UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June

22, 2020

|

Camber Energy, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

001-32508

|

|

20-2660243

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

1415 Louisiana, Suite 3500, Houston, Texas

77002

(Address of principal executive offices)

(210) 998-4035

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☒

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☒

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 Par Value Per Share

|

CEI

|

NYSE American

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☐

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

June 2020 Stock Purchase Agreement

On and effective

June 22, 2020, Camber Energy, Inc. (the “Company”, “Camber”, “we” and

“us”) and an institutional investor (the “Investor”), entered into a Stock Purchase Agreement

(the “June 2020 Purchase Agreement”).

Under the terms of

the June 2020 Purchase Agreement, the Investor purchased 630 shares of Series C Redeemable Convertible Preferred Stock (“Series

C Preferred Stock”), for $6 million, at a 5% original issue discount to the $10,000 face value of such preferred stock

(the “Face Value”).

Pursuant to the June

2020 Purchase Agreement, as long as the Investor holds any shares of Series C Preferred Stock, we agreed that, except as contemplated

in connection with the merger contemplated by that certain Agreement and Plan of Merger entered into between the Company and Viking

Energy Group, Inc. on February 3, 2020, as amended from time to time (the “Merger”), we would not issue or enter

into or amend an agreement pursuant to which we may issue any shares of common stock, other than (a) for restricted securities

with no registration rights, (b) in connection with a strategic acquisition, (c) in an underwritten public offering, or (d) at

a fixed price. We also agreed that we would not issue or amend any debt or equity securities convertible into, exchangeable or

exercisable for, or including the right to receive, shares of common stock (i) at a conversion price, exercise price or exchange

rate or other price that is based upon or varies with, the trading prices of or quotations for the shares of common stock at any

time after the initial issuance of the security or (ii) with a conversion, exercise or exchange price that is subject to being

reset at some future date after the initial issuance of the security or upon the occurrence of specified or contingent events directly

or indirectly related to the business of the Company or the market for the common stock.

Additionally, provided

that we have not materially breached the terms of the June 2020 Purchase Agreement, we may at any time, in our sole and absolute

discretion, repurchase from Investor all, but not less than all, of the then outstanding shares of Series C Preferred Stock sold

pursuant to the agreement by paying to Investor 110% of the aggregate face value of all such shares.

We also agreed to

provide the Investor a right of first offer to match any offer for financing we receive from any person while the shares of Series

C Preferred Stock sold pursuant to the June 2020 Purchase Agreement are outstanding, except for debt financings not convertible

into common stock, which are excluded from such right to match.

Finally, we agreed

that if we issue any security with any term more favorable to the holder of such security or with a term in favor of the holder

of such security that was not similarly provided to Investor, then we would notify Investor of such additional or more favorable

term and such term, at Investor’s option, may become a part of the transaction documents with Investor.

The June 2020 Purchase

Agreement includes customary provisions requiring that the Company indemnify the Investor against certain losses; representations

and warranties and covenants.

We agreed pursuant

to the June 2020 Purchase Agreement that if the Merger does not close by the required date approved by the parties thereto (as

such may be extended from time to time), we are required, at the Investor’s option in its sole and absolute discretion, to

immediately repurchase from the Investor all then outstanding Series C Preferred Stock shares acquired by the Investor pursuant

to the June 2020 Purchase Agreement, by paying to the Investor 110% of the aggregate Face Value of all such shares (the “Repurchase

Requirement”), which totals $6,930,000.

Finally, we agreed

to include proposals relating to the approval of the June 2020 Purchase Agreement and the issuance of the shares of common stock

upon conversion of the Series C Preferred Stock sold pursuant to the June 2020 Purchase Agreement, as well as an increase in authorized

common stock to fulfill our obligations to issue such shares, at the meeting held to approve the Merger or a separate meeting in

the event the Merger is terminated prior to shareholder approval, and to use commercially reasonable best efforts to obtain such

approvals as soon as possible and in any event prior to December 31, 2020.

