Certified Semi-annual Shareholder Report for Management Investment Companies (n-csrs)

July 07 2020 - 11:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22902

First Trust New Opportunities

MLP & Energy Fund

(Exact name of registrant as specified in charter)

10 Westport Road, Suite C101a

Wilton,

CT 06897

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address of agent for service)

registrant’s telephone number,

including area code: 630-765-8000

Date of fiscal year end: October 31

Date of reporting period: April 30,

2020

Form N-CSR is to be used by management

investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report

that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking

roles.

A registrant is required to disclose

the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to

respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management

and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden

estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington,

DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

First Trust

New Opportunities

MLP & Energy Fund (FPL)

Semi-Annual

Report

For the Six

Months Ended

April 30,

2020

First Trust New Opportunities MLP

& Energy Fund (FPL)

Semi-Annual Report

April 30, 2020

|

1

|

|

2

|

|

3

|

|

5

|

|

7

|

|

8

|

|

9

|

|

10

|

|

11

|

|

12

|

|

20

|

Caution Regarding

Forward-Looking Statements

This report contains

certain forward-looking statements within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding the goals,

beliefs, plans or current expectations of First Trust Advisors L.P. (“First Trust” or the “Advisor”) and/or Energy Income Partners, LLC (“EIP” or the “Sub-Advisor”) and

their respective representatives, taking into account the information currently available to them. Forward-looking statements include all statements that do not relate solely to current or historical fact. For

example, forward-looking statements include the use of words such as “anticipate,” “estimate,” “intend,” “expect,” “believe,” “plan,”

“may,” “should,” “would” or other words that convey uncertainty of future events or outcomes.

Forward-looking

statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of First Trust New Opportunities MLP & Energy Fund (the

“Fund”) to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. When evaluating the information included in this report, you

are cautioned not to place undue reliance on these forward-looking statements, which reflect the judgment of the Advisor and/or Sub-Advisor and their respective representatives only as of the date hereof. We undertake

no obligation to publicly revise or update these forward-looking statements to reflect events and circumstances that arise after the date hereof.

Performance and Risk

Disclosure

There is no assurance

that the Fund will achieve its investment objective. The Fund is subject to market risk, which is the possibility that the market values of securities owned by the Fund will decline and that the value of the

Fund’s shares may therefore be less than what you paid for them. Accordingly, you can lose money by investing in the Fund. See “Risk Considerations” in the Additional Information section of this

report for a discussion of certain other risks of investing in the Fund.

Performance data quoted

represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visit www.ftportfolios.com or speak with your financial advisor. Investment returns, net asset value and common share price will fluctuate and Fund shares, when sold,

may be worth more or less than their original cost.

The Advisor may also

periodically provide additional information on Fund performance on the Fund’s web page at www.ftportfolios.com.

How to Read This

Report

This report contains

information that may help you evaluate your investment in the Fund. It includes details about the Fund and presents data and analysis that provide insight into the Fund’s performance and investment approach.

By reading the portfolio

commentary by the portfolio management team of the Fund, you may obtain an understanding of how the market environment affected the Fund’s performance. The statistical information that follows may help you

understand the Fund’s performance compared to that of relevant market benchmarks.

It is important to keep

in mind that the opinions expressed by personnel of First Trust and EIP are just that: informed opinions. They should not be considered to be promises or advice. The opinions, like the statistics, cover the period

through the date on the cover of this report. The material risks of investing in the Fund are spelled out in the prospectus, the statement of additional information, this report and other Fund regulatory filings.

First Trust New Opportunities MLP

& Energy Fund (FPL)

Semi-Annual Letter from the Chairman

and CEO

April 30, 2020

Dear Shareholders,

First Trust is pleased

to provide you with the semi-annual report for the First Trust New Opportunities MLP & Energy Fund (the “Fund”), which contains detailed information about the Fund for the six months ended April 30,

2020.

Just one month ago, I

noted in a letter to shareholders that a handful of states were set to open some “nonessential” businesses by early May. As of May 20, 2020, I am pleased to report that all 50 states and U.S. territories

have eased some restrictions on businesses and social activity. Keep in mind, however, that the plan does entail governors phasing in the opening of businesses in the coming weeks or potentially months, so I see this

news as essentially marking the beginning of the rebuilding process for the U.S. economy. We all need to be aware as well of the possibility of an uptick or even surge in the coronavirus (“COVID-19”)

infections as more people venture out of their homes. Prior to the last couple of weeks or so, the stay-at-home mandate severely restricted the movements of close to 315 million Americans, according to The Washington

Post. To put this further into perspective, because so many stores have been closed and so many people have been hunkering down at home, retail-store traffic in the U.S. plunged 91.2% year-over-year for the week ended

May 16, 2020, according to Bloomberg. Truly amazing!

In this COVID-19

pandemic, there appears to be a notable disconnect between the state of the U.S. economy, which is expected to go from bad to downright terrible between the first quarter and second quarter of the year, and the

performance of the stock market, which has been much better than expected. While the data and commentary in this report are technically supposed to run through April 30, 2020, I feel compelled to offer insight that is

as up to date as possible. The 2020 peak in the stock market, as measured by the S&P 500® Index (the “Index”), occurred on February 19. That day also marked the all-time high for the Index. From

February 19, 2020, through March 23, 2020, the Index declined by 33.92% on a price-only basis (no dividends included), according to Bloomberg. We should note that the Index slid into bear market territory on March 12,

2020. A bear market is defined by a 20% or greater decline in price from its most recent peak. That took just 16 trading days, the quickest plunge into a bear market ever. From March 23, 2020 through May 20, 2020, the

Index staged an impressive rebound, posting a price-only gain of 32.82%, according to Bloomberg. As of May 20, 2020, the Index stood just 12.24% below its all-time high set on February 19, 2020. But the game, as they

say, is not over. Even though stocks have rebounded significantly from their March lows, 68% of the money managers that participated in the most recent Bank of America global fund manager survey believe that stocks

are still in a bear market, according to MarketWatch. What are they likely concerned about? In addition to a dismal economic outlook for the near-term, research from Bespoke Investment Group, an independent research

firm, indicates that there have been 25 bear markets since 1928 and 60% of the time the Index declined a second time during the bear market and went on to establish a new low for the period.

With respect to the

state of the economy, the Congressional Budget Office announced on May 19, 2020, that it sees real U.S. gross domestic product (“GDP”) declining by an annualized 38% in the second quarter of 2020,

reportedly in line with Wall Street economists, according to CNBC. Some estimates are more dire. The GDP estimate from the Atlanta Federal Reserve calls for a 42% plunge. These numbers are so large in scope they are

mind-boggling. The Bureau of Economic Analysis is scheduled to release its GDP report on July 30, 2020. Until then, we may continue to have a disconnect between the economy and the markets. Let us hope it is as

positive as the one we are currently enjoying.

The U.S. government shut

down huge chunks of our economy in order to protect lives and prevent our health care system from being overwhelmed by COVID-19 patients. Our economic woes, in other words, are man-made. The remedies to this pandemic

will also likely be man-made. They could come in the form of therapeutics and/or a vaccine. Perhaps more than one vaccine. At this stage of the pandemic fight, we have one message for investors: Stay the course!

Thank you for giving

First Trust the opportunity to play a role in your financial future. We value our relationship with you and will report on the Fund again in six months.

