ContraFect Corporation (Nasdaq:

CFRX), a clinical-stage biotechnology company focused on

the discovery and development of direct lytic agents (DLAs),

including lysins and amurin peptides, as new medical modalities for

the treatment of life-threatening, antibiotic-resistant infections,

today announced financial results and business updates for the

second quarter ended June 30, 2020.

“We continued to advance the Phase 3 DISRUPT

superiority study of our FDA designated Breakthrough Therapy new

modality drug candidate, exebacase, while taking steps to

meaningfully strengthen the Company’s financial position. We were

very pleased to have received a significant CARB-X award, an

important acknowledgment of our novel approach to developing

medicines for infectious disease. ContraFect also completed a

successful public offering and private placement which have

provided valuable resources that will support our efforts to

develop potentially transformative, first-in-class, first-in-field

treatments for life-threatening infections,” said Roger J.

Pomerantz, M.D., President, Chief Executive Officer, and Chairman

of ContraFect.

Q2 2020 Highlights and Recent

Developments

- In July, the Company announced that

CARB-X (Combating Antibiotic Resistant Bacteria Biopharmaceutical

Accelerator), a global non-profit partnership dedicated to

accelerating antibacterial research and development, is awarding

the Company up to $18.9 million in additional non-dilutive capital

to progress its second product candidate, CF-370, an engineered

lysin targeting Pseudomonas aeruginosa (P. aeruginosa),

in IND-enabling activities toward future Phase 1 clinical trials.

The award provides initial funding of $4.9 million, and ContraFect

could receive additional funding at the discretion of CARB-X if

certain project milestones are met.

- In June, the Company announced the

publication of the exebacase Phase 2 study results in the July 1,

2020 issue of the Journal of Clinical Investigation. The study

results established clinical proof-of-concept for exebacase and

informed the design of the ongoing Phase 3 DISRUPT (Direct Lysis

of Staph aureus Resistant Pathogen Trial) study of

exebacase for the treatment of patients with Staph

aureus bloodstream infections (BSIs), including right-sided

endocarditis.

- In June, the Company announced the

appointment of Lishan Aklog, M.D. to the Company’s board of

directors. Dr. Aklog is Co-Founder, Chairman and Chief Executive

Officer of PAVmed Inc. (Nasdaq: PAVM). Dr. Aklog has also served as

Executive Chairman of Lucid Diagnostics Inc. since its inception in

2018, as a co-founding Partner of both Pavilion Holdings Group LLC,

a medical device holding company, since its inception in 2007, and

Pavilion Medical Innovations LLC, a venture-backed medical device

incubator, since its inception in 2009.

- In May, the Company announced that

Pfizer Inc. (NYSE: PFE) entered into a stock purchase agreement to

purchase ContraFect securities for approximately $3.0 million in a

private placement transaction. This was the second investment by

Pfizer in ContraFect. The recent private placement was concurrent

with an underwritten public equity offering. The gross proceeds

from the public offering were approximately $52.5 million. Both

transactions closed on May 27, 2020.

Ongoing COVID-19 Response

- ContraFect continues to actively

monitor the evolving impact of COVID-19 on its business and

operations, with a primary focus on the health and safety of

employees. After initial shutdown restrictions were put in place in

March, operations were immediately adjusted, enabling the majority

of employees to work remotely. Once the Company re-opened its

laboratories in the second quarter, health and safety measures were

implemented to address risks posed by the COVID-19 pandemic. These

included strict cleaning and sanitizing plans, daily screening for

COVID-19 symptoms, mandatory use of personal protective equipment

and social distancing measures for on-site employees.

- The Phase 3 DISRUPT study of

exebacase is ongoing. The Company continues to enroll patients and

open new clinical trial sites across the United States. The study

continues to experience some delays in patient enrollment due to

the diversion of healthcare resources resulting from the COVID-19

pandemic in certain high impact areas.

Second Quarter 2020 Financial Results

- Research and development (R&D)

expenses were $5.5 million for the second quarter of 2020 compared

to $4.8 million in the comparable period in 2019. This increase was

primarily attributable to increases in spending for the ongoing

Phase 3 clinical study of exebacase and the chemistry,

manufacturing and controls activities that will ultimately support

a biologics license application for exebacase. The Company also

increased both clinical headcount and external professional support

for the Phase 3 clinical study.

