Icahn Enterprises L.P. Enters Into Agreement with Brett Icahn

October 01 2020 - 8:00AM

Icahn Enterprises L.P. (NASDAQ:IEP) today announced that it and its

investment management subsidiary, Icahn Capital LP, have entered

into an Agreement with Brett Icahn, the son of Chairman Carl Icahn.

Pursuant to the Agreement, Brett Icahn and a new team of portfolio

managers will manage a portfolio of assets within Icahn

Enterprises’ Investment segment over a 7-year term, subject to

certain veto rights by Carl Icahn. Brett Icahn will also join the

Board of Directors of Icahn Enterprises and purchase $10 million in

market value of depositary units from Carl Icahn.

Brett Icahn, a graduate of Princeton University,

joined Icahn Capital in 2002 and in 2010 became responsible for

co-managing the Sargon Portfolio, a portfolio of assets within the

Investment segment, subject to certain veto rights by Carl Icahn.

The Sargon Portfolio generated annualized gross returns of 26.8%

from its formation on April 1, 2010 through its expiration on July

31, 2016.

Icahn Enterprises also announced the adoption of

a management succession plan, pursuant to which it is currently

anticipated that Brett Icahn will succeed Carl Icahn as Chairman of

Icahn Enterprises and Chief Executive Officer of the Investment

segment following the end of the 7-year term of the Agreement or

earlier if Carl Icahn should so determine.

Icahn Capital has hired three portfolio managers

who will work in the Investment segment under the supervision of

Brett Icahn and Carl Icahn: Gary Hu, most recently an Analyst with

Silver Point Capital; Steven Miller, most recently an Analyst in

the Distressed and Special Situations group at BlueMountain Capital

Management; and Andrew Teno, most recently a director at Fir Tree

Partners.

About Icahn Enterprises

L.P.

Icahn Enterprises L.P., a master limited

partnership, is a diversified holding company engaged in seven

primary business segments: Investment, Energy, Automotive, Food

Packaging, Metals, Real Estate and Home Fashion.

Caution Concerning Forward-Looking

Statements

This release contains or may be deemed to

contain certain "forward-looking statements" within the meaning of

the Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by words such as

"expects," "anticipates," "intends," "plans," "believes," "seeks,"

"estimates," "will" or words of similar meaning and include, but

are not limited to, statements about the expected future business

and financial performance of Icahn Enterprises L.P. and its

subsidiaries. Actual events, results and outcomes may differ

materially from our expectations due to a variety of known and

unknown risks, uncertainties and other factors, including risks and

uncertainties detailed from time to time in our filings with the

Securities and Exchange Commission. Past performance in our

Investment segment is not indicative of future performance. There

can be no assurance that any forward-looking information will

result or be achieved. We undertake no obligation to publicly

update or review any forward-looking information, whether as a

result of new information, future developments or otherwise.

Investor Contact:SungHwan Cho,

Chief Financial Officer(305) 422-4000

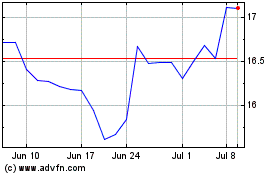

Icahn Enterprises (NASDAQ:IEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Icahn Enterprises (NASDAQ:IEP)

Historical Stock Chart

From Apr 2023 to Apr 2024