As filed with the Securities and Exchange Commission on November 16, 2020

Registration No. 333-237961

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

POST-EFFECTIVE AMENDMENT NO. 1

TO FORM S-1 ON

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

____________________

Virgin Galactic Holdings, Inc.

(Exact name of registrant as specified in its charter)

____________________

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

85-3608069

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

166 North Roadrunner Parkway, Suite 1C

Las Cruces, New Mexico 88011

(575) 424-2100

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Michael Colglazier

Chief Executive Officer

166 North Roadrunner Parkway, Suite 1C

Las Cruces, New Mexico 88011

(575) 424-2100

(Address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

|

|

|

|

|

|

|

|

|

|

Justin G. Hamill

Drew Capurro

Latham & Watkins LLP

885 Third Avenue

New York, NY 10022

(212) 906-1200

|

|

Michelle Kley

Executive Vice President, General Counsel and Secretary

166 North Roadrunner Parkway, Suite 1C

Las Cruces, New Mexico 88011

(575) 424-2100

|

|

|

|

|

|

|

|

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: From time to time after the effective date of this registration statement.

|

|

|

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective on filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☐

|

Smaller reporting company

|

☐

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for comply with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

On May 1, 2020, Virgin Galactic Holdings, Inc. (the “Company”) filed a registration statement with the Securities and Exchange Commission (the “SEC”) on Form S-1 (File No. 333-237961) (the “Registration Statement”). The Registration Statement, as amended, was initially declared effective by the SEC on May 13, 2020 and initially registered for resale by the selling stockholders identified in the prospectus of up to 150,464,840 shares of the Company’s common stock, par value $0.0001 per share.

This Post-Effective Amendment No. 1 to Form S-1 on Form S-3 (“Post-Effective Amendment No. 1”) is being filed by the Company (i) to convert the registration statement on Form S-1 into a registration statement on Form S-3 and (ii) to include updated information regarding the selling stockholders named in the prospectus, including a reduction in the number of shares of common stock being offered by the selling stockholders to 112,964,840 shares of common stock. No additional securities are being registered under this Post-Effective Amendment No. 1. All applicable registration fees were paid at the time of the original filing of the Registration Statement.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated November 16, 2020.

PROSPECTUS

Virgin Galactic Holdings, Inc.

112,964,840 Shares of Common Stock

This prospectus relates to the resale of up to 112,964,840 shares of our common stock by the selling stockholders named in this prospectus or their permitted transferees, which includes up to 104,964,840 outstanding shares of our common stock and up to 8,000,000 shares of our common stock that are issuable upon the exercise of warrants to purchase our common stock that were initially issued in connection with a private placement. We are registering the shares for resale pursuant to such stockholders’ registration rights under a registration rights agreement between us and such stockholders. Subject to any contractual restrictions on them selling the shares of our common stock they hold, the selling stockholders may offer, sell or distribute all or a portion of their shares of our common stock publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any of the proceeds from the sale of the shares of our common stock owned by the selling stockholders. We will bear all costs, expenses and fees in connection with the registration of these shares of our common stock, including with regard to compliance with state securities or “blue sky” laws. The selling stockholders will bear all commissions and discounts, if any, attributable to their sale of shares of our common stock.

See “Plan of Distribution” beginning on page 21 of this prospectus.

INVESTING IN OUR SECURITIES INVOLVES RISKS. SEE “RISK FACTORS” BEGINNING ON PAGE 12 OF THIS PROSPECTUS AND ANY SIMILAR SECTION CONTAINED IN ANY APPLICABLE PROSPECTUS SUPPLEMENT TO READ ABOUT CERTAIN FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES.

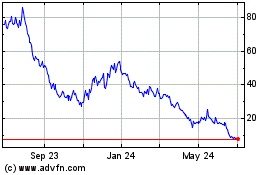

Our common stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “SPCE”. On November 13, 2020 the last reported sale price of our common stock was $22.27 per share.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2020.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. By using a shelf registration statement, the selling stockholders named in this prospectus may, from time to time, sell up to 112,964,840 shares of common stock from time to time in one or more offerings as described in this prospectus. To the extent necessary, each time that the selling stockholders offer and sell securities, we or the selling stockholders may provide a prospectus supplement to this prospectus that contains specific information about the securities being offered and sold and the specific terms of that offering. To the extent permitted by law, we may also authorize one or more free writing prospectuses that may contain material information relating to these offerings. Such prospectus supplement or free writing prospectus may also add, update or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or free writing prospectus, you should rely on the prospectus supplement or free writing prospectus, as applicable. Before purchasing any securities, you should carefully read both this prospectus and the applicable prospectus supplement (and any applicable free writing prospectuses), together with the additional information described under the heading “Where You Can Find More Information; Incorporation by Reference.”

Neither we nor the selling stockholders have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus, any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither we nor the selling stockholders take any responsibility for, nor provide any assurance as to the reliability of, any other information that others may give you. Neither we nor the selling stockholders will make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and the applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover, that the information appearing in any applicable free writing prospectus is accurate only as of the date of that free writing prospectus, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus incorporates by reference, and any prospectus supplement or free writing prospectus may contain and incorporate by reference, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, neither we nor the selling stockholders guarantee the accuracy or completeness of this information and neither we nor the selling stockholders have independently verified this information. In addition, the market and industry data and forecasts that may be included or incorporated by reference in this prospectus, any prospectus supplement or any applicable free writing prospectus may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained in this prospectus, any applicable prospectus supplement and any applicable free writing prospectus, and under similar headings in other documents that are incorporated by reference into this prospectus. Accordingly, investors should not place undue reliance on this information.

