Table of Contents

As filed with the Securities and Exchange

Commission on October 5, 2020

Registration No. 333-______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

IIOT-OXYS,

INC.

(Exact name of registrant as specified

in its charter)

|

Nevada

|

|

7372

|

|

56-2415252

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Primary Standard

Classification Code)

|

|

(IRS Employer

Identification No.)

|

705 Cambridge Street

Cambridge, MA 02141

Telephone: (401) 307-3092

(Address, including

zip code, and telephone number, including area code,

of registrant’s

principal executive offices)

Clifford L.

Emmons

Chief Executive

Officer

IIOT-OXYS, Inc.

705 Cambridge Street

Cambridge, MA 02141

Telephone: (401) 307-3092

(Name, address,

including zip code, and telephone number, including area code, of agent for service)

Copy to:

Business Legal

Advisors, LLC

14888 Auburn

Sky Drive

Draper, UT 84020

Approximate

date of commencement of proposed sale to the public:

As soon as practicable

after the effective date of this Registration Statement.

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, check the following box. [X]

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the

same offering. [ ]

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If

this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

Large accelerated filer

|

[ ]

|

|

Accelerated filer

|

[ ]

|

|

Non-accelerated filer

|

[X]

|

|

Smaller reporting company

|

[X]

|

|

|

|

|

Emerging growth company

|

[X]

|

|

|

|

|

|

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. [ ]

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities to be registered

|

|

Amount To Be Registered(1)

|

|

|

Proposed Maximum Offering Price Per Share(2)

|

|

|

Proposed Maximum Aggregate Offering Price

|

|

|

Amount of Registration Fee(3)

|

|

|

Common Stock, $0.001 par value

|

|

|

18,000,000

|

|

|

$

|

0.0105

|

|

|

$

|

189,000

|

|

|

$

|

20.62

|

|

|

Total:

|

|

|

18,000,000

|

|

|

|

0.0105

|

|

|

$

|

189,000

|

|

|

$

|

20.62

|

|

|

|

(1)

|

In accordance with Rule 416(a), this registration statement shall also cover an indeterminate number

of shares that may be issued and resold resulting from stock splits, stock dividends or similar transactions

|

|

|

(2)

|

Estimated pursuant to Rule 457(c) under the Securities Act of 1933, as amended (the “Securities

Act”), based on the average of the closing prices as reported on the OTCQB within 5 business days prior to the date of

the filing of this Registration Statement.

|

|

|

(3)

|

The fee is calculated at a rate of $109.10 per million dollars, pursuant to Section 6(b) of the

Securities Act.

|

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment

which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities

and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this

preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed

with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion. Dated

October 5, 2020.

PRELIMINARY PROSPECTUS

IIOT-OXYS, INC.

18,000,000 Shares of Common Stock

The selling stockholder identified in this

Prospectus may offer an indeterminate number of shares of its common stock, which will consist of up to 18,000,000 shares of common

stock to be sold by GHS Investments LLC (“GHS”) pursuant to an Equity Financing Agreement (the “Equity

Financing Agreement”) dated July 29, 2020. If issued presently, the 18,000,000 shares of common stock registered for

resale by GHS would represent 11.26% of our issued and outstanding shares of common stock as of September 25, 2020. Additionally,

the 18,000,000 shares of our common stock registered for resale herein would represent approximately 14.08% of the Company’s

public float (all current free-trading shares).

The selling stockholder may sell all or

a portion of the shares being offered pursuant to this Prospectus at fixed prices and prevailing market prices at the time of sale,

at varying prices, or at negotiated prices. See the section of this Prospectus entitled “Plan of Distribution” for

additional information.

We will not receive any proceeds from the

sale of the shares of our common stock by GHS. We will sell shares to GHS at a price equal to 80% of the lowest traded price of

our common stock during the ten consecutive trading day period preceding the date on which we deliver a put notice to GHS (the

“Purchase Price”). There will be a minimum of ten trading days between put notices.

GHS is an underwriter within the meaning

of the Securities Act and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters”

within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts

under the Securities Act.

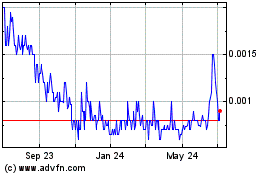

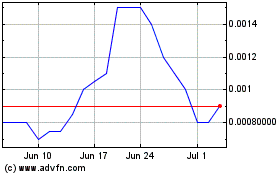

Our common stock is traded on OTCQB Markets

under the symbol “ITOX.” On September 25, 2020, the reported closing price for our common stock was $0.0103 per share.

This offering is highly speculative,

and these securities involve a high degree of risk and should be considered only by persons who can afford the loss of their entire

investment. See “Risk Factors” beginning on page 8. Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of

this Prospectus. Any representation to the contrary is a criminal offense.

The date of this Prospectus is October 5,

2020.

TABLE OF CONTENTS

You may only rely on the information

contained in this Prospectus or that we have referred you to. We have not authorized any person to give you any supplemental information

or to make any representations for us. This Prospectus does not constitute an offer to sell or a solicitation of an offer to buy

any securities other than the Common Stock offered by this Prospectus. This Prospectus does not constitute an offer to sell or

a solicitation of an offer to buy any Common Stock in any circumstances in which such offer or solicitation is unlawful. Neither

the delivery of this Prospectus nor any sale made in connection with this Prospectus shall, under any circumstances, create any

implication that there has been no change in our affairs since the date of this Prospectus is correct as of any time after its

date. You should not rely upon any information about our company that is not contained in this Prospectus. Information contained

in this Prospectus may become stale. You should not assume the information contained in this Prospectus or any Prospectus supplement

is accurate as of any date other than their respective dates, regardless of the time of delivery of this Prospectus, any Prospectus

supplement or of any sale of the shares. Our business, financial condition, results of operations, and Prospects may have changed

since those dates. The selling stockholders are offering to sell and seeking offers to buy shares of our common stock only in jurisdictions

where offers and sales are permitted.

PROSPECTUS SUMMARY

This summary

highlights information contained elsewhere in this Prospectus and does not contain all of the information that you should consider

in making your investment decision. Before investing in our common stock, you should carefully read this entire Prospectus, including

our financial statements and the related notes and the information set forth under the headings “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” in each case included

elsewhere in this Prospectus.

Unless the

context otherwise requires, references to “we,” “our,” “us,” or the “Company” in

this Prospectus mean IIOT-OXYS, Inc. on a consolidated basis with its wholly-owned subsidiaries.