- General and administrative

(G&A) expenses were $2.6 million for both the second quarter of

2020 and 2019. Although there was no overall change, there was an

increase in administrative headcount and related personnel costs

which was offset by a decrease in costs incurred for intellectual

property and general corporate legal fees.

- Net loss was $17.6 million, or a

loss of $0.88 per share, for the second quarter of 2020 compared to

a net loss of $8.7 million, or a loss of $1.09 per share, for the

comparable period in 2019. The net loss per share in the current

period includes a $5.9 million, or $0.30 per share, increase in the

non-cash charge for the change in the fair value of warrant

liabilities and a $2.2 million, or $0.11 per share, non-cash charge

for the allocation of offering expenses.

- As of June 30, 2020, ContraFect had

cash, cash equivalents and marketable securities of $58.3

million.

About DISRUPT:

DISRUPT is an ongoing, randomized, double-blind,

placebo-controlled, multi-center Phase 3 clinical study of

exebacase for the treatment of Staph aureus bacteremia,

including right-sided endocarditis. This study compares the

efficacy, safety and tolerability of exebacase used in addition to

SOC antibiotics to SOC antibiotics alone. DISRUPT is designed to

enroll approximately 350 patients randomized 2:1 to receive either

a single dose of exebacase administered as a 2-hour IV infusion in

addition to SOC antibiotics or placebo plus SOC antibiotics. The

primary efficacy endpoint is clinical response at day 14. Secondary

endpoints include clinical response at Day 14 in all Staph aureus

patients (MRSA and MSSA), 30-day all-cause mortality in MRSA

patients, and clinical response at day 30 and day 60 in both MRSA

and all Staph aureus patients. The principal investigator is Dr.

Vance Fowler, Professor of Medicine in the Division of Infectious

Diseases at Duke University.

About Exebacase (CF-301):

Exebacase is a recombinantly-produced lysin

(cell wall hydrolase enzyme) with potent bactericidal activity

against Staph aureus, a major cause of bloodstream infections

(BSIs) also known as bacteremia. Exebacase has the potential to be

a first-in-class treatment for Staph aureus bacteremia.

It has a novel, rapid, and specific mechanism of action that

targets the peptidoglycan cell wall that is vital to Staph

aureus bacteria. In addition, in vitro and in vivo experiments

have shown that exebacase is highly active against biofilms which

complicate Staph aureus infections. Exebacase was

licensed from The Rockefeller University and is being developed at

ContraFect.

About ContraFect:

ContraFect is a biotechnology company focused on

discovering and developing differentiated biologic therapies for

life-threatening, drug-resistant infectious diseases, particularly

those treated in hospital settings. An estimated 700,000 deaths

worldwide each year are attributed to antimicrobial-resistant

infections. We intend to address life threatening infections using

our therapeutic product candidates from our platform of DLAs, which

include lysins and amurin peptides. Lysins are a new class of DLAs

which are recombinantly produced antimicrobial proteins with a

novel mechanism of action associated with the rapid killing of

target bacteria, eradication of biofilms and synergy with

conventional antibiotics. Amurin peptides are a new class of DLAs,

which exhibit broad-spectrum activity against a wide range of

antibiotic-resistant Gram-negative pathogens,

including Pseudomonas aeruginosa (P.

aeruginosa), Acinetobacter baumannii,

and Enterobacter species. We believe that the properties

of our lysins and amurin peptides will make them suitable for

targeting antibiotic-resistant organisms, such as MRSA and P.

aeruginosa, which can cause serious infections such as bacteremia,

pneumonia and osteomyelitis. Our lead lysin candidate, exebacase,

was granted Breakthrough Therapy designation by the FDA for the

treatment of MRSA bloodstream infections (bacteremia), including

right-sided endocarditis, when used in addition to standard-of-care

(SOC) anti-staphylococcal antibiotics in adult patients.

Follow ContraFect on

Twitter @ContraFectCorp and LinkedIn.

Forward-Looking Statements

This press release contains, and our officers

and representatives may make from time to time, “forward-looking

statements” within the meaning of the U.S. federal securities laws.

Forward-looking statements can be identified by words such as

“projects,” “may,” “will,” “could,” “would,” “should,” “believes,”

“expects,” “anticipates,” “estimates,” “intends,” “plans,”

“potential,” “promise” or similar references to future periods.

