UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to

Section

14(a) of the Securities

Exchange

Act of 1934

(Amendment

No. )

Filed

by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

|

[X]

|

Preliminary Proxy Statement

|

|

[ ]

|

Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2))

|

|

[ ]

|

Definitive Proxy Statement

|

|

[ ]

|

Definitive Additional Materials

|

|

[ ]

|

Soliciting Material Pursuant to §240.14a-12

|

RESPIRERX

PHARMACEUTICALS INC.

(Name

of Registrant As Specified In Its Charter)

Payment

of Filing Fee (Check the appropriate box):

|

[X]

|

No fee required

|

|

[ ]

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1)

and 0-11

|

(1)

Title of each class of securities to which transaction applies:

(2)

Aggregate number of securities to which transaction applies:

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set

forth the amount on which the filing fee is calculated and state how it was determined):

(4)

Proposed maximum aggregate value of transaction:

(5) Total fee

paid:

[ ]

Fee paid previously with preliminary materials.

[ ]

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of

its filing.

(1)

Amount Previously Paid:

(2)

Form, Schedule or Registration Statement No.:

(3)

Filing Party:

(4)

Date Filed:

PRELIMINARY

PROXY STATEMENT—SUBJECT TO COMPLETION

RESPIRERX

PHARMACEUTICALS INC.

126

Valley Road, Suite C

Glen

Rock, New Jersey 07452

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

To

Be Held on November 24, 2020

To

the Stockholders of RespireRx Pharmaceuticals Inc.:

A

Special Meeting of Stockholders of RespireRx Pharmaceuticals Inc. (the “Company”) will be held virtually via live

webcast on November 24, 2020 at 9:00 a.m., Eastern time, to approve (i) an amendment to our second restated certificate of incorporation

to effect, at the discretion of our Board of Directors, a ten-to-one (10:1) reverse stock split of all of the outstanding shares

of our common stock, par value $0.001 per share, and (ii) an amendment to our second restated certificate of incorporation to

set the number of the company’s authorized shares of stock at two billion five million (2,005,000,000) shares consisting

of two billion (2,000,000,000) shares designated as common stock, par value $0.001 per share, and five million (5,000,000) shares

designated as preferred stock, par value $0.001 per share. Attached to this notice is a proxy statement setting forth information

with respect to these proposals and certain other information.

The

Board of Directors has established October 16, 2020 as the record date for the determination of stockholders entitled to notice

of and to vote at the special meeting. For a period of 10 days prior to the special meeting, a complete list of stockholders of

record entitled to vote at the special meeting will be available upon request from our Corporate Secretary at 126 Valley Road,

Suite C, Glen Rock, New Jersey 07452 for inspection by stockholders for proper purposes. Such list will also be available upon

request during the special meeting at www.virtualshareholdermeeting.com/RSPI2020SM.

Due

to public health and safety concerns related to coronavirus (COVID-19), this Special Meeting of the Stockholders will be held

“virtually.” There is no physical location for this meeting. You will be able to attend the meeting, vote and submit

your questions during the meeting by visiting www.virtualshareholdermeeting.com/RSPI2020SM at the meeting date and time

described above and in the accompanying proxy statement and entering the 16-digit control number included in our notice of Internet

availability of the proxy materials, on your proxy card or in the instructions that accompanied your proxy materials. Guests may

attend, but will not be able to vote or ask questions. If you are a stockholder, you will be able to ask questions pertinent

to the agenda and will have the opportunity to vote during the meeting to the same extent as you would at an in-person meeting.

This

proxy statement and the accompanying form of proxy are being mailed to stockholders on or about [ ], 2020.

|

|

By

order of the Board of Directors,

|

|

|

|

|

|

Jeff

E. Margolis

|

|

|

Senior

Vice President, Chief Financial Officer, Treasurer and Secretary

|

Dated:

[ ], 2020

Important

Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting To Be Held on November 24, 2020. The

notice of meeting and this proxy statement is available at www.respirerx.com.

PRELIMINARY

PROXY STATEMENT—SUBJECT TO COMPLETION

RESPIRERX

PHARMACEUTICALS INC.

126

Valley Road, Suite C

Glen

Rock, New Jersey 07452

PROXY

STATEMENT FOR

SPECIAL

MEETING OF STOCKHOLDERS

This

proxy statement is furnished in connection with the solicitation of proxies by our Board of Directors for use at the Special Meeting

of Stockholders of RespireRx Pharmaceuticals Inc., a Delaware corporation (the “Company,” “we,” “us”

or “our”), to be held on November 24, 2020 or at any adjournment or postponement thereof, at the time and place and

for the purposes specified in the accompanying notice of special meeting.

All

properly delivered proxies pursuant to this solicitation, and not later revoked, will be voted at the special meeting in accordance

with the instructions given in the proxy. When voting regarding (i) the approval

of the amendment to our second restated certificate of incorporation to effect, at the discretion of our Board of Directors, a

ten-to-one (10:1) reverse stock split of the outstanding shares of all of the outstanding shares of our common stock, par value

$0.001 per share (the “Common Stock”) (“Proposal 1”), and (ii) the approval of the amendment to our second

restated certificate of incorporation to set the Company’s authorized shares of stock at two billion five million (2,005,000,000)

shares consisting of two billion (2,000,000,000) shares designated as Common Stock and five million (5,000,000) shares designated

as preferred stock, par value $0.001 per share (“Proposal 2” and together with Proposal 1, the “Proposals”),

and other terms to be determined at the discretion of the Board of Directors, stockholders may vote for or against

either Proposal or may abstain from voting. Stockholders should vote their shares on the proxy card we have provided.

If no choice is indicated, proxies that are signed and returned will be voted for the Proposal.

All

shares of our Common Stock represented by properly delivered and unrevoked proxies will be voted if such proxies are received

in time for the meeting.

QUORUM,

VOTE REQUIRED AND REVOCATION OF PROXIES

The

Board of Directors has established October 16, 2020 as the record date for the determination of stockholders entitled to notice

of and to vote at the special meeting. As of the record date, 577,842,003 shares of Common Stock and 37,500 shares of Series B

convertible preferred stock, par value $0.001 per share (“Series B Preferred Stock”), were outstanding. No other classes

of preferred stock were outstanding. The holders of Series B Preferred Stock are not eligible to vote at the Special Meeting of

Stockholders. The Common Stock is the only class of stock eligible to vote at the Special Meeting of Stockholders. Each share

of Common Stock is entitled to one vote on the Proposals. Based on the ownership of Common Stock as of the record date with respect

to the special meeting, holders of the Common Stock are entitled to cast all of the votes entitled to be cast. The presence, either

live at the virtual meeting or by proxy, of the holders of shares of Common Stock entitled to cast a majority of the votes that

could be cast at the special meeting by the holders of all outstanding shares of Common Stock entitled to vote at the meeting

is necessary to constitute a quorum.

