Current Report Filing (8-k)

August 18 2020 - 5:01PM

Edgar (US Regulatory)

0001555074false00015550742020-08-132020-08-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 18, 2020 (August 13, 2020)

ALTISOURCE ASSET MANAGEMENT CORPORATION

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Virgin Islands

|

|

001-36063

|

|

66-0783125

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

5100 Tamarind Reef

Christiansted, U.S. Virgin Islands 00820

(Address of principal executive offices including zip code)

(340) 692-0525

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter):

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, par value $0.01 per share

|

AAMC

|

NYSE American

|

Item 1.01 Entry into a Material Definitive Agreement.

On August 13, 2020, Altisource Asset Management Corporation (“AAMC” or the “Company”) entered into a Termination and Transition Agreement (the “Termination Agreement”) with Front Yard Residential Corporation (“Front Yard”) and Front Yard Residential L.P. (“FYR LP”) to terminate that certain Amended and Restated Asset Management Agreement, dated as of May 7, 2019 (the “AMA”), by and among the Front Yard, FYR LP and AAMC, and to provide for a transition plan to facilitate the internalization of Front Yard’s asset management function (the “Transition Plan”).

Pursuant to the terms of the Termination Agreement, effective on the date that the parties mutually agree that the Transition Plan has been satisfactorily completed (the “Termination Date”), which will be no later than February 9, 2021, the AMA will be terminated in its entirety.

In connection with the Termination Agreement, AAMC will be paid by Front Yard an aggregate termination fee (the “Termination Fee”) of $46,000,000, with payments consisting of $15,000,000 in cash payable within two business days after the execution of the Termination Agreement, $15,000,000 in cash payable on the Termination Date and $16,000,000 in cash or Front Yard common stock (“Common Stock”), at Front Yard’s election, payable on the Termination Date. During the transition period, AAMC will continue to be paid the base management fee provided for in the AMA (equal to $3,584,000 per quarter as contemplated by the AMA) and a pro rata portion of the base management fee for any partial calendar quarter during such period, until such time as Front Yard determines that the transition has been satisfactorily completed. The incentive fee provided for in the AMA will not be due or payable to AAMC under any circumstances, unless earned by AAMC in the period between the date of the execution of the Termination Agreement and the Termination Date.

In addition, in connection with the termination, the Company will transfer to Front Yard, at Front Yard’s election, either the equity interests or assets of the Company’s Indian subsidiary, the equity interests of the Company’s Cayman Islands subsidiary, the right to solicit and hire designated employees of the Company that currently oversee the management of Front Yard’s business and other assets of the Company that are used in connection with the operation of Front Yard’s business (the “Transferred Assets”). The aggregate purchase price (the “Purchase Price”) for the Transferred Assets is $8,200,000, with payments consisting of $3,200,000 in cash payable within two business days after the execution of the Termination Agreement and $5,000,000 in cash or Common Stock, at the Front Yard’s election, payable on the Termination Date. The Company has the right to retain certain employees that do not currently oversee the management of Front Yard’s business and the right to solicit and retain certain other designated employees of the Company. In addition to the retention of such key employees, AAMC will retain certain assets and operating subsidiaries to continue to build out its asset management businesses focused on the origination and underwriting of short duration construction loans backed by single-family rental homes as well as other new business initiatives.

For any portion of the Termination Fee or Purchase Price that is paid in Common Stock, the value of each share of Common Stock will be the volume-weighted average share price, as determined by reference to a Bloomberg terminal, of Common Stock for the five business days immediately preceding the date on which such portion is actually paid. In addition, for any portion of the Termination Fee or Purchase Price that is paid in Common Stock, the Company has agreed to vote any such shares of Common Stock in accordance with recommendations of Front Yard’s board of directors for a period of one year following the Termination Date.

The Termination Agreement contains various covenants, including, among others, that until the Termination Date, AAMC will perform its obligations under the AMA and manage the business of the Front Yard and its subsidiaries in the ordinary course of business consistent with past practice, except as otherwise directed by the board of directors of Front Yard in accordance with the AMA.

The foregoing description of the Termination Agreement does not purport to be complete and is subject to and qualified in its entirety by reference to the full text of the Termination Agreement, which is filed as Exhibit 10.1 hereto and is incorporated herein by reference.

Item 2.01 Termination of a Material Definitive Agreement.

The information set forth in Item 1.01 hereof is incorporated herein by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

In connection with the execution of the Termination Agreement, the Board of Directors of the Company, (i) reinstated George G. Ellison and N. Robin Lowe from the indefinite administrative leaves that went into effect on June 9, 2020, (ii) reinstated George G. Ellison and N. Robin Lowe in their roles as co-Chief Executive Officer and Chief Financial Officer of the Company, respectively, and (iii) reinstated George G. Ellison and N. Robin Lowe’s base compensation from August 13, 2020 retroactively to June 9, 2020. With the reinstatement of N. Robin Lowe, Rene Dittrich, the Company’s Chief Accounting Officer, ceased to perform the interim responsibilities as the Company’s Chief Financial Officer effective immediately following the filing of the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2020.

