As filed with the Securities and Exchange Commission on June 26, 2020

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ARAVIVE, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

2834

|

|

26-4106690

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification No.)

|

River Oaks Tower

3730 Kirby Drive, Suite 1200

Houston, Texas 77098

(936) 355-1910

(Address, including zip code, of principal executive offices)

Gail McIntyre

Chief Executive Officer

River Oaks Tower

3730 Kirby Drive, Suite 1200

Houston, Texas 77098

(936) 355-1910

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Leslie Marlow, Esq.

Hank Gracin, Esq.

Patrick J. Egan, Esq.

Gracin & Marlow, LLP

The Chrysler Building

405 Lexington Avenue, 26th Floor

New York, New York 10174

Telephone: (212) 907-6457

Facsimile: (212) 208-4657

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

Large accelerated filer ☐

|

|

Accelerated filer ☐

|

|

Non-accelerated filer ☒

|

|

Smaller reporting company ☒

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities

to be Registered

|

|

Amount to be

Registered(1)

|

|

Proposed Maximum

Offering Price Per

Share(2)

|

|

Proposed Maximum

Aggregate Offering Price(2)

|

|

Amount of Registration

Fee

|

|

|

Common Stock, par value $0.0001 per share

|

|

931,098 shares

|

|

$ 14.03

|

|

$ 13,063,305

|

|

$1,696

|

(1) This Registration Statement registers 931,098 shares of common stock, all of which were acquired by the selling stockholder in a private placement. Pursuant to Rule 416 under the Securities Act of 1933, as amended, this Registration Statement also covers such indeterminable number of additional shares of the Registrant’s common stock that may become issuable by reason of any stock split, stock dividend, recapitalization, or similar transaction that is effected without the receipt of consideration and results in an increase in the number of shares of the Registrant’s common stock that are outstanding.

(2) Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) under the Securities Act. The price per share and aggregate offering price are based on the average of the high and low price of the Registrant’s common stock on June 24, 2020, as reported on the Nasdaq Global Select Market.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine

The information in this prospectus is not complete and may be changed. The Selling Stockholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated June 26, 2020

PROSPECTUS

931,098 Shares of Common Stock

This prospectus relates to the offer and resale from time to time of up to 931,098 shares of Aravive, Inc. common stock, par value $0.0001 per share, by the selling stockholder identified in this prospectus or in supplements to this prospectus or its transferees. The selling stockholder acquired the shares of our common stock in a private placement transaction in April 2020. We are filing the registration statement on Form S-3, of which this prospectus forms a part, to fulfill our contractual obligations with the selling stockholder to provide for the resale by the selling stockholder of the shares of common stock offered hereby. See “Selling Stockholder.” The registration of the shares of common stock to which this prospectus relates does not require the selling stockholder to sell any of its shares of our common stock.

We are not offering any shares of common stock under this prospectus and will not receive any proceeds from the sale or other disposition of the shares covered hereby, but we have agreed to pay certain registration expenses, other than underwriting discounts and commissions. The selling stockholder from time to time may offer and sell through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices the shares held by it directly or through underwriters, agents or broker-dealers on terms to be determined at the time of sale, as described in more detail in this prospectus. The selling stockholder will pay or assume discounts, commissions, fees of underwriters, selling brokers or dealer managers and similar expenses, if any, incurred for the sale of shares of our common stock. For more information, see “Plan of Distribution” beginning on page 14 of this prospectus for more information about how the selling stockholder may sell its shares of common stock.

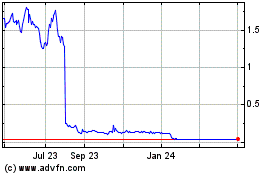

Our common stock is listed on the Nasdaq Global Select Market under the symbol “ARAV.” On June 24, 2020, the last reported sale price of our common stock on the Nasdaq Global Select Market was $14.11 per share.

An investment in shares of our common stock involves risks. See the “Risk Factors” section of our latest Annual Report on Form 10-K filed with the Securities and Exchange Commission and any updates to those risk factors or new risk factors contained in our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the Securities and Exchange Commission, all of which we incorporate by reference herein.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2020.

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, which we refer to as the SEC, utilizing a “shelf” registration process. Under this shelf registration process, the selling stockholder named in this prospectus may from time to time sell shares of our common stock in one or more offerings.

This prospectus provides you with a general description of the shares of common stock the selling stockholder may offer. Each time the selling stockholder sells shares of our common stock using this prospectus, to the extent necessary, we will provide a prospectus supplement that will contain specific information about the terms of that offering, including the number of shares being offered, the manner of distribution, the identity of any underwriters or other counterparties and other specific terms related to the offering. Each prospectus supplement may also add, update or change information contained in this prospectus. To the extent that any statement made in an accompanying prospectus supplement is inconsistent with statements made in this prospectus, the statements made in this prospectus will be deemed modified or superseded by those made in the accompanying prospectus supplement. You should read both this prospectus and any accompanying prospectus supplement together with the additional information described under the heading “Where You Can Find More Information” beginning on page 17 of this prospectus.

Neither we nor the selling stockholder have authorized anyone to provide you with information different from that contained in this prospectus, any accompanying prospectus supplement or in any related free-writing prospectus filed by us with the SEC. Neither we nor the selling stockholder take any responsibility for, or provide any assurance as to the reliability of, any information other than the information in this prospectus, any accompanying prospectus supplement or in any related free-writing prospectus filed by us with the SEC. This prospectus and any accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the securities described in this prospectus or any accompanying prospectus supplement or an offer to sell or the solicitation of an offer to buy such securities in any circumstances in which such offer or solicitation is unlawful. You should assume that the information appearing in this prospectus, any prospectus supplement, the documents incorporated by reference and any related free-writing prospectus is accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed materially since those dates.

Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “Aravive,” “the company,” “we,” “us,” “our” and similar references refer to Aravive, Inc., an entity incorporated under the laws of the State of Delaware, and where appropriate our consolidated subsidiaries.