Series C Redeemable Convertible Preferred

Stock

Holders of the Series

C Preferred Stock are entitled to cumulative dividends in the amount of 24.95% per annum (adjustable up to 34.95% if a trigger

event, as described in the designation of the Series C Preferred Stock occurs), payable upon redemption, conversion, or maturity,

and when, as and if declared by our Board of Directors in its discretion, provided that upon any redemption, conversion, or maturity,

seven years of dividends are due and payable on such redeemed, converted or matured stock. The Series C Preferred Stock ranks senior

to the common stock. The Series C Preferred Stock has no right to vote on any matters, questions or proceedings of the Company

including, without limitation, the election of directors except: (a) during a period where a dividend (or part of a dividend) is

in arrears; (b) on a proposal to reduce the Company’s share capital; (c) on a resolution to approve the terms of a buy-back

agreement; (d) on a proposal to wind up the Company; (e) on a proposal for the disposal of all or substantially all of the Company’s

property, business and undertakings; and (f) during the winding-up of the Company.

The Series C Preferred

Stock may be converted into shares of common stock (“Conversion Shares”) at any time at the option of the holder,

or at our option if certain equity conditions (as defined in the certificate of designation for the Series C Preferred Stock),

are met. Upon conversion, we will pay the holders of the Series C Preferred Stock being converted an amount, in cash or stock at

our sole discretion, equal to the dividends that such shares would have otherwise earned if they had been held through the maturity

date (i.e., seven years), and issue to the holders such number of shares of Common stock equal to $10,000 per share of Series C

Preferred Stock multiplied by the number of such shares of Series C Preferred Stock divided by the applicable Conversion Price

(as defined in the certificate of designation for the Series C Preferred Stock).

The conversion premium

under the Series C Preferred Stock is payable and the dividend rate under the Series C Preferred Stock is adjustable. Specifically,

the conversion rate of such premiums and dividends equals 95% of the average of the lowest 5 individual daily volume weighted average

prices during the Measuring Period, not to exceed 100% of the lowest sales prices on the last day of the Measuring Period, less

$0.05 per share of common stock, unless a triggering event has occurred, in which case the conversion rate equals 85% of the lowest

daily volume weighted average price during the Measuring Period, less $0.10 per share of common stock not to exceed 85% of the

lowest sales prices on the last day of such Measuring Period, less $0.10 per share. The “Measuring Period” is

the period beginning, if no trigger event has occurred, 30 trading days, and if a trigger event has occurred, 60 trading days,

before the applicable notice has been provided regarding the exercise or conversion of the applicable security, and ending, if

no trigger event has occurred, 30 trading days, and if a trigger event has occurred, 60 trading days, after the applicable number

of shares stated in the initial exercise/conversion notice has actually been received into the Investor’s designated brokerage

account in electronic form and fully cleared for trading (subject to certain extensions described in the applicable securities,

which have been triggered to date). Triggering events are described in the designation of the Series C Preferred Stock, but include

items which would typically be events of default under a debt security, including filing of reports late with the Securities and

Exchange Commission.

The Series C Preferred

Stock has a maturity date that is seven years after the date of issuance and, if the Series C Preferred Stock has not been wholly

converted into shares of common stock prior to such date, we may redeem the Series C Preferred Stock on such date by repaying to

the investor in cash 100% of the Face Value plus an amount equal to any accrued but unpaid dividends thereon. 100% of the Face

Value, plus an amount equal to any accrued but unpaid dividends thereon, automatically becomes payable in the event of a liquidation,

dissolution or winding up by us.

We may not issue

any other preferred stock that is pari passu or senior to the Series C Preferred Stock with respect to any rights for a period

of one year after the earlier of such date (i) a registration statement is effective and available for the resale of all shares

of common stock issuable upon conversion of the Series C Preferred Stock, or (ii) Rule 144 under the Securities Act of 1933, as

amended, is available for the immediate unrestricted resale of all shares of common stock issuable upon conversion of the Series

C Preferred Stock.