IIOT-OXYS, Inc., a Nevada corporation

(the “Company”), and OXYS, were originally established for the purposes of designing, building, testing,

and selling Edge Computing systems for the Industrial Internet. Both companies were, and presently are, early stage

technology startups that are largely pre-revenue in their development phase. HereLab is also an early-stage

technology development company. The Company received its first revenues in the last quarter of 2017, continued to realize

revenues during 2018 and 2019, and expects to realize revenue growth in 2020 due to its business development pipeline.

We develop hardware,

software and algorithms that monitor, measure and predict conditions for energy, structural, agricultural and medical applications.

We use domain-specific Artificial Intelligence to solve industrial and environmental challenges. Our engineered solutions focus

on common sense approaches to machine learning, algorithm development and hardware and software products.

Our customers

have issues and they need improvements. We design a system of hardware and software, assemble, install, monitor data and apply

our algorithms to help provide the customer insights.

We use off the

shelf components, with reconfigurable hardware architecture that adapts to a wide range of customer needs and applications. We

use open source software tools, while still creating proprietary content for customers, thereby reducing software development time

and cost. The software works with the hardware to collect data from the equipment or structure that is being monitored.

We focus on developing

insights. We develop algorithms that help our customers create insights from vast data streams. The data collected is analyzed

and reports are created for the customer. From these insights, the customer can act to improve their process, product or structure.

OUR SOLUTIONS ACHIEVE TWO OBJECTIVES

ADD VALUE

|

|

·

|

We show clear path to improved asset reliability, machine uptime, machine utilization, energy consumption,

and quality.

|

|

|

·

|

We provide advanced algorithms and insights as a service.

|

RISK MINIMIZATION

|

|

·

|

We use simple measurements requiring almost zero integration – minimally invasive.

|

|

|

·

|

We do not interfere with command and control of critical equipment.

|

|

|

·

|

We do not physically touch machine control networks – total isolation of networks.

|

HOW WE DO IT

Our location in Cambridge, Massachusetts

is ideal since market-leading Biotech, Medtech, and Pharma multinational firms have offices or R&D centers in Cambridge or

the Greater Boston area, which gives us easier access to potential sales which, in turn, lowers out cost of sales. Additionally,

we continue to add value to structural health monitoring and smart manufacturing customers as well. We, therefore, have a range

of opportunities as we continue to expand our customer base.

Our goal is to help Biotech, Pharma, and

Medical Device companies realize the next wave of performance, productivity, and quality gains for their organizations, and become

Industry 4.0 compliant.

We have a unique value proposition in a

fast-growing worldwide multi-billion USD market, and have positioned with strategic partners for accelerated growth. We are therefore

well-poised for rapid growth in 2019 and beyond, as we execute our plans and quickly acquire additional customers.

WHAT MARKETS WE SERVE

SMART MANUFACTURING

We help our customers maintain machine

uptime and maximize operational efficiency. We also enable then to do energy monitoring, predictive maintenance that anticipates

problems before they happen, and improve part and process quality.

BIOTECH, PHARMACEUTICAL, AND MEDICAL

DEVICES

We are on the operations side, not the

patient-facing side. In this market vertical, our customers must provide high-quality products that must also pass rigorous review

by governing bodies such as the FDA. Here again, we focus on machine uptime, operational efficiency, and predictive maintenance

to avoid unplanned downtime.

SMART INFRASTRUCTURE

For bridges and other civil infrastructure,

local, state and federal agencies have limited resources. We help our clients prioritize how to spend limited funds by addressing

those fixes which need to be made first.

OUR UNIQUE VALUE PROPOSITION

EDGE COMPUTING AS A COMPLIMENT TO CLOUD

COMPUTING

Within the Internet of Things (“IoT”)

and Industrial Internet of Things (“IIoT”), most companies right now are adopting an approach which sends all

sensor data to the cloud for processing. We specialize in edge computing, where the data processing is done locally right where

the data is collected. We also have advanced cloud-based algorithms that implement various machine learning and artificial intelligence

algorithms.

ADVANCED ALGORITHMS

We have sought to differentiate from our

competitors by developing advanced algorithms on our own and in collaboration with world-leading research institutions. These algorithms

are an essential part of the edge computing strategy that convert raw data into actionable knowledge right where the data is collected

without having to send the data to the cloud first.

RECONFIGURABLE HARDWARE AND SOFTWARE

Instead of focusing on creating tools,

we use open source tools to create proprietary content.

Company Information and History

We were incorporated in the State of New

Jersey on October 1, 2003 under the name of Creative Beauty Supply of New Jersey Corporation and subsequently changed our name

to Gotham Capital Holdings, Inc. on May 18, 2015. We commenced operations in the beauty supply industry as of January 1, 2004.

On November 30, 2007, our Board of Directors approved a plan to dispose of our wholesale and retail beauty supply business. From

January 1, 2009 until July 28, 2017, we had no operations and were a shell company.

On March 16, 2017, our Board of Directors

adopted resolutions, which were approved by shareholders holding a majority of our outstanding shares, to change our name to “IIOT-OXYS,

Inc.”, to authorize a change of domicile from New Jersey to Nevada, to authorize a 2017 Stock Awards Plan, and to approve

the Securities Exchange Agreement (the “OXYS SEA”) between the Company and OXYS Corporation (“OXYS”),

a Nevada corporation incorporated on August 4, 2016.

Under the terms of the OXYS SEA we acquired

100% of our issued voting shares of OXYS in exchange for 34,687,244 shares of our Common Stock. We also cancelled 1,500,000 outstanding

shares of our Common Stock and changed our management to Mr. DiBiase who also served in management of OXYS. Also, one of our principal

shareholders entered into a consulting agreement with OXYS to provide consulting services during the transition. The OXYS SEA was

effective on July 28, 2017, and our name was changed to “IIOT-OXYS, Inc.” at that time. Effective October 26, 2017,

our domicile was changed from New Jersey to Nevada.

On December 14, 2017, we entered into a

Share Exchange Agreement (the “HereLab SEA”) with HereLab, Inc., a Delaware corporation (“HereLab”),

and HereLab’s two shareholders pursuant to which we would acquire all the issued and outstanding shares of HereLab in exchange

for the issuance of 1,650,000 shares of our Common Stock, on a pro rata basis, to HereLab’s two shareholders. The closing

of the transaction occurred on January 11, 2018 and HereLab became our wholly-owned subsidiary.

A new management team was put into place

in 2018, which constitutes our current management team.

At the present time, we have two, wholly-owned

subsidiaries which are OXYS Corporation and HereLab, Inc., through which our operations are conducted.

Our principal executive offices are located at 705 Cambridge

Street, Cambridge, MA 02141. Our telephone number is (401) 307-3092. Our common stock is listed on the OTC Markets Pink under the

symbol “ITOX.”

