Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

Table of Contents

Filed pursuant to Rule 424(b)(5)

Registration No. 333-232256

The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus

supplement and the accompanying base prospectus are part of an effective registration statement filed with the Securities and Exchange Commission. This preliminary prospectus supplement and the

accompanying base prospectus are not an offer to sell these securities nor do they seek an offer to buy these securities in any jurisdiction where the offer or sale is

not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 14, 2020

PRELIMINARY PROSPECTUS SUPPLEMENT TO PROSPECTUS DATED JUNE 21, 2019

Brookfield Infrastructure Partners L.P.

Units

% Class A Preferred Limited Partnership Units, Series 13

(Liquidation Preference $25.00 per Series 13 Preferred Unit)

We are offering units of

our % Class A Preferred Limited

Partnership Units, Series 13, with a liquidation preference

of $25.00 per unit (the "Series 13 Preferred Units"). As described under "Use of Proceeds" herein, we intend to allocate an amount equal to

the net proceeds from this offering to the financing and/or refinancing of Eligible Green Projects (as defined herein), including the development and redevelopment of such projects.

Distributions

on the Series 13 Preferred Units are cumulative from the date of original issue and will be payable quarterly in arrears on the fifteenth day of March, June, September and

December in each year, as and when declared by Brookfield Infrastructure Partners Limited, our general partner. The pro-rated initial distribution on the Series 13 Preferred Units offered

hereby, if declared, will be payable on December 15, 2020 in an amount equal to approximately

$ per Series 13 Preferred Unit.

Distributions on the Series 13

Preferred Units will be payable out of amounts legally available therefor at a rate equal

to % per annum of the $25.00 liquidation

preference.

At

any time on or after October 15, 2025, we may redeem the Series 13 Preferred Units, in whole or in part, out of amounts legally available therefor, at a redemption price of $25.00 per

Series 13 Preferred Unit, plus an amount equal to all accrued and unpaid distributions thereon to, but excluding, the date of redemption, whether or not declared. In addition, if certain

ratings agency events occur prior to October 15, 2025, as described under "Description of the Offered Securities — Description of Series 13

Preferred Units — Redemption — Optional Redemption Upon a Ratings Event," we may, at our option, redeem the Series 13

Preferred Units, in whole but not in part, at a price of $25.50 per Series 13 Preferred Unit plus an amount equal to all accrued and unpaid distributions thereon to, but excluding, the date of

redemption, whether or not declared. In addition, at any time following the occurrence of a change in tax law, as described under "Description of the Offered

Securities — Description of Series 13 Preferred Units — Redemption — Optional

Redemption Upon a Change in Tax Law," we may, at our option, redeem the Series 13 Preferred Units, in whole and not in part, at a redemption price of $25.00 per Series 13 Preferred Unit,

plus an amount equal to all accrued and unpaid distributions thereon to, but excluding, the date of redemption, whether or not declared. The Series 13 Preferred Units do not have a fixed

maturity date and are not redeemable at the option of the holders thereof. The Series 13 Preferred Units will rank pari passu in right of

payment with our Parity Securities (as defined herein), including each of our outstanding series of Existing Preferred Units (as defined herein) (see "Description of the Offered

Securities — Description of Class A Preferred Units — Series"), junior to our Senior Securities (as defined

herein) and senior to our Junior Securities (as defined herein) with respect to payment of distributions and distribution of our assets upon our liquidation, dissolution or winding up. See

"Description of the Offered Securities — Description of Series 13 Preferred Units — Ranking." The Series 13

Preferred Units will be structurally subordinated to all existing and future debt and guarantee obligations of each of our subsidiaries and any capital stock of our subsidiaries held by others.

The Series 13 Preferred Units have not been, and will not be, guaranteed by any of our subsidiaries and will not be guaranteed by the BIPC Guarantor (as defined herein) that guarantees

the Existing Preferred Units.

We

will apply to have the Series 13 Preferred Units listed on the New York Stock Exchange ("NYSE") under the symbol "BIP PR A." If the

application is approved, we expect trading of the Series 13 Preferred Units on the NYSE to begin within 30 days after their original issue date. Currently, there is no public market for

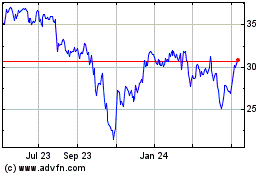

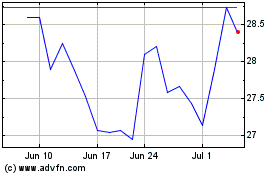

the Series 13 Preferred Units. Our non-voting limited partnership units ("LP Units") are listed on the NYSE under the symbol "BIP" and on

the Toronto Stock Exchange (the "TSX") under the symbol "BIP.UN."

Investing in our Series 13 Preferred Units involves risks. See "Risk Factors" on page S-9 of this prospectus supplement,

"Risk Factors" on page 1 of the accompanying base prospectus dated June 21, 2019, the risk factors included in our Annual Report on Form 20-F for the fiscal year ended

December 31, 2019 (the "Annual Report") and the risks in other documents we incorporate in this prospectus supplement by reference (including in our quarterly reports on

Form 6-K), for information regarding risks you should consider before investing in our Series 13 Preferred Units.

Neither the Securities and Exchange Commission (the "SEC") nor any state securities commission has approved or disapproved of these

securities or determined if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Price to

Public

|

|

Underwriting

Discounts

|

|

Proceeds to

Brookfield

Infrastructure

Partners L.P.

(before expenses)

|

|

|

Per Series 13 Preferred Unit

|

|

$

|

|

|

$

|

|

|

$

|

|

|

|

Total(1)

|

|

$

|

|

|

$

|

|

|

$

|

|

|

-

(1)

-

Assumes

no exercise by the underwriters of the right (the "Over-Allotment Option"), exercisable until

the date which is 30 days following the date of this prospectus supplement, to purchase from us on the same terms up

to Series 13 Preferred Units. See

"Underwriting."

The

underwriters expect to deliver the Series 13 Preferred Units through the facilities of The Depository Trust Company ("DTC") on

or about , 2020, which is

the business day following the date of pricing of the Series 13 Preferred Units (such settlement cycle being

referred to as

"T+ "). Purchasers of the Series 13 Preferred Units should note that trading of the Series 13 Preferred Units may be affected by this settlement date.

Joint Book-Running Managers

|

|

|

|

|

|

|

|

|

|

|

Morgan Stanley

|

|

BofA Securities

|

|

J.P. Morgan

|

|

RBC Capital

Markets

|

|

Wells Fargo

Securities

|

Co-Manager

TD Securities

The date of this prospectus supplement is , 2020

Table of Contents

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

Table of Contents

IMPORTANT INFORMATION IN THIS PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING BASE PROSPECTUS

This prospectus supplement is part of a shelf registration statement on Form F-3, as amended, that we filed with the SEC under

the Securities Act of 1933, as amended (the "Securities Act"). The first part is this prospectus supplement, which describes the specific terms

of this offering of Series 13 Preferred Units. The second part is the accompanying base prospectus, which gives more general information, some of which may not apply to this offering of

Series 13 Preferred Units. Generally, when we refer only to the "prospectus," we are referring to both documents combined. If the information about this offering of Series 13 Preferred

Units varies between this prospectus supplement and the accompanying base prospectus, you should rely on the information in this prospectus supplement.