Sincerely,

James A. Bowen

Chairman of the Board of Trustees

Chief Executive Officer of First Trust

Advisors L.P.

First Trust New Opportunities MLP &

Energy Fund (FPL)

“AT A GLANCE”

As of April 30, 2020

(Unaudited)

|

Fund Statistics

|

|

|

Symbol on New York Stock Exchange

|

FPL

|

|

Common Share Price

|

$4.71

|

|

Common Share Net Asset Value (“NAV”)

|

$5.30

|

|

Premium (Discount) to NAV

|

(11.13)%

|

|

Net Assets Applicable to Common Shares

|

$136,326,331

|

|

Current Distribution per Common Share(1)

|

$0.0375

|

|

Current Annualized Distribution per Common Share

|

$0.4500

|

|

Current Distribution Rate on Common Share Price(2)

|

9.55%

|

|

Current Distribution Rate on NAV(2)

|

8.49%

|

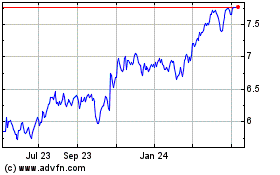

Common Share Price & NAV (weekly closing price)

|

Performance

|

|

|

|

|

|

|

|

|

Average Annual

Total Returns

|

|

|

6 Months

Ended

4/30/20

|

1 Year

Ended

4/30/20

|

5 Years

Ended

4/30/20

|

Inception

(3/26/14)

to 4/30/20

|

|

Fund Performance(3)

|

|

|

|

|

|

NAV

|

-39.67%

|

-41.62%

|

-14.41%

|

-10.75%

|

|

Market Value

|

-41.74%

|

-42.86%

|

-14.74%

|

-13.11%

|

|

Index Performance

|

|

|

|

|

|

S&P 500® Index

|

-3.16%

|

0.86%

|

9.11%

|

9.92%

|

|

Alerian MLP Total Return Index

|

-34.48%

|

-40.79%

|

-15.02%

|

-11.75%

|

|

Wells Fargo Midstream MLP Total Return Index

|

-32.47%

|

-36.76%

|

-13.34%

|

-8.91%

|

|

Industry Classification

|

% of Total

Investments

|

|

Petroleum Product Transmission

|

36.2%

|

|

Natural Gas Transmission

|

36.1

|

|

Crude Oil Transmission

|

20.5

|

|

Electric Power & Transmission

|

3.8

|

|

Other

|

1.6

|

|

Propane

|

1.0

|

|

Coal

|

0.8

|

|

Total

|

100.0%

|

|

Top Ten Holdings

|

% of Total

Investments

|

|

Enterprise Products Partners, L.P.

|

14.6%

|

|

TC PipeLines, L.P.

|

12.8

|

|

Magellan Midstream Partners, L.P.

|

10.7

|

|

Williams (The) Cos., Inc.

|

7.1

|

|

ONEOK, Inc.

|

5.5

|

|

Energy Transfer, L.P.

|

5.0

|

|

Holly Energy Partners, L.P.

|

5.0

|

|

Shell Midstream Partners, L.P.

|

4.5

|

|

Plains All American Pipeline, L.P.

|

4.3

|

|

TC Energy Corp.

|

4.2

|

|

Total

|

73.7%

|

|

(1)

|

Most recent distribution paid or declared through 4/30/2020. Subject to change in the future.

|

|

(2)

|

Distribution rates are calculated by annualizing the most recent distribution paid or declared through the report date and then dividing by Common Share Price or NAV, as applicable, as of 4/30/2020.

Subject to change in the future.

|

|

(3)

|

Total return is based on the combination of reinvested dividend, capital gain, and return of capital distributions, if any, at prices obtained by the Dividend Reinvestment Plan and changes in NAV per

share for NAV returns and changes in Common Share Price for market value returns. Total returns do not reflect sales load and are not annualized for periods of less than one year. Past performance is not indicative of

future results.

|

Portfolio Commentary

First Trust New

Opportunities MLP & Energy Fund (FPL)

Semi-Annual Report

April 30, 2020

(Unaudited)

Advisor

First Trust Advisors L.P.

(“First Trust” or the “Advisor”) serves as the investment advisor to the First Trust New Opportunities MLP & Energy Fund (the “Fund”). First Trust is responsible for the ongoing

monitoring of the Fund’s investment portfolio, managing the Fund’s business affairs and providing certain administrative services necessary for the management of the Fund.

Sub-Advisor

Energy Income Partners,

LLC

Energy Income Partners,

LLC (“EIP”), located in Westport, CT, was founded in 2003 to provide professional asset management services in the area of energy-related master limited partnerships (“MLPs”) and other

high-payout securities such as pipeline companies, power utilities, YieldCos and energy infrastructure real estate investment trusts (“REITs”). EIP mainly focuses on investments in energy-related

infrastructure assets such as pipelines, power transmission and distribution, petroleum storage and terminals that receive fee-based or regulated income from their corporate and individual customers. EIP manages or

supervises approximately $4.1 billion of assets as of April 30, 2020. EIP advises two privately offered partnerships for U.S. high net worth individuals and an open-end mutual fund. EIP also manages separately managed

accounts and provides its model portfolio to unified managed accounts. Finally, EIP serves as a sub-advisor to three closed-end management investment companies in addition to the Fund, two actively managed

exchange-traded funds (“ETF”), a sleeve of an actively managed ETF, a sleeve of a series of variable insurance trust, and an open-end UCITS fund incorporated in Ireland. EIP is a registered investment

advisor with the Securities and Exchange Commission.

Portfolio Management

Team

James J. Murchie –

Co-Portfolio Manager, Founder and CEO of Energy Income Partners, LLC

Eva Pao –

Co-Portfolio Manager, Principal of Energy Income Partners, LLC

John Tysseland –

Co-Portfolio Manager, Principal of Energy Income Partners, LLC

Commentary

First Trust New

Opportunities MLP & Energy Fund

The Fund’s

investment objective is to seek a high level of total return with an emphasis on current distributions paid to common shareholders. The Fund seeks to provide its common shareholders with a vehicle to invest in a

portfolio of cash-generating securities, with a focus on investing in publicly traded MLPs, MLP-related entities and other companies in the energy sector and energy utility industries that are weighted towards

non-cyclical, fee-for-service revenues. There can be no assurance that the Fund’s investment objective will be achieved. The Fund may not be appropriate for all investors.

Market Recap

As measured by the

Alerian MLP Total Return Index (“AMZX”) and the Wells Fargo Midstream MLP Total Return Index (“WCHWMIDT”) (collectively the “MLP benchmarks”), the total returns for the MLP

benchmarks for the six-month period ended April 30, 2020 were -34.48% and -32.47%, respectively. For AMZX, this return reflects a positive 2.91% from distribution payments, while the remaining returns are due to share

price depreciation. For WCHWMIDT, this return reflects a positive 2.89% from distribution payments, while the remaining returns are due to share price depreciation. These figures are according to data collected from

several sources, including the MLP benchmarks and Bloomberg. While in the short term, market share price appreciation can be volatile, we believe that over the long term, such share price appreciation will approximate

growth in per share quarterly cash distributions paid by MLPs.