This prospectus and the information incorporated herein by reference include trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus, any applicable prospectus supplement or any related free writing prospectus are the property of their respective owners.

ii

PROSPECTUS SUMMARY

This summary highlights about us and selected information contained elsewhere in this prospectus and in the documents we incorporate by reference. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus and the documents incorporated by reference carefully, especially the risks of investing in our common stock discussed under and incorporated by reference in “Risk Factors” on page 4 of this prospectus, along with our consolidated financial statements and notes to those consolidated financial statements and the other information incorporated by reference in this prospectus, before making an investment decision.

Overview

We are a clinical-stage biopharmaceutical company developing treatments designed to halt the progression of life-threatening diseases, including cancer and fibrosis.

Our lead product candidate, AVB-500, is an ultrahigh-affinity, decoy protein that targets the GAS6-AXL signaling pathway. By capturing serum GAS6, AVB-500 starves the AXL pathway of its signal, potentially halting the biological programming that promotes disease progression. AXL receptor signaling plays an important role in multiple types of malignancies by promoting metastasis, cancer cell survival, resistance to treatments, and immune suppression. The GAS6-AXL signaling pathway also plays a significant role in fibrogenesis.

Our current development program benefits from the availability of a proprietary serum-based biomarker that we expect will help accelerate drug development and reduce risk by allowing us to select a pharmacologically active dose.

In our completed Phase 1 clinical trial with our clinical lead product candidate, AVB-500, we have demonstrated proof of mechanism for AVB-500 in neutralizing GAS6. Importantly, AVB-500 had a favorable safety profile preclinically and in the first in human trial. In December 2018, we initiated the Phase 1b portion of a Phase 1b/2 clinical trial of AVB-500 combined with standard of care therapies in patients with platinum-resistant ovarian cancer and are currently enrolling the expansion cohort in the Phase 1b. In August 2018, the U.S. Food and Drug Administration (“FDA”) designated as a Fast Track development program the investigation of our lead development candidate, AVB-500, for platinum-resistant recurrent ovarian cancer. In January 2020, we announced that the FDA has cleared our Investigational New Drug (“IND”) application for investigation of AVB-500, in the treatment of our second oncology indication, clear cell renal cell carcinoma (“ccRCC”).

With the global spread of the ongoing novel coronavirus (“COVID-19”) pandemic in the first quarter of 2020, we have implemented business continuity plans designed to address and mitigate the impact of the COVID-19 pandemic on our employees and our business. While we are experiencing limited financial impacts at this time, given the global economic slowdown, the overall disruption of global healthcare systems and the other risks and uncertainties associated with the pandemic, our business, financial condition, results of operations and growth prospects could be materially adversely affected. As we advance our clinical programs, we are in close contact with our clinical research organizations and clinical sites and are assessing the impact of COVID-19 on our studies and current timelines and costs. With the recent and rapidly evolving impact of COVID-19 on patient recruitment in clinical trials and considering patient safety and trial integrity, we have decided to amend our ccRCC trial to initiate treatment at a higher dose given the safety profile seen with the 15 mg/kg dosing cohort of the platinum resistant ovarian cancer (“PROC”) trial and the initiation of the 20 mg/kg dosing cohort. While this may delay first patient dosing, the overall timelines may not be significantly impacted given the higher starting dose, assuming the COVID-19 situation does not interfere with ongoing clinical studies. We have paused new enrollment in our IgA nephropathy (“IgAN”) trial, which initiated in December 2019, until the risk of unnecessary exposure of patients to COVID-19 is decreased. If the COVID-19 pandemic continues and persists for an extended period of time, we could experience significant disruptions to our clinical development timeline, which would adversely affect our business, financial condition, results of operations and growth prospects.

Corporate Information

We were incorporated under the laws of the State of Delaware in December 2008 under the name Versartis, Inc. and completed our initial public offering in March 2014. Aravive Biologics was incorporated under the laws of the State of Delaware in April 2007, originally under the name of Hypoximed, Inc, which name was changed to Ruga Corporation in July 2009 and changed to Aravive Biologics, Inc. in October 2016. The merger between Aravive Biologics, Inc. and Versartis, Inc. became effective on October 12, 2018. On October 15, 2018, we changed our name from Versartis, Inc. to Aravive, Inc.

Our principal executive offices are located at River Oaks Tower, 3730 Kirby Drive, Suite 1200, Houston, Texas 77098. Our telephone number is (936) 355-1910, and our website address is www.aravive.com. The information contained on, or that can be accessed through, our website is not part of, and should not be construed as being incorporated by reference into, this prospectus supplement.

1

For further information regarding us and our financial information, you should refer to our recent filings with the SEC. See “Where You Can Find More Information.”

As of December 31, 2019, we are no longer an emerging growth company under the Jumpstart Our Business Startups Act enacted in April 2012 (“JOBS ACT”). However, for the years ended December 31, 2019 and 2018 we were an emerging growth company. As an emerging growth company and for so long as we continued to be an emerging growth company, we were permitted to and did rely on exemptions from certain disclosure requirements that are applicable to other public companies that are not emerging growth companies.

Private Placement

On April 6, 2020, we entered into an investment agreement (the “Investment Agreement”), with Eshelman Ventures, LLC, a North Carolina limited liability company, and, solely for purposes of Article IV and Article V of the Investment Agreement, Fredric N. Eshelman, Pharm.D. On April 8, 2020, pursuant to the Investment Agreement, Eshelman Ventures, LLC purchased 931,098 shares of our common stock for an aggregate purchase price of approximately $5.0 million.

2

THE OFFERING

|

Common Stock offered by us in this offering

|

|

We are not selling any shares of common stock pursuant to this prospectus.

|

|

|

|

|

|

Common Stock offered by the selling stockholder

|

|

Up to 931,098 shares of common stock.

|

|

|

|

|

|

Terms of the offering

|

|

The selling stockholder will determine when and how it will sell the common stock offered in this prospectus, as described in “Plan of Distribution” on page 14 of this prospectus.

|

|

|

|

|

|

Use of Proceeds

|

|

The selling stockholder will receive all of the proceeds of the sale of shares of common stock offered from time to time pursuant to this prospectus. Accordingly, we will not receive any proceeds from the sale of shares of common stock that may be sold from time to time pursuant to this prospectus. See “Use of Proceeds” on pages 6 of this prospectus.

|

|

|

|

|

|

Risk factors

|

|

You should read the “Risk Factors” section of this prospectus on page 4 and the information incorporated by reference therein for a discussion of factors to consider before deciding to purchase shares of our common stock.

|

|

|

|

|

|

Nasdaq Global Select Market symbol

|

|

ARAV

|

3

RISK FACTORS

Investing in our shares of common stock involves a high degree of risk. Before deciding whether to invest in our common stock, you should consider carefully the risks and uncertainties described under the section entitled “Risk Factors” contained in our most recent Annual Report on Form 10-K, as may be updated by subsequent annual, quarterly and other reports that are incorporated by reference into this prospectus in their entirety. The risks described in these documents are not the only ones we face, but those that we consider to be material. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. For more information, see the section entitled “Where You Can Find Additional Information.” Please also read carefully the section below entitled “Forward-Looking Statements.”

