Cavco Industries, Inc. (Nasdaq: CVCO) today announced financial

results for the second fiscal quarter ended September 26,

2020.

- Net revenue decreased 4.0% to $258.0 million

for the second quarter of fiscal year 2021 compared to $268.7

million in the same quarter last year. Net revenue for the first

six months of fiscal 2021 was $512.8 million, a 3.7% decrease from

$532.7 million in the comparable prior year period.

- In the Factory-built housing segment, Net revenue decreased

4.6% to $241.0 million for the second quarter of fiscal year 2021

compared to $252.7 million in the same quarter last year.

Factory-built housing Net revenue for the first six months of

fiscal 2021 was $479.1 million, a 4.5% decrease from $501.5 million

in the comparable prior year period. Note that Destiny Homes was

purchased in August 2019 and Lexington Homes was closed in June

2020. The decrease was primarily from 9% and 11% lower home sales

volume during the three and six months ended September 26, 2020,

respectively, partially offset by higher home selling prices

compared to last year. Strong incoming order rates that began in

the last half of the first quarter continued throughout the second

quarter of fiscal year 2021. Production inefficiencies from

challenges related to the novel coronavirus COVID-19 ("COVID-19")

pandemic limited factory delivery volume, causing factory backlogs

to increase dramatically, as discussed further below.

- Financial services segment Net revenue increased primarily due

to $0.7 million and $1.7 million of unrealized gains on marketable

equity investments in the insurance subsidiary's portfolio during

the three and six months ended September 26, 2020, respectively,

compared to $0.2 million in unrealized gains in each of the prior

year periods. These unrealized gains resulted mainly from the

recovery of the underlying equity markets during the relevant

periods.

- Income from operations decreased 19.2% to

$18.1 million for the second quarter of fiscal year 2021 compared

to $22.4 million in the same quarter last year. Income from

operations for the first six months of fiscal 2021 was $38.1

million, a 19.6% decrease from $47.4 million in the comparable

prior year period.

- In the factory-built housing segment, gross profit was lower in

the three and six months ended September 26, 2020 due to fewer home

sales as a result of COVID-19 related production inefficiencies.

During the second quarter of fiscal year 2021, the Company incurred

$0.5 million in expenses related to the Securities and Exchange

Commission ("SEC") inquiry. However, the Company also received a

$0.8 million insurance recovery of prior expenses, resulting in a

net benefit of $0.3 million for the second quarter of fiscal year

2021 compared to $0.8 million in expense in the second quarter of

fiscal year 2020. For the six months ended September 26, 2020, the

Company has recorded a net benefit of $0.2 million for

investigation related expenses compared to $1.6 million in expense

in the comparable prior year period. Both periods incurred

identical charges for the amortization of additional director and

officer ("D&O") insurance premium, which is now fully

amortized.

- In the financial services segment, Income from operations was

adversely impacted by $3.3 million and $4.4 million of higher

weather-related claims volume compared to the three and six months

ended September 28, 2019, respectively. Interest income earned on

the acquired loan portfolios that continue to amortize was also

lower. These declines were partially offset by unrealized gains on

marketable equity investments, as described above.

- Income before income taxes for the second

quarter of fiscal year 2021 was $19.6 million, down 28.2% from

$27.3 million for the second quarter of fiscal year 2020. For the

six months ended September 26, 2020, Income before income

taxes was $41.3 million, down 24.4% from $54.6 million. Interest

expense for the period decreased due to the repurchase of the

2007-1 securitized loan portfolio in August 2019, thereafter

eliminating the related interest expense. Other income, net,

declined primarily due to a $3.4 million net gain on the sale of

idle land that was recorded in the second quarter of fiscal year

2020, as well as a reduction in interest earned in the current

periods on cash and commercial loan receivables, given the lower

interest rate environment.

- Income taxes totaled $4.5 million in the

second quarter of fiscal year 2021 compared to $6.4 million, in the

second quarter of fiscal year 2020. For the six months ended

September 26, 2020, Income taxes totaled $9.6 million compared

to $12.5 million for the same period of the prior year.

- Net income decreased 28.2% to $15.0 million

for the second quarter of fiscal year 2021, compared to net income

of $20.9 million in the same quarter of the prior year. For the six

months ended September 26, 2020, net income was $31.7 million, down

24.9% from net income of $42.2 million in the prior year period.

Diluted net income per share was $1.62 and $3.42 for the three and

six months ended September 26, 2020, respectively, compared to

$2.25 and $4.56 for the same periods last year.

