SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of August, 2020

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

MARKET

ANNOUNCEMENT

CENTRAIS

ELÉTRICAS BRASILEIRAS S/A

CNPJ: 00.001.180/0001-26 | NIRE: 533.0000085-9

PUBLIC COMPANY

Centrais Elétricas Brasileiras

S/A (“Companhia” ou “Eletrobras”) (B3: ELET3, ELET5 & ELET6; NYSE: EBR & EBR.B; LATIBEX: XELT.O

& XELT.B) hereby informs its shareholders and the market in general that received, on this date, from B3 – Brasil, Bolsa,

Balcão, the Official Letter 614/2020-SLS, below transcript, requesting clarification regarding atypical movements of the

Company’s shares:

Free translation of the Official

Letter 614/2020-SLS

“Centrais Elétricas

Brasileiras S.A. - Eletrobras

At. Ms. Elvira Baracuhy Cavalcanti

Presta

CFO and IRO

Ref.: Atypical Movements of

the Company’s Shares

Dear Sirs,

In view of the latest fluctuations

registered with the shares issued by this company, the number of trades and the quantity traded, as below, we request that be informed,

until 08/24/2020, if there is any fact of your knowledge that can justify them

|

Common Shares

|

|

Prices (BRL shares)

|

|

Date

|

Opening

|

Minimum

|

Maximum

|

Medium

|

Last

|

Oscil. %

|

Nº neg.

|

Amount

|

Volume (BRL)

|

|

08/10/2020

|

37.66

|

36.84

|

37.76

|

37.19

|

37.25

|

-1.08

|

12,785

|

2,696,900

|

100,302,304.00

|

|

08/11/2020

|

37.73

|

36.42

|

37.94

|

36.90

|

36.65

|

-1.61

|

13,448

|

3,359,000

|

123,945,165.00

|

|

08/12/2020

|

36.20

|

34.72

|

36.20

|

35.25

|

35.87

|

-2.12

|

37,323

|

9,884,500

|

348,429,028.00

|

|

08/13/2020

|

36.46

|

32.57

|

36.88

|

34.07

|

33.38

|

-6.94

|

52,166

|

17,635,200

|

600,916,584.00

|

|

08/14/2020

|

33.66

|

32.62

|

34.40

|

33.53

|

34.08

|

2.09

|

40,816

|

11,068,000

|

371,079,837.00

|

|

08/17/2020

|

34.18

|

31.15

|

34.27

|

32.45

|

31.81

|

-6.66

|

37,297

|

13,846,100

|

449,252,086.00

|

|

08/18/2020

|

32.87

|

31.55

|

32.87

|

32.18

|

32.58

|

2.42

|

31,777

|

7,161,500

|

230,466,694.00

|

|

08/19/2020

|

32.70

|

31.33

|

32.70

|

31.71

|

31.67

|

-2.79

|

24,751

|

6,263,800

|

198,612,112.00

|

|

08/20/2020

|

30.80

|

30.60

|

31.93

|

31.26

|

31.82

|

0.47

|

25,281

|

6,876,300

|

214,953,591.00

|

|

08/21/2020*

|

31.85

|

31.65

|

35.13

|

34.11

|

34.98

|

9.93

|

22,017

|

8,167,100

|

278,610,384.00

|

*Update until 00:19 pm

This document may contain

estimates and forecasts that are not statements of fact that occurred in the past but reflect our management beliefs and expectations

and may constitute future events' forecasts and estimates under Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities and Exchange Act of 1934, as amended. The words "believe", "may", "estimate",

"continue", "anticipate", "intend", "expect" and related words are intended to identify

estimates that necessarily involve risks and uncertainties, known or unknown . Known risks and uncertainties include, but are not

limited to: general economic, regulatory, political and commercial conditions in Brazil and abroad, changes in interest rates,

inflation and value of the Real, changes in volumes and the pattern of use of electricity by consumer, competitive conditions,

our level of indebtedness, the possibility of receiving payments related to our receivables, changes in rainfall and water levels

in the reservoirs used to operate our hydroelectric plants, our financing and capital investment plans, existing and future government

regulations , and other risks described in our annual report and other documents filed with CVM and SEC. Estimates and forecasts

refer only to the date they were expressed and we assume no obligation to update any of these estimates or forecasts due to the

occurrence of new information or future events. Future results of the Company's operations and initiatives may differ from current

expectations and the investor should not rely solely on the information contained herein. This material contains calculations that

may not reflect accurate results due to rounding.

|

Preferred B Shares

|

|

Prices (BRL shares)

|

|

Date

|

Opening

|

Minimum

|

Maximum

|

Medium

|

Last

|

Oscil. %

|

Nº neg.

|

Amount

|

Volume (BRL)