4

FORWARD-LOOKING STATEMENTS

This prospectus, including the documents that we incorporate by reference herein, contains, and any applicable prospectus supplement or free writing prospectus including the documents we incorporate by reference therein may contain, forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including statements regarding our future financial condition, business strategy and plans and objectives of management for future operations. Forward-looking statements include all statements that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “believe,” “will,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “might,” “approximately,” “expect,” “predict,” “could,” “potentially” or the negative of these terms or other similar expressions. Forward-looking statements appear in a number of places throughout this prospectus and include statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things, our ongoing and planned preclinical development and clinical trials, the timing of and our ability to make regulatory filings and obtain and maintain regulatory approvals for our product candidates, our intellectual property position, the degree of clinical utility of our product candidates, our ability to develop commercial functions, expectations regarding clinical trial data, our results of operations, cash needs, spending of the proceeds from any offering, financial condition, liquidity, prospects, growth and strategies, the industry in which we operate and the trends that may affect the industry or us.

Discussions containing these forward-looking statements may be found, among other places, in the sections entitled “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in the documents incorporated by reference herein, including our most recent Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q, as well as any amendments thereto.

These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that could cause our actual results, levels of activity, performance or achievement to differ materially from those expressed or implied by these forward-looking statements. We discuss in greater detail, and incorporate by reference into this prospectus in their entirety, many of these risks and uncertainties under the heading “Risk Factors” contained in the applicable prospectus supplement, in any free writing prospectus we may authorize for use in connection with a specific offering, and in the documents incorporated by reference herein. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. All forward-looking statements are qualified in their entirety by this cautionary statement.

5

USE OF PROCEEDS

The selling stockholder will receive all of the proceeds of the sale of shares of common stock offered from time to time pursuant to this prospectus. Accordingly, we will not receive any proceeds from the sale of shares of common stock that may be sold from time to time pursuant to this prospectus.

We will bear the out-of-pocket costs, expenses and fees incurred in connection with the registration of shares of our common stock to be sold by the selling stockholder pursuant to this prospectus. Other than registration expenses, the selling stockholder will bear underwriting discounts, commissions, placement agent fees or other similar expenses payable with respect to sales of shares of our common stock.

6

DIVIDEND POLICY

We have never declared or paid any cash dividends on our common stock and we do not currently intend to pay any cash dividends on our common stock in the foreseeable future. We expect to retain all available funds and future earnings, if any, to fund the development and growth of our business. Any future determination to pay dividends, if any, on our common stock will be at the discretion of our board of directors and will depend on, among other factors, our results of operations, financial condition, capital requirements and contractual restrictions.

7

SELLING STOCKHOLDER

We are registering the offer and resale of 931,098 shares of our common stock held by Eshelman Ventures, LLC, a North Carolina limited liability company, to permit it, or its permitted transferees or other successors-in-interest that may be identified in a supplement to this prospectus or, if required, a post-effective amendment to the registration statement of which this prospectus is a part, to resell or otherwise dispose of these shares in the manner contemplated under the section entitled "Plan of Distribution" in this prospectus (as may be supplemented and amended). On April 6, 2020, we entered into an investment agreement (the “Investment Agreement”) with Eshelman Ventures, LLC and, solely for purposes of Article IV and Article V of the Investment Agreement, Fredric N. Eshelman, Pharm.D. On April 8, 2020, pursuant to the Investment Agreement, Eshelman Ventures, LLC, an entity wholly owned by Dr. Eshelman, purchased from us 931,098 shares of our common stock for an aggregate purchase price of approximately $5,000,000. We are filing the registration statement of which this prospectus forms a part to fulfill our contractual obligations under the Investment Agreement with the selling stockholder to provide for the resale by the selling stockholder of the shares of common stock offered hereby. Pursuant to the Investment Agreement, we agreed to file such registration statement within six months following the date of the Investment Agreement. We will pay all expenses, other than underwriting discounts and commissions, related to the registration statement of which this prospectus forms a part and agreed to pay up to $50,000 for the selling stockholder’s legal, accounting and other fees, costs and expenses incurred in connection with the Investment Agreement and the transactions contemplated thereby, including fees incurred in reviewing the registration statement of which this prospectus forms a part.

In addition, effective April 8, 2020, Dr. Eshelman was appointed to our board of directors as a Class III director and non-executive Chairman of the board.

Based upon information requested from and provided by Dr. Eshelman, our board of directors has determined that Dr. Eshelman is “independent” in accordance with the published listing requirements of the Nasdaq Stock Market, Inc. As a non-employee director, Dr. Eshelman is compensated in accordance with our director compensation program as disclosed in our definitive proxy statement on Schedule 14A filed with the SEC on August 8, 2019 in connection with our 2019 Annual Meeting of Stockholders. Pursuant to our director compensation program, on June 1, 2020 we granted Dr. Eshelman an option to purchase 7,500 shares of common stock at a per share price of $12.72 (of which 417 shares vested on the grant date and the remaining balance vests pro rata on a monthly basis over 34 months) and an option to purchase 3,226 shares of common stock at a per share price of $12.72 (of which 1,110 shares vested on the grant date and 529 shares vest on a monthly basis commencing June 19, 2020 with full vesting, if not fully vested at such time, on the date of our next annual meeting of stockholders). As of June 24, 2020, Dr. Eshelman indirectly beneficially owned an aggregate of 931,098 shares of common stock and directly beneficially owned 3,530 shares of common stock underlying the stock options. Please refer to our Current Report on Form 8-K filed with the SEC on April 9, 2020, which is incorporated by reference into this Registration Statement in its entirety, for further information about the Investment Agreement and Dr. Eshelman.

