By Dawn Lim

Money-management giant BlackRock Inc.'s quarterly profit rose

21% as investors leaned on its bond funds to make rapid bets in

volatile markets roiled by the coronavirus pandemic.

Driving the company's performance, BlackRock's bond

exchange-traded-funds did a brisk business in the quarter as

traders and financial institutions used ETFs to zip in and out of

markets, make wagers, or hedge their portfolios during

unprecedented volatility. ETFs are collections of instruments that

trade like stocks on exchanges.

BlackRock bond ETFs took in a record quarterly $57 billion in

net flows. The firm also posted net inflows overall into all ETFs

in the second quarter, with more complex, higher-fee ETF strategies

generally taking in the bulk of flows.

BlackRock's gains signal that the firm with $7.3 trillion under

management stands to cement its power in a world shaken by

Covid-19.

A quarter ago, asset managers came under acute pressure as

markets sold off. But after the Federal Reserve rushed in to

stabilize markets, many investment firms reaped the benefits of the

Fed's intervention in the second quarter. Higher asset prices

translate to bigger revenues for managers like BlackRock. Asset

managers take a cut of fees on money they oversee for

investors.

"The quarter illuminates the importance of the ETF market,"

Chief Executive Laurence Fink said in an interview.

The challenge BlackRock faces is maintaining investors' trust

that its funds can hold up in market stress as a pandemic continues

to ripple through the markets and economy.

In midmorning trading, BlackRock stock rose more than 3% and was

the best performer on the S&P 500, according to Dow Jones

Market Group. The firm beat revenue and profit estimates by Wall

Street analysts, who say the firm's sprawling lineup and

early-mover advantage in areas such as bond ETFs will insulate it

from the market turmoil more than smaller managers.

BlackRock gains show the confounding reality of a

post-coronavirus world, where big winners have emerged even as the

economy remains in an extended downturn. As the coronavirus

pandemic continues, Mr. Fink said BlackRock clients are looking for

more contextual information and support.

"We're seeing an economy that is almost bipolar," he said. "Some

parts of the economy are doing quite well, and some parts are doing

quite poorly."

For the second quarter, the investment firm posted a profit of

$1.2 billion, or $7.85 a share, up from the year-prior period of $1

billion, or $6.41 a share. Its revenue rose 4% to $3.6 billion.

Partly helping the firm's revenue gains, BlackRock sells

software, including a suite of tools called Aladdin, to banks and

other institutions to evaluate financial risks. Its

technology-services revenue -- which includes fees from Aladdin --

rose by 17%.

That technology gives BlackRock a vantage point into markets and

helped the firm's advisory arm land a coveted, but highly

scrutinized, role in helping the Fed buy ETFs and bonds to support

credit markets. A small portion of BlackRock ETF bond flows were

powered by Fed purchases, though the firm is waiving fees on any

Fed money going into its ETFs.

The firm wasn't immune to the challenges of the quarter.

BlackRock said that price changes to some products cut into

revenue. The firm faces an escalating fight with other investment

firms for dollars and clout. It expects to undertake more fee

reductions on products after announcing some earlier this year. The

fee wars have put acute pressure on issuers both big and small.

The rise and fall of markets compounded price pressures for

BlackRock. As U.S. stocks rose and the dollar appreciated, so did

assets that BlackRock manages in cheaper products that track U.S.

markets, analysts say. Meanwhile, a fall in other equity markets

outside the U.S. reduced assets -- and fees BlackRock could charge

-- on what are generally more lucrative strategies.

BlackRock's earnings are also significant because they help show

how money moved through the firm's sprawling lineup of investment

strategies in the quarter. Those flows provide cues into how

investors are behaving more broadly.

Investors were cautious with the coronavirus shutting down

swaths of the economy. BlackRock investors pulled money from

BlackRock's equity funds, mirroring a broader flight across the

industry from stock to bond funds.

Investors drove about a quarter of the net new money BlackRock

took into cash products -- a less lucrative business for the money

manager -- but still a way to park money with the firm until they

are ready to move into other funds. BlackRock's active-equity

strategies took in record inflows, as investors sought the

expertise of managers that seek to beat rather than mirror

markets.

Big investment institutions pulled money from BlackRock indexed

products but added net flows to the firm's actively managed

products. Money coming in from retail investors helped to offset

outflows from institutional clients.

In coming months, Wall Street will be watching for signs of

whether BlackRock plans to be more aggressive with acquisitions in

the asset-management or technology sphere. In a tough market

environment, many predict a shakeout in the asset-management

space.

During the last financial crisis, BlackRock swooped in to buy

the investment-management business of Barclays. The 2009 deal

turned the firm into a behemoth. PNC Financial Services Group Inc.,

BlackRock's longtime largest investor, recently exited its stake in

the asset manager, locking in a tidy profit.

Write to Dawn Lim at dawn.lim@wsj.com

(END) Dow Jones Newswires

July 17, 2020 12:41 ET (16:41 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

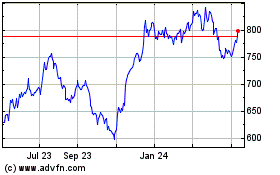

BlackRock (NYSE:BLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

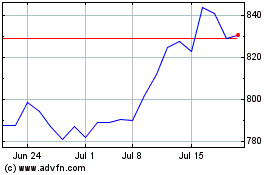

BlackRock (NYSE:BLK)

Historical Stock Chart

From Apr 2023 to Apr 2024