By Cara Lombardo, Maureen Farrell and Asa Fitch

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 14, 2020).

The impending sale of Arm Holdings to Nvidia Corp. for $40

billion could have wide-ranging implications for the global

semiconductor industry, further elevating one of its highest fliers

and unwinding another big bet by SoftBank Group Corp.

The Japanese technology conglomerate said late Sunday that it

has reached a deal to sell Arm to Nvidia for a mix of cash and

stock, confirming a report Saturday by The Wall Street Journal.

Nvidia will pay $21.5 billion in stock and $12 billion in cash.

SoftBank may also receive up to $5 billion in cash or stock subject

to Arm hitting financial-performance targets. Nvidia will also

issue $1.5 billion in stock to Arm employees.

Nvidia, which makes graphics processors, and Arm, which designs

microprocessors that power most of the world's smartphones, may not

be household names, but they are some of the biggest players in the

chip industry. A union would instantly lift Nvidia, whose stock has

been one of the market's best performers this year, into a dominant

force in the market for smartphones and a big supplier of

technology for a range of other devices from smart speakers to

fitness trackers.

The deal, one of the largest semiconductor takeovers ever, marks

a win for SoftBank and its chief executive, Masayoshi Son, which

bought Arm four years ago for $32 billion and had struggled to

jump-start growth in the business.

For Nvidia Chief Executive Jensen Huang, it is the biggest

gamble since he helped co-found the chip maker in 1993.

Nvidia is a fast-growing industry player best known for making

the graphics chips that power videogames like on the wildly popular

Nintendo Switch. The chips have been in hot demand during the

pandemic as lockdowns keep people at home.

Nvidia's chips also go into data centers that are increasingly

in demand as remote work has taken off, and they have become the

workhorses of artificial-intelligence calculations that have grown

as more businesses embrace automation.

Success in those markets has driven investor enthusiasm that has

led Nvidia to generate record sales in its most recent quarter and

its shares to double this year. With a market capitalization of

about $300 billion, Nvidia is the most valuable U.S. semiconductor

company after overtaking Intel Corp., whose stock has slumped amid

production missteps.

The deal would add around $1.9 billion in annual sales to the

$11 billion Nvidia, based in Santa Clara, Calif., posted for last

year. It would also add breadth to its relationship with customers,

including the world's largest smartphone makers, namely Apple Inc.

and China's Huawei Technologies Co., which would owe Nvidia license

fees for the use of Arm technology.

But buying Arm also carries risk for Nvidia.

Arm, founded in 1990 as a spinoff of a joint venture that

included Apple, designs blueprints for clients, including other

chip companies, to make smartphone processors. Its designs are used

in processors that power around 90% of the world's smartphones and

in many other types of mobile chips.

Following a sale to Nvidia, customers like Samsung Electronics

Co., Apple and Qualcomm Inc. would face the prospect of one of

their chip-making competitors owning Arm, potentially undermining

its attractiveness as a neutral supplier.

Analysts have said that a Nvidia purchase of Arm wouldn't go

down well, with Bernstein Research's Stacy Rasgon writing in a note

that any single company acquiring Arm "would wield enormous power

over competitors," calling the outcome "an unpalatable

situation."

The deal also is likely to face regulatory scrutiny,

particularly given the heightened tensions between the U.S. and

China that have led to close reviews of semiconductor deals.

President Trump blocked Broadcom Inc.'s $117 billion takeover bid

for San Diego-based mobile- phone chip maker Qualcomm Inc. in 2018,

amid fears that it could hamper U.S. dominance in emerging 5G

technology. Qualcomm's proposed $44 billion purchase of Dutch chip

maker NXP Semiconductors NV fell through after China failed to give

its approval.

Nvidia's biggest acquisition to date, a $7 billion deal for

Mellanox Technologies Ltd., faced delays because of protracted

regulatory scrutiny in China. It closed in April.

China could bristle at the idea of Arm, a company used by many

Chinese smartphone makers, falling into the hands of an American

company. Arm's ownership, first as a publicly traded British

company and later as a subsidiary of Japan's SoftBank, largely kept

it outside the fray of Sino-American friction.

The transaction, which would make SoftBank one of Nvidia's

largest shareholders, is one of a series of big asset sales by the

Japanese firm.

It had been under pressure to shore up its flagging stock price

and promised some $40 billion in asset disposals. Most or all of

that is already under way or completed, and SoftBank shares are up

more than 20% this year. Among the sales: big chunks of its

holdings in China's Alibaba Group Holding Ltd. and T-Mobile US Inc.

following the wireless provider's merger with Sprint Corp.

At SoftBank, Mr. Son has been working with a small team to

negotiate the Arm deal including the chief executive of the chip

company, Simon Segars, Chief Financial Officer Yoshimitsu Goto as

well as Rajeev Misra, CEO of the firm's giant Vision Fund, and

Akshay Naheta, another SoftBank executive.

Write to Cara Lombardo at cara.lombardo@wsj.com, Maureen Farrell

at maureen.farrell@wsj.com and Asa Fitch at asa.fitch@wsj.com

(END) Dow Jones Newswires

September 14, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

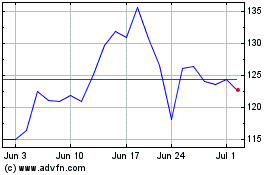

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Apr 2023 to Apr 2024