The following table sets forth information as of June 24, 2020, with respect to the selling stockholder and the shares of our common stock beneficially owned by the selling stockholder that may from time to time be offered or sold pursuant to this prospectus. Beneficial ownership is determined in accordance with the rules of the SEC. Information concerning the selling stockholder may change from time to time, and any changed information will be set forth in supplements to this prospectus or a post-effective amendment to the registration statement to which this prospectus relates, if and when necessary. The selling stockholder may offer all, some or none of its shares of common stock. We cannot advise you as to whether the selling stockholder will in fact sell any or all of such shares of common stock. In addition, the selling stockholder may have sold or transferred, in transactions pursuant to this prospectus or otherwise, some or all of its shares since the date as of which the information is presented in the table below. The selling stockholder is not a broker-dealer nor an affiliate of a broker-dealer.

|

|

|

Shares of Common Stock

Beneficially Owned

|

|

Shares of Common

|

|

Shares of Common Stock Beneficially

Owned Immediately Following the Sale

of Such Shares of Common Stock

|

|

Selling Stockholder

|

|

Number of

Shares

|

|

Percent of Common

Stock Outstanding

|

|

Stock that May be

Offered for Resale

|

|

Number of

Shares

|

|

Percent of Common

Stock Outstanding

|

|

Eshelman Ventures LLC

|

|

934,628(1)

|

|

5.8%(2)

|

|

931,098

|

|

3,530

|

|

*(2)

|

|

(1)

|

Reflects 931,098 shares of common stock directly held by Eshelman Ventures, LLC, an entity wholly owned by Fredric N. Eshelman, Pharm.D, Chairman of our board of directors. Dr. Eshelman may be deemed to be the beneficial owner of such shares. Dr. Eshelman also beneficially owns 3,530 shares of common stock that may be acquired by him upon the exercise of stock option issued to him on June 1, 2020. The address for Eshelman Ventures is 319 North 3rd Street, Suite 301, Wilmington, NC 28401.

|

|

(2)

|

Based on 15,996,177 shares issued and outstanding as of June 24, 2020.

|

8

DESCRIPTION OF CAPITAL STOCK

As of the date of this prospectus, our certificate of incorporation, authorizes us to issue up to 100,000,000 shares of common stock, $0.0001 par value per share, and 5,000,000 shares of preferred stock, $0.0001 par value per share. As of June 24, 2020, 15,996,177 shares of common stock were outstanding and no shares of preferred stock were outstanding.

The following summary describes the material terms of our capital stock. The description of capital stock is qualified by reference to our certificate of incorporation and our bylaws.

Common Stock

Voting Rights. Each holder of our common stock is entitled to one vote for each share of common stock held on all matters submitted to a vote of stockholders, except as otherwise required by statute. Except as otherwise provided by statute or by applicable stock exchange rules, in all matters other than the election of directors, stockholders may take action with the affirmative vote of the majority of shares present in person, by remote communication, if applicable, or represented by proxy at a stockholder meeting and entitled to vote generally on the subject matter. Cumulative voting for the election of directors is not provided for in our certificate of incorporation. Except as otherwise provided by statute, stockholders may elect directors by a plurality of the votes of the shares present in person, by remote communication, if applicable.

Dividends. Subject to preferences that may apply to any shares of preferred stock outstanding at the time, the holders of outstanding shares of our common stock are entitled to receive dividends out of funds legally available at the times and in the amounts that our board of directors may determine.

Liquidation Rights. Upon our liquidation, dissolution or winding-up, the assets legally available for distribution to our stockholders would be distributable ratably among the holders of our common stock and any participating convertible preferred stock outstanding at that time after payment of liquidation preferences, on any outstanding shares of convertible preferred stock and payment of other claims of creditors.

Rights and Preferences. The rights, preferences, and privileges of holders of our common stock are subject to, and may be adversely affected by, the rights of holders of shares of any series of preferred stock that we may designate and issue in the future.

Preemptive or Similar Rights. Our common stock is not entitled to preemptive rights and is not subject to conversion or redemption.

Fully Paid and Nonassessable. All of our issued and outstanding shares of common stock are fully paid and nonassessable.

Preferred Stock

As of June 24, 2020, no shares of preferred stock were outstanding. The terms of any series of preferred stock will be described in any prospectus supplement or SEC filing relating to that series of preferred stock. The terms of any series of preferred stock may differ from the terms described below. Certain provisions of the preferred stock described below and in any applicable prospectus supplement or SEC filing are not complete.

Our board of directors may, without further action by our stockholders, fix the rights, preferences, privileges and restrictions of up to an aggregate of 5,000,000 shares of preferred stock in one or more series and authorize their issuance. These rights, preferences and privileges could include dividend rights, conversion rights, voting rights, terms of redemption, liquidation preferences, sinking fund terms and the number of shares constituting any series or the designation of such series, any or all of which may be greater than the rights of our common stock. The issuance of our preferred stock could adversely affect the voting power of holders of our common stock and the likelihood that such holders will receive dividend payments and payments upon liquidation. In addition, the issuance of preferred stock could have the effect of delaying, deferring or preventing a change of control or other corporate action.

The following summary of terms of our preferred stock is not complete. You should refer to the provisions of our certificate of incorporation and bylaws and the resolutions containing the terms of each class or series of the preferred stock which have been or will be filed with the SEC at or prior to the time of issuance of such class or series of preferred stock and described in the applicable prospectus supplement. The applicable prospectus supplement may also state that any of the terms set forth herein are inapplicable to such series of preferred stock, provided that the information set forth in such prospectus supplement does not constitute material changes to the information herein such that it alters the nature of the offering or the securities offered.

