- Revenues Increased 11.5 Percent – Driven by Growth in Both

Retail Pharmacy and Pharmacy Services Segments

- Front-End Market Share Increased by 130 Basis Points in

Dollars and 150 Basis Points in Unit Sales

- Net Loss from Continuing Operations Narrowed $65.5 Million

to $13.2 Million, or $0.25 Per Share

- Adjusted EBITDA from Continuing Operations Increased $17.4

Million or 13% to $151.6 Million

- Company Issues Revised Fiscal 2021 Guidance

Rite Aid Corporation (NYSE: RAD) today reported operating

results for its second fiscal quarter ended August 29, 2020.

For the second quarter, net loss from continuing operations

narrowed $65.5 million to $13.2 million, or $0.25 loss per share.

Adjusted net income from continuing operations increased $7.2

million to $13.5 million, or $0.25 earnings per share, and Adjusted

EBITDA from continuing operations increased $17.4 million to $151.6

million, or 2.5 percent of revenues.

“We are pleased with our second quarter performance as we

delivered another quarter of strong results while making solid

progress on our bold, new RxEvolution strategy,” said Heyward

Donigan, president and chief executive officer, Rite Aid. “Our

retail pharmacists and associates have always been deeply committed

to our communities, and they are doing a great job protecting our

customers during a global pandemic. Thanks to them, Rite Aid

continues to gain retail market share and increase both same store

prescription count and front-end sales.”

“And at Elixir, our new leadership team is in place, and we are

making progress on modernizing and integrating our many assets. We

also officially launched our new Elixir brand and are focused on

enhancing our curated solutions, products, clinical and digital

capabilities. We grew membership in our Medicare Part D business

and benefitted from strong expense control, especially as we

continue to integrate Rite Aid and Elixir.”

“I am so proud of our 50,000 associates and how they are working

together each and every day to deliver operational excellence and

help our customers to not just get healthy, but get thriving.

Together, we are building a strong foundation for sustainable

growth and setting the stage to engage with consumers in ways never

before seen in health care. A whole new Rite Aid is coming to life,

and I’m excited to continue our journey to become a dominant

mid-market PBM, unlock the value of our pharmacists and revitalize

our retail and digital experiences.”

Consolidated Second Quarter Summary

(dollars in thousands)

Thirteen Week Period Ended

Twenty-six Week Period Ended

August 29, 2020

August 31, 2019

August 29, 2020

August 31, 2019

Revenues from continuing operations

$

5,981,970

$

5,366,264

$

12,009,346

$

10,738,853

Net loss from continuing operations

(13,197

)

(78,705

)

(85,899

)

(178,044

)

Adjusted EBITDA from continuing

operations

151,603

134,190

258,995

244,537

Revenues from continuing operations for the quarter were $5.98

billion compared to revenues from continuing operations of $5.37

billion in the prior year’s quarter. The increase in revenues was

driven by growth at both the Retail Pharmacy and Pharmacy Services

segments.

Net loss from continuing operations was $13.2 million, or $0.25

per share compared to last year’s second quarter net loss from

continuing operations of $78.7 million, or $1.48 per share. The

improvement in net loss is due primarily to an increase in Adjusted

EBITDA, decreases in income tax and interest expense, a LIFO credit

in the current quarter compared to a LIFO charge in the prior year

second quarter, and a gain on debt modification in the current

quarter. These benefits were partially offset by an increase in

lease termination and impairment charges caused by the wind down of

our RediClinic business in the current quarter.

Adjusted EBITDA from continuing operations was $151.6 million or

2.5% of revenues, compared to last year’s second quarter Adjusted

EBITDA of $134.2 million or 2.5% of revenues. The improvement in

Adjusted EBITDA was driven by increased revenues and a reduction in

SG&A expenses.

Retail Pharmacy Segment

(dollars in thousands)

Thirteen Week Period Ended

Twenty-six Week Period Ended

August 29, 2020

August 31, 2019

August 29, 2020

August 31, 2019

Revenues from continuing operations

$

4,017,912

$

3,848,104

$

8,141,183

$

7,712,912

Adjusted EBITDA from continuing

operations

122,340

92,673

185,322

176,681

Retail Pharmacy Segment revenues from continuing operations

increased 4.4 percent over the prior year quarter. Same store sales

from continuing operations for the second quarter increased 3.5

percent over the prior year period, consisting of a 4.6 percent

increase in front-end sales and a 2.3 percent increase in pharmacy

sales. Front-end same store sales, excluding cigarettes and tobacco

products, increased 6.1 percent, driven by increases across a

number of categories. The company increased its front-end market

share by 130 basis points in dollars and 150 basis points in unit

sales1. The number of prescriptions filled in same stores, adjusted

to 30-day equivalents, increased 2.6 percent over the prior year

period driven by increases in maintenance prescriptions, supported

by personalized Medication Therapy Management interventions and

home deliveries, partially offset by a reduction in acute

prescriptions of 4.9 percent.

Retail Pharmacy Segment Adjusted EBITDA from continuing

operations was $122.3 million or 3.0 percent of revenues for the

second quarter compared to last year’s second quarter Adjusted

EBITDA from continuing operations of $92.7 million or 2.4 percent

of revenues. The increase of $29.6 million is due to a reduction in

SG&A expenses and increased gross profit. SG&A expenses

were favorably impacted by changes to modernize our associate paid

time off (PTO) plans along with strong expense control. These

savings were partially offset by incremental costs associated with

the COVID-19 pandemic and the absence of Transition Services

Agreement income in the current quarter, as services under that

agreement have been completed. Gross profit benefited from

increased revenue, partially offset by continued pharmacy

reimbursement rate pressures that were not fully offset by generic

drug cost reductions.

