Current Report Filing (8-k)

August 12 2020 - 3:39PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August ___, 2020

PHARMAGREEN BIOTECH INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

333-151350

|

|

26-1679929

|

|

(State or other jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

of Incorporation)

|

|

|

|

Identification Number)

|

|

|

|

2987 Blackbear Court

Coquitlam, British Columbia, V3E 3A2

702-803-9404

|

|

|

(Address, including zip code, and telephone number, including area code,

of registrant's principal executive offices)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ]Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ]Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ]Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2) [X]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act [X]

ITEM 1.03 BANKRUPTCY OR RECEIVERSHIP

On August 7, 2020, (the “Petition Date”), Pharmagreen Biotech, Inc., Inc. (the “Company” or the “Debtors”), filed voluntary petitions for reorganization (the “Bankruptcy Petitions” and the cases commenced thereby, the “Chapter 11 Cases”) under chapter 11 of the United States Bankruptcy Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Nevada (the “Court”). The Debtors filing with the Court was designated as Case No. 20-13886. During the pendency of this matter, the Debtors have also filed motions with the Court seeking authorization to continue to operate their businesses as “debtors-in-possession” under the jurisdiction of the Court and in accordance with the applicable provisions of the Bankruptcy Code and orders of the Court. The Debtors expect to continue their existing operations without interruption during the pendency of the Chapter 11 Cases. To maintain and continue uninterrupted ordinary course operations during the Chapter 11 Cases, the Debtors have filed a variety of “first day” motions seeking approval from the Court for various forms of customary relief. These motions are designed primarily to minimize the effect of bankruptcy on the Company’s operations, customers and employees.

ITEM 2.04 TRIGGERING EVENTS THAT ACCELERATE OR INCREASE A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATIONS UNDER AN OFF-BALANCE SHEET ARRANGEMENT

The commencement of the Chapter 11 Cases described in Item 1.03 of this report constitutes an event of default under certain of the Company’s debt instruments, including various Unsecured Convertible Note Agreements (collectively, the “Unsecured Notes”), which results in automatic acceleration of the Company’s obligations under such debt instruments. Any efforts to enforce payment obligations under the aforementioned debt instruments are automatically stayed as a result of the filing of the Chapter 11 Cases and the creditors’ rights of enforcement in respect of the debt instruments are subject to the applicable provisions of the Bankruptcy Code.

ITEM 7.01 REGULATION FD DISCLOSURE

On August 11, 2020, the Company issued a press release announcing the filing of the Bankruptcy Petitions. A copy of the press release is attached to this report as Exhibit 99.1 and incorporated herein by reference.

The information furnished pursuant to Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is not subject to the liabilities of that section and is not deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), unless specifically identified therein as being incorporated therein by reference.

ITEM 8.01 OTHER EVENTS.

The Company cautions that trading in the Company’s securities during the pendency of the Chapter 11 Cases is highly speculative and poses substantial risks. Trading prices for the Company’s securities may bear little or no relationship to the actual recovery, if any, by holders of the Company’s securities in the Chapter 11 Cases.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits. The following exhibits are either filed as a part hereof or are incorporated by reference. Exhibit numbers correspond to the numbering system in Item 601 of Regulation S-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

PHARMAGREEN BIOTECH INC.

|

|

|

|

|

|

|

|

Dated: August 11, 2020

|

By:

|

/s/ Peter Wojcik

|

|

|

|

|

Peter Wojcik

|

|

|

|

|

Chief Executive Officer, Director

|

|

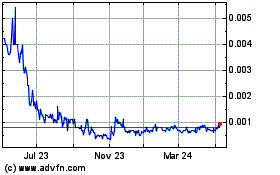

Pharmagreen Biotech (PK) (USOTC:PHBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

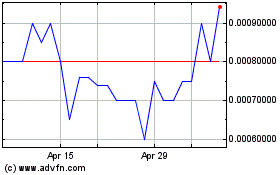

Pharmagreen Biotech (PK) (USOTC:PHBI)

Historical Stock Chart

From Apr 2023 to Apr 2024