9

We will fix the designations, voting powers, preferences and rights of the preferred stock of each series we issue, as well as the qualifications, limitations or restrictions thereof, in the certificate of designation relating to that series. We will incorporate by reference from reports that we file with the SEC the form of any certificate of designation that describes the terms of the series of preferred stock that we may offer in the future. Any preferred stock will have terms established by us and set forth in a prospectus supplement or SEC filing relating to a particular series of preferred stock. You should read the prospectus supplement or SEC filing relating to any particular series of preferred stock for specific terms, including:

|

|

•

|

the title and stated value;

|

|

|

•

|

the number of shares we are offering;

|

|

|

•

|

the liquidation preference per share;

|

|

|

•

|

the dividend rate, period and payment date and method of calculation for dividends;

|

|

|

•

|

whether dividends will be cumulative or non-cumulative and, if cumulative, the date from which dividends will accumulate;

|

|

|

•

|

the procedures for any auction and remarketing;

|

|

|

•

|

the provisions for a sinking fund;

|

|

|

•

|

the provisions for redemption or repurchase, if applicable, and any restrictions on our ability to exercise those redemption and repurchase rights;

|

|

|

•

|

any listing of the preferred stock on any securities exchange or market;

|

|

|

•

|

whether the preferred stock will be convertible into our common stock, and, if applicable, the conversion price, or how it will be calculated, and the conversion period;

|

|

|

•

|

whether the preferred stock will be exchangeable into debt securities, and, if applicable, the exchange price, or how it will be calculated, and the exchange period;

|

|

|

•

|

voting rights of the preferred stock;

|

|

|

•

|

restrictions on transfer, sale or other assignment;

|

|

|

•

|

whether interests in the preferred stock will be represented by depositary shares;

|

|

|

•

|

a discussion of material United States federal income tax considerations applicable to the preferred stock;

|

|

|

•

|

the relative ranking and preferences of the preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs;

|

|

|

•

|

any limitations on the issuance of any class or series of preferred stock ranking senior to or on a parity with the series of preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs; and

|

|

|

•

|

any other specific terms, preferences, rights or limitations of, or restrictions on, the preferred stock.

|

If we issue shares of preferred stock, such shares will be fully paid and non-assessable.

The issuance of preferred stock could adversely affect the voting power of holders of common stock and reduce the likelihood that common stockholders will receive dividend payments and payments upon liquidation. The issuance could have the effect of decreasing the market price of the common stock. The issuance of preferred stock also could have the effect of delaying, deterring or preventing a change in control of us.

10

Effects of Authorized but Unissued Stock

We have shares of common stock and preferred stock available for future issuance without stockholder approval, subject to any limitations imposed by the listing standards of the Nasdaq Global Select Market. We may utilize these additional shares for a variety of corporate purposes, including for future public offerings to raise additional capital, or facilitate corporate acquisitions or for payment as a dividend on our capital stock. The existence of unissued and unreserved common stock and preferred stock may enable our board of directors to issue shares to persons friendly to current management or to issue preferred stock with terms that could have the effect of making it more difficult for a third party to acquire, or could discourage a third party from seeking to acquire, a controlling interest in our company by means of a merger, tender offer, proxy contest or otherwise. In addition, if we issue preferred stock, the issuance could adversely affect the voting power of holders of common stock, and the likelihood that such holders will receive dividend payments and payments upon liquidation.

Anti-Takeover Effects of Our Charter Documents and Some Provisions of Delaware Law

Delaware Law

We are incorporated in the State of Delaware. As a result, we are subject to Section 203 of the Delaware General Corporation Law, which prohibits a Delaware corporation from engaging in any business combination with any interested stockholder for a period of three years after the date that such stockholder became an interested stockholder, with the following exceptions:

|

|

•

|

before such date, the board of directors of the corporation approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder;

|

|

|

•

|

upon completion of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction began, excluding for purposes of determining the voting stock outstanding (but not the outstanding voting stock owned by the interested stockholder) those shares owned (1) by persons who are directors and also officers and (2) employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

|

|

|

•

|

on or after such date, the business combination is approved by the board of directors and authorized at an annual or special meeting of the stockholders, and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock that is not owned by the interested stockholder.

|

In general, Section 203 defines a “business combination” to include the following:

|

|

•

|

any merger or consolidation involving the corporation and the interested stockholder;

|

|

|

•

|

any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder;

|

|

|

•

|

subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder;

|

|

|

•

|

any transaction involving the corporation that has the effect of increasing the proportionate share of the stock or any class or series of the corporation beneficially owned by the interested stockholder; or

|

|

|

•

|

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits by or through the corporation.

|

In general, Section 203 defines an “interested stockholder” as an entity or person who, together with the person’s affiliates and associates, beneficially owns, or within three years prior to the time of determination of interested stockholder status did own, 15% or more of the outstanding voting stock of the corporation. A Delaware corporation may “opt out” of these provisions with an express provision in its certificate of incorporation. We have not opted out of these provisions, which may as a result, discourage or prevent mergers or other takeover or change of control attempts of us.

11

Certificate of Incorporation and Bylaws

Our certificate of incorporation provides for our board of directors to be divided into three classes with staggered three-year terms. Only one class of directors is elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms. Because our stockholders do not have cumulative voting rights, stockholders holding a majority of the shares of common stock outstanding are able to elect all of our directors. Our certificate of incorporation and our bylaws also provide that directors may be removed by the stockholders only for cause upon the vote of 66 2/3% of our outstanding common stock. Furthermore, the authorized number of directors may be changed only by resolution of the board of directors, and vacancies and newly created directorships on the board of directors may, except as otherwise required by law or determined by the board, only be filled by a majority vote of the directors then serving on the board, even though less than a quorum.

Our certificate of incorporation and bylaws also provide that all stockholder actions must be effected at a duly called meeting of stockholders and eliminates the right of stockholders to act by written consent without a meeting. Our bylaws also provide that only our chairman of the board, chief executive officer or the board of directors pursuant to a resolution adopted by a majority of the total number of authorized directors may call a special meeting of stockholders.

Our bylaws also provide that stockholders seeking to present proposals before a meeting of stockholders to nominate candidates for election as directors at a meeting of stockholders must provide timely advance notice in writing, and specify requirements as to the form and content of a stockholder’s notice.

Our certificate of incorporation and bylaws provide that the stockholders cannot amend many of the provisions described above except by a vote of 66 2/3% or more of our outstanding common stock.

The combination of these provisions makes it more difficult for our existing stockholders to replace our board of directors as well as for another party to obtain control of us by replacing our board of directors. Since our board of directors has the power to retain and discharge our officers, these provisions could also make it more difficult for existing stockholders or another party to effect a change in management. In addition, the authorization of undesignated preferred stock makes it possible for our board of directors to issue preferred stock with voting or other rights or preferences that could impede the success of any attempt to change our control.