1 – Source: IRI. Excludes tobacco, cigarettes, greeting cards

and online sales. For drug store channel during Rite Aid’s second

fiscal quarter.

Pharmacy Services Segment

(dollars in thousands)

Thirteen Week Period Ended

Twenty-six Week Period Ended

August 29, 2020

August 31, 2019

August 29, 2020

August 31, 2019

Revenues from continuing operations

$

2,038,378

$

1,579,069

$

4,015,624

$

3,145,361

Adjusted EBITDA from continuing

operations

29,263

41,517

73,673

67,856

Pharmacy Services Segment revenues were $2.0 billion, an

increase of 29.1 percent compared to the prior year period. The

increase in Pharmacy Services Segment revenues was due primarily to

a membership increase of 259,000 in Medicare Part D.

Pharmacy Services Segment Adjusted EBITDA from continuing

operations was $29.3 million or 1.4 percent of revenues for the

second quarter compared to last year’s second quarter Adjusted

EBITDA from continuing operations of $41.5 million or 2.6 percent

of revenues. The decrease in Adjusted EBITDA of $12.3 million was

primarily due to a reduction of $21.0 million in gross profit

related to a change in rebate aggregator at our MedTrak subsidiary.

The company anticipates that the new rebate aggregator contract

will drive improved gross profit for the company and savings for

its clients. The unfavorable gross profit reduction was partially

offset by increased revenues, improved pharmacy network management

and strong expense control.

Outlook for Fiscal 2021

Rite Aid Corporation is issuing revised fiscal 2021 guidance.

The company’s guidance assumes strong demand for flu immunizations,

continued improvement in pharmacy network management at Elixir and

savings from our previously announced cost reduction initiatives,

offset by continued reimbursement rate pressure and the impact of a

less severe cough, cold and flu season on OTC sales and related

prescriptions.

Rite Aid Corporation expects revenues to be between $23.5

billion and $24.0 billion in fiscal 2021 with same store sales

expected to range from an increase of 3.0 percent to an increase of

4.0 percent over fiscal 2020.

Net loss is expected to be between $190 million and $140

million.

Adjusted EBITDA is expected to be between $475 million and $525

million.

Adjusted net (loss) income per share is expected to be between

$(0.67) and $0.09.

Capital expenditures are expected to be approximately $275

million.

Free cash flow is expected to be between $110 million and $160

million.

Conference Call Broadcast

Rite Aid will hold an analyst call at 8:30 a.m. Eastern Time

today with remarks by Rite Aid's management team. The call will be

broadcast via the Internet at

https://www.riteaid.com/corporate/investor-relations/presentations.

The telephone replay will be available beginning at 12 p.m. Eastern

Time today and ending at 11:59 p.m. Eastern Time on, Sept. 26,

2020. To access the replay of the call, telephone (800) 585-8367 or

(416) 621-4642 and enter the seven-digit reservation number

6691435. The webcast replay of the call will also be available at

https://www.riteaid.com/corporate/investor-relations/presentations

starting at 12 p.m. Eastern Time today. The playback will be

available until the company’s next conference call.

About Rite Aid Corporation

Rite Aid Corporation is on the front lines of delivering

healthcare services and retail products to more than 1.6 million

Americans daily. Our pharmacists are uniquely positioned to engage

with customers and improve their health outcomes. We provide an

array of whole being health products and services for the entire

family through over 2,400 retail pharmacy locations across 18

states. Through Elixir, we provide pharmacy benefits and services

to approximately 4 million members nationwide. For more

information, www.riteaid.com.

Cautionary Statement Regarding Forward-Looking

Statements

Statements in this release that are not historical, are

forward-looking statements made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Such statements include, but are not limited to, statements

regarding Rite Aid's outlook and guidance for fiscal 2021, the

ability to generate positive free cash flows in fiscal 2021; the

continued impact of the recent global coronavirus (COVID-19)

pandemic on Rite Aid’s business; and any assumptions underlying any

of the foregoing. Words such as "anticipate," "believe,"

"continue," "could," "estimate," "expect," "intend," "may," "plan,"

"predict," "project," "should," and "will" and variations of such

words and similar expressions are intended to identify such

forward-looking statements.

These forward-looking statements are not guarantees of future

performance and involve risks, assumptions and uncertainties,

including, but not limited to: the impact of COVID-19 on our

workforce, operations, stores, expenses, and supply chain, and the

operations of our customers, suppliers and business partners; our

ability to successfully implement our new business strategy

(including any delays and adjustments as a result of COVID-19) and

improve the operating performance of our stores; our high level of

indebtedness and our ability to satisfy our obligations and the

other covenants contained in our debt agreements; general

competitive, economic, industry, market, political (including

healthcare reform) and regulatory conditions, civil unrest

(including any resulting store closures, damage, or loss of

inventory), as well as other factors specific to the markets in

which we operate; the impact of private and public third-party

payers continued reduction in prescription drug reimbursements and

efforts to encourage mail order; our ability to manage expenses and

our investments in working capital; our ability to achieve the

benefits of our efforts to reduce the costs of our generic and

other drugs; our ability to achieve cost savings and other benefits

of our organizational restructuring within our anticipated

timeframe, if at all; outcomes of legal and regulatory matters; and

our ability to partner and have relationships with health plans and

health systems.