Any

statement made in this prospectus or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded for

purposes of this prospectus to the extent that a statement contained in this prospectus or in any other subsequently filed document that is also incorporated by reference into this prospectus modifies

or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus. Please read "Documents

Incorporated by Reference" on page S-52 of this prospectus supplement.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this

prospectus supplement or the accompanying base prospectus were made solely for the benefit of the parties to such agreement and for the purpose of allocating risk among the parties to such agreements,

and should not be deemed to be a representation, warranty or covenant to you. Such representations, warranties and covenants should not be relied on as accurately representing the current state of

our affairs.

Neither

we nor the underwriters have authorized anyone to provide you with any information other than the information contained in this prospectus supplement and the accompanying base

prospectus or incorporated by reference into this prospectus supplement or the accompanying base prospectus, or any "free writing prospectus" we may authorize to be delivered to you. Neither we nor

the underwriters take any responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters are offering to sell the

Series 13 Preferred Units, and seeking offers to buy the Series 13 Preferred Units, only in jurisdictions where offers and sales are permitted. This prospectus supplement and the

accompanying base prospectus do not constitute, and may not be used in connection with, an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not authorized or

in which the person making such offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such offer or solicitation. You should not assume that the information

contained in this prospectus supplement, the accompanying base prospectus or any free writing prospectus is accurate as of any date other than the dates shown in these documents or that any

information we have incorporated by reference herein is accurate as of any date other than the date of the document incorporated by reference. Our business, financial condition, results of operations

and prospects may have changed since such dates.

In

this prospectus supplement, unless the context suggests otherwise, references to "we",

"us" and "our" are to the Partnership, collectively with the Holding LP, the Holding Entities and

the operating entities, each as defined below, taken together on a consolidated basis. Unless the context suggests otherwise, in this prospectus supplement

references to:

-

•

-

"BIP General Partner" are to the general partner of the Partnership, which

is Brookfield Infrastructure Partners Limited, an indirect wholly-owned subsidiary of Brookfield Asset Management;

-

•

-

"BIP Group" are to the Partnership, collectively with the

Holding LP, the Holding Entities, the operating entities and any other direct or indirect subsidiary of a Holding Entity;

-

•

-

"BIPC" are to Brookfield Infrastructure Corporation;

-

•

-

"BIPC Guarantee" are to the guarantee by the BIPC Guarantor of each series

of the Existing Preferred Units as to the payment of distributions when due, the payment of amounts due upon redemption, and the payment of amounts due upon liquidation, dissolution or winding up of

the Partnership;

S-i

Table of Contents

-

•

-

"BIPC Guarantor" are to BIPC Holdings Inc., a subsidiary of BIPC;

-

•

-

"Brookfield" are to Brookfield Asset Management and any subsidiary of

Brookfield Asset Management, other than us;

-

•

-

"Brookfield Asset Management" are to Brookfield Asset

Management Inc.;

-

•

-

"Brookfield Infrastructure" are to the Partnership, the Holding LP,

the Holding Entities and the operating entities, taken together, or any one or more of them, as the context requires;

-

•

-

"Class A Preferred Units" are to the Class A Limited

Partnership Units of the Partnership;

-

•

-

"Exchangeable LP Units" are to the exchangeable units of Brookfield

Infrastructure Partners Exchange LP, a subsidiary of the Partnership, which were issued in connection with the Partnership's acquisition of an effective 30% interest in Enercare Inc.,

and which provide holders with economic terms that are substantially equivalent to those of LP Units and are exchangeable, on a one-for-one basis, for LP Units;

-

•

-

"Existing Preferred Units" are as defined in "Description of the Offered

Securities — Description of Class A Preferred Units — Series" in this prospectus supplement;

-

•

-

"Holding Entities" are to certain subsidiaries of the Holding LP,

through which the Holding LP from time-to-time indirectly holds all of our interests in the operating entities;

-

•

-

"Holding LP" are to Brookfield Infrastructure L.P.;

-

•

-

"LP Unitholders" are to the holders of our LP Units;

-

•

-

"LP Units" are to the non-voting limited partnership units in the

Partnership;

-

•

-

"Master Services Agreement" are to the amended and restated master

services agreement dated as of March 13, 2015 (as amended on March 31, 2020), among the Service Recipients, Brookfield Asset Management, the Service Providers and others;

-

•

-

"operating entities" are to the entities which directly or indirectly hold

our current operations and assets that we may acquire in the future, including any assets held through joint ventures, partnerships and consortium arrangements;

-

•

-

the "Partnership" or "BIP"

are to Brookfield Infrastructure Partners L.P., a Bermuda exempted limited partnership;

-

•

-

"Preferred LP Units" are to preferred limited partnership units in

the Partnership, including the Class A Preferred Units;

-

•

-

"Redeemable Partnership Units" are to the limited partnership units of the

Holding LP that have the rights of the Redemption-Exchange Mechanism;

-

•

-

"Redemption-Exchange Mechanism" are to the mechanism by which Brookfield

may request redemption of its limited partnership interests in the Holding LP in whole or in part in exchange for cash, subject to the right of the Partnership to acquire such interests

(in lieu of such redemption) in exchange for LP Units;

-

•

-

"Series 13 Preferred Unitholders" are to holders of our

Series 13 Preferred Units;

-

•

-

"Service Providers" are to Brookfield Infrastructure Group L.P.,

Brookfield Asset Management Private Institutional Capital Adviser (Canada), LP, Brookfield Asset Management Barbados Inc., Brookfield Global Infrastructure Advisor Limited, Brookfield

Infrastructure Group (Australia) Pty Limited and, unless the context otherwise requires, includes any other affiliate of Brookfield Asset Management that provides services to us pursuant to the Master

Services Agreement or any other service agreement or arrangement; and

-

•

-

"Service Recipients" are to the Partnership, the Holding LP, BIPC

and certain of the Holding Entities in their capacity as recipients of services under the Master Services Agreement.

S-ii

Table of Contents

The

financial information contained in this prospectus, unless otherwise indicated, is presented in U.S. dollars and, unless otherwise indicated, has been prepared in accordance

with International Financial Reporting Standards as issued by the International Accounting Standards Board ("IFRS"). Amounts in "$" are to

U.S. Dollars, and amounts in Canadian Dollars ("C$") are identified where applicable.

Your ability to enforce civil liabilities under the United States federal securities laws may be affected adversely because the Partnership is formed under

the laws of Bermuda, some of the directors of the BIP General Partner, some of the officers of the Service Providers and some of the experts named in this prospectus supplement are residents of Canada

or another non-U.S. jurisdiction and a portion of our assets and the assets of those officers, directors and experts are located outside the United States.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This prospectus supplement, the accompanying base prospectus and the documents incorporated by reference in this prospectus supplement

and in the accompanying base prospectus contain certain "forward-looking statements" and "forward-looking information" within the meaning of applicable U.S. and Canadian securities laws. The

forward-looking statements and information relate to, among other things, our business, operations, objectives, goals, strategies, intentions, plans, beliefs, expectations and estimates and

anticipated events or trends. In particular, our statements regarding the use of proceeds of this offering, and our statements with respect to the continuity plans and preparedness measures we have

implemented in response to the novel coronavirus ("COVID-19") pandemic and its expected impact on our businesses, operations, earnings and results, are forward-looking statements. In some cases, you

can identify forward-looking statements and information by terms such as "anticipate," "believe," "could," "estimate," "likely," "expect," "intend," "may," "continue," "plan," "potential,"

"objective," "tend," "seek," "target," "foresee," "aim to," "outlook," "endeavor," "will," "would," "should," "designed," "predict" and "depend," or the negative of those terms or other comparable

terminology. These forward-looking statements and information are not historical facts but reflect our current expectations regarding future results or events and are based on information currently

available to us and on assumptions we believe are reasonable.