Performance Analysis

On a net asset value

(“NAV”) basis, for the six-month period ended April 30, 2020, the Fund provided a total return1 of -39.67%, including the reinvestment of dividends. This compares, according to collected data, to a total return of -3.16%

for the S&P 500® Index (the “Index”), -34.48% for AMZX and -32.47% for WCHWMIDT. On a market value basis, the Fund had a

total return1, including the reinvestment of dividends, of -41.74% for the six-month period ended April 30, 2020. At the end of the

period, the Fund was priced at $4.71, while the NAV was $5.30, a discount of 11.13%. On October 31, 2019, the Fund was priced at $8.66, while the NAV was $9.41, a discount of 7.97%.

|

1

|

Total return is based on the combination of reinvested dividend, capital gain and return of capital distributions, if any, at prices obtained by the Dividend Reinvestment Plan and changes in NAV per

Common Share for NAV returns and changes in Common Share price for market value returns. Total returns do not reflect a sales load and are not annualized for periods of less than one year. Past performance is not

indicative of future results.

|

Portfolio Commentary (Continued)

First Trust New

Opportunities MLP & Energy Fund (FPL)

Semi-Annual Report

April 30, 2020

(Unaudited)

The Fund’s regular

monthly Common Share distribution was $0.075 for the period from November 2019 through April 2020. A monthly distribution of $0.0375 was declared for the period May 2020 through July 2020. The distribution reduction

results from three factors that have lowered the Fund’s distributable cash flow: 1) a reduction in Fund assets as a result of portfolio sales to reduce Fund leverage to maintain compliance with applicable

leverage limits, 2) reduced dividend payments from portfolio companies lowering dividend payout ratios and 3) anticipated changes to the portfolio composition including the Fund’s use of leverage and reductions

to income from the covered call strategy.

For the six-month period

ended April 30, 2020, the Fund’s NAV underperformed the -33.48% average of the MLP benchmarks by 619 basis points (“bps”). Leverage had a negative effect on the performance of the Fund and is the

primary driver of the Fund’s underperformance during the reporting period. Derivatives had a positive impact on the performance of the Fund over the reporting period. Two important factors affecting the return

of the Fund, relative to the average of the MLP benchmarks, are the Fund’s accrual for taxes and the use of financial leverage through a line of credit. The Fund established a committed facility agreement with

BNP Paribas Prime Brokerage Inc. with a current maximum commitment amount of $40,000,000. The Fund uses leverage because its portfolio managers believe that, over time, leverage can enhance total return for common

shareholders. However, the use of leverage can also increase the volatility of the NAV and, therefore, the share price. During the reporting period, prices of securities held by the Fund declined and the effect of

changes in common share NAV and common share total return loss was magnified by the use of leverage. Unlike the Fund, the MLP benchmarks are not leveraged, nor are their returns net of an accrual for taxes.

Market and Fund Outlook

The dramatic price

declines in crude oil due to Saudi and Russian production decisions coupled with the demand shock related to the coronavirus (“COVID-19”) pandemic triggered an unprecedented sell-off of energy pipeline and

midstream companies in the first four months of 2020. These dramatic share price declines far exceed any expected reduction in composite earnings of the Fund’s portfolio companies. The reason for this, in

EIP’s view, is a massive de-leveraging of the MLP-dedicated closed-end funds that hold a significant portion of the shares of the MLPs in the Fund.

Weak market conditions

drove a -21% decline in the AMZX between January 1 and February 28, 2020, then panic took hold in March driving another -59% decline by March 18 (Source: Bloomberg). Our analysis indicates that forced selling by

levered closed-end MLP funds was ~$4.3 billion and outflows from open-end funds were ~$0.9 billion in a four-week period. This is nearly $1 billion more than the selling that occurred over a nine-month period in

2015-2016 when oil prices corrected from their highs of over $100 per barrel, due to outflows and de-leveraging but on assets that were nearly three times as large as today.

We believe the potential

effect on the earnings of the Fund’s portfolio from recent events is far less severe than the price decline experienced in the first four months of 2020. For example, at the end of April 2020, nearly half of the

portfolio was invested in state-regulated utilities, sponsored vehicles of much larger corporations like Royal Dutch Shell PLC, and natural gas pipelines for which we expect negligible medium-term recurring earnings

impact. The reason is that state-regulated utilities earn an allowed return on invested capital and any near-term hit to earnings will mostly be recovered in customer rates over time. The sponsored vehicles may also

exhibit some near-term earnings weakness but since most of their revenues come from their own parent organizations, we do not expect much more than a 10% reduction to recurring earnings through 2021. Additionally, the

Fund’s second largest holding at the end of the period was a Canadian pipeline company that is unique among other midstream companies as over 90% of the company’s cash flow is derived from regulated or

contracted assets.

Overall, we expect the

Fund’s portfolio companies to experience much less earnings pressure in 2020 and 2021 than the S&P 500® Index yet the companies owned by the Fund have underperformed this broad market index. Calendar year 2020 consensus

earnings expectations for the S&P 500® Index are down 26% from the end of January to the end of April while the weighted average 2020 consensus earnings

expectations of the Fund’s portfolio companies are down only 11% over the same period. Consensus expectations for 2021 earnings tell a similar story yet the Fund’s portfolio company valuations have

suffered a much bigger decline because of the liquidity event at the MLP-dedicated closed-end funds. At the end of April 2020, the Fund’s portfolio traded at 11.0x 2020 P/E multiple which compares to 22.5x for

the S&P 500® Index despite having earnings that appear less affected by the extraordinary events that have unfolded over the last

few months (Source: Bloomberg, FactSet).

First Trust New Opportunities MLP &

Energy Fund (FPL)

Portfolio of Investments

April 30, 2020

(Unaudited)

Shares/

Units

|

|

Description

|

|

Value

|

|

MASTER LIMITED PARTNERSHIPS – 79.7%

|

|

|

|

Chemicals – 1.9%

|

|

|

|

142,300

|

|

Westlake Chemical Partners, L.P. (a)

|

|

$2,558,554

|

|

|

|

Gas Utilities – 1.1%

|

|

|

|

99,500

|

|

Suburban Propane Partners, L.P. (a)

|

|

1,537,275

|

|

|

|

Independent Power & Renewable Electricity Producers – 1.2%

|

|

|

|

33,319

|

|

NextEra Energy Partners, L.P. (a) (b)

|

|

1,675,612

|

|

|

|

Oil, Gas & Consumable Fuels – 75.5%

|

|

|

|

321,211

|

|

Alliance Resource Partners, L.P.

|

|

1,246,299

|

|

245,441

|

|

BP Midstream Partners, L.P. (a)

|

|

2,807,845

|

|

22,000

|

|

Cheniere Energy Partners, L.P. (a)

|

|

742,060

|

|

938,960

|

|

Energy Transfer, L.P. (a)

|

|

7,887,264

|

|

1,300,864

|

|

Enterprise Products Partners, L.P. (a) (c)

|

|

22,843,172

|

|

530,217

|

|

Holly Energy Partners, L.P. (a)

|

|

7,810,096

|

|

407,689

|

|

Magellan Midstream Partners, L.P. (a) (c)

|

|

16,768,249

|

|

170,100

|

|

MPLX, L.P. (a)

|

|

3,078,810

|

|

138,100

|

|

Phillips 66 Partners, L.P. (a)

|

|

5,876,155

|

|

759,700

|

|

Plains All American Pipeline, L.P. (a)

|

|

6,708,151

|

|

483,700

|

|

Shell Midstream Partners, L.P. (a)

|

|

7,105,553

|

|

597,732

|

|

TC PipeLines, L.P. (a)

|

|

20,024,022

|

|

|

|

|

|

102,897,676

|

|

|

|

Total Master Limited Partnerships

|

|

108,669,117

|

|

|

|

(Cost $149,593,872)

|

|

|

|

COMMON STOCKS – 35.2%

|

|

|

|

Electric Utilities – 1.1%

|

|

|

|

20,000

|

|

Exelon Corp.