The Series C Preferred

Stock is subject to a beneficial ownership limitation, which prevents any holder of the Series C Preferred Stock from converting

such Series C Preferred Stock into common stock, if upon such conversion, the holder would beneficially own greater than 9.99%

of our outstanding common stock.

The issuance of the

Conversion Shares is subject to NYSE American approval and approval of our stockholders.

The description of the

June 2020 Purchase Agreement and the Series C Preferred Stock above, are subject to, and qualified in their entirety by, (a) the

form of June 2020 Purchase Agreement, a copy of which is incorporated by reference hereto as Exhibit 10.1; and

(b) the designation of the Series C Preferred Stock, incorporated by reference as Exhibit 3.1 hereto, which

is incorporated in this Item 1.01 by reference in their entirety.

The Company plans to use

the funds raised through the sale of Series C Preferred Stock to pay operating expenses and expenses in connection with the Merger

and subject to the parties coming to an agreement on terms and conditions relating to such advance, to advance a portion of such

funds to Viking, in anticipation of the Merger.

Amendment Agreement

On June 22, 2020, the Company

and the Investor entered into an Amendment to Stock Purchase Agreement (the “SPA Amendment”), pursuant to which

the Investor agreed to terminate the obligation set forth in the Stock Purchase Agreement previously entered into between the Company

and the Investor on February 3, 2020, which contained a Repurchase Requirement substantially similar to the one contained in the

June 2020 Purchase Agreement (as to the 525 shares of Series C Preferred Stock sold to the Investor on February 3, 2020), which

would have required that we pay the Investor an aggregate of $5,775,000 in connection with the redemption of the 525 shares of

Series C Preferred Stock we sold to the Investor in the event the Merger was terminated.

As a result of such

amendment, the $5,000,000 paid by the Investor to the Company for the purchase of the 525 shares of Series C Preferred Stock

on February 3, 2020, will no longer need to be repaid.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information disclosed

in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03 in

its entirety.

|

Item 3.02.

|

Unregistered Sales of Equity Securities.

|

The information disclosed

in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02.

On June 22, 2020,

the Investor purchased 630 shares of Series C Preferred Stock. The sale and issuance of the Series C Preferred Stock described

above has been determined to be exempt from registration under the Securities Act of 1933, as amended (the “Securities

Act”) in reliance on Section 4(a)(2) of the Securities Act and Rule 506 of Regulation D promulgated thereunder, as transactions

by an issuer not involving a public offering. The Investor has represented that it is an accredited investor, as that term is defined

in Regulation D. The Investor also has represented that it is acquiring the securities for investment purposes only and not with

a view to or for sale in connection with any distribution thereof.

As

of the date of this Report, the Series C Preferred Stock sold on June 22, 2020, would convert into approximately 16,409,771 shares

of our common stock if fully converted, which number includes 38,769 shares of common stock convertible upon conversion of all

of the outstanding shares of outstanding Series C Preferred Stock at a conversion price of $162.50 per share (based on the $10,000

face amount of the Series C Preferred Stock) and approximately 16,371,001 shares of common stock for premium shares due thereunder

(based on the current dividend rate of 24.95% per annum), and a conversion price of $0.6721 per share (the last conversion price

provided in a conversion notice provided by the Investor), which may be greater than or less than the conversion price that currently

applies to the conversion of the Series C Preferred Stock pursuant to the terms of the Designation, which number of premium shares

may increase significantly from time to time as the trading price of our common stock decreases, upon the occurrence of any trigger

event under the Designation of the Series C Preferred Stock and upon the occurrence of certain other events, as described in greater

detail in the Designation of the Series C Preferred Stock.

The conversion of

the Series C Preferred Stock into common stock of the Company will create substantial dilution to existing stockholders.

Item 8.01 Other Events.

On June 23, 2020,

the Company published a press release disclosing the sale of Series C Preferred Stock to the Investor. A copy of the press release

is included herewith as Exhibit 99.1 and the information in the press release is incorporated by reference

into this Item 8.01.

