MicroVision Announces Second Quarter 2020 Results

August 05 2020 - 4:15PM

MicroVision, Inc. (NASDAQ:MVIS), a leader in innovative

ultra-miniature projection display and sensing technology, today

announced its second quarter 2020 results.

Revenue for the second quarter of 2020 was $0.6 million,

compared to $1.2 million for the second quarter of 2019.

MicroVision's net loss for the second quarter of 2020 was $2.3

million, or $0.02 per share, compared to a net loss of $9.0

million, or $0.08 per share for the second quarter of 2019. The

Company ended the second quarter of 2020 with $7.8 million in cash

and cash equivalents, compared to $5.8 million at the end of the

fourth quarter of 2019.

“With the assistance of our financial advisor, Craig-Hallum

Capital Group LLC, we continue to explore strategic alternatives to

maximize the value of MicroVision for our shareholders, including

the sale of a product vertical, strategic investment, or potential

sale or merger of the Company,” said Sumit Sharma, MicroVision's

Chief Executive Officer.

Financial Results Webcast

MicroVision will host a webcast which will start at 2:00

p.m. Pacific Time on Wednesday, August 5, 2020 to discuss its

second quarter results. Interested parties can listen to the

company's webcast by accessing the Investor Relations section of

MicroVision’s website on the Investor Relations Events Calendar

page at https://microvision.gcs-web.com/investor-event-calendar.

Investors may submit questions for management in advance to

IR@MicroVision.com or beginning 10 minutes before or during the

live webcast on August 5, 2020.The webcast will be available for

rebroadcast from the Investor Relations section of MicroVision’s

website on the Investor Relations Events Calendar page.

About MicroVision

MicroVision is the creator of PicoP® scanning technology,

an ultra-miniature sensing and projection solution based on the

laser beam scanning methodology pioneered by the Company.

MicroVision’s platform approach for this sensing and display

solution means that its technology can be adapted to a wide array

of applications and form factors. We combine our hardware,

software, and algorithms to unlock value for our customers by

providing them a differentiated advanced solution for a rapidly

evolving, always-on world.

MicroVision has a substantial portfolio of patents relating

to laser beam scanning projection and sensing. MicroVision’s

industry leading technology is a result of its extensive research

and development. The Company is based in Redmond,

Washington.

MicroVision and PicoP are trademarks of MicroVision,

Inc. in the United States and other countries. All

other trademarks are the properties of their respective owners.

Forward-Looking Statements

Certain statements contained in this release, including those

relating to strategic alternatives, sale or merger of the Company,

completing a transaction, the Company’s future products and product

applications and those including words like “explore” are

forward-looking statements that involve a number of risks and

uncertainties that could cause actual results to differ materially

from those in the forward-looking statements. Factors that could

cause actual results to differ materially from those projected in

our forward-looking statements include the risk that the Company

may not succeed in finding licensing or other strategic solutions,

including a potential sale of the Company, with acceptable timing,

benefits or costs, our ability to operate with limited cash or to

raise additional capital when needed; market acceptance of our

technologies and products; and for products incorporating our

technologies; the failure of our commercial partners to perform as

expected under our agreements, including from the impact of the

COVID-19 (coronavirus); our ability to identify parties interested

in paying any amounts or amounts we deem desirable for the purchase

or license of intellectual property assets; our or our customers’

failure to perform under open purchase orders, our financial and

technical resources relative to those of our competitors; our

ability to keep up with rapid technological change; government

regulation of our technologies; our ability to enforce our

intellectual property rights and protect our proprietary

technologies; the ability to obtain additional contract awards and

develop partnership opportunities; the timing of commercial product

launches and delays in product development; the ability to achieve

key technical milestones in key products; dependence on third

parties to develop, manufacture, sell and market our products;

potential product liability claims; our ability to maintain our

listing on the Nasdaq Stock Market, and other risk factors

identified from time to time in the Company's SEC reports,

including the Company's Annual Report on Form 10-K filed with the

SEC. These factors are not intended to represent a complete list of

the general or specific factors that may affect us. It should

be recognized that other factors, including general economic

factors and business strategies, may be significant, now or in the

future, and the factors set forth in this release may affect us to

a greater extent than indicated. Except as expressly required by

federal securities laws, we undertake no obligation to publicly

update or revise any forward-looking statements, whether as a

result of new information, future events, changes in circumstances

or any other reason.