Each

Proposal is subject to the approval of the holders of a majority in voting power of the outstanding Common Stock as of the record

date for the special meeting.

Brokers

holding shares of our Common Stock must vote according to specific instructions they receive from the beneficial owners of those

shares. If brokers do not receive specific instructions, your shares may be voted only with respect to so-called “routine”

matters where the broker has discretionary voting authority over your shares. Both Proposal 1 and Proposal 2 are “routine”

matters over which the broker will have discretionary voting authority if you do not return a signed proxy card.

“Broker

non-votes” are shares held in street name by brokers and other holders of record that are present or represented by proxy

at a stockholders meeting to vote on routine matters, but for which the beneficial owner has not provided the record holder with

instructions on how to vote on a non-routine matter. Because both Proposal 1 and Proposal 2 are routine matters, there will not

be any broker non-votes in respect of either proposal.

Abstentions

are counted as present in determining whether the quorum requirement is satisfied.

Any

holder of our Common Stock has the right to revoke his or her proxy at any time prior to the voting thereof at the special meeting

by (1) filing a written revocation with the Corporate Secretary of the Company prior to the voting of such proxy, (2) giving a

duly executed proxy bearing a later date, or (3) attending the special meeting and voting in person. Attendance by a stockholder

at the special meeting will not itself revoke his or her proxy. If you hold your shares in the name of a bank, broker or other

nominee, you should follow the instructions provided by your bank, broker or nominee in revoking your previously granted proxy.

COST

AND METHOD OF PROXY SOLICITATION

The

Company will bear the cost of the solicitation of proxies. In addition to solicitation by mail, our directors, officers and employees

may solicit proxies from stockholders by telephone, facsimile or electronic mail (e-mail), or in person. We

will supply banks, brokers, dealers and other custodian nominees and fiduciaries with proxy materials to enable them to

send a copy of such material by mail to each beneficial owner of shares of our Common Stock that they hold of record and will,

upon request, reimburse them for their reasonable expenses in doing so.

PROPOSAL

1 - APPROVAL OF AMENDMENT OF RESTATED CERTIFICATE OF INCORPORATION TO EFFECT REVERSE STOCK SPLIT

Our

Board of Directors has unanimously adopted a resolution declaring advisable, and recommending to our stockholders for their approval,

an amendment to Article Fourth of our second restated certificate of incorporation authorizing a ten-to-one (10:1) reverse stock

split of the outstanding shares of our Common Stock (the “Reverse Stock Split”). The Reverse Stock Split will not

impact authorized shares of Common Stock that are not issued and outstanding. The form of the proposed amendment is attached to

this proxy statement as Annex A (the “Proposed Amendment”), and the changes related to the Reverse Stock Split

appear in Section 2(ii). The Proposed Amendment will effectuate the Reverse Stock Split by reducing the number of outstanding

shares of Common Stock to approximately one-tenth (1/10) of the number of outstanding shares immediately prior to the effectiveness

of the Reverse Stock Split, but will not increase the par value of the Common Stock. Nor will this Proposed Amendment on its own

change the total number of authorized shares of capital stock of the Company. If implemented, the number of shares of our Common

Stock owned by each of our stockholders will be reduced by the same proportion as the reduction in the total number of shares

of our Common Stock outstanding, so that the percentage of our outstanding Common Stock owned by each of our stockholders immediately

prior to the Reverse Stock Split will remain approximately the same immediately following the Reverse Stock Split, except to the

extent that the Reverse Stock Split could result in some or all of our stockholders receiving cash in lieu of any fractional shares.

Reasons

for the Proposed Amendment

On

the date of the mailing of this proxy statement, our Common Stock was quoted on the OTCQB under the symbol “RSPI”.

The

purpose of the Reverse Stock Split is to decrease the total number of shares of our Common Stock outstanding and increase the

market price of our Common Stock. The bid price for the Common Stock of the Company has closed below $0.01 for more than 30 consecutive

calendar days and no longer meets the Standards for Continued Eligibility for OTCQB quotation as per the OTCQB Standards, Section

2.3(2), which requires a minimum closing bid price of $0.01 per share on at least one of the prior thirty consecutive calendar

days. Per Section 4.1 of the OTCQB Standards, the company was granted an extended cure period of 120 calendar days during which

the minimum closing bid price for the Company’s Common Stock must be at least $0.01 for ten consecutive trading days in

order to continue trading on the OTCQB marketplace, and such extension period was further extended to December 10, 2020. Without

undertaking the Reverse Stock Split, the Board of Directors does not currently anticipate that this requirement will be met

by such deadline, and therefore, the Board of Directors expects that the Company’s Common Stock will be delisted from the

OTCQB marketplace. The Reverse Stock Split is intended to raise the price of the Company’s Common Stock in order to permit

it to continue to trade on the OTCQB marketplace, which management and the Board of Directors believe is important to facilitate

the Company’s ability to raise additional equity capital to fund its operations and, in particular, its research and development

programs, including its ongoing and planned clinical trials. If the Reverse Stock Split is effected, we believe that we will be

able to meet the minimum closing bid requirement for ten consecutive trading days. If the Company is not able to meet this requirement,

it is likely that the Common Stock will be downgraded to the OTC Pink Market until the Common Stock trades above the minimum closing

bid price of $0.01 for ten consecutive trading days and satisfies any other conditions necessary for eligibility to be quoted

on the OTCQB.

The

Board of Directors has determined that it would be in the best interests of the Company to recommend to the Company’s stockholders

and, in accordance with all Company bylaws and all applicable law, to seek a vote of the Company’s stockholders to approve

an amendment to the Company’s Second Restated Certificate of Incorporation, as amended to date (the “Charter”),

to effect the Reverse Stock Split.

There

can be no assurance that the Reverse Stock Split, if implemented, will cause the market price of our Common Stock to rise in proportion

to the reduction in the number of outstanding shares resulting from the Reverse Stock Split, or that we can maintain such price

if obtained. It is also possible that other factors will prevent the continued quotation of our Common Stock on the OTCQB marketplace.