These and other risks, assumptions and uncertainties are more

fully described in Item 1A (Risk Factors) of our most recent Annual

Report on Form 10-K, in Item 1A (Risk Factors) of our Quarterly

Report on Form 10-Q filed on July 2, 2020 and in other documents

that we file or furnish with the Securities and Exchange Commission

(the “SEC”), which you are encouraged to read. To the extent that

COVID-19 adversely affects our business and financial results, it

may also have the effect of heightening many of such risk

factors.

Should one or more of these risks or uncertainties materialize,

or should underlying assumptions prove incorrect, actual results

may vary materially from those indicated or anticipated by such

forward-looking statements. Accordingly, you are cautioned not to

place undue reliance on these forward-looking statements, which

speak only as of the date they are made.

The degree to which COVID-19 may adversely affect Rite Aid’s

results and operations, including its ability to achieve its

outlook for fiscal 2021 guidance, will depend on numerous evolving

factors and future developments, which are highly uncertain,

including, but not limited to, the duration and spread of the

outbreak, its severity, the actions to contain the virus or treat

its impact (such as travel bans and restrictions, quarantines,

shelter-in-place orders and shutdowns), including the reinstitution

of more stringent regulations, and how quickly and to what extent

normal economic and operating conditions can resume. As a result,

the impact on Rite Aid’s financial and operating results cannot be

reasonably estimated with specificity at this time, but the impact

could be material. Rite Aid expressly disclaims any current

intention to update publicly any forward-looking statement after

the distribution of this release, whether as a result of new

information, future events, changes in assumptions or

otherwise.

Reconciliation of Non-GAAP Financial Measures

Rite Aid separately reports financial results on the basis of

Adjusted Net Income (Loss), Adjusted Net Income (Loss) per Diluted

Share and Adjusted EBITDA which are non-GAAP financial measures.

See the attached tables for a reconciliation of Adjusted Net Income

(Loss), Adjusted Net Income (Loss) per Diluted Share and Adjusted

EBITDA to net income (loss), and net income (loss) per diluted

share, which are the most directly comparable GAAP financial

measures. Adjusted Net Income (Loss) and Adjusted Net Income (Loss)

per Diluted Share exclude amortization expense, merger and

acquisition-related costs, non-recurring litigation settlement,

gains and losses on debt retirements and modifications, LIFO

adjustments, goodwill and intangible asset impairment charges,

restructuring-related costs and the WBA merger termination fee.

Adjusted EBITDA is defined as net income (loss) excluding the

impact of income taxes, interest expense, depreciation and

amortization, LIFO adjustments, charges or credits for facility

closing and impairment, goodwill and intangible asset impairment

charges, inventory write-downs related to store closings, gains or

losses on debt retirements and modifications, the WBA merger

termination fee, and other items (including stock-based

compensation expense, merger and acquisition-related costs,

non-recurring litigation settlement, severance,

restructuring-related costs and costs related to facility closures

and gain or loss on sale of assets). The add back of LIFO (credit)

charge when calculating Adjusted EBITDA, Adjusted Net Income (Loss)

and Adjusted Net Income (Loss) per Diluted Share removes the entire

impact of LIFO (credits) charges, and effectively reflects Rite

Aid's results as if the company was on a FIFO inventory basis.

RITE AID CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE

SHEETS (Dollars in thousands) (unaudited)

August 29, 2020 February 29, 2020 ASSETS Current assets: Cash and

cash equivalents

$

92,730

$

218,180

Accounts receivable, net

1,920,866

1,286,785

Inventories, net of LIFO reserve of $518,824 and $539,640

1,937,953

1,921,604

Prepaid expenses and other current assets

114,148

181,794

Current assets held for sale

-

92,278

Total current assets

4,065,697

3,700,641

Property, plant and equipment, net

1,140,658

1,215,838

Operating lease right-of-use assets

2,860,710

2,903,256

Goodwill

1,108,136

1,108,136

Other intangibles, net

305,730

359,491

Deferred tax assets

16,680

16,680

Other assets

122,588

148,327

Total assets

$

9,620,199

$

9,452,369

LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities:

Current maturities of long-term debt and lease financing

obligations

$

6,902

$

8,840

Accounts payable

1,448,682

1,484,081

Accrued salaries, wages and other current liabilities

637,610

746,318

Current portion of operating lease liabilities

487,844

490,161

Current liabilities held for sale

-

37,063

Total current liabilities

2,581,038

2,766,463

Long-term debt, less current maturities

3,506,708

3,077,268

Long-term operating lease liabilities

2,657,891

2,710,347

Lease financing obligations, less current maturities

17,935

19,326

Other noncurrent liabilities

253,589

204,438

Total liabilities

9,017,161

8,777,842

Commitments and contingencies

-

-

Stockholders' equity: Common stock

55,224

54,716

Additional paid-in capital

5,893,590

5,890,903

Accumulated deficit

(5,298,932

)

(5,222,194

)

Accumulated other comprehensive loss

(46,844

)

(48,898

)

