Ideanomics, Inc. Reports Q3 2020 Financial Results

- Revenues for the three months ended September 30, 2020, was

$10.6 million, an increase of 2.3x compared to Q2 2020 and 3.4x

compared to Q3 2019

- Strong cash position, finished the quarter with $27.6

million

- Q3 revenues were supported by strong growth in the Taxi and

Ridesharing segment

- Strategic Investment into California e-tractor company,

Solectrac, which services agricultural and specialty vehicle

market

NEW YORK, NY -- November 9, 2020 -- InvestorsHub

NewsWire -- Ideanomics (NASDAQ: IDEX)

("Ideanomics" or the "Company"), a global company focused on

monetizing the adoption of commercial electric vehicles and

associated energy consumption, as well as enabling the next

generation of financial services and fintech products, announced

today its third quarter 2020 operating results for the period

ended September 30, 2020 (a full copy of the Company's

10-Q report is available at www.sec.gov).

Conference Call: Ideanomics' management, including Alf

Poor (Chief Executive Officer), Conor

McCarthy (Chief Financial Officer) and Tony

Sklar (SVP of Investor Relations), will host live an earnings

release conference call at 4:30 pm ET, Monday, November

9, 2020. http://investors.ideanomics.com. Time permitting,

Ideanomics management will answer questions during the live Q&A

session. A replay of the earnings call will be available soon after

the conclusion of the event.

To join the webcast, please visit the 'Events &

Presentations' section of the Ideanomics corporate website

(https://investors.ideanomics.com/), or copy/paste this

link:

https://78449.themediaframe.com/dataconf/productusers/ssc/mediaframe/41438/indexl.html

"We reported our third consecutive quarter of MEG revenue

growth, and our pipeline gives us confidence that we can maintain

this momentum through our product and service offerings and global

footprint," said Alf Poor, CEO of Ideanomics. "The MEG

division in China, Treeletrik in Malaysia, and Medici

Motor Works and Solectrac in the U.S. are all progressing towards

our objectives for the remainder of 2020, and into 2021 and beyond.

Strong growth in our taxi and ridesharing business is continuing

and we are beginning to bring other revenues online in Q4,

including activity in the bus segment of our business."

Ideanomics Third Quarter 2020 Operating

Results

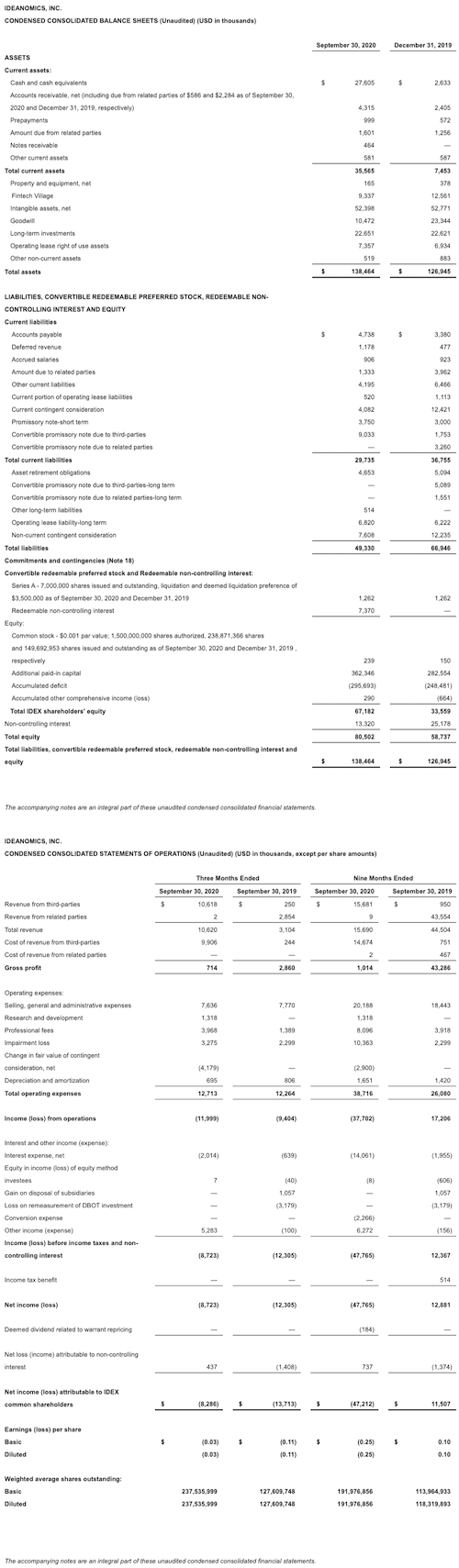

Revenue for the three months ended September 30, 2020,

was $10.6 million, of which $10.1 million were

generated by the Company's MEG business unit; this represents the

largest revenues earned by MEG since the Company commenced

business.

