India Globalization Capital, Inc. (NYSE American: IGC) announces

its financial results for the Fiscal Year Ended March 31, 2020.

During Fiscal 2020, total revenue was approximately $4.1 million

compared to approximately $5.1 million for Fiscal 2019. In both

years, revenue was primarily derived from our India-based

Infrastructure Business. In Fiscal 2020, the Company generated

$411,000 revenue from its Life Sciences segment that was previously

referred to as the Plant and Cannabinoid segment. Revenue in Fiscal

2020 was lower than Fiscal 2019 primarily due to economic slowdown,

social distancing, travel and stay at home restrictions brought on

by Covid-19 in the last quarter of our fiscal year.

The highlights for Fiscal 2020 are:

- We filed a provisional patent, IGC 510, Compositions and

Methods using cannabidiol (“CBD”) for treating stammering and

symptoms of Tourette syndrome with the USPTO.

- We received notification that on March 24, 2020, the USPTO

issued a method and composition patent (#10,596,159 B2) for the

Company’s cannabinoid formulation for the treatment of cachexia and

eating disorders in humans and veterinary animals.

- The Company filed an Investigational New Drug Application with

the FDA for a double-blind, placebo-controlled, 100-person trial,

for its proprietary patent-pending formulation based on IGC-AD1

that uses ultra-low doses of cannabinoids with other natural

compounds intended to assist in the management of the care of

patients suffering from Alzheimer’s disease.

- We established a facility in San Juan, Puerto Rico to house and

conduct clinical trials.

- We established a production and manufacturing facility in

Washington State.

- The Company, in response to the Covid-19 pandemic, adapted the

manufacturing facilities to produce and package hand sanitizers

that are anticipated to go on sale in Fiscal 2021.

- We completed the development of several online and retail

brands, building out our “house of CBD brands” that we anticipate

will come to market in accordance with applicable law and

regulation in the future.

General and administrative expenses for Fiscal 2020 was

approximately $6 million as compared to approximately $3.5 million

for Fiscal 2019. The increase is largely attributed to increased

legal fees, and increased compensation expenses from an increased

employee and contractor head count. We anticipate legal fees will

abate over Fiscal 2021.

Research and Development (R&D) expense for Fiscal 2020 was

approximately $1 million compared to approximately $1.3 million for

the Fiscal 2019. The cost associated with this work is mostly

research comprising of plant extracts, data to support the efficacy

of extracts, and running FDA trials.

Net loss for Fiscal 2020 was approximately $7.3 million or $0.19

per share, compared to approximately $4.1 million or $0.13 per

share for Fiscal 2019. The larger loss is largely attributed to

increased legal and increased employee-related expenses.

On July 6, 2020, the United States District Court for the

District of Maryland entered an order formally and finally

approving a settlement that resolves all pending shareholder

derivative suits filed against the Company between November 2018

and the present. Details of the settlement were previously

disclosed on May 7, 2020 and in the Company’s public filings.

About IGC: IGC has two segments: Infrastructure and Life

Sciences. The company is based in Maryland, U.S.A. Our website:

www.igcinc.us.Twitter @IGCIR

Forward-looking Statements: This press release contains

forward-looking statements within the meaning of Section 21E of the

Securities Exchange Act of 1934. These forward-looking statements

are based largely on IGC’s expectations and are subject to several

risks and uncertainties, certain of which are beyond IGC’s control.

Actual results could differ materially from these forward-looking

statements as a result of, among other factors, competitive

conditions in the industries in which IGC operates, failure to

commercialize one or more of the technologies of IGC, general

economic conditions that are less favorable than expected, the

Federal Food and Drug Administration’s (FDA) general position

regarding hemp based products and our products in particular, the

ongoing Covid-19 pandemic and its effect on the global and regional

economies in which the Company participates, and other factors,

many of which are discussed in our SEC filings. The Company

incorporates by reference the Risk Factors identified in its Fiscal

2020 annual report filed with the SEC on Form 10-K on July 13,

2020. In light of these risks and uncertainties, there can be no

assurance that the forward-looking information contained in this

release will in fact occur.

India Globalization Capital,

Inc.

CONSOLIDATED BALANCE

SHEETS

(in thousands, except share

data)

March 31, 2020

March 31, 2019

($)

($)

ASSETS

Current assets:

Cash and cash equivalents

7,258

25,610

Marketable Securities

5,081

-

Accounts receivable, net

133

84

Inventories

4,245

248

Deposits and advances

1,040

781

Total current assets

17,757

26,723

Intangible assets, net

252

184

Property, plant and equipment, net

9,780

5,886

Non-Marketable Securities

11

794

Claims and advances

610

878

Operating lease asset

574

-

Total long-term assets

11,227

7,742

Total assets

28,984

34,465

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities:

Accounts payable

762

319

Accrued liabilities and others

1,134

509

Short-term loan

50

50

Total current liabilities

1,946

878

Other liabilities

16

15

Operating lease liability

485

-

Total non-current liabilities

501

15

Total liabilities

2,447

893

Commitments and Contingencies – See

Note 12

Stockholders' equity:

Preferred stock, $0.0001 per value:

authorized 1,000,000 shares, no share issued or outstanding as on

March 31, 2020 and March 31, 2019

-

-

Common stock and additional paid-in

capital, $0.0001 par value: 150,000,000 shares authorized;

39,320,116 and 39,501,407 shares issued and outstanding as on March

31, 2020 and March 31, 2019, respectively.

94,754

94,043

Accumulated other comprehensive loss

(2,850

)

(2,419

)

Accumulated deficit

(65,367

)

(58,052

)

Total stockholders' equity

26,537

33,572

Total liabilities and stockholders'

equity

28,984

34,465

These financial statements should be read in

connection with the accompanying notes on Form 10-K for the fiscal

year ending March 31, 2020, filed with the SEC on July 10,

2020.

India Globalization Capital,

Inc.

CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except loss per

share)

Years Ended March 31,

2020 ($)

2019 ($)

Revenues

4,072

5,116

Cost of revenues

(3,957

)

(4,984

)

Gross profit

115

132

General and administrative expenses

(5,968

)

(3,519

)

Research and development expenses

(1,011

)

(1,256

)

Operating loss

(6,864

)

(4,643

)

Impairment of investment

(782

)

-

Other income – net

331

548

Loss before income taxes

(7,315

)

(4,095

)

Income taxes expense

-

(2

)

Net loss attributable to common

stockholders

(7,315

)

(4,097

)

Foreign currency translation

adjustments

(431

)

(362

)

Comprehensive loss

(7,746

)

(4,459

)

Loss per share attributable to common

stockholders:

Basic & diluted

$

(0.19

)

$

(0.13

)

Weighted-average number of shares used in

computing loss per share amounts:

39,490

35,393

These financial statements should be read in

connection with the accompanying notes on Form 10-K for the fiscal

year ending March 31, 2020, filed with the SEC on July 10,

2020.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200713005607/en/

Claudia Grimaldi. Phone: 301-983-0998

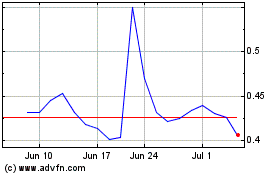

IGC Pharma (AMEX:IGC)

Historical Stock Chart

From Mar 2024 to Apr 2024

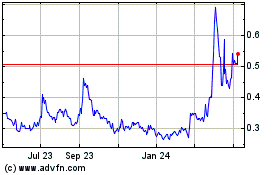

IGC Pharma (AMEX:IGC)

Historical Stock Chart

From Apr 2023 to Apr 2024