Examples of forward-looking statements in this release include,

without limitation, statements regarding: whether the public equity

offering, Pfizer private placement and CARB-X grant will advance

the Company’s lead product candidates, statements made by Dr.

Pomerantz, ContraFect’s ability to discover and develop DLAs as new

medical modalities for the treatment of life-threatening,

antibiotic-resistant infections, whether CARB-X will award the

Company up to $18.9 million, whether the Company receives the $4.9

million, the Company’s ability to meet project milestones and

receive additional funding, the availability of funding, whether

the Company will continue to monitor the impact of COVID-19 on its

business, whether the Company will primarily focus on the health

and safety of its employees, statements made regarding how COVID-19

has affected the Company’s Phase 3 DISRUPT study, clinical trial

site opening and patient enrollment, whether exebacase has the

potential to be a first-in-class treatment for Staph aureus

bacteremia, the Company’s financial results, financial position,

balance sheets and statements of operations, ContraFect’s ability

to discover and develop differentiated biologic therapies for

life-threatening, drug-resistant infectious diseases, whether

lysins are a new class of DLAs which are recombinantly produced,

antimicrobial proteins with a novel mechanism of action associated

with the rapid killing of target bacteria, eradication of biofilms

and synergy with conventional antibiotics, whether amurins are a

new class of DLAs which exhibit broad-spectrum activity against a

wide range of antibiotic-resistant Gram-negative pathogens, and

whether the properties of ContraFect’s lysins and amurins will make

them suitable for targeting antibiotic-resistant organisms, such as

MRSA and P. aeruginosa. Forward-looking statements are statements

that are not historical facts, nor assurances of future

performance. Instead, they are based on ContraFect’s current

beliefs, expectations and assumptions regarding the future of its

business, future plans, strategies, projections, anticipated events

and trends, the economy and other future conditions. Because

forward-looking statements relate to the future, they are subject

to inherent risks, uncertainties and changes in circumstances that

are difficult to predict and many of which are beyond ContraFect’s

control, including those detailed under the caption “Risk Factors”

in ContraFect's filings with the Securities and Exchange

Commission. Actual results may differ from those set forth in the

forward-looking statements. Important factors that could cause

actual results to differ include, among others, our ability to

develop treatments for drug-resistant infectious diseases. Any

forward-looking statement made by ContraFect in this press release

is based only on information currently available and speaks only as

of the date on which it is made. Except as required by applicable

law, ContraFect expressly disclaims any obligations to publicly

update any forward-looking statements, whether written or oral,

that may be made from time to time, whether as a result of new

information, future developments or otherwise.

CONTRAFECT

CORPORATIONCondensed Balance Sheets

|

|

June 30,

2020 |

|

December 31,

2019 |

|

|

|

(unaudited) |

|

|

(audited) |

| Assets |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash

equivalents................................................................................................................................................................................. |

$ |

30,819,397 |

|

$ |

24,184,140 |

|

Short-term marketable

securities........................................................................................................................................................................ |

|

8,831,981 |

|

|

— |

|

Prepaid expenses and other current

assets........................................................................................................................................................ |

|

5,327,699 |

|

|

6,575,375 |

|

|

|

|

|

|

|

| Total current

assets....................................................................................................................................................................................................... |

|

44,979,077 |

|

|

30,759,515 |

| Long-term marketable

securities................................................................................................................................................................................... |

|

18,686,836 |

|

|

— |

| Property and equipment,

net......................................................................................................................................................................................... |

|

1,004,389 |

|

|

1,099,948 |

| Operating lease right-of-use

assets.............................................................................................................................................................................. |

|

2,930,022 |

|

|

3,043,826 |

| Other

assets.................................................................................................................................................................................................................. |

|

105,420 |

|

|

105,420 |

|

|

|

|

|

|

|

| Total

assets................................................................................................................................................................................................................... |