Our internet website address is www.oxyscorp.com.

Employees

We currently have four employees, all on

W2’s, including the CEO, COO and CTO. All employees are currently part time.

GHS Equity Financing Agreement and

Registration Rights Agreement

On July 29, 2020, we entered into the Equity

Financing Agreement and Registration Rights Agreement (“Registration Rights Agreement”) with GHS. Under the

terms of the Equity Financing Agreement, GHS agreed to provide the Company with up to $5,000,000 upon effectiveness of a registration

statement on Form S-1 (the “Registration Statement”) filed with the U.S. Securities and Exchange Commission

(the “Commission”).

Following effectiveness of the Registration

Statement, the Company shall have the discretion to deliver puts (each, a “Put”) to GHS and GHS will be obligated

to purchase shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”) based

on the investment amount specified in each Put notice. The maximum amount that the Company shall be entitled to put to GHS in each

Put notice shall not be less than $10,000 nor exceed $400,000 and any single drawdown may not exceed 200% of the average daily

trading dollar volume of the Company’s Common Stock during the ten trading days preceding the Put. Pursuant to the Equity

Financing Agreement, GHS and its affiliates will not be permitted to purchase shares, and the Company may not request Puts from

GHS, that would result in GHS’s beneficial ownership equaling more than 9.99% of the Company’s outstanding Common Stock.

The price of each share in a Put shall be equal to 80% of the Purchase Price. There will be a minimum of ten trading days between

Puts. Puts may be delivered by the Company to GHS until (i) the earlier of thirty-six (36) months after the date of the Equity

Financing Agreement, (ii) the date on which GHS has purchased an aggregate of $5,000,000 worth of Common Stock under the terms

of the Equity Financing Agreement; (iii) upon mutual termination of the Equity Financing Agreement; or (iv) such time the Registration

Statement is no longer in effect. In accordance with the Equity Financing Agreement, the Company issued to GHS a commitment promissory

note in the principal amount of $75,000 in order to offset transaction costs (the “Commitment Note”). In addition

to the Commitment Note, the Company also issued to GHS a promissory note in the principal amount of $100,000.

The Registration Rights Agreement provides

that the Company shall (i) use its best efforts to file with the Commission the Registration Statement within 45 days of the date

of the Registration Rights Agreement; and (ii) use reasonable commercial efforts to have the Registration Statement declared effective

by the Commission within 30 days after the date the Registration Statement is filed with the Commission, but in no event more than

90 days after the Registration Statement is filed.

Summary of the Offering

|

Shares currently outstanding (1):

|

|

141,825,630

|

|

|

|

|

|

Shares being offered:

|

|

18,000,000

|

|

|

|

|

|

Offering Price per share:

|

|

The selling stockholders may sell all or a portion of the shares being offered pursuant to this Prospectus at fixed prices and prevailing market prices at the time of sale, at varying prices or at negotiated prices.

|

|

|

|

|

|

Use of Proceeds:

|

|

We will not receive any proceeds from the sale of the shares of our common stock by the selling stockholder.

|

|

|

|

|

|

Trading Symbol:

|

|

ITOX

|

|

|

|

|

|

Risk Factors:

|

|

See “Risk Factors”

beginning on page 8 herein and the other information in this Prospectus for a discussion of the factors you should consider

before deciding to invest in shares of our common stock.

|

|

|

(1)

|

The number of shares of our Common Stock outstanding prior to and to be outstanding immediately

after this offering, as set forth in the table above, is based on 141,825,630 shares outstanding as of September 25, 2020, and

excluding 18,000,000 shares of Common Stock issuable in this offering

|

RISK FACTORS

Risks Related to Our Business

A pandemic, epidemic or outbreak

of an infectious disease in the markets in which we operate or that otherwise impacts our facilities or suppliers could

adversely impact our business.

If a pandemic,

epidemic, or outbreak of an infectious disease including the recent outbreak of respiratory illness caused by a novel coronavirus (COVID-19)

first identified in Wuhan, Hubei Province, China, or other public health crisis were to affect our markets or facilities or those

of our suppliers, our business could be adversely affected. Consequences of the coronavirus outbreak are resulting in disruptions

in or restrictions on our ability to travel. If such an infectious disease broke out at our office, facilities or work sites, our

operations may be affected significantly, our productivity may be affected, our ability to complete projects in accordance with

our contractual obligations may be affected, and we may incur increased labor and materials costs. If the customers with which

we contract are affected by an outbreak of infectious disease, service work may be delayed or cancelled, and we may incur increased

labor and materials costs. If our subcontractors with whom we work were affected by an outbreak of infectious disease, our labor

supply may be affected and we may incur increased labor costs. In addition, we may experience difficulties with certain suppliers

or with vendors in their supply chains, and our business could be affected if we become unable to procure essential equipment,

supplies or services in adequate quantities and at acceptable prices. Further, infectious outbreak may cause disruption to the

U.S. economy, or the local economies of the markets in which we operate, cause shortages of materials, increase costs associated

with obtaining materials, affect job growth and consumer confidence, or cause economic changes that we cannot anticipate. Overall,

the potential impact of a pandemic, epidemic or outbreak of an infectious disease with respect to our market or our facilities

is difficult to predict and could adversely impact our business. In response to the COVID-19 situation, federal, state and local

governments (or other governments or bodies) are considering placing, or have placed, restrictions on travel and conducting or

operating business activities. At this time those restrictions are very fluid and evolving. We have been and will continue to be

impacted by those restrictions. Given that the type, degree and length of such restrictions are not known at this time, we cannot

predict the overall impact of such restrictions on us, our customers, our subcontractors and supply chain, others that we work

with or the overall economic environment. As such, the impact these restrictions may have on

our financial position, operating results and liquidity cannot be reasonably estimated at this time, but the impact may be material.

In addition, due to the speed with which the COVID-19 situation is developing and evolving, there

is uncertainty around its ultimate impact on public health, business operations and the overall economy; therefore, the negative

impact on our financial position, operating results and liquidity cannot be reasonably estimated at this time, but the impact may

be material.

Because of our continued losses,

there is substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing.

Our financial statements as of and for

the years ended December 31, 2018 and 2019 were prepared assuming that we would continue as a going concern. Our significant cumulative

losses from operations as of December 31, 2019, raised substantial doubt about our ability to continue as a going concern. If the

going-concern assumption were not appropriate for our financial statements, then adjustments would be necessary to the carrying

values of the assets and liabilities, the reported revenues and expenses, and the balance sheet classifications used. Since December

31, 2019, we have continued to experience losses from operations. We have continued to fund operations primarily through the sale

of equity securities. Nevertheless, we will require additional funding to complete much of our planned operations. Our ability

to continue as a going concern is subject to our ability to generate a profit (i.e. through partnerships such as our current partnership

with Aingura) and/or obtain necessary additional funding from outside sources, including obtaining additional funding from the

sale of our securities. Except for potential proceeds from the sale of equity in offerings by us and minimal revenues, we have

no other source for additional funding. Our continued net operating losses and stockholders’ deficiency increase the difficulty

in meeting such goals and there can be no assurances that such methods will prove successful.

