|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

|

OMB APPROVAL

|

|

|

|

OMB Number: 3235-0058

|

|

|

|

Expires: February 28, 2022

|

|

|

|

Estimated average burden hours per response ... 2.50

|

|

|

|

|

|

|

|

SEC FILE NUMBER

|

|

|

|

000-55177

|

|

(Check one):

|

|

☐ Form 10-K ☐ Form 20-F ☐ Form 11-K X Form 10-Q ☐ Form 10-D ☐ Form N-SAR ☐ Form N-CSR

|

|

|

|

|

|

|

|

For Period Ended:

|

September 30, 2020

|

|

|

|

|

|

|

|

☐ Transition Report on Form 10-K

|

|

|

|

|

|

|

|

☐ Transition Report on Form 20-F

|

|

|

|

|

|

|

|

☐ Transition Report on Form 11-K

|

|

|

|

|

|

|

|

☐ Transition Report on Form 10-Q

|

|

|

|

|

|

|

|

☐ Transition Report on Form N-SAR

|

|

|

|

|

|

|

|

For the Transition Period Ended:

|

|

Read Instruction (on back page) Before Preparing

Form. Please Print or Type.

Nothing in this form shall be construed to imply

that the Commission has verified any information contained herein.

|

|

|

If the notification relates to a portion of

the filing checked above, identify the Item(s) to which the notification relates:

PART I — REGISTRANT INFORMATION

VPR BRANDS, LP

Full Name of Registrant

N/A

Former Name if Applicable

3001 Griffin Road

Address of Principal Executive Office (Street and

Number)

Fort Lauderdale, FL 33312

City, State and Zip Code

PART II — RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable

effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box

if appropriate)

|

|

(a) The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense

|

|

X

|

(b) The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and

|

|

|

(c) The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

|

PART III — NARRATIVE

State below in reasonable detail

the reasons why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-SAR, N-CSR, or the transition report or portion thereof, could not be filed

within the prescribed time period.

The filing of the Company’s

Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2020 (“Quarterly Report”) will be delayed

due to circumstances related to COVID-19 and its impact on the Company’s accounting operations. Management has been focused

on analyzing, and taking actions in response to, the impacts and disruptions of the COVID-19 pandemic on the registrant’s

business, operations, financial condition and financial reporting processes, including by seeking to maintain the health and safety

of its workers and customers, assessing the impact on demand for the registrant’s products, analyzing the availability of

government assistance and assessing the disruption to the economy more broadly, This prevented the Company from completing the

tasks necessary, without unreasonable effort or expense, to file this Quarterly Report by its November 16, 2020 due date. The registrant

anticipates that it will file its Quarterly Report on Form 10-Q no later than November 23, 2020.

PART IV — OTHER INFORMATION

|

(1)

|

Name and telephone number of person to contact in regard to this notification

|

|

|

|

|

|

|

|

Kevin Frija

|

|

(954)

|

|

715-7001

|

|

(Name)

|

|

(Area Code)

|

|

(Telephone Number)

|

|

|

|

|

|

|

|

|

(2)

|

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s).

|

|

|

Yes ☒ No ☐

|

|

|

|

|

(3)

|

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof?

|

|

|

Yes ☒ No ☐

|

|

|

|

|

|

If

so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons

why a reasonable estimate of the results cannot be made. See Attachment A hereto.

|

ATTACHMENT A

to

Form 12b-25

of

VPR Brands, LP

The Company’s revenues for the three months ended September

30, 2020 and 2019 were $993,509 and $1,435,063, respectively. Revenues for the nine months ended September 30, 2020 and 2019 were

$2,797,512 and $4,334,358, respectively. The decrease was is related to the ban on flavored e-cigarettes implemented by the U.S.

Food and Drug Administration and disturbances to our revenue channels from COVID-19.

The following summarizes the Company’s statements of operations

for the three and nine months ended September 30, 2020 and 2019:

Results of Operations for the Three Months Ended September

30, 2020 Compared to the Three Months Ended September 30, 2019

Revenues

Our revenues for the three months ended September

30, 2020 and 2019 were $993,509 and $1,435,063, respectively. The decrease in revenues is related to the ban on flavored e-cigarettes

implemented by the U.S. Food and Drug Administration and disturbances to our revenue channels from COVID-19.

Cost of Sales

Cost of sales for the three months ended September

30, 2020 and 2019 was $562,057 and $824,429, respectively. The decrease is a result of the decreased sales during the current year.

Gross margin remained at 43% due to pricing pressures from the decreased demand related to the industry crisis.

Operating Expenses

Operating expenses for the three months ended

September 30, 2020 were $393,233 as compared to $675,648 for the three months ended September 30, 2019. The decrease in expenses

is primarily due cost cutting measures to offset decreased demand.

Other Expense

Interest expense increased to $140,908

for the three months ended September 30, 2020 as compared to $87,507 for the three months ended September 30, 2019 due to increased

borrowings.

Net Loss

Net loss for the three months ended

September 30, 2020 was $102,689 compared to a net loss of $152,521 for the three months ended September 30, 2019.

Results of Operations for the Nine Months Ended September

30, 2020 Compared to the Nine Months Ended September 30, 2019

Revenues

Our revenues for the nine months ended September

30, 2020 and 2019 were $2,797,512 and $4,334,358, respectively. The decrease in revenues is related to the ban on flavored e-cigarettes

implemented by the U.S. Food and Drug Administration and disturbances to our revenue channels from COVID-19.

Cost of Sales

Cost of sales for the nine months ended September

30, 2020 and 2019 was $1,699,876 and $2,628,479, respectively. The decrease is a result of the decreased sales during the current

year. Gross margin remained at 39% due to pricing pressures from the decreased demand related to the industry crisis.

Operating Expenses

Operating expenses for the nine months ended

September 30, 2020 were $1,242,671 as compared to $1,834,985 for the nine months ended September 30, 2019. The decrease in expenses

is primarily due cost cutting measures to offset decreased demand.

Other Expense

Interest expense increased to $429,561

for the nine months ended September 30, 2020 as compared to $350,952 for the nine months ended September 30, 2019 due to increased

borrowings.

Net Loss

Net loss for the nine months ended September

30, 2020 was $574,596 compared to a net loss of $480,058 for the nine months ended September 30, 2019.

VPR BRANDS, LP

(Name of Registrant as Specified in

Charter)

has caused this notification to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Date:

|

November 17, 2020

|

By:

|

/s/ Kevin Frija

|

|

|

|

|

Name: Kevin Frija

|

|

|

|

|

Title: Chief Executive Officer and Chief Financial Officer

|

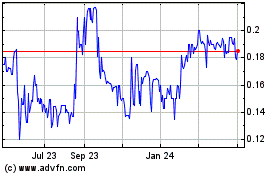

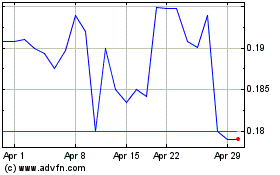

VPR Brands (QB) (USOTC:VPRB)

Historical Stock Chart

From Mar 2024 to Apr 2024

VPR Brands (QB) (USOTC:VPRB)

Historical Stock Chart

From Apr 2023 to Apr 2024