Current Report Filing (8-k)

June 30 2020 - 6:37AM

Edgar (US Regulatory)

0001253986

false

0001253986

2020-06-24

2020-06-25

0001253986

abr:CommonStockParValue0.01PerShareMember

2020-06-24

2020-06-25

0001253986

abr:PreferredStock8.25SeriesCumulativeRedeemableParValue0.01PerShareMember

2020-06-24

2020-06-25

0001253986

abr:PreferredStock7.75SeriesBCumulativeRedeemableParValue0.01PerShareMember

2020-06-24

2020-06-25

0001253986

abr:PreferredStock8.50SeriesCCumulativeRedeemableParValue0.01PerShareMember

2020-06-24

2020-06-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 25, 2020

Arbor Realty Trust, Inc.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN

ITS CHARTER)

maryland

(STATE OF INCORPORATION)

|

001-32136

|

20-0057959

|

|

(COMMISSION FILE NUMBER)

|

(IRS EMPLOYER ID. NUMBER)

|

|

333 Earle Ovington Boulevard, Suite 900

|

|

|

Uniondale, New York

|

11553

|

|

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

|

(ZIP CODE)

|

(516) 506-4200

(REGISTRANT’S TELEPHONE NUMBER, INCLUDING

AREA CODE)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

|

ABR

|

|

New York Stock Exchange

|

|

Preferred Stock, 8.25% Series A Cumulative Redeemable, par value $0.01 per share

|

|

ABR-PA

|

|

New York Stock Exchange

|

|

Preferred Stock, 7.75% Series B Cumulative Redeemable, par value $0.01 per share

|

|

ABR-PB

|

|

New York Stock Exchange

|

|

Preferred Stock, 8.50% Series C Cumulative Redeemable, par value $0.01 per share

|

|

ABR-PC

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.03. Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information included in Item 8.01 below

is incorporated by reference into this Item 2.03.

Item 8.01 Other

Events.

8.00% Senior Notes due 2023

On June 25, 2020, Arbor Realty Trust, Inc.,

a Maryland corporation (the “Company”), completed the issuance and sale of $30,250,000 aggregate principal amount of

its 8.00% Senior Notes due 2023 (the “Reopened Notes”) pursuant to an Amended and Restated Note Purchase Agreement

(the “Purchase Agreement”), by and among the Company, Arbor Realty Limited Partnership, a Delaware limited partnership,

and the purchasers named therein, whereby the Company agreed to sell to certain purchasers and such purchasers agreed to purchase

from the Company, subject to and upon the terms and conditions set forth in the Purchase Agreement, the Reopened Notes. The Company

intends to use the net proceeds from the offering to repay secured indebtedness, make investments relating to its business and

for general corporate purposes.

The Reopened Notes are a further issuance

of, are fully fungible with, and rank equally in right of payment with and form a single series with the $40,500,000 aggregate

principal amount of 8.00% Senior Notes due 2023 initially issued by the Company on April 24, 2020 (the “Initial Notes”

and, together with the Reopened Notes, the “Notes”). Following this offering, the aggregate outstanding principal amount

of the Notes is $70,750,000.

The Reopened Notes were offered in a private

offering that is exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”).

The Reopened Notes were offered only to persons reasonably believed to be “qualified institutional buyers” under Rule 144A

and institutional accredited investors under Rule 501(a)(1), (2), (3) or (7). The Reopened Notes will not be registered

under the Securities Act or the securities laws of any other jurisdiction. Unless so registered, the Reopened Notes may not be

offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration

requirements of the Securities Act and applicable state securities laws.

On June 29, 2020, the Company announced

the closing of the offering of the Reopened Notes disclosed in Item 2.03 and 8.01 of this Form 8-K. A copy of the press release

issued is filed as Exhibit 99.1 hereto.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ARBOR REALTY TRUST, INC.

|

|

|

|

|

|

By:

|

/s/ Paul Elenio

|

|

|

Name:

|

Paul Elenio

|

|

|

Title:

|

Chief Financial Officer

|

|

|

|

|

Date: June 29, 2020

|

|

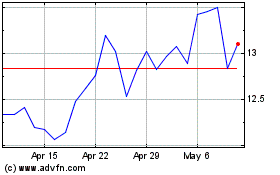

Arbor Realty (NYSE:ABR)

Historical Stock Chart

From Mar 2024 to Apr 2024

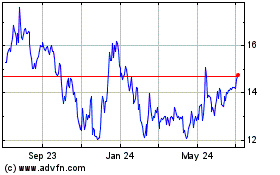

Arbor Realty (NYSE:ABR)

Historical Stock Chart

From Apr 2023 to Apr 2024