The

market price of our Common Stock is dependent upon our performance and other factors, many of which are unrelated to the number

of shares outstanding. If the Reverse Stock Split is effected and the market price of our Common Stock declines, the percentage

decline as an absolute number and as a percentage of our overall market capitalization may be substantially greater than would

occur in the absence of the Reverse Stock Split. Furthermore, the reduced number of shares that will be outstanding after the

Reverse Stock Split could significantly reduce the trading volume and otherwise adversely affect the trading market in and the

liquidity of our Common Stock.

Vote

Required and Board Recommendation

Approval

of the foregoing proposal requires the affirmative majority vote of all of the outstanding Common Stock. Abstentions will have

the same effect as a vote “against.”

Your

board of directors recommends a vote “FOR” approval of the amendment of the second restated certificate of

incorporation to effect the Reverse Stock Split.

PROPOSAL

2 - APPROVAL OF AMENDMENT OF RESTATED CERTIFICATE OF INCORPORATION TO INCREASE AUTHORIZED SHARES OF COMMON STOCK

Our

Board of Directors has unanimously adopted a resolution declaring advisable, and recommending to our stockholders for their approval,

an amendment to Article Fourth of our second restated certificate of incorporation authorizing an increase in the number of authorized

shares of Common Stock from 1,000,000,000 (one billion) to 2,00,000,000 (two billion). The form of Proposed Amendment is attached

to this proxy statement as Annex A, and the changes related to the increase in authorized share capital appear in Section

2(i).

Reasons

for the Proposed Amendment

The

purpose of the increase in authorized share capital is to: (i) ensure compliance with Common Stock reserve requirements of convertible

notes issued by the Company in May 2019 and in April, June and July of 2020, pursuant to which principal, interest and/or related

warrants with anti-dilution protections remain outstanding, (ii) provide for an adequate number of shares for the issuance of

up to $2,000,000 in shares of Common Stock pursuant to the Company’s put right under the Equity Purchase Agreement between

the Company and White Lion Capital, LLC (“White Lion”), dated as of July 28, 2020 (the “Equity Purchase Agreement”)

and (iii) provide for an adequate number of shares of Common Stock available for future capital raise transactions, including

pursuant to Regulation A under the Securities Act of 1933, as amended (the “Securities Act”).

Historically,

the Company has issued shares to settle debt, in connection with acquisitions, to pay compensation to its officers, directors,

consultants and advisors, and to secure additional capital. The Company may use its additional equity for any or all of these

purposes, or other purposes, in the future.

Vote

Required and Board Recommendation

Approval

of the foregoing proposal requires the affirmative majority vote of all of the outstanding Common Stock. Abstentions will have

the same effect as a vote “against.”

Your

board of directors recommends a vote “FOR” approval of the amendment of the second restated certificate of

incorporation to increase the Company’s authorized share capital.

EFFECTS

OF THE PROPOSED AMENDMENT

Pursuant

to the Reverse Stock Split, each holder of our Common Stock outstanding immediately prior to the effectiveness of the Reverse

Stock Split (“Old Common Stock”) will become the holder of fewer shares of our Common Stock (“New Common Stock”)

after consummation of the Reverse Stock Split. The Reverse Stock Split will not impact authorized shares of Common Stock that

are not issued and outstanding.

Although

the Reverse Stock Split will not, by itself, impact our assets, operations or prospects, the Reverse Stock Split could result

in a decrease in the aggregate market value of our Common Stock. The Board of Directors believes that this risk is outweighed

by the benefits of a maintaining the quotation of our Common Stock on the OTCQB marketplace.

If

effected, the Reverse Stock Split will result in some stockholders owning “odd-lots” of less than 100 shares of Common

Stock. Brokerage commissions and other costs of transactions in odd-lots are generally higher than the costs of transactions in

“round-lots” of even multiples of 100 shares.

Based

on 577,842,003 shares of our Common Stock outstanding as of the record date, the following table reflects an estimate of the approximate

number of shares of our Common Stock that would be outstanding as a result of the Reverse Stock Split.

|

Approximate

Number of Shares of Common Stock Outstanding before the Reverse Stock Split

|

|

Proposed

Ratio

|

|

Approximate

Number of Shares of Common Stock to be Outstanding after the Reverse Stock Split*

|

|

577,842,003

|

|

10:1

|

|

57,784,000

|

*A

small portion of the shares of Common Stock outstanding prior to the Reverse Stock Split shown above will be cashed out in the

Reverse Stock Split as fractional shares, as discussed elsewhere in this proxy statement. The exact number of shares will be calculated

as of the effective date of the Reverse Stock Split. As a result, the final number of shares outstanding after the Reverse Stock

Split is expected to be slightly less than the number shown above.

The

Reverse Stock Split will affect all stockholders equally and will not affect any stockholder’s proportionate equity interest

in the Company, except with respect to those stockholders that will receive cash in lieu of fractional shares. None of the rights

currently accruing to holders of our Common Stock will be affected by the Reverse Stock Split. Following the Reverse Stock Split,

each share of New Common Stock will entitle the holder thereof to one vote per share and will otherwise be identical to Old Common

Stock. The Reverse Stock Split, in itself, also will have no effect on the number of authorized shares of our Common Stock, but

Proposal 2, if approved and effected by the Company, will adjust the number of authorized shares of the Company. The shares of

New Common Stock will be fully paid and non-assessable.

We

are currently authorized to issue 1,000,000,000 shares of our Common Stock. As of the record date, there were 577,842,003

shares of our Common Stock issued and outstanding. Because only outstanding shares of Common Stock will be impacted by the Reverse

Stock Split, the number of authorized but unissued shares of our Common Stock will increase as a result of the Reverse Stock Split,

and the number of shares of our Common Stock issued and outstanding will be reduced substantially. As a result, the Reverse Stock

Split will effectively increase the number of authorized and unissued shares of our Common Stock available for future issuance.