|

|

741,600

|

|

28,000

|

|

PPL Corp.

|

|

711,760

|

|

|

|

|

|

1,453,360

|

|

|

|

Multi-Utilities – 3.7%

|

|

|

|

55,000

|

|

Public Service Enterprise Group, Inc.

|

|

2,789,050

|

|

18,000

|

|

Sempra Energy

|

|

2,229,300

|

|

|

|

|

|

5,018,350

|

|

|

|

Oil, Gas & Consumable Fuels – 30.4%

|

|

|

|

146,985

|

|

Enbridge, Inc. (c)

|

|

4,509,500

|

|

126,493

|

|

Equitrans Midstream Corp. (a)

|

|

1,060,011

|

|

238,400

|

|

Inter Pipeline, Ltd. (CAD) (a)

|

|

1,993,589

|

|

84,604

|

|

Keyera Corp. (CAD) (a)

|

|

1,255,126

|

|

416,128

|

|

Kinder Morgan, Inc. (c)

|

|

6,337,630

|

|

285,561

|

|

ONEOK, Inc. (a)

|

|

8,546,841

|

|

143,487

|

|

TC Energy Corp. (a)

|

|

6,652,057

|

|

573,717

|

|

Williams (The) Cos., Inc. (a) (c)

|

|

11,112,898

|

|

|

|

|

|

41,467,652

|

|

|

|

Total Common Stocks

|

|

47,939,362

|

|

|

|

(Cost $69,670,399)

|

|

|

|

|

|

Total Investments – 114.9%

|

|

156,608,479

|

|

|

|

(Cost $219,264,271) (d)

|

|

|

|

Number of Contracts

|

|

Description

|

|

Notional Amount

|

|

Exercise Price

|

|

Expiration Date

|

|

Value

|

|

CALL OPTIONS WRITTEN – (0.5)%

|

|

(1,460)

|

|

Enbridge, Inc. (e)

|

|

$(4,479,280)

|

|

$42.50

|

|

Jul 2020

|

|

(1,460)

|

See Notes to Financial Statements

Page 5

First Trust New Opportunities MLP &

Energy Fund (FPL)

Portfolio of Investments

(Continued)

April 30, 2020

(Unaudited)

|

Number of Contracts

|

|

Description

|

|

Notional Amount

|

|

Exercise Price

|

|

Expiration Date

|

|

Value

|

|

CALL OPTIONS WRITTEN (Continued)

|

|

(3,100)

|

|

Enterprise Products Partners, L.P.

|

|

$(5,443,600)

|

|

$18.00

|

|

Jun 2020

|

|

$(387,500)

|

|

(3,461)

|

|

Kinder Morgan, Inc. (e)

|

|

(5,271,103)

|

|

23.00

|

|

Jun 2020

|

|

(6,922)

|

|

(900)

|

|

Magellan Midstream Partners, L.P.

|

|

(3,701,700)

|

|

47.50

|

|

Jun 2020

|

|

(58,500)

|

|

(3,500)

|

|

Williams (The) Cos., Inc.

|

|

(6,779,500)

|

|

21.00

|

|

Jun 2020

|

|

(220,500)

|

|

|

|

Total Call Options Written

|

|

(674,882)

|

|

|

|

(Premiums received $572,228)

|

|

|

|

|

|

|

|

|

|

|

Outstanding Loan – (17.5)%

|

|

(23,900,000)

|

|

|

Net Other Assets and Liabilities – 3.1%

|

|

4,292,734

|

|

|

Net Assets – 100.0%

|

|

$136,326,331

|

|

|

(a)

|

All or a portion of this security serves as collateral on the outstanding loan.

|

|

(b)

|

This security is taxed as a “C” corporation for federal income tax purposes.

|

|

(c)

|

All or a portion of this security’s position represents cover for outstanding options written.

|

|

(d)

|

Aggregate cost for federal income tax purposes was $182,317,662. As of April 30, 2020, the aggregate gross unrealized appreciation for all investments in which there was an excess of

value over tax cost was $18,079,392 and the aggregate gross unrealized depreciation for all investments in which there was an excess of tax cost over value was $44,463,457. The net unrealized depreciation was

$26,384,065. The amounts presented are inclusive of derivative contracts.

|

|

(e)

|

This investment is fair valued by the Advisor’s Pricing Committee in accordance with procedures adopted by the Fund’s Board of Trustees, and in

accordance with the provisions of the Investment Company Act of 1940, as amended. At April 30, 2020, investments noted as such are valued at $(8,382) or (0.0)% of net assets.

|

|

CAD

|

Canadian Dollar - Security is denominated in Canadian Dollars and is translated into U.S. Dollars based upon the current exchange rate.

|

Valuation Inputs

A summary of the inputs

used to value the Fund’s investments as of April 30, 2020 is as follows (see Note 2A - Portfolio Valuation in the Notes to Financial Statements):

|

ASSETS TABLE

|

|

|

Total

Value at

4/30/2020

|

Level 1

Quoted

Prices

|

Level 2

Significant

Observable

Inputs

|

Level 3

Significant

Unobservable

Inputs

|

|

Master Limited Partnerships*

|

$ 108,669,117

|

$ 108,669,117

|

$ —

|

$ —

|

|

Common Stocks*

|

47,939,362

|

47,939,362

|

—

|

—

|

|

Total Investments

|

$ 156,608,479

|

$ 156,608,479

|

$—

|

$—

|

|

LIABILITIES TABLE

|

|

|

Total

Value at

4/30/2020

|

Level 1

Quoted

Prices

|

Level 2

Significant

Observable

Inputs

|

Level 3

Significant

Unobservable

Inputs

|

|

Call Options Written

|

$ (674,882)

|

$ (666,500)

|

$ (8,382)

|

$ —

|

|

*

|

See Portfolio of Investments for industry breakout.

|

Page 6

See Notes to Financial Statements

First Trust New Opportunities MLP &

Energy Fund (FPL)