These provisions are intended to enhance the likelihood of continued stability in the composition of our board of directors and its policies and to discourage coercive takeover practices and inadequate takeover bids. These provisions are also designed to reduce our vulnerability to hostile takeovers and to discourage certain tactics that may be used in proxy fights. However, such provisions could have the effect of discouraging others from making tender offers for our shares and may have the effect of delaying changes in our control or management. As a consequence, these provisions may also inhibit fluctuations in the market price of our stock that could result from actual or rumored takeover attempts. We believe that the benefits of these provisions, including increased protection of our potential ability to negotiate with the proponent of an unfriendly or unsolicited proposal to acquire or restructure our company, outweigh the disadvantages of discouraging takeover proposals, because negotiation of takeover proposals could result in an improvement of their terms.

Choice of Forum

Our certificate of incorporation provides that the Court of Chancery of the State of Delaware will be the exclusive forum for:

|

|

•

|

any derivative action or proceeding brought on our behalf;

|

|

|

•

|

any action asserting a breach of fiduciary duty; any action asserting a claim against us arising pursuant to the Delaware General Corporation Law, our certificate of incorporation or our bylaws; or

|

|

|

•

|

any action asserting a claim against us that is governed by the internal affairs doctrine.

|

A Delaware corporation is allowed to mandate in its corporate governance documents a chosen forum for the resolution of state law based shareholder class actions, derivative suits and other intra-corporate disputes.

Our management believes limiting state law based claims to Delaware will provide the most appropriate outcomes as the risk of another forum misapplying Delaware law is avoided, Delaware courts have a well-developed body of case law and limiting the forum will preclude costly and duplicative litigation and avoids the risk of inconsistent outcomes. Additionally, Delaware Chancery Courts can typically resolve disputes on an accelerated schedule when compared to other forums.

12

While management believes limiting the forum for state law based claims is a benefit, shareholders could be inconvenienced by not being able to bring a state law based action in another forum they find favorable.

Several lawsuits involving other companies have been brought challenging the validity of choice of forum provisions in certificates of incorporation, and it is possible that a court could note such provision is inapplicable or unenforceable.

Limitations on Liability and Indemnification of Officers and Directors

Our certificate of incorporation limits the personal liability of directors for breach of fiduciary duty to the maximum extent permitted by the Delaware General Corporation Law and provides that no director will have personal liability to us or to our stockholders for monetary damages for breach of fiduciary duty as a director. However, these provisions do not eliminate or limit the liability of any of our directors:

|

|

•

|

for any breach of the director’s duty of loyalty to us or our stockholders;

|

|

|

•

|

for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law;

|

|

|

•

|

for voting or assenting to unlawful payments of dividends, stock repurchases or other distributions; or

|

|

|

•

|

for any transaction from which the director derived an improper personal benefit.

|

Any amendment to or repeal of these provisions will not eliminate or reduce the effect of these provisions in respect of any act, omission or claim that occurred or arose prior to such amendment or repeal. If the Delaware General Corporation Law is amended to provide for further limitations on the personal liability of directors of corporations, then the personal liability of our directors will be further limited to the greatest extent permitted by the Delaware General Corporation Law.

Our certificate of incorporation provides that we must indemnify our directors and officers and we must advance expenses, including attorneys’ fees, to our directors and officers in connection with legal proceedings, subject to very limited exceptions.

We maintain a general liability insurance policy that covers certain liabilities of our directors and officers arising out of claims based on acts or omissions in their capacities as directors or officers.

Indemnification Agreements

We have entered into indemnification agreements with each of our directors and executive officers. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors or executive officers, we have been informed that in the opinion of the SEC such indemnification is against public policy and is therefore unenforceable.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is American Stock Transfer & Trust Company, LLC. The transfer agent’s address is 6201 15th Avenue, Brooklyn, New York 11219. The transfer agent for any series of preferred stock that we may offer will be named and described in prospectus supplement or SEC filing relating to a particular series of preferred stock.

Listing on the Nasdaq Global Select Market

Our common stock is listed on the Nasdaq Global Select Market under the symbol “ARAV.” The applicable prospectus supplement or SEC filing will contain information, where applicable, as to any other listing, if any, on any securities market or other exchange of the specific security covered by such prospectus supplement or SEC filing.

13

PLAN OF DISTRIBUTION

The selling stockholder, and its permitted transferees or other successors in interest, may from time to time offer and sell, separately or together, shares of common stock covered by this prospectus. Registration of the shares of common stock covered by this prospectus does not mean, however, that those shares of common stock necessarily will be offered or sold.

The shares of common stock covered by this prospectus may be sold from time to time, at market prices prevailing at the time of sale, at prices related to market prices, at a fixed price or prices subject to change or at negotiated prices, by a variety of methods including the following:

|

|

•

|

on the Nasdaq Global Select Market (including through at the market offerings);

|

|

|

•

|

in the over-the-counter market;

|

|

|

•

|

in privately negotiated transactions;

|

|

|

•

|

through broker-dealers, who may act as agents or principals;

|

|

|

•

|

through one or more underwriters on a firm commitment or best-efforts basis;

|

|

|

•

|

in a block trade in which a broker-dealer will attempt to sell a block of shares of common stock as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

•

|

through put or call option transactions relating to the shares of common stock;

|

|

|

•

|

directly to one or more purchasers;

|

|

|

•

|

in any combination of the above.

|

In effecting sales, brokers or dealers engaged by us and/or the selling stockholder may arrange for other brokers or dealers to participate. Broker/dealer transactions may include:

|

|

•

|

purchases of the shares of common stock by a broker-dealer as principal and resales of the shares of common stock by the broker-dealer for its account pursuant to this prospectus;

|

|

|

•

|

ordinary brokerage transactions; or

|

|

|

•

|

transactions in which the broker/dealer solicits purchasers on a best efforts basis.

|

The selling stockholder has not entered into any agreements, understandings or arrangements with any underwriters or broker-dealers regarding the sale of the common stock covered by this prospectus. At any time a particular offer of the shares of common stock covered by this prospectus is made, a revised prospectus or prospectus supplement, if required, will set forth the aggregate amount of shares of common stock covered by this prospectus being offered and the terms of the offering, including the name or names of any underwriters, dealers, brokers or agents. In addition, to the extent required, any discounts, commissions, concessions and other items constituting underwriters’ or agents’ compensation, as well as any discounts, commissions or concessions allowed or reallowed or paid to dealers, will be set forth in such prospectus supplement. To the extent required, any such prospectus supplement, and, if necessary, a post-effective amendment to the registration statement of which this prospectus is a part, will be filed with the SEC to reflect the disclosure of additional information with respect to the distribution of the shares of common stock covered by this prospectus.

