UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE

14A

Proxy Statement Pursuant

to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

☐

|

Preliminary Proxy Statement

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

☐

|

Definitive Proxy Statement

|

|

|

☒

|

Definitive Additional Materials

|

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

FREIGHTCAR

AMERICA, INC.

(Name of Registrant as Specified

In Its Charter)

(Name of Person(s) Filing

Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

☒

|

No fee required.

|

|

|

|

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule

0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify

the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or

the Form or Schedule and the date of its filing.

|

|

|

1)

|

Amount Previously Paid:

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

In connection with

the Special Meeting of Stockholders (the “Special Meeting”) of FreightCar America, Inc. (the “Company”),

the Company filed a definitive proxy statement and accompanying proxy card with the U.S. Securities and Exchange Commission on

November 2, 2020. On November 10, 2020, the Company held an investors’ call to discuss the Company’s earnings for the

third quarter (the “Q3 Earnings Call”). Below is the script for the Company’s Q3 Earnings Call.

FreightCar

America

Third Quarter

2020 Earnings Call Script

Version 5 as

of 11.9.20 4PM

SPEAKERS

Jim Meyer – President and Chief Executive Officer, FreightCar

America

Chris Eppel – Chief Financial

Officer, FreightCar America

Matt Tonn – Chief Commercial

Officer, FreightCar America

Joe Caminiti – Investor

Relations

Moderator

Welcome to FreightCar America’s Third

Quarter 2020 Earnings Conference Call and Webcast. At this time, all participant lines are in a listen-only mode. For those of

you participating on the conference call, there will be an opportunity for your questions at the end of today’s prepared

comments. Please note this conference is being recorded. An audio replay of the conference call will be available on the Company’s

website within a few hours after this call.

I would now like to turn the call over

to Joe Caminiti, Investor Relations.

J. Caminiti

Thank you and welcome. Joining me today

are Jim Meyer, President and Chief Executive Officer, Chris Eppel, Chief Financial Officer, and Matt Tonn, Chief Commercial Officer.

I’d like to remind everyone that

statements made during this conference call relating to the Company’s expected future performance, future business prospects,

or future events or plans, may include forward-looking statements as defined under the Private Securities Litigation Reform Act

of 1995. Participants are directed to FreightCar America’s 2019 Form 10-K and its third quarter 2020 form 10-Q for a description

of certain business risks, some of which may be outside of the control of the Company that may cause actual results to materially

differ from those expressed in the forward-looking statements. We expressly disclaim any duty to provide updates to our forward-looking

statements, whether as a result of new information, future events, or otherwise.

Our 2019 Form 10-K and earnings release

for the third quarter of 2020 are posted on the Company’s Web site at www.freightcaramerica.com.

With that, let me now turn the call over

to Jim for a few opening remarks.

J. Meyer

Thank you, Joe. Good morning and thank

you all for joining us today. While it has only been three weeks since our special call to provide you with an update on our business

repositioning process, we have continued to make progress and we’re excited to provide some additional updates for you today.

Let me take a few minutes to recap some

of the critical steps we have taken, and that we are still in the process of completing, to finalize the restructuring.

First, we successfully completed the acquisition

of the remaining 50% of our Joint Venture in Castaños, Mexico in mid-October.

Production at the new Castaños factory

started in July, with the first car completed in August, and I am happy to announce that the manufacturing facility is now fully

certified by Association of American Railroads, or AAR. To the best of our knowledge, this was completed in record time, which

was due entirely to the strong team we have at Castaños. As a result, we will be shipping our first railcars from the facility

this week. So, in short, Castaños is manned with a highly experienced workforce, is AAR certified, is producing and is now

generating revenue.

During the third quarter we also successfully

negotiated the early termination of our lease at the Cherokee, AL or Shoals facility. As of October, we have no additional rent

due at Shoals and we have agreed to sell and transfer certain basic infrastructure at the facility to the landlord in exchange

for the early termination. Again, there is no additional capital required as part of the lease at this stage.

By early 2021, our entire freight car portfolio

will be produced in Castaños. We will continue to produce aftermarket parts for our parts business in Richland, PA and this

is not expected to change. And as I always do, I want to thank our employees at Shoals for their dedication and commitment to completing

our remaining orders at that facility. They continue to work with both professionalism and pride.

