By Nina Trentmann and Kristin Broughton

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 7, 2020).

Companies have been stockpiling cash to navigate the coronavirus

pandemic, and some are getting eager to spend it.

Cash holdings of U.S. public companies amounted to $2.54

trillion during the latest reported quarter, up from $1.96 trillion

at the end of 2019 and $1.86 trillion from the second quarter in

2019, according to S&P Global Market Intelligence.

While it can be reassuring for finance chiefs to have ample cash

and liquidity amid the economic downturn, many executives feel they

need to put their companies' capital to work, using it to seize

growth opportunities and generate returns for shareholders.

"We absolutely want to go and deploy capital," said Greg Lewis,

chief financial officer of Honeywell International Inc. "This is

truly an opportunity for us to go do that." The industrial

conglomerate -- with more than $15 billion in cash holdings and

short-term investments as of June 30, according to S&P -- plans

to use its liquidity to scoop up other companies.

The coronavirus pandemic has created a divide between corporate

haves and have-nots, with some companies building on existing

stockpiles of cash and enjoying access to cheap debt, while others

are struggling to survive. The tally of chapter 11 filings in the

first seven months of the year rose 30%, according to data by

legal-services firm Epiq Systems Inc.

Microsoft Corp., with $136.5 billion, topped the list of

America's cash-rich companies as of June 30, according to S&P.

The software company could find use for some of that as it is in

advanced talks to purchase the U.S. operations of video app TikTok.

Other companies with significant cash and short-term investments

include Google parent Alphabet Inc., with $121.1 billion, and car

maker Ford Motor Co., with nearly $40 billion in the

latest-reported quarter, S&P data show.

Most companies have held back from spending on share-buyback

programs and dividends since the beginning of the pandemic. Some

businesses with strong cash holdings, such as cereal maker Kellogg

Co., said they plan to focus on investing in their brands, capital

expenditures and repaying debt.

Other executives are starting to look at deal making again

despite an uncertain economic outlook and the coming presidential

election, said David Hunt, a senior director for mergers and

acquisitions at Willis Towers Watson PLC, an advisory and brokerage

firm.

Beyond the potential Microsoft-TikTok deal, some recent

transactions include Google's deal to buy a 6.6% stake in

security-monitoring provider ADT Inc. for $450 million. Marathon

Petroleum Corp. on Sunday said it plans to sell its gas stations to

7-Eleven Inc. for $21 billion.

Atkore International Group Inc., an electrical infrastructure

company based in Harvey, Ill., had put its acquisition strategy on

hold earlier this year when the pandemic unfolded. A recent rebound

in the company's stock price and an increase in cash reserves

prompted Atkore to revisit potential deals, said David Johnson, the

company's CFO. Mr. Johnson said the company is looking for deals to

expand in areas such as specialty metal conduits and security

products.

"Barring a major global lockdown being imposed, we can expect a

continued acceleration of deal making with cash being an element of

it," said Andrea Guerzoni, global vice chair for strategy and

transactions at Ernst & Young. "Big and financially robust

companies are ready and able to fund significant deals if they want

to."

Even though transaction volumes are significantly down compared

with the prior-year period, mergers-and-acquisitions activity has

picked up in June and July, according to EY.

PayPal Holdings Inc., the payments company, said it is sticking

to its annual target of spending $1 billion to $3 billion on

acquisitions even during the pandemic. "We've always been balanced

between M&A, organic investment and returning cash to

shareholders, and we've also been opportunistic," Chief Financial

Officer John Rainey said on a second-quarter earnings call in July.

The company had about $13 billion in cash and short-term

investments at the end of June, according to S&P. Its latest

transaction was the $4 billion purchase of shopping and rewards

platform Honey Science, which closed in January.

Average cash holdings in the tech sector increased roughly

twofold over the decade through 2019 to $9.95 billion, according to

Bain & Co., a management consulting firm. By contrast, average

cash holdings for the total S&P 500 increased 35% to $3.65

billion over the same period.

Still, tech companies aren't making aggressive plays yet in this

recession like they did during the credit crisis. "Executive focus

is on Covid-19 and managing through Covid-19," said Adam Haller, a

partner at Bain. "So finding the executive bandwidth and mind share

to focus on acquisitions is a big part of why you're not seeing

M&A happen in tech right now."

Also, tech companies are under more regulatory scrutiny, said

Daniel Ives, an analyst at financial-services firm Wedbush

Securities Inc. Companies in other sectors could move into

acquisition mode in the coming quarters amid rising cash balances,

he said.

FleetCor Technologies Inc., an Atlanta-based payment-solutions

company, is searching for potential acquisition targets following

four deals in 2019, said Steve Greene, executive vice president for

corporate development and strategy. "As the economic picture

becomes a little more certain, we are again starting to look at big

deals," Mr. Greene said, adding the company would spend about $3

billion or more on such a transaction and likely would use a

combination of cash and debt to fund a deal. FleetCor had about

$1.1 billion in cash on its balance sheet as of March 31, the

latest available figure.

As part of its due diligence, FleetCor is scrutinizing the

ability of potential acquisitions to recover from the pandemic, Mr.

Greene said. "We want to see the trajectory and whether companies

will make it back to their pre-Covid levels," he said.

Mark Maurer contributed to this article.

Write to Nina Trentmann at nina.trentmann@wsj.com and Kristin

Broughton at kristin.broughton@wsj.com

(END) Dow Jones Newswires

August 07, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

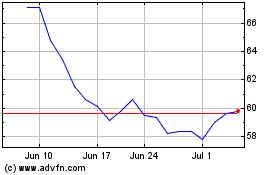

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Apr 2023 to Apr 2024