As used in this prospectus, unless otherwise indicated or the context otherwise requires, the terms “we,” “our,” “us” and the “Company” mean Virgin Galactic Holdings, Inc. and its subsidiaries, which was a special purpose acquisition company called “Social Capital Hedosophia Holdings Corp.” prior to the closing of the Virgin Galactic Business Combination (as defined herein) on October 25, 2019. When we refer to “you,” we mean the potential holders of the shares of our common stock.

In this prospectus, we refer to our common stock and warrants to purchase shares of common stock, collectively, as “securities.”

WHERE YOU CAN FIND MORE INFORMATION; INCORPORATION BY REFERENCE

Available Information

We file reports, proxy statements and other information with the SEC. The SEC maintains a web site that contains reports, proxy and information statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

Our web site address is www.virgingalactic.com. The information on our web site, however, is not, and should not be deemed to be, a part of this prospectus.

This prospectus and any applicable prospectus supplement are part of a registration statement that we filed with the SEC and do not contain all of the information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Statements in this prospectus or any prospectus supplement about these documents are summaries and each statement is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant matters. You may inspect a copy of the registration statement through the SEC’s website, as provided above.

Incorporation by Reference

The SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede that information. Any statement contained in this prospectus or a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or a subsequently filed document incorporated by reference modifies or replaces that statement.

This prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that have previously been filed with the SEC:

•our Annual Report on Form 10-K for the year ended December 31, 2019, filed with the SEC on February 28, 2020;

•the information specifically incorporated by reference into our Annual Report on Form 10-K from our Definitive Proxy Statement on Schedule 14A, filed with the SEC on April 20, 2020;

•our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2020, June 30, 2020 and September 30, 2020, filed with the SEC on May 6, 2020, August 3, 2020 and November 6, 2020, respectively;

•our Current Reports on Form 8-K filed with the SEC on January 15, 2020, February 24, 2020, March 16, 2020, March 17, 2020, March 26, 2020, June 5, 2020, July 15, 2020 (only with respect to Item 5.02), July 31, 2020, August 13, 2020 and November 12, 2020;

•our Amended Current Report on Form 8-K/A filed with the SEC on March 19, 2020; and

•the description of our common stock contained in our registration statement on Form 8-A, dated September 11, 2017, filed with the SEC on September 12, 2017 and any amendment or report filed with the SEC for the purpose of updating the description, including Exhibit 4.4 to our Annual Report on Form 10-K for the year ended December 31, 2019.

All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act” in this prospectus, prior to

the termination of this offering, including all such documents we may file with the SEC after the date of the initial registration statement and prior to the effectiveness of the registration statement, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports and documents.

You may request a free copy of any of the documents incorporated by reference in this prospectus by writing or telephoning us at the following address:

Virgin Galactic Holdings, Inc.

166 North Roadrunner Parkway, Suite 1C

Las Cruces, New Mexico 88011

(575) 424-2100

Exhibits to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus or any accompanying prospectus supplement.

THE COMPANY

We are a vertically-integrated aerospace company, pioneering human spaceflight for private individuals and researchers, as well as a manufacturer of advanced air and space vehicles. Using our proprietary and reusable technologies and supported by a distinctive, Virgin-branded customer experience, we are developing a spaceflight system designed to offer customers, whom we refer to as “future astronauts,” a unique, multi-day, transformative experience. This culminates in a spaceflight that includes views of Earth from space and several minutes of weightlessness that will launch from Spaceport America, New Mexico. We believe that one of the most exciting and significant opportunities of our time lies in the commercial exploration of space and the development of technology that will change the way we travel across the globe in the future. Together we are opening access to space to change the world for good.

We were initially formed on May 5, 2017 as a Cayman Islands exempted company for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. On October 25, 2019, we domesticated as a Delaware corporation and consummated the merger transactions contemplated by the Agreement and Plan of Merger, dated as of July 29, 2019, as amended on October 2, 2019, by and among us, Vieco USA, Inc. (“Vieco US”), Vieco 10 Limited, TSC Vehicle Holdings, Inc., Virgin Galactic Vehicle Holdings, Inc., Virgin Galactic Holdings, LLC and the other parties thereto (the “Virgin Galactic Business Combination”). From the time of our formation to the time of the consummation of the Virgin Galactic Business Combination in October 2019, our name was “Social Capital Hedosophia Holdings Corp.”

Our principal executive offices are located at 166 North Roadrunner Parkway, Suite 1C, Las Cruces, New Mexico 88011, and our telephone number is (575) 424-2100.

THE OFFERING

|

|

|

|

|

|

|

|

Issuer

|

Virgin Galactic Holdings, Inc.

|

|

|

|

|

Shares of Common Stock Offered by the Selling Stockholders

|

Up to 112,964,840 shares of common stock

|

|

|

|

|

Use of Proceeds

|

We will not receive any proceeds from the sale of shares of common stock by the selling stockholders.

|

|

|

|

|

Market for Common Stock

|

Our common stock is listed on the NYSE under the symbol “SPCE”.

|

|

|

|

|

Risk Factors

|

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 12 of this prospectus for a discussion of factors you should carefully consider before investing in our common stock.

|

RISK FACTOR SUMMARY

Your investment in our common stock will involve certain risks. Set forth below is only a summary of the principal risks associated with an investment in our common stock. You should consider carefully the following discussion of risks, as well as the discussion of risks included in this prospectus and any applicable prospectus supplement, before you decide that an investment in the notes is appropriate for you.

•We have incurred significant losses since inception, we expect to incur losses in the future and we may not be able to achieve or maintain profitability.

•The success of our business will be highly dependent on our ability to effectively market and sell human spaceflights.

•A pandemic outbreak of a novel strain of coronavirus, also known as COVID-19, has disrupted and may continue to adversely affect our business operations and our financial results.