This is what we have accomplished in recent

months, but what exactly are we trying to create? First and foremost, let us remember what we are. We do not have a big lease fleet

to fall back on, and that isn’t what our customers want from us anyway. What we are and what our customers want us to be,

is a ‘pure play’ manufacturer. And given this, we better be the best in the business at it – for cost, for quality,

and for on-time delivery performance.

We have been working for almost three years

now to create the best cost structure in the business, and with the recent announcement describing our final transformative steps,

we believe we are there. No one else in our industry is producing from a single efficient site and on the cost structure that we

have in Mexico. Nobody else can start turning a manufacturing profit on the volume levels that we will soon be able to do. And

in addition, we have almost three years of product re-engineering and strategic sourcing initiatives from our ‘Back to Basics’

work, which transfer with us to the new footprint. Starting now, we can compete in every product category in which we have an offering.

Let us next talk about quality. We have

said for some time that our goal is to be the industry leader in quality. Our move to Castaños is fully aligned with this

objective. Beyond the careful attention that went into the design of our new factory, we are assembling the very best workforce

in the business. Now, for the first time, we are located in the heart of railcar manufacturing for North America, with access to

a large pool of highly trained railcar manufacturing personnel. We are hiring the best. Period. The facts that (a), we delivered

the first steel to the plant in July and completed our first car in August, and (b) we had our onsite inspection audits from the

AAR in September and were formally certified just one month later, are testimony to this. And again, we will start shipping cars

to customers this week.

By moving all production to Castaños

by early 2021, we will have reset our cost-base and are multiple steps closer to reaching our goal to become the highest quality

and lowest cost producer in the industry.

Lastly, our industry remains in a cyclical

downturn, which has been greatly intensified by a ‘once in a century’ pandemic. While there are some initial signs

of market stabilization and small wins, which Matt will talk about in a few minutes, we cannot be certain how long the downturn

will last.

As a result, we have done several things

to mitigate the risks associated with these external conditions. First, we have accelerated our business repositioning plan as

the full shift of production to Castaños provides significant financial and operational flexibility to ride out these headwinds.

We have lowered our breakeven economics to less than 2,000 cars per year. And the Castaños facility will be scaled quickly

once we see signs that the pandemic and its economic effects are leaving us for good. I would argue we will be in one of the best

positions in our industry to navigate this pandemic with this new lean and scalable business profile, and that it will allow us

to emerge quickly and from a position of strength when conditions allow. We have also obtained a new asset-backed credit facility,

and we are in the final steps of completing a $40 million term loan. I will talk more about the latter later in the call.

With that brief overview, I’ll pass the call to Chris

to talk more specifically about our financial results and performance in the third quarter. Chris?

C. Eppel

Thanks Jim. Turning to our financial results,

consolidated revenues for the third quarter totaled $25.2 million, compared to $17.5 million in the second quarter of 2020 and

$40.7 million in the third quarter of 2019. We delivered 163 railcars in the quarter, compared to 100 in the second quarter of

2020 and 467 in the third quarter of 2019.

As previously noted, our current backlog

of 2020 orders, scheduled to ship this year, is heavily weighted to the second half of the year. That said, we shipped fewer cars

in the third quarter than we expected as we made the strategic decision to shift some of our orders from Shoals to Castaños

to take advantage of the certification timing and improved economics of the new facility. This resulted in a pushout of deliveries

from Q3 into Q4 and beyond. Thus, we still expect to come within the bottom end of the guidance range we provided for you last

quarter, but have narrowed it to 750 to 850 railcars for the second half of 2020.

Our gross profit improved to a negative

$4.1 million, compared to negative $6.1 million in the second quarter of this year, and negative $5.4 million in Q3 of 2019. Gross

profit performance reflects previous cost reductions and a mix of higher margin railcars, which offsets the impact of negative

efficiencies due to lower production volumes.

SG&A for the quarter totaled $7.2 million

up from $6.5 million in the second quarter of 2020, but down from $7.8 million in Q3 of 2019. The sequential increase included

several onetime costs related to the deal activity and certain commercial reserves for approximately $1 million. The Company expects

to have additional SG&A costs related to the financing in both Q4 of this year and Q1 of 2021. Excluding these costs, the Company’s

SG&A will remain under $7 million.