To the extent required, the applicable prospectus supplement will set forth whether or not underwriters may over-allot or effect transactions that stabilize, maintain or otherwise affect the market price of the common stock at levels above those that might otherwise prevail in the open market, including, for example, by entering stabilizing bids, effecting syndicate covering transactions or imposing penalty bids.

If the selling stockholder utilizes a dealer in the sale of the securities being offered pursuant to this prospectus, the selling stockholder will sell the securities to the dealer, as principal. The dealer may then resell the securities to the public at varying prices to be determined by the dealer at the time of resale.

14

The selling stockholder may also authorize agents or underwriters to solicit offers by certain types of institutional investors to purchase securities at a public offering price set forth in a revised prospectus or prospectus supplement pursuant to delayed delivery contracts providing for payment and delivery on a specified date in the future. The conditions to these contracts and the commission that the selling stockholder must pay for solicitation of these contracts will be described in a revised prospectus or prospectus supplement, to the extent such revised prospectus or prospectus supplement is required.

In connection with the sale of the shares of common stock covered by this prospectus through underwriters, underwriters may receive compensation in the form of underwriting discounts or commissions and may also receive commissions from purchasers of shares of common stock for whom they may act as agent. Underwriters may sell to or through dealers, and such dealers may receive compensation in the form of discounts, concessions or commissions from the underwriters and/or commissions from the purchasers for whom they may act as agent.

Any underwriters, broker/dealers or agents participating in the distribution of the shares of common stock covered by this prospectus may be deemed to be “underwriters” within the meaning of the Securities Act, and any commissions received by any of those underwriters, broker/dealers or agents may be deemed to be underwriting commissions under the Securities Act.

We and the selling stockholder may agree to indemnify underwriters, broker-dealers or agents against certain liabilities, including liabilities under the Securities Act, and may also agree to contribute to payments which the underwriters, broker/dealers or agents may be required to make.

Certain of the underwriters, broker/dealers or agents who may become involved in the sale of the shares of common stock may engage in transactions with and perform other services for us in the ordinary course of their business for which they receive customary compensation.

Some of the shares of common stock covered by this prospectus may be sold by selling stockholder in private transactions or under Rule 144 under the Securities Act rather than pursuant to this prospectus.

15

LEGAL MATTERS

The validity of the shares of common stock offered hereby will be passed upon for us by Gracin & Marlow, LLP, New York, New York. As of the date of this prospectus, an attorney of Gracin & Marlow, LLP beneficially owns securities exercisable to purchase shares of our common stock that represent less than 1% of our outstanding shares of common stock.

EXPERTS

The consolidated financial statements as of December 31, 2019 and 2018, and for the years then ended, incorporated by reference in this prospectus and the registration statement have been so incorporated in reliance on the report of BDO USA, LLP, an independent registered public accounting firm, incorporated herein by reference, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of a registration statement we filed with the SEC. This prospectus does not contain all of the information set forth in the registration statement and the exhibits to the registration statement. For further information with respect to us and the securities being offered under this prospectus, we refer you to the registration statement and the exhibits and schedules filed as a part of the registration statement. Neither we, the selling stockholder nor any agent, underwriter or dealer has authorized any person to provide you with different information. Neither we nor the selling stockholder are making an offer of these securities in any state where the offer is not permitted. You should not assume that the information in this prospectus is accurate as of any date other than the date on the front page of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities offered by this prospectus.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public at the SEC’s website at www.sec.gov. Additional information about Aravive, Inc. is contained at our website, www.aravive.com. Information on our website is not incorporated by reference into this prospectus. We make available on our website our SEC filings as soon as reasonably practicable after those reports are filed with the SEC.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The SEC file number for the documents incorporated by reference in this prospectus is 001-36361. The documents incorporated by reference into this prospectus contain important information that you should read about us.

The following documents are incorporated by reference into this prospectus:

|

|

•

|

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, filed with the SEC on March 27, 2020;

|

|

|

•

|

Our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2020, filed with the SEC on May 6, 2020;

|

|

|

•

|

The description of our common stock set forth in our registration statement on Form 8-A, filed with the SEC on March 19, 2014, including any amendments thereto or reports filed for the purposes of updating this description.

|

We also incorporate by reference into this prospectus all documents (other than portions of those documents not deemed filed) that are filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (Commission File Number 001-36361) after (i) the date of this registration statement and prior to effectiveness of this registration statement and (ii) the date of this prospectus and before the completion of the offering of the shares of our common stock included in this prospectus. These documents include periodic reports, such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as proxy statements.

16

We will provide to each person, including any beneficial owner, to whom a prospectus is delivered, without charge upon written or oral request, a copy of any or all of the documents that are incorporated by reference into this prospectus but not delivered with this prospectus, including exhibits that are specifically incorporated by reference into such documents. You can request a copy of these filings, at no cost, by writing or telephoning us at the following address or telephone number:

Aravive, Inc.

River Oaks Tower

3730 Kirby Drive, Suite 1200

Houston, Texas 77098

(936) 355-1910

Any statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes that statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

17

PART II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table sets forth the costs and expenses, other than any underwriting discounts and commissions, payable in connection with the offering and sale of the shares of common stock being registered, all of which will be paid by Aravive, Inc. (the “Registrant”). The Selling Stockholder will pay any underwriting discounts, commissions and transfer taxes applicable to shares of common stock sold by it. All amounts are estimates except the Securities and Exchange Commission (the “SEC”) registration fee.

|

|

|

|

|

|

|

|

|

Amount

|

|

|

SEC registration fee

|

|

$1,696

|

|

|

|

Printing and engraving expenses

|

|

5,000

|

|

|

|

Legal fees and expenses

|

|

30,000

|

|

|

|

Accounting fees and expenses

|

|

15,000

|

|

|

|

Transfer agent and registrar fees and expenses

|

|

2,000

|

|

|

|

Miscellaneous

|

|

4,304

|

|

|

|

|

|

|

|

|

|

Total

|

|

$58,000

|

|

|

|

|

|

|

|

|

Item 15. Indemnification of Directors and Officers.