Items ancillary to our core operations had the

following impact on the results of operations (in millions):

| |

|

Three Months Ended |

|

Six Months Ended |

| |

September 26, 2020 |

|

September 28, 2019 |

|

September 26, 2020 |

|

September 28, 2019 |

| Net

revenue |

|

|

Unrealized gains on marketable equity securities in the financial

services segment |

$ |

0.7 |

|

|

$ |

0.2 |

|

|

$ |

1.7 |

|

|

$ |

0.2 |

|

| Selling,

general and administrative expenses |

|

|

| |

Amortization of additional

D&O insurance premiums |

(2.1 |

) |

|

(2.1 |

) |

|

(4.2 |

) |

|

(4.2 |

) |

| |

Legal and other expense

related to the SEC inquiry, net of recovery |

0.3 |

|

|

(0.8 |

) |

|

0.2 |

|

|

(1.6 |

) |

| Other

income, net |

| |

Unrealized gains on corporate

marketable equity securities |

0.6 |

|

|

0.2 |

|

|

1.6 |

|

|

1.1 |

|

| |

Gain on sale of idle land |

— |

|

|

3.4 |

|

|

— |

|

|

3.4 |

|

| Income

tax expense |

| |

Tax benefits from stock option

exercises |

0.4 |

|

|

0.3 |

|

|

0.7 |

|

|

0.9 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Business Update on the COVID-19

Pandemic

In March 2020, the World Health Organization

declared COVID-19 a global pandemic. As the business was considered

essential, the Company continued to operate substantially all of

its homebuilding and retail sales facilities while working to

follow COVID-19 health guidelines. The Company has worked to

minimize exposure and transmission risks by implementing enhanced

facility cleaning, social distancing and related protocols while

continuing to serve its customers. Operational efficiencies

declined from adjusting home production processes to comply with

health guidelines, managing higher factory employee absenteeism,

limited new-hire availability and certain building material supply

shortages. Accordingly, the Company's total average plant capacity

utilization rate was approximately 65% during the second fiscal

quarter of 2021, ending the quarter at approximately 70%. This is

lower than pre-pandemic levels of more than 80%.

Sales order activity has continued to improve

during the second fiscal quarter of 2021 to the point where home

sales order rates were nearly 65% higher than the comparable prior

year quarter. Increased order volume is the result of a higher

number of well-qualified home buyers making purchase decisions,

supported by reduced home loan interest rates. Increased orders

outpaced the challenging production environment during the quarter,

raising order backlogs 134% to $321 million at September 26,

2020, compared to $137 million at September 28, 2019 and $157

million at June 27, 2020. The backlog of home orders excludes

orders that have been paused or canceled at the request of the

customer.

Commenting on the quarter, Bill Boor, President

and Chief Executive Officer said, "Across the company, our teams

have done a tremendous job safely continuing operations over the

last two quarters. In manufacturing, while our ability to produce

homes has been hampered by labor and supply challenges, the rapid

increase in our backlog has largely been driven by a sustained and

unprecedented level of orders. That demand is clearly indicative of

the long-term shortage of affordable housing and has been enabled

by record low interest rates. We are working very hard to increase

production by addressing significant labor challenges. Throughout

this period of time, we have demonstrated our ability to generate

cash and our strong financial position continues to support our

strategic direction."

Cavco's management will hold a conference call

to review these results tomorrow, October 30, 2020, at 1:00 PM

(Eastern Time). Interested parties can access a live webcast of the

conference call on the Internet at https://investor.cavco.com or

via telephone at + 1 (844) 348-1686 (domestic) or + 1 (213)

358-0891 (international). An archive of the webcast and

presentation will be available for 90 days at

https://investor.cavco.com.

2020 Stock Repurchase

Program

On October 27, 2020, the Company’s Board of

Directors approved a $100 million stock repurchase program that may

be used to purchase its outstanding common stock. This program

replaces a previously standing $10 million authorization, which is

now canceled.

The purchases may be made in the open market or

one or more privately negotiated transactions in compliance with

applicable securities laws and other legal requirements. The actual

timing, number and value of shares repurchased under the program

will be determined by the Company in its discretion and will depend

on a number of factors, including market conditions, applicable

legal requirements and other strategic capital needs and

opportunities. The plan does not obligate Cavco to acquire any

particular amount of common stock and may be suspended or

discontinued at any time.