•The market for commercial human spaceflight has not been established with precision, is still emerging and may not achieve the growth potential we expect or may grow more slowly than expected.

•We anticipate commencing commercial spaceflight operations with a single spaceflight system, which has yet to complete flight testing. Any delay in completing the flight test program and the final development of our existing spaceflight system would adversely impact our business, financial condition and results of operations.

•Any inability to operate our spaceflight system after commercial launch at our anticipated flight rate could adversely impact our business, financial condition and results of operations.

•Our ability to grow our business depends on the successful development of our spaceflight systems and related technology, which is subject to many uncertainties, some of which are beyond our control.

•Unsatisfactory safety performance of our spaceflight systems could have a material adverse effect on our business, financial condition and results of operation.

•Our investments in developing new offerings and technologies and exploring the application of our existing proprietary technologies for other uses and those offerings, technologies or opportunities may never materialize.

•The “Virgin” brand is not under our control, and negative publicity related to the Virgin brand name could materially adversely affect our business.

•If we fail to adequately protect our proprietary intellectual property rights, our competitive position could be impaired and we may lose valuable assets, generate reduced revenue and incur costly litigation to protect our rights.

•Virgin Investments Limited and the other stockholders that are party to the Stockholders’ Agreement have the ability to control the direction of our business, and the concentrated ownership of our common stock will prevent you and other stockholders from influencing significant decisions.

RISK FACTORS

Investment in any securities offered pursuant to this prospectus and any applicable prospectus supplement involves risks. You should carefully consider the risk factors incorporated by reference to our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained in any applicable prospectus supplement and any applicable free writing prospectus before acquiring any of such securities. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities.

USE OF PROCEEDS

We will not receive any proceeds from the sale of shares of common stock by the selling stockholders.

DESCRIPTION OF CAPITAL STOCK

The following description of our capital stock is not complete and may not contain all the information you should consider before investing in our capital stock. This description is summarized from, and qualified in its entirety by reference to, our certificate of incorporation and bylaws, which have been publicly filed with the SEC. See “Where You Can Find More Information.” The summary below is also qualified by reference to the provisions of the General Corporation Law of the State of Delaware (the “DGCL”).

Authorized Capital Stock

The total amount of our authorized capital stock consists of 700,000,000 shares of common stock, par value $0.0001 per share, and 10,000,000 shares of preferred stock, par value $0.0001 per share.

Common Stock

General

Holders of our common stock are not entitled to preemptive or other similar subscription rights to purchase any of our securities. Our common stock is neither convertible nor redeemable. Unless our board of directors determines otherwise, we expect to issue all shares of our capital stock in uncertificated form.

Voting Rights

Each holder of our common stock is entitled to one vote per share on each matter submitted to a vote of stockholders, as provided by our certificate of incorporation. Our bylaws provide that the holders of a majority of the capital stock issued and outstanding and entitled to vote thereat, present in person or represented by proxy, will constitute a quorum at all meetings of stockholders for the transaction of business. When a quorum is present, the affirmative vote of a majority of the votes cast is required to take action, unless otherwise specified by law, the Stockholders’ Agreement, dated October 25, 2019, by and among us, Virgin Investments Limited, a company limited by shares under the laws of the British Virgin Islands (“VIL”), SCH Sponsor Corp., a Cayman Islands exempted company (the “Sponsor”), Chamath Palihapitiya and the other parties thereto (as may be amended from time to time, the “Stockholders’ Agreement”), our bylaws or our certificate of incorporation, and except for the election of directors, which is determined by a plurality vote. There are no cumulative voting rights.

Under the Stockholders’ Agreement, VIL has the right to designate three directors (the “VG designees”) for as long as VIL and Aabar Space, Inc., a company limited by shares under the laws of the British Virgin Islands (“Aabar”) beneficially own a number of shares of our common stock representing at least 50% of the number of shares beneficially owned by Vieco US immediately following the effective time of the transactions effected on October 25, 2019 in connection with our initial business combination, provided that (x) when such percentage falls below 50%, VIL will have the right to designate only two directors, (y) when such percentage falls below 25%, VIL will have the right to designate only one director and (z) when such percentage falls below 10%, VIL will not have the right to designate any directors. For purposes of determining the number of shares beneficially owned by VIL and the extent of VIL’s nomination and consent rights under the Stockholders’ Agreement, the shares distributed to Aabar are deemed to be held by VIL until such time as Aabar transfers or sells such shares, subject to certain exceptions, as contemplated by the Stockholders’ Agreement. Each of the Sponsor and Mr. Palihapitiya have agreed to vote, or cause to vote, all of their outstanding shares of common stock at any annual or special meeting of stockholders in which directors are elected, so as to cause the election of the VG designees.

Additionally, pursuant to the Stockholders’ Agreement, Mr. Palihapitiya has the right to designate two directors (the “CP designees”), one of which must qualify as an “independent director” under applicable stock exchange regulations, for as long as Mr. Palihapitiya and the Sponsor collectively beneficially own a number of shares of our common stock representing at least 90% of the number of shares beneficially owned by them as of immediately following the effective time of the transactions effected on October 25, 2019 in connection with our initial business

combination (excluding the shares purchased from Vieco US by Mr. Palihapitiya on that date), provided that (x) when such percentage falls below 90%, Mr. Palihapitiya will have the right to designate only one director, who will not be required to qualify as an “independent director” and (y) when such percentage falls below 50%, Mr. Palihapitiya will not have the right to designate any directors. VIL has agreed to vote, or cause to vote, all of its outstanding shares of our common stock at any annual or special meeting of stockholders in which directors are elected, so as to cause the election of the CP designees.