Consolidated operating loss for the third

quarter of 2020 was $41.3 million, compared to an operating loss of $12.9 million in the second quarter of 2020 and a loss of $36.3

million in the year ago period. The sequential increase in the loss was primarily attributable to $30.1 million of restructuring

and impairment charges incurred during the quarter. As a reminder, the majority of these charges specifically related to the exit

from the Shoals facility. Specifically, the charge included a $17.5 million non-cash impairment charge recorded to reduce the Shoals

facility lease asset to its fair value, non-cash impairment charges for property, plant and equipment of $9.0 million, and employee

severance and retention charges of $3.4 million. Furthermore, the final agreement with the landlord was reached in the beginning

of the fourth quarter, which requires us to write down the lease liability associated with the facility in that quarter in line

with Generally Accepted Accounting Principles. As such, we will record a non-cash gain related to the lease in our Q4 results.

Moving to the balance sheet, we finished

the quarter with cash and cash equivalents, including restricted cash and certificates of deposit, of $32.9 million, down from

$52.4 million at the end of Q2 and down $37.1 million from the year end 2019. Part of the decline in our cash results is attributable

to a build in our working capital. Inventories increased to $60.2 million, from $47.1 million last quarter and $25.1 million as

of December 31, 2019. This increase is related to the delivery guidance we are providing.

Capital expenditures for the third quarter

of 2020 totaled $1.3 million dollars, the majority of which was related to the needs of our Mexico facility to support our production

ramp-up. The Company anticipates between $1-to-2 million of additional capital investments in 2020, which will allow us to complete

the first phase of our Mexican capacity production investments.

Now I’d like to turn the call over

to Matt for a few commercial comments related to the third quarter and moving forward. Matt.

M. Tonn

Thanks, Chris. Our industry continues to

navigate the challenges of this cyclical downturn. Key market indicators including rail traffic and railcar storage levels are

trending in the right direction although the economy in general remains uncertain due to the pandemic. Our view is that customer

sentiment remained very cautious in the third quarter, and thus, we don’t anticipate meaningful demand improvement in the

near-term.

Although down from the second quarter,

third quarter inquiries represented a greater mix of car types that FreightCar America is well suited to deliver. Our third quarter

orders reflect the continued weakness and caution in the industry.

We are extremely confident that the move

to Castaños will strengthen our competitive position and allow us to earn our share of orders once the market begins to

return to some level of normalcy. Despite the pandemic and the associated travel restrictions, we remain focused on staying engaged

with our customers. Through the use of video, we have started hosting live and virtual customer meetings from Castaños,

and have received great feedback on the facility and experienced leadership there.

I’ll end with a review of our backlog.

Our order backlog as of September 30, 2020 consisted of 1,776 railcars, compared to 1,839 railcars at the end of the second quarter.

Our backlog has an estimated sale value of approximately $195 million. We’ve had no order cancellations as a result of our

manufacturing shift, and again continue to receive positive feedback from customers about both Castanos and our new business repositioning

plan.

With that, I’ll now turn the call

back over to Jim for a few closing remarks. Jim.

J. Meyer

Thanks, Matt. We have spent the last few

weeks talking about this critical business repositioning process and we have had a few consistent questions. So, I thought the

best thing we could do today is to address these questions on this call.

The first question is why now? Why does

FreightCar America need to execute such an aggressive repositioning plan in the middle of a pandemic, when the market’s in

the middle of a downcycle?

To start, our ‘Back to Basics’

strategy made significant progress in lowing our cost per car, but it hasn’t been enough, not in this pandemic and the resulting

prolonged industry downturn.

We entered 2020 with cautious optimism,

but the impact of the downcycle and pandemic forced us to accelerate our plans. We must change our cost structure and we must do

so quickly. We cannot afford to sustain our current level of losses, and we must put quarters like this one behind us once and

for all. This move gets us to where we need to be. And the good news is that through the ‘Back to Basics’ work and

then the JV formation and Castaños plant start-up, we can do it now, as in right now, and we can do it without disruption

and without giving up future scale and upside. We will just no longer be paying for that scale until we need it.