Total stockholders' equity

603,038

674,527

Total liabilities and stockholders' equity

$

9,620,199

$

9,452,369

RITE AID CORPORATION AND SUBSIDIARIES CONSOLIDATED

STATEMENTS OF OPERATIONS (Dollars in thousands, except per share

amounts) (unaudited) Thirteen weeks

endedAugust 29, 2020 Thirteen weeks endedAugust 31, 2019 Revenues

$

5,981,970

$

5,366,264

Costs and expenses: Cost of revenues

4,821,625

4,221,825

Selling, general and administrative expenses

1,116,142

1,135,530

Lease termination and impairment charges

11,528

1,471

Interest expense

50,007

60,102

Gain on debt modification, net

(5,274

)

-

Loss (gain) on sale of assets, net

1,092

(1,587

)

5,995,120

5,417,341

Loss from continuing operations before income taxes

(13,150

)

(51,077

)

Income tax expense

47

27,628

Net loss from continuing operations

(13,197

)

(78,705

)

Net loss from discontinued operations, net of tax

-

(574

)

Net loss

$

(13,197

)

$

(79,279

)

Basic and diluted loss per share:

Numerator for loss per share: Net loss from continuing operations

attributable to common stockholders - basic and diluted

$

(13,197

)

$

(78,705

)

Net loss from discontinued operations attributable to common

stockholders - basic and diluted

-

(574

)

Loss attributable to common stockholders - basic and diluted

$

(13,197

)

$

(79,279

)

Denominator: Basic and diluted weighted

average shares

53,573

53,041

Basic and diluted loss per share Continuing operations

$

(0.25

)

$

(1.48

)

Discontinued operations

$

-

$

(0.01

)

Net basic and diluted loss per share

$

(0.25

)

$

(1.49

)

RITE AID CORPORATION AND SUBSIDIARIES CONSOLIDATED

STATEMENTS OF OPERATIONS (Dollars in thousands, except per share

amounts) (unaudited) Twenty-six weeks

endedAugust 29, 2020 Twenty-six weeks endedAugust 31, 2019 Revenues

$

12,009,346

$

10,738,853

Costs and expenses: Cost of revenues

9,650,682

8,467,691

Selling, general and administrative expenses

2,313,289

2,298,182

Lease termination and impairment charges

15,281

1,949

Intangible asset impairment charges

29,852

-

Interest expense

100,554

118,372

Gain on debt modification, net

(5,274

)

-

Gain on sale of assets, net

(1,168

)

(4,299

)

12,103,216

10,881,895

Loss from continuing operations before income taxes

(93,870

)

(143,042

)

Income tax (benefit) expense

(7,971

)

35,002

Net loss from continuing operations

(85,899

)

(178,044

)

Net income (loss) from discontinued operations, net of tax

9,161

(894

)

Net loss

$

(76,738

)

$

(178,938

)

Basic and diluted loss per share:

Numerator for loss per share: Net loss from continuing operations

attributable to common stockholders - basic and diluted

$

(85,899

)

$

(178,044

)

Net income (loss) from discontinued operations attributable to

common stockholders - basic and diluted

9,161

(894

)

Loss attributable to common stockholders - basic and diluted

$

(76,738

)

$

(178,938

)

Denominator: Basic and diluted weighted

average shares

53,528

53,084

Basic and diluted loss per share Continuing operations

$

(1.60

)

$

(3.35

)

Discontinued operations

$

0.17

$

(0.02

)

Net basic and diluted loss per share

$

(1.43

)

$

(3.37

)

RITE AID CORPORATION AND SUBSIDIARIES CONSOLIDATED

STATEMENTS OF CASH FLOWS (Dollars in thousands) (unaudited)

Thirteen weeks endedAugust 29, 2020 Thirteen weeks

endedAugust 31, 2019 OPERATING ACTIVITIES: Net loss

$

(13,197

)

$

(79,279

)

Net loss from discontinued operations, net of tax

-

(574

)

Net loss from continuing operations

$

(13,197

)

$

(78,705

)

Adjustments to reconcile to net cash used in operating activities

of continuing operations: Depreciation and amortization

87,117

83,044

Lease termination and impairment charges

11,528

1,471

LIFO (credit) charge

(8,750

)

7,504

Loss (gain) on sale of assets, net

1,092

(1,587

)

Stock-based compensation expense

3,936

4,712

Gain on debt modification, net

(5,274

)

-

Changes in deferred taxes

-

26,979

Changes in operating assets and liabilities: Accounts receivable

(327,919

)

(135,704

)

Inventories

(39,174

)

(100,536

)

Accounts payable

(11,372

)

(9,730

)

Operating lease right-of-use assets and operating lease liabilities

(11,898

)

46,875

Other assets

(19,664

)

(67,187

)

Other liabilities

(24,747

)

(55,935

)

Net cash used in operating activities of continuing operations

(358,322

)

(278,799

)

INVESTING ACTIVITIES: Payments for property, plant and equipment

(34,626

)

(43,079

)

Intangible assets acquired

(11,857

)

(7,498

)

Proceeds from insured loss

12,500

-

Proceeds from dispositions of assets and investments

3,155

3,765

Proceeds from sale-leaseback transactions

8,461

-

Net cash used in investing activities of continuing operations

(22,367

)

(46,812

)