Statement of Assets and

Liabilities

April 30, 2020

(Unaudited)

|

ASSETS:

|

|

|

Investments, at value

(Cost $219,264,271)

|

$ 156,608,479

|

|

Cash

|

3,133,699

|

|

Receivables:

|

|

|

Dividends

|

1,591,373

|

|

Investment securities sold

|

149,111

|

|

Income taxes

|

32,204

|

|

Prepaid expenses

|

18,317

|

|

Total Assets

|

161,533,183

|

|

LIABILITIES:

|

|

|

Outstanding loan

|

23,900,000

|

|

Options written, at value (Premiums received $572,228)

|

674,882

|

|

Payables:

|

|

|

Interest and fees on loan

|

342,477

|

|

Investment advisory fees

|

116,867

|

|

Audit and tax fees

|

91,363

|

|

Shareholder reporting fees

|

36,233

|

|

Custodian fees

|

14,167

|

|

Legal fees

|

7,269

|

|

Administrative fees

|

7,190

|

|

Transfer agent fees

|

7,133

|

|

Financial reporting fees

|

1,467

|

|

Trustees’ fees and expenses

|

1,460

|

|

Other liabilities

|

6,344

|

|

Total Liabilities

|

25,206,852

|

|

NET ASSETS

|

$136,326,331

|

|

NET ASSETS consist of:

|

|

|

Paid-in capital

|

$ 321,612,219

|

|

Par value

|

257,154

|

|

Accumulated distributable earnings (loss)

|

(185,543,042)

|

|

NET ASSETS

|

$136,326,331

|

|

NET ASSET VALUE, per Common Share (par value $0.01 per Common Share)

|

$5.30

|

|

Number of Common Shares outstanding (unlimited number of Common Shares has been authorized)

|

25,715,381

|

See Notes to Financial Statements

Page 7

First Trust New Opportunities MLP &

Energy Fund (FPL)

Statement of Operations

For the Six Months Ended

April 30, 2020 (Unaudited)

|

INVESTMENT INCOME:

|

|

|

Dividends (net of foreign withholding tax of $141,285)

|

$ 4,287,578

|

|

Interest

|

11,206

|

|

Total investment income

|

4,298,784

|

|

EXPENSES:

|

|

|

Interest and fees on loan

|

6,109,349

|

|

Investment advisory fees

|

1,377,613

|

|

Administrative fees

|

66,886

|

|

Audit and tax fees

|

49,424

|

|

Shareholder reporting fees

|

37,400

|

|

Custodian fees

|

19,339

|

|

Transfer agent fees

|

13,622

|

|

Listing expense

|

13,306

|

|

Trustees’ fees and expenses

|

8,189

|

|

Legal fees

|

6,142

|

|

Financial reporting fees

|

4,551

|

|

Other

|

50,253

|

|

Total expenses

|

7,756,074

|

|

NET INVESTMENT INCOME (LOSS) BEFORE TAXES

|

(3,457,290)

|

|

Current state income tax benefit (expense)

|

(126,203)

|

|

|

Current federal income tax benefit (expense)

|

(2,530,093)

|

|

|

Deferred federal income tax benefit (expense)

|

(16,480,015)

|

|

|

Deferred state income tax benefit (expense)

|

(740,315)

|

|

|

Total income tax benefit (expense)

|

(19,876,626)

|

|

NET INVESTMENT INCOME (LOSS)

|

(23,333,916)

|

|

NET REALIZED AND UNREALIZED GAIN (LOSS):

|

|

|

Net realized gain (loss) before taxes on:

|

|

|

Investments

|

(14,524,421)

|

|

Written options contracts

|

2,492,576

|

|

Foreign currency transactions

|

(16,214)

|

|

Net realized gain (loss) before taxes

|

(12,048,059)

|

|

Current federal income tax benefit (expense)

|

2,530,093

|

|

|

Current state income tax benefit (expense)

|

118,927

|

|

|

Total income tax benefit (expense)

|

2,649,020

|

|

Net realized gain (loss) on investments, written options and foreign currency transactions

|

(9,399,039)

|

|

Net change in unrealized appreciation (depreciation) before taxes on:

|

|

|

Investments

|

(77,667,426)

|

|

Written options contracts

|

(809,062)

|

|

Foreign currency translation

|

223

|

|

Net change in unrealized appreciation (depreciation) before taxes

|

(78,476,265)

|

|

Deferred federal income tax benefit (expense)

|

16,480,015

|

|

|

Deferred state income tax benefit (expense)

|

740,315

|

|

|

Total income tax benefit (expense)

|

17,220,330

|

|

Net change in unrealized appreciation (depreciation) on investments, written options and foreign currency translation

|

(61,255,935)

|

|

NET REALIZED AND UNREALIZED GAIN (LOSS)

|

(70,654,974)

|

|

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS

|

$(93,988,890)

|

Page 8

See Notes to Financial Statements

First Trust New Opportunities MLP &

Energy Fund (FPL)

Statements of Changes in

Net Assets

|

|

Six Months

Ended

4/30/2020

(Unaudited)

|

|

Year

Ended

10/31/2019

|

|

OPERATIONS:

|

|

|

|

|

Net investment income (loss)

|

$ (23,333,916)

|

|

$ 3,202,847

|

|

Net realized gain (loss)

|

(9,399,039)

|

|

(4,288,047)

|

|

Net increase from payment by the sub-advisor

|

—

|

|

177

|

|

Net change in unrealized appreciation (depreciation)

|

(61,255,935)

|

|

23,803,646

|

|

Net increase (decrease) in net assets resulting from operations

|

(93,988,890)

|

|

22,718,623

|

|

DISTRIBUTIONS TO SHAREHOLDERS FROM:

|

|

|

|

|

Investment operations

|

—

|

|

(6,521,445)

|

|

Return of capital

|

(11,566,061)

|

|

(16,608,333)

|

|

Total distributions to shareholders

|

(11,566,061)

|

|

(23,129,778)

|

|

CAPITAL TRANSACTIONS:

|

|

|

|

|

Proceeds from Common Shares reinvested

|

66,216

|

|

—

|

|

Net increase (decrease) in net assets resulting from capital transactions

|

66,216

|

|

—

|

|

Total increase (decrease) in net assets

|

(105,488,735)

|

|

(411,155)

|

|

NET ASSETS:

|

|

|

|

|

Beginning of period

|

241,815,066

|

|

242,226,221

|

|

End of period

|

$ 136,326,331

|

|

$ 241,815,066

|

|

COMMON SHARES:

|

|

|

|

|

Common Shares at beginning of period

|

25,699,753

|

|

25,699,753

|

|

Common Shares issued as reinvestment under the Dividend Reinvestment Plan

|

15,628

|

|

—

|

|

Common Shares at end of period

|

25,715,381

|

|

25,699,753

|

See Notes to Financial Statements

Page 9

First Trust New Opportunities MLP &

Energy Fund (FPL)

Statement of Cash Flows

For the Six Months Ended

April 30, 2020 (Unaudited)

|

Cash flows from operating activities:

|

|

|

|

Net increase (decrease) in net assets resulting from operations

|

$(93,988,890)

|

|

|

Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided by operating

activities:

|

|

|

|

Purchases of investments

|

(134,000,490)

|

|

|

Sales of investments

|

204,724,730

|

|

|

Proceeds from written options

|

2,987,540

|

|

|

Amount paid to close written options

|

(149,452)

|

|

|

Return of capital received from investment in MLPs

|

5,098,890

|

|

|

Net realized gain/loss on investments and written options

|

12,031,845

|

|

|

Net change in unrealized appreciation/depreciation on investments and written options

|

78,476,488

|

|

|

Changes in assets and liabilities:

|

|

|

|

Decrease in income tax receivable

|

41,594

|

|

|

Decrease in dividends receivable

|

797,190

|

|

|

Increase in prepaid expenses

|

(10,022)

|

|

|

Increase in interest and fees payable on loan

|

14,596

|

|

|

Decrease in investment advisory fees payable

|

(168,025)

|

|

|

Decrease in audit and tax fees payable

|

(7,634)