Dividend Rights

Each holder of shares of our common stock is entitled to the payment of dividends and other distributions as may be declared by our board of directors from time to time out of our assets or funds legally available for dividends or other distributions. These rights are subject to the preferential rights of the holders of our preferred stock, if any, and any contractual limitations on our ability to declare and pay dividends.

Other Rights

Each holder of our common stock is subject to, and may be adversely affected by, the rights of the holders of any series of our preferred stock that we may designate and issue in the future.

Liquidation Rights

If we are involved in voluntary or involuntary liquidation, dissolution or winding up of our affairs, or a similar event, each holder of our common stock will participate pro rata in all assets remaining after payment of liabilities, subject to prior distribution rights of our preferred stock, if any, then outstanding.

Anti-Takeover Effects of the Certificate of Incorporation and the Bylaws

Our certificate of incorporation and our bylaws contain provisions that may delay, defer or discourage another party from acquiring control of our company. We expect that these provisions, which are summarized below, will discourage coercive takeover practices and inadequate takeover bids. These provisions are also designed to encourage persons seeking to acquire control of our company to first negotiate with our board of directors, which we believe may result in an improvement of the terms of any such acquisition in favor of our stockholders. However, they also give our board of directors the power to discourage mergers that some stockholders may favor.

Special Meetings of Stockholders

Our certificate of incorporation provides that a special meeting of stockholders may be called by the (a) the chairperson of our board of directors or (b) our board of directors.

No Stockholder Action by Written Consent

Our certificate of incorporation provides that any action required or permitted to be taken by our stockholders of the Corporation must be effected at a duly called annual or special meeting of stockholders and not by written consent.

Removal of Directors

Pursuant to the Stockholders’ Agreement, VIL has the exclusive right to remove one or more of the VIL directors from our board of directors and Mr. Palihapitiya has the exclusive right to remove one or more of Mr. Palihapitiya’s directors from our board of directors. VIL and Mr. Palihapitiya have the exclusive right to designate directors for election to our board of directors to fill vacancies created by reason of death, removal or resignation of the VIL designees and the CP designees, respectively. VIL will not be able to remove independent directors until the expiration of the earlier of (x)(i) VIL no longer has the right to designate two directors to our board of directors and

(ii) Mr. Palihapitiya no longer has the right to designate two directors to our board of directors (the “Sunset Date”) and (y) the expiration of the two-year lock-up period.

VIL’s Approval Rights

Amendment to Certificate of Incorporation and Bylaws

The DGCL provides generally that the affirmative vote of a majority of the outstanding stock entitled to vote on amendments to a corporation’s certificate of incorporation or bylaws is required to approve such amendment, unless a corporation’s certificate of incorporation or bylaws, as the case may be, requires a greater percentage. Our bylaws may be further amended, altered, changed or repealed by a majority vote of our board of directors. However, pursuant to the Stockholders’ Agreement, no amendment to our certificate of incorporation or bylaws may be made without VIL’s prior written consent for so long as VIL has the right to designate at least one director to our board of directors under the Stockholders’ Agreement.

Operational Matters

VIL has expansive rights of approval for certain material operational and other matters for us, including:

•for so long as VIL is entitled to designate at least one director to our board of directors under the Stockholders’ Agreement, in addition to any vote or consent of the stockholders or our board of directors as required by law, we and our subsidiaries must obtain VIL’s prior written consent to engage in:

◦any business combination or similar transaction;

◦a liquidation or related transaction; or

◦an issuance of capital stock in excess of 5% of our then issued and outstanding shares or those of any of our subsidiaries; and

•for so long as VIL is entitled to designate at least two directors to our board of directors under the Stockholders’ Agreement, in addition to any vote or consent of our stockholders or board of directors as required by law, we must obtain VIL’s prior written consent to engage in:

◦a business combination or similar transaction having a fair market value of $10.0 million or more;

◦a non-ordinary course sale of assets or equity interest having a fair market value of $10.0 million or more;

◦an acquisition of any business or assets having a fair market value of $10.0 million or more;

◦approval of any non-ordinary course investment having a fair market value of $10.0 million or more;

◦an issuance or sale of any shares of our capital stock, other than an issuance of shares of our capital stock upon the exercise of options to purchase shares of our capital stock;

◦making any dividends or distribution to our stockholders other than those made in connection with the cessation of services of employees;

◦incurring indebtedness outside of the ordinary course in an amount greater than $25.0 million in a single transaction or $100.0 million in aggregate consolidated indebtedness;

◦amendment of the terms of the Stockholders’ Agreement or the Amended and Restated Registration Rights Agreement, dated October 25, 2019, by and among us, VIL, the Sponsor and Mr. Palihapitiya;

◦a liquidation or similar transaction;

◦transactions with any interested stockholder pursuant to Item 404 of Regulation S-K; or

◦increasing or decreasing the size of our board of directors.

Delaware Anti-Takeover Statute

Section 203 of the DGCL provides that if a person acquires 15% or more of the voting stock of a Delaware corporation, such person becomes an “interested stockholder” and may not engage in certain “business combinations” with such corporation for a period of three years from the time such person acquired 15% or more of such corporation’s voting stock, unless: (1) the board of directors of such corporation approves the acquisition of stock or the merger transaction before the time that the person becomes an interested stockholder, (2) the interested stockholder owns at least 85% of the outstanding voting stock of such corporation at the time the merger transaction commences (excluding voting stock owned by directors who are also officers and certain employee stock plans) or (3) the merger transaction is approved by the board of directors of such corporation and at a meeting of stockholders, not by written consent, by the affirmative vote of two-thirds of the outstanding voting stock which is not owned by the interested stockholder. A Delaware corporation may elect in its certificate of incorporation or bylaws not to be governed by this particular Delaware law.