We have debt which is secured by

all our assets. If there is an occurrence of an uncured event of default, the lenders can foreclose on all our assets, which would

make any stock in the Company worthless.

We have entered into several secured loan

transactions with investors (as disclosed herein), pursuant to which the outstanding debt was secured by all our assets. In the

event we are unable to make payments, when due, on our secured debt, the lenders may foreclose on all our assets. In the event

the lenders foreclose on our assets, any stock in the Company would have no value. Our ability to make payments on secured debt,

when due, will depend upon our ability to make profit from operations and to raise additional funds through equity or debt financings.

At the moment, we have no funding commitments that have not been previously disclosed, and we may not obtain any in the future.

Our future success is dependent upon

the success of partnerships with other similarly-situated entities.

Effective March 18, 2020, we entered into

the Collaboration Agreement with Aingura IIoT, S.L. (“Aingura”) pursuant to which Aingura appointed and authorized

us to act as the sales network of Aingura’s services and products. Aingura delivers engineered, high-tech solutions

by implementing Smart Factory Operational Architectures. The agreement has an initial term of one year from the execution date.

Unless terminated prior, the agreement automatically renews for successive annual periods, unless either party notifies the other

in writing of its express intention not to renew the agreement at least two months prior to the date of termination of the agreement.

There are restrictive provisions in the agreement that may prevent us from pursuing other business opportunities during the term

of the agreement. In addition, if we are unable to make sales under the agreement, we will not collect any sales commissions and

our business could fail.

Most of our sales come from a small

number of customers and a reduction in demand or loss of one or more of our significant customers may adversely affect our business.

At the present time, we are dependent on

a small number of direct customers for most of our business, revenue and results of operations. We at present have customers in

the civil infrastructure sector, and the pharmaceutical sector. Our customers are a state government and a large pharmaceutical

company. To date, these customers have generated all our revenue. We expect to continue to experience significant customer concentration

in future periods.

This customer concentration increases the

risk of quarterly fluctuations in our operating results and sensitivity to any material, adverse developments experienced by our

significant customers. Although we believe that our relationships with our major customers are good, we generally do not have long-term

contracts with any of them, which is typical of our industry. In addition, orders can be, and often are, rescheduled, canceled

and modified with little or no notice. The loss of, or any substantial reduction in sales to, any of our major direct or end customers

could have a material adverse effect on our business, financial condition and results of operations.

Our operating subsidiaries have limited

operating history and have generated very limited revenues thus far.

The limited operating history of OXYS and

HereLab in the IIoT field, makes evaluating our business and future prospects difficult. OXYS was incorporated on August 4, 2016

and HereLab was incorporated on February 27, 2017. We have not yet generated substantial income from OXYS or HereLab’s operations

and we only anticipate doing so if we are able to successfully implement our business plan. To date we have generated approximately

$439,000_ in sales from business operations, none of which was generated from HereLab in 2019 as we focused solely on OXYS during

2019. We intend in the longer term to derive further revenues from partnerships, consulting services, product sales, and software

licensing. Development of our services, products, and software will require significant investment prior to commercial introduction,

and we may never be able to successfully develop or commercialize the services, products, or software in a material way.

We will require additional funding

to develop and commercialize our services, products, and software. If we are unable to secure additional financing on acceptable

terms, or at all, we may be forced to modify our current business plan or to curtail or cease our planned operations.

We anticipate incurring significant operating

losses and using significant funds for product development and operating activities. Our existing cash resources are insufficient

to finance even our immediate operations. Accordingly, we will need to secure additional sources of capital to develop our business

and product candidates, as planned. We intend to seek substantial additional financing through public and/or private financing,

which may include equity and/or debt financings, and through other arrangements, including collaborative arrangements. As part

of such efforts, we may seek loans from certain of our executive officers, directors and/or current shareholders.

If we are unable to secure additional financing

in the near term, we may be forced to:

|

|

·

|

curtail or abandon our existing business plans;

|

|

|

·

|

default on any debt obligations;

|

|

|

·

|

seek to sell some or all our assets; and/or

|

If we are forced to take any of these steps

our Common Stock may be worthless.

Any future financing may result in

ownership dilution to our existing shareholders and may grant rights to investors more favorable than the rights currently held

by our existing shareholders.

If we raise additional capital by issuing

equity, equity-related or convertible securities, the economic, voting and other rights of our existing shareholders may be diluted,

and those newly-issued securities may be issued at prices that are at a significant discount to current and/or then prevailing

market prices. In addition, any such newly issued securities may have rights superior to those of our common stock. If we obtain

additional capital through collaborative arrangements, we may be required to relinquish greater rights to our technologies or product

candidates than we might otherwise have or become subject to restrictive covenants that may affect our business.

Uncertain global economic conditions

could materially adversely affect our business and results of operations.

Our operations and performance are sensitive

to fluctuations in general economic conditions, both in the U.S. and globally. The ongoing uncertainty created by the COVID-19

pandemic, volatile currency markets, the anticipated weakness in all sectors, alone or in combination, may continue to have a material

adverse effect on our net sales and the financial results of our operations. In addition, we remain concerned about the geopolitical

and fiscal instability in the Middle East and some emerging markets as well as the continued volatility of the equity markets.

The upcoming U.S. election may also create additional domestic and global economic uncertainty. These factors could have a material

adverse effect on the spending patterns of businesses including our current and potential customers which could have a material

adverse effect on our net sales and our results of operations. Other factors that could adversely influence demand for our products

include unemployment, labor and healthcare costs, access to credit, consumer and business confidence, and other macroeconomic factors

that could have a negative impact on capital investment and spending behavior.

We are subject to various risks associated

with international operations and foreign economies.

