Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

August 31 2020 - 6:08AM

Edgar (US Regulatory)

Filed pursuant to Rule 433

Issuer Free Writing Prospectus dated August 28, 2020

Relating to Preliminary Prospectus Supplement dated August 27, 2020

to Prospectus dated June 9, 2020

Registration No. 333-239047

NIO Inc., or the Company, we or us,

has filed a registration statement on Form F-3 (Registration No. 333-239047), including a prospectus dated June 9,

2020, and a preliminary prospectus supplement dated August 27, 2020 with the Securities and Exchange Commission (the “SEC”)

for the offering to which this free writing prospectus relates. Before you invest, you should read the prospectus included in the

registration statement, the preliminary prospectus supplement, the documents incorporated by reference in the registration statement

and other documents the Company has filed with the SEC for more complete information about us and this offering. Investors should

rely upon the prospectus, the preliminary prospectus supplement and any relevant free writing prospectus for complete details of

this offering. You may obtain these documents and other documents the Company has filed for free by visiting EDGAR on the SEC website

at www.sec.gov. Alternatively, the Company, any underwriter or any dealer participating in the offering will arrange to send you

the prospectus and the preliminary prospectus supplement, if you request them by contacting (1) Morgan Stanley &

Co. LLC, Prospectus Department, 2nd Floor, 180 Varick Street, New York, NY 10014, United States of America, Attention: Prospectus

Department; (2) China International Capital Corporation Hong Kong Securities Limited, 29th Floor, One International Finance

Centre, 1 Harbour View Street, Central, Hong Kong; or (3) BofA Securities, NC1-004-03-43, 200 North College Street, 3rd floor,

Charlotte NC 28255-0001, Attention: Prospectus Department, Email: dg.prospectus_requests@bofa.com. You may also access the Company’s

most recent preliminary prospectus supplement dated August 27, 2020, as filed with the SEC via EDGAR on August 27, 2020,

by visiting EDGAR on the SEC website at: https://www.sec.gov/Archives/edgar/data/1736541/000110465920099693/tm2022004-6_424b5.htm.

The following information supplements and

updates the information contained in the Company’s preliminary prospectus supplement dated August 27, 2020 (the “Preliminary

Prospectus Supplement”). In the Preliminary Prospectus Supplement, we proposed to offer 75,000,000 ADSs and grant the

underwriters an option to purchase up to an aggregate of 11,250,000 additional ADSs from us. The number of ADSs to be offered

by us in the offering has increased to 88,500,000 ADSs, and we will grant the underwriters an option to purchase up to an

aggregate of 13,275,000 additional ADSs from us.

This issuer free writing prospectus updates

certain information contained in the Preliminary Prospectus Supplement to reflect the increases in the number of ADSs being offered,

the impact on net proceeds and capitalization, as well as certain other changes. This free writing prospectus reflects the following

amendments and supplements that were made to the Preliminary Prospectus Supplement. All references to page numbers are to

page numbers in the Preliminary Prospectus Supplement.

|

|

(1)

|

Amend the corresponding portion of “The Offering”

beginning on page S-11 as follows:

|

THE OFFERING

|

ADSs offered by us

|

|

88,500,000 ADSs (or 101,775,000 ADSs if the underwriters exercise the option to purchase additional ADSs in full).

|

|

|

|

|

|

Class A ordinary shares outstanding immediately after this offering

|

|

1,068,374,787 Class A ordinary shares (or 1,081,649,787 Class A ordinary shares if the option to purchase additional ADSs is exercised in full by the underwriters).

|

|

|

|

|

|

Option to purchase additional shares

|

|

We have granted the underwriters an option, exercisable within 30 days from the date of this prospectus supplement, to purchase up to an aggregate of 13,275,000 additional ADSs.

|

|

|

|

|

|

Use of proceeds

|

|

We estimate that the net proceeds to us

from this offering will be approximately US$1,469.5 million (or approximately US$1,690.1 million assuming the underwriters exercise

their option to purchase additional ADSs in full), after deducting underwriting commissions and fees and the estimated offering

expenses payable by us.

We expect to use the net proceeds from

this offering mainly to increase the share capital of and our ownership in NIO China, to repurchase equity interests held by certain

minority shareholders of NIO China, and for research and development in autonomous driving technologies, global market development

and general corporate purposes.