With respect to the number of shares reserved for issuance under our 2014 Equity, Equity-Linked and Equity Derivative Incentive

Plan (the “2014 Plan”) and our 2015 Stock and Stock Option Plan (the “2015 Plan” and together with the

2014 Plan, the “Plans”), our Board of Directors will proportionately reduce such reserves in accordance with the terms

of the Plans. As of September 30, 2020, there were 15,635 shares of Common Stock reserved for issuances in respect of options

already granted and an additional 63,245 shares of Common Stock reserved for future awards under the 2014 Plan and 71,623,559

shares of Common Stock reserved for issuances in respect of options already granted and an additional 87,033,715 shares of Common

Stock reserved for future awards under the 2015 Plan. Following the Reverse Stock Split, if any, such reserve will be reduced

to 1,563 shares of Common Stock reserved for issuances related to options already granted and 6,324 reserved for future issuances

under the 2014 Plan, and approximately 7,162,355 shares of Common Stock reserved for issuances related to options already granted

and approximately 8,703,371 reserved for future issuances under the 2015 Plan. As of September 30, 2020, there were 251,011,402

shares of Common Stock contractually reserved for the conversion of convertible notes and related warrants, which is a multiple

of the number of shares into which such convertible notes and associated warrants would convert and exercise, respectively, as

of such date. In addition, there are 12,448,671 shares of Common Stock reserved for the exercise of other warrants as of September

30, 2020. Following the Reverse Stock Split, if any, such reserves will be reduced to approximately 151,992,000 and 1,244,867

shares of Common Stock, respectively. The reserves will not be reduced in the same proportion as the Reverse Stock Split because

certain of our outstanding instruments that are convertible or exercisable into Common Stock are silent as to adjustment of the

conversion or exercise price upon a reverse stock split. See “ --Effects on Outstanding Convertible Notes and Related Warrant.” The reserve requirements vary over time due to fluctuations in the price of our Common Stock and due to the expiration of

certain waivers of contractual reserve requirements on November 25, 2020.

If

the increase in authorized share capital is effected, the Company will be authorized to issue 2,000,000,000 shares of its Common

Stock. Assuming that the Reverse Stock Split is also effected, the Company will have approximately 1,942,216,000 authorized but

unissued shares of Common Stock, 1,908,704,000 of which are not reserved and are available for future issuance as described below.

The

Board of Directors will have the authority, subject to applicable securities laws, contractual restrictions and restrictions in

the Company’s organizational documents, to issue authorized and unissued shares, upon such terms and conditions as the Board

of Directors deems appropriate. Such future issuances include the issuance of up to $2,000,000 in shares of Common Stock pursuant

to the Company’s put right under the Equity Purchase Agreement and other future capital raise transactions, including pursuant

to Regulation A under the Securities Act.

The

Company has filed a registration statement on Form S-1 (the “Form S-1”) to register the resale of 115,000,000 of the

shares of Common Stock issuable pursuant to the put right described above. The Form S-1 was initially filed on October 14, 2020

and is not yet effective. The Company intends to file an amendment to the Form S-1 as soon as reasonably practical and intends

to immediately thereafter request acceleration of the effective date of the Form S-1. The Company intends to use any net proceeds

from the exercise of its put right related to the 115,000,000 shares registered on the Form S-1, although the Company may choose

to use the net proceeds differently, as follows:

|

|

●

|

To

manufacture, on a pilot scale, one or more new proprietary formulations of dronabinol with the enhanced properties described

in the Company’s patent applications, for which the Company would spend approximately $150,000 to bench test in vitro

several versions of dronabinol formulations in order to determine those with the best physico-chemical properties.

|

|

|

●

|

To

initiate clinical testing of the Company’s AMPAkines in the treatment of spinal cord injury (“SCI”), approximately

$145,000 of which would be utilized to assess the purity of the Company’s existing drug supplies and finalize a clinical

trial protocol for a Phase 2A clinical trial to determine the safety and pharmacokinetic (“PK”) properties of

one of the Company’s lead AMPAkines in patients who have had SCI.

|

|

|

●

|

Any

remaining balance of the net proceeds after investing in 1 and 2 above would be for general corporate purposes and partial

settlement of outstanding liabilities.

|

The

Company currently intends to use the net proceeds from any additional capital raise transactions as follows and to the extent

such amounts are available:

|

|

●

|

Approximately

$450,000 to $600,000 of these funds would be directed to the continued development of a proprietary formulation of dronabinol.

This development would include (i) improvements to the Company’s intellectual property position, (ii) improvements to

the Company’s dronabinol formulation’s PK profile, (iii) improvements to regulatory compliance, and (iv) expenditures

for the initial stocking of clinical supply, packaging and distribution in anticipation of a Phase 2 PK/PD clinical trial

and a pivotal Phase 3 clinical study. The Phase 2 PK/PD clinical trial and Phase 3 clinical study, however, would require

additional funds.

|

|

|

●

|

Continue

to focus on SCI, including: (i) an estimated spend of $200,000 for chemistry, manufacturing and controls (“CMC”)

efforts, depending on the assessment of our drug supplies, (ii) an estimated spend of $400,000 on an initial Phase 2A single

ascending dose safety and PK and pharmacodynamic (“PD”) study in human SCI patients, (iii) an estimated spend

of $600,000 on a Phase 2A multiple ascending dose safety and PK and PD study in SCI patients, and (iv) an estimated spend

of $650,000 on a Phase 2B efficacy study in SCI patients. Our anticipated spend for ADHD would be approximately $100,000 with

the larger spends occurring later dependent upon availability of financing.

|

|

|

●

|

Develop

the Company’s GABAkines program within the EndeavourRx neuromodulators platform. These efforts would be in preparation

of an IND to be submitted to the FDA to commence human studies of KRM-II-81, the Company’s lead GABAkine drug candidate,

for treatment-resistant epilepsy, and expenditures would include (i) an estimated spend of $530,000 for CMC efforts, (ii)

an estimated spend of $450,000 for pre-clinical pharmacology, safety and absorption, distribution, metabolism, excretion studies,

(iii) an estimated spend of $225,000 for animal safety studies and (iv) an estimated spend of $65,000 for regulatory consultants.

|

If

the Proposed Amendment is approved by our stockholders, the Board of Directors will have the discretion to implement both Proposals,

one but not the other Proposal or to not effect the Proposed Amendment at all. The Board of Directors currently intends to effect

both of the Proposals.

We

have not proposed either of the Proposals in response to any effort of which we are aware to accumulate our shares of Common Stock

or to facilitate any party obtaining control of the Company, nor is it a plan by management to recommend a series of similar actions

to our Board of Directors or our stockholders. Notwithstanding the decrease in the number of outstanding shares of Common Stock

following the Reverse Stock Split, our Board of Directors does not intend for this transaction to be the first step in a “going

private transaction” within the meaning of Rule 13e-3 of the Securities Exchange Act of 1934 (the “Exchange Act”).