Under our certificate of incorporation, we have opted out of Section 203 of the DGCL.

Pursuant to the Stockholders’ Agreement, until the Sunset Date, our board of directors may not approve any transaction (excluding those involving consideration less than $0.1 million) between an interested stockholder (defined as VIL or any affiliate of VIL) and us, without the affirmative vote of at least a majority of our directors that are not designees of VIL.

Under certain circumstances, this provision would make it more difficult for us to effect various transactions with a person who would be an “interested stockholder” for these purposes. However, this provision would not be likely to discourage any parties interested in entering into a potential transaction with us, other than VIL and its affiliates. This provision may encourage VIL and VIL’s affiliates, to the extent they are interested in entering into certain significant transactions with us, to negotiate in advance with the full board of directors because the board approval requirement would be satisfied by the affirmative vote of at least a majority of our directors that are not designees of VIL.

Corporate Opportunity

Under our certificate of incorporation, an explicit waiver regarding corporate opportunities is granted to certain “exempted persons” (including VIL and Mr. Palihapitiya and their respective affiliates, successors, directly or indirectly managed funds or vehicles, partners, principals, directors, officers, members, managers and employees, including any of the foregoing who serve as our directors). Such “exempted persons” will not include us or our officers or employees and such waiver will not apply to any corporate opportunity that is expressly offered to any of our directors in their capacity as such (in which such opportunity we do not renounce an interest or expectancy). Our certificate of incorporation provides that, to the fullest extent permitted by law, (i) the exempted persons do not have any fiduciary duty to refrain from engaging directly or indirectly in the same or similar business activities or lines of business as us, (ii) we renounce any interest or expectancy in, or in being offered an opportunity to participate in, business opportunities that are from time to time presented to the exempted persons, even if the opportunity is one that we might reasonably be deemed to have pursued or had the ability or desire to pursue if granted the opportunity to do so and (iii) no exempted person will have any duty to communicate or offer such business opportunity to us and no exempted person will be liable to us for breach of any fiduciary or other duty, as a director or officer or otherwise, by reason of the fact that such exempted person pursues or acquires such business opportunity, directs such business opportunity to another person or fails to present such business opportunity, or information regarding such business opportunity, to us.

Limitations on Liability and Indemnification of Officers and Directors

Our certificate of incorporation limits the liability of our officers and directors to the fullest extent permitted by the DGCL, and our bylaws provide that we will indemnify them to the fullest extent permitted by such law. We have entered into and expect to continue to enter into agreements to indemnify our directors, officers and other employees as determined by our board of directors. Under the terms of such indemnification agreements, we are required to indemnify each of our directors and officers, to the fullest extent permitted by the laws of the state of Delaware, if the basis of the indemnitee’s involvement was by reason of the fact that the indemnitee is or was our director or officer or was serving at our request in an official capacity for another entity. We must indemnify our officers and directors against all reasonable fees, expenses, charges and other costs of any type or nature whatsoever, including any and all expenses and obligations paid or incurred in connection with investigating, defending, being a witness in, participating in (including on appeal), or preparing to defend, be a witness or participate in any completed, actual, pending or threatened action, suit, claim or proceeding, whether civil, criminal, administrative or investigative, or establishing or enforcing a right to indemnification under the indemnification agreement. The indemnification agreements also require us, if so requested, to advance all reasonable fees, expenses, charges and other costs that such director or officer incurred, provided that such person will return any such advance if it is ultimately determined that such person is not entitled to indemnification by us. Any claims for indemnification by our directors and officers may reduce our available funds to satisfy successful third-party claims against us and may reduce the amount of money available to us.

Exclusive Jurisdiction of Certain Actions

Our certificate of incorporation requires, to the fullest extent permitted by law, that derivative actions brought in our name against our directors, officers or employees for breach of fiduciary duty, any provision of the DGCL, our certificate of incorporation or our bylaws or other similar actions may be brought only in the Court of Chancery in the State of Delaware and, if brought outside of Delaware, the stockholder bringing the suit will be deemed to have consented to service of process on such stockholder’s counsel. Notwithstanding the foregoing, our certificate of incorporation provides that the exclusive forum provision will not apply to suits brought to enforce a duty or liability created by the Securities Act of 1933, as amended (the “Securities Act”), the Exchange Act or any other claim for which the federal courts have exclusive jurisdiction. Section 22 of the Securities Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. Similarly, Section 27 of the Exchange Act creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder. Although we believe this provision benefits us by providing increased consistency in the application of Delaware law in the types of lawsuits to which it applies, the provision may have the effect of discouraging lawsuits against our directors and officers.

Transfer Agent

The transfer agent for our common stock is Continental Stock Transfer & Trust Company.

SELLING STOCKHOLDERS

This prospectus covers the resale from time to time by the selling stockholders identified in the table below of up to 112,964,840 shares of our common stock. We are registering the shares for resale pursuant to such stockholders’ registration rights under a registration rights agreement between us and such stockholders.

The selling stockholders identified in the table below may from time to time offer and sell under this prospectus any or all of the shares of common stock described under the column “Maximum Number of Shares That May be Offered Pursuant to this Prospectus” in the table below. The table below has been prepared based upon information furnished to us by the selling stockholders. The selling stockholders identified below may have sold, transferred or otherwise disposed of some or all of their shares since the date on which the information in the following table is presented in transactions exempt from or not subject to the registration requirements of the Securities Act. Information concerning the selling stockholders may change from time to time and, if necessary, we will amend or supplement this prospectus accordingly and as required.

The following table and footnote disclosure following the table sets forth the name of each selling stockholder, the nature of any position, office or other material relationship, if any, that the selling stockholder has had within the past three years with us or with any of our predecessors or affiliates and the number of shares of our common stock beneficially owned by the selling stockholder prior to this offering.

