AquaBounty Technologies Announces Financial Results for the Quarter and Six Months Ended June 30, 2020, and Provides Corporat...

August 06 2020 - 4:01PM

AquaBounty Technologies, Inc. (NASDAQ: AQB) (“AquaBounty” or the

“Company”), a land-based aquaculture company utilizing technology

to enhance productivity and sustainability, has provided a

corporate update and financial results for the second quarter and

six months ended June 30, 2020.

Key Second Quarter 2020 & Subsequent

Company Highlights:

- Completed the first harvest of conventional Atlantic salmon in

June at the Company’s Indiana farm, validating its land-based

Recirculating Aquaculture System (RAS) as an efficient and

sustainable way to raise Atlantic salmon. The Indiana-based

farm expects to ramp up monthly harvest of conventional salmon

throughout the summer and plans to reach 100 metric tons per month

by early 2021.

- Closed a $4.0 million loan with First Farmers Bank &

Trust to fund capital improvements and automation equipment at the

Indiana farm.

- Selected Site Selection Group to identify the most advantageous

site for the Company’s planned 10,000 metric ton farm and CRB USA

to design the facility.

- Engaged international investor relations specialists MZ Group

to expand its strategic investor relations and financial

communications program across key markets.

Management Commentary

Sylvia Wulf, Chief Executive Officer of

AquaBounty, stated: “The highlight of the second quarter was the

announcement of our first harvest of conventional Atlantic salmon

at our Indiana farm, an important milestone as we refine harvest

systems and processes ahead of our expected initial harvest of

AquAdvantage salmon in the fourth quarter this year in Indiana,

followed by the anticipated first harvest of AquAdvantage salmon at

our Canada-based, Prince Edward Island Farm in the first quarter of

2021.

“The first harvest of conventional salmon

represents the start of the commercialization phase for

AquAdvantage salmon (AAS), a milestone over 30 years in the

making. This will be a breakthrough moment not only for

AquaBounty, but for the industry—as it will be the first sale of a

genetically engineered animal protein in the U.S. We

completed proprietary consumer research in Q4 of 2019, and the

insights have been used to build out our communications program

that we began executing in conjunction with our first harvest and

anticipate will support the commercial launch of AAS later this

year. Furthermore, we continue to receive inbound interest

from potential offtake partners, who see the inherent value in AAS,

from both a sustainability and economic perspective, and we

anticipate finalizing commercial agreements with key potential

customers and distributors in advance of the first AAS harvest.

“After engaging Site Selection Group and CRB

USA, we have made significant progress on finalizing the potential

site and design for our planned 10,000 metric ton farm and will

soon select the farm’s RAS technology provider. We are on

schedule to select the farm’s location this quarter and expect to

begin construction in early 2021. We believe we are now

positioned to seize emerging growth opportunities within the

space.

“While we plan to construct our own facilities

at first to validate our business model to the world, our

long-term, capital-light goal is to make AAS the clear choice for

existing land-based RAS farm operators who wish to remain

competitive in the marketplace. I eagerly look forward to

what the future holds for AquaBounty,” concluded Wulf.

Financial Summary through June 30,

2020

- Cash and cash equivalents were $10.0 million as of

June 30, 2020 ($2.8 million at December 31, 2019).

In February, the Company completed a public offering of common

shares that provided $14.5 million in net proceeds.

- Cash used in operations for the six months ended June 30,

2020, was $7.0 million, compared with $5.2 million in the

same period of the prior year. Growth of fish inventory

biomass was the driver.

- Cash used for capital projects for the six months ended

June 30, 2020, was $1.6 million compared with

$0.9 million in the same period of the prior year. The

funds were primarily used for equipment upgrades at the Indiana

farm.

- Net loss for the six months ended June 30, 2020, was

$6.6 million, or $0.22 per share, compared to a net loss of

$6.8 million, or $0.37 per share, in the same period of the

prior year.

About AquaBounty Technologies,

Inc.

AquaBounty Technologies, Inc. (NASDAQ: AQB) is a

commercial aquaculture company focused on improving efficiency,

sustainability, and profitability, leveraging decades of

biotechnology expertise to ensure the availability of high-quality

seafood to meet global consumer demand. Both the U.S. Food and Drug

Administration and Health Canada approved the Company’s

AquAdvantage salmon as the first and only bioengineered animal

protein for human consumption.