Our international sales are subject to

inherent risks, including:

|

|

·

|

global pandemics such as the COVID-19 pandemic;

|

|

|

·

|

fluctuations in foreign currencies relative to the U.S. dollar;

|

|

|

·

|

unexpected changes to currency policy or currency restrictions in foreign jurisdictions;

|

|

|

·

|

delays in collecting trade receivable balances from customers in developing economies;

|

|

|

·

|

unexpected changes in regulatory requirements;

|

|

|

·

|

difficulties and the high tax costs associated with the repatriation of earnings;

|

|

|

·

|

fluctuations in local economies;

|

|

|

·

|

disparate and changing employment laws in foreign jurisdictions;

|

|

|

·

|

difficulties in staffing and managing foreign operations;

|

|

|

·

|

costs and risks of localizing products for foreign countries;

|

|

|

·

|

unexpected changes in regulatory requirements;

|

|

|

·

|

government actions throughout the world;

|

|

|

·

|

tariffs and other trade barriers; and

|

|

|

·

|

the burdens of complying with a wide variety of foreign laws.

|

Moreover, there can be no assurance that

our international sales will continue at existing levels or grow in accordance with our efforts to increase foreign market penetration.

In many foreign countries, particularly

in those with developing economies, it is common to engage in business practices that are prohibited by U.S. regulations applicable

to us such as the Foreign Corrupt Practices Act. Although we have policies and procedures designed to ensure compliance with these

laws, there can be no assurance that all of our employees, contractors and agents, including those based in or from countries where

practices which violate such U.S. laws may be customary, will not take actions in violation of our policies. Any violation of foreign

or U.S. laws by our employees, contractors or agents, even if such violation is prohibited by our policies, could have a material

adverse effect on our business. We must also comply with various import and export regulations. The application of these various

regulations depends on the classification of our products which can change over time as such regulations are modified or interpreted.

As a result, even if we are currently in compliance with applicable regulations, there can be no assurance that we will not have

to incur additional costs or take additional compliance actions in the future. Failure to comply with these regulations could result

in fines or termination of import and export privileges, which could have a material adverse effect on our operating results. Additionally,

the regulatory environment in some countries is very restrictive as their governments try to protect their local economy and value

of their local currency against the U.S. dollar.

Any future product revenues are dependent

on certain industries, and contractions in these industries could have a material adverse effect on our results of operations.

Sales of our products are dependent on

customers in certain industries. As we have experienced in the past, and as we may continue to experience in the future, downturns

characterized by diminished product demand in any one or more of these industries may result in decreased sales and a material

adverse effect on our operating results. We cannot predict when and to what degree contractions in these industries may occur;

however, any sharp or prolonged contraction in one or more of these industries could have a material adverse effect on our business

and results of operations.

We intend to make significant investments

in new products that may not be successful or achieve expected returns.

We plan to continue to make significant

investments in research, development, and marketing for new and existing products and technologies. These investments involve a

number of risks as the commercial success of such efforts depend on many factors, including our ability to anticipate and respond

to innovation, achieve the desired technological fit, and be effective with our marketing and distribution efforts. If our existing

or potential customers do not perceive our latest product offerings as providing significant new functionality or value, or if

we are late to market with a new product or technology, we may not achieve our expected return on our investments or be able recover

the costs expended to develop new product offerings, which could have a material adverse effect on our operating results. Even

if our new products are profitable, our operating margins for new products may not be as high as the margins we have experienced

historically.

Our success depends on new product

introductions and market acceptance of our products.

The market for our products is characterized

by technological change, evolving industry standards, changes in customer needs and frequent new product introductions, and is

therefore highly dependent upon timely product innovation. Our success is dependent on our ability to successfully develop and

introduce new and enhanced products on a timely basis to replace declining revenues from older products, and on increasing penetration

in domestic and international markets. Any significant delay in releasing new products could have a material adverse effect on

the ultimate success of a product and other related products and could impede continued sales of predecessor products, any of which

could have a material adverse effect on our operating results. There can be no assurance that we will be able to introduce new

products, that our new products will achieve market acceptance or that any such acceptance will be sustained for any significant

period. Failure of our new products to achieve or sustain market acceptance could have a material adverse effect on our operating

results.

Our reported financial results may

be adversely affected by changes in accounting principles generally accepted in the U.S.

We prepare our financial statements in

conformity with accounting principles generally accepted in the U.S. These accounting principles are subject to interpretation

by the Financial Accounting Standards Board (“FASB”) and the Securities and Exchange Commission. A change in

these policies or interpretations could have a significant effect on our reported financial results, may retroactively affect previously

reported results, could cause unexpected financial reporting fluctuations, and may require us to make costly changes to our operational

processes and accounting systems.

We operate in intensely competitive

markets.

The markets in which we operate are characterized

by intense competition from numerous competitors, some of which are divisions of large corporations having far greater resources

than we have, and we may face further competition from new market entrants in the future. Some examples of large and small competitors

include, but are not limited to:

|

|

·

|

General Electric with its GE Predix product for IoT;

|

|

|

·

|

IBM with its IBM BlueMix and IBM IoT Watson products;

|

|

|

·

|

Siemens with its MindSphere IoT product;

|

|

|

·

|

Microsoft with its Microsoft Azure IoT Suite;

|

Our financial results are subject

to fluctuations due to various factors that may adversely affect our business and result of operations.

Our operating results have fluctuated in

the past and may fluctuate significantly in the future due to several factors, including:

|

|

·

|

global pandemics such as the COVID-19 pandemic;

|

|

|

·

|

fluctuations in foreign currency exchange rates;

|

|

|

·

|

changes in global economic conditions;

|

|

|

·

|

changes in the mix of products sold;

|

|

|

·

|

the availability and pricing of components from third parties (especially limited sources);

|

|

|

·

|

the difficulty in maintaining margins, including the higher margins traditionally achieved in international

sales;

|

|

|

·

|

changes in pricing policies by us, our competitors or suppliers;

|

|

|

·

|

the timing, cost or outcome of any future intellectual property litigation or commercial disputes;

|

|

|

·

|

delays in product shipments caused by human error or other factors; or

|

|

|

·

|

disruptions in transportation channels.

|

Any future acquisitions made by us

will be subject to several related costs and challenges that could have a material adverse effect on our business and results of

operations.

We plan to make more acquisitions in the

future. Achieving the anticipated benefits of an acquisition depends upon whether the integration of the acquired business, products

or technology is accomplished efficiently and effectively. In addition, successful acquisitions generally require, among other

things, integration of product offerings, manufacturing operations and coordination of sales and marketing and R&D efforts.

These difficulties can become more challenging due to the need to coordinate geographically separated organizations, the complexities

of the technologies being integrated, and the necessities of integrating personnel with disparate business backgrounds and combining

different corporate cultures. The integration of operations following an acquisition also requires the dedication of management

resources, which may distract attention from our day-to-day business and may disrupt key R&D, marketing or sales efforts. Our

inability to successfully integrate any of our acquisitions could harm our business. The existing products previously sold by entities

we have acquired may be of a lesser quality than our products or could contain errors that produce incorrect results on which users

rely or cause failure or interruption of systems or processes that could subject us to liability claims that could have a material

adverse effect on our operating results or financial position. Furthermore, products acquired in connection with acquisitions may

not gain acceptance in our markets, and we may not achieve the anticipated or desired benefits of such transactions.