The number of shares reflected are those beneficially owned by the selling stockholders and the information is not necessarily indicative of beneficial ownership for any other purpose. Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power over that security, including options and warrants that are currently exercisable or exercisable within 60 days.

We have assumed that all shares of common stock reflected in the table as being offered in the offering covered by this prospectus will be sold from time to time in this offering. We cannot provide an estimate as to the number of shares of common stock that will be held by the selling stockholders upon termination of the offering covered by this prospectus because the selling stockholders may offer some, all or none of their shares of common stock being offered in the offering.

The beneficial ownership of our voting securities is based on 234,342,464 shares of our common stock issued and outstanding as of November 5, 2020.

Unless otherwise indicated, we believe that all persons named in the table below have sole voting and investment power with respect to the voting securities beneficially owned by them.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Beneficially Owned

|

|

Maximum Number of Shares That May be Offered Pursuant to this Prospectus

|

|

Shares Beneficially Owned after this Offering

|

|

Selling Stockholder(1)

|

Shares

|

|

% of Ownership

|

|

|

Shares

|

|

% of Ownership

|

|

Virgin Investments Limited(2)

|

62,403,260

|

|

|

26.6

|

%

|

|

62,403,260

|

|

|

-

|

|

|

-

|

|

|

SCH Sponsor Corp.(3)

|

23,750,000

|

|

|

9.8

|

%

|

|

23,750,000

|

|

|

-

|

|

|

-

|

|

|

Aabar Space, Inc.(4)

|

14,887,178

|

|

|

6.4

|

%

|

|

14,887,178

|

|

|

-

|

|

|

-

|

|

|

Chamath Palihapitiya(3),(5)

|

33,750,000

|

|

|

13.9

|

%

|

|

33,750,000

|

|

|

-

|

|

|

-

|

|

|

Boeing HorizonX Ventures, LLC(6)

|

1,924,402

|

|

|

*

|

|

1,924,402

|

|

|

-

|

|

|

-

|

|

__________________________

* Less than one percent

(1) Unless otherwise noted, the business address of each of those listed in the table above is 166 North Roadrunner Parkway, Suite 1C, Las Cruces, NM 88011.

(2) Virgin Investments Limited is a company limited by shares under the laws of the British Virgin Islands. Virgin Investments Limited is wholly owned by Virgin Group Investments LLC, whose sole managing member is Corvina Holdings Limited, which is wholly owned by Virgin Group Holdings Limited (“Virgin Group Holdings”). Virgin Group Holdings is owned by Sir Richard Branson, and he has the ability to appoint and remove the management of Virgin Group Holdings and, as such, may indirectly control the decisions of Virgin Group Holdings regarding the voting and disposition of securities held by Virgin Group Holdings. Therefore, Sir Richard Branson may be deemed to have indirect beneficial ownership of the shares held by Virgin Group Holdings. The address of Virgin Group Holdings Limited, Virgin Investments Limited and Corvina Holdings Limited is Craigmuir Chambers, Road Town, Tortola, VG1110, British Virgin Islands. The address of Sir Richard Branson is Branson Villa (Necker Beach Estate), Necker Island, VG 1150, British Virgin Islands.

(3) Includes 15,750,000 shares of our common stock directly held by the Sponsor and 8,000,000 shares issuable upon the exercise of warrants issued to the Sponsor in a private placement concurrent with our initial public offering. Chamath Palihapitiya may be deemed to beneficially own securities held by the Sponsor by virtue of his shared control over the Sponsor. The address of the Sponsor is 317 University Avenue, Suite 200, Palo Alto, California 94301.

(4) Aabar Space, Inc. (“Aabar”) is a company limited by shares under the laws of the British Virgin Islands. Aabar is wholly owned by Aabar Investments PJS, a private joint stock company established under the laws of the Emirate of Abu Dhabi and wholly owned by International Petroleum Investment Company PJSC, a public joint stock company established under the laws of the Emirate of Abu Dhabi and wholly owned by Mubadala Investment Company PJSC, a public joint stock company established under the laws of the Emirate of Abu Dhabi and wholly owned by the Government of Abu Dhabi. The address of Aabar, International Petroleum Investment Company PJSC, and Mubadala Investment Company PJSC is PO Box 45005, Abu Dhabi, United Arab Emirate. The address of Aabar Investments PJS is PO Box 107888, Abu Dhabi, United Arab Emirate. Aabar directly owns 14,887,178 shares of Common Stock.

(5) Mr. Palihapitiya, the Chairperson of our board of directors, has pledged, hypothecated or granted security interests in all of the shares of our common stock held by him (but not those shares held by the Sponsor) pursuant to a margin loan agreement with customary default provisions. In the event of a default under the margin loan agreement, the secured parties may foreclose upon any and all shares of common stock pledged to them and may seek recourse against the borrower.

(6) The shares beneficially owned by Boeing HorizonX Ventures, LLC (“HorizonX Ventures”) and offered pursuant to this prospectus were acquired pursuant to a subscription agreement entered in October 2019, and purchased immediately following the closing of the Virgin Galactic Business Combination. The Boeing Company is the sole member of HorizonX Ventures and through its board of directors has the power to vote or dispose of the securities held of record by HorizonX Ventures and beneficially owns the securities. The members of the board of directors of The Boeing Company disclaim beneficial ownership with respect to such shares, except to the extent of their pecuniary interest therein, if any. The address for The Boeing Company is 100 N. Riverside Plaza, Chicago, Illinois 60606.

PLAN OF DISTRIBUTION

The selling stockholders, which as used herein includes their permitted transferees, may, from time to time, sell, transfer or otherwise dispose of any or all of their shares on the NYSE or any other stock exchange, market or trading facility on which such shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale or at negotiated prices.

