Nvidia Reports 50% Sales Leap On Chip Demand -- WSJ

August 20 2020 - 3:02AM

Dow Jones News

By Maria Armental

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 20, 2020).

Graphic-chip maker Nvidia Corp. continued its run of strong

financial performance during the coronavirus pandemic, posting

record sales in the latest quarter propelled by strong demand for

online gaming and remote computing services.

The Santa Clara, Calif.-based company said earnings per share

for the quarter ended July 31 rose to 99 cents from 90 cents in the

year-ago period driven by a 50% jump in sales to $3.87 billion.

Wall Street expected earnings of 95 cents a share and $3.65 billion

in revenue.

"The pandemic will have a lasting impact on how we work,"

financial chief Colette Kress told analysts on a call, adding that

the company's sales mix would "likely reflect this evolution in

enterprise workforce trends with a greater focus on technologies,

such as Nvidia laptops and virtual workstations, that enable remote

work and virtual collaboration."

Nvidia shares have surged during the health crisis, making it

the best performing stock in the S&P 500 index and overtaking

Intel Corp. as the largest U.S. semiconductor company by value.

While Intel has stumbled with development of its newest chips,

punishing the stock, Nvidia has enjoyed investor favor because its

chips -- optimized to run the intense calculations for graphics --

are in hot demand as people turn to videogames for distraction

while stuck at home. The company is now valued at around $300

billion after its stock more than doubled this year, almost $100

billion more than Intel. Intel, in turn, has seen its stock fall

almost 20% in 2020.

Intel on Wednesday said it plans to buy back $10 billion of its

stock on an accelerated basis, as part of a $20 billion repurchase

program it suspended in March. "Intel shares are currently trading

well below our intrinsic valuation," Chief Executive Bob Swann

said, adding that data-driven chip demand gives him confidence in

the company's product plan.

Nvidia shares, which hit a record level this week, closed down

1% Wednesday and slid 1.7% in after-hours trading. Intel's stock

rose 3.9% after hours following its share repurchase

disclosure.

Nvidia also has benefited from higher demand for cloud-computing

infrastructure as more companies have shifted to working remotely,

helping deliver growth for vendors such as Amazon.com Inc. and

Microsoft Corp.

Many of Nvidia's chips also are sold to data centers, where they

make rapid calculations that power artificial intelligence. The

company's supercomputers are being used in the fight against the

coronavirus pandemic. Nvidia in May said it shipped the first DGX

A100 -- a new line of high-performance computers -- to the U.S.

Department of Energy's Argonne National Laboratory for Covid-19

research.

The company said last quarter's data-center business, which

includes DGX sales and revenue from recently acquired Mellanox

Technologies, more than doubled to a record $1.75 billion. Revenue

at its games segment increased 26% to $1.65 billion.

Nvidia, for the current quarter, projects record revenue of

about $4.4 billion. Wall Street is expecting $3.97 billion,

according to analysts surveyed by FactSet. Gaming and data-center

sales are projected to drive the increase, Ms. Kress said.

The recent strength for the data-center and gaming businesses

aren't just a temporary, pandemic-effect, Chief Executive Jensen

Huang said in the call. "This is the future," he said, "and there's

no going back."

The company, though, wasn't immune to effects of the pandemic on

the wider economy. Sales for its professional visualization segment

fell 30% from a year ago because corporate customers delayed

workstation spending, Nvidia said. Sales to the hard-hit car

sector, down 47% year-over-year, also weighed on revenue. Company

officials said auto production volumes have started to recover but

remain well below prepandemic levels.

"Despite the pandemic's impact on our professional visualization

and automotive platforms, we are well positioned to grow, as

gaming, AI, cloud computing and autonomous machines drive the next

industrial revolution around the world," Mr. Huang said.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

August 20, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

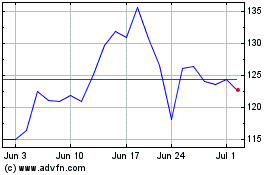

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Apr 2023 to Apr 2024