Nvidia Arms Up for Trouble -- Heard on the Street

September 14 2020 - 5:29AM

Dow Jones News

By Dan Gallagher

Forty billion dollars will buy Nvidia a world-class

semiconductor research and licensing business. It might also buy

the rapidly ascending chip maker a whole new kind of trouble.

Nvidia confirmed Sunday that it would pay $40 billion to acquire

Arm Holdings from SoftBank. The deal, which has been churning

through the rumor mill for several weeks, is Nvidia's largest by

miles, nearly six times as large as last year's acquisition of

Mellanox. Fortunately, Nvidia's gravity-defying stock makes for

valuable currency. The company is kicking in only $12 billion in

cash, just a little above what was on its balance sheet as of two

months ago.

But the main risk to this deal was never financial. U.K.-based

Arm provides the basic designs for the low-power central processor

chips that form the main brains of devices such as smartphones and

tablets. Companies including Apple, Samsung and Qualcomm license

those designs for their own chips. The upshot is that nearly every

company that makes processors for mobile devices and other types of

chips has a licensing relationship with Arm. And a lot of those are

chip makers that either compete with Nvidia, or are likely to in

the future.

As such, Nvidia will need to strike a delicate balance between

running its own chip business and allowing Arm's a certain degree

of independence--all while trying to fully realize the value of its

$40 billion outlay. Both companies realize this. Nvidia Chief

Executive Jensen Huang said Sunday that he plans to fully maintain

Arm's "open licensing and neutrality," while Arm CEO Simon Segars

added that it would be "value destructive to do anything else."

But that is easier said than done. Qualcomm's efforts to run

both a chipset and licensing business have enmeshed the company for

years in lawsuits and battles with regulators. And Nvidia's

strength in artificial-intelligence computing that has made the

company a Wall Street darling also makes it the name to beat for

others targeting this lucrative field. In a note to clients Sunday

night, Stacy Rasgon of Bernstein said Nvidia's "dominance will be

extended into virtually every important compute domain" if it can

complete this deal.

Therefore, even completing the deal is a big "if." The

acquisition will need the approval of regulators across the globe.

That includes the U.S. and China, where semiconductors have become

a battleground in an escalating trade and technology war. It took

Nvidia more than a year to push through its relatively

uncontroversial acquisition of Mellanox. Mr. Huang wouldn't even

put a rough guess on how long it would take to get the necessary

signoffs for buying Arm. The chance of a long, drawn-out battle for

approvals is high.

And the real risk for Nvidia is that getting the world's biggest

governments on board may turn out to be the easy part. If the

company can't find the right balance between reassuring Arm's

licensees and making the most of its investment, the real winners

from this deal could be the lawyers.

Write to Dan Gallagher at dan.gallagher@wsj.com

(END) Dow Jones Newswires

September 14, 2020 05:14 ET (09:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

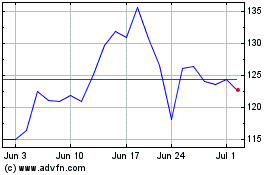

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Apr 2023 to Apr 2024