Current Report Filing (8-k)

July 02 2020 - 5:33PM

Edgar (US Regulatory)

false00012979960001494877MDMDCA 0001297996 2020-07-02 2020-07-02 0001297996 dlr:DigitalRealtyTrustLPMember 2020-07-02 2020-07-02 0001297996 us-gaap:CommonStockMember 2020-07-02 2020-07-02 0001297996 us-gaap:SeriesCPreferredStockMember 2020-07-02 2020-07-02 0001297996 us-gaap:SeriesGPreferredStockMember 2020-07-02 2020-07-02 0001297996 dlr:SeriesIPreferredStockMember 2020-07-02 2020-07-02 0001297996 dlr:SeriesJPreferredStockMember 2020-07-02 2020-07-02 0001297996 dlr:SeriesKPreferredStockMember 2020-07-02 2020-07-02 0001297996 dlr:SeriesLPreferredStockMember 2020-07-02 2020-07-02

SECURITIES AND EXCHANGE COMMISSION

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 2, 2020

DIGITAL REALTY TRUST, INC.

DIGITAL REALTY TRUST, L.P.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(State or other jurisdiction

|

|

|

|

|

|

|

|

|

Four Embarcadero Center, Suite 3200

San Francisco, California

|

|

|

(Address of principal executive offices)

|

|

|

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series C Cumulative Redeemable Perpetual Preferred Stock

|

|

|

|

|

Series G Cumulative Redeemable Preferred Stock

|

|

|

|

|

Series I Cumulative Redeemable Preferred Stock

|

|

|

|

|

Series J Cumulative Redeemable Preferred Stock

|

|

|

|

|

Series K Cumulative Redeemable Preferred Stock

Series L Cumulative Redeemable Preferred Stock

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934 (§

240.12b-2

of this chapter).

|

|

|

|

Digital Realty Trust, Inc.:

|

|

Emerging growth company

☐

|

|

|

|

|

Digital Realty Trust, L.P.:

|

|

Emerging growth company

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Digital Realty Trust, Inc.:

☐

Digital Realty Trust, L.P.:

☐

Unless otherwise indicated or unless the context requires otherwise, all references in this report to “we,” “us,” “our,” “our company,” “the company” or “Digital Realty” refer to Digital Realty Trust, Inc., together with its consolidated subsidiaries, including Digital Realty Trust, L.P., our “operating partnership.”

On July 2, 2020, Digital Realty announced that its operating partnership has elected to redeem the $300 million aggregate principal amount outstanding of its 3.625% Notes due 2022 (the “3.625% Notes”) and the $500 million aggregate principal amount outstanding of its 3.950% Notes due 2022 (the “3.950% Notes,” and, together with the 3.625% Notes, the “Notes”) on August 3, 2020 (the “Redemption Date”). The redemption price for the 3.625% Notes is equal to the sum of (a) $1,060.018 per $1,000 principal amount of the 3.625% Notes, or 106.0018% of the aggregate principal amount of the 3.625% Notes, plus (b) accrued and unpaid interest to, but excluding, the Redemption Date equal to $12.285 per $1,000 principal amount of the 3.625% Notes. The redemption price for the 3.950% Notes is equal to the sum of (a) $1,060.306 per $1,000 principal amount of the 3.950% Notes, or 106.0306% of the aggregate principal amount of the 3.950% Notes, plus (b) accrued and unpaid interest to, but excluding, the Redemption Date equal to $3.511 per $1,000 principal amount of the 3.950% Notes.

Wells Fargo Bank, National Association, as trustee for each of the 3.625% Notes and the 3.950% Notes, issued notices to registered holders of the 3.625% Notes and the 3.950% Notes, respectively, concerning the redemptions. After such redemptions, no Notes will remain outstanding. The foregoing does not constitute a notice of redemption with respect to the Notes.

A copy of the press release, dated July 2, 2020, announcing the redemptions is attached hereto as Exhibit 99.1 and is incorporated in this Item 8.01 by this reference.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form

8-K

contains certain “forward-looking” statements as that term is defined by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements that are predictive in nature, that depend on or relate to future events or conditions, or that include words such as “believes”, “anticipates”, “expects”, “may”, “will”, “would”, “should”, “estimates”, “could”, “intends”, “plans” or other similar expressions are forward-looking statements. Forward-looking statements involve significant known and unknown risks and uncertainties that may cause the company’s actual results in future periods to differ materially from those projected or contemplated in the forward-looking statements as a result of, but not limited to, the following factors: timing and consummation of the redemption of Notes; risks and uncertainties related to market conditions and satisfaction of customary closing conditions related to the redemption of Notes; and the impact of legislative, regulatory and competitive changes and other risk factors relating to the industries in which we operate, as detailed from time to time in each of our reports filed with the SEC. There can be no assurance that the proposed transactions will be consummated on the terms described herein or at all.

The risks included here are not exhaustive, and additional factors could adversely affect our business and financial performance. We discussed a number of additional material risks in our annual report on Form

10-K

for the year ended December 31, 2019, our quarterly report on Form

10-Q

for the quarter ended March 31, 2020 and other filings with the Securities and Exchange Commission. Those risks continue to be relevant to our performance and financial condition. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time and it is not possible for management to predict all such risk factors, nor can it assess the impact of all such risk factors on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We expressly disclaim any responsibility to update forward-looking statements, whether as a result of new information, future events or otherwise.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Digital Realty Trust, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Executive Vice President, General Counsel and Secretary

|

|

|

|

|

|

|

|

Digital Realty Trust, L.P.

|

|

|

|

|

|

|

|

Digital Realty Trust, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Executive Vice President, General Counsel and Secretary

|

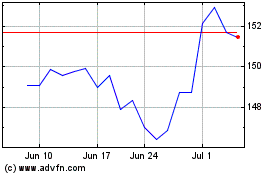

Digital Realty (NYSE:DLR)

Historical Stock Chart

From Mar 2024 to Apr 2024

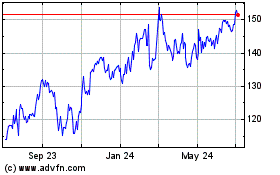

Digital Realty (NYSE:DLR)

Historical Stock Chart

From Apr 2023 to Apr 2024