FINANCING ACTIVITIES: Proceeds from issuance of long-term debt

849,918

-

Net proceeds from revolver

408,000

250,000

Principal payments on long-term debt

(1,054,884

)

(1,671

)

Change in zero balance cash accounts

(262

)

18,325

Payments for taxes related to net share settlement of equity awards

(2,002

)

(791

)

Financing fees paid for early debt redemption

(2,399

)

-

Deferred financing costs paid

(13,268

)

(129

)

Net cash provided by financing activities of continuing operations

185,103

265,734

Cash flows from discontinued operations: Operating activities of

discontinued operations

-

11,605

Investing activities of discontinued operations

-

-

Net cash provided by discontinued operations

-

11,605

Decrease in cash and cash equivalents

(195,586

)

(48,272

)

Cash and cash equivalents, beginning of period

288,316

190,453

Cash and cash equivalents, end of period

$

92,730

$

142,181

RITE AID CORPORATION AND SUBSIDIARIES CONSOLIDATED

STATEMENTS OF CASH FLOWS (Dollars in thousands) (unaudited)

Twenty-six weeks endedAugust 29, 2020 Twenty-six

weeks endedAugust 31, 2019 OPERATING ACTIVITIES: Net

loss

$

(76,738

)

$

(178,938

)

Net income (loss) from discontinued operations, net of tax

9,161

(894

)

Net loss from continuing operations

$

(85,899

)

$

(178,044

)

Adjustments to reconcile to net cash used in operating activities

of continuing operations: Depreciation and amortization

166,220

166,970

Lease termination and impairment charges

15,281

1,949

Intangible asset impairment charges

29,852

-

LIFO (credit) charge

(20,816

)

14,993

Gain on sale of assets, net

(1,168

)

(4,299

)

Stock-based compensation expense

5,810

10,092

Gain on debt modification, net

(5,274

)

-

Changes in deferred taxes

-

26,979

Changes in operating assets and liabilities: Accounts receivable

(636,555

)

(153,269

)

Inventories

4,473

(111,990

)

Accounts payable

1,948

(85,623

)

Operating lease right-of-use assets and operating lease liabilities

(18,493

)

34,982

Other assets

79,513

(44,674

)

Other liabilities

(11,484

)

(8,104

)

Net cash used in operating activities of continuing operations

(476,592

)

(330,038

)

INVESTING ACTIVITIES: Payments for property, plant and equipment

(63,085

)

(84,060

)

Intangible assets acquired

(22,572

)

(15,708

)

Proceeds from insured loss

12,500

-

Proceeds from dispositions of assets and investments

5,910

4,423

Proceeds from sale-leaseback transactions

8,461

-

Net cash used in investing activities of continuing operations

(58,786

)

(95,345

)

FINANCING ACTIVITIES: Proceeds from issuance of long-term debt

849,918

-

Net proceeds from revolver

650,000

375,000

Principal payments on long-term debt

(1,056,182

)

(3,451

)

Change in zero balance cash accounts

(26,829

)

54,712

Payments for taxes related to net share settlement of equity awards

(2,101

)

(986

)

Financing fees paid for early debt redemption

(2,399

)

-

Deferred financing costs paid

(14,600

)

(315

)

Net cash provided by financing activities of continuing operations

397,807

424,960

Cash flows from discontinued operations: Operating activities of

discontinued operations

(82,189

)

(2,272

)

Investing activities of discontinued operations

94,310

523

Net cash provided by (used in) discontinued operations

12,121

(1,749

)

Decrease in cash and cash equivalents

(125,450

)

(2,172

)

Cash and cash equivalents, beginning of period

218,180

144,353

Cash and cash equivalents, end of period

$

92,730

$

142,181

RITE AID CORPORATION AND SUBSIDIARIES SUPPLEMENTAL SEGMENT

OPERATING INFORMATION (Dollars in thousands) (unaudited)

Thirteen weeks endedAugust 29, 2020 Thirteen weeks

endedAugust 31, 2019

Retail Pharmacy Segment Revenues

from continuing operations (a)

$

4,017,912

$

3,848,104

Cost of revenues from continuing operations (a)

2,955,999

2,815,660

Gross profit from continuing operations

1,061,913

1,032,444

LIFO (credit) charge from continuing operations

(8,750

)

7,504

FIFO gross profit from continuing operations

1,053,163

1,039,948

Adjusted EBITDA gross profit from continuing operations

1,056,222

1,045,257

Gross profit as a percentage of revenues - continuing

operations

26.43

%

26.83

%

LIFO (credit) charge as a percentage of revenues - continuing

operations

-0.22

%

0.20

%

FIFO gross profit as a percentage of revenues - continuing

operations

26.21

%

27.02

%

Adjusted EBITDA gross profit as a percentage of revenues -

continuing operations

26.29

%

27.16

%

Selling, general and administrative expenses from continuing

operations

1,030,075

1,044,818

Adjusted EBITDA selling, general and administrative expenses from

continuing operations

933,882

952,584

Selling, general and administrative expenses as a percentage of

revenues - continuing operations

25.64

%

27.15

%

Adjusted EBITDA selling, general and administrative expenses as a

percentage of revenues - continuing operations

23.24

%

24.75

%

Cash interest expense

46,767

56,304

Non-cash interest expense

3,240

3,798

Total interest expense

50,007

60,102

Interest expense - continuing operations

50,007

60,102

Interest expense - discontinued operations

-

-

Adjusted EBITDA - continuing operations

122,340

92,673

Adjusted EBITDA as a percentage of revenues - continuing operations

3.04

%

2.41

%

Pharmacy Services Segment Revenues (a)