Although

we believe that our anticipated future results, performance or achievements expressed or implied by the forward-looking statements and information in this prospectus supplement,

the accompanying base prospectus and the documents incorporated by reference herein are based upon reasonable assumptions and expectations, we cannot assure you that such expectations will prove to

have been correct. You should not place undue reliance on forward-looking statements and information as such statements and information involve known and unknown risks, uncertainties and other factors

which may cause our actual results, performance or achievements to differ materially from anticipated future results, performance or achievements expressed or implied by such forward-looking

statements and information. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us or are within our control. If a

change occurs, our business, financial condition, liquidity and results of operations and our plans and strategies may vary materially from those expressed in the forward-looking statements and

information herein.

Factors

that could cause our actual results to differ materially from those contemplated or implied by our forward-looking statements and information include, without

limitation:

-

•

-

our assets are or may become highly leveraged and we intend to incur indebtedness above the asset level;

-

•

-

the Partnership is a holding entity that relies on its subsidiaries to provide the funds necessary to pay its

distributions and meet its financial obligations;

-

•

-

future sales and issuances of our LP Units, Preferred LP Units or securities exchangeable for our

LP Units or Preferred LP Units, or the perception of such sales or issuances, could depress the trading price of our LP Units or Preferred LP Units;

-

•

-

pending acquisitions, dispositions and other transactions may not be completed on the timeframe or in the manner

contemplated, or at all;

-

•

-

deployment of capital for our committed backlog and other projects we are pursuing may be delayed, curtailed or redirected

altogether;

S-iii

Table of Contents

-

•

-

acquisitions may subject us to additional risks and the expected benefits of our acquisitions may not materialize;

-

•

-

foreign currency risk and risk management activities;

-

•

-

increasing political uncertainty, which may impact our ability to expand in certain markets;

-

•

-

general economic conditions and risks relating to the economy;

-

•

-

pandemics or epidemics, including risks associated with the global pandemic caused by COVID-19, and the related global

reduction in commerce and travel and substantial volatility in stock markets worldwide, which may result in a decrease of cash flows and impairment losses and/or revaluations of our investments and

infrastructure assets;

-

•

-

commodity risks;

-

•

-

alternative technologies could impact the demand for, or use of, the businesses and assets that we own and operate and

could impair or eliminate the competitive advantage of our businesses and assets;

-

•

-

availability and cost of credit;

-

•

-

government policy and legislation change;

-

•

-

exposure to uninsurable losses and force majeure events;

-

•

-

infrastructure operations may require substantial capital expenditures;

-

•

-

labor disruptions and economically unfavorable collective bargaining agreements;

-

•

-

exposure to occupational health and safety related accidents;

-

•

-

exposure to increased economic regulation and adverse regulatory decisions;

-

•

-

exposure to environmental risks, including weather affecting our business, increasing environmental legislation and the

broader impacts of climate change;

-

•

-

high levels of government regulation upon many of our operating entities, including with respect to rates set for our

regulated businesses;

-

•

-

First Nations claims to land, adverse claims or governmental claims may adversely affect our infrastructure operations;

-

•

-

the competitive market for acquisition opportunities and the inability to identify and complete acquisitions

as planned;

-

•

-

our ability to renew existing contracts and win additional contracts with existing or potential customers;

-

•

-

timing and price for the completion of unfinished projects;

-

•

-

some of our current operations are held in the form of joint ventures or partnerships or through consortium arrangements;

-

•

-

our infrastructure business is at risk of becoming involved in disputes and possible litigation;

-

•

-

some of our businesses operate in jurisdictions with less developed legal systems and could experience difficulties in

obtaining effective legal redress, which creates uncertainties;

-

•

-

actions taken by national, state, or provincial governments, including nationalization, or the imposition of new taxes,

could materially impact the financial performance or value of our assets;

-

•

-

reliance on technology and exposure to cyber-security attacks;

-

•

-

customers may default on their obligations;

-

•

-

reliance on tolling and revenue collection systems;

-

•

-

our ability to finance our operations due to the status of the capital markets;

S-iv

Table of Contents

-

•

-

changes in our credit ratings;

-

•

-

our operations may suffer a loss from fraud, bribery, corruption or other illegal acts;

-

•

-

some of our acquisitions may be of distressed companies, which may subject us to increased risks, including the incurrence

of legal or other expenses;

-

•

-

Brookfield's influence over the Partnership and the Partnership's dependence on the Service Providers;

-

•

-

the lack of an obligation of Brookfield to source acquisition opportunities for us;

-

•

-

our dependence on Brookfield and its professionals;

-

•

-

the role and ownership of Brookfield in the Partnership and in the Holding LP may change and interests in our BIP

General Partner may be transferred to a third party without unitholder or preferred unitholder consent;

-

•

-

Brookfield may increase its ownership of the Partnership;

-

•

-

our Master Services Agreement and our other arrangements with Brookfield do not impose on Brookfield any fiduciary duties

to act in the best interests of LP Unitholders or preferred unitholders;

-

•

-

conflicts of interest between the Partnership, its preferred unitholders and its LP Unitholders, on the one hand,

and Brookfield, on the other hand;

-

•

-

our arrangements with Brookfield may contain terms that are less favorable than those which otherwise might have been

obtained from unrelated parties;

-

•

-

the BIP General Partner may be unable or unwilling to terminate the Master Services Agreement;

-

•

-

the limited liability of, and our indemnification of, the Service Providers;

-

•

-

our LP Unitholders and preferred unitholders do not have a right to vote on partnership matters or to take part in

the management of the Partnership;

-

•

-

market price of our LP Units and preferred units may be volatile;

-

•

-

dilution of existing unitholders;

-

•

-

adverse changes in currency exchange rates;

-

•

-

investors may find it difficult to enforce service of process and enforcement of judgments against us;

-

•

-

we may not be able to continue paying comparable or growing cash distributions to unitholders in the future;

-

•

-

the Partnership may become regulated as an investment company under the U.S. Investment Company Act of 1940,

as amended;

-

•

-

we are exempt from certain requirements of Canadian securities laws and we are not subject to the same disclosure

requirements as a U.S. domestic issuer;

-

•

-

we may be subject to the risks commonly associated with a separation of economic interest from control or the incurrence

of debt at multiple levels within an organizational structure;

-

•

-

effectiveness of our internal controls over financial reporting;

-

•

-

changes in tax law and practice; and

-

•

-

other factors described in the Annual Report, including, but not limited to, those described under Item 3.D "Risk

Factors" and elsewhere in the Annual Report.

We

caution that the foregoing list of important factors that may affect future results is not exhaustive. When relying on our forward-looking statements or information, investors and

others should carefully consider the foregoing factors and other uncertainties and potential events.

S-v

Table of Contents

The

risk factors included in this prospectus supplement, the accompanying base prospectus, our Annual Report, our quarterly reports on Form 6-K and the risks in other documents

incorporated by reference could cause our actual results, performance, achievements, plans and strategies to vary from our forward-looking statements. In light of these risks, uncertainties and

assumptions, the events described by our forward-looking statements and information might not occur. We qualify any and all of our forward-looking statements and information by these risk factors.

Please keep this cautionary note in mind as you read this prospectus supplement, the accompanying base prospectus and the documents incorporated by reference.

Except

as required by law, we undertake no obligation to publicly update or revise any forward-looking statements or information, whether written or oral, that may be as a result of new

information, future events or otherwise.

