July 1, 2020

Quarterly Report Under Section 13 or 15(d) of

The Securities Exchange Act of 1934

Commission File Number 333-65069

EXACT NAME as this appears in our Charter: Access-Power, Inc.

YEAR: 1996

STATE OF INC: FLORIDA

QUARTERLY REPORT PERIOD ENDING: June 30, 2020

I.R.S. Employer Identification No. 59-3420985

PO BOX 598

Grand Haven, MI 49417

(Address of principal executive office) (Zip Code)

Issuer's telephone number, including area code: (616) 312-5390

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

/X/ Quarterly Report Under Section 13 or 15(d) of

The Securities Exchange Act of 1934

For the Quarterly Period Ended June 30, 2020

/_/ Transition Report Under Section 13 or 15(d) of The Exchange Act

Commission File Number 333-65069

Access-Power, Inc.

(Exact Name of Small Business Issuer as Specified in its Charter)

Florida 59-3420985

(State or other jurisdiction of

(State or other jurisdiction of

|

Corporation or organization) (I.R.S. Employer Identification No.)

17164 Dune View Drive Apt 106, Grand Haven MI 49417

(Address of principal executive office) (Zip Code)

|

Issuer's telephone number, including area code: (616)312-5390

Transitional Small Business Disclosure Format (check one): Yes __ No X

Smaller Reporting Company: Yes X NO ___

Emerging Growth Company: Yes X NO ___

Indicate whether registrant is a shell company: Yes ___ NO X

MOST RECENT CLOSING PRICE $.0048 PER SHARE.

On October 18, 2019, we started trading in the PINK NO INFORMATION

tier of OTC Markets.

As of July 1, 2020, the Company is in advanced talks to go PINK CURRENT tier

within OTC Markets, and our expectation is within 30 days from the date of this

filing.

AS OF THE CLOSE OF BUSINESS JUNE 30, 2020, THE AGGREGATE MARKET

CAPITALIZATION ON A FULLY DILUTED BASIS IS $1,440,00

BASED ON A CLOSING PRICE OF $.0048 PER SHARE.

My Dear Shareholders and the Commissioners of the SEC,

Access-Power & Co., Inc. a fixed DTC float Company with 98,376,146 shares.

We only have 1 Director with the Company since March 1, 2012. We have had

a long road of being victimized pre-2012. We were victims of a criminal toxic

floorless convertible debenture, which diluted and murdered our common stock

via our Transfer Agent. We have had the same Transfer Agent since May

1997, and our TA is SEC registered.

WE ONLY HAVE COMMON STOCK IN OUR SHARE STRUCTURE.

Our Share Structure remains:

AUTHORIZED 300,000,000 common shares

OUTSTANDING 300,000,000 common shares

PATRICK RESTRICTED 186,984,379 common shares or 62.3281% of VOTE

DTC CLEAR FLOAT 98,376,146 common shares held since 3/1/2012

|

https://www.otcmarkets.com/stock/ACCR/security

As of July 1, 2020 ----> we are in final discussions to be upgraded to PINK

CURRENT tier within OTC MARKETs, and the RED STOP SIGN will be

removed and replaced with a new PINK CURRENT logo. This has been a long

road for my Shareholders.

Our Corporation lives forever here:

http://www.sunbiz.org

A NEW EXECUTIVE MANAGEMENT TEAM IS VERBALLY ON BOARD.

As of July 1, 2020, we have $12,670.00 in our Premiere Checking account now.

We have 2 premiere checking accounts located within the US and

are FDIC Insured. CASH IS KING in today's market.

We plan to find a MARKET MAKER to file our FORM 211 with FINRA.

PATRICK

Part I. Financial Information

Item 1. Financial Statements

ACCESS-POWER, INC.

(An Emerging Growth Company)

Balance Sheets Comps Assets

March 31, June 30,

2020 2020

------------------------- --------------

(unaudited)

Current assets:

Cash $ 1,205.61 $12,670.00

CDs

Accounts receivable $ 0 $ 0

Prepaid expenses $1,500.00 $3,000.00

----------------------------- ------------

Total current assets $ $ 2,638.73 $15,670.00

--------------------------------------

Property and equipment, net $ 0 $ 1,000

Other assets $ 0 $ 0

---------------------------------------------------------

Total assets $ 2,638.73 $15,670.00

===================================

Liabilities and

Stockholders' Equity

(Deficit)

Current liabilities:

Accounts payable and accrued

expenses $2,000.00 $ 0

Current portion of long-term debt -

Total current liabilities $ 0 $ 0

Convertible debentures $ 0 $ 0

Total liabilities $2,000.00 $ 0

----------------------------------

Stockholders' equity

(deficit):

Common stock,

$.001 par value,

authorized

300,000,000 shares issues

=================================

Total liabilities

and stockholders'

|

equity (deficit) $300,000,000.00 $244,144.12

ACCESS-POWER, INC

CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS (unaudited)

THREE MONTHS ENDED June 30 , 2020:

CASH FLOW

CASH REVENUE $ 11,370.50

COST OF REVENUE $ 0

---------------------------------------------------------------------------

GROSS PROFIT (LOSS) $ 11,370.00

|

OPERATING EXPENSES

Selling, general and administrative exp rent, and utilities $ 0.00

Consulting fees $ 0.00

Professional fees and related expenses $ 11,370.00

TOTAL OPERATING EXPENSES $ 0.00

Salaries $ 9,000.00

Fair value of derivative liability $ 0.00

OTHER INCOME nonrecurring $ 0.00

Gain on debt extinguishment $ 0.00

(LOSS) INCOME BEFORE PROVISION FOR $ 0.00

INCOME TAXES $ 11,370.00

PROVISION FOR INCOME TAXES

treated as prepaid expense on

balance sheet $ 0.00

NET (LOSS) INCOME $ 20,370.00

BASIC (LOSS) INCOME PER SHARE

DILUTED (LOSS) INCOME PER SHARE $ 0.12

WEIGHTED AVERAGE COMMON SHARES

OUTSTANDING BASIC 300,000,000 shares

RESTRICTED SHARES 201,625,854 shares

ESTIMATED FLOAT LESS THAN 98,376,146 shares

/s/

Patrick J Jensen

|

FUTURE EDGAR FILINGS WILL BE DONE BY THE NEW

EXECUTIVE MANAGEMENT TEAM COMING IN.....

Item 2. MANAGEMENT'S DISCUSSION AND ANALYSIS

Overview and Plan of Operation

OIL REVENUES TO BE DERIVED BY EMERGING MARKETS

COUNTRIES HAS CHANGED FOREVER. PATRICK HAS

NOT YET CLOSED ON PROMISED $50,000.00 CAPITAL

DONATION FOR THIS PINK CURRENT TO BE COMPANY.

Business Overview

ACCR will come back. We have multiple business segments.

I have a dream:

http://tsdr.uspto.gov/#caseNumber=88690325&caseType=

SERIAL_NO&searchType=statusSearch

ACCR is not currently offering any stock for sale.

Any stock to be purchased is available in the open market.

We are current in our obligation to report with the SEC. We plan to

file a FORM 10 with re-done 10Ks for 2018 and 2019 from a

PCAOB auditor. We are in final talks in receicing our ENGAGEMENT

LETTER. We have conference called our prospective PCAOB

auditor with the SEC's Chief Accountant's Office of the Division of

Corporate Finance at the SEC.

We want all partied involved to become comfortable.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings

NONE.

Item 2. Changes in Securities and Use of Proceeds

NONE.

ILLUSTRATIVE PURPOSES BELOW:

At $.0001 BID, the entire value of the Company shares on a fully

diluted basis is: $30,000.00

At $.001 BID, the entire value of the Company shares on a fully

diluted basis is: $300,000.00

At $.01 BID, the entire value of the Company shares on a fully

diluted basis is: $3,000,000.00

At $.06 BID, the entire value of the Company shares on a fully

diluted basis is: $30,000,000.00

at $.100 BID the entire value of the Company shares on a fully

diluted basis is: $300,000,000.00

Management will make informed well processed decisions, and management

will succeed, as failure is not an option.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

There is no current risk with management. Everything is under control.

**********

Item 4. Controls and Procedures

Access-Power & Co., Inc. will FOREVER employ good management

decision making.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings

NONE

**********

Item 1A. Risk Factors

MANY

**********

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

NONE

**********

Item 3. Defaults Upon Senior Securities

NONE

**********

Item 4. Other Information

NONE.

**********

Item 5. Exhibits

(a) No Exhibits are being filed.

My contact information is:

pjensen@myaccess-power.com

616-312-5390

Our comeback song is, and be prepared for an

INCREDIBLE comeback soon:

The NEW INCOMING EXECUTIVE MANAGEMENT TEAM

will make all the day to day decision making for the Corporation.