$ |

67,705,744 |

|

$ |

35,008,709 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

| Liabilities and

stockholders’ equity |

|

|

|

|

|

| Current

liabilities............................................................................................................................................................................................................ |

|

5,894,333 |

|

|

10,057,950 |

| Warrant

liabilities........................................................................................................................................................................................................... |

|

44,349,846 |

|

|

6,068,978 |

| Long-term portion of lease

liabilities.............................................................................................................................................................................. |

|

3,115,284 |

|

|

3,264,128 |

| Other

liabilities............................................................................................................................................................................................................... |

|

72,747 |

|

|

72,747 |

|

|

|

|

|

|

|

| Total

liabilities................................................................................................................................................................................................................ |

|

53,432,210 |

|

|

19,463,803 |

| |

|

|

|

|

|

| Total stockholders’

equity............................................................................................................................................................................................... |

|

14,273,534 |

|

|

15,544,906 |

|

|

|

|

|

|

|

| Total liabilities and

stockholders’

equity.......................................................................................................................................................................... |

$ |

67,705,744 |

|

$ |

35,008,709 |

CONTRAFECT

CORPORATIONUnaudited Statements of

Operations

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2020 |

|

|

|

2019 |

|

|

|

2020 |

|

|

|

2019 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and

development...................................................... |

$ |

5,544,000 |

|

|

$ |

4,804,076 |

|

|

$ |

10,648,441 |

|

|

$ |

8,911,216 |

|

|

General and

administrative....................................................... |

|

2,618,797 |

|

|

|

2,603,403 |

|

|

|

5,578,697 |

|

|

|

4,857,996 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating

expenses............................................................... |

|

8,162,797 |

|

|

|

7,407,479 |

|

|

|

16,227,138 |

|

|

|

13,769,212 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from

operations...................................................................... |

|

(8,162,797 |

) |

|

|

(7,407,479 |

) |

|

|

(16,227,138 |

) |

|

|

(13,769,212 |

) |

| Other (expense) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

income........................................................................... |

|

25,546 |

|

|

|

104,441 |

|

|

|

95,568 |

|

|

|

253,560 |

|

|

Other

expense............................................................................ |

|

(2,174,653 |

) |

|

|

― |

|

|

|

(2,174,653 |

) |

|

|

― |

|

|

Change in fair value of warrant

liabilities.................................... |

|

(7,305,332 |

) |

|

|

(1,363,868 |

) |

|

|

(6,889,499 |

) |

|

|

16,435,761 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other (expense)

income........................................................... |

|

(9,454,439 |

) |

|

|

(1,259,427 |

) |

|

|

(8,968,584 |

) |

|

|

16,689,321 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss)

income......................................................................... |

$ |

(17,617,236 |

) |

|

$ |

(8,666,906 |

) |

|

$ |

(25,195,722 |

) |

|

$ |

2,920,109 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per share information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net (loss) income per share

................................................ |

$ |

(0.88 |

) |

|

$ |

(1.09 |

) |

|

$ |

(1.43 |

) |

|

$ |

0.37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in computing basic net income (loss) per

share...... |

|

19,991,894 |

|

|

|

7,940,931 |

|

|

|

17,661,968 |

|

|

|

7,940,931 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted net (loss) income per

share............................................... |

$ |

(0.88 |

) |

|

$ |

(1.09 |

) |

|

$ |

(1.43 |

) |

|

$ |

0.37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in computing diluted net (loss) income per

share..... |

|

19,991,894 |

|

|

|

7,940,931 |

|

|

|

17,661,968 |

|

|

|

7,945,768 |

|

The Company's financial position as of June 30,

2020 and results of operations for the three and six months ended

June 30, 2020 and 2019 have been extracted from the Company's

Quarterly Report on Form 10-Q filed with the Securities and

Exchange Commission. The Company's financial position as of

December 31, 2019 has been extracted from the Company's audited

financial statements included in its Annual Report on Form 10-K

filed with the Securities and Exchange Commission on March 18,

2020. You should refer to both the Company's Quarterly Report on

Form 10-Q and its Annual Report on Form 10-K for a complete

discussion of financial information.

Investor Relations Contacts:

Michael Messinger ContraFect Corporation Tel: 914-207-2300

Email: mmessinger@contrafect.com

Carlo Tanzi, PhD Kendall Investor Relations Tel: 617-914-0008

Email: ctanzi@kendallir.com

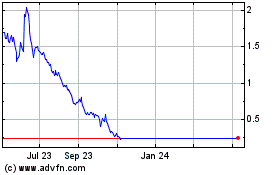

ContraFect (NASDAQ:CFRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

ContraFect (NASDAQ:CFRX)

Historical Stock Chart

From Apr 2023 to Apr 2024