$

2,038,378

$

1,579,069

Cost of revenues (a)

1,939,946

1,467,074

Gross profit

98,432

111,995

Gross profit as a percentage of revenues

4.83

%

7.09

%

Adjusted EBITDA

29,263

41,517

Adjusted EBITDA as a percentage of revenues

1.44

%

2.63

%

(a) -

Revenues and cost of revenues include $74,320 and $60,909 of

inter-segment activity for the thirteen weeks ended August 29, 2020

and August 31, 2019, respectively, that is eliminated in

consolidation. RITE AID CORPORATION AND SUBSIDIARIES

SUPPLEMENTAL SEGMENT OPERATING INFORMATION (Dollars in thousands)

(unaudited) Twenty-six weeks endedAugust 29, 2020

Twenty-six weeks endedAugust 31, 2019

Retail Pharmacy

Segment Revenues from continuing operations (a)

$

8,141,183

$

7,712,912

Cost of revenues from continuing operations (a)

5,997,734

5,649,973

Gross profit from continuing operations

2,143,449

2,062,939

LIFO (credit) charge from continuing operations

(20,816

)

14,993

FIFO gross profit from continuing operations

2,122,633

2,077,932

Adjusted EBITDA gross profit from continuing operations

2,154,649

2,085,520

Gross profit as a percentage of revenues - continuing

operations

26.33

%

26.75

%

LIFO (credit) charge as a percentage of revenues - continuing

operations

-0.26

%

0.19

%

FIFO gross profit as a percentage of revenues - continuing

operations

26.07

%

26.94

%

Adjusted EBITDA gross profit as a percentage of revenues -

continuing operations

26.47

%

27.04

%

Selling, general and administrative expenses from continuing

operations

2,139,051

2,116,143

Adjusted EBITDA selling, general and administrative expenses from

continuing operations

1,969,327

1,908,839

Selling, general and administrative expenses as a percentage of

revenues - continuing operations

26.27

%

27.44

%

Adjusted EBITDA selling, general and administrative expenses as a

percentage of revenues - continuing operations

24.19

%

24.75

%

Cash interest expense

94,135

110,914

Non-cash interest expense

6,419

7,458

Total interest expense

100,554

118,372

Interest expense - continuing operations

100,554

118,372

Interest expense - discontinued operations

-

-

Adjusted EBITDA - continuing operations

185,322

176,681

Adjusted EBITDA as a percentage of revenues - continuing operations

2.28

%

2.29

%

Pharmacy Services Segment Revenues (a)

$

4,015,624

$

3,145,361

Cost of revenues (a)

3,800,409

2,937,138

Gross profit

215,215

208,223

Gross profit as a percentage of revenues

5.36

%

6.62

%

Adjusted EBITDA

73,673

67,856

Adjusted EBITDA as a percentage of revenues

1.83

%

2.16

%

(a) -

Revenues and cost of revenues include $147,461 and $119,420 of

inter-segment activity for the twenty-six weeks ended August 29,

2020 and August 31, 2019, respectively, that is eliminated in

consolidation. RITE AID CORPORATION AND SUBSIDIARIES SUPPLEMENTAL

INFORMATION RECONCILIATION OF NET LOSS TO ADJUSTED EBITDA (In

thousands) (unaudited) Thirteen weeks

endedAugust 29, 2020 Thirteen weeks endedAugust 31, 2019

Reconciliation of net loss to adjusted EBITDA: Net loss -

continuing operations

$

(13,197

)

$

(78,705

)

Adjustments: Interest expense

50,007

60,102

Income tax expense

47

27,628

Depreciation and amortization

87,117

83,044

LIFO (credit) charge

(8,750

)

7,504

Lease termination and impairment charges

11,528

1,471

Gain on debt modification, net

(5,274

)

-

Merger and Acquisition-related costs

-

514

Stock-based compensation expense

3,936

4,712

Restructuring-related costs

23,186

25,145

Inventory write-downs related to store closings

1,058

3,149

Loss (gain) on sale of assets, net

1,092

(1,587

)

Other

853

1,213

Adjusted EBITDA - continuing operations

$

151,603

$

134,190

Percent of revenues - continuing operations

2.53

%

2.50

%

RITE AID CORPORATION AND SUBSIDIARIES SUPPLEMENTAL INFORMATION

RECONCILIATION OF NET LOSS TO ADJUSTED EBITDA (In thousands)

(unaudited) Twenty-six weeks endedAugust 29,

2020 Twenty-six weeks endedAugust 31, 2019

Reconciliation of net loss to adjusted EBITDA: Net loss -

continuing operations

$

(85,899

)

$

(178,044

)

Adjustments: Interest expense

100,554

118,372

Income tax (benefit) expense

(7,971

)

35,002

Depreciation and amortization

166,220

166,970

LIFO (credit) charge

(20,816

)

14,993

Lease termination and impairment charges

15,281

1,949

Intangible asset impairment charges

29,852

-

Gain on debt modification, net

(5,274

)

-

Merger and Acquisition-related costs

-

3,599

Stock-based compensation expense

5,810

10,092

Restructuring-related costs

58,921

68,495

Inventory write-downs related to store closings

1,892

3,990

Gain on sale of assets, net

(1,168

)