The Company’s AquAdvantage fish program is based

upon a single, specific molecular modification that results in more

rapid growth during early development, resulting in a 70 percent

increase in annual production output for AquAdvantage versus

conventional Atlantic salmon. With aquaculture facilities located

in Indiana and on Prince Edward Island, AquaBounty is raising its

disease-free, antibiotic-free salmon in land-based Recirculating

Aquaculture Systems, resulting in a reduced carbon footprint and no

risk of pollution to marine ecosystems as compared to traditional

sea-cage farming. For more information, please visit

www.aquabounty.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934,

each as amended. All statements other than statements of historical

fact contained in this press release are forward-looking

statements, including statements regarding the potential for,

timing of and expected yields from the harvesting and sale of our

fish from our production farms, the size of any such harvests,

future revenues, the development of new farms and the selection of

related service providers, the development of a shareholder

communication program, and arrangements with potential customers,

distributors, and processors; the effectiveness of our COVID-19

response and the potential impact of the pandemic; the sufficiency

of prior capital raises; our scale and volume of production; and

the potential for fish diseases, use of antibiotics, pollution of

the marine environment, annual production increases, demonstration

of aquaculture expertise, reduction in carbon footprint,

development of new technologies, and our geographic expansion.

Forward-looking statements may be identified with words such as

“will,” “may,” “expect,” “plan,” “anticipate,” “upcoming,”

“believe,” “estimate,” or similar terminology, and the negative of

these terms. Forward-looking statements are not promises or

guarantees of future performance and are subject to a variety of

risks and uncertainties, many of which are beyond our control,

which could cause actual results to differ materially from those

contemplated in these forward-looking statements. Forward-looking

statements speak only as of the date hereof, and, except as

required by law, we undertake no obligation to update or revise

these forward-looking statements. For additional information

regarding these and other risks faced by us, please refer to our

public filings with the Securities and Exchange Commission (“SEC”),

available on the Investors section of our website at

www.aquabounty.com and on the SEC’s website at www.sec.gov.

Company Contact:

AquaBounty TechnologiesDave ConleyCorporate Communications(613)

294-3078

Investor Relations:

Greg Falesnik or Luke ZimmermanMZ Group - MZ North America(949)

385-6449AQB@mzgroup.us

AquaBounty Technologies,

Inc.Consolidated Balance

Sheets(Unaudited)

| |

As of |

| |

June 30, |

|

December 31, |

| |

2020 |

|

2019 |

|

Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

10,021,394 |

|

|

$ |

2,798,744 |

|

|

Other receivables |

57,369 |

|

|

55,198 |

|

|

Inventory |

2,489,773 |

|

|

1,232,049 |

|

|

Prepaid expenses and other current assets |

696,455 |

|

|

391,162 |

|

|

Total current assets |

13,264,991 |

|

|

4,477,153 |

|

| |

|

|

|

| Property, plant and equipment,

net |

24,562,409 |

|

|

25,065,836 |

|

| Right of use assets, net |

371,292 |

|

|

399,477 |

|

| Definite-lived intangible

assets, net |

150,736 |

|

|

157,588 |

|

| Indefinite-lived intangible

assets |

101,661 |

|

|

101,661 |

|

| Other assets |

44,306 |

|

|

32,024 |

|

|

Total assets |

$ |

38,495,395 |

|

|

$ |

30,233,739 |

|

|

|

|

|

|

| Liabilities and

stockholders’ equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable and accrued liabilities |