CAUTIONARY STATEMENT REGARDING THE USE OF NON-IFRS ACCOUNTING MEASURES

To measure performance, we focus on net income, an IFRS measure, as well as certain non-IFRS measures, including but not limited to

Funds from Operations ("FFO"), Adjusted Funds from Operations ("AFFO"), adjusted EBITDA

("Adjusted EBITDA"), adjusted earnings ("Adjusted Earnings"), along with other non-IFRS measures. We

define FFO as net income excluding the impact of depreciation and amortization, deferred income taxes, breakage and transaction costs, and non-cash valuation gains or losses. Our definition of FFO may

differ from the definition used by other organizations, as well as the definition of Funds from Operations used by the Real Property Association of Canada and the National Association of Real Estate

Investment Trusts, Inc. ("NAREIT"), in part because the NAREIT definition is based on generally accepted accounting principles in the

United States, as opposed to IFRS. We define AFFO as FFO less capital expenditures required to maintain the current performance of our operations (maintenance capital expenditures).

In

addition to FFO and AFFO, we focus on Adjusted EBITDA, which we define as net income excluding the impact of depreciation and amortization, interest expense, current and deferred

income taxes, breakage and transaction costs, and non-cash valuation gains or losses. We also focus on Adjusted Earnings, which we define as net income attributable to the Partnership, excluding any

incremental depreciation and amortization expense associated with the revaluing of the Partnership's property, plant and equipment and the impact of purchase price accounting, mark-to-market on

hedging items and disposition gains or losses.

Each

of these non-IFRS measures is a measure of operating performance that is not calculated in accordance with, and does not have any standardized meaning prescribed by, IFRS. These

non-IFRS measures are therefore unlikely to be comparable to similar measures presented by other issuers and have limitations as analytical tools.

For

further details regarding our use of FFO, AFFO, Adjusted EBITDA and Adjusted Earnings, as well as a reconciliation of the most comparable IFRS measures to these performance measures,

please see the "Reconciliation of Non-IFRS Financial Measures" section in Item 5 "Operating and Financial Review and Prospects — Management's Discussion

and Analysis of Financial Condition and Results of Operations" in our Annual Report and our quarterly reports on Form 6-K. We urge you to review the IFRS financial measures in our Annual Report

and quarterly reports on Form 6-K, including the financial statements, the notes thereto and the other financial information contained herein, and not to rely on any single financial measure to

evaluate the Partnership.

S-vi

Table of Contents

MARKET DATA AND INDUSTRY DATA

Market and industry data presented throughout, or incorporated by reference in, this prospectus was obtained from third party sources,

industry publications, and publicly available information, as well as industry and other data prepared by us and the Partnership on the basis of our collective knowledge of the Canadian, U.S. and

international markets and economies (including estimates and assumptions relating to these markets and economies based on that knowledge). We believe that the market and economic data is accurate and

that the estimates and assumptions are reasonable, but there can be no assurance as to the accuracy or completeness thereof. The accuracy and completeness of the market and economic data used

throughout this prospectus, or incorporated by reference herein, are not guaranteed and we do not make any representation as to the accuracy of such information. Although we believe it to be reliable,

we have not independently verified any of the data from third party sources referred to or incorporated by reference in this prospectus, analyzed or verified the underlying studies or surveys relied

upon or referred to by such sources, or ascertained the underlying economic and other assumptions relied upon by such sources.

S-vii

Table of Contents

SUMMARY

The Partnership

The Partnership is a Bermuda exempted limited partnership that was established on May 21, 2007 under the provisions of the

Exempted Partnerships Act 1992 of Bermuda and the Limited Partnership Act 1883, as amended, of Bermuda. Our head and registered office is located at 73 Front Street, 5th Floor, Hamilton

HM 12, Bermuda, its website is https://bip.brookfield.com and our telephone number is (441) 294-3309. The information found on our website is not part of this prospectus supplement.

We

own and operate high quality, long-life assets that generate stable cash flows, require relatively minimal maintenance capital expenditures and, by virtue of barriers to entry and

other characteristics, tend to appreciate in value over time. Our current operations consist of utilities, transport, energy and data infrastructure businesses in North and South America, Europe and

Asia Pacific.

The

Partnership's sole material assets are its managing general partnership interest and preferred limited partnership interest in the Holding LP. The Partnership serves as the

Holding LP's managing general partner and has sole authority for the management and control of the Holding LP.

Recent Developments

COVID-19

The Partnership has a diversified portfolio of operating businesses in the utilities, transport, energy and data infrastructure

sectors, most of which operate under regulated frameworks or have long-term take-or-pay contracts with minimal volume risk. To date, Brookfield Infrastructure has not experienced a material impact to

its operations, financial condition, cash flows or financial performance as a result of the ongoing circumstances surrounding COVID-19. See "Risk Factors — Risks

Associated with the COVID-19 Pandemic."

Recent Transactions

On August 31, 2020, Brookfield Infrastructure, alongside its institutional partners, completed the acquisition of a 100% stake

in a telecom tower company in India from Reliance Industrial Investments and Holdings Limited, a wholly-owned subsidiary of Reliance Industries Limited, thereby acquiring a portfolio of approximately

135,000 recently constructed communication towers that form the infrastructure backbone of Reliance Jio's telecom business. We invested approximately $600 million of equity (Brookfield

Infrastructure's share) in the business.

On

September 1, 2020, a subsidiary of the Partnership issued C$500 million aggregate principal amount of medium term notes, due September 1, 2032, which bear

interest at a rate of 2.855% per annum. A subsidiary of the Partnership received the net proceeds from the offering and will have the primary responsibility for the payment of principal and interest

of these newly issued medium term notes. These newly issued medium term notes are fully and unconditionally guaranteed by the Partnership and certain of its key holding subsidiaries.

On

September 1, 2020, the Partnership also announced that its subsidiaries exercised their right to redeem their C$450,000,000, 3.452%, Series 2 Notes, due March 11,

2022. The redemption is expected to occur on October 6, 2020.

S-1

Table of Contents

THE OFFERING

|

|

|

|

|

Issuer

|

|

Brookfield Infrastructure Partners L.P.

|

|

Securities Offered

|

|

of

our % Series 13 Preferred Units, liquidation preference $25.00 per Series 13 Preferred Unit (or of

our Series 13 Preferred Units if the underwriters exercise in full their option to purchase additional Series 13 Preferred Units). For a detailed description of the Series 13 Preferred Units, see "Description of the Offered

Securities."

|

|

Price per Series 13 Preferred Unit

|

|

$25.00

|

|

Maturity

|

|

Perpetual unless redeemed by us, (i) prior to October 15, 2025, at our option, in connection with a Ratings Event

(as defined herein); (ii) on or after October 15, 2025, at our option; and (iii) at any time, in connection with a Change in Tax Law (as defined herein). See "— Optional Redemption Upon a Ratings Event,"

"— Optional Redemption on or after October 15, 2025" and "— Optional Redemption Upon a Change in Tax Law."

|

|

Distributions

|

|

Distributions on the Series 13 Preferred Units will accrue and be cumulative from the date that the Series 13

Preferred Units are originally issued, and will be payable on each Distribution Payment Date (as defined herein) as and when declared by the board of directors of the BIP General Partner, out of legally available funds for such

purpose.

|

|

Distribution Payment Dates and Record Dates

|

|

Distributions will be payable, if declared by the BIP General Partner, quarterly on the fifteenth day of March, June, September

and December in each year, in each case to holders of record as of the close of business on the last business day of the calendar month prior to the applicable Distribution Payment Date, or such other record date as may be fixed by the BIP General