We may experience component shortages

that may adversely affect our business and result of operations.

We have experienced difficulty in securing

certain types of high-power connectors for one of our projects and anticipate that supply shortages of components used in our products,

including limited source components, can result in significant additional costs and inefficiencies in manufacturing. If we are

unsuccessful in resolving any such component shortages in a timely manner, we will experience a significant impact on the timing

of revenue, a possible loss of revenue, or an increase in manufacturing costs, any of which would have a material adverse impact

on our operating results.

We rely on management information

systems. interruptions in our information technology systems or cyber-attacks on our systems could adversely affect our business.

We rely on the efficient and uninterrupted

operation of complex information technology systems and networks to operate our business. We rely on a primary global center for

our management information systems and on multiple systems in branches not covered by our global center. As with any information

system, unforeseen issues may arise that could affect our ability to receive adequate, accurate and timely financial information,

which in turn could inhibit effective and timely decisions. Furthermore, it is possible that our global center for information

systems or our branch operations could experience a complete or partial shutdown. A significant system or network disruption could

be the result of new system implementations, computer viruses, cyber-attacks, security breaches, facility issues or energy blackouts.

Threats to our information technology security can take a variety of forms and individuals or groups of hackers or sophisticated

organizations including state-sponsored organizations, may take steps that pose threats to our customers and our infrastructure.

If we were to experience a shutdown, disruption or attack, it would adversely impact our product shipments and net sales, as order

processing and product distribution are heavily dependent on our management information systems. Such an interruption could also

result in a loss of our intellectual property or the release of sensitive competitive information or partner, customer or employee

personal data. Any loss of such information could harm our competitive position, result in a loss of customer confidence, and cause

us to incur significant costs to remedy the damages caused by the disruptions or security breaches. In addition, changing laws

and regulations governing our responsibility to safeguard private data could result in a significant increase in operating or capital

expenditures needed to comply with these new laws or regulations. Accordingly, our operating results in such periods would be adversely

impacted.

We are continually working to maintain

reliable systems to control costs and improve our ability to deliver our products in our markets worldwide. Our efforts include,

but are not limited to the following: firewalls, antivirus protection, patches, log monitors, routine backups with offsite retention

of storage media, system audits, data partitioning and routine password modifications. Our internal information technology systems

environment continues to evolve and our business policies and internal security controls may not keep pace as new threats emerge.

No assurance can be given that our efforts to continue to enhance our systems will be successful.

We are subject to risks associated

with our website.

We devote significant resources to maintaining

our website, www.oxyscorp.com, as a key marketing, sales and support tool and expect to continue to do so in the future. Failure

to properly maintain our website may interrupt normal operations, including our ability to run and market our business which would

have a material adverse effect on our results of operations. We host our website internally. Any failure to successfully maintain

our website or any significant downtime or outages affecting our website could have a material adverse impact on our operating

results.

Our products are complex and may

contain bugs or errors.

As has occurred in the past and as may

be expected to occur in the future, our new software products or new operating systems of third parties on which our products are

based often contain bugs or errors that can result in reduced sales or cause our support costs to increase, either of which could

have a material adverse impact on our operating results.

Compliance with sections 302 and

404 of the Sarbanes-Oxley Act of 2002 is costly and challenging.

As required by Section 302 of the Sarbanes-Oxley

Act of 2002, our periodic reports contain our management’s certification of adequate disclosure controls and procedures,

a report by our management on our internal control over financial reporting including an assessment of the effectiveness of our

internal control over financial reporting, and an attestation and report by our external auditors with respect to the effectiveness

of our internal control over financial reporting under Section 404. While these assessments and reports have not revealed any material

weaknesses in our internal control over financial reporting, compliance with Sections 302 and 404 is required for each future fiscal

year end. We expect that the ongoing compliance with Sections 302 and 404 will continue to be both very costly and very challenging

and there can be no assurance that material weaknesses will not be identified in future periods. Any adverse results from such

ongoing compliance efforts could result in a loss of investor confidence in our financial reports and have an adverse effect on

our stock price.

Our business depends on our proprietary

rights and we have been subject to intellectual property litigation.

Our success depends on our ability to obtain

and maintain patents and other proprietary rights relative to the technologies used in our principal products. Despite our efforts

to protect our proprietary rights, unauthorized parties may have in the past infringed or violated certain of our intellectual

property rights. We from time to time may engage in litigation to protect our intellectual property rights. In monitoring and policing

our intellectual property rights, we may be required to spend significant resources. We from time to time may be notified that

we are infringing certain patent or intellectual property rights of others. There can be no assurance that any future intellectual

property dispute or litigation will not result in significant expense, liability, injunction against the sale of some of our products,

and a diversion of management’s attention, any of which may have a material adverse effect on our operating results.

We are subject to the risk of product

liability claims.

Our products are designed to provide information

upon which users may rely. Our products are also used in “real time” applications requiring extremely rapid and continuous

processing and constant feedback. Such applications give rise to the risk that a failure or interruption of the system or application

could result in economic damage, bodily harm or property damage. We attempt to assure the quality and accuracy of the processes

contained in our products, and to limit our product liability exposure through contractual limitations on liability, limited warranties,

express disclaimers and warnings as well as disclaimers contained in our “shrink wrap” and electronically displayed

license agreements with end-users. If our products contain errors that produce incorrect results on which users rely or cause failure

or interruption of systems or processes, customer acceptance of our products could be adversely affected. Further, we could be

subject to liability claims that could have a material adverse effect on our operating results or financial position. Although

we maintain liability insurance for product liability matters, there can be no assurance that such insurance or the contractual

limitations used by us to limit our liability will be sufficient to cover or limit any claims which may occur.

Each of our current product candidates

and services is in an early stage of development and we may never succeed in developing and/or commercializing them. If we are

unable to commercialize our services, products, or software, or if we experience significant delays in doing so, our business may

fail.

We intend to invest a significant portion

of our efforts and financial resources in our software and we will depend heavily on its success. This software is currently in

the beta stage of development. We need to devote significant additional research and development, financial resources and personnel

to develop additional commercially viable products, establish intellectual property rights, if necessary, and establish a sales

and marketing infrastructure. We are likely to encounter hurdles and unexpected issues as we proceed in the development of our

software and our other product candidates. There are many reasons that we may not succeed in our efforts to develop our product

candidates, including the possibility that our product candidates will be deemed undesirable; our product candidates will be too

expensive to develop or market or will not achieve broad market acceptance; others will hold proprietary rights that will prevent

us from marketing our product candidates; or our competitors will market products that are perceived as equivalent or superior.