(4,299

)

Other

1,593

3,418

Adjusted EBITDA - continuing operations

$

258,995

$

244,537

Percent of revenues - continuing operations

2.16

%

2.28

%

RITE AID CORPORATION AND SUBSIDIARIES SUPPLEMENTAL INFORMATION

ADJUSTED NET INCOME (Dollars in thousands, except per share

amounts) (unaudited) Thirteen weeks endedAugust 29,

2020 Thirteen weeks endedAugust 31, 2019 Net loss from

continuing operations

$

(13,197

)

$

(78,705

)

Add back - Income tax expense

47

27,628

Loss before income taxes - continuing operations

(13,150

)

(51,077

)

Adjustments: Amortization expense

22,695

26,596

LIFO (credit) charge

(8,750

)

7,504

Gain on debt modification, net

(5,274

)

-

Merger and Acquisition-related costs

-

514

Restructuring-related costs

23,186

25,145

Adjusted income before income taxes - continuing operations

18,707

8,682

Adjusted income tax expense (a)

5,171

2,394

Adjusted net income from continuing operations

$

13,536

$

6,288

Adjusted net income per diluted share - continuing

operations: Numerator for adjusted net income per diluted

share: Adjusted net income from continuing operations

$

13,536

$

6,288

Denominator: Basic weighted average shares

53,573

53,041

Outstanding options and restricted shares, net

842

651

Diluted weighted average shares

54,415

53,692

Net loss from continuing operations per diluted share -

continuing operations

$

(0.25

)

$

(1.48

)

Adjusted net income per diluted share - continuing

operations

$

0.25

$

0.12

(a)

The fiscal year 2021 and 2020 annual effective tax rates,

calculated using a federal rate plus a net state rate that excluded

the impact of state NOL's, state credits and valuation allowance,

was used for the thirteen weeks ended August 29, 2020 and August

31, 2019, respectively. RITE AID CORPORATION AND SUBSIDIARIES

SUPPLEMENTAL INFORMATION ADJUSTED NET INCOME (LOSS) (Dollars in

thousands, except per share amounts) (unaudited)

Twenty-six weeks endedAugust 29, 2020 Twenty-six weeks endedAugust

31, 2019 Net loss from continuing operations

$

(85,899

)

$

(178,044

)

Add back - Income tax (benefit) expense

(7,971

)

35,002

Loss before income taxes - continuing operations

(93,870

)

(143,042

)

Adjustments: Amortization expense

47,115

54,256

LIFO (credit) charge

(20,816

)

14,993

Intangible asset impairment charges

29,852

-

Gain on debt modification, net

(5,274

)

-

Merger and Acquisition-related costs

-

3,599

Restructuring-related costs

58,921

68,495

Adjusted income (loss) before income taxes - continuing

operations

15,928

(1,699

)

Adjusted income tax expense (benefit) (a)

4,402

(468

)

Adjusted net income (loss) from continuing operations

$

11,526

$

(1,231

)

Adjusted net income (loss) per diluted share - continuing

operations: Numerator for adjusted net income (loss) per

diluted share: Adjusted net income (loss) from continuing

operations

$

11,526

$

(1,231

)

Denominator: Basic weighted average shares

53,528

53,084

Outstanding options and restricted shares, net

775

-

Diluted weighted average shares

54,303

53,084

Net loss from continuing operations per diluted share -

continuing operations

$

(1.60

)

$

(3.35

)

Adjusted net income (loss) per diluted share -

continuing operations

$

0.21

$

(0.02

)

(a)

The fiscal year 2021 and 2020 annual effective tax rates,

calculated using a federal rate plus a net state rate that excluded

the impact of state NOL's, state credits and valuation allowance,

was used for the twenty-six weeks ended August 29, 2020 and August

31, 2019, respectively. RITE AID CORPORATION AND SUBSIDIARIES

SUPPLEMENTAL INFORMATION RECONCILIATION OF ADJUSTED EBITDA GROSS

PROFIT AND RECONCILIATION OF ADJUSTED EBITDA SELLING, GENERAL AND

ADMINISTRATIVE EXPENSES- RETAIL PHARMACY SEGMENT (In thousands)

(unaudited) Thirteen weeks endedAugust 29,

2020 Thirteen weeks endedAugust 31, 2019

Reconciliation of adjusted EBITDA gross profit: Revenues

$

4,017,912

$

3,848,104

Gross Profit

1,061,913

1,032,444

Addback: LIFO (credit) charge

(8,750

)

7,504

Depreciation and amortization (cost of goods sold portion only)

2,167

2,205

Other

892

3,104

Adjusted EBITDA gross profit - continuing operations

$

1,056,222

$

1,045,257

Percent of revenues - continuing operations

26.29

%

27.16

%

Reconciliation of adjusted EBITDA selling,

general and administrative expenses: Revenues

$

4,017,912

$

3,848,104

Selling, general and administrative expenses

1,030,075

1,044,818

Less: Depreciation and amortization (SG&A portion only)