In addition, we have not proposed the Proposals to increase the authorized share capital with the intention of using the additional

shares for anti-takeover purposes, although we could theoretically use the additional shares to make more difficult or to discourage

an attempt to acquire control of the Company.

We

do not believe that our officers or directors have interests in either Proposal that are different from or greater than those

of any other of our stockholders, other than permitting there to be a sufficient number of authorized shares of Common Stock

to continue to compensate our officers and directors in part with equity, as we have done in the past. Other than due to the immaterial

effects of the Company paying cash in lieu of issuing fractional shares, we believe that the percentage ownership by management

will not change materially after effecting the Proposed Amendment.

Effects

on Outstanding Stock Options and Warrants to Purchase Common Stock

If

the Reverse Stock Split is effected, all outstanding stock options and other than as described below under “Effects on

Outstanding Convertible Notes and Related Warrant,” all outstanding warrants entitling their holders to purchase shares

of our Common Stock will be proportionately reduced by our Board of Directors and/or by their terms in the same ratio as the reduction

in the number of shares of outstanding Common Stock, except that any fractional shares resulting from such reduction will be rounded

down to the nearest whole share to comply with the requirements of the Internal Revenue Code of 1986, as amended (the “Code”),

Section 409A. Correspondingly, the per share exercise price of such stock options will be increased in direct proportion to the

Reverse Stock Split ratio, so that the aggregate dollar amount payable for the purchase of the shares subject to the stock options

and warrants will remain unchanged. For example, assuming that we effect the Reverse Stock Split and that an optionee holds stock

options to purchase 1,000 shares of our Common Stock at an exercise price of $1.00 per share, upon the effectiveness of the Reverse

Stock Split, the number of shares of the Common Stock subject to that option would be reduced to 100 and the exercise price would

be proportionately increased to $10.00 per share. Holders of outstanding stock options and warrants to purchase shares of Common

Stock do not have any rights of Common Stockholders, including voting rights, until such stock options or warrants are exercised

and the underlying common shares are issued. Stock options and warrants to purchase shares of Common Stock do not have the right

to receive cash under any circumstances.

Effects

on Outstanding Convertible Notes and Related Warrant

If

the Reverse Stock Split is effected, five of the Company’s six outstanding convertible notes provide that the number of shares

of Common Stock into which the convertible notes are convertible would be proportionately adjusted to account for the Reverse Stock

Split. The convertible note held by White Lion with a principal amount of $40,000 is silent as to adjustment of the conversion

price in the case of a reverse stock split. The conversion price is fixed at $0.02 per share. Such note does, however, restrict

conversion that would result in White Lion beneficially owning more than 9.99% of the Company’s outstanding Common Stock.

The

one outstanding warrant issued in connection with one of the Company's convertible notes is silent as to adjustment of the exercise

price in the case of a reverse stock split. The exercise price is $0.0016. Such warrant does, however, restrict exercises that

would result in the holder beneficially owning more than 4.99% of the Company's outstanding Common Stock.

Accounting

Matters

The

par value per share of the Common Stock will remain unchanged at $0.001 per share after the Reverse Stock Split. As a result,

on the effective date of the Reverse Stock Split, if any, the stated capital on our balance sheet attributable to the Common Stock

will be reduced proportionately based on the ten-to-one (10:1) Reverse Stock Split ratio, from its present amount, and the additional

paid-in capital account will be increased by the amount by which the stated capital is reduced. After the Reverse Stock Split,

net income or loss per share and other per share amounts will be increased because there will be fewer shares of our Common Stock

outstanding. In addition, other than as a result of paying cash in lieu of issuing fractional shares, the Reverse Stock Split

will not impact the total amount of stockholder’s equity on the Company’s balance sheet. In future financial statements,

net income or loss per share and other per share amounts for all periods ending before the Reverse Stock Split will be restated

to give retroactive effect to the impact of the Reverse Stock Split.

The

number of shares of authorized but unissued Common Stock reported in our consolidated financial statements and the notes related

thereto will increase as a result of both (1) the decrease in the number of shares of Common Stock that are issued and outstanding

due to the Reverse Stock Split contemplated by Proposal 1 and (2) the increase in the number of authorized shares contemplated

by Proposal 2.

As

described above under “Effects of the Reverse Stock Split on Outstanding Stock Options and Warrants to Purchase Common Stock,”

the per share exercise price of outstanding stock option awards and warrants would increase proportionately, and the number of

shares of our Common Stock issuable upon the exercise of outstanding stock options and warrants would decrease proportionately,

in each case based on the ten-to-one (10:1) Reverse Stock Split ratio. The Company does not anticipate that the Reverse Stock

Split will have a material effect (other than those described above) on the Company’s results of operations, from a cash,

revenue, expense or profitability perspective, or that any other accounting consequences would arise as a result of the Reverse

Stock Split.

An

increase in the number of authorized shares of Common Stock pursuant to Proposal 2 may increase the Company’s Delaware Franchise

Tax.

Shares

of Common Stock Issued and Outstanding

With

the exception of the number of shares issued and outstanding, the rights and preferences of the shares of our Common Stock prior

and subsequent to the Reverse Stock Split and the increase in authorized share capital will remain the same. We do not anticipate

that our financial condition, the percentage ownership of management, or any aspect of our business or operations would materially

change as a result of these actions. Any of our stockholders holding fewer than 10 shares of Common Stock will cease be a stockholder

of the Company as a result of the payment of cash in lieu of issuing fractional shares.

Our

Common Stock is currently registered under Section 12(g) of the Exchange Act, and as a result, we are subject to the periodic

reporting and other requirements of the Exchange Act. If effected, the Proposed Amendment will not affect the registration of

our Common Stock under the Exchange Act or our periodic or other reporting requirements thereunder.