|

|

08/10/2020

|

39.28

|

38.21

|

39.28

|

38.69

|

38.98

|

-0.76

|

7,856

|

1,772,000

|

68,564,545.00

|

|

08/11/2020

|

39.28

|

38.03

|

39.45

|

38.49

|

38.44

|

-1.38

|

9,014

|

1,910,900

|

73,545,104.00

|

|

08/12/2020

|

37.98

|

36.50

|

37.98

|

36.96

|

37.15

|

-3.35

|

19,251

|

4,720,400

|

174,446,620.00

|

|

08/13/2020

|

37.57

|

34.51

|

38.14

|

35.76

|

35.15

|

-5.38

|

25,984

|

6,515,200

|

232,957,592.,00

|

|

08/14/2020

|

35.37

|

34.59

|

36.10

|

35.25

|

35.64

|

1.39

|

15,142

|

3,774,400

|

133,064,890.00

|

|

08/17/2020

|

35.64

|

32.41

|

35.84

|

33.81

|

33.80

|

-5.16

|

23,716

|

7,113,900

|

240,515,835.00

|

|

08/18/2020

|

34.57

|

33.35

|

34.60

|

33.95

|

34.37

|

1.68

|

13,821

|

3,229,900

|

109,646,939.00

|

|

08/19/2020

|

34.40

|

32.93

|

34.60

|

33.21

|

33.16

|

-3.52

|

17,689

|

4,952,400

|

164,474,132.00

|

|

08/20/2020

|

32.25

|

31.75

|

32.90

|

32.25

|

32.90

|

-0.78

|

21,662

|

5,014,900

|

161,747,673.00

|

|

08/21/2020*

|

32.90

|

32.51

|

36.18

|

35.08

|

35.87

|

9.02

|

11,916

|

3,773,000

|

132,388,701.00

|

*Update until 00:19 pm

In view of the aforementioned Official

Letter, we clarify that Eletrobras' shares have been fluctuating as a result of news that are disclosed in the media, not necessarily

directly related to the Company, but that change the market's perspective regarding the acceptability by the National Congress

of the draft bill number 5,877, which brings the model proposed by the Federal Government to the privatization process of the Eletrobras

System.

In this regard, on August 11, 2020,

the exit of the Secretary of Privatizations, Salim Mattar, from the Ministry of Economy was announced, in addition to rumors about

the possible exit of other members of that Ministry, which could, in the view of the market, complicate the privatization process

and, consequently, there was a decrease in the value of the shares. On August 18, 2020, the President of the Lower House, Rodrigo

Maia, declared that there was no consensus to privatize Eletrobras in 2020. Today, the press announced the maintenance, by the

Lower House, of the presidential veto to the readjustment government employees by 2021, which probably, according to the specialized

press, reinforced the market's confidence that the Federal Government would have support from the National Congress to approve

the privatization project, in addition to other statements by political agents.

As can be seen, the events above

are out of Eletrobras control and are not directly related to Company’s matters, but rather to a macroeconomic and political

assessment made by investors that ends up reflecting on their investment decisions.

This document may contain

estimates and forecasts that are not statements of fact that occurred in the past but reflect our management beliefs and expectations

and may constitute future events' forecasts and estimates under Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities and Exchange Act of 1934, as amended. The words "believe", "may", "estimate",

"continue", "anticipate", "intend", "expect" and related words are intended to identify

estimates that necessarily involve risks and uncertainties, known or unknown . Known risks and uncertainties include, but are not

limited to: general economic, regulatory, political and commercial conditions in Brazil and abroad, changes in interest rates,

inflation and value of the Real, changes in volumes and the pattern of use of electricity by consumer, competitive conditions,

our level of indebtedness, the possibility of receiving payments related to our receivables, changes in rainfall and water levels

in the reservoirs used to operate our hydroelectric plants, our financing and capital investment plans, existing and future government

regulations , and other risks described in our annual report and other documents filed with CVM and SEC. Estimates and forecasts

refer only to the date they were expressed and we assume no obligation to update any of these estimates or forecasts due to the

occurrence of new information or future events. Future results of the Company's operations and initiatives may differ from current

expectations and the investor should not rely solely on the information contained herein. This material contains calculations that

may not reflect accurate results due to rounding.

In this sense, the Company reiterates

that it has no knowledge of a new relevant fact, not disclosed to the market, about the privatization process and reiterates that

it will keep the market informed about the matter.

Rio de Janeiro, August 21, 2020

Elvira Cavalcanti Presta

CFO and Investor Relations Officer

This document may contain

estimates and forecasts that are not statements of fact that occurred in the past but reflect our management beliefs and expectations

and may constitute future events' forecasts and estimates under Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities and Exchange Act of 1934, as amended. The words "believe", "may", "estimate",

"continue", "anticipate", "intend", "expect" and related words are intended to identify

estimates that necessarily involve risks and uncertainties, known or unknown . Known risks and uncertainties include, but are not

limited to: general economic, regulatory, political and commercial conditions in Brazil and abroad, changes in interest rates,

inflation and value of the Real, changes in volumes and the pattern of use of electricity by consumer, competitive conditions,

our level of indebtedness, the possibility of receiving payments related to our receivables, changes in rainfall and water levels

in the reservoirs used to operate our hydroelectric plants, our financing and capital investment plans, existing and future government

regulations , and other risks described in our annual report and other documents filed with CVM and SEC. Estimates and forecasts

refer only to the date they were expressed and we assume no obligation to update any of these estimates or forecasts due to the

occurrence of new information or future events. Future results of the Company's operations and initiatives may differ from current

expectations and the investor should not rely solely on the information contained herein. This material contains calculations that

may not reflect accurate results due to rounding.

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

Date: August 21, 2020

|

CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS

|

|

|

|

|

|

By:

|

/S/ Elvira Baracuhy Cavalcanti Presta

|

|

|

|

Elvira Baracuhy Cavalcanti Presta

CFO and Investor Relations Officer

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking

statements. These statements are statements that are not historical facts, and are based on management's current view and estimates

offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates",

"believes", "estimates", "expects", "plans" and similar expressions, as they relate to

the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends,

the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations

and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements.

Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee

that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including

general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors

could cause actual results to differ materially from current expectations.

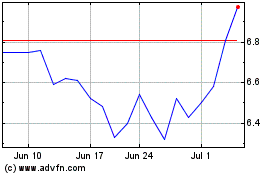

Centrais Eletricas Brasi... (NYSE:EBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

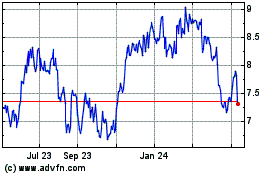

Centrais Eletricas Brasi... (NYSE:EBR)

Historical Stock Chart

From Apr 2023 to Apr 2024