The selling stockholders may use any one or more of the following methods when disposing of their shares of our common stock:

•ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

•purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•an exchange distribution in accordance with the rules of the applicable exchange;

•privately negotiated transactions;

•in underwritten transactions;

•short sales;

•through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated price;

•distribution to members, limited partners or stockholders of selling stockholders;

•“at the market” or through market makers or into an existing market for the shares;

•a combination of any such methods of sale; and

•any other method permitted pursuant to applicable law.

The selling stockholders may, from time to time, pledge or grant a security interest in some or all of the shares of our common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell their shares, from time to time, under this prospectus, a prospectus supplement or other applicable provision of the Securities Act amending the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus. The selling stockholders also may transfer their shares in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of our common stock or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of our securities in the course of hedging the positions they assume. The selling stockholders may also sell their securities short and deliver these securities to close out their short positions, or loan or pledge such securities to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of the shares offered by this

prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

To facilitate an offering of the securities, certain persons participating in the offering may engage in transactions that stabilize, maintain, or otherwise affect the price of the securities. This may include over-allotments or short sales of the securities, which involves the sale by persons participating in the offering of more securities than we sold to them. In these circumstances, these persons would cover the over-allotments or short positions by making purchases in the open market or by exercising their over-allotment option. In addition, these persons may stabilize or maintain the price of the securities by bidding for or purchasing securities in the open market or by imposing penalty bids, whereby selling concessions allowed to dealers participating in the offering may be reclaimed if securities sold by them are repurchased in connection with stabilization transactions. The effect of these transactions may be to stabilize or maintain the market price of the securities at a level above that which might otherwise prevail in the open market. These transactions may be discontinued at any time.

The aggregate proceeds to the selling stockholders from the sale of the shares offered by them will be the purchase price of the share less discounts or commissions, if any. Each of the selling stockholders reserves the right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of their shares to be made directly or through agents. We will not receive any of the proceeds from the resale of shares of our common stock being offered by the selling stockholders named herein.

The selling stockholders may engage in at the market offerings into an existing trading market in accordance with Rule 415 of the Securities Act.

The selling stockholders also may resell all or a portion of their shares in open market transactions in reliance upon Rule 144 under the Securities Act (“Rule 144”), provided that they meet the criteria and conform to the requirements of that rule.

In connection with an underwritten offering, underwriters or agents may receive compensation in the form of discounts, concessions or commissions from the selling stockholders or from purchasers of the offered shares for whom they may act as agents. In addition, underwriters may sell the shares to or through dealers, and those dealers may receive compensation in the form of discounts, concessions or commissions from the underwriters and/or commissions from the purchasers for whom they may act as agents. The selling stockholders and any underwriters, dealers or agents participating in a distribution of the shares may be deemed to be “underwriters” within the meaning of the Securities Act, and any profit on the sale of the shares by the selling stockholders and any commissions received by broker-dealers may be deemed to be underwriting commissions under the Securities Act.

To the extent required, the shares of our common stock to be sold, the names of the selling stockholders, the respective purchase prices and public offering prices, the names of any agent, dealer or underwriter, and any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

Blue Sky Restrictions on Resale

In order to comply with the securities laws of some states, if applicable, shares of our common stock may be sold in these jurisdictions only through registered or licensed brokers or dealers. In addition, in some states shares of our common stock may not be sold unless they have been registered or qualified for sale or an exemption from registration or qualification requirements is available and is complied with.

If a selling stockholder wants to sell its shares of our common stock under this prospectus in the United States, the selling stockholders will also need to comply with state securities laws, also known as “Blue Sky laws,” with regard to secondary sales. All states offer a variety of exemption from registration for secondary sales. Many states, for example, have an exemption for secondary trading of securities registered under Section 12(g) of the Exchange Act or for securities of issuers that publish continuous disclosure of financial and non-financial information in a

recognized securities manual, such as Standard & Poor’s. The broker for a selling stockholder will be able to advise a selling stockholder in which states shares of our common stock are exempt from registration for secondary sales.

Any person who purchases shares of our common stock from a selling stockholder offered by this prospectus who then wants to sell such shares will also have to comply with Blue Sky laws regarding secondary sales.

When the registration statement that includes this prospectus becomes effective, and a selling stockholder indicates in which state(s) he desires to sell his shares of our common stock we will be able to identify whether it will need to register or will rely on an exemption there from.

We have advised the selling stockholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of securities in the market and to the activities of the selling stockholders and their affiliates. In addition, we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the selling stockholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The selling stockholders may indemnify any broker-dealer that participates in transactions involving the sale of their shares against certain liabilities, including liabilities arising under the Securities Act.

We have agreed to indemnify, to the extent permitted by law, the selling stockholders (and each selling stockholder’s officers, directors and agents and each person who controls such selling stockholder within the meaning of the Securities Act) against liabilities resulting from any untrue or alleged untrue statement of material fact contained in this prospectus or the registration statement of which this prospectus forms a part (including any amendment or supplement thereof) or any omission or alleged omission of a material fact required to be stated therein or necessary to make the statements therein not misleading, except insofar as the same are caused by or contained in any information or affidavit furnished in writing to us by such selling stockholder expressly for use herein. We have also agreed to keep the registration statement of which this prospectus forms a part effective until the earlier of (i) the date on which all of their shares are disposed of pursuant to this prospectus; (ii) such shares shall have been otherwise transferred, new certificates for such shares not bearing a legend restricting further transfer shall have been delivered by us and subsequent public distribution of such shares shall not require registration under the Securities Act; (iii) such shares shall have ceased to be outstanding; (iv) such shares have been sold without registration pursuant to Rule 144 or (v) such shares have been sold to, or through, a broker, dealer or underwriter in a public distribution or other public securities transaction.