Effectiveness

of the Proposed Amendment

The

Proposed Amendment, if approved by our stockholders, will become effective upon the filing with the Secretary of State of the

State of Delaware of a certificate of amendment to our second restated certificate of incorporation, as amended, in substantially

the form of the Proposed Amendment attached to this proxy statement as Annex A. The exact timing of the filing of the Proposed

Amendment will be determined by the Board of Directors based upon its evaluation of when such action will be most advantageous

to the Company and our stockholders. The Board of Directors reserves the right, notwithstanding stockholder approval and without

further action by our stockholders, to elect not to proceed with the Proposed Amendment, in whole or in part, if, at any time

prior to filing the Proposed Amendment, the Board of Directors, in its sole discretion, determines that it is no longer in the

best interests of the Company and our stockholders. The Board of Directors currently intends to effect the Proposed Amendment

unless it determines that doing so would not have the desired effect of supporting the continued quotation of our Common Stock

on the OTCQB and the other desired effects described in “Reasons for the Proposed Amendment” under each of Proposal

1 and Proposal 2 above.

Assuming

both Proposals are approved by the stockholders, the Board of Directors intends to effect the amendment, or abandon it, within

sixty days of the date of the Special Meeting.

Effect

on Registered and Beneficial Stockholders

Upon

the effectiveness of the Reverse Stock Split, the Company intends to treat stockholders holding shares of our Common Stock in

“street name” (that is, held through a bank, broker or other nominee) in the same manner as stockholders of record

whose shares of Common Stock are registered in their names. Banks, brokers or other nominees will be instructed to effect the

Reverse Stock Split for their beneficial holders holding shares of our Common Stock in “street name;” however, these

banks, brokers or other nominees may apply their own specific procedures for processing the Reverse Stock Split. If you hold your

shares of our Common Stock with a bank, broker or other nominee, and have any questions in this regard, the Company encourages

you to contact your nominee directly.

Effect

on “Book-Entry” Stockholders of Record

The

Company’s stockholders of record may hold some or all of their shares electronically in book-entry form. These stockholders

will not have stock certificates evidencing their ownership of our Common Stock; however, they are provided with a statement reflecting

the number of shares of Common Stock registered in their accounts.

If

you hold registered shares of Old Common Stock in a book-entry form, you do not need to take any action to receive your shares

of New Common Stock in registered book-entry form, if applicable. A transaction statement will automatically be sent to your address

of record as soon as practicable after the effective time of the Reverse Stock Split indicating the number of shares of New Common

Stock you hold, and, if applicable, payment with respect to any fractional shares will be deposited directly into your account

with the organization holding your shares.

Effect

on Registered Certificated Shares

Some

stockholders of record hold their shares of our Common Stock in certificate form or a combination of certificate and book-entry

form. If any of your shares of our Common Stock are held in certificate form, you will be sent a transmittal letter by the Company

or the Company’s transfer agent as soon as practicable after the effective time of the Reverse Stock Split, if any. The

transmittal letter will be accompanied by instructions specifying how to exchange your certificate representing the Old Common

Stock for a statement of holding or a certificate of New Common Stock and, if applicable, payment with respect to any fractional

shares, which will be made by check.

STOCKHOLDERS

SHOULD NOT DESTROY ANY SHARE CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL ADVISED TO DO SO.

Fractional

Shares

Fractional

shares will not be issued in connection with the Reverse Stock Split. Any fractional shares resulting from the Reverse Stock Split

will not be issued but will be paid out in cash (without interest or deduction) in an amount equal to the number of shares exchanged

into such fractional share multiplied by the simple average of the closing trading price of our Common Stock on the OTCQB for

the five trading days immediately before the certificate of amendment effecting the Reverse Share Split is filed with the Delaware

Secretary of State.

If

a stockholder who holds shares in certificated form is entitled to a payment in lieu of any fractional share interest, the stockholder

will receive a check as soon as practicable after the effective time and after the stockholder has submitted an executed letter

of transmittal and surrendered all stock certificates, as described above in “Effect on Registered Certificated Shares.”

Stockholders who hold shares of Common Stock with a broker, bank or other nominee should contact their broker, bank or other nominee

for information on the treatment and processing of fractional shares. By signing and cashing the check, stockholders will warrant

that they owned the shares of Common Stock for which they received a cash payment. The cash payment is subject to applicable federal

and state income tax and state abandoned property laws. Stockholders will not be entitled to receive interest for the period of

time between the effective time and the date payment is received.

As

a result of the Reverse Stock Split, holders of fewer than 10 shares of Common Stock would be eliminated as stockholders of the

Company as a result of the payment of cash in lieu of issuing fractional shares.

Appraisal

Rights

Under

the Delaware General Corporation Law, our stockholders are not entitled to appraisal or dissenter’s rights with respect

to the Proposed Amendment, and we will not independently provide our stockholders with any such rights.

Certain

Federal Income Tax Consequences

The

following is a discussion of certain material U.S. federal income tax consequences of the Reverse Stock Split to U.S. holders

(as defined below). This discussion is included for general information purposes only and does not purport to address all aspects

of U.S. federal income tax law that may be relevant to U.S. holders in light of their particular circumstances. This discussion

is based on the Code and current Treasury regulations, administrative rulings and court decisions, all of which are subject to

change, possibly on a retroactive basis, and any such change could affect the continuing validity of this discussion.

STOCKHOLDERS

ARE URGED TO CONSULT THEIR TAX ADVISORS AS TO THE PARTICULAR FEDERAL, STATE, LOCAL, OR FOREIGN TAX CONSEQUENCES TO THEM OF THE

REVERSE STOCK SPLIT.

This

discussion does not address tax consequences to stockholders that are subject to special tax rules, such as banks, insurance companies,

regulated investment companies, personal holding companies, U.S. holders whose functional currency is not the U.S. dollar, partnerships

(or other flow-through entities for U.S. federal income purposes and their partners or members), persons who acquired their shares

in connection with employment or other performance of services, broker-dealers, foreign entities, nonresident alien individuals

and tax-exempt entities. This summary also assumes that the Old Common Stock shares were, and the New Common Stock shares will

be, held as a “capital asset,” as defined in Section 1221 of the Code.

As

used herein, the term “U.S. holder” means a holder that is, for U.S. federal income tax purposes:

|

|

●

|

an

individual citizen or resident of the United States;

|

|

|

●

|

a

corporation or other entity taxed as a corporation created or organized in or under the laws of the United States or any political

subdivision thereof;

|

|

|

●

|

an

estate the income of which is subject to U.S. federal income tax regardless of its source; or

|

|

|

●

|

a

trust (A) if a U.S. court is able to exercise primary supervision over the administration of the trust and one or more “U.S.

persons” (as defined in the Code) have the authority to control all substantial decisions of the trust or (B) that has

a valid election in effect to be treated as a U.S. person.

|

The

Company has not sought and will not seek an opinion of counsel or a ruling from the Internal Revenue Service regarding the federal

income tax consequences of the Reverse Stock Split. The state and local tax consequences of the Reverse Stock Split may vary as

to each stockholder, depending on the jurisdiction in which such stockholder resides. This discussion should not be considered

as tax or investment advice, and the tax consequences of the Reverse Stock Split may not be the same for all stockholders. Stockholders

should consult their own tax advisors to know their individual federal, state, local and foreign tax consequences.

