General Mills Reports Stronger Sales, But Growth Moderates -- Update

September 23 2020 - 8:52AM

Dow Jones News

By Micah Maidenberg

General Mills Inc. reported higher sales for its latest quarter,

but growth was slower than in the spring, when consumers first

quarantined at home amid efforts to curtail the spread of the

coronavirus.

The maker of Cheerios, Nature Valley granola bars, Bisquick

mixes and other foods on Wednesday said it generated $4.36 billion

in sales for the quarter ended Aug. 30, up from $4 billion a year

earlier and ahead of expectations from analysts.

On a comparable basis, which excludes currency fluctuations and

the effect of deals, sales increased 10%. For the quarter ended in

May, comparable sales jumped 16%, reflecting how consumers raced to

fill up pantries and refrigerators as much of the economy closed

down. The reopening of restaurants and easing of pandemic-related

restrictions drove the slower pace, the company said.

"At-home food demand continues to remain elevated relative to

pre-pandemic levels though it has moderated as we expected," Kofi

Bruce, finance chief at General Mills, said at an investor

conference earlier this month.

The packaged-food industry has caught a tailwind for much of

this year because the pandemic reshuffled how consumers approached

food. Families bought more groceries to eat at home amid closures

of restaurants and capacity limitations on dining rooms.

More recently, consumers who had tapped enhanced unemployment

benefits the federal government provided after the pandemic led to

job cuts have pulled back on spending on food after that benefit

expired in July. Others are shifting back to lifestyles that may

include more eating out. Campbell Soup Co. said earlier this month

that the pace of its sales growth had also moderated in its latest

quarter.

General Mills reported $2.71 billion in quarterly sales for its

business focused on selling food to retailers in the U.S. and

Canada, up 14% year over year. The Minneapolis-based company said

it saw stronger growth for products like refrigerated baked goods,

dessert mixes and soup. Sales in the U.S. for its cereals rose 10%,

but sales of snacks were down 2%.

Profit in the latest period rose to $638.9 million, or $1.03 a

share, from $520.6 million, or 85 cents a share, the year earlier.

The company's adjusted profit of $1 a share surpassed the 87 cents

a share that analysts were looking for.

The company said it believes demand for food used in homes will

remain higher than pre-pandemic levels in its current quarter, but

warned that it had limited visibility into how long the heightened

need would last.

"The magnitude and duration of elevated at-home food demand

remains highly uncertain," it said.

The company said its unit serving convenience stores,

restaurants and other food-service outlets continued to struggle in

the latest quarter, with sales falling 12% to $392 million. Demand

rose in markets overseas, including in its business focused on Asia

and Latin America.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

September 23, 2020 08:37 ET (12:37 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

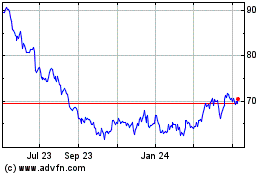

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

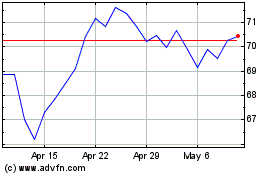

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024