|

MicroVision, Inc. |

|

Balance Sheet |

|

(In thousands) |

|

(Unaudited) |

| |

June 30, |

|

December 31, |

|

|

|

2020 |

|

|

|

2019 |

|

| |

|

|

|

| Assets |

|

|

|

| Current Assets |

|

|

|

| Cash and cash

equivalents |

$ |

7,805 |

|

|

$ |

5,837 |

|

| Accounts receivable,

net |

|

- |

|

|

|

1,079 |

|

| Inventory |

|

- |

|

|

|

192 |

|

| Other current

assets |

|

301 |

|

|

|

729 |

|

| Total current

assets |

|

8,106 |

|

|

|

7,837 |

|

| |

|

|

|

| Property and equipment,

net |

|

1,623 |

|

|

|

1,849 |

|

| Operating lease right-of-use

asset |

|

1,132 |

|

|

|

1,308 |

|

| Restricted cash |

|

435 |

|

|

|

435 |

|

| Intangible assets, net |

|

192 |

|

|

|

221 |

|

| Other assets |

|

18 |

|

|

|

186 |

|

| Total assets |

$ |

11,506 |

|

|

$ |

11,836 |

|

| |

|

|

|

| |

|

|

|

| Liabilities and

Shareholders' Equity (Deficit) |

|

|

|

| Current Liabilities |

|

|

|

| Accounts payable |

$ |

1,498 |

|

|

$ |

1,871 |

|

| Accrued

liabilities |

|

501 |

|

|

|

2,045 |

|

| Deferred revenue |

|

- |

|

|

|

21 |

|

| Contract

liabilities |

|

8,699 |

|

|

|

9,755 |

|

| Other current

liabilities |

|

- |

|

|

|

83 |

|

| Current portion of

long-term debt |

|

694 |

|

|

|

- |

|

| Current portion of

operating lease liability |

|

666 |

|

|

|

656 |

|

| Current portion of

finance lease obligations |

|

20 |

|

|

|

25 |

|

| Total current

liabilities |

|

12,078 |

|

|

|

14,456 |

|

| |

|

|

|

| Long term debt, net of current

portion |

|

880 |

|

|

|

- |

|

| Operating lease liability, net

of current portion |

|

1,069 |

|

|

|

1,348 |

|

| Finance lease obligations, net

of current portion |

|

1 |

|

|

|

9 |

|

| Total liabilities |

|

14,028 |

|

|

|

15,813 |

|

| |

|

|

|

| Commitments and

contingencies |

|

|

|

| |

|

|

|

| Shareholders' Equity

(Deficit) |

|

|

|

| Common stock at par

value |

|

143 |

|

|

|

126 |

|

| Additional paid-in

capital |

|

577,172 |

|

|

|

568,496 |

|

| Accumulated

deficit |

|

(579,837 |

) |

|

|

(572,599 |

) |

| Total shareholders'

equity (deficit) |

|

(2,522 |

) |

|

|

(3,977 |

) |

| Total liabilities and

shareholders' equity (deficit) |

$ |

11,506 |

|

|

$ |

11,836 |

|

|

MicroVision, Inc. |

|

Statement of Operations |

|

(In thousands, except earnings per share

data) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

| |

Three months ended June 30, |

|

Six months ended June 30, |

|

|

|

2020 |

|

|

|

2019 |

|

|

|

2020 |

|

|

|

2019 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Product revenue |

$ |

- |

|

|

$ |

- |

|

|

$ |

1,247 |

|

|

$ |

199 |

|

| License and royalty

revenue |

|

572 |

|

|

|

- |

|

|

|

784 |

|

|

|

- |

|

| Contract revenue |

|

15 |

|

|

|

1,240 |

|

|

|

25 |

|

|

|

2,892 |

|

|

Total revenue |

|

587 |

|

|

|

1,240 |

|

|

|

2,056 |

|

|

|

3,091 |

|

| |

|

|

|

|

|

|

|

| Cost of product revenue |

|

(1 |

) |

|

|

1,025 |

|

|

|

1,394 |

|

|

|

1,313 |

|

| Cost of contract revenue |

|

- |

|

|

|

798 |

|

|

|

4 |

|

|

|

1,753 |

|

|

Total cost of revenue |

|

(1 |

) |

|

|

1,823 |

|

|

|

1,398 |

|

|

|

3,066 |

|

| |

|

|

|

|

|

|

|

| Gross margin |

|

588 |

|

|

|

(583 |

) |

|

|

658 |

|

|

|

25 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Research and development

expense |

|

1,607 |

|

|

|

5,945 |

|

|

|

5,290 |

|

|

|

11,918 |

|

| Sales, marketing, general and

administrative expense |

|

1,280 |

|

|

|

2,455 |

|

|

|

3,051 |

|

|

|

5,154 |

|

| Gain on disposal of fixed

assets |

|

- |

|

|

|

- |

|

|

|

(450 |

) |

|

|

- |

|

| Total operating

expenses |

|

2,887 |

|

|

|

8,400 |

|

|

|

7,891 |

|

|

|

17,072 |

|

| |

|

|

|

|

|

|

|

| Loss from operations |

|

(2,299 |

) |

|

|

(8,983 |

) |

|

|

(7,233 |

) |

|

|

(17,047 |

) |

| |

|

|

|

|

|

|

|

| Other expense, net |

|

(5 |

) |

|

|

(7 |

) |

|

|

(5 |

) |

|

|

(11 |

) |

| |

|

|

|

|

|

|

|

| Net loss |

$ |

(2,304 |

) |

|

$ |

(8,990 |

) |

|

$ |

(7,238 |

) |

|

$ |

(17,058 |

) |

| |

|

|

|

|

|

|

|

| Net loss per share - basic and

diluted |

$ |

(0.02 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.16 |

) |

| |

|

|

|

|

|

|

|

| Weighted-average shares

outstanding - basic and diluted |

|

140,107 |

|

|

|

106,872 |

|

|

|

133,661 |

|

|

|

104,435 |

|

Investor Relations Contact

David H. Allen Darrow Associates, Inc. 408.427.4463

dallen@darrowir.com

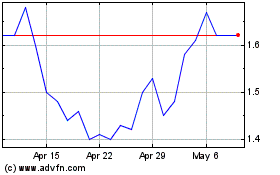

Microvision (NASDAQ:MVIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Microvision (NASDAQ:MVIS)

Historical Stock Chart

From Apr 2023 to Apr 2024