|

|

|

Decrease in legal fees payable

|

(4,206)

|

|

|

Increase in shareholder reporting fees payable

|

16,234

|

|

|

Decrease in administrative fees payable

|

(7,917)

|

|

|

Increase in custodian fees payable

|

4,855

|

|

|

Increase in transfer agent fees payable

|

2,570

|

|

|

Decrease in Trustees’ fees and expenses payable

|

(4,066)

|

|

|

Increase in financial reporting fees payable

|

696

|

|

|

Increase in other liabilities payable

|

6,074

|

|

|

Cash provided by operating activities

|

|

$75,862,600

|

|

Cash flows from financing activities:

|

|

|

|

Proceeds from Common Shares reinvested

|

66,216

|

|

|

Distributions to Common Shareholders from return of capital

|

(11,566,061)

|

|

|

Repayment of borrowing

|

(65,100,000)

|

|

|

Cash used in financing activities

|

|

(76,599,845)

|

|

Decrease in cash and foreign currency (a)

|

|

(737,245)

|

|

Cash and foreign currency at beginning of period

|

|

3,870,944

|

|

Cash at end of period

|

|

$3,133,699

|

|

Supplemental disclosure of cash flow information:

|

|

|

|

Cash paid during the period for interest and fees

|

|

$6,094,753

|

|

Cash paid during the period for taxes

|

|

$—

|

|

(a)

|

Includes net change in unrealized appreciation (depreciation) on foreign currency of $223.

|

Page 10

See Notes to Financial Statements

First Trust New Opportunities MLP &

Energy Fund (FPL)

Financial Highlights

For a Common Share

outstanding throughout each period

|

|

Six Months

Ended

4/30/2020

(Unaudited)

|

|

Year Ended October 31,

|

|

|

2019

|

|

2018

|

|

2017

|

|

2016

|

|

2015

|

|

Net asset value, beginning of period

|

$ 9.41

|

|

$ 9.43

|

|

$ 11.95

|

|

$ 12.92

|

|

$ 14.63

|

|

$ 20.41

|

|

Income from investment operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income (loss)

|

(0.91)

|

|

0.12

|

|

(0.28)

|

|

(0.02)

|

|

0.91

|

|

(0.22)

|

|

Net realized and unrealized gain (loss)

|

(2.75)

|

|

0.76 (a)

|

|

(1.04) (a)

|

|

0.30

|

|

(1.36) (a)

|

|

(4.34)

|

|

Total from investment operations

|

(3.66)

|

|

0.88

|

|

(1.32)

|

|

0.28

|

|

(0.45)

|

|

(4.56)

|

|

Distributions paid to shareholders from:

|

|

|

|

|

|

|

|

|

|

|

|

|

Net realized gain

|

—

|

|

(0.25)

|

|

—

|

|

—

|

|

—

|

|

—

|

|

Return of capital

|

(0.45)

|

|

(0.65)

|

|

(1.20)

|

|

(1.26)

|

|

(1.26)

|

|

(1.22)

|

|

Total distributions paid to Common Shareholders

|

(0.45)

|

|

(0.90)

|

|

(1.20)

|

|

(1.26)

|

|

(1.26)

|

|

(1.22)

|

|

Common Shares offering costs charged to paid-in capital

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

0.00 (b)

|

|

Premiums from shares sold in at the market offering

|

—

|

|

—

|

|

—

|

|

0.01

|

|

0.00 (b)

|

|

—

|

|

Net asset value, end of period

|

$5.30

|

|

$9.41

|

|

$9.43

|

|

$11.95

|

|

$12.92

|

|

$14.63

|

|

Market value, end of period

|

$4.71

|

|

$8.66

|

|

$8.65

|

|

$11.91

|

|

$12.81

|

|

$13.86

|

|

Total return based on net asset value (c)

|

(39.67)%

|

|

10.34% (a)

|

|

(11.66)% (a)

|

|

1.99%

|

|

(1.54)% (a)

|

|

(22.78)%

|

|

Total return based on market value (c)

|

(41.74)%

|

|

10.70%

|

|

(18.70)%

|

|

2.52%

|

|

3.04%

|

|

(16.75)%

|

|

Net assets, end of period (in 000’s)

|

$ 136,326

|

|

$ 241,815

|

|

$ 242,226

|

|

$ 300,916

|

|

$ 307,919

|

|

$ 347,550

|

|

Portfolio turnover rate

|

50%

|

|

74%

|

|

64%

|

|

50%

|

|

68%

|

|

45%

|

|

Ratios of expenses to average net assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

Including current and deferred income taxes (d)

|

7.61% (e) (f)

|

|

2.89%

|

|

2.81%

|

|

2.71%

|

|

2.38%

|

|

(2.93)%

|

|

Excluding current and deferred income taxes

|

7.60% (e) (f)

|

|

2.86%

|

|

2.79%

|

|

2.70%

|

|

2.65%

|

|

2.24%

|

|

Excluding current and deferred income taxes and interest expense

|

1.61% (e)

|

|

1.58%

|

|

1.57%

|

|

1.58%

|

|

1.54%

|

|

1.50%

|

|

Ratios of net investment income (loss) to average net assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income (loss) ratio before tax expenses

|

(3.39)% (e) (f)

|

|

(0.90)%

|

|

(0.40)%

|

|

(0.67)%

|

|

(0.87)%

|

|

0.15%

|

|

Net investment income (loss) ratio including tax expenses (d)

|

(3.40)% (e) (f)

|

|

(0.93)%

|

|

(0.41)%

|

|

(0.68)%

|

|

(0.60)%

|

|

5.32%

|

|

Indebtedness:

|

|

|

|

|

|

|

|

|

|

|

|

|

Total loan outstanding (in 000’s)

|

$ 23,900

|

|

$ 89,000

|

|

$ 87,500

|

|

$ 106,500

|

|

$ 104,500

|

|

$ 128,000

|

|

Asset coverage per $1,000 of indebtedness (g)

|

$ 6,704

|

|

$ 3,717

|

|

$ 3,768

|

|

$ 3,826

|

|

$ 3,947

|

|

$ 3,715

|

|

(a)

|

During the fiscal years ended October 31, 2019, 2018 and 2016, the Fund received reimbursements from the sub-advisor in the amounts of $228, $12,533 and $5,716, respectively, in

connection with trade errors, which represent less than $0.01 per share. Since the sub-advisor reimbursed the Fund, there was no effect on the Fund’s total return.

|

|

(b)

|

Amount represents less than $0.01 per share.

|

|

(c)

|

Total return is based on the combination of reinvested dividend, capital gain and return of capital distributions, if any, at prices obtained by the Dividend Reinvestment Plan, and

changes in net asset value per share for net asset value returns and changes in Common Share Price for market value returns. Total returns do not reflect sales load and are not annualized for periods of less than one

year. Past performance is not indicative of future results.

|

|

(d)

|

Includes current and deferred income taxes associated with each component of the Statement of Operations.

|

|

(e)

|

Annualized.

|

|

(f)

|

This ratio includes breakage fees. If breakage fees had not been included, these expense ratios would have been 4.63% lower and the net investment income ratios would have been 4.63%

higher. See Note 6 - Borrowings in the Notes to Financial Statements for additional information.

|

|

(g)

|

Calculated by subtracting the Fund’s total liabilities (not including the loan outstanding) from the Fund’s total assets, and dividing by the

outstanding loan balance in 000’s.

|

See Notes to Financial Statements

Page 11

Notes to Financial Statements

First Trust New

Opportunities MLP & Energy Fund (FPL)

April 30, 2020

(Unaudited)

1. Organization

First Trust New

Opportunities MLP & Energy Fund (the “Fund”) is a non-diversified, closed-end management investment company organized as a Massachusetts business trust on October 15, 2013, and is registered with the

Securities and Exchange Commission under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund trades under the ticker symbol “FPL” on the New York Stock Exchange

(“NYSE”).