Section 145 of the Delaware General Corporation Law authorizes a court to award, or a corporation’s board of directors to grant, indemnity to directors and officers in terms sufficiently broad to permit such indemnification under certain circumstances for liabilities, including reimbursement for expenses incurred, arising under the Securities Act.

Our certificate of incorporation provides for indemnification of our directors, officers, employees and other agents to the maximum extent permitted by the Delaware General Corporation Law, and our bylaws provide for indemnification of our directors, officers, employees and other agents to the maximum extent permitted by the Delaware General Corporation Law.

We have entered into indemnification agreements with our directors and officers whereby we have agreed to indemnify our directors and officers to the fullest extent permitted by law, including indemnification against expenses and liabilities incurred in legal proceedings to which the director or officer was, or is threatened to be made, a party by reason of the fact that such director or officer is or was a director, officer, employee or agent of Aravive, Inc., provided that such director or officer acted in good faith and in a manner that the director or officer reasonably believed to be in, or not opposed to, the best interest of Aravive, Inc. At present, there is no pending litigation or proceeding involving a director or officer of Aravive, Inc. regarding which indemnification is sought, nor is the registrant aware of any threatened litigation that may result in claims for indemnification.

We maintain insurance policies that indemnify our directors and officers against various liabilities arising under the Securities Act and the Exchange Act of 1934, as amended, that might be incurred by any director or officer in his capacity as such.

Any underwriting agreement, agency agreement, equity distribution agreement or similar agreement that may be entered into in connection with sales of shares of common stock under this Registration Statement will likely provide for indemnification of directors and certain officers of the Registrant by the underwriters or agents against certain liabilities, including liabilities under the Securities Act. of 1933, as amended (the “Securities Act”).

II-1

Item 16. Exhibits.

|

Exhibit

Number

|

|

Description

|

|

|

|

|

1.1#

|

|

Form of Underwriting Agreement

|

|

|

|

|

|

3.1

|

|

Amended and Restated Certificate of Incorporation (Incorporated herein by reference to the Exhibit 3.1 of the Registrant’s Current Report on Form 8-K (File No. 001-36361) filed with the SEC on March 26, 2014)

|

|

|

|

|

3.2

|

|

Certificate of Amendment of Amended and Restated Certificate of Incorporation of Versartis, Inc. (Incorporated herein by reference to Exhibit 3.1 of the Registrant’s Current Report on Form 8-K (File No. 001-36361) filed with the SEC on June 1, 2017)

|

|

|

|

|

|

3.3

|

|

Certificate of Amendment of Amended and Restated Certificate of Incorporation of Versartis, Inc. (Incorporated herein by reference to Exhibit 3.1 of the Registrant’s Current Report on Form 8-K (File No. 001-36361) filed with the SEC on September 12, 2017)

|

|

|

|

|

|

3.4

|

|

Certificate of Amendment of Amended and Restated Certificate of Incorporation of Versartis, Inc. (Incorporated herein by reference to Exhibit 3.1 of the Registrant’s Current Report on Form 8-K (File No. 001-36361), as filed with the SEC on October 16, 2018)

|

|

|

|

|

|

3.5

|

|

Certificate of Amendment of Amended and Restated Certificate of Incorporation of Versartis, Inc. (Incorporated herein by reference to exhibit number 3.2 of our current report on Form 8-K (File No. 001-36361), as filed with the SEC on October 16, 2018)

|

|

|

|

|

|

3.6

|

|

Certificate of Correction to Certificate of Amendment of Amended and Restated Certificate of Incorporation of Aravive, Inc. (Incorporated herein by reference to Exhibit 3.6 of the Registrant’s Annual Report on Form 10-K (File No. 001-36361) filed with the SEC on March 15, 2019)

|

|

|

|

|

|

3.7

|

|

Amended and Restated Bylaws (Incorporated herein by reference to Exhibit 3.4 of the Registrant’s Registration Statement on Form S-1, as amended (File No. 333-193997), filed with the SEC on March 6, 2014)

|

|

|

|

|

4.1

|

|

Form of Common Stock Certificate (Incorporated herein by reference to Exhibit 4.1 of the Registrant’s Quarterly Report on Form 10-Q (File No. 001-36361) for the quarterly period ended March 31, 2014 filed with the SEC on May 14, 2014)

|

|

|

|

|

5.1*

|

|

Opinion of Gracin & Marlow, LLP

|

|

|

|

|

|

10.1

|

|

Investment Agreement, dated as of April 6, 2020, by and among the Company, Eshelman Ventures, LLC, and, solely for purposes of Article IV and Article V of the Investment Agreement, Fredric N. Eshelman, Pharm.D. (Incorporated herein by reference to exhibit number 10.1 of our current report on Form 8-K (File No. 001-36361), as filed with the SEC on April 9, 2020)

|

|

|

|

|

23.1*

|

|

Consent of BDO USA, LLP, independent registered public accounting firm for the Registrant

|

|

|

|

|

23.2*

|

|

Consent of Gracin & Marlow, LLP (included in Exhibit 5.1)

|

|

|

|

|

24.1*

|

|

Powers of Attorney (included on the signature page of the Registration Statement)

|

|

#

|

To be filed, if necessary, by amendment to this Registration Statement or incorporated by reference from documents filed with the SEC under the Exchange Act in connection with the offering of securities.

|

Item 17. Undertakings.

The undersigned Registrant hereby undertakes:

To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

|

(i)

|

to include any prospectus required by Section 10(a)(3) of the Securities Act;

|

II-2

|

(ii)

|

to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

|

|

(iii)

|

to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

|

provided, however, that paragraphs (i), (ii) and (iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

That, for the purpose of determining liability under the Securities Act to any purchaser:

|

(A)

|

Each prospectus filed by a Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

|

|

(B)

|