As of June 22, 2020, the Company had 11,721,729 shares of common

stock issued and outstanding (which does not include certain shares of common stock which are still due to the holder of the Company’s

Series C Preferred Stock from prior conversions of Series C Preferred Stock, and which are currently held in abeyance, subject

to issuance at the request of such holder, and such holder’s 9.99% ownership limitation). The increase in our outstanding

shares of common stock from the date of the Company’s April 16, 2020 increase in authorized shares of common stock (from

5 million shares, to 25 million shares, pursuant to the approval of the stockholders of the Company at the annual meeting of stockholders

held on the same day), is almost solely entirely due to conversions of shares of Series C Preferred Stock of the Company into common

stock, and conversion premiums due thereon, which are payable in shares of common stock, pursuant to the designation of such Series

C Preferred Stock. The conversions are in the sole discretion of the Series C Preferred Stockholder. The number of shares of common

stock due to the Series C Preferred Stock holder are subject to increase and adjustment as the price of the Company’s common

stock declines in value.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

Exhibit

Number

|

|

Description of Exhibit

|

|

3.1

|

|

Camber Energy, Inc. Amended and Restated Certificate of Designations of Preferences, Powers, Rights and Limitations of Series C Redeemable Convertible Preferred Stock as filed with the Secretary of State of Nevada on July 8, 2019 (Filed as Exhibit 3.1 to the Company’s Current Report on Form 8-K, filed with the Commission on July 9, 2020, and incorporated herein by reference)(File No. 001-32508)

|

|

10.1*+

|

|

Form of Stock Purchase Agreement relating to the purchase of $6 million in shares of Series C Redeemable Convertible Preferred Stock dated June 22, 2020

|

|

10.2*

|

|

Form of Amendment to Stock Purchase Agreements dated June 22, 2020, by and between Camber Energy, Inc. and the Investor Named Therein

|

|

99.1*

|

|

Press Release dated June 23, 2020

|

* Filed herewith.

** Furnished herewith.

+ Certain schedules, annexes and similar attachments have

been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule or exhibit will be furnished supplementally

to the Securities and Exchange Commission upon request; provided, however that Camber Energy, Inc. may request confidential treatment

pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended, for any schedule or exhibit so furnished.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

CAMBER ENERGY, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Robert Schleizer

|

|

|

|

Name:

|

Robert Schleizer

|

|

|

Title:

|

Chief Financial Officer

|

Date: June 23, 2020

EXHIBIT INDEX

Exhibit

Number

|

|

Description of Exhibit

|

|

|

3.1

|

|

Camber Energy, Inc. Amended and Restated Certificate of Designations of Preferences, Powers, Rights and Limitations of Series C Redeemable Convertible Preferred Stock as filed with the Secretary of State of Nevada on July 8, 2019 (Filed as Exhibit 3.1 to the Company’s Current Report on Form 8-K, filed with the Commission on July 9, 2020, and incorporated herein by reference)(File No. 001-32508)

|

|

|

10.1*+

|

|

Form of Stock Purchase Agreement relating to the purchase of $6 million in shares of Series C Redeemable Convertible Preferred Stock dated June 22, 2020

|

|

|

10.2*

|

|

Form of Amendment to Stock Purchase Agreements dated June 22, 2020, by and between Camber Energy, Inc. and the Investor Named Therein

|

|

|

99.1*

|

|

Press Release dated June 23, 2020

|

|

|

|

|

|

|

|

* Filed herewith.

** Furnished herewith.

+ Certain schedules, annexes and similar attachments have

been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule or exhibit will be furnished supplementally

to the Securities and Exchange Commission upon request; provided, however that Camber Energy, Inc. may request confidential treatment

pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended, for any schedule or exhibit so furnished.

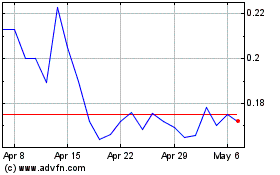

Camber Energy (AMEX:CEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Camber Energy (AMEX:CEI)

Historical Stock Chart

From Apr 2023 to Apr 2024