Once the FORM 10 with the last 2 years of audited financials from

our Company IF APPROVED BY THE SEC, will bring fully

compliant our Company withing all aspects of the Securities Act of

'33 and the Exchange Act of '34.

May GOD BLESS my new incoming management team.

We just have a verbal commitment, and I believe in them.

https://www.youtube.com/watch?v=xbhCPt6PZIU

Access-Power, Inc. was the victim of naked convertible short selling.

This is the reason why we have a RED STOP SIGN at OTC

MARKETS.COM, and I am planning on getting rid of this very soon.

There is NO DILUTION PERIOD in Access-Power, INC.

I have a vision to do this merger. It has been my dream

to do this. I will do this. Why? This is a perfect time for a

classic reverse merger as an alternative

re-IPO process. I believe in myself,

Respectfully yours,

PATRICK

SIGNATURES*

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on

its behalf by the undersigned thereunto duly authorized.

In accordance with the requirements of the Exchange Act, the Company

caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

ACCESS-POWER, INC.

BY:

/s/

Patrick J. Jensen

Director

July 1, 2020

|

The Sarbanes-Oxley Act of 2002 protects investors in publicly traded

companies by requiring employees to improve the "accuracy and reliability

of corporate disclosures, according to SOX-Online's Sarbanes-Oxley

Information Center. SOX defines individual accountability and requires

employees to practice due diligence and outlines criminal and

financial penalties for specific misconduct.

There are various risk factors that should be carefully considered in

evaluating our business; because such factors may have a significant impact

on our business, our operating results, our liquidity and financial condition.

As a result of these various risk factors, actual results could differ

materially from those projected in any forward-looking statements.

Additional risks and uncertainties not presently known to us, or that

we currently consider to be immaterial, may also impact our business, result

of operations, liquidity and financial condition. If any such risks occur,

our business, its operating results, liquidity and financial condition

could be materially affected in an adverse manner. Under such circumstances,

if a stable trading market for our securities is established, the trading price

of our securities could decline, and you may lose all or part of your

investment.

SECURITIES ISSUED BY THE COMPANY INVOLVE A HIGH DEGREE

OF RISK AND, THEREFORE, SHOULD BE CONSIDERED EXTREMELY

SPECULATIVE. THEY SHOULD NOT BE PURCHASED BY PERSONS

WHO CANNOT AFFORD THE POSSIBILITY OF THE LOSS OF THE

ENTIRE INVESTMENT. PROSPECTIVE INVESTORS SHOULD READ

ALL OF THE COMPANY'S FILINGS, INCLUDING ALL EXHIBITS, AND

CAREFULLY CONSIDER, AMONG OTHER FACTORS THE VARIOUS

RISK FACTORS THAT MAY BE PRESENT.

You should be aware that there are many substantial risks to an investment in

our common stock. Carefully consider these risk factors, along with any

available information currently reported by the Company

(of which there are note), before you decide to invest in shares of

our common stock.

If these risk factors were to occur, our business, financial condition, results

of operations or future prospects could be materially adversely affected.

If that happens, the market price for our common stock, if any,

could decline, and prospective investors would likely lose all or

even part of their investment.

Cautionary Language Concerning Forward-Looking Statements

Statements in this press release may be "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act of 1995.

Words such as "anticipate", "believe", "estimate", "expect", "intend", and

similar expressions, as they relate to the Company or its management,

identify forward-looking statements. These statements are based on

current expectations, estimates, and projections about the Company's

business, based, in part, on assumptions made by management. These

statements are not guarantees of future performance and involve risks,

uncertainties, and assumptions that are difficult to predict.

Therefore, actual outcomes and results may, and probably will, differ

materially from what is expressed or forecasted in such forward-looking

statements due to numerous factors.

Contact Information:

Patrick J. Jensen

Director

Tel: 616.312.5390

Email: pjensen@myaccess-power.com

Corporate Website: http://www.myaccess-power.com

Access-Power & Co., Inc.

OTC Ticker: ACCR

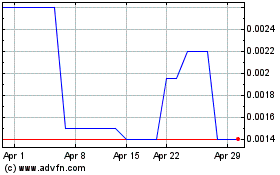

Access Power & (PK) (USOTC:ACCR)

Historical Stock Chart

From Mar 2024 to Apr 2024

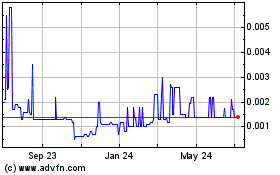

Access Power & (PK) (USOTC:ACCR)

Historical Stock Chart

From Apr 2023 to Apr 2024