In the third quarter of 2020, the Company continued to develop

its MEG business and recognized $10.6 million revenue

from the sales of vehicles, which included revenue of $1.3

million from the sale of traditional combustion engine

vehicles. In the third quarter of 2020 the Company acted in both a

Principal and Agent capacity in relation to vehicle sales. For

those contracts in which it acted in a Principal capacity revenues

were recorded on a Gross basis and for those contracts where it

acted in an Agent capacity the revenues were recorded on a Net

basis.

Gross Profit

Gross profit for the three months ended September 30,

2020 was $0.7 million, as compared to gross profit in the

amount of $2.9 million during the same period in

2019.

Operating Loss

The Loss from Operations was $12.0 million as compared

to $9.4 million in the prior period. The increased

Operating Loss is almost entirely due to the lower gross profit in

the current quarter.

About Ideanomics

Ideanomics is a global company that

facilitates the adoption of commercial electric vehicles and

supports next-generation financial services and fintech products.

Our electric vehicle division, Mobile Energy Global (MEG) provides

group purchasing discounts on commercial electric vehicles, EV

batteries and electricity, as well as financing and charging

solutions; we refer to this business model as sales to financing to

charging (S2F2C). Ideanomics Capital provides intelligent and

innovative services for the fintech industry. Together, MEG and

Ideanomics Capital provide our global customers and partners with

more efficient solutions.

The company is headquartered in New York, NY, with offices

in Beijing, Hangzhou, and Qingdao, and operations in

the U.S., China, Ukraine, and Malaysia.

Safe Harbor Statement

This press release contains certain statements that may include

"forward looking statements". All statements other than statements

of historical fact included herein are "forward-looking

statements." These forward-looking statements are often identified

by the use of forward-looking terminology such as "believes,"

"expects" or similar expressions, involve known and unknown risks

and uncertainties, and include statements regarding our intention

to transition our business model to become a next-generation

financial technology company, our business strategy and planned

product offerings, our intention to phase out our oil trading and

consumer electronics businesses, and potential future financial

results. Although the Company believes that the expectations

reflected in such forward-looking statements are reasonable, they

do involve assumptions, risks and uncertainties, and these

expectations may prove to be incorrect. You should not place undue

reliance on these forward-looking statements, which speak only as

of the date of this press release. The Company's actual results

could differ materially from those anticipated in these

forward-looking statements as a result of a variety of risks and

uncertainties, such as risks related to: our ability to continue as

a going concern; our ability to raise additional financing to meet

our business requirements; the transformation of our business

model; fluctuations in our operating results; strain to our

personnel management, financial systems and other resources as we

grow our business; our ability to attract and retain key employees

and senior management; competitive pressure; our international

operations; and other risks and uncertainties disclosed under the

sections entitled "Risk Factors" and "Management's Discussion and

Analysis of Financial Condition and Results of Operations" in our

most recent Form 10-K and Form 10-Q filed with the Securities and

Exchange Commission, and similar disclosures in subsequent reports

filed with the SEC, which are available on the SEC website

at www.sec.gov. All forward-looking statements

attributable to the Company or persons acting on its behalf are

expressly qualified in their entirety by these risk factors. Other

than as required under the securities laws, the Company does not

assume a duty to update these forward-looking statements.

Investor Relations and Media Contact

Tony Sklar, VP of Communications

1441 Broadway, Suite 5116, New York, NY 10018

ir@ideanomics.com

Valerie Christopherson / Lora Wilson

Global Results Communications (GRC)

+1 949 306 6476

valeriec@globalresultspr.com

SOURCE Ideanomics

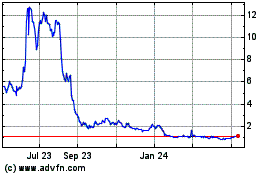

Ideanomics (NASDAQ:IDEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

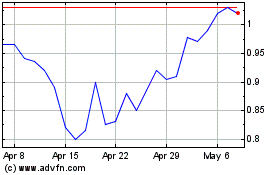

Ideanomics (NASDAQ:IDEX)

Historical Stock Chart

From Apr 2023 to Apr 2024