Current Report Filing (8-k)

August 26 2020 - 4:19PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 or 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of report (date of earliest event reported): August 20, 2020

HealthLynked

Corp.

(Exact Name of Registrant as Specified in its Charter)

|

Nevada

|

|

47-1634127

|

|

(State of Incorporation)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

1726

Medical Blvd., Suite 101, Naples, Florida

|

|

34110

|

|

(Address of Principal

Executive Offices)

|

|

(ZIP Code)

|

(239)

513-1992

(Registrant’s

Telephone Number, Including Area Code)

N/A

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant

under any of the following provisions:

|

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter). ☒

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

On

August 20, 2020, HealthLynked Corp. (the “Company”) entered into a contribution agreement (the

“Contribution Agreement”) with The Michael T. Dent, Trustee of the Mary S. Dent Gifting Trust dated January 31,

2006 (the “Gifting Trust”), Michael Thomas Dent, Trustee under the Michael Thomas Dent Declaration of Trust dated

March 23, 1998, as amended (the “MTD Trust” and together with the Gifting Trust, the “Trusts”), and

Michael T. Dent, the Chief Executive Officer and Chairman of the board of directors of the Company. Pursuant to the

Contribution Agreement, the Trusts contributed an aggregate of 76,026 shares of common stock of NeoGenomics, Inc. to the

Company. In addition, Dr. Dent assigned certain intellectual property to the Company that was developed for the benefit of

the Company. Furthermore, Dr. Dent assigned to the Company the HealthLynked COVID-19 Tracker. In consideration for the

foregoing, the Company issued the Trusts an aggregate of 2,750,000 shares of the Company’s newly designated Series B

Preferred Stock (as defined herein) and an aggregate of 24,522,727 shares of the Company’s common stock par value

$0.001 per share (the “Common Stock”).

The

foregoing summary of the Contribution Agreement

does not purport to be complete and is qualified in its entirety by reference to the Contribution Agreement

which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is hereby incorporated by reference.

Item

5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On

August 24, 2020, in connection with the Contribution Agreement, the Company filed a Certificate of Designation of

Preferences, Rights and Limitations of Series B Convertible Preferred Voting Stock (the “Certificate of

Designation”) with the Secretary of State of the State of Nevada that became effective on August 20, 2020. Pursuant to the

Certificate of Designation, the Company designated 2,750,000 shares of the Company’s previously undesignated preferred

stock as Series B Convertible Preferred Voting Stock (“Series B Preferred Stock”).

Beginning

on December 31, 2022, each share of Series B Preferred Stock is convertible into five shares of the Company’s Common Stock,

subject to customary anti-dilution adjustments, including in the event of any stock split. The Series B Preferred Stock ranks

senior to the Common Stock.

Upon

a liquidation, dissolution or winding up of the Company, whether voluntary or involuntary, the assets of the Company available

for distribution to its stockholders will be distributed to holders of Series B Preferred Stock on an as converted basis and pro

rata with the holders of Common Stock. Holders of Series B Preferred Stock are also entitled to participate in dividends declared

or paid on the Common Stock on an as-converted basis.

The

holders of Series B Preferred Stock generally are entitled to vote with the holders of the shares of Common Stock on all matters

submitted for a vote of holders of shares of Common Stock (voting together with the holders of shares of Common Stock as one class).

The holder of the shares of Preferred B Stock shall have that number of votes (identical in every other respect to the voting

rights of the holders of Common Stock entitled to vote at any regular or special meeting of the shareholders) equal to 100 shares

of Common Stock for each share of Preferred B Preferred Stock held (which shall never be deemed less than 51% of the vote required

to approve any action), which Nevada law provides may or must be approved by vote or consent of the holders of Common Stock or

the holders of other securities entitled to vote, if any.

The

foregoing description of the terms pertaining to the Series B Preferred Stock is not complete and is qualified in its entirety

by reference to the full text of the Certificate of Designation, a copy of which is filed as Exhibit 3.1 to this Current Report

on Form 8-K and incorporated by reference herein.

Item

8.01. Other Events.

On

August 25, 2020, the Company issued a press release with respect to, among other things, a $3 million equity investment in the

Company by its Chairman and Chief Executive Officer. A copy of the press release is filed

as Exhibit 99.1 to this Current Report on Form 8-K and is hereby incorporated by reference.

Item

9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No.

|

|

Description

|

|

3.1

|

|

Certificate of Designations, filed with the Nevada Secretary of State on August 24, 2020

|

|

10.1

|

|

Contribution Agreement by and among the Company, The Michael T. Dent, Trustee of the Mary S. Dent Gifting Trust dated January 31, 2006, Michael Thomas Dent, Trustee under the Michael Thomas Dent Declaration of Trust dated March 23, 1998, as amended, and Michael T. Dent dated August 20, 2020

|

|

99.1

|

|

Press release, dated August 25, 2020

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

HEALTHLYNKED CORP.

|

|

|

|

|

Dated: August 26, 2020

|

/s/

George O’Leary

|

|

|

George O’Leary

|

|

|

Chief Financial Officer

|

-3-

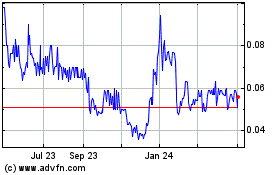

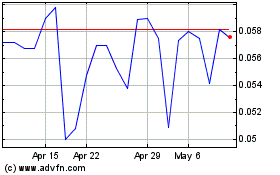

HealthLynked (QB) (USOTC:HLYK)

Historical Stock Chart

From Mar 2024 to Apr 2024

HealthLynked (QB) (USOTC:HLYK)

Historical Stock Chart

From Apr 2023 to Apr 2024