The Company expects to finance the program from

existing cash resources. As of September 26, 2020, the Company had

cash and short term investments of approximately $329 million.

"Our priorities for capital remain unchanged. As

we've continually evaluated those priorities alongside our growing

cash balance, we have become convinced that we have the opportunity

to return value directly to our stockholders without compromising

our ability to create long-term value through investment. We remain

committed to growth, both organically and through acquisitions,"

said Mr. Boor.

Cavco Industries, Inc., headquartered in

Phoenix, Arizona, designs and produces factory-built housing

products primarily distributed through a network of independent and

Company-owned retailers. The Company is one of the largest

producers of manufactured homes in the United States, based on

reported wholesale shipments and marketed under a variety of brand

names including Cavco, Fleetwood, Palm Harbor, Fairmont,

Friendship, Chariot Eagle and Destiny. The Company is also a

leading producer of park model RVs, vacation cabins and

systems-built commercial structures, as well as modular homes.

Cavco's finance subsidiary, CountryPlace Mortgage, is an approved

Fannie Mae and Freddie Mac seller/servicer and a Ginnie Mae

mortgage-backed securities issuer that offers conforming mortgages,

non-conforming mortgages and home-only loans to purchasers of

factory-built homes. Our insurance subsidiary, Standard Casualty,

provides property and casualty insurance to owners of manufactured

homes.

Forward-Looking Statements

Certain statements contained in this release are forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, Section 21E of the Securities and Exchange Act of 1934 and

the Private Securities Litigation Reform Act of 1995. In general,

all statements that are not historical in nature are

forward-looking. Forward-looking statements are typically included,

for example, in discussions regarding the manufactured housing and

site-built housing industries; our financial performance and

operating results; and the expected effect of certain risks and

uncertainties on our business, financial condition and results of

operations. All forward-looking statements are subject to risks and

uncertainties, many of which are beyond our control. As a result,

our actual results or performance may differ materially from

anticipated results or performance. Factors that could cause such

differences to occur include, but are not limited to: the impact of

local or national emergencies including the COVID-19 pandemic,

including such impacts from state and federal regulatory action

that restricts our ability to operate our business in the ordinary

course and impacts on (i) customer demand and the availability of

financing for our products, (ii) our supply chain and the

availability of raw materials for the manufacture of our products,

(iii) the availability of labor and the health and safety of our

workforce and (iv) our liquidity and access to the capital markets;

our ability to successfully integrate past acquisitions or future

acquisitions and the ability to attain the anticipated benefits of

such acquisitions; the risk that any past or future acquisition may

adversely impact our liquidity; involvement in vertically

integrated lines of business, including manufactured housing

consumer finance, commercial finance and insurance; information

technology failures or cyber incidents; curtailment of available

financing from home-only lenders; availability of wholesale

financing and limited floor plan lenders; our participation in

certain wholesale and retail financing programs for the purchase of

our products by industry distributors and consumers, which may

expose us to additional risk of credit loss; significant warranty

and construction defect claims; our contingent repurchase

obligations related to wholesale financing; market forces and

housing demand fluctuations; net losses were incurred in certain

prior periods and our ability to generate income in the future; a

write-off of all or part of our goodwill; the cyclical and seasonal

nature of our business; limitations on our ability to raise

capital; competition; our ability to maintain relationships with

independent distributors; our business and operations being

concentrated in certain geographic regions; labor shortages and the

pricing and availability of raw materials; unfavorable zoning

ordinances; loss of any of our executive officers; organizational

document provisions delaying or making a change in control more

difficult; volatility of stock price; general deterioration in

economic conditions and turmoil in the credit markets; governmental

and regulatory disruption, including federal government shutdowns;

extensive regulation affecting manufactured housing; potential

financial impact on the Company from the subpoenas we received from

the SEC and its ongoing investigation, including the risk of

potential litigation or regulatory action, and costs and expenses

arising from the SEC subpoenas and investigation and the events

described in or covered by the SEC subpoenas and investigation,

which include the Company's indemnification obligations and

insurance costs regarding such matters, and potential reputational

damage that the Company may suffer; and losses not covered by our

director and officer insurance, which may be large, adversely

impacting financial performance; together with all of the other

risks described in our filings with the SEC. Readers are

specifically referred to the Risk Factors described in Item 1A of

the 2020 Form 10-K, as may be amended from time to time, which

identify important risks that could cause actual results to differ

from those contained in the forward-looking statements. Cavco

expressly disclaims any obligation to update any forward-looking

statements contained in this release, whether as a result of new

information, future events or otherwise. Investors should not place

undue reliance on any such forward-looking statements.