70,884

64,975

Stock-based compensation expense

3,631

4,432

Merger and Acquisition-related costs

-

514

Restructuring-related costs

20,441

21,055

Other

1,237

1,258

Adjusted EBITDA selling, general and administrative expenses -

continuing operations

$

933,882

$

952,584

Percent of revenues - continuing operations

23.24

%

24.75

%

Adjusted EBITDA - continuing operations

$

122,340

$

92,673

RITE AID CORPORATION AND SUBSIDIARIES SUPPLEMENTAL INFORMATION

RECONCILIATION OF ADJUSTED EBITDA GROSS PROFIT AND RECONCILIATION

OF ADJUSTED EBITDA SELLING, GENERAL AND ADMINISTRATIVE EXPENSES-

RETAIL PHARMACY SEGMENT (In thousands) (unaudited)

Twenty-six weeks endedAugust 29, 2020 Twenty-six weeks

endedAugust 31, 2019 Reconciliation of adjusted

EBITDA gross profit: Revenues

$

8,141,183

$

7,712,912

Gross Profit

2,143,449

2,062,939

Addback: LIFO (credit) charge

(20,816

)

14,993

Depreciation and amortization (cost of goods sold portion only)

4,830

4,468

Restructuring-related costs - SKU optimization charges

25,763

-

Other

1,423

3,120

Adjusted EBITDA gross profit - continuing operations

$

2,154,649

$

2,085,520

Percent of revenues - continuing operations

26.47

%

27.04

%

Reconciliation of adjusted EBITDA selling,

general and administrative expenses: Revenues

$

8,141,183

$

7,712,912

Selling, general and administrative expenses

2,139,051

2,116,143

Less: Depreciation and amortization (SG&A portion only)

131,793

130,014

Stock-based compensation expense

5,356

9,697

Merger and Acquisition-related costs

-

2,828

Restructuring-related costs

30,387

60,436

Other

2,188

4,329

Adjusted EBITDA selling, general and administrative expenses -

continuing operations

$

1,969,327

$

1,908,839

Percent of revenues - continuing operations

24.19

%

24.75

%

Adjusted EBITDA - continuing operations

$

185,322

$

176,681

RITE AID CORPORATION AND SUBSIDIARIES SUPPLEMENTAL INFORMATION

RECONCILIATION OF NET LOSS GUIDANCE TO ADJUSTED EBITDA GUIDANCE

YEAR ENDING FEBRUARY 27, 2021 (In thousands) (unaudited)

Guidance Range Low High Total

Revenues

$

23,500,000

$

24,000,000

PBM Revenues

$

7,550,000

$

7,650,000

Same store sales

3.00

%

4.00

%

Gross Capital Expenditures

$

275,000

$

275,000

Reconciliation of net loss to adjusted EBITDA: Net

loss

$

(190,000

)

$

(140,000

)

Adjustments: Interest expense

202,000

202,000

Income tax benefit

(12,000

)

(7,000

)

Depreciation and amortization

338,000

338,000

LIFO credit

(38,000

)

(38,000

)

Lease termination and impairment charges

53,000

53,000

Intangible asset impairment charges

30,000

30,000

Gain on debt modification, net

(5,300

)

(5,300

)

Restructuring-related costs

75,000

75,000

Other

22,300

17,300

Adjusted EBITDA

$

475,000

$

525,000

RITE AID CORPORATION AND SUBSIDIARIES SUPPLEMENTAL INFORMATION

RECONCILIATION OF NET LOSS GUIDANCE TO ADJUSTED NET (LOSS) INCOME

GUIDANCE YEAR ENDING FEBRUARY 27, 2021 (In thousands) (unaudited)

Guidance Range Low High

Net loss

$

(190,000

)

$

(140,000

)

Add back - income tax benefit

(12,000

)

(7,000

)

Loss before income taxes

(202,000

)

(147,000

)

Adjustments: Amortization expense

92,000

92,000

LIFO credit

(38,000

)

(38,000

)

Intangible asset impairment charges

30,000

30,000

Gain on debt modification, net

(5,300

)

(5,300

)

Restructuring-related costs

75,000

75,000

Adjusted (loss) income before adjusted income taxes

(48,300

)

6,700

Adjusted income tax (benefit) expense

(12,000

)

2,000

Adjusted net (loss) income

$

(36,300

)

$

4,700

Diluted adjusted net (loss) income per share

$

(0.67

)

$

0.09

RITE AID CORPORATION AND SUBSIDIARIES SUPPLEMENTAL INFORMATION

RECONCILIATION OF ADJUSTED EBITDA GUIDANCE TO FREE CASH FLOW

GUIDANCE YEAR ENDING FEBRUARY 27, 2021 (In thousands) (unaudited)

Guidance Range Low High

Adjusted EBITDA

$

475,000

$

525,000

Cash interest expense

(189,000

)

(189,000

)

Restructuring-related costs

(75,000

)

(75,000

)

Closed store rent

(26,000

)

(26,000

)

Working capital benefit

200,000

200,000

Cash flow from operations

385,000

435,000

Gross capital expenditures

(275,000

)

(275,000

)

Free cash flow

$

110,000

$

160,000

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200924005410/en/

INVESTORS: Trent Kruse (717) 975-3710 investor@riteaid.com

MEDIA: Christopher Savarese (717) 975-5718

Christopher.Savarese@riteaid.com

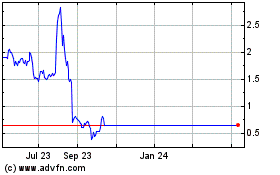

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Apr 2023 to Apr 2024