some allocators to hedge funds aren't worried. Jens Foehrenbach,

chief investment officer of Man FRM, a division of Man Group PLC

that allocates to hedge funds and advises on such investments, said

he isn't making changes to his strategy based on last week's

rotation. "Maybe it was a paradigm shift, maybe not. It doesn't

change our broader view" of the funds in which Man FRM is

invested.

Write to Joe Wallace at Joe.Wallace@wsj.com and Julie Steinberg

at julie.steinberg@wsj.com

(END) Dow Jones Newswires

November 18, 2020 05:44 ET (10:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

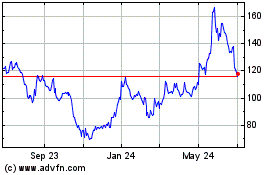

Moderna (NASDAQ:MRNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

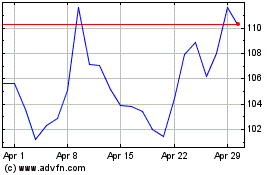

Moderna (NASDAQ:MRNA)

Historical Stock Chart

From Apr 2023 to Apr 2024