Partner. The pro-rated initial distribution on the Series 13 Preferred Units offered hereby will be payable, if declared, on December 15, 2020 in an amount equal to approximately

$ per Series 13 Preferred Unit. If any Distribution Payment Date falls on a day that is not a Business Day, declared distributions will be paid on the immediately succeeding

Business Day without the accrual of additional distributions.

|

|

Distribution Rate

|

|

The distribution rate for the Series 13 Preferred Units from and including the date of original issue will

be % per annum of the $25.00 liquidation preference per unit (equal to $ per unit per annum).

|

|

Payment of Additional Amounts

|

|

Subject to certain limitations, we will pay additional amounts to holders of the Series 13 Preferred Units, as additional

distributions, to make up for any deduction or withholding for any taxes or other charges imposed by or on behalf of any Relevant Taxing Jurisdiction (as defined herein) (other than the United States), on amounts we must pay with respect to

the Series 13 Preferred Units, so that every net payment, after such withholding or deduction (including any such withholding or deduction from such additional amounts), will be equal to the amount we would otherwise be required to pay had no

such withholding or deduction been required. See "Description of the Offered Securities — Description of Series 13 Preferred Units — Payment of Additional Amounts."

|

|

Ranking

|

|

The Series 13 Preferred Units, unlike our indebtedness, will represent perpetual interests in the Partnership and will not

give rise to a claim for payment of a principal amount at a particular date.

|

S-2

Table of Contents

|

|

|

|

|

|

|

The Series 13 Preferred Units will rank:

|

|

|

|

•

senior to the

LP Units and any other partnership interests of the Partnership that pursuant to a written agreement rank junior to the Class A Preferred Units with respect to payment of distributions and distributions upon dissolution, liquidation or

winding-up of the Partnership, whether voluntary or involuntary (collectively, the "Junior Securities");

|

|

|

|

•

on parity in right of

payment with every other series of Class A Preferred Units, including the Existing Preferred Units (as defined in "Description of the Offered Securities — Description of Class A Preferred Units — Series"),

and any other partnership interests of the Partnership that pursuant to a written agreement rank equally with the Class A Preferred Units with respect to payment of distributions and distributions upon dissolution, liquidation or winding-up of

the Partnership, whether voluntary or involuntary (collectively, the "Parity Securities");

|

|

|

|

•

junior to any class or

series of partnership interests of the Partnership that pursuant to a written agreement rank senior to the Class A Preferred Units with respect to payment of distributions and distributions upon dissolution, liquidation or winding-up of the

Partnership, whether voluntary or involuntary (the "Senior Securities"); and

|

|

|

|

•

junior to all of the

existing and future indebtedness obligations of the Partnership.

|

|

|

|

In addition, the Series 13 Preferred Units will be structurally subordinated to all existing and future debt and guarantee

obligations of our subsidiaries (including the BIPC Guarantee of the Existing Preferred Units) and any capital stock of our subsidiaries held by others as to the payment of distributions and amounts payable upon a liquidation event.

|

|

|

|

The Series 13 Preferred Units are not, and will not be, guaranteed by any of our subsidiaries, or by the BIPC Guarantor

that guarantees the Existing Preferred Units.

|

|

|

|

Parity Securities with respect to the Series 13 Preferred Units may include classes and series of the Partnership's

securities (including other series of Class A Preferred Units, such as the Existing Preferred Units) that have different coupons, distribution rates, mechanics, payment periods, payment dates, record dates, guarantees and/or other terms than the

Series 13 Preferred Units.

|

S-3

Table of Contents

|

|

|

|

|

Restrictions on Distributions

|

|

No distribution may be declared or paid or set apart for payment on any Junior Securities (other than a distribution payable solely in Junior

Securities) unless all accrued and unpaid distributions up to and including the distribution payable for the last completed period for which distributions were payable on all outstanding Series 13 Preferred Units and any Parity Securities

(including the Existing Preferred Units) have been declared and paid or set apart for payment. To the extent a distribution period applicable to a class of Junior Securities or Parity Securities is shorter than the distribution period applicable to

the Series 13 Preferred Units (e.g., monthly rather than quarterly), the BIP General Partner may declare and pay regular distributions with respect to such Junior Securities or Parity Securities so

long as, at the time of declaration of such distribution, the BIP General Partner expects to have sufficient funds to pay the full distribution in respect of the Series 13 Preferred Units on the next successive Distribution Payment

Date.

|

|

|

|

As long as any Series 13 Preferred Units are outstanding, except out of the net cash proceeds of a substantially concurrent

issue of Junior Securities, we may not redeem, repurchase or otherwise acquire any partnership interests in the Partnership (other than a Class A Preferred Unit) or any other series of Junior Securities unless all accrued and unpaid

distributions up to and including the distribution payable for the last completed period for which distributions were payable on all Series 13 Preferred Units and any Parity Securities (including the Existing Preferred Units) have been declared

and paid or set apart for payment.

|

|

Optional Redemption by the Partnership Upon a Ratings Event

|

|

Prior to October 15, 2025, at any time within 120 days after the conclusion of any review or appeal process instituted

by us following the occurrence of a Ratings Event, we may, at our option, redeem the Series 13 Preferred Units in whole, but not in part, at a redemption price in cash per Series 13 Preferred Unit equal to $25.50 (102% of the liquidation

preference of $25.00), plus an amount equal to all accrued and unpaid distributions thereon to, but excluding, the date fixed for redemption, whether or not declared. We must provide not less than 30 days' and not more than 60 days' written

notice of any such redemption. Any such redemption would be effected only out of funds legally available for such purpose and will be subject to compliance with the provisions of our outstanding indebtedness.

|

|

|

|

"Ratings Event" means a change by any nationally recognized statistical rating

organization (within the meaning of Section 3(a)(62) of the Securities Exchange Act of 1934, as amended (the "Exchange Act")) that publishes a rating for us (a "rating agency") to its equity credit criteria for securities such as the Series 13 Preferred Units, as such criteria are in effect as of the original issue date of the Series 13 Preferred Units

(the "current criteria"), which change results in (i) any shortening of the length of time for which the current criteria are scheduled to be in effect with respect to the Series 13

Preferred Units, or (ii) a lower Equity Credit (defined below) being given to the Series 13 Preferred Units than the Equity Credit that would have been assigned to the Series 13 Preferred Units by such rating agency pursuant to its

current criteria.

|

S-4

Table of Contents

|

|

|

|

|

|

|

"Equity Credit" for the purposes of the Series 13 Preferred Units means the dollar amount or

percentage in relation to the stated liquidation preference amount of $25.00 per Series 13 Preferred Unit assigned to the Series 13 Preferred Units as equity, rather than debt, by a rating agency in evaluating the capital structure of an

entity.

|

|

Optional Redemption by the Partnership on or after October 15, 2025

|

|

At any time on or after October 15, 2025, we may redeem, in whole or in part, the Series 13 Preferred Units at a

redemption price of $25.00 per Series 13 Preferred Unit, plus an amount equal to all accrued and unpaid distributions thereon to, but excluding, the date of redemption, whether or not declared. We must provide not less than 30 days' and not

more than 60 days' written notice of any such redemption. Any such redemption would be effected only out of funds legally available for such purpose and will be subject to compliance with the provisions of our outstanding

indebtedness.

|

|

Optional Redemption by the Partnership Upon a Change in Tax Law

|

|

We will have the option to redeem all but not less than all of the Series 13 Preferred Units at a redemption price of

