UnitedHealth Profit Declines, Reflecting Return to More Usual Health-Care Levels

October 14 2020 - 12:37PM

Dow Jones News

By Anna Wilde Mathews and Matt Grossman

UnitedHealth Group Inc.'s profit declined after outsize results

in the previous quarter, as health care returned closer to normal

levels after a dramatic pandemic-related pause in the spring and

early summer.

Minnetonka, Minn.-based UnitedHealth, the parent of the largest

U.S. insurer, UnitedHealthcare, as well as a sprawling

health-services arm under the Optum name, said its third-quarter

results were affected by the cost of efforts to help customers. The

company pointed to waivers of copayments for Medicare Advantage

enrollees and some premium discounts. UnitedHealth and other

insurers have come under pressure from some regulators and

lawmakers to disburse some of the profit they realized from the

falloff in routine health care earlier this year.

The company logged a continued decline in commercial membership,

to 26.35 million in the third quarter from 25.77 million in the

second quarter and 27.84 million in the year-ago period, reflecting

the loss of some employer-based insurance during the economic

downturn.

UnitedHealth said it had seen declines in sectors including

transportation, hospitality and energy. But it said it didn't

believe growing enrollment in its Medicaid plans stemmed from

people signing up after job losses.

The company reported third-quarter net income of $3.17 billion,

or $3.30 a share, compared with $3.54 billion, or $3.67 a share, in

the same three-month period a year earlier.

In the second quarter of 2020, UnitedHealth posted net income of

$6.64 billion, or $6.91 a share, and adjusted earnings were $7.12 a

share.

On an adjusted basis, UnitedHealth's third-quarter profit was

$3.51 a share. Analysts surveyed by FactSet had forecast an

adjusted profit of $3.11 a share. Revenue was $65.12 billion, up

7.9% from $60.35 billion in last year's third quarter.

In the spring and early summer, UnitedHealth's insurance unit

benefited financially from cost savings as it paid for fewer doctor

visits, surgeries and hospital stays this spring and early in the

summer. Hospitals and other health-care providers stopped many

procedures as they braced for surges of coronavirus patients, and

many Americans steered clear of clinics and emergency rooms.

Hospital inpatient costs and other types of care picked back up

in the quarter. Health-care activity was at more than 95% of

typical baseline rates, UnitedHealth said. The insurance unit's

medical-loss ratio, or the share of premiums paid out in claims,

was 81.9% in the third quarter, compared with 70.2% in the

second.

UnitedHealth raised its guidance for full-year adjusted 2020

earnings to a range $16.50 to $16.75 a share, from $16.25 to $16.55

previously.

Write to Anna Wilde Mathews at anna.mathews@wsj.com and Matt

Grossman at matt.grossman@wsj.com

(END) Dow Jones Newswires

October 14, 2020 12:22 ET (16:22 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

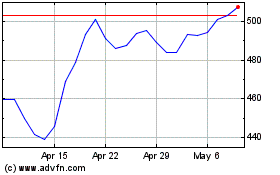

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Apr 2023 to Apr 2024