PayPal Trades at Record Levels on Strong Guidance Amid Pandemic

July 30 2020 - 1:41PM

Dow Jones News

By Maria Armental

PayPal Holdings Inc. traded at record levels a day after posting

a record performance for the second quarter, driven by a surge in

digital payments during the coronavirus pandemic that company

officials bet would be a turning point for the former eBay Inc.

subsidiary

Shares, which traded as high as $198.66, were up 4.4% at $192.68

in afternoon trade and on track for a record closing.

The net dollar value of transactions reached a record $222

billion in the quarter, the highest growth rate since PayPal's

separation from eBay in 2015. That year, PayPal's total payment

volume, as the metric is known, was about $282 billion, according

to a securities filing.

While others have reported lower cross-border volumes,

transactions where the merchant and consumer are in different

countries, PayPal said it saw a 24% rise in the quarter, driving

transaction revenue growth.

"Three months ago, the idea that our PayPal branded experiences

would enjoy TPV [total payment volume] growth for an entire quarter

at a level consistent with and

only previously seen during high-velocity holiday selling days

like Black Friday and Cyber Monday was bold and even somewhat

inconceivable, especially in the midst of a global pandemic and the

highest levels of unemployment in our lifetime," Chief Financial

Officer John D. Rainey said during a conference call with analysts,

adding that despite the prevalent uncertainty from the pandemic

"What we do know is that this is a pivotal moment in PayPal's

history.

"We believe that we've never been better positioned to realize

our ambition for greater relevance, ubiquity and impact as a global

payments leader," he said.

PayPal, citing the strong momentum for the first half of the

year and payment trends, reinstated financial projections for the

year. It now expects revenue for the year to increase about 20% and

profit on a per-share basis, to increase about 25%.

It expects to add about a net 70 million new accounts, compared

with the 37.3 million it added in 2019.

Just in the second quarter, PayPal added a net 21.3 million new

active accounts in the second quarter, ending the quarter with

about 346 million active accounts.

Canaccord Genuity analysts Joseph Vafi and Pallav Saini raised

their price target on the shares to $218 a share from $190, citing

PayPal's opportunity to capitalize on consumer shopping trends,

including the growing use of contactless payments.

PayPal is rolling out its QR code functionality in the U.S. and

is adding digital-wallet services, such as bill pay. In addition,

they said, PayPal is on track to launch a Venmo credit card this

year.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

July 30, 2020 13:26 ET (17:26 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

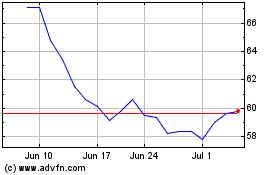

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

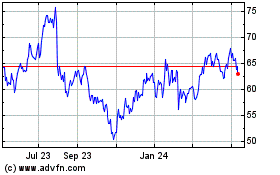

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Apr 2023 to Apr 2024