$25.00 per Series 13 Preferred Unit, if as a result of a Change in Tax Law there is, in our reasonable determination, a substantial probability that we or any Successor Entity (as defined in "Description of the Offered

Securities — Description of Series 13 Preferred Units — Payment of Additional Amounts") would become obligated to pay any additional amounts on the next succeeding distribution payment date with respect to the

Series 13 Preferred Units and the payment of those additional amounts cannot be avoided by the use of any reasonable measures available to us or any Successor Entity (a "Tax Event"). We must

provide not less than 30 days' and not more than 60 days' written notice of any such redemption. Any such redemption would be effected only out of funds legally available for such purpose and will be subject to compliance with the

provisions of our outstanding indebtedness.

|

|

|

|

"Change in Tax Law" means (i) a change in or amendment to laws, regulations

or rulings of any Relevant Taxing Jurisdiction, (ii) a change in the official application or interpretation of those laws, regulations or rulings, (iii) any execution of or amendment to any treaty affecting taxation to which any Relevant

Taxing Jurisdiction is party or (iv) a decision rendered by a court of competent jurisdiction in any Relevant Taxing Jurisdiction, whether or not such decision was rendered with respect to us, in each case described in (i)-(iv) above occuring

after the date of this prospectus supplement; provided that in the case of a Relevant Taxing Jurisdiction other than Bermuda in which a successor company is organized, such Change in Tax Law must occur after the date on which we consolidate, merge or

amalgamate (or engage in a similar transaction) with the Successor Entity, or convey, transfer or lease substantially all of our properties and assets to the Successor Entity, as applicable.

|

|

|

|

"Relevant Taxing Jurisdiction" means (i) Bermuda or any political

subdivision or governmental authority of or in Bermuda with the power to tax, (ii) any jurisdiction from or through which we or our distribution disbursing agent are making payments on the Series 13 Preferred Units or any political

subdivision or governmental authority of or in that jurisdiction with the power to tax or (iii) any other jurisdiction in which BIP or a Successor Entity is organized or generally subject to taxation or any political subdivision or governmental

authority of or in that jurisdiction with the power to tax.

|

S-5

Table of Contents

|

|

|

|

|

Substitution or Variation

|

|

In lieu of redemption upon or following a Tax Event, we may, without the consent of any holders of the Series 13 Preferred Units, vary the

terms of, or exchange for new securities, the Series 13 Preferred Units to eliminate the substantial probability that we would be required to pay additional amounts with respect to the Series 13 Preferred Units as a result of a Change in

Tax Law. The terms of the varied securities or new securities, considered in the aggregate, cannot be less favorable to holders than the terms of the Series 13 Preferred Units prior to being varied or exchanged, and no such variation of terms or

securities in exchange shall change certain specified terms of the Series 13 Preferred Units. See "Description of the Offered Securities — Description of Series 13 Preferred Units — Substitution or

Variation".

|

|

Conversion; Exchange and Preemptive Rights

|

|

The Series 13 Preferred Units will not be subject to preemptive rights or be convertible into or exchangeable for any other

securities or property, except under the circumstances set forth under "Description of the Offered Securities — Description of Series 13 Preferred Units — Substitution or Variation."

|

|

Voting Rights; Amendments

|

|

Holders of the Series 13 Preferred Units generally will have no voting rights (except as otherwise provided by law and

except for meetings of holders of Class A Preferred Units as a class and meetings of all holders of Series 13 Preferred Units as a series). Holders of the Series 13 Preferred Units will not be entitled to receive notice of, attend, or

vote at, any meeting of unitholders of the Partnership, unless and until the Partnership shall have failed to pay eight quarterly distributions on the Series 13 Preferred Units, whether or not consecutive and whether or not such distributions

have been declared and whether or not there are any monies of the Partnership legally available for distributions under Bermuda law.

|

|

|

|

In connection with the closing of this offering of Series 13 Preferred Units, we expect to further amend our Amended and

Restated Limited Partnership Agreement (as amended, our "Partnership Agreement") to reflect the issuance of the Series 13 Preferred Units. We may not adopt any subsequent amendment to our

Partnership Agreement that has a material adverse effect on the powers, preferences, duties or special rights of the Class A Preferred Units unless such amendment (i) is approved by a resolution signed by the holders of Class A

Preferred Units owning not less than the percentage of the Class A Preferred Units that would be necessary to authorize such action at a meeting of the holders of the Class A Preferred Units at which all holders of the Class A

Preferred Units were present and voted or were represented by proxy or (ii) is passed by an affirmative vote of at least 662/3% of the votes cast at a meeting of holders of the Class A Preferred Units as a class

duly called for that purpose and at which the holders of at least 25% of the outstanding Class A Preferred Units are present or represented by proxy.

|

S-6

Table of Contents

|

|

|

|

|

|

|

Similarly, we may not adopt an amendment to our Partnership Agreement that has a material adverse effect on the powers, preferences, duties or

special rights of the Series 13 Preferred Units unless such amendment (i) is approved by a resolution signed by the holders of Series 13 Preferred Units owning not less than the percentage of the Series 13 Preferred Units that

would be necessary to authorize such action at a meeting of the holders of the Series 13 Preferred Units at which all holders of the Series 13 Preferred Units were present and voted or were represented by proxy or (ii) is passed by an

affirmative vote of at least 662/3% of the votes cast at a meeting of holders of the Series 13 Preferred Units duly called for that purpose and at which the holders of at least 25% of the outstanding Series 13

Preferred Units are present or represented by proxy.

|

|

|

|

We may issue Junior Securities and Parity Securities (including additional Class A Preferred Units) from time to time

without the consent of holders of outstanding Class A Preferred Units.

|

|

|

|

Further, unless we have received the affirmative vote or consent of the holders of at least a majority of the outstanding

Class A Preferred Units, we may not issue any Senior Securities.

|

|

|

|

At any meeting of holders of Series 13 Preferred Units as a series, each such holder shall be entitled to one vote in

respect of each Series 13 Preferred Unitheld.

|

|

Fixed Liquidation Preference

|

|

In the event of any liquidation, dissolution or winding-up of our affairs, whether voluntary or involuntary, unless the

Partnership is continued under the election to reconstitute and continue the Partnership, holders of the Series 13 Preferred Units will generally, subject to the discussion under "Description of the Offered

Securities — Description of Series 13 Preferred Units — Liquidation Rights", have the right to receive the liquidation preference of $25.00 per Series 13 Preferred Unit plus an amount equal to all accrued and

unpaid distributions thereon to but excluding the date of payment, whether or not declared. A consolidation or merger of us with or into any other entity, individually or in a series of transactions, will not be deemed a liquidation, dissolution or

winding-up of our affairs.

|

|

Sinking Fund

|

|

The Series 13 Preferred Units will not be entitled or subject to any sinking fund requirements.

|

|

Use of Proceeds

|

|

We estimate that the net proceeds from this offering (after deducting the underwriting discounts and estimated offering

expenses), will be approximately $ million ($ million if the underwriters exercise in full their

option to purchase additional Series 13 Preferred Units).