CAVCO INDUSTRIES,

INC.CONSOLIDATED BALANCE SHEETS(Dollars

in thousands, except per share amounts)

| |

September 26, 2020 |

|

March 28, 2020 |

| ASSETS |

(Unaudited) |

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

312,243 |

|

|

$ |

241,826 |

|

|

Restricted cash, current |

16,691 |

|

|

13,446 |

|

|

Accounts receivable, net |

36,852 |

|

|

42,800 |

|

|

Short-term investments |

16,589 |

|

|

14,582 |

|

|

Current portion of consumer loans receivable, net |

39,023 |

|

|

32,376 |

|

|

Current portion of commercial loans receivable, net |

13,261 |

|

|

14,657 |

|

|

Current portion of commercial loans receivable from affiliates,

net |

1,700 |

|

|

766 |

|

|

Inventories |

111,872 |

|

|

113,535 |

|

|

Prepaid expenses and other current assets |

49,193 |

|

|

42,197 |

|

| Total current assets |

597,424 |

|

|

516,185 |

|

| Restricted cash |

335 |

|

|

335 |

|

| Investments |

30,278 |

|

|

31,557 |

|

| Consumer loans receivable,

net |

42,817 |

|

|

49,928 |

|

| Commercial loans receivable,

net |

20,946 |

|

|

23,685 |

|

| Commercial loans receivable

from affiliates, net |

5,571 |

|

|

7,457 |

|

| Property, plant and equipment,

net |

77,836 |

|

|

77,190 |

|

| Goodwill |

75,090 |

|

|

75,090 |

|

| Other intangibles, net |

14,736 |

|

|

15,110 |

|

| Operating lease right-of-use

assets |

17,477 |

|

|

13,894 |

|

| Total assets |

$ |

882,510 |

|

|

$ |

810,431 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

32,919 |

|

|

$ |

29,924 |

|

|

Accrued expenses and other current liabilities |

173,184 |

|

|

139,930 |

|

|

Current portion of secured credit facilities and other |

2,118 |

|

|

2,248 |

|

| Total current liabilities |

208,221 |

|

|

172,102 |

|

| Operating lease

liabilities |

14,602 |

|

|

10,743 |

|

| Secured credit facilities and

other |

11,933 |

|

|

12,705 |

|

| Deferred income taxes |

7,066 |

|

|

7,295 |

|

| Stockholders’ equity: |

|

|

|

|

Preferred stock, $0.01 par value; 1,000,000 shares authorized; No

shares issued or outstanding |

— |

|

|

— |

|

|

Common stock, $0.01 par value; 40,000,000 shares authorized;

Outstanding 9,188,162 and 9,173,242 shares, respectively |

92 |

|

|

92 |

|

|

Additional paid-in capital |

254,297 |

|

|

252,260 |

|

|

Retained earnings |

386,134 |

|

|

355,144 |

|

|

Accumulated other comprehensive income |

165 |

|

|

90 |

|

| Total stockholders’

equity |

640,688 |

|

|

607,586 |

|

| Total liabilities and

stockholders’ equity |

$ |

882,510 |

|

|

$ |

810,431 |

|

| |

|

|

|

|

|

|

|

CAVCO INDUSTRIES,

INC.CONSOLIDATED STATEMENTS OF

INCOME(Dollars in thousands, except per share

amounts)(Unaudited)