We are required to pay all fees and expenses incident to the registration of the shares of our common stock covered by this prospectus, including with regard to compliance with state securities or Blue Sky laws. Otherwise, all discounts, commissions or fees incurred in connection with the sale of shares of our common stock offered hereby will be paid by the selling stockholders.

LEGAL MATTERS

The validity of the shares of common stock offered hereby has been passed upon for us by Latham & Watkins LLP.

EXPERTS

The consolidated financial statements of Virgin Galactic Holdings, Inc. as of and for the years ended December 31, 2019, 2018 and 2017, have been incorporated by reference in this prospectus in reliance upon the report of KPMG LLP, an independent registered public accounting firm, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following is an estimate of the expenses (all of which are to be paid by the registrant) that we may incur in connection with the securities being registered hereby.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SEC registration fee

|

$

|

342,172

|

|

FINRA filing fee

|

$

|

225,500

|

|

Legal fees and expenses

|

$

|

200,000

|

|

Accounting fees and expenses

|

$

|

104,000

|

|

Miscellaneous

|

$

|

15,328

|

|

Total

|

$

|

887,000

|

Item 15. Indemnification of Directors and Officers

Subsection (a) of Section 145 of the General Corporation Law of the State of Delaware (the “DGCL”) empowers a corporation to indemnify any person who was or is a party or who is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with such action, suit or proceeding if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person’s conduct was unlawful.

Subsection (b) of Section 145 empowers a corporation to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that the person acted in any of the capacities set forth above, against expenses (including attorneys’ fees) actually and reasonably incurred by the person in connection with the defense or settlement of such action or suit if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation, except that no indemnification shall be made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the Court of Chancery or the court in which such action or suit was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which the Court of Chancery or such other court shall deem proper.

Section 145 further provides that to the extent a director or officer of a corporation has been successful on the merits or otherwise in the defense of any action, suit or proceeding referred to in subsections (a) and (b) of Section 145, or in defense of any claim, issue or matter therein, such person shall be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection therewith; that indemnification provided for by Section 145 shall not be deemed exclusive of any other rights to which the indemnified party may be entitled; and the indemnification provided for by Section 145 shall, unless otherwise provided when authorized or ratified, continue as to a person who has ceased to be a director, officer, employee or agent and shall inure to the benefit of such person’s heirs, executors and administrators. Section 145 also empowers the corporation to purchase

and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against any liability asserted against such person and incurred by such person in any such capacity, or arising out of his status as such, whether or not the corporation would have the power to indemnify such person against such liabilities under Section 145.

Section 102(b)(7) of the DGCL provides that a corporation’s certificate of incorporation may contain a provision eliminating or limiting the personal liability of a director to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, provided that such provision shall not eliminate or limit the liability of a director (i) for any breach of the director’s duty of loyalty to the corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) under Section 174 of the DGCL, or (iv) for any transaction from which the director derived an improper personal benefit.

Any underwriting agreement or distribution agreement that the registrant enters into with any underwriters or agents involved in the offering or sale of any securities registered hereby may require such underwriters or dealers to indemnify the registrant, some or all of its directors and officers and its controlling persons, if any, for specified liabilities, which may include liabilities under the Securities Act of 1933, as amended.

Additionally, our certificate of incorporation limits the liability of our directors to the fullest extent permitted by the DGCL, and our bylaws provide that we will indemnify them to the fullest extent permitted by such law. We have entered into and expect to continue to enter into agreements to indemnify our directors, executive officers and other employees as determined by our board of directors. Under the terms of such indemnification agreements, we required to indemnify each of our directors and officers, to the fullest extent permitted by the laws of the state of Delaware, if the basis of the indemnitee’s involvement was by reason of the fact that the indemnitee is or was our director or officer or was serving at our request in an official capacity for another entity. We must indemnify our officers and directors against all reasonable fees, expenses, charges and other costs of any type or nature whatsoever, including any and all expenses and obligations paid or incurred in connection with investigating, defending, being a witness in, participating in (including on appeal), or preparing to defend, be a witness or participate in any completed, actual, pending or threatened action, suit, claim or proceeding, whether civil, criminal, administrative or investigative, or establishing or enforcing a right to indemnification under the indemnification agreement. The indemnification agreements also require us, if so requested, to advance all reasonable fees, expenses, charges and other costs that such director or officer incurred, provided that such person will return any such advance if it is ultimately determined that such person is not entitled to indemnification by us. Any claims for indemnification by our directors and officers may reduce our available funds to satisfy successful third-party claims against us and may reduce the amount of money available to us.

Item 16. Exhibits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Incorporated by Reference

|

|

|

Exhibit No.

|

Exhibit Description

|

Form

|

File No.

|

Exhibit

|

Filing Date

|

Filed Herewith

|

|

3.1

|

|

8-K

|

001-38202

|

3.1

|

10/29/2019

|

|

|

3.2

|

|

8-K

|

001-38202

|

3.2

|

10/29/2019

|

|

|

4.1

|

|

8-K

|

001-38202

|

4.2

|

10/29/2019

|

|

|

4.2

|

|

8-K

|

001-38202

|

4.4

|

09/18/2017

|

|

|

5.1

|

|

S-1/A

|

333-237961

|

5.1

|

05/11/2020

|

|

|

23.1

|

|

|

|

|

|

X

|

|

23.2

|

|

S-1/A

|

333-237961

|

5.1

|

05/11/2020

|

|

|

24.1

|

|

S-1

|

333-237961

|

24.1

|

05/01/2020

|

|

Item 17. Undertakings

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (a)(1)(i), (ii), and (iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(5) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(A) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(b) The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.