We depend on third parties to assist

us in the development of our software and other product candidates, and any failure of those parties to fulfill their obligations

could result in costs and delays and prevent us from successfully commercializing our software and product candidates on a timely

basis, if at all.

We may engage consultants and other third

parties to help our software and product candidates. We may face delays in our commercialization efforts if these parties do not

perform their obligations in a timely or competent fashion or if we are forced to change service providers. Any third parties that

we hire may also provide services to our competitors, which could compromise the performance of their obligations to us. If these

third parties do not successfully carry out their duties or meet expected deadlines, the commercialization of our software and

product candidates may be extended, delayed or terminated or may otherwise prove to be unsuccessful. Any delays or failures as

a result of the failure to perform by third parties would cause our development costs to increase, and we may not be able to commercialize

our product candidates. In addition, we may not be able to establish or maintain relationships with these third parties on favorable

terms, if at all. If we need to enter into replacement arrangements because a third party is not performing in accordance with

our expectations, we may not be able to do so without undue delays or considerable expenditures or at all.

The loss of or inability to retain

key personnel could materially adversely affect our operations.

Our management includes a select group

of experienced technology professionals, particularly Clifford Emmons, Karen McNemar, and Antony Coufal, who will be instrumental

in the development of our software and product candidates. The success of our operations will, in part, depend on the successful

continued involvement of these individuals. If these individuals leave the employment of or engagement with us, OXYS, or HereLab,

then our ability to operate will be negatively impacted. We do not have any employment agreements with these parties and do not

maintain any “key-man” insurance for them.

Risks Related to Our Intellectual Property

Patents acquired by us may not be

valid or enforceable and may be challenged by third parties.

We do not intend to seek a legal opinion

or other independent verification that any patents issued or licensed to us would be held valid by a court or administrative body

or that we would be able to successfully enforce our patents against infringers, including our competitors. The issuance of a patent

is not conclusive as to its validity or enforceability, and the validity and enforceability of a patent is susceptible to challenge

on numerous legal grounds. Challenges raised in patent infringement litigation brought by or against us may result in determinations

that patents that have been issued or licensed to us or any patents that may be issued to us or our licensors in the future are

invalid, unenforceable or otherwise subject to limitations. In the event of any such determinations, third parties may be able

to use the discoveries or technologies claimed in these patents without paying licensing fees or royalties to us, which could significantly

diminish the value of our intellectual property and our competitive advantage. Even if our patents are held to be enforceable,

others may be able to design around our patents or develop products similar to our products that are not within the scope of any

of our patents.

In addition, enforcing any patents that

may be issued to us in the future against third parties may require significant expenditures regardless of the outcome of such

efforts. Our inability to enforce our patents against infringers and competitors may impair our ability to be competitive and could

have a material adverse effect on our business.

If we are not able to protect and

control our unpatented trade secrets, know-how and other technological innovation, we may suffer competitive harm.

We rely on unpatented technology, trade

secrets, confidential information and proprietary know-how to protect our technology and maintain any future competitive position,

especially when we do not believe that patent protection is appropriate or can be obtained. Trade secrets are difficult to protect.

In order to protect proprietary technology and processes, we rely in part on confidentiality and intellectual property assignment

agreements with our employees, consultants and others. These agreements generally provide that the individual must keep confidential

and not disclose to other parties any confidential information developed or learned by the individual during the course of the

individual’s relationship with us except in limited circumstances. These agreements generally also provide that we shall

own all inventions conceived by the individual in the course of rendering services to us. These agreements may not effectively

prevent disclosure of confidential information or result in the effective assignment to us of intellectual property and may not

provide an adequate remedy in the event of unauthorized disclosure of confidential information or other breaches of the agreements.

In addition, others may independently discover trade secrets and proprietary information that have been licensed to us or that

we own, and in such case, we could not assert any trade secret rights against such party.

Enforcing a claim that a party illegally

obtained and is using trade secrets that have been licensed to us or that we own is difficult, expensive and time-consuming, and

the outcome is unpredictable. In addition, courts outside the United States may be less willing to protect trade secrets. Costly

and time-consuming litigation could be necessary to seek to enforce and determine the scope of our proprietary rights, and failure

to obtain or maintain trade secret protection could have a material adverse effect on our business. Moreover, some of our academic

institution licensors, collaborators and scientific advisors have rights to publish data and information to which we have rights.

If we cannot maintain the confidentiality of our technologies and other confidential information in connection with our collaborations,

our ability to protect our proprietary information or obtain patent protection in the future may be impaired, which could have

a material adverse effect on our business.

Risks Related to Our Common Stock

The public trading market for our

common stock is volatile and will likely result in higher spreads in stock prices.

Our common stock is trading in the over-the-counter

market and is quoted on the OTC Pink. The over-the-counter market for securities has historically experienced extreme price and

volume fluctuations during certain periods. These broad market fluctuations and other factors, such as our ability to implement

our business plan, as well as economic conditions and quarterly variations in our results of operations, may adversely affect the

market price of our common stock. In addition, the spreads on stock traded through the over-the-counter market are generally unregulated

and higher than on stock exchanges, which means that the difference between the price at which shares could be purchased by investors

on the over-the-counter market compared to the price at which they could be subsequently sold would be greater than on these exchanges.

Significant spreads between the bid and asked prices of the stock could continue during any period in which a sufficient volume

of trading is unavailable or if the stock is quoted by an insignificant number of market makers. We cannot ensure that our trading

volume will be sufficient to significantly reduce this spread, or that we will have sufficient market makers to affect this spread.

These higher spreads could adversely affect investors who purchase the shares at the higher price at which the shares are sold,

but subsequently sell the shares at the lower bid prices quoted by the brokers. Unless the bid price for the stock increases and

exceeds the price paid for the shares by the investor, plus brokerage commissions or charges, shareholders could lose money on

the sale. For higher spreads such as those on over-the-counter stocks, this is likely a much greater percentage of the price of

the stock than for exchange listed stocks. There is no assurance that at the time the shareholder wishes to sell the shares, the

bid price will have sufficiently increased to create a profit on the sale.

Because our shares are designated

as “penny stock”, broker-dealers will be less likely to trade in our stock due to, among other items, the requirements

for broker-dealers to disclose to investors the risks inherent in penny stocks and to make a determination that the investment

is suitable for the purchaser.