The Fund’s

investment objective is to seek a high level of total return with an emphasis on current distributions paid to common shareholders. The Fund seeks to provide its Common Shareholders with a vehicle to invest in a

portfolio of cash-generating securities, with a focus on investing in publicly-traded master limited partnerships (“MLPs”), MLP-related entities and other companies in the energy sector and energy utility

industries that are weighted towards non-cyclical, fee-for-service revenues. Under normal market conditions, the Fund will invest at least 85% of its managed assets in equity and debt securities of MLPs, MLP-related

entities and other energy sector and energy utilities companies that the Fund’s Sub-Advisor believes offer opportunities for growth and income. There can be no assurance that the Fund will achieve its investment

objective. The Fund may not be appropriate for all investors.

2. Significant

Accounting Policies

The Fund is considered an

investment company and follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, “Financial Services-Investment

Companies.” The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. The preparation of the financial statements in

accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures

in the financial statements. Actual results could differ from those estimates.

A. Portfolio

Valuation

The net asset value

(“NAV”) of the Common Shares of the Fund is determined daily as of the close of regular trading on the NYSE, normally 4:00 p.m. Eastern time, on each day the NYSE is open for trading. If the NYSE closes

early on a valuation day, the NAV is determined as of that time. Foreign securities are priced using data reflecting the earlier closing of the principal markets for those securities. The Fund’s NAV per Common

Share is calculated by dividing the value of all assets of the Fund (including accrued interest and dividends), less all liabilities (including accrued expenses, the value of call options written (sold), dividends

declared but unpaid, deferred income taxes and any borrowings of the Fund), by the total number of Common Shares outstanding.

The Fund’s

investments are valued daily at market value or, in the absence of market value with respect to any portfolio securities, at fair value. Market value prices represent last sale or official closing prices from a

national or foreign exchange (i.e., a regulated market) and are primarily obtained from third-party pricing services. Fair value prices represent any prices not considered market value prices and are either obtained

from a third-party pricing service or are determined by the Pricing Committee of the Fund’s investment advisor, First Trust Advisors L.P. (“First Trust” or the “Advisor”), in accordance

with valuation procedures adopted by the Fund’s Board of Trustees, and in accordance with provisions of the 1940 Act. Investments valued by the Advisor’s Pricing Committee, if any, are footnoted as such in

the footnotes to the Portfolio of Investments. The Fund’s investments are valued as follows:

Common

stocks, real estate investment trusts, MLPs, and other equity securities listed on any national or foreign exchange (excluding The Nasdaq Stock Market LLC (“Nasdaq”) and the London Stock Exchange

Alternative Investment Market (“AIM”)) are valued at the last sale price on the exchange on which they are principally traded or, for Nasdaq and AIM securities, the official closing price. Securities

traded on more than one securities exchange are valued at the last sale price or official closing price, as applicable, at the close of the securities exchange representing the principal market for such securities.

Exchange-traded options contracts are valued at the closing price in the market where such contracts are principally traded. If no closing price is available, exchange-traded options contracts are fair valued at the

mean of their most recent bid and asked price, if available, and otherwise at their closing bid price. Over-the-counter options contracts are fair valued at the mean of their most recent bid and asked price, if

available, and otherwise at their closing bid price.

Securities traded in an over-the-counter market are fair valued at the mean of their most recent bid and asked price, if available, and otherwise at their closing bid price.

Certain securities may

not be able to be priced by pre-established pricing methods. Such securities may be valued by the Fund’s Board of Trustees or its delegate, the Advisor’s Pricing Committee, at fair value. These securities

generally include, but are not limited to, restricted securities (securities which may not be publicly sold without registration under the Securities Act of 1933, as amended (the “1933 Act”)) for which a

third-party pricing service is unable to provide a market price; securities whose trading has been formally suspended; a security whose market or fair value price is not available from a pre-established pricing source;

a security with respect to which an event has occurred that is likely to materially affect the value of the security after the market has closed but before the

Notes to Financial Statements (Continued)

First Trust New

Opportunities MLP & Energy Fund (FPL)

April 30, 2020

(Unaudited)

calculation of the Fund’s NAV or

make it difficult or impossible to obtain a reliable market quotation; and a security whose price, as provided by the third-party pricing service, does not reflect the security’s fair value. As a general

principle, the current fair value of a security would appear to be the amount which the owner might reasonably expect to receive for the security upon its current sale. When fair value prices are used, generally they

will differ from market quotations or official closing prices on the applicable exchanges. A variety of factors may be considered in determining the fair value of such securities, including, but not limited to, the

following:

|

1)

|

the type of security;

|

|

2)

|

the size of the holding;

|

|

3)

|

the initial cost of the security;

|

|

4)

|

transactions in comparable securities;

|

|

5)

|

price quotes from dealers and/or third-party pricing services;

|

|

6)

|

relationships among various securities;

|

|

7)

|

information obtained by contacting the issuer, analysts, or the appropriate stock exchange;

|

|

8)

|

an analysis of the issuer’s financial statements; and

|

|

9)

|

the existence of merger proposals or tender offers that might affect the value of the security.

|

If the securities in

question are foreign securities, the following additional information may be considered:

|

1)

|

the value of similar foreign securities traded on other foreign markets;

|

|

2)

|

ADR trading of similar securities;

|

|

3)

|

closed-end fund or exchange-traded fund trading of similar securities;

|

|

4)

|

foreign currency exchange activity;

|

|

5)

|

the trading prices of financial products that are tied to baskets of foreign securities;

|

|

6)

|

factors relating to the event that precipitated the pricing problem;

|

|

7)

|

whether the event is likely to recur; and

|

|

8)

|

whether the effects of the event are isolated or whether they affect entire markets, countries or regions.

|

The Fund is subject to

fair value accounting standards that define fair value, establish the framework for measuring fair value and provide a three-level hierarchy for fair valuation based upon the inputs to the valuation as of the

measurement date. The three levels of the fair value hierarchy are as follows:

|

•

|

Level 1 – Level 1 inputs are quoted prices in active markets for identical investments. An active market is a market in which transactions for the investment occur with sufficient frequency and

volume to provide pricing information on an ongoing basis.

|

|

•

|

Level 2 – Level 2 inputs are observable inputs, either directly or indirectly, and include the following:

|

|

o

|

Quoted prices for similar investments in active markets.

|

|

o

|

Quoted prices for identical or similar investments in markets that are non-active. A non-active market is a market where there are few transactions for the investment, the prices are not current, or

price quotations vary substantially either over time or among market makers, or in which little information is released publicly.

|

|

o

|

Inputs other than quoted prices that are observable for the investment (for example, interest rates and yield curves observable at commonly quoted intervals, volatilities, prepayment speeds, loss

severities, credit risks, and default rates).

|

|

o

|

Inputs that are derived principally from or corroborated by observable market data by correlation or other means.

|

|

•

|

Level 3 – Level 3 inputs are unobservable inputs. Unobservable inputs may reflect the reporting entity’s own assumptions about the assumptions that market participants would use in pricing

the investment.

|

The inputs or

methodologies used for valuing investments are not necessarily an indication of the risk associated with investing in those investments. A summary of the inputs used to value the Fund’s investments as of April

30, 2020, is included with the Fund’s Portfolio of Investments.