$ |

1,764,124 |

|

|

$ |

1,462,809 |

|

|

Current lease liabilities and other |

63,836 |

|

|

62,286 |

|

|

Current debt |

140,288 |

|

|

163,155 |

|

|

Total current liabilities |

1,968,248 |

|

|

1,688,250 |

|

| |

|

|

|

| Long-term lease

obligations |

321,728 |

|

|

352,808 |

|

| Long-term debt |

4,423,028 |

|

|

4,432,052 |

|

|

Total liabilities |

6,713,004 |

|

|

6,473,110 |

|

| |

|

|

|

| Commitments and

contingencies |

|

|

|

| |

|

|

|

| Stockholders’ equity: |

|

|

|

|

Common stock, $0.001 par value, 50,000,000 shares authorized; |

|

|

|

|

32,105,684 (2019: 21,635,365) shares outstanding |

32,106 |

|

|

21,635 |

|

|

Additional paid-in capital |

171,102,440 |

|

|

156,241,363 |

|

|

Accumulated other comprehensive loss |

(576,644 |

) |

|

(360,160 |

) |

|

Accumulated deficit |

(138,775,511 |

) |

|

(132,142,209 |

) |

|

Total stockholders’ equity |

31,782,391 |

|

|

23,760,629 |

|

|

|

|

|

|

| Total liabilities and

stockholders’ equity |

$ |

38,495,395 |

|

|

$ |

30,233,739 |

|

| |

|

|

|

|

|

|

|

AquaBounty Technologies,

Inc.Consolidated Statements of Operations and

Comprehensive Loss(Unaudited)

| |

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

|

|

|

|

|

|

|

|

|

| Revenues |

|

|

|

|

|

|

|

|

Product revenues |

$ |

2,950 |

|

|

$ |

42,486 |

|

|

$ |

9,703 |

|

|

$ |

140,371 |

|

| |

|

|

|

|

|

|

|

| Costs and

expenses |

|

|

|

|

|

|

|

|

Production costs |

1,041,316 |

|

|

941,113 |

|

|

1,882,750 |

|

|

1,803,368 |

|

|

Sales and marketing |

137,434 |

|

|

103,390 |

|

|

188,222 |

|

|

175,381 |

|

|

Research and development |

635,655 |

|

|

813,449 |

|

|

1,204,417 |

|

|

1,476,930 |

|

|

General and administrative |

1,693,544 |

|

|

2,204,253 |

|

|

3,330,734 |

|

|

3,460,105 |

|

|

Total costs and expenses |

3,507,949 |

|

|

4,062,205 |

|

|

6,606,123 |

|

|

6,915,784 |

|

|

|

|

|

|

|

|

|

|

| Operating

loss |

(3,504,999 |

) |

|

(4,019,719 |

) |

|

(6,596,420 |

) |

|

(6,775,413 |

) |

| |

|

|

|

|

|

|

|

| Other income

(expense) |

|

|

|

|

|

|

|

|

Interest expense |

(18,147 |

) |

|

(14,212 |

) |

|

(35,192 |

) |

|

(27,550 |

) |

|

Other income (expense), net |

(538 |

) |

|

7,200 |

|

|

(1,690 |

) |

|

12,300 |

|

|

Total other income (expense) |

(18,685 |

) |

|

(7,012 |

) |

|

(36,882 |

) |

|

(15,250 |

) |

|

|

|

|

|

|

|

|

|

| Net loss |

$ |

(3,523,684 |

) |

|

$ |

(4,026,731 |

) |

|

$ |

(6,633,302 |

) |

|

$ |

(6,790,663 |

) |

|

|

|

|

|

|

|

|

|

| Other comprehensive

income (loss): |

|

|

|

|

|

|

|

|

Foreign currency translation gain (loss) |

165,501 |

|

|

84,788 |

|

|

(216,484 |

) |

|

172,340 |

|

|

Total other comprehensive income (loss) |

165,501 |

|

|

84,788 |

|

|

(216,484 |

) |

|

172,340 |

|

|

|

|

|

|

|

|

|

|

| Comprehensive

loss |

$ |

(3,358,183 |

) |

|

$ |

(3,941,943 |

) |

|

$ |

(6,849,786 |

) |

|

$ |

(6,618,323 |

) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Basic and diluted net loss per

share |

$ |

(0.11 |

) |

|

$ |

(0.19 |

) |

|

$ |

(0.22 |

) |

|

$ |

(0.37 |

) |

| Weighted average number of

Common Shares - |

|

|

|

|

|

|

|

|

basic and diluted |

32,097,992 |

|

|

21,313,055 |

|

|

29,607,373 |

|

|

18,515,907 |

|

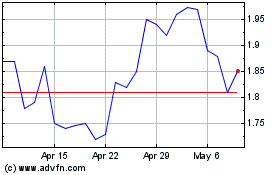

AquaBounty Technologies (NASDAQ:AQB)

Historical Stock Chart

From Mar 2024 to Apr 2024

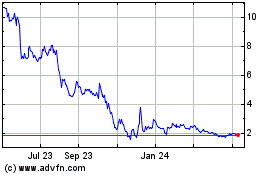

AquaBounty Technologies (NASDAQ:AQB)

Historical Stock Chart

From Apr 2023 to Apr 2024