In connection with the execution of the Termination Agreement, on August 13, 2020, George G. Ellison and the Company entered into a resignation letter agreement (the “Resignation Letter Agreement”) pursuant to which Mr. Ellison agreed to step down as Chairman of AAMC’s Board of Directors, effective immediately, and irrevocably agreed to resign from the Board of Directors and as Co-Chief Executive Officer of AAMC effective as of two (2) days prior to the Termination Date. The resignation shall be treated as a termination of Mr. Ellison’s service by the Company without cause for purposes of all agreements, arrangements, plans and policies of the Company and all agreements between the Company and Mr. Ellison. The Resignation Letter Agreement also contains mutual releases by the Company and Mr. Ellison for all claims, known or unknown, for acts occurring prior to the date of the Resignation Letter Agreement.

The foregoing description of the Resignation Letter Agreement does not purport to be complete and is subject to and qualified in its entirety by reference to the full text of the Resignation Letter Agreement, which is filed as Exhibit 10.2 hereto and is incorporated herein by reference.

On August 17, 2020, the Compensation Committee of the Board of Directors of AAMC adopted a bonus plan for the Company’s senior officers and executives that currently oversee the management of Front Yard’s business, which may include certain of the Company’s named executive officers, in an aggregate amount equal to $1,237,500 (the “Bonus Pool Amount”). Front Yard is entitled to direct the Company and its Compensation Committee on the individuals that will be eligible to receive these bonuses and the portion of the Bonus Pool Amount that each such individual will receive. The Company will pay these bonuses in cash within five (5) business days following the completion of the Transition Plan.

Forward-looking Statements

This Current Report on Form 8-K contains forward-looking statements that involve a number of risks and uncertainties. Those forward-looking statements include all statements that are not historical fact, including statements about management’s beliefs and expectations. Forward-looking statements are based on management’s beliefs as well as assumptions made by and information currently available to management. Because such statements are based on expectations as to future economic performance and are not statements of historical fact, actual results may differ materially from those projected. The risks and uncertainties to which forward-looking statements are subject include, but are not limited to: AAMC's ability to implement its business strategy and the business strategy of Front Yard; risks associated with the termination of AAMC's asset management agreement with Front Yard, including the potential effects that the termination can have on our new business initiatives, results of operations and financial condition; AAMC’s ability to successfully complete the transition period under the Termination Agreement; AAMC's ability to retain key employees; AAMC's ability to develop and implement new businesses or, to the extent such businesses are developed, its ability to make them successful or sustain the performance of any such businesses; AAMC's ability to retain and maintain its strategic relationships; AAMC's ability to obtain additional asset management clients; the potential for the COVID-19 pandemic to adversely affect AAMC's business, financial position, operations, business prospects, customers, employees and third-party service providers; AAMC's ability to effectively compete with its competitors; Front Yard's ability to complete future or pending transactions, which could affect AAMC's management fees; the failure of AAMC's service providers to effectively perform their obligations under their agreements with AAMC; AAMC's ability to integrate newly acquired rental assets into Front Yard’s portfolio; AAMC's ability to effectively manage the performance of Front Yard’s internal property manager at the level and/or the cost that it anticipates; developments in the litigations regarding AAMC's redemption obligations under the Certificate of Designations of its Series A Convertible Preferred Stock (the “Series A Shares”), including AAMC's ability to obtain declaratory relief confirming that AAMC was not obligated to redeem any of the Series A Shares on the March 15, 2020 redemption date since AAMC did not have funds legally available to redeem all, but not less than all, of the Series A Shares requested to be redeemed on that redemption date; AAMC's failure to maintain Front Yard’s qualification as a REIT; general economic and market conditions; governmental regulations, taxes and policies and other risks and uncertainties detailed in the “Risk Factors” and other sections described from time to time in the Company’s current and future filings with the Securities and Exchange Commission. The foregoing list of factors should not be construed as exhaustive.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

Termination and Transition Agreement, dated as August 13, 2020, by and among Front Yard Residential Corporation, Front Yard Residential L.P. and Altisource Asset Management Corporation.

|

|

|

|

Resignation Letter Agreement, dated as of August 13, 2020, from George G. Ellison to Altisource Asset Management Corporation.

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Altisource Asset Management Corporation

|

|

August 18, 2020

|

By:

|

/s/ Indroneel Chatterjee

|

|

|

|

Indroneel Chatterjee

Co-Chief Executive Officer

|

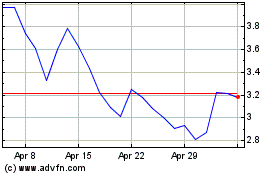

Altisource Asset Managem... (AMEX:AAMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

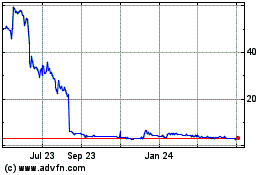

Altisource Asset Managem... (AMEX:AAMC)

Historical Stock Chart

From Apr 2023 to Apr 2024