B. Option

Contracts

The Fund is subject to

equity price risk in the normal course of pursuing its investment objective and may write (sell) options to hedge against changes in the value of equities. Also, the Fund seeks to generate additional income, in the

form of premiums received, from writing (selling) the options. The Fund may write (sell) covered call or put options (“options”) on all or a portion of the MLPs and common stocks held in the Fund’s

portfolio as determined to be appropriate by the Sub-Advisor. The number of options the Fund can

Notes to Financial Statements (Continued)

First Trust New

Opportunities MLP & Energy Fund (FPL)

April 30, 2020

(Unaudited)

write (sell) is limited by the amount of

MLPs and common stocks the Fund holds in its portfolio. The Fund will not write (sell) “naked” or uncovered options. When the Fund writes (sells) an option, an amount equal to the premium received by the

Fund is included in “Options written, at value” on the Fund’s Statement of Assets and Liabilities. Options are marked-to-market daily and their value will be affected by changes in the value and

dividend rates of the underlying equity securities, changes in interest rates, changes in the actual or perceived volatility of the securities markets and the underlying equity securities and the remaining time to the

options’ expiration. The value of options may also be adversely affected if the market for the options becomes less liquid or trading volume diminishes.

The options that the Fund

writes (sells) will either be exercised, expire or be canceled pursuant to a closing transaction. If the price of the underlying equity security exceeds the option’s exercise price, it is likely that the option

holder will exercise the option. If an option written (sold) by the Fund is exercised, the Fund would be obligated to deliver the underlying equity security to the option holder upon payment of the strike price. In

this case, the option premium received by the Fund will be added to the amount realized on the sale of the underlying security for purposes of determining gain or loss and is included in “Net realized gain

(loss) before taxes on investments” on the Statement of Operations. If the price of the underlying equity security is less than the option’s strike price, the option will likely expire without being

exercised. The option premium received by the Fund will, in this case, be treated as short-term capital gain on the expiration date of the option. The Fund may also elect to close out its position in an option prior

to its expiration by purchasing an option of the same series as the option written (sold) by the Fund. Gain or loss on options is presented separately as “Net realized gain (loss) before taxes on written

options” on the Statement of Operations.

The options that the Fund

writes (sells) give the option holder the right, but not the obligation, to purchase a security from the Fund at the strike price on or prior to the option’s expiration date. The ability to successfully

implement the writing (selling) of covered call options depends on the ability of the Sub-Advisor to predict pertinent market movements, which cannot be assured. Thus, the use of options may require the Fund to sell

portfolio securities at inopportune times or for prices other than current market value, which may limit the amount of appreciation the Fund can realize on an investment, or may cause the Fund to hold a security that

it might otherwise sell. As the writer (seller) of a covered option, the Fund foregoes, during the option’s life, the opportunity to profit from increases in the market value of the security covering the option

above the sum of the premium and the strike price of the option, but has retained the risk of loss should the price of the underlying security decline. The writer (seller) of an option has no control over the time

when it may be required to fulfill its obligation as a writer (seller) of the option. Once an option writer (seller) has received an exercise notice, it cannot effect a closing purchase transaction in order to

terminate its obligation under the option and must deliver the underlying security to the option holder at the exercise price.

Over-the-counter options

have the risk of the potential inability of counterparties to meet the terms of their contracts. The Fund’s maximum equity price risk for purchased options is limited to the premium initially paid. In addition,

certain risks may arise upon entering into option contracts including the risk that an illiquid secondary market will limit the Fund’s ability to close out an option contract prior to the expiration date and

that a change in the value of the option contract may not correlate exactly with changes in the value of the securities hedged.

C. Securities

Transactions and Investment Income

Securities transactions

are recorded as of the trade date. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recorded on the ex-dividend date. Interest income is recorded

daily on the accrual basis, including amortization of premiums and accretion of discounts. The Fund will rely to some extent on information provided by the MLPs, which is not necessarily timely, to estimate taxable

income allocable to the MLP units held in the Fund’s portfolio and to estimate the associated deferred tax asset or liability. From time to time, the Fund will modify its estimates and/or assumptions regarding

its deferred tax liability as new information becomes available. To the extent the Fund modifies its estimates and/or assumptions, the NAV of the Fund will likely fluctuate.

Distributions received

from the Fund’s investments in MLPs generally are comprised of return of capital and investment income. The Fund records estimated return of capital and investment income based on historical information

available from each MLP. These estimates may subsequently be revised based on information received from the MLPs after their tax reporting periods are concluded.

In July 2017, the

Financial Conduct Authority (“FCA”) announced that it will no longer persuade or compel banks to submit rates for the calculations of the London Interbank Offered Rates (“LIBOR”) after 2021.

Further, the FCA has subsequently stated, as recently as March 2020, that the central assumption continues to be that firms should not rely on LIBOR being published after the end of 2021.

In the United States, the

Alternative Reference Rates Committee (the “ARRC”), a group of market participants convened by the Board of Governors of the Federal Reserve System and the Federal Reserve Bank of New York in cooperation

with other federal and state government agencies, has since 2014 undertaken efforts to identify U.S. dollar reference interest rates as alternatives to LIBOR and to facilitate the mitigation of LIBOR-related risks. In

June 2017, the ARRC identified the Secured Overnight Financing Rate (“SOFR”),

Notes to Financial Statements (Continued)

First Trust New

Opportunities MLP & Energy Fund (FPL)

April 30, 2020

(Unaudited)

a broad measure of the cost of cash

overnight borrowing collateralized by U.S. Treasury securities, as the preferred alternative for U.S. dollar LIBOR. The Federal Reserve Bank of New York began daily publishing of SOFR in April 2018.

At this time, it is not

possible to predict the full impact of the elimination of LIBOR and the establishment of an alternative reference rate on the Fund or its investments.

D. Foreign

Currency

The books and records of

the Fund are maintained in U.S. dollars. Foreign currencies, investments and other assets and liabilities are translated into U.S. dollars at the exchange rates prevailing at the end of the period. Purchases and sales

of investments and items of income and expense are translated on the respective dates of such transactions. Unrealized gains and losses on assets and liabilities, other than investments in securities, which result

from changes in foreign currency exchange rates have been included in “Net change in unrealized appreciation (depreciation) before taxes on foreign currency translation” on the Statement of Operations.

Unrealized gains and losses on investments in securities which result from changes in foreign exchange rates are included with fluctuations arising from changes in market price and are included in “Net change in

unrealized appreciation (depreciation) before taxes on investments” on the Statement of Operations. Net realized foreign currency gains and losses include the effect of changes in exchange rates between trade

date and settlement date on investment security transactions, foreign currency transactions and interest and dividends received and are included in “Net realized gain (loss) before taxes on foreign currency