See “Use of Proceeds” for additional

information.

|

|

|

(2)

|

Amend the first paragraph under “Use of Proceeds” on page S-101 as follows:

|

We estimate that the

net proceeds to us from this offering will be approximately US$1,469.5 million (or approximately US$1,690.1 million assuming the

underwriters exercise their option to purchase additional ADSs in full), after deducting underwriting commissions and fees and

the estimated offering expenses payable by us.

|

|

(3)

|

Amend “Capitalization” beginning on page S-102 as follows:

|

CAPITALIZATION

The following table

sets forth our capitalization as of June 30, 2020:

|

|

·

|

on an actual basis; and

|

|

|

·

|

on a pro forma as adjusted basis to give effect to the issuance and sale by us of 88,500,000

Class A ordinary shares in the form of ADSs pursuant to this prospectus supplement and the accompanying prospectus, resulting

in estimated net proceeds of US$1,469.5 million, after deducting estimated underwriting discounts and commissions and estimated

offering expenses payable by us, assuming the underwriters do not exercise the option to purchase additional ADSs .

|

The pro forma

as adjusted information is illustrative only. You should read this table in conjunction with our consolidated financial statements

and related notes included and “Item 5. Operating and Financial Review and Prospects” in our 2019 Annual

Report, which is incorporated by reference in this prospectus supplement and the accompanying prospectus.

|

|

|

As of June 30, 2020

|

|

|

|

|

Actual

|

|

|

As Adjusted

|

|

|

|

|

RMB

|

|

|

US$

|

|

|

RMB

|

|

|

US$

|

|

|

|

|

(in thousands)

(unaudited)

|

|

|

Current Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

10,494,509

|

|

|

|

1,485,401

|

|

|

|

20,884,791

|

|

|

|

2,956,050

|

|

|

Restricted cash

|

|

|

441,413

|

|

|

|

62,478

|

|

|

|

441,413

|

|

|

|

62,478

|

|

|

Short-term investments

|

|

|

231,590

|

|

|

|

32,779

|

|

|

|

231,590

|

|

|

|

32,779

|

|

|

Shareholders’ (Deficit)/Equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A ordinary shares

|

|

|

1,512

|

|

|

|

214

|

|

|

|

1,667

|

|

|

|

236

|

|

|

Class B ordinary shares

|

|

|

226

|

|

|

|

32

|

|

|

|

226

|

|

|

|

32

|

|

|

Class C ordinary shares

|

|

|

254

|

|

|

|

36

|

|

|

|

254

|

|

|

|

36

|

|

|

Treasury shares

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Additional paid-in capital

|

|

|

43,726,092

|

|

|

|

6,189,026

|

|

|

|

54,109,161

|

|

|

|

7,658,654

|

|

|

Accumulated other comprehensive loss

|

|

|

(306,113

|

)

|

|

|

(43,327

|

)

|

|

|

(306,113

|

)

|

|

|

(43,327

|

)

|

|

Accumulated deficit

|

|

|

(49,216,851

|

)

|

|

|

(6,966,193

|

)

|

|

|

(49,217,628

|

)

|

|

|

(6,966,303

|

)

|

|

Total NIO Inc. Shareholders’ (Deficit)/Equity

|

|

|

(5,794,880

|

)

|

|

|

(820,212

|

)

|

|

|

4,587,567

|

|

|

|

649,328

|

|

|

Noncontrolling interests

|

|

|

6,187

|

|

|

|

876

|

|

|

|

6,187

|

|

|

|

876

|

|

|

Total Shareholders’ (Deficit)/Equity

|

|

|

(5,788,693

|

)

|

|

|

(819,336

|

)

|

|

|

4,593,754

|

|

|

|

650,204

|

|

|

Total Capitalization

|

|

|

7,575,625

|

|

|

|

1,072,261

|

|

|

|

17,958,072

|

|

|

|

2,541,801

|

|

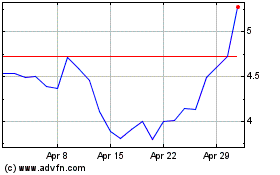

NIO (NYSE:NIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

NIO (NYSE:NIO)

Historical Stock Chart

From Apr 2023 to Apr 2024