|

S-7

Table of Contents

|

|

|

|

|

|

|

We will use the net proceeds from this offering to subscribe for Series 13 Holding LP Mirror Units (as defined in "Description of

the Offered Securities — Description of Series 13 Preferred Units — Series 13 Holding LP Mirror Units") that are designed to mirror the economic terms of the Series 13 Preferred Units. We intend to

allocate an amount equal to the net proceeds from this offering to the financing and/or refinancing of recently completed and future Eligible Green Projects (as defined below), including the development and redevelopment of such projects. On

closing, the net proceeds of the offering will be used to repay amounts drawn within the past year under our unsecured revolving credit facility. Such draws had been used to fund a portion of our intended allocation to Eligible Green Projects, with

the remainder drawn for investments and acquisitions, as well as general corporate purposes. Our unsecured revolving credit facility accrues interest at a floating rate based on LIBOR plus 1.2% and matures on June 28, 2024. See "Use of Proceeds"

and "Description of the Offered Securities — Series 13 Holding LP Mirror Units."

|

|

|

|

Affiliates of BofA Securities, Inc., J.P. Morgan Securities LLC, RBC Capital Markets, LLC, Wells Fargo Securities,

LLC and TD Securities (USA) LLC are lenders under our credit facilities. We intend to use the net proceeds from this offering to repay borrowings outstanding under our unsecured revolving credit facility. As such, affiliates of BofA

Securities, Inc., J.P. Morgan Securities LLC, RBC Capital Markets, LLC, Wells Fargo Securities, LLC and TD Securities (USA) LLC are expected to receive a portion of the net proceeds from this offering. See

"Underwriting."

|

|

Material U.S. Federal Income Tax Consequences

|

|

For a discussion of material U.S. federal income tax considerations that may be relevant to certain prospective holders of

Series 13 Preferred Units, see "Material U.S. Federal Income Tax Considerations" in this prospectus supplement.

|

|

Form

|

|

The Series 13 Preferred Units will be issued and maintained in book-entry form registered in the name of DTC or its nominee,

except under limited circumstances. See "Description of the Offered Securities — Description of Series 13 Preferred Units — Book-Entry System."

|

|

Listing; Absence of Public Market

|

|

We will file an application to list the Series 13 Preferred Units on the NYSE. If the application is approved, trading of

the Series 13 Preferred Units on the NYSE is expected to begin within 30 days after the original issue date of the Series 13 Preferred Units. The underwriters have advised us that they intend to make a market in the Series 13

Preferred Units prior to commencement of any trading on the NYSE. However, the underwriters will have no obligation to do so, and no assurance can be given that a market for the Series 13 Preferred Units will develop prior to commencement of

trading on the NYSE or, if developed, will be maintained.

|

|

Risk Factors

|

|

Investing in our Series 13 Preferred Units involves risks. See "Risk Factors" beginning on page S-9 of this prospectus

supplement and page 1 of the accompanying base prospectus, and in the documents incorporated by reference in this prospectus supplement and the accompanying base prospectus, as well as other cautionary statements in this prospectus supplement,

the accompanying base prospectus and the documents incorporated by reference herein and therein regarding risks you should consider before investing in our Series 13 Preferred Units.

|

|

Settlement

|

|

The underwriters expect to deliver the Series 13 Preferred Units to the purchasers in book-entry form through the

facilities of DTC and its direct participants, on or about , 2020.

|

S-8

Table of Contents

RISK FACTORS

An investment in our Series 13 Preferred Units involves risks. You should carefully consider all of the information contained in

this prospectus supplement, the accompanying base prospectus and the documents incorporated by reference as provided under "Documents Incorporated by Reference," including our Annual Report and our

quarterly reports on Form 6-K, and the risk factors described therein. This prospectus supplement, the accompanying base prospectus and the documents incorporated by reference also contain

forward-looking statements that involve risks and uncertainties. Please read "Cautionary Statement Regarding Forward-Looking Information" herein. Our actual results could differ materially from those

anticipated in the forward-looking statements as a result of certain factors, including the risks described elsewhere in this prospectus supplement, in the accompanying base prospectus and in the

documents incorporated by reference. If any of these risks occur, our business, financial condition, results of operations, liquidity and the market price of the Series 13 Preferred Units could

be adversely affected.

Risks Associated with the COVID-19 Pandemic

The rapid spread of the COVID-19 virus, which was declared by the World Health Organization to be a pandemic on March 11,

2020, and actions taken globally in response to COVID-19, have significantly disrupted international business activities. In addition, our business relies, to a certain extent, on free movement of

goods, services, and capital from around the world, which has been significantly restricted as a result of COVID-19. Although the Partnership has implemented a response plan designed to maintain its

operations despite the outbreak of the virus, we have and may experience in the future direct or indirect impacts from the pandemic, including delays in development or construction activities in our

business, and we have experienced reduced movement of goods and people resulting in lower revenues in our transport segment. We also have some risk that our contract counterparties could fail to meet

their obligations to us.

Given

the ongoing and dynamic nature of the circumstances surrounding COVID-19, it is difficult to predict how significant the impact of COVID-19, including any responses to it, will be

on the global economy and the business of the Partnership or for how long any disruptions are likely to continue. The extent of such impact will depend on future developments, which are highly

uncertain, rapidly evolving and difficult to predict, including new information which may emerge concerning the severity of COVID-19 and additional actions which may be taken to contain COVID-19. Such

developments could have an adverse effect on our assets, liabilities, business, financial condition, results of operations and cash flow.

Risks Related to the Series 13 Preferred Units

The Series 13 Preferred Units represent perpetual interests in us, and investors should not expect us to redeem any Series 13 Preferred Units on the date the

Series 13 Preferred Units become redeemable by us or on any particular date thereafter.

The Series 13 Preferred Units represent perpetual interests in us, they have no maturity or mandatory redemption date and are

not redeemable at the option of investors under any circumstances. As a result, unlike our indebtedness, none of the Series 13 Preferred Units will give rise to a claim for payment of a

principal amount at a particular date. Instead, the Series 13 Preferred Units may be redeemed by us at our option (i) following a Change in Tax Law, in whole but not in part, out of

funds legally available for such redemption, at a redemption price in cash of $25.00 per Series 13 Preferred Unit plus an amount equal to all accrued and unpaid distributions thereon to, but

excluding, the date of redemption, whether or not declared, (ii) prior to October 15, 2025, following the occurrence of a Ratings Event, in whole but not in part, out of funds legally

available for such redemption, at a redemption price in cash of $25.50 per Series 13 Preferred Unit (102% of the liquidation preference of $25.00) plus an amount equal to all accrued and unpaid

distributions thereon to, but excluding, the date of redemption, whether or

not declared, or (iii) at any time on or after October 15, 2025, at our option, in whole or in part, out of funds legally available for such redemption, at a redemption price in cash of

$25.00 per Series 13 Preferred Unit plus an amount equal to all accrued and unpaid distributions thereon to, but excluding, the date of redemption, whether or not declared.

Any

decision we may make at any time to redeem the Series 13 Preferred Units will depend upon, among other things, our evaluation of our capital position, the terms and

circumstances of any Ratings Event or Change

S-9

Table of Contents

in

Tax Law, as applicable, and general market conditions at that time. The instruments governing our outstanding indebtedness also may limit our ability to redeem the Series 13 Preferred Units.

As a result, the holders of the Series 13 Preferred Units may be required to bear the financial risks of an investment in the Series 13 Preferred Units for an indefinite period

of time.

The Series 13 Preferred Units are structurally subordinated to our existing and future debt obligations and Senior Securities as well as existing and future debt

obligations of our subsidiaries and any capital stock of our subsidiaries held by others, including on Existing Preferred Units to the extent of the guarantees thereof.