Our shares are designated as “penny

stock” as defined in Rule 3a51-1 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and thus may be more illiquid than shares not designated as penny stock. The SEC has adopted rules which regulate

broker-dealer practices in connection with transactions in “penny stocks.” Penny stocks are defined generally as: non-Nasdaq

equity securities with a price of less than $5.00 per share; not traded on a “recognized” national exchange; or in

issuers with net tangible assets less than $2,000,000, if the issuer has been in continuous operation for at least three years,

or $10,000,000, if in continuous operation for less than three years, or with average revenues of less than $6,000,000 for the

last three years. The penny stock rules require a broker-dealer to deliver a standardized risk disclosure document prepared by

the SEC, to provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer

and its salesperson in the transaction, monthly account statements showing the market value of each penny stock held in the customer’s

account, to make a special written determination that the penny stock is a suitable investment for the purchaser and receive the

purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level

of trading activity, if any, in the secondary market for a stock that is subject to the penny stock rules. Since our securities

are subject to the penny stock rules, investors in the shares may find it more difficult to sell their shares. Many brokers have

decided not to trade in penny stocks because of the requirements of the penny stock rules and, as a result, the number of broker-dealers

willing to act as market makers in such securities is limited. The reduction in the number of available market makers and other

broker-dealers willing to trade in penny stocks may limit the ability of purchasers in this offering to sell their stock in any

secondary market. These penny stock regulations, and the restrictions imposed on the resale of penny stocks by these regulations,

could adversely affect our stock price.

Our Board of Directors can, without

shareholder approval, cause preferred stock to be issued on terms that adversely affect common shareholders.

Under our Articles of Incorporation, our

board of directors is authorized to issue up to 10,000,000 shares of preferred stock, none of which are issued and outstanding

as of the date of this Prospectus. Also, our board of directors, without shareholder approval, may determine the price, rights,

preferences, privileges and restrictions, including voting rights, of those shares. If our board of directors causes any shares

of preferred stock to be issued, the rights of the holders of our common stock could be adversely affected. Our board of directors’

ability to determine the terms of preferred stock and to cause its issuance, while providing desirable flexibility in connection

with possible acquisitions and other corporate purposes, could have the effect of making it more difficult for a third party to

acquire a majority of our outstanding voting stock. Preferred shares issued by our board of directors could include voting rights,

or even super voting rights, which could shift the ability to control our company to the holders of our preferred stock. Preferred

shares could also have conversion rights into shares of our common stock at a discount to the market price of the common stock

which could negatively affect the market for our common stock. In addition, preferred shares would have preference in the event

of our liquidation, which means that the holders of preferred shares would be entitled to receive the net assets of our company

distributed in liquidation before the common stock holders receive any distribution of the liquidated assets.

We have not paid, and do not intend

to pay in the near future, dividends on our common shares and therefore, unless our common stock appreciates in value, our shareholders

may not benefit from holding our common stock.

We have not paid any cash dividends since

inception. Therefore, any return on the investment made in our shares of common stock will likely be dependent initially upon the

shareholder’s ability to sell our common shares in the open market, at prices in excess of the amount paid for our common

shares and broker commissions on the sales.

Because we became public by means

of a reverse merger, we may not be able to attract the attention of brokerage firms.

Additional risks may exist because we became

public through a “reverse merger.” Securities analysts of brokerage firms may not provide coverage of our company since

there is little incentive for brokerage firms to recommend the purchase of our common stock. No assurance can be given that brokerage

firms will want to conduct secondary offerings on our behalf in the future.

Shares of our common stock that have

not been registered under federal securities laws are subject to resale restrictions imposed by Rule 144, including those set forth

in Rule 144(i) which apply to a former “shell company.”

Prior to the closing of the SEA, we were

deemed a “shell company” under applicable SEC rules and regulations because we had no or nominal operations and either

no or nominal assets, assets consisting solely of cash and cash equivalents, or assets consisting of any amount of cash and cash

equivalents and nominal other assets. Pursuant to Rule 144 promulgated under the Securities Act sales of the securities of a former

shell company, such as us, under that rule are not permitted (i) until at least 12 months have elapsed from the date on which Form

10-type information reflecting our status as a non-shell company, is filed with the SEC and (ii) unless at the time of a proposed

sale, we are subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act and have filed all reports and other

materials required to be filed by Section 13 or 15(d) of the Exchange Act, as applicable, during the preceding 12 months, other

than Form 8-K reports. Without registration under the Securities Act, our shareholders will be forced to hold their shares of our

common stock for at least that 12-month period after the filing of the report on Form 8-K following the closing of the reverse

merger before they are eligible to sell those shares pursuant to Rule 144, and even after that 12-month period, sales may not be

made under Rule 144 unless we are in compliance with other requirements of Rule 144. Further, it will be more difficult for us

to raise funding to support our operations through the sale of debt or equity securities unless we agree to register such securities

under the Securities Act, which could cause us to expend significant time and cash resources. The lack of liquidity of our securities

as a result of the inability to sell under Rule 144 for a longer period of time than a non-former shell company could negatively

affect the market price of our securities.

We are an “emerging growth

company,” and will be able take advantage of reduced disclosure requirements applicable to “emerging growth companies,”

which could make our common stock less attractive to investors.

We are an “emerging growth company,”

as defined in the Jumpstart Our Business Startups Act of 2012, or JOBS Act, and, for as long as we continue to be an “emerging

growth company,” we intend to take advantage of certain exemptions from various reporting requirements applicable to other

public companies but not to “emerging growth companies,” including, but not limited to, not being required to comply

with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive

compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory

vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We could be an

“emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year

in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined

in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates

exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which

we have issued more than $1 billion in non-convertible debt during the preceding three year period. We cannot predict if investors

will find our common stock less attractive if we choose to rely on these exemptions. If some investors find our common stock less

attractive as a result of any choices to reduce future disclosure, there may be a less active trading market for our common stock

and our stock price may be more volatile.

Risks Related to the Offering

Our existing stockholders may experience

significant dilution from the sale of our common stock pursuant to the GHS Equity Financing Agreement.

The sale of our common stock to GHS Investments

LLC in accordance with the Equity Financing Agreement may have a dilutive impact on our shareholders. As a result, the market price

of our common stock could decline. In addition, the lower our stock price is at the time we exercise our put options, the more

shares of our common stock we will have to issue to GHS in order to exercise a put under the Equity Financing Agreement. If our

stock price decreases, then our existing shareholders would experience greater dilution for any given dollar amount raised through

the offering.

The perceived risk of dilution may cause

our stockholders to sell their shares, which may cause a decline in the price of our common stock. Moreover, the perceived risk

of dilution and the resulting downward pressure on our stock price could encourage investors to engage in short sales of our common