| |

Three Months Ended |

|

Six Months Ended |

| |

September 26, 2020 |

|

September 28, 2019 |

|

September 26, 2020 |

|

September 28, 2019 |

|

Net revenue |

$ |

257,976 |

|

|

$ |

268,675 |

|

|

$ |

512,777 |

|

|

$ |

532,717 |

|

| Cost of sales |

204,435 |

|

|

210,208 |

|

|

403,913 |

|

|

413,952 |

|

| Gross profit |

53,541 |

|

|

58,467 |

|

|

108,864 |

|

|

118,765 |

|

| Selling, general and

administrative expenses |

35,453 |

|

|

36,083 |

|

|

70,776 |

|

|

71,347 |

|

| Income from operations |

18,088 |

|

|

22,384 |

|

|

38,088 |

|

|

47,418 |

|

| Interest expense |

(194 |

) |

|

(302 |

) |

|

(390 |

) |

|

(788 |

) |

| Other income, net |

1,702 |

|

|

5,173 |

|

|

3,578 |

|

|

7,987 |

|

| Income before income taxes |

19,596 |

|

|

27,255 |

|

|

41,276 |

|

|

54,617 |

|

| Income tax expense |

(4,547 |

) |

|

(6,370 |

) |

|

(9,553 |

) |

|

(12,450 |

) |

| Net income |

$ |

15,049 |

|

|

$ |

20,885 |

|

|

$ |

31,723 |

|

|

$ |

42,167 |

|

| |

|

|

|

|

|

|

|

| Net income per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

1.64 |

|

|

$ |

2.29 |

|

|

$ |

3.46 |

|

|

$ |

4.63 |

|

|

Diluted |

$ |

1.62 |

|

|

$ |

2.25 |

|

|

$ |

3.42 |

|

|

$ |

4.56 |

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

9,182,945 |

|

|

9,119,835 |

|

|

9,178,609 |

|

|

9,111,260 |

|

|

Diluted |

9,295,409 |

|

|

9,266,085 |

|

|

9,280,080 |

|

|

9,241,834 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

CAVCO INDUSTRIES,

INC.OTHER OPERATING DATA(Dollars in

thousands)(Unaudited)

| |

Three Months Ended |

|

Six Months Ended |

| |

September 26, 2020 |

|

September 28, 2019 |

|

September 26, 2020 |

|

September 28, 2019 |

| Net revenue: |

|

|

|

|

|

|

|

|

Factory-built housing |

$ |

240,967 |

|

|

$ |

252,690 |

|

|

$ |

479,057 |

|

|

$ |

501,458 |

|

|

Financial services |

17,009 |

|

|

15,985 |

|

|

33,720 |

|

|

31,259 |

|

| Total net revenue |

$ |

257,976 |

|

|

$ |

268,675 |

|

|

$ |

512,777 |

|

|

$ |

532,717 |

|

| |

|

|

|

|

|

|

|

| Gross profit: |

|

|

|

|

|

|

|

|

Factory-built housing |

$ |

46,155 |

|

|

$ |

48,639 |

|

|

$ |

93,147 |

|

|

$ |

100,774 |

|

|

Financial services |

7,386 |

|

|

9,828 |

|

|

15,717 |

|

|

17,991 |

|

| Total gross profit |

$ |

53,541 |

|

|

$ |

58,467 |

|

|

$ |

108,864 |

|

|

$ |

118,765 |

|

| |

|

|

|

|

|

|

|

| Income from operations: |

|

|

|

|

|

|

|

|

Factory-built housing |

$ |

15,430 |

|

|

$ |

17,059 |

|

|

$ |

31,685 |

|

|

$ |

38,443 |

|

|

Financial services |

2,658 |

|

|

5,325 |

|

|

6,403 |

|

|

8,975 |

|

| Total income from

operations |

$ |

18,088 |

|

|

$ |

22,384 |

|

|

$ |

38,088 |

|

|

$ |

47,418 |

|

| |

|

|

|

|

|

|

|

| Capital expenditures |

$ |

1,917 |

|

|

$ |

1,881 |

|

|

$ |

3,773 |

|

|

$ |

3,944 |

|

| Depreciation |

$ |

1,382 |

|

|

$ |

1,257 |

|

|

$ |

2,808 |

|

|

$ |

2,417 |

|

| Amortization of other

intangibles |

$ |

187 |

|

|

$ |

151 |

|

|

$ |

374 |

|

|

$ |

231 |

|

| |

|

|

|

|

|

|

|

| Total factory-built homes

sold |

3,427 |

|

|

3,781 |

|

|

6,776 |

|

|

7,588 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

For additional information,

contact:

Mark FuslerDirector of Financial Reporting and

Investor Relationsinvestor_relations@cavco.com

Phone: 602-256-6263On the

Internet: www.cavco.com

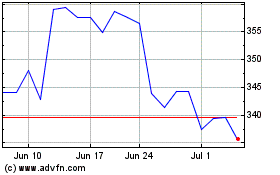

Cavco Industries (NASDAQ:CVCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

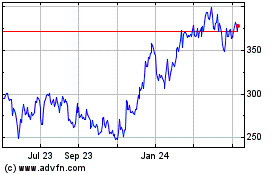

Cavco Industries (NASDAQ:CVCO)

Historical Stock Chart

From Apr 2023 to Apr 2024