The Series 13 Preferred Units will rank junior to all of our existing and future indebtedness and Senior Securities with respect

to assets available to satisfy claims against us, and rank pari passu in right of payment with every other class or series of Class A

Preferred Units (including the Existing Preferred Units) and any other class or series of partnership interest that pursuant to a written agreement rank equally with the Class A Preferred

Units. As of June 30, 2020, our total consolidated debt, including amounts borrowed under our corporate credit facilities, was approximately $20,934 million, and we had the ability to

borrow an additional $1,710 million under our corporate credit facilities, subject to certain limitations (including pursuant to our incremental $1.0 billion syndicated revolving credit

facility entered into in April 2020). In addition, we have an undrawn $500 million revolving credit facility with Brookfield and on September 1, 2020, a subsidiary of the

Partnership issued C$500 million aggregate principal amount of medium term notes, due September 1, 2032. In addition, as of June 30, 2020, we had 49,867,650 Existing

Preferred Units issued and outstanding, each with a liquidation preference of C$25.00 per unit, and each of which has the benefit of the BIPC Guarantee. See "Description of the Offered

Securities — Description of Class A Preferred Units — Series." Payments made in respect of our debt and any Senior

Securities reduces cash available for distribution to the holders of the Series 13 Preferred Units. In addition, the Series 13 Preferred Units will be structurally subordinated to all

existing and future debt and guarantee obligations of our subsidiaries and any capital stock of our subsidiaries held by others. In addition, while the Existing Preferred Units are guaranteed by the

BIPC Guarantor, and future series of Class A Preferred Units may be similarly guaranteed, neither the BIPC Guarantor nor any of the Partnership's subsidiaries will guarantee, or otherwise has

become obligated with respect to, the Series 13 Preferred Units.

In

addition, while the Existing Preferred Units have been guaranteed by the BIPC Guarantor, and future series of Class A Preferred Units may be similarly guaranteed, none of the

Partnership's subsidiaries has guaranteed, or otherwise has become obligated with respect to, the Series 13 Preferred Units, and it is not expected that any of the Partnership's subsidiaries

will guarantee, or will otherwise become obligated with respect to, the Series 13 Preferred Units in the future. Therefore, the BIPC Guarantor will have no obligation, contingent or otherwise,

in respect of the Series 13 Preferred Units and the Series 13 Preferred Units will be structurally subordinated to all existing and future debt and equity obligations of the BIPC

Guarantor and each of our other subsidiaries. Only the Existing Preferred Units, and any future series of Class A Preferred Units which benefit from a similar guarantee in the future, will have

the benefit of credit support from the BIPC Guarantor, and the Series 13 Preferred Units will not.

Our ability to issue additional Parity Securities and Senior Securities, and our ability to incur additional indebtedness, in the future could adversely affect the rights of

holders of our Series 13 Preferred Units.

The Series 13 Preferred Units will rank pari passu in right of payment

with the Existing Preferred Units and any other Parity Securities. We are allowed to issue additional Parity Securities without any vote of the holders of the Existing Preferred Units and/or the

Series 13 Preferred Units, and we may issue Senior Securities if we have received the affirmative vote or consent of the holders of at least a majority of the outstanding Class A

Preferred Units. The issuance of any additional Parity Securities would dilute the interests of the holders of the Series 13 Preferred Units. Furthermore, the issuance of any Senior Securities

or additional Parity Securities could affect our ability to pay distributions on, redeem, or pay the liquidation preference on the Series 13 Preferred Units if we do not have sufficient funds

to pay all liquidation preferences of any Senior Securities, the Existing Preferred Units, the Series 13 Preferred Units and any other Parity Securities in full. In addition, future issuances

and sales of Senior Securities or Parity Securities, or the perception that such issuances and sales could occur, may cause prevailing market prices for the Series 13 Preferred Units to decline

and may adversely affect our ability to raise additional capital in the financial markets at times and prices favorable to us.

S-10

Table of Contents

In

addition, the terms of the Series 13 Preferred Units do not limit our ability to incur indebtedness. Although some of the agreements governing our existing indebtedness contain

restrictions on our ability to incur additional indebtedness, these restrictions are subject to a number of important qualifications and exceptions and the indebtedness we could incur in compliance

with these restrictions could be substantial. As a result, we and our subsidiaries may incur indebtedness that will rank senior to the Series 13 Preferred Units. The incurrence of indebtedness

or other liabilities that will rank senior to the Series 13 Preferred Units may reduce the amount available for distributions and the amount recoverable by holders of Series 13 Preferred

Units.

The declaration of distributions on the Series 13 Preferred Units will be at the discretion of the BIP General Partner.

The declaration of distributions on the Series 13 Preferred Units will be at the discretion of the BIP General Partner. Holders

of Series 13 Preferred Units will not have a right to distributions on such units unless declared by the BIP General Partner. The declaration of distributions will be at the discretion of the

BIP General Partner even if the Partnership has sufficient funds, net of its liabilities, to pay such distributions. This may result in holders of the Series 13 Preferred Units not receiving

the full amount of distributions that they expect to receive, or any distributions, and may make it more difficult to resell Series 13 Preferred Units or to do so at a price that the holder

finds attractive. The BIP General Partner will not allow the Partnership to pay a distribution (i) unless there is sufficient cash available, (ii) which would render the Partnership

unable to pay its debts as and when they come due, or (iii) which, in the opinion of the BIP General Partner, would or might leave the Partnership with insufficient funds to meet any future or

contingent obligations. In addition, although unpaid distributions are cumulative, we are not required to accumulate cash for purpose of making distributions to holders of the Existing Preferred

Units, Series 13 Preferred Units or any other preferred units we may issue, which may limit the cash available to make distributions on the Series 13 Preferred Units.

The Series 13 Preferred Units have limited voting rights.

Except as set forth in our Partnership Agreement or as otherwise required by Bermuda law, and except as described in "Description of

the Offered Securities — Description of Series 13 Preferred Units — Voting Rights," holders of the Series 13

Preferred Units generally will have no voting rights. For example, the Partnership may sell, exchange or otherwise dispose of all or substantially all of its assets in a single transaction or a series

of related transactions without the approval of holders of the Series 13 Preferred Units. Although the holders of the Series 13 Preferred Units are entitled to limited protective voting

rights with respect to certain matters, as described in "Description of the Offered Securities — Description of Series 13 Preferred

Units — Voting Rights," the Series 13 Preferred Units will generally vote as a separate class, or along with all other classes or series of our Parity

Securities, including the Existing Preferred Units or other preferred units that we may issue upon which like voting rights have been conferred and are exercisable. As a result, the voting rights of

holders of Series 13 Preferred Units may be significantly diluted, and the holders of such other classes or series of Parity Securities (including the Existing Preferred Units) that we have

issued, or may issue in the future, may be able to control or significantly influence the outcome of any vote.

The terms of the Series 13 Holding LP Mirror Units, which are designed to mirror the economic terms of the Series 13 Preferred Units, may be amended by

the Holding LP, which we control, in a manner that could be detrimental to holders of Series 13 Preferred Units, and the terms of the Series 13 Holding LP Mirror Units

should not be relied upon to ensure that we have sufficient cash flows to pay distributions on or redeem the Series 13 Preferred Units.

We intend to authorize and create a proportionate number of Series 13 Holding LP Mirror Units with terms designed to

mirror the economic terms of the Series 13 Preferred Units, and the Partnership will use the net proceeds of this offering to subscribe for such Series 13 Holding LP

Mirror Units. See "Use of Proceeds" and "Description of the Offered Securities — Description of Series 13 Preferred

Units — Series 13 Holding LP Mirror Units."

The

terms of the Series 13 Holding LP Mirror Units will provide that no distribution may be declared or paid or set apart for payment on any Mirror Junior Securities