The next question involves the structure

of our purchase of the remaining interest in our joint venture in Mexico. Specifically, why did we choose to purchase the Gil Family’s

50% interest in the JV, in exchange for approximately 14 and a half percent of our common stock?

The simple

answer is that Castaños

is our future. And with the decision to move all our production to Mexico, we needed to ensure more complete management control

of our soon-to-be only manufacturing facility. We also needed to have complete ownership of the profit stream coming out of it.

We did the deal in stock versus for two

reasons. One, cash must be managed carefully in this time of economic uncertainty, and two, we did the deal in stock because we

believed it was absolutely critical to directly align our interests with those of our partners. As to the amount, approximately

14 and a half percent, consider that the JV is where the majority, the large majority, of our future profits are expected to be

earned. So, we believe strongly that purchasing 50% of the future profits coming out of Mexico for approximately 14 and a half

percent of company equity represents very good value for our stockholders.

The third question involves our new

term-loan, and investors obviously want to better understand why we need this capital today?

There are really two answers to this question

as well, one involves risk management, and the second is focused on the need for growth capital. In terms of risk management, our

cash position is down nearly $40 million since the end of 2019 and the pandemic has clearly elongated the current downturn in our

industry cycle. Not only do our investors see that, but our customers do too. In a capital intensive business like ours, we require

strong liquidity and customers need to know we have a balance sheet that will allow us to fulfill our commitments to them. Without

the proper balance sheet, winning business becomes that much harder.

But equally important is when this industry

downturn finally reverses – and it always does – we need to be in a position to leverage the opportunity. That will

require additional capital to ramp up production, build the 3rd and 4th production lines at Castaños,

and support working capital needs to build inventory. We must leverage the next upcycle to win share and become a larger company

again, and that’s going to need capital to support it.

This incremental funding is vital to our

plans and vital to our future.

Lastly, we’ve had a common question

around our capital raise process. Some investors view the term loan structure as expensive, since it includes a warrant that provides

our new lending partner with the ability to purchase up to 23% of the Company’s outstanding common stock for a penny a share.

So, the question has been, what was the process and why this deal?

Let me start by saying this solution was

not entered into lightly. This team ran a process for nearly a year. We went to the market with a plan and asked what it would

cost to underwrite it. This plan wasn’t backed by assets and it wasn’t backed by a strong positive EBITDA stream. Rather

it was focused on value-creation and the expectation that we can turn around past negative EBITDA results into real profitability

in the future. We reviewed countless proposals, and it quickly became clear that every solution required some degree of equity

for whichever partner we selected.

The bottom-line is, this was the best solution

available to us. We will not find a better deal and remember that we are in the middle of a pandemic causing great uncertainty.

We need to reposition this business and we need to do it now. We need this capital to complete the restructuring, reassure our

customers that we have the staying power, backstop the business through the pandemic, and fund our future working capital and growth

investment needs.

So, while we understand that this business

repositioning plan will require roughly 35% in total dilution for our stockholders, through the JV purchase and the new term loan,

it’s THE RIGHT solution. Owning a business that’s struggling to compete and isn’t growing, with limited capital

to fix itself….versus a business that has a clear path for becoming the lowest cost, highest quality producer in its industry

– one that will grow and earn profit at a significantly higher rate – is an easy decision.

Thus, I am asking all of you as stockholders

to vote for our plan by submitting your proxy in support of this new term loan. This is an extraordinarily important decision,

and we need your support.

That concludes our prepared remarks and

I’ll now turn the call over to the operator for Q&A.

Moderator

At this time there are no other

questions in queue.

Jim

Thank you again for your time today. We need your support to

complete this business repositioning process and to ensure our future. I look forward to entering an exciting new phase for our

Company with all of you and strongly believe we have the right plan to deliver strong value. Have a great day.

11

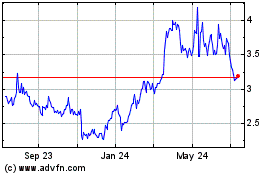

FreightCar America (NASDAQ:RAIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

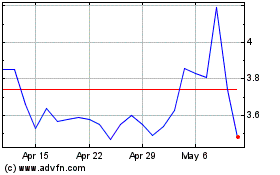

FreightCar America (NASDAQ:RAIL)

Historical Stock Chart

From Apr 2023 to Apr 2024