Other

than with respect to any stockholder that receives cash in lieu of any fractional share, a stockholder generally will not recognize

a gain or loss by reason of such stockholder’s receipt of shares of New Common Stock pursuant to the Reverse Stock Split

solely in exchange for shares of Old Common Stock held by such stockholder immediately prior to the Reverse Stock Split. A stockholder’s

aggregate tax basis in the shares of New Common Stock received pursuant to the Reverse Stock Split (including any fractional shares)

will equal the stockholder’s aggregate basis in the Old Common Stock exchanged therefore and will be allocated among the

shares of New Common Stock received in the Reverse Stock Split on a pro-rata basis. Stockholders who have used the specific identification

method to identify their basis in the shares of Old Common Stock held immediately prior to the Reverse Stock Split should consult

their own tax advisers to determine their basis in the shares of New Common Stock received in exchange therefor in the Reverse

Stock Split. A stockholder’s holding period in the shares of New Common Stock received pursuant to the Reverse Stock Split

will include the stockholder’s holding period in the shares of Old Common Stock surrendered in exchange therefore, provided

the shares of Old Common Stock surrendered are held as capital assets at the time of the Reverse Stock Split.

In

general, a stockholder who receives cash in lieu of a fractional share of New Common Stock pursuant to the Reverse Stock Split

should be treated for U.S. federal income tax purposes as having received a fractional share pursuant to the Reverse Stock Split

and then as having received cash in exchange for the fractional share and should generally recognize capital gain or loss equal

to the difference between the amount of cash received and the stockholder’s tax basis allocable to the fractional share.

Any capital gain or loss will generally be long term capital gain or loss if the stockholder’s holding period in the fractional

share is greater than one year as of the effective date of the Reverse Stock Split. Stockholders should consult their own tax

advisors regarding the tax effects to them of receiving cash in lieu of fractional shares based on their particular circumstances.

No

gain or loss will be recognized by us for federal income tax purposes as a result of the Reverse Stock Split.

This

section does not address, and the Company makes no representations regarding, any state, local or foreign tax law consequences.

As mentioned above, you are urged to consult your tax advisor regarding these potential tax consequences.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNER AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

Beneficial

Ownership of Common Stock

The

following table sets forth certain information regarding the beneficial ownership of the Company’s Common Stock as of September

30, 2020, by (i) each person known by the Company to be the beneficial owner of more than 5% of the outstanding Common Stock,

(ii) each of the Company’s directors, (iii) each of the Company’s named executive officers, and (iv) all of the Company’s

executive officers and directors as a group. For purposes of this calculation, the Company has used the number of shares of Common

Stock outstanding on September 30, 2020 of 577,842,303. Except as indicated in the footnotes to this table, the Company believes

that the persons named in this table have sole voting and investment power with respect to the shares of Common Stock indicated.

In computing the number and percentage ownership of shares beneficially owned by a person, shares of Common Stock that a person

has a right to acquire within sixty (60) days of September 30, 2020 pursuant to stock options, warrants or other rights are considered

as outstanding, while these shares are not considered as outstanding for computing the percentage ownership of any other person

or group. Except as otherwise indicated, the address of each beneficial owner is c/o RespireRx Pharmaceuticals Inc., 126 Valley

Road, Suite C, Glen Rock, New Jersey 07452.

|

|

|

Shares Beneficially Owned

|

|

|

Directors, Officers and 5% Stockholders

|

|

Number

|

|

|

Percentage

|

|

|

|

|

|

|

|

|

|

|

Arnold Lippa Family Trust of 2007

|

|

|

225,213,997

|

(a)

|

|

|

32.71

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Jeff Margolis Trusts

|

|

|

209,026,631

|

(b)

|

|

|

30.72

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Directors and Officers:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jeff E. Margolis

|

|

|

209,026,631

|

(b)

|

|

|

30.72

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Arnold S. Lippa, Ph.D.

|

|

|

1,416

|

(c)

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

Timothy Jones

|

|

|

25,818,126

|

(d)

|

|

|

4.31

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Kathryn MacFarlane

|

|

|

12,640,421

|

(e)

|

|

|

2.14

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Richard Purcell

|

|

|

5,263,077

|

(f)

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

David Dickason

|

|

|

2,000,000

|

(g)

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

All directors and current executive officers as a group (6 persons)

|

|

|

254,749,671

|

|

|

|

50.03

|

%

|

|

*

|

Less

than 1%.

|

|

(a)

|

All

of these holdings were acquired by Dr. Arnold Lippa and subsequently transferred to the Trust, or are held by an entity owned

by the Trust. Dr. Lippa is neither the trustee nor the beneficiary of the Trust. Linda Lippa, his wife, is a beneficiary of

the Trust. Included in the total are 109,786,458 warrants to purchase an equal number of shares of common stock ignoring any

blocker provisions that may prevent exercise, resulting from the conversion of the trust’s Series H Preferred Stock

options to acquire an additional 810,365 shares of Common Stock.

|

|

(b)

|

All

of these holdings were acquired by Mr. Margolis and subsequently transferred to six family trusts. Mr. Margolis’ wife

is the trustee of three trusts. Mr. Margolis is the trustee of three trusts. Mr. Margolis is not a beneficiary of any of the

trusts for which his wife is trustee. Mr. Margolis is the beneficiary of one trust of which he is also the trustee. The one

trust of which Mr. Margolis is both the beneficiary and the trustee owns 3,076 shares of common stock and 43,076 options.

All other shares of common stock, options warrants are owned by one or more of the other five trusts. In the aggregate, the

holdings of the trusts include: (i) 106,451,947 shares of Common Stock, (ii) options to acquire an additional 664,457 shares

of Common Stock, (iii) warrants exercisable into 101,905,382 shares of Common Stock , resulting from the conversion of the

trusts’ Series H Preferred Stock on September 30, 2020 (iv) the 4,845 warrants to purchase shares of common received

as an owner of Aurora Capital LLC from the warrants Aurora received as a placement agent in the sale of the Company’s

Common Stock and Warrant Financing.

|

|

(c)

|

Dr.

Lippa’s holdings include: (i) 598 shares of Common Stock, and (ii) 818 warrants to purchase shares of Common Stock.

In addition, Dr. Lippa no longer beneficially owns many of the shares of the Company that were initially awarded to him because

he has transferred these shares into family trusts, of which he is neither the trustee nor the beneficiary, including the

Arnold Lippa Family Trust of 2007 as noted in footnote (a) above. In addition, Dr. Lippa has been awarded options to acquire

an additional 15,385 shares of Common Stock which have been assigned to another family trust for the benefit of other family

members. Dr. Lippa is neither the trustee nor the beneficiary of that trust.

|

|

(d)

|

Timothy

Jones was appointed to the Board on January 28, 2020. Mr. Jones was appointed President and Chief Executive Officer on May

6, 2020. Mr. Jones owns 4,409,063 shares of Common Stock resulting from the conversion of Mr. Jones’ Series H Preferred

Stock and also owns options exercisable into 17,000,000 shares of Common Stock.

|

|

(e)

|

Dr.

MacFarlane’s holdings include: (i) 6,154 shares of Common Stock, and (ii) options to purchase 12,634,267 shares of Common

Stock.

|

|

(f)

|

Mr.

Purcell’s holdings include: (i) 6,154 shares of Common Stock, and (ii) options to purchase 5,256,923 shares of Common

Stock.

|

|

(g)

|

Mr.

Dickason’s holdings include options to purchase 2,000,000 shares of Common Stock.

|

The

Company is not aware of any arrangements that may at a subsequent date result in a change of control of the Company.

ADDITIONAL

INFORMATION

Discretionary

Voting of Proxies on Other Matters

Management

does not intend to bring before the special meeting any matters other than those disclosed in the notice of special meeting of

stockholders attached to this proxy statement, and it does not know of any business that persons other than management intend

to present at the meeting. If any other matters are properly presented at the special meeting for action, the persons named in

the form of proxy and acting thereunder generally will have discretion to vote on those matters in accordance with their best

judgment.

Delivery

of Documents to Security Holders Sharing an Address

The

Company will deliver only one copy of this Proxy Statement to multiple stockholders sharing an address unless the Company has

received contrary instructions from one or more of the stockholders. The Company undertakes to deliver promptly upon written or

oral request a separate copy of the Proxy Statement to a stockholder at a shared address to which a single copy of the Proxy Statement

is delivered. A stockholder can notify us that the stockholder wishes to receive a separate copy of the Proxy Statement by contacting

the Company at: RespireRx Pharmaceuticals Inc., 126 Valley Road, Suite C, Glen Rock, New Jersey 07452, Attention: Corporate Secretary,

or by phone at (201) 444-4947. If multiple stockholders sharing an address receive multiple Proxy Statements and wish to receive

only one, such stockholders can notify the Company at the address set forth above.

Annex

A

Fourth

Certificate of Amendment of

Second

Restated Certificate of Incorporation of

RespireRx

Pharmaceuticals Inc.

RespireRx

Pharmaceuticals Inc. (the “Corporation”), a corporation organized and existing under the General Corporation Law of

the State of Delaware (the “DGCL”), hereby adopts this Fourth Certificate of Amendment (this “Certificate of

Amendment”), which amends its Second Restated Certificate of Incorporation (as amended by the Certificates of Designation,

Preferences, Rights and Limitations filed March 14, 2014 and July 13, 2020, as amended on September 30, 2020, the Certificate

of Amendment filed April 17, 2014, the Second Certificate of Amendment filed December 16, 2015 and the Third Certificate of Amendment

filed September 1, 2016, the “Certificate of Incorporation”), as described below, and does hereby further certify

that:

|

|

1.

|

The

Board of Directors of the Corporation duly adopted a resolution proposing and declaring advisable the amendment to the Certificate

of Incorporation described herein, and the Corporation’s stockholders duly adopted such amendment, all in accordance

with the provisions of Section 242 of the DGCL.

|

|

|

|

|

|

|

2.

|

Article

Fourth of the Certificate of Incorporation is hereby amended by:

|

(i)

amending and restating paragraph (A)(1) of such article in its entirety as follows:

FOURTH:

(A)(1) - AUTHORIZED CAPITAL. The total number of shares of capital stock which the Corporation has the authority to issue is two

billion five million (2,005,000,000) consisting of two billion (2,000,000,000) shares of common stock, $0.001 par value per share

(“Common Stock”), and five million (5,000,000) shares of preferred stock, $0.001 par value per share.

(ii)

adding the following paragraph to succeed paragraph (A)(2) of such article and to precede current paragraph (A)(3) of such article:

(3)

Effective as of the close of business, Eastern Time, on the date of filing of this Certificate of Amendment with the Secretary

of State of the State of Delaware (the “Effective Time”), each ten (10) outstanding shares of the Corporation’s

Common Stock shall automatically and without any action on the part of the respective holders thereof be exchanged and combined

into one (1) share of Common Stock. No fractional shares shall be issued in connection with the exchange. Any fractional shares

resulting from the reverse stock split will not be issued but will be paid out in cash (without interest or deduction) in an amount

equal to the number of shares exchanged into such fractional share multiplied by the average closing trading price of our Common

Stock on the OTCQB for the five trading days immediately before the Effective Time.”

and

(iii), changing the paragraph number at the beginning of paragraph (A)(3) from “(3)” to “(4)”.

|

|

3.

|

All

other provisions of the Certificate of Incorporation shall remain in full force and effect.

|

|

|

By:

|

|

|

|

Name:

|

Jeff

Margolis

|

|

|

Title:

|

Senior

Vice President, Chief Financial Officer,

Treasurer

and Secretary

|

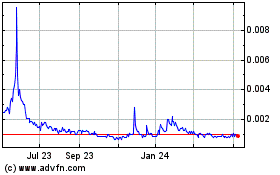

RespireRx Pharmaceuticals (PK) (USOTC:RSPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

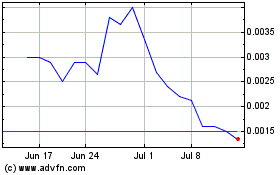

RespireRx Pharmaceuticals (PK) (USOTC:RSPI)

